13 June 2022 Morning Session Analysis

Dollar skyrocketed as inflation accelerated.

The dollar index, which gauges its value against a basket of six major currencies jumped after US labor department released an upbeat inflation data. According to the Bureau of Labor Statistics, US Consumer Price Index (CPI) came in at 8.6% YoY, far higher than the economist forecast at 8.3% YoY, while US Core CPI was remained at 0.6% MoM, but still slightly above the 0.5% expectation of the economist. With that, the accelerated inflation figures have dented the hopes that inflation may have peaked and evoked investors fears that US economy is getting closer to a recession. Prior to that, investors recked on that inflation may have peaked, and thus, Federal Reserve would less likely to have a more aggressive rate hike in the future. Nevertheless, the May’s report likely solidifies the likelihood of multiple 50 basis point interest rate increases ahead, as Fed target was to calm down the inflationary pressures to the level of 2%. As of writing, the dollar index surged 0.15% to 104.30.

In the commodities market, crude oil prices were down by 1.51 % to $116.20 as strengthening of dollar index putting downward pressures on this black commodity price. Besides, gold prices were down 0.35% to $1875.80 per troy ounce despite the CPI data showed inflation accelerated further.

Today’s Holiday Market Close

Time Market Event

All Day AUD Queen’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.7% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM)(Apr) | -0.2% | 0.2% | – |

Technical Analysis

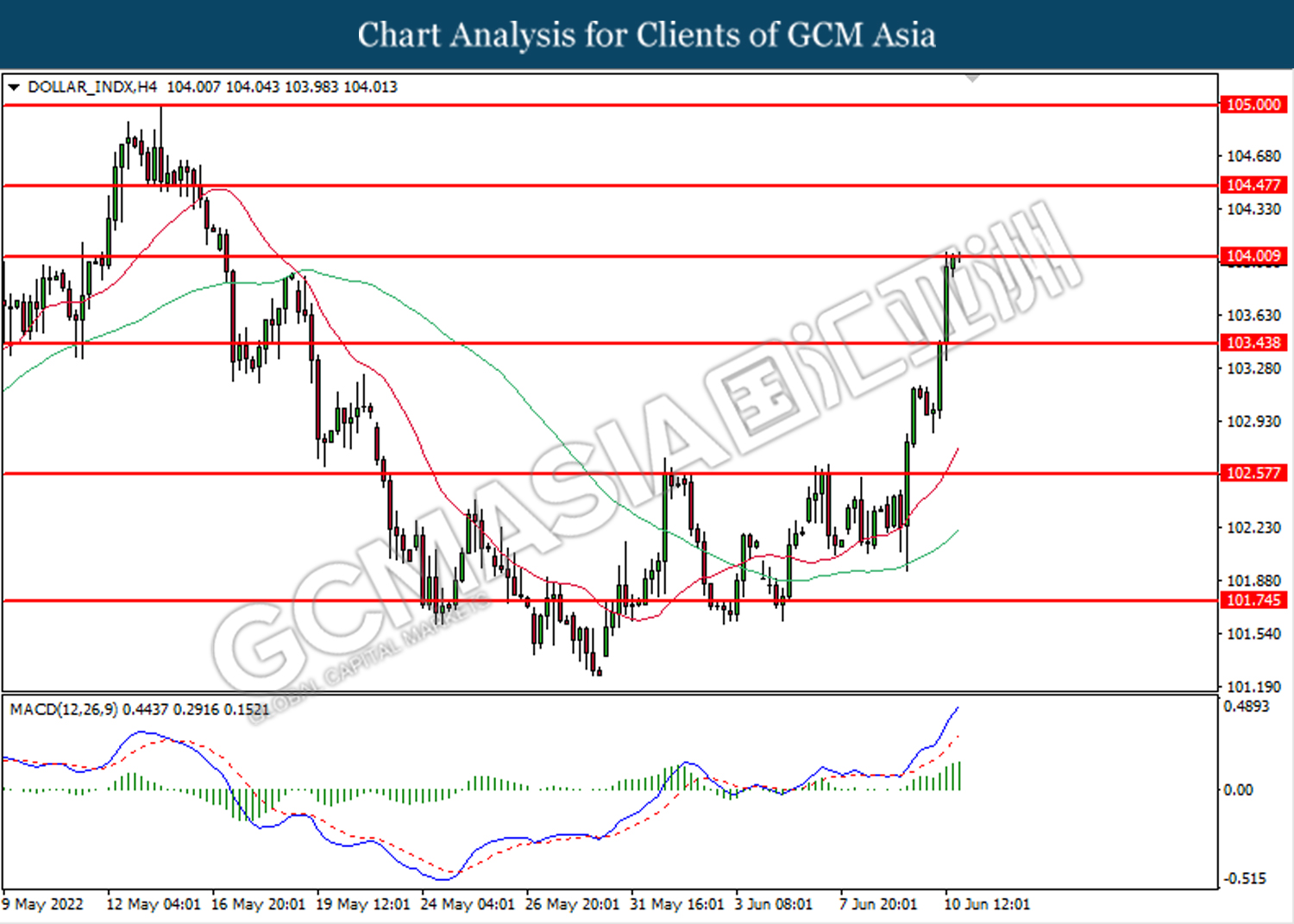

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 104.00. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 104.00, 104.45

Support level: 103.45, 102.55

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2325. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2235.

Resistance level: 1.2325, 1.2425

Support level: 1.2235, 1.2165

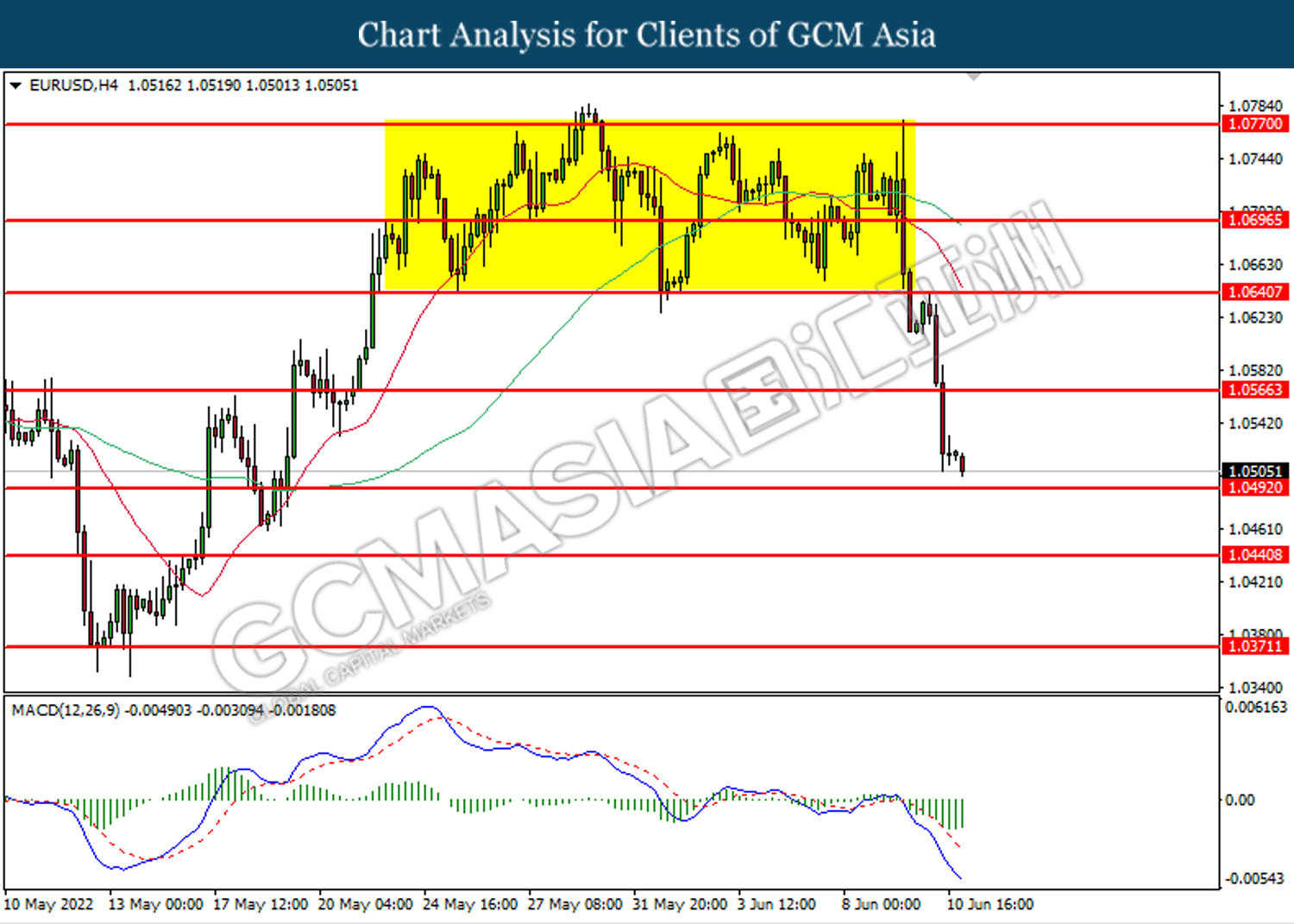

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.0565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0490.

Resistance level: 1.0565, 1.0640

Support level: 1.0490, 1.0440

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.75. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

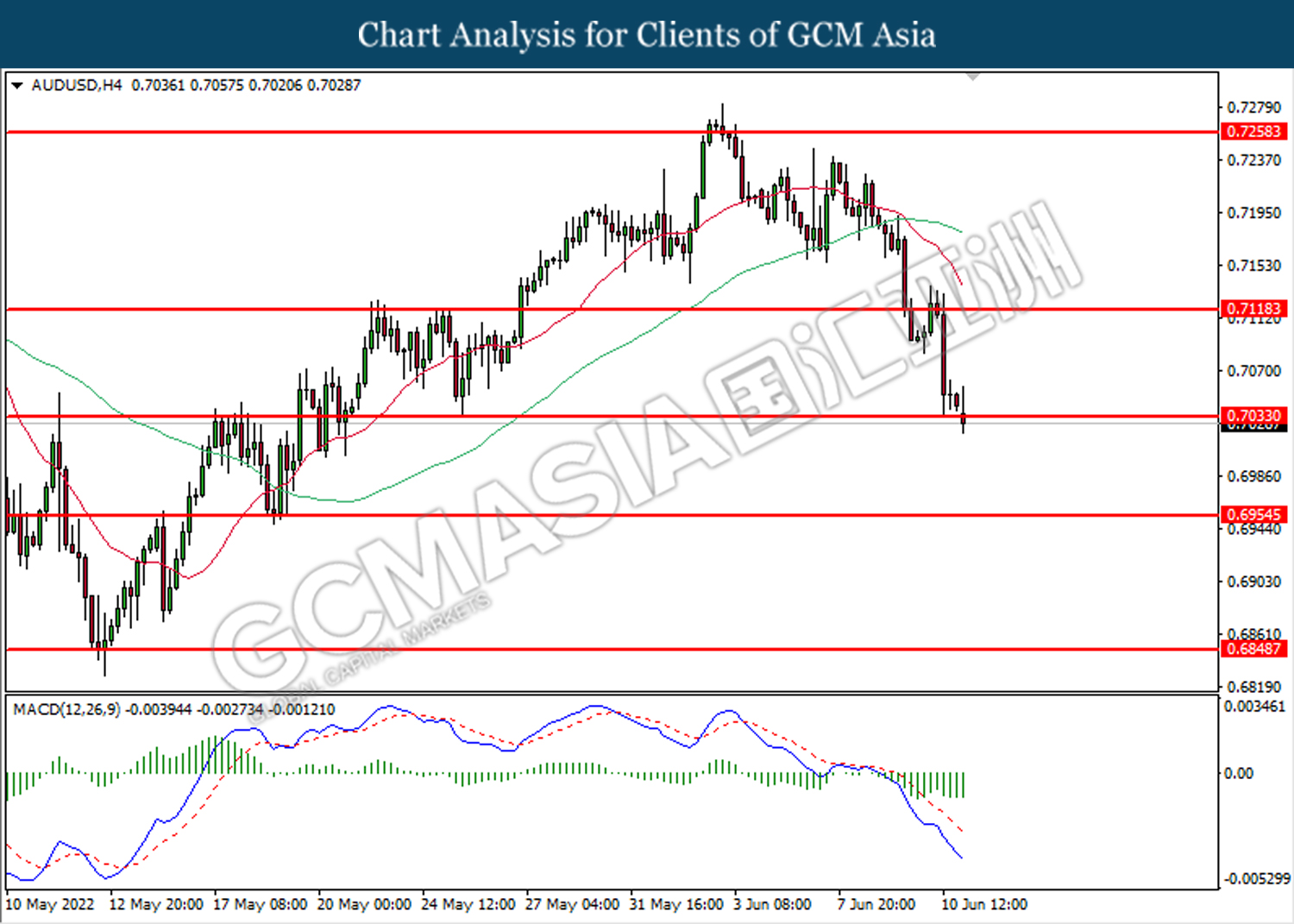

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.7035. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.7120, 0.7260

Support level: 0.7035, 0.6955

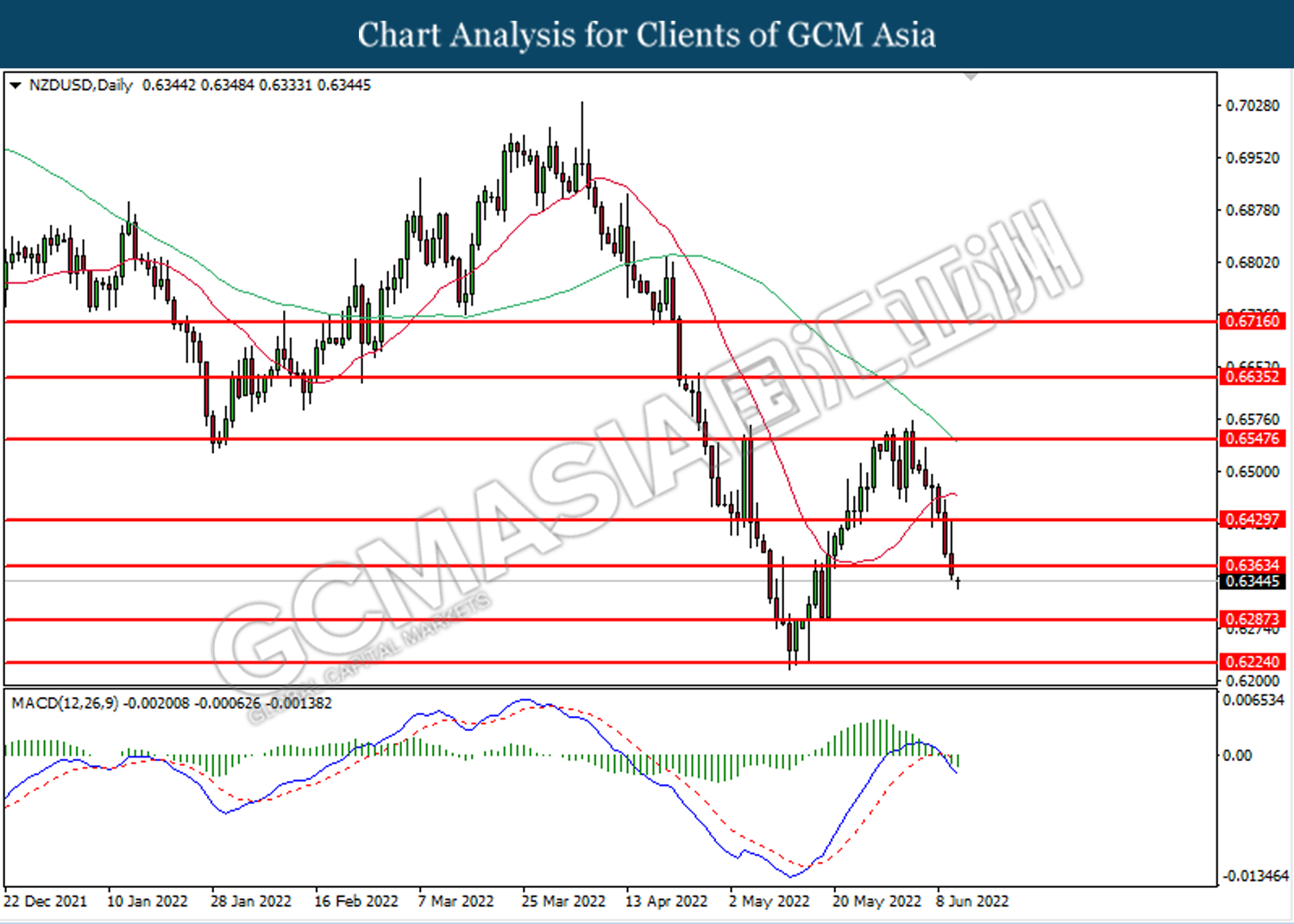

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6365. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6285.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

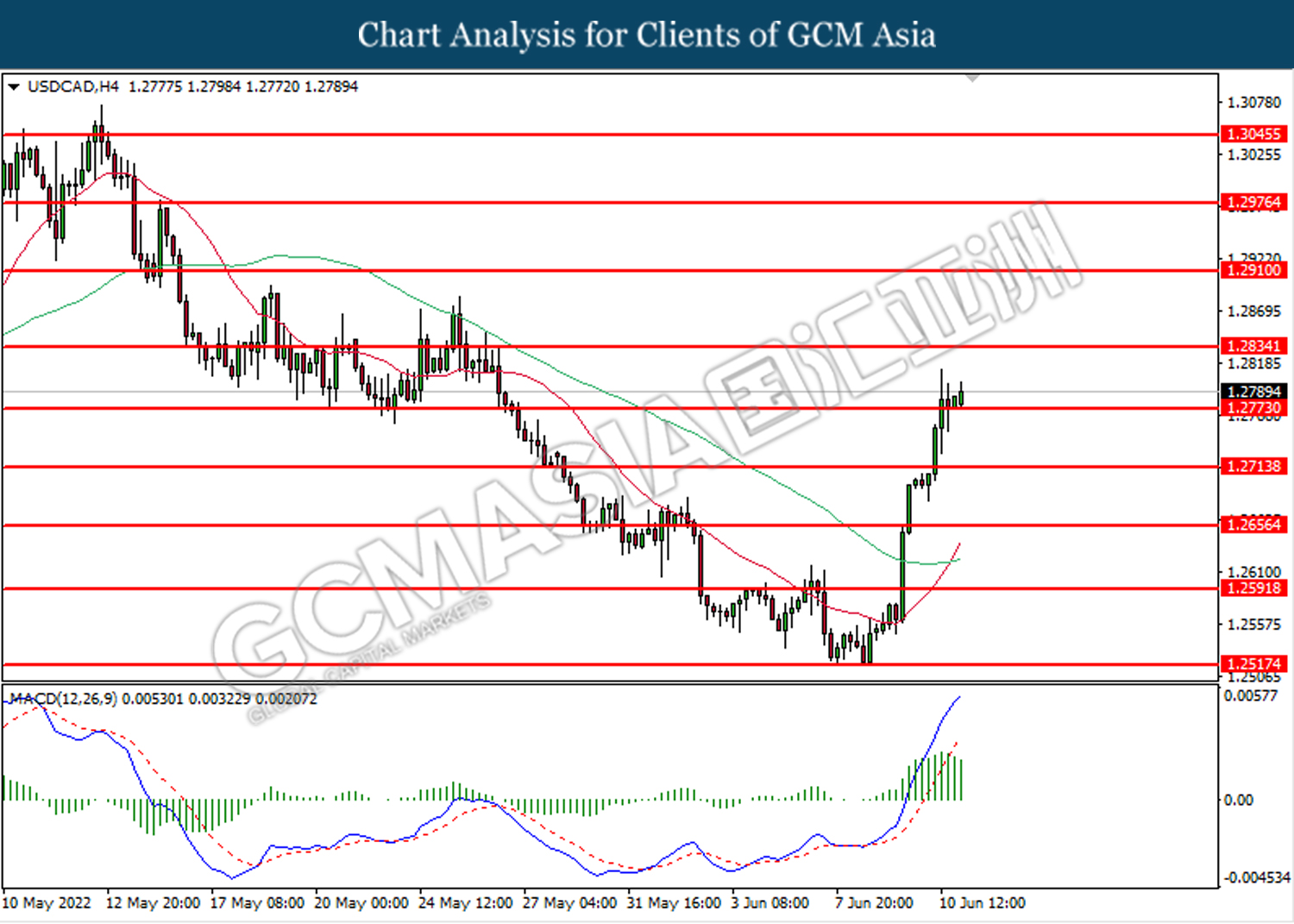

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2775. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2835.

Resistance level: 1.2835, 1.2910

Support level: 1.2775, 1.2715

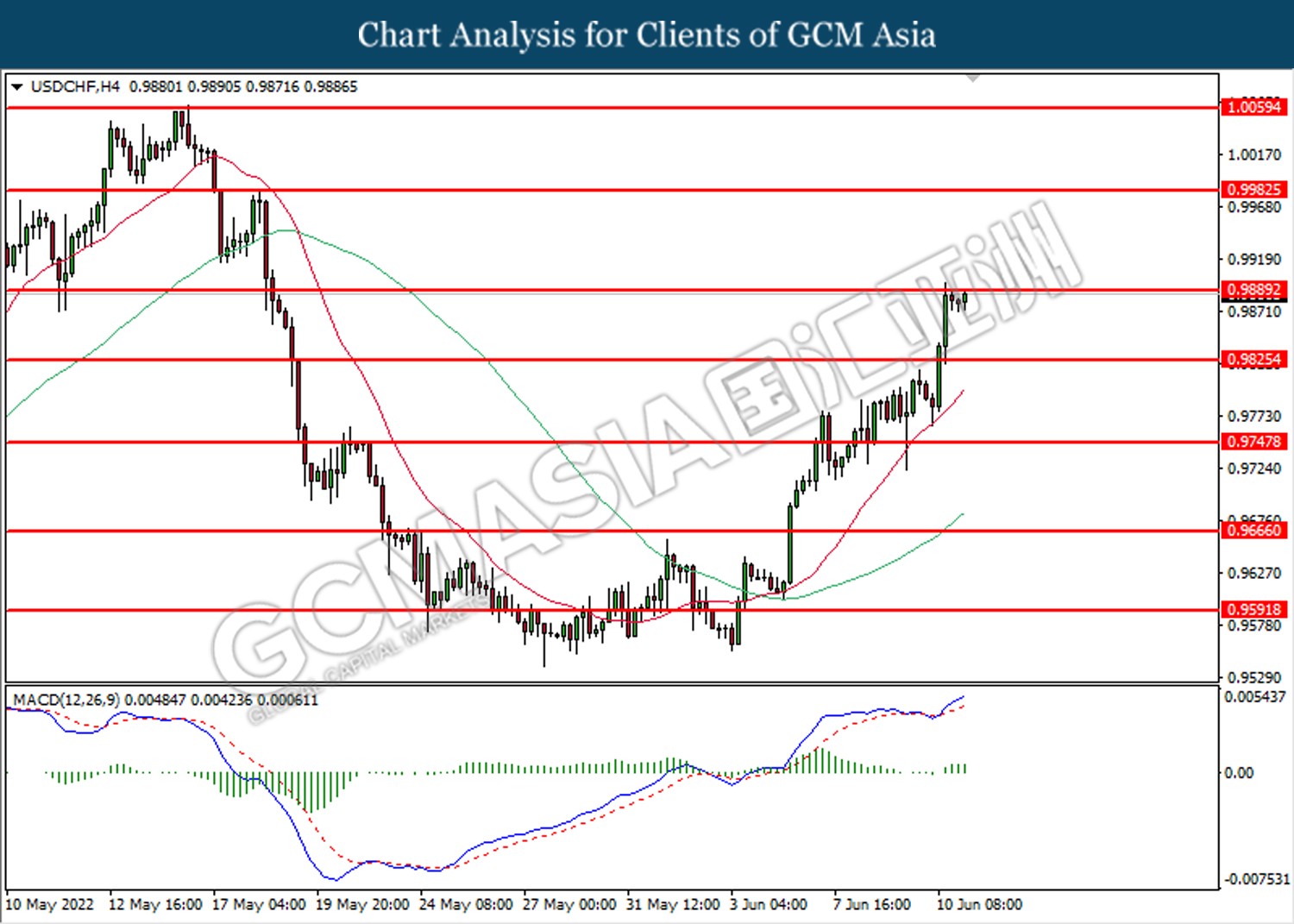

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9890. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9890, 0.9980

Support level: 0.9825, 0.9750

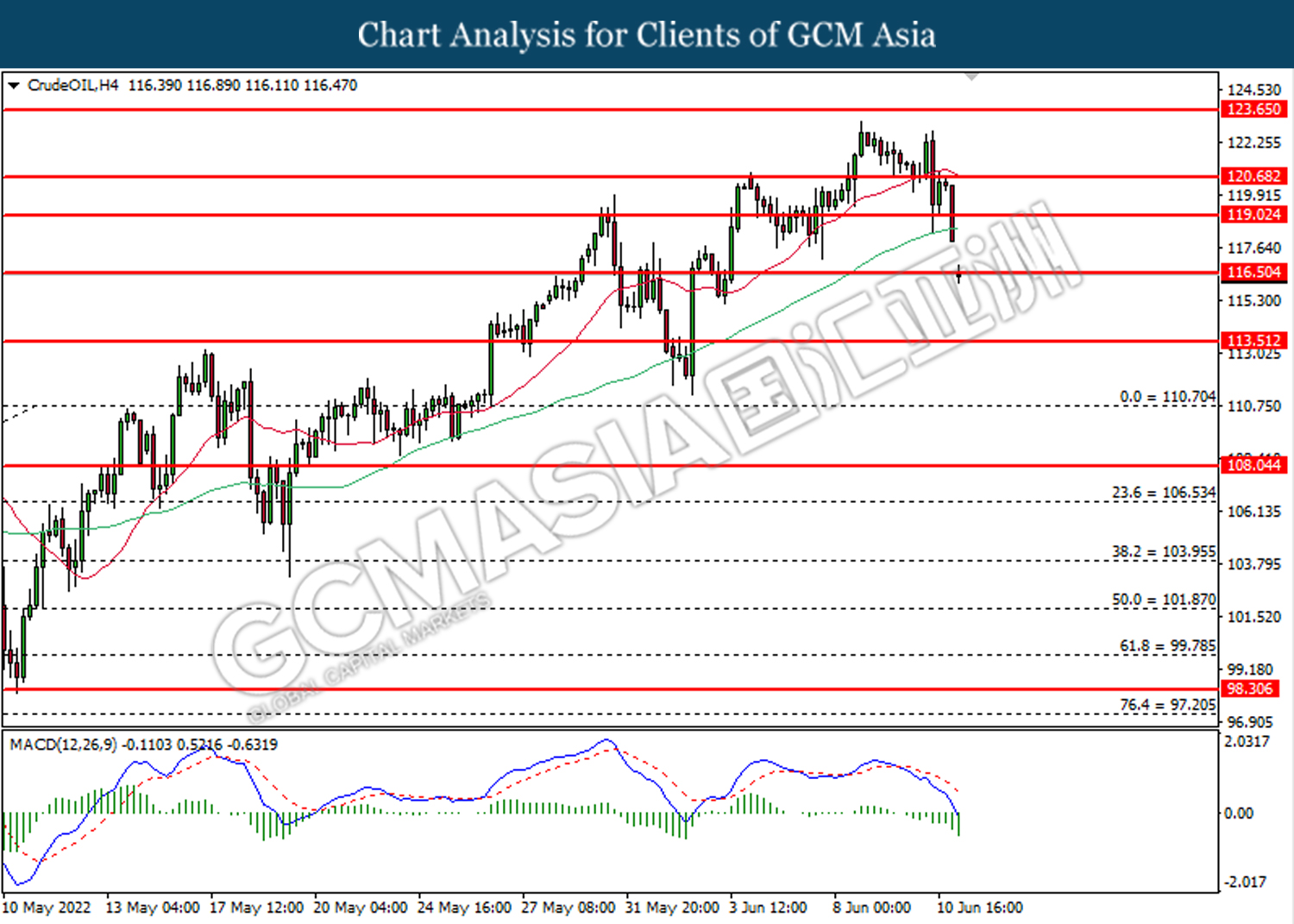

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 116.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 113.50.

Resistance level: 116.50, 119.00

Support level: 113.50, 110.70

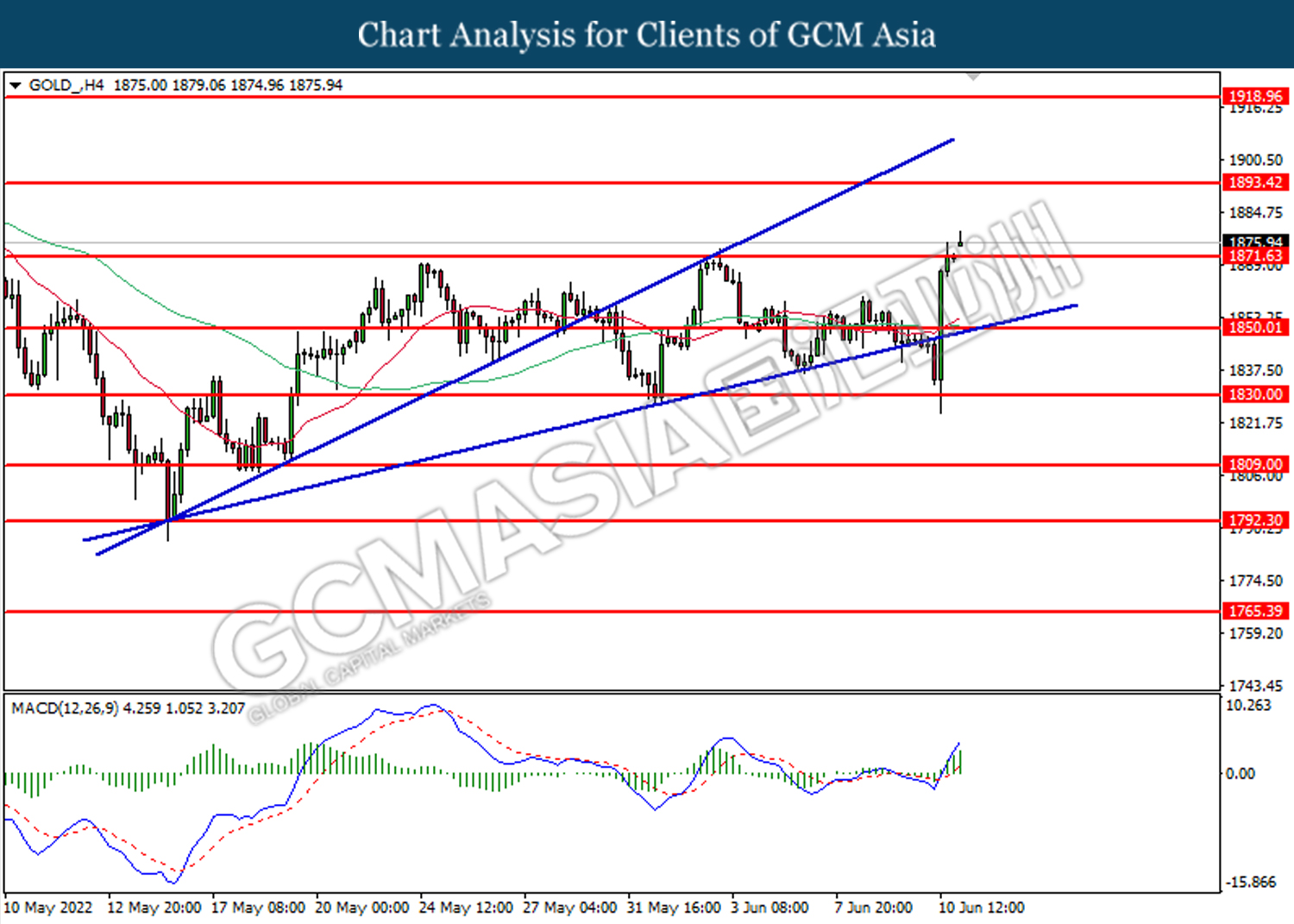

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1871.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1893.40.

Resistance level: 1893.40, 1918.95

Support level: 1871.65, 1850.00