13 June 2023 Afternoon Session Analysis

Greenback dipped as CPI data looms.

The dollar index, which was traded against a basket of six major currencies, teetered near the brink of collapse ahead of the long-awaited Consumer Price Index (CPI) data. According to the Investing.com, the economists are expecting the inflation rate to come in at 4.1%, far below the market consensus forecast at 4.9%, mirroring that they are optimistic over the effectiveness of the prior rate hikes on cooling down the inflation rate. With that, the financial market is expected to experience huge volatility today due to the announcement of the CPI data. Besides, it is noteworthy to highlight that the inflation reading will also be take into consideration of the Fed’s decision on interest rates following the two-day meeting on Thursday. Based on the CME FedWatch Tool, the probability of making no changes on the US interest rate surged from 70.1% to 81.5% today, whereas the likelihood of a 25 basis point of rate hike is at 18.5% as of writing. However, the losses of the dollar index was limited by the rate cut by the PBOC. The PBOC cut its seven-day reverse repo rate by 10 basis point from 2.0% to 1.9%. As of writing, the dollar index edged down by -0.17% to 103.45.

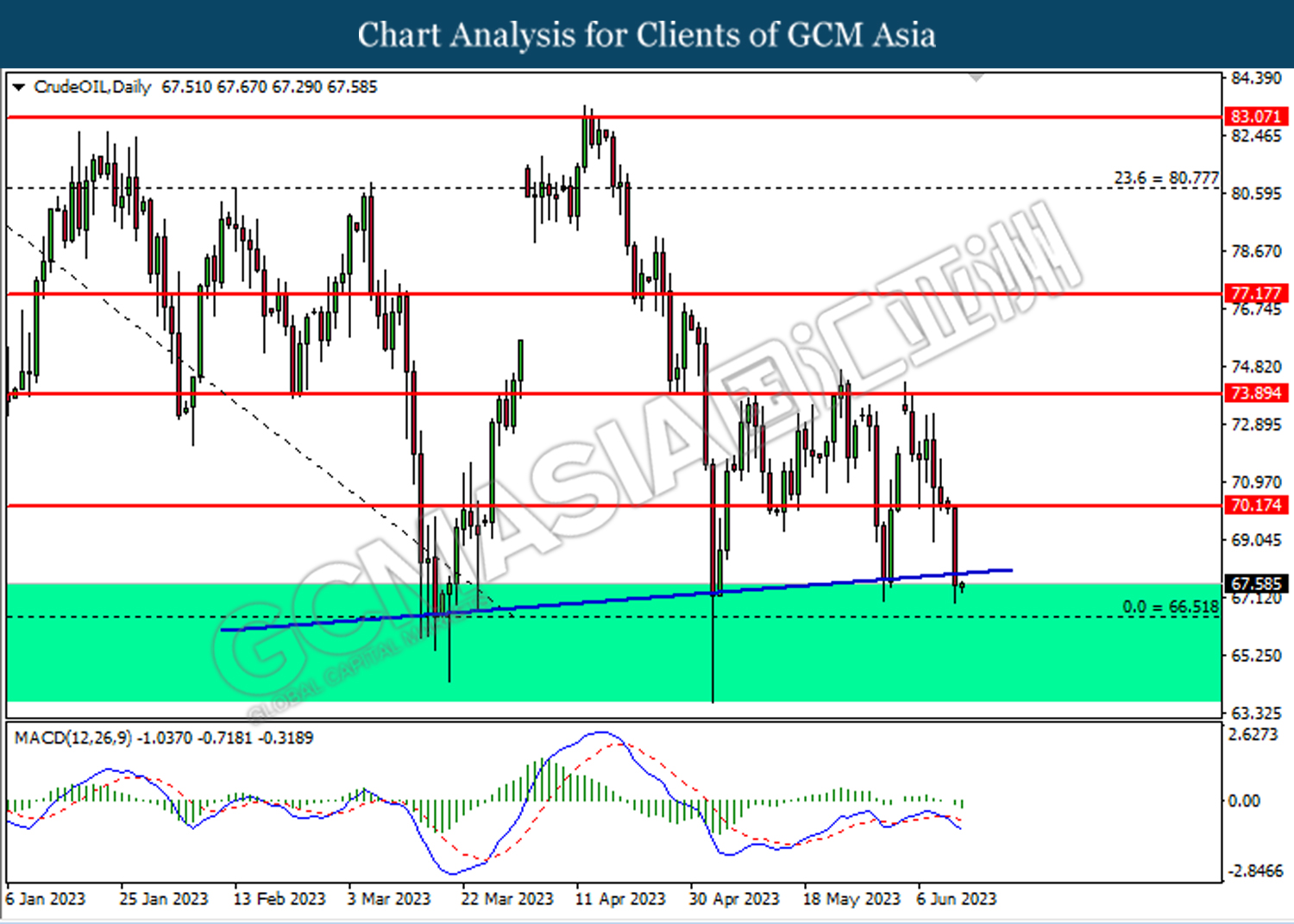

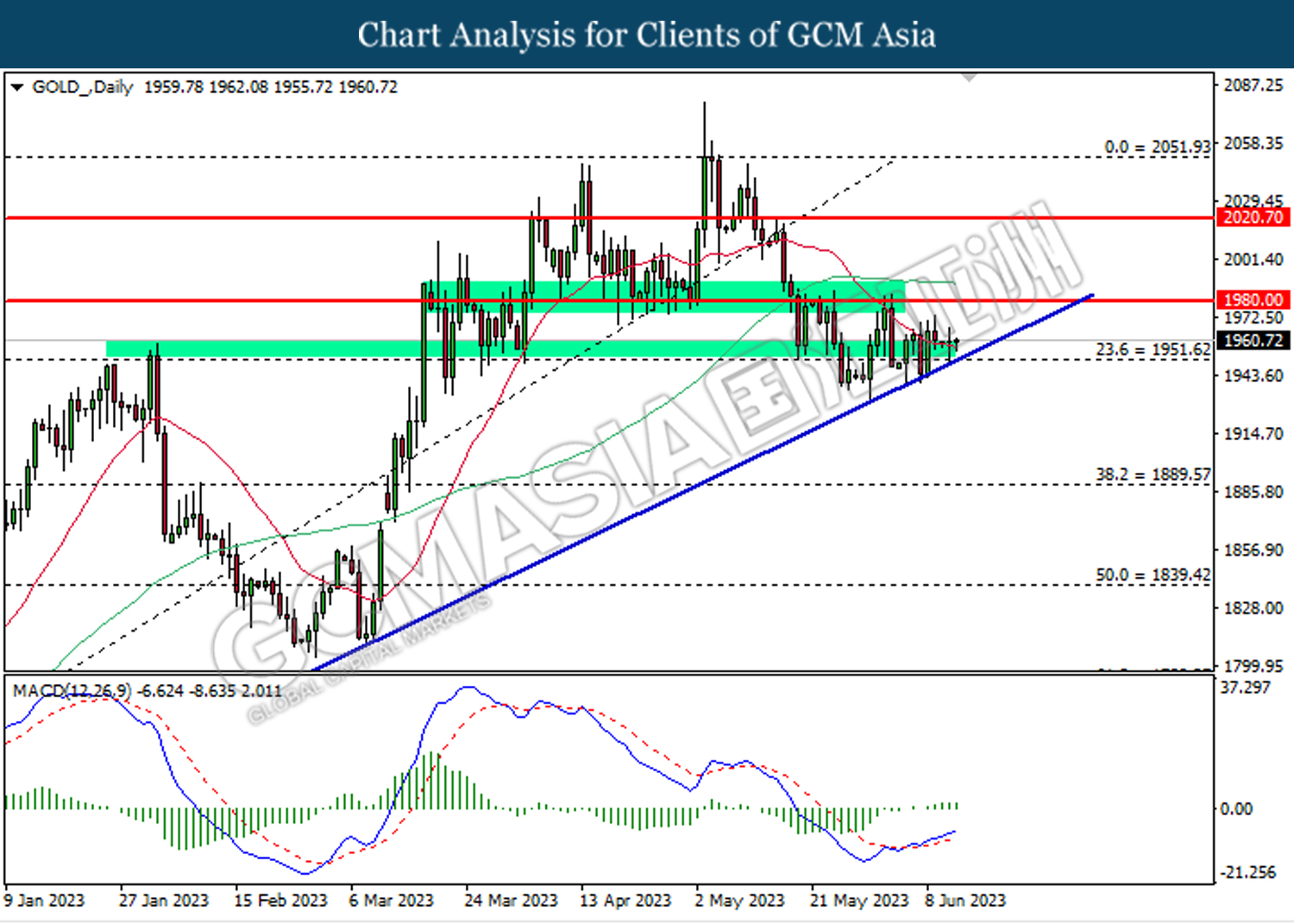

In the commodities market, crude oil prices edged up 0.22% to $67.45 per barrel ahead of the US CPI data, where the data would provide further confirmation if Fed to hike its rate on Thursday. Besides, gold prices were up by 0.19% to $1961.25 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Core CPI (MoM) (May) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (May) | 0.4% | 0.2% | – |

| 20:30 | USD – CPI (YoY) (May) | 4.9% | 4.1% | – |

Technical Analysis

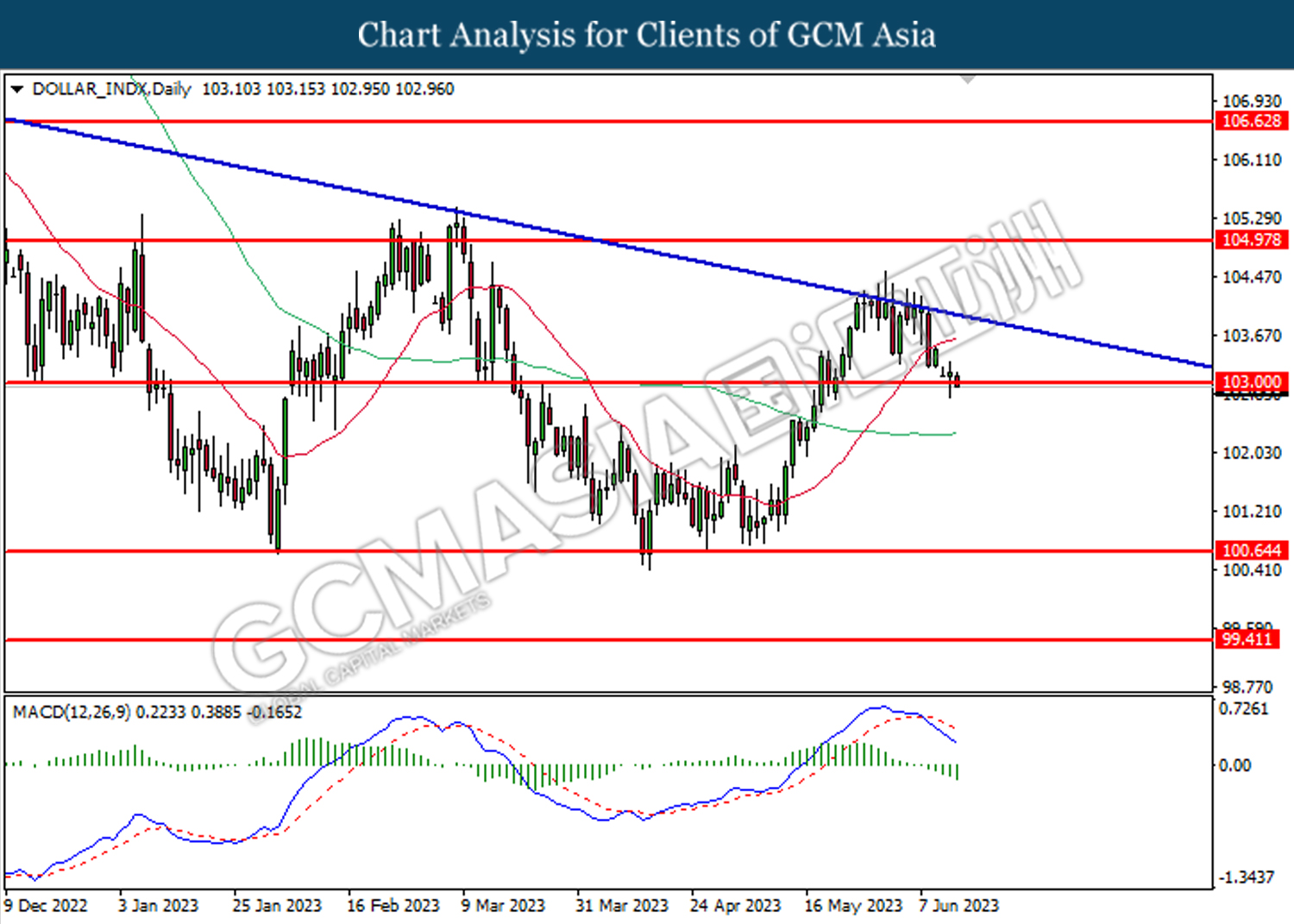

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

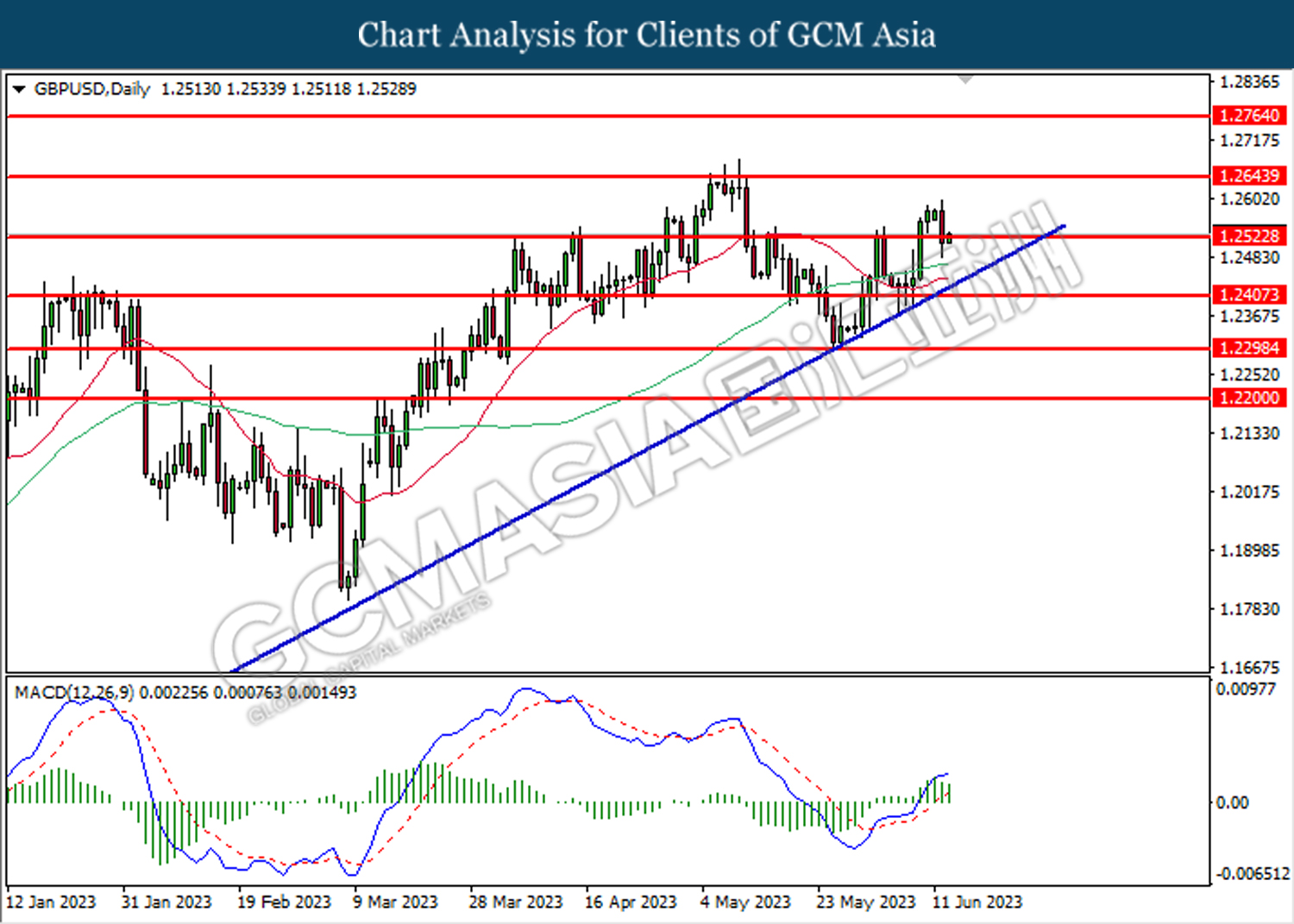

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

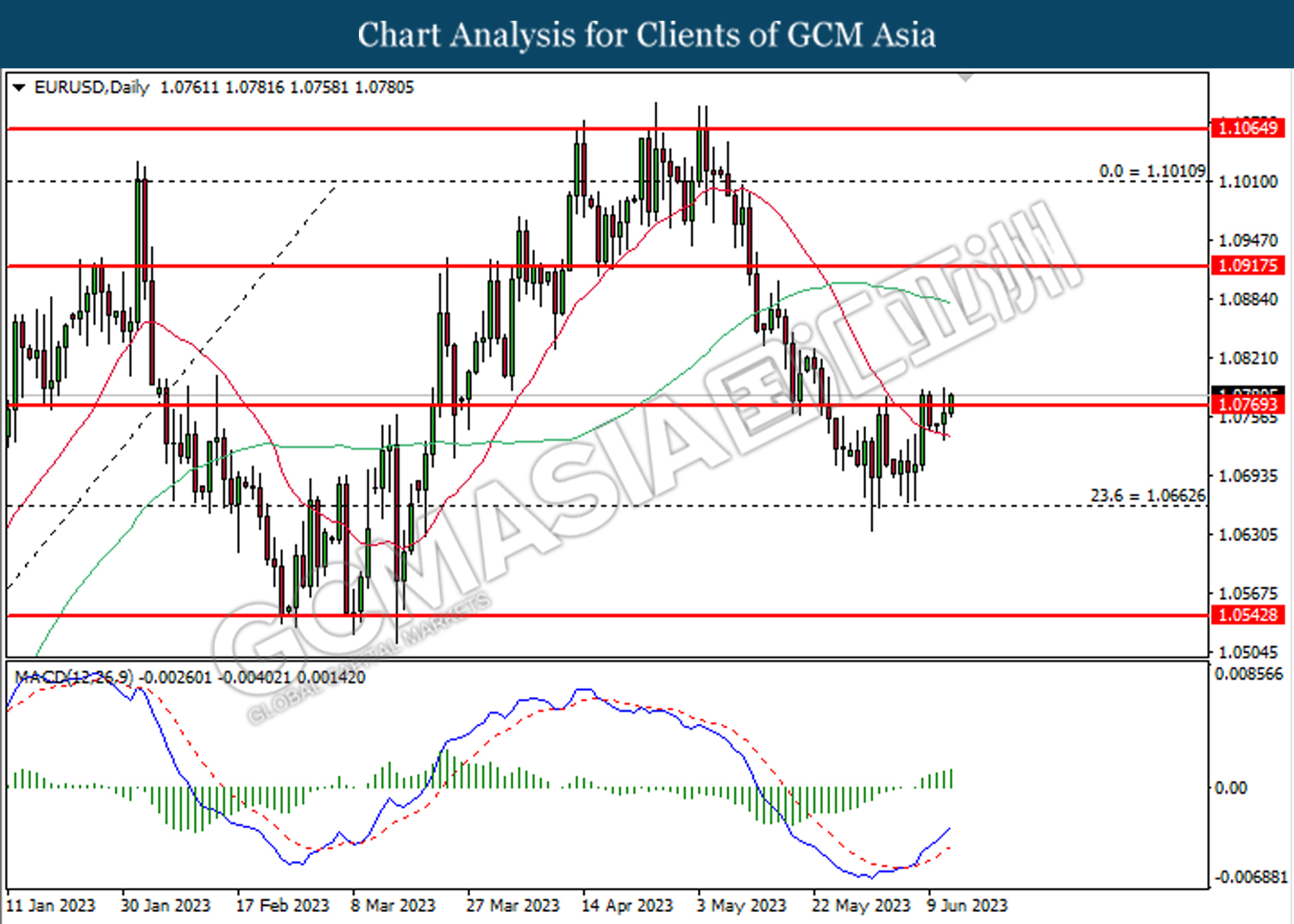

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

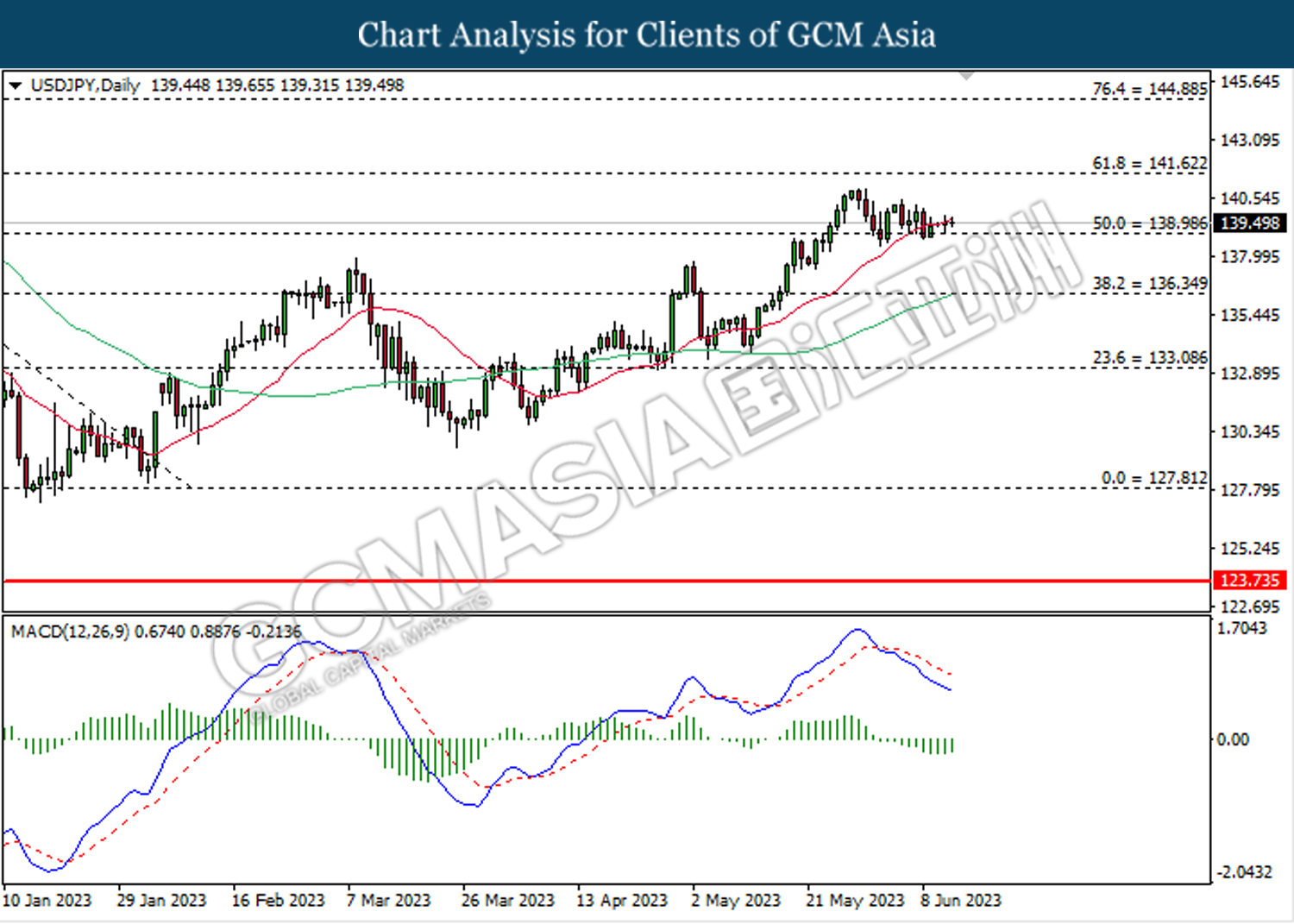

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

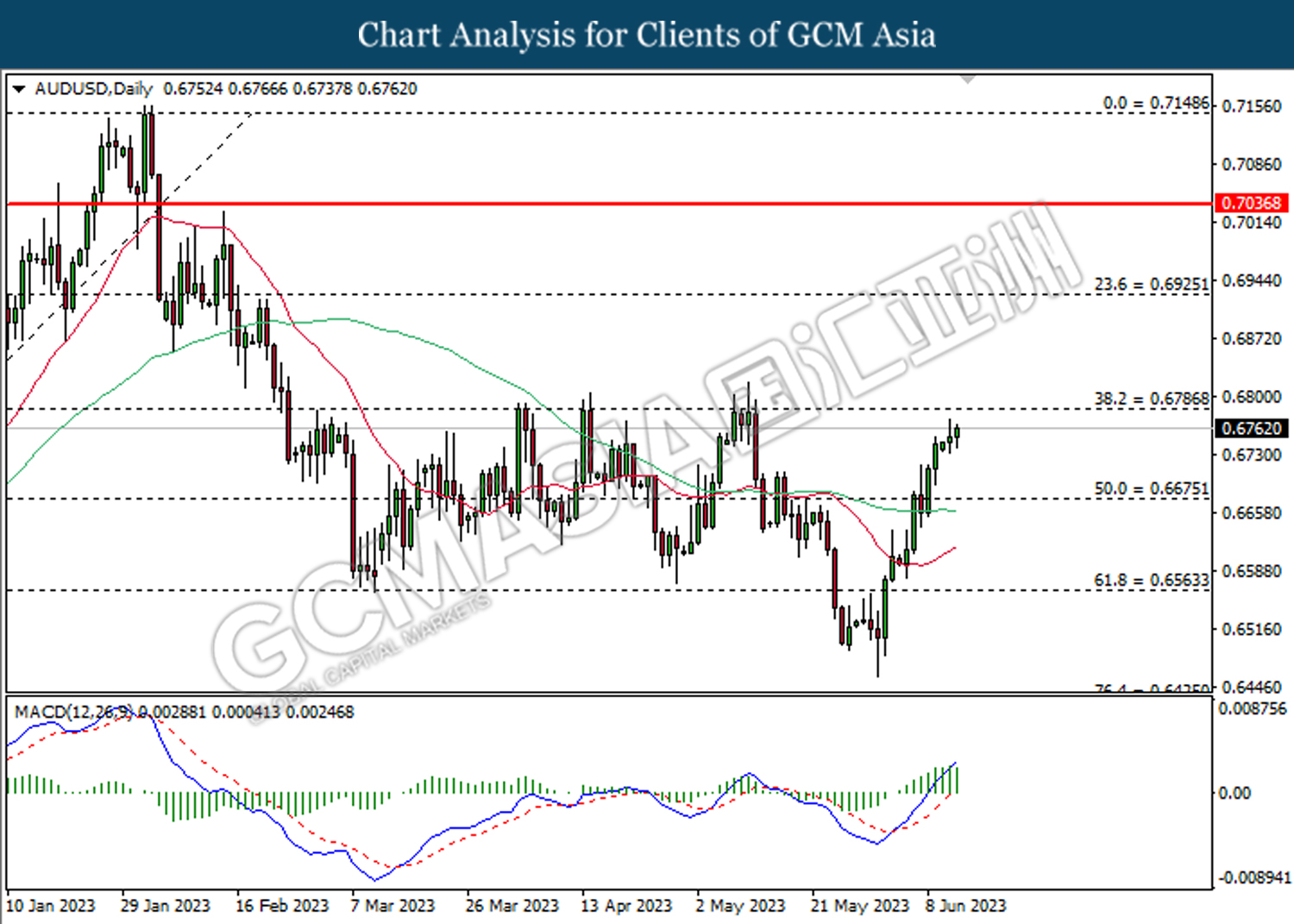

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

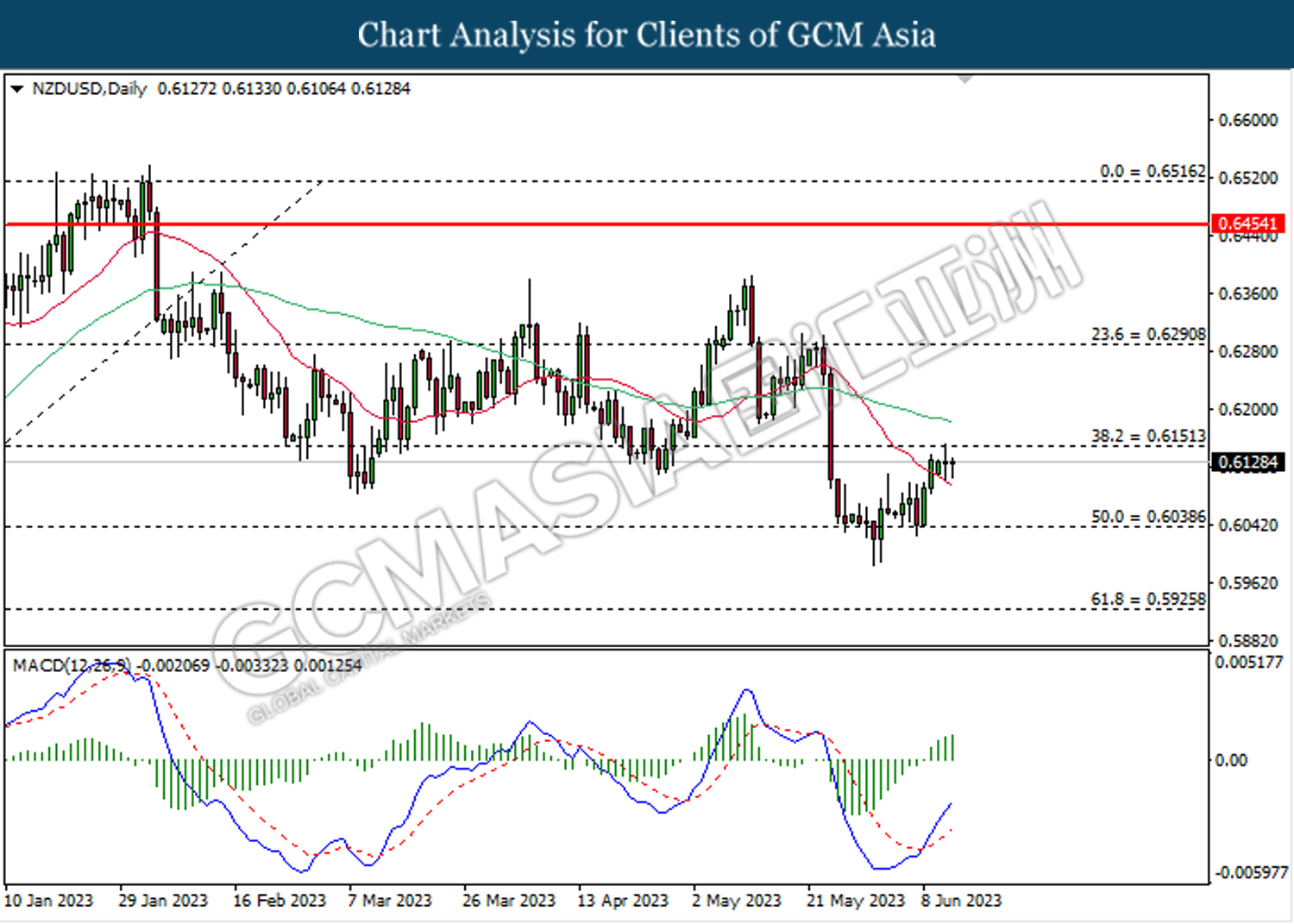

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

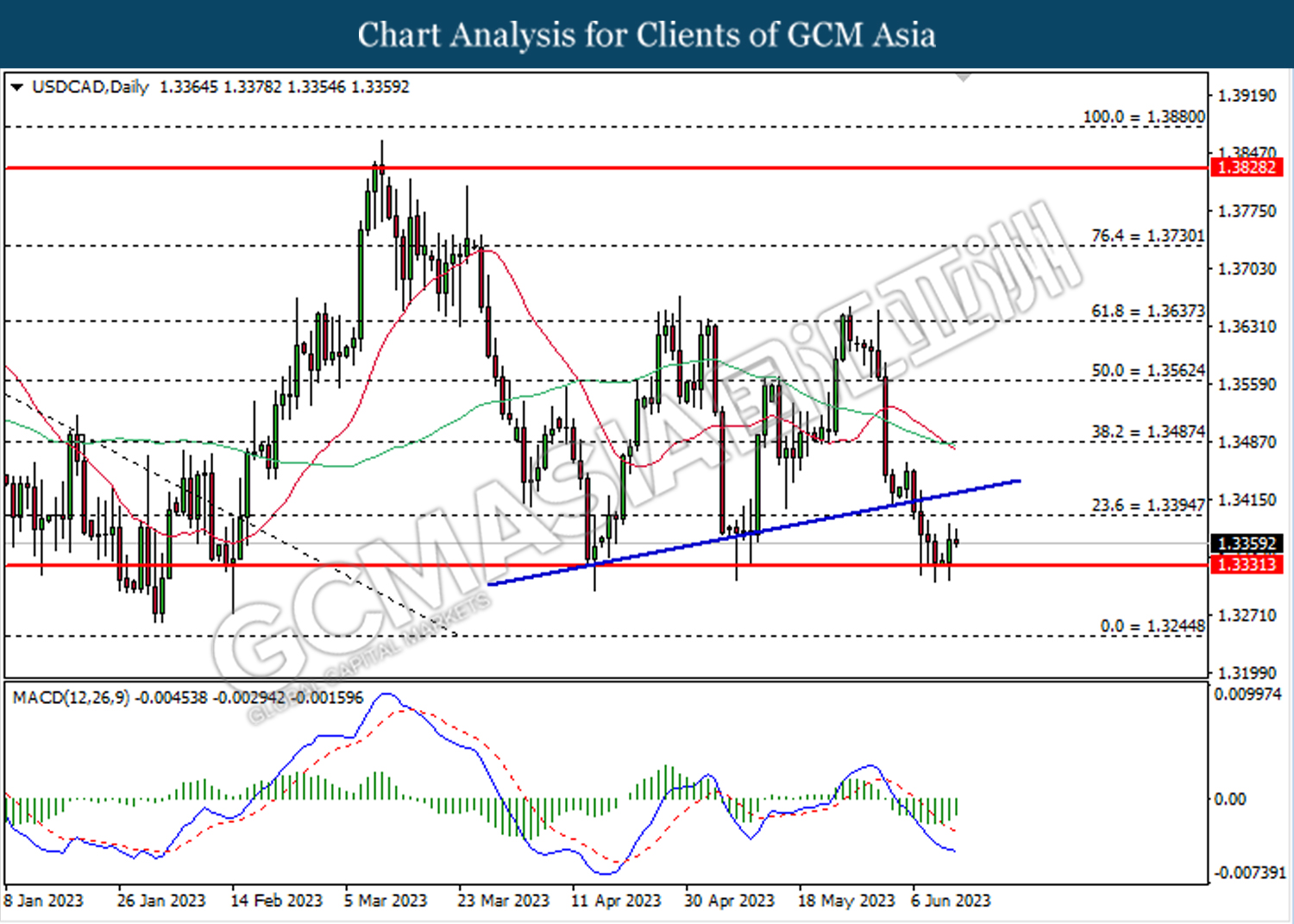

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

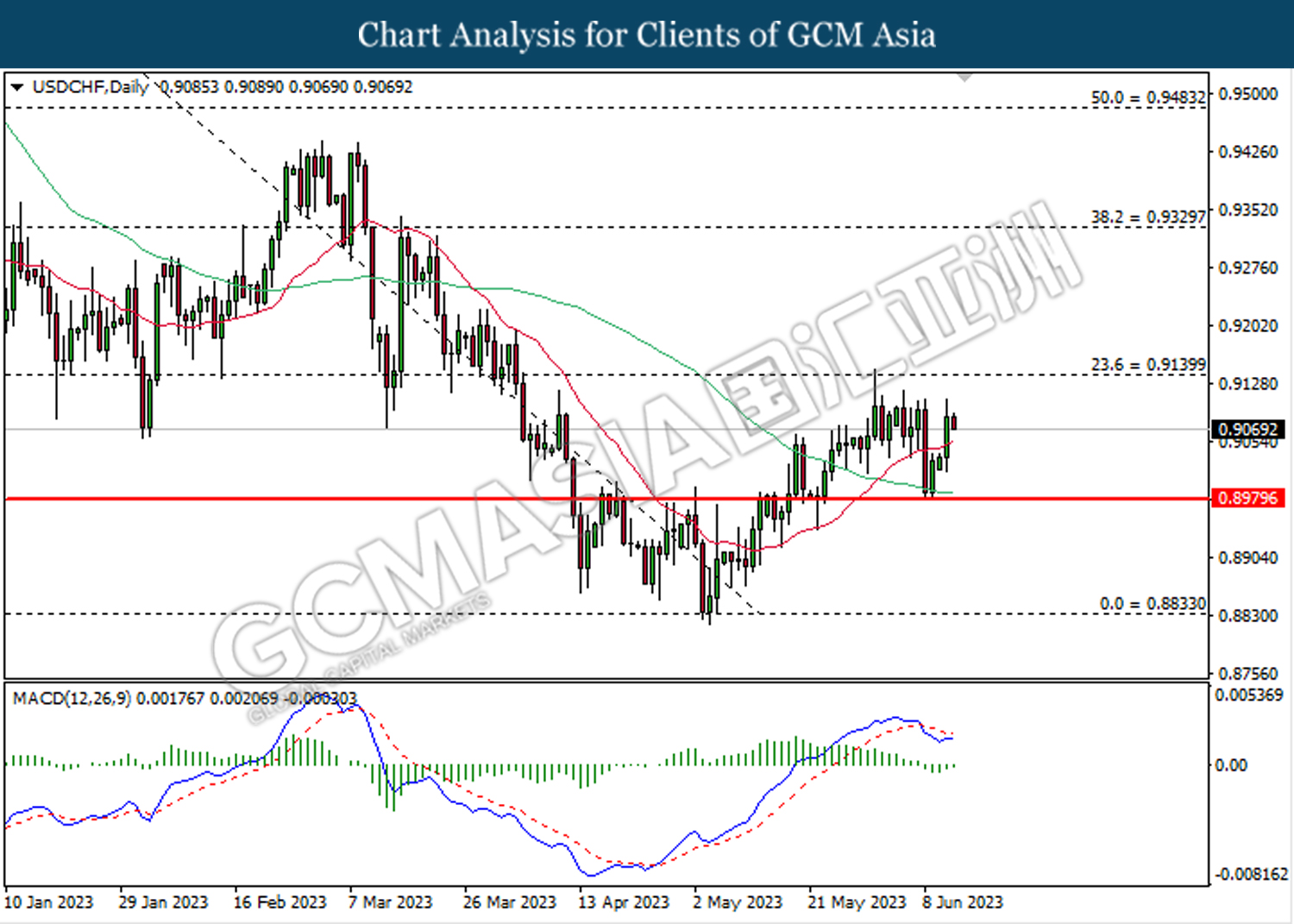

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9140.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous upward trend line. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 74.00

Support level: 66.50, 62.00

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55