13 May 2022 Afternoon Session Analysis

Pound slumped amid negative economic data.

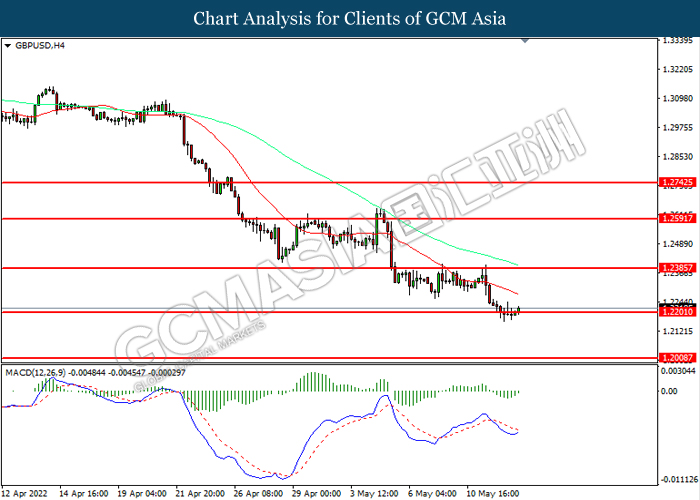

The Pound Sterling was traded lower over the backdrop of bearish economic data. According to Office for National Statistics, UK Gross Domestic Product YoY came in at 8.7%, missing the market forecast at 9.0%. Meanwhile, U.K. Monthly Gross Domestic Product (GDP) 3M/3M Change came in at 0.8%, which also fared worse than the market forecast at 1.0%. Such bearish data indicated that the Britain’s economy unexpectedly shrank significantly in March, marking a weak end to the first quarter of a year when the risk of recession continue to looming and spiking numbers of inflation rate. Besides, the Pound Sterling extend its losses following the International Monetary Fund unleashed their bearish tone toward the economic momentum in UK. According to Reuters, the International Monetary Fund predicts Britain will see the weakest growth and highest inflation among major advanced economies next year. As of writing, GBP/USD depreciated by 0.03% to 1.2215.

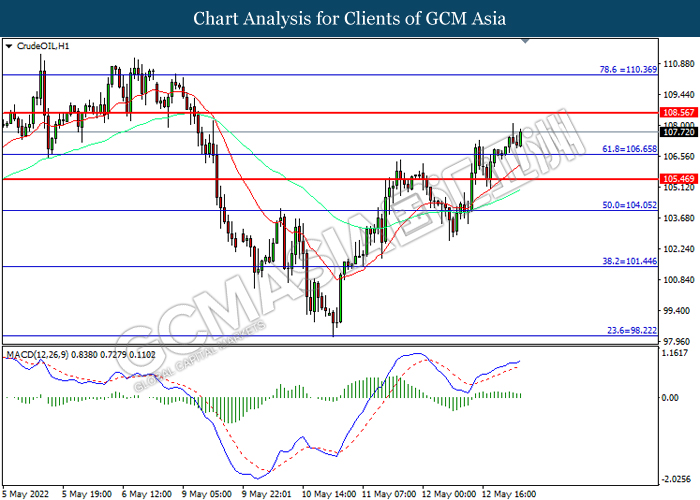

In the commodities market, the crude oil price appreciated by 0.86% to $107.80 per barrel as of writing. The oil market edged higher amid the rising tensions between Russian-Ukraine continue to spur bullish momentum on the crude oil price. On the other hand, the gold price appreciated by 0.26% to $1826.60 per troy ounces amid global inflation risk continue to insinuate demand on the inflation-hedging instrument gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 65.2 | 64.0 | – |

Technical Analysis

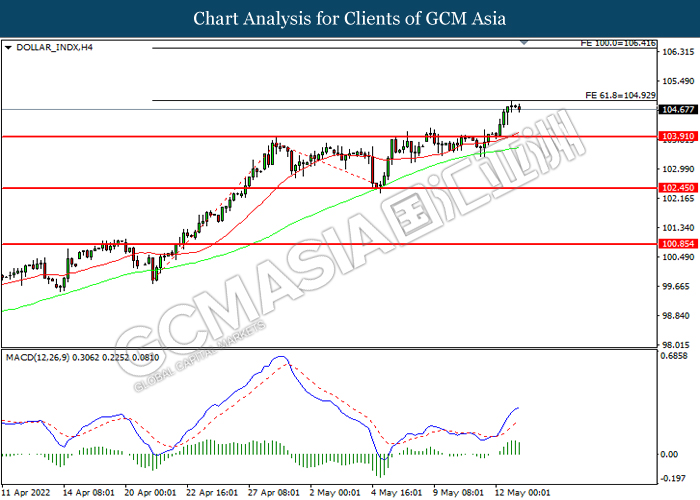

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 104.95. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.95, 106.40

Support level: 103.90, 102.45

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2385, 1.2590

Support level: 1.2200, 1.2010

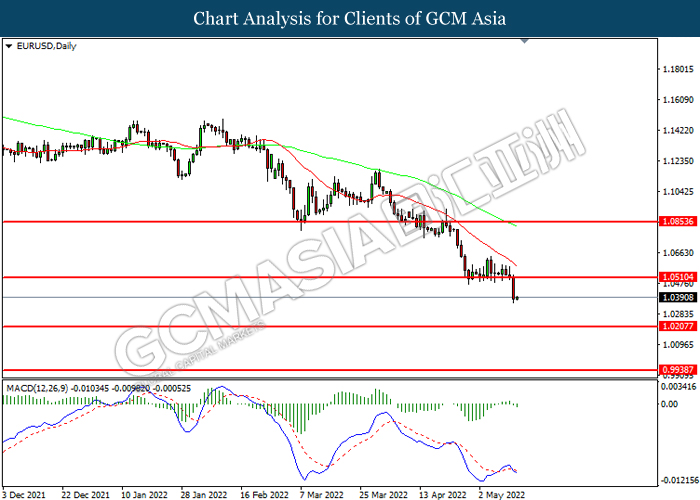

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.0205.

Resistance level: 1.0510, 1.0855

Support level: 1.0205, 0.9940

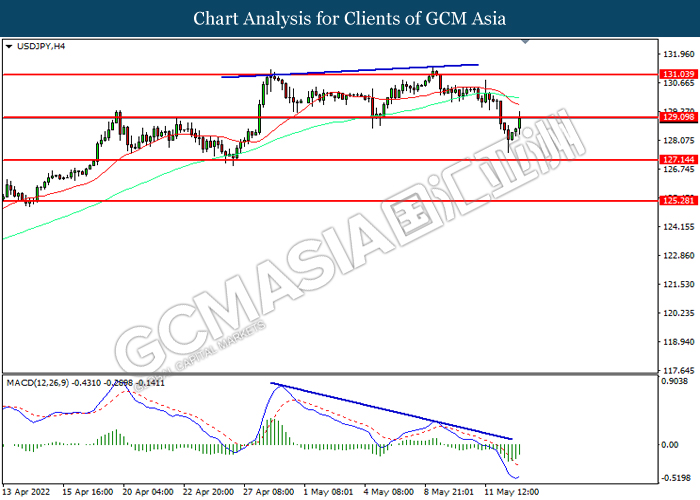

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

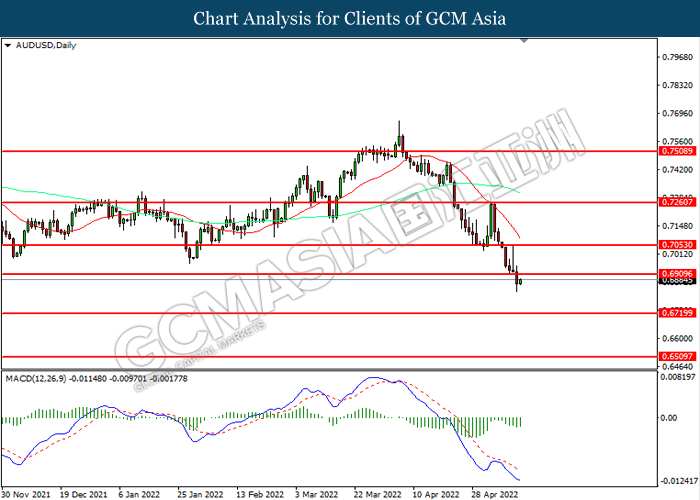

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6910, 0.7055

Support level: 0.6720, 0.6510

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6150, 0.5920

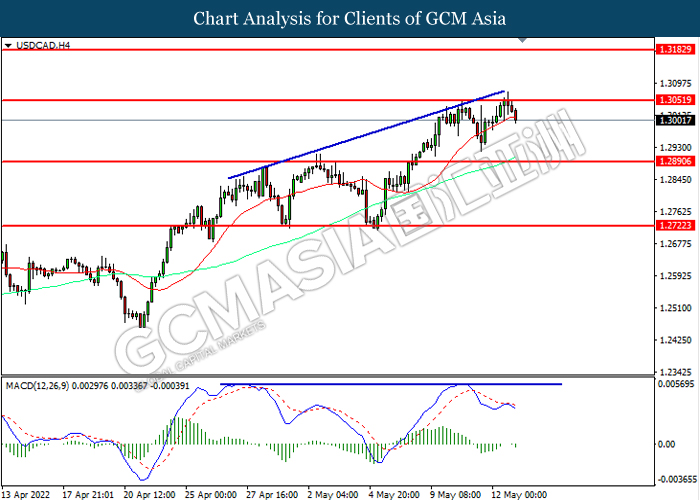

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3050, 1.3185

Support level: 1.2890, 1.2720

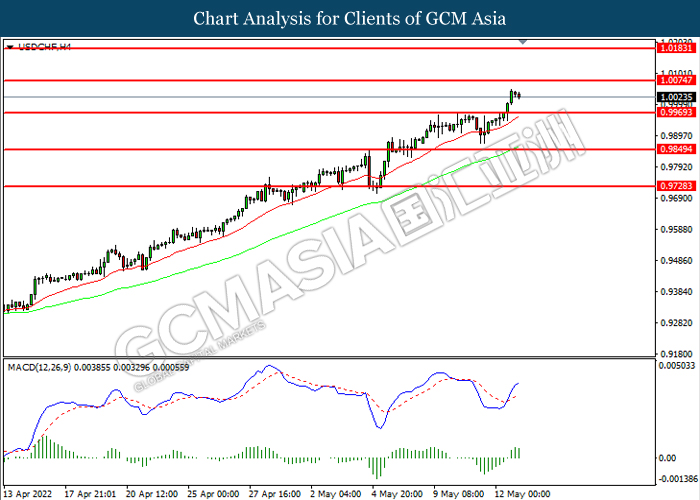

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 108.55, 110.35

Support level: 106.65, 105.45

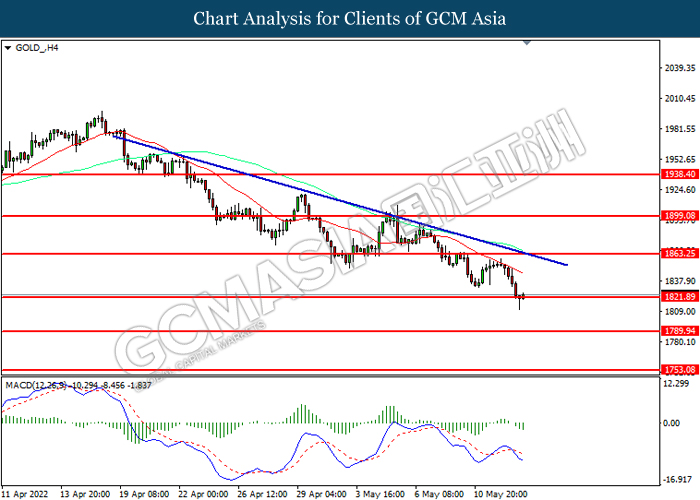

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1863.25, 1899.10

Support level: 1821.90, 1789.95