13 June 2022 Afternoon Session Analysis

Australian Dollar slumped as bullish US CPI data announced.

The AUSUSD was traded lower on Monday amid the backdrop of the strengthening of US Dollar. According to US Department of Labor, the The US Core Consumer Price Index (CPI) MoM for May came in at the reading of 0.6%, exceeding the economist forecast of 0.5%. It indicated that the inflation in US had rose by 8.6%, which reached its 41-years highs. It adding odds of aggressive rate hike from Federal Reserve in order to lower down the inflation risk. The implementation of tightening monetary policy would likely to increase risk-off return of investors, which sparked the appeal of the US Dollar. Besides, Australia Dollar remained its bearish trend over the Shanghai reintroduce lockdown in some cities after the rising Covid-19 cases. As Australia was the trading partner for China, the lockdown would likely to bring negative prospects toward economic progression in China while Australia would be affected directly. It prompted investors to shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, the AUDUSD depreciated by 0.60% to 0.7009.

In the commodities market, crude oil price slumped by 1.81% to $118.48 per barrel as of writing following the diminishing oil demand due to the lockdown in China. On the other hand, gold price eased by 0.60% to $1864.20 per troy ounce as of writing following the spike of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day AUD Queen’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.7% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM)(Apr) | -0.2% | 0.2% | – |

Technical Analysis

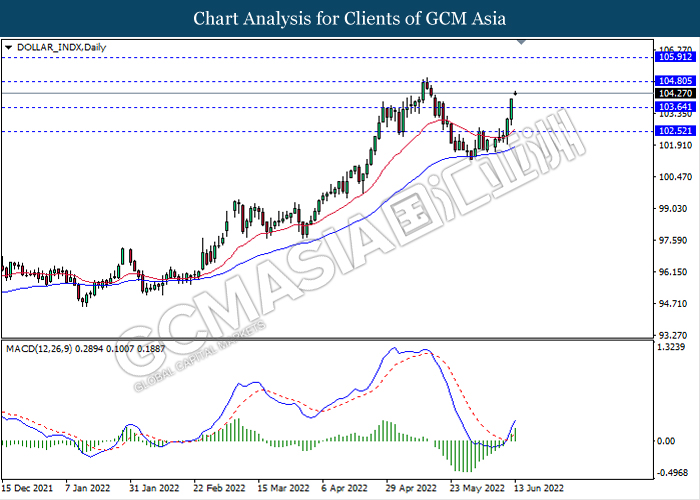

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

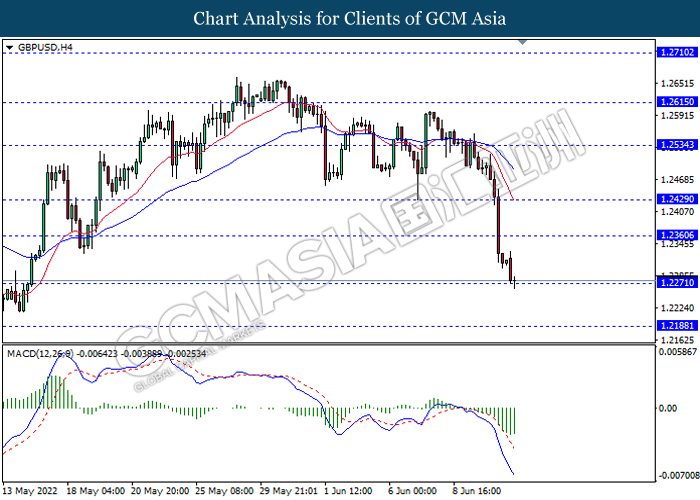

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2360, 1.2430

Support level: 1.2270, 1.2190

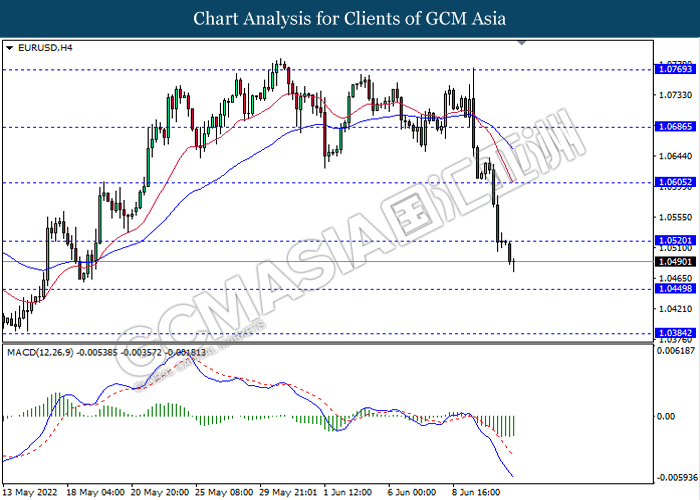

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0520, 1.0605

Support level: 1.0450, 1.0385

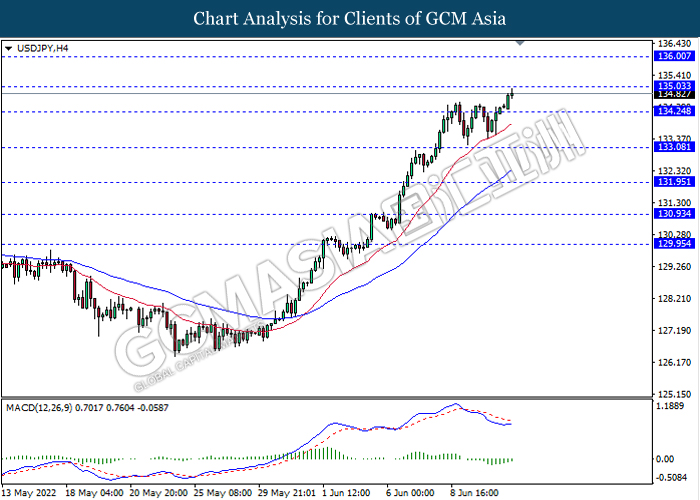

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 135.05, 136.00

Support level: 134.25, 133.10

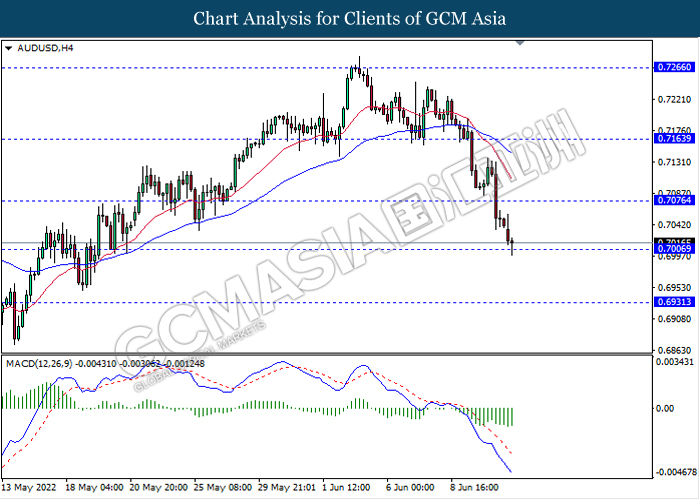

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7075, 0.7165

Support level: 0.7005, 0.6930

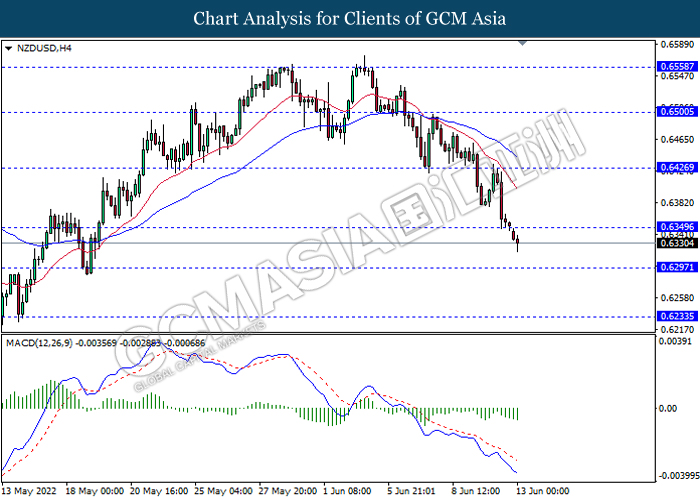

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6235

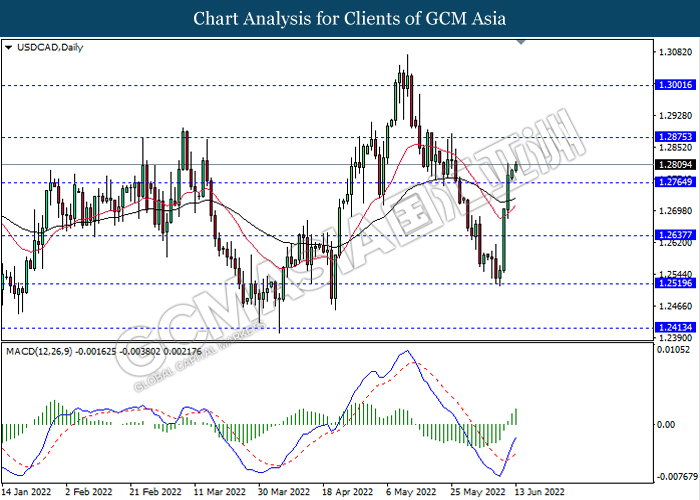

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2875, 1.3000

Support level: 1.2765, 1.2635

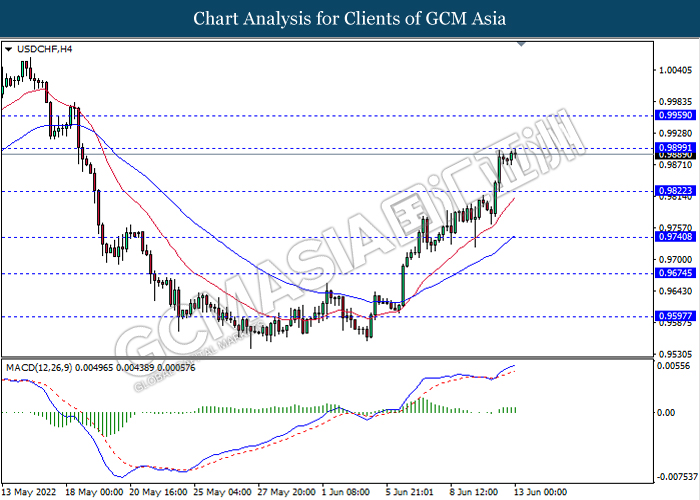

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 0.9960

Support level: 0.9820, 0.9740

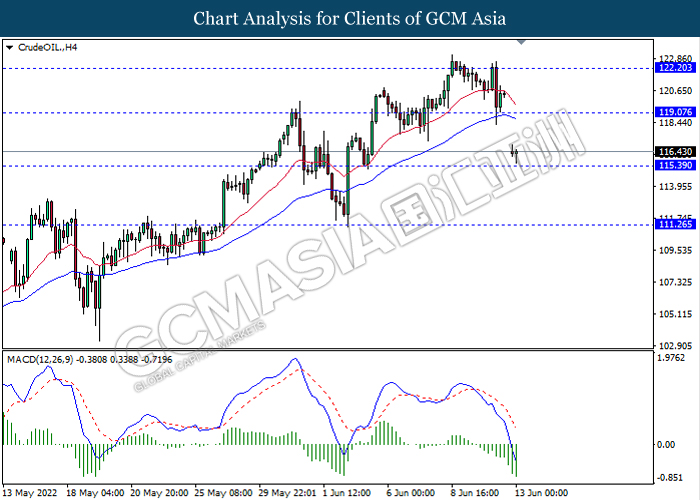

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 119.05, 122.20

Support level: 115.40, 111.25

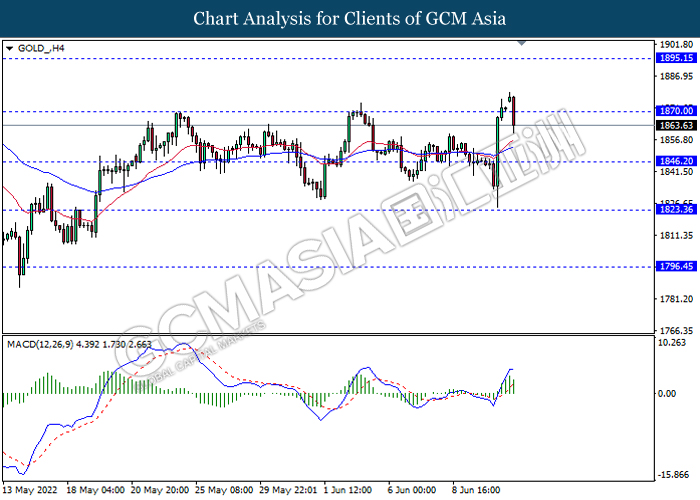

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend it losses.

Resistance level: 1870.00, 1895.15

Support level: 1846.20, 1823.35