13 July 2022 Afternoon Session Analysis

US Dollar rallied upon economy recession fears.

The Dollar Index which traded against a basket of six major currencies rose on Tuesday amid the soaring fears of global economic slowdown. According to Reuters, hundreds of thousands of people were under lockdown in a small China city on Tuesday after just one case of Covid-19 was detected. As China stands with its zero-Covid policy, the government of China has to implement the lockdown to tamp down the spread of the Covid variant. Nonetheless, the implementation of lockdown would likely drag down the economic progression in China, which stoked a shift in sentiment toward safe-haven assets such as US Dollar. Besides, the overall trend of Dollar Index remained bullish following the rising expectation of rate hikes from Federal Reserve. According to CME FedWatch Tool, possibility of 75 basis point increase has reached 91.2%. In addition, investors would continue to focus on the CPI data which will be released tonight in order to gauge the likelihood movement of Dollar Index. As of writing, the Dollar Index appreciated by 0.11% to 108.02.

In the commodities market, crude oil price edged up by 0.17% to $96.00 per barrel after the sharp decline throughout the overnight session over the diminishing demand for oil which was driven by China’s lockdown. On the other hand, gold price appreciated by 0.05% to $1725.70 per troy ounce as of writing. However, gold price stayed under heavy pressure following the strengthening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.70% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM) (May) | -1.00% | 0.10% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.20% | – | – |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.60% | 0.60% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 8.60% | 8.80% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.50% | 2.25% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

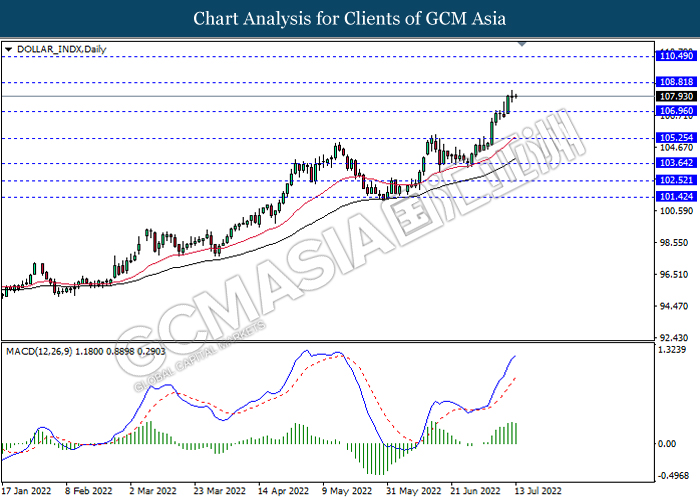

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

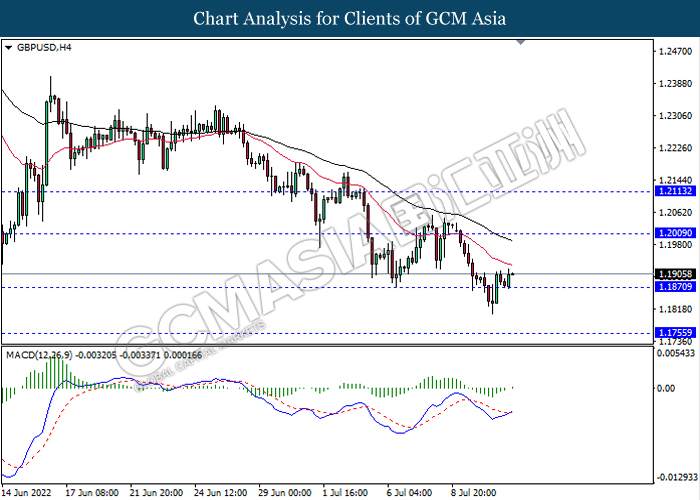

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

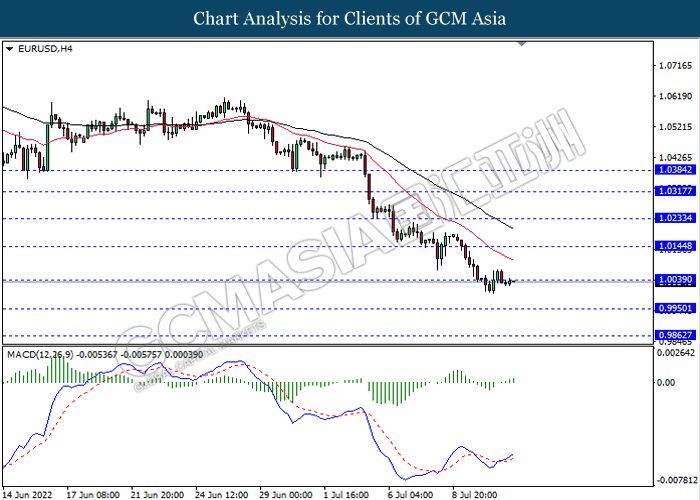

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0040, 1.0145

Support level: 0.9950, 0.9860

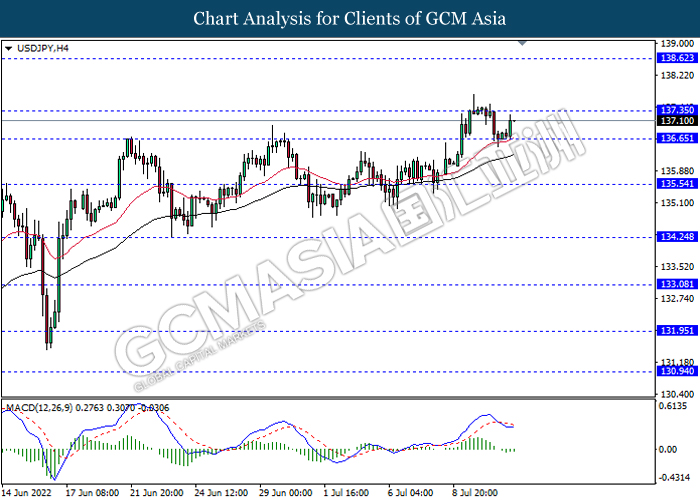

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

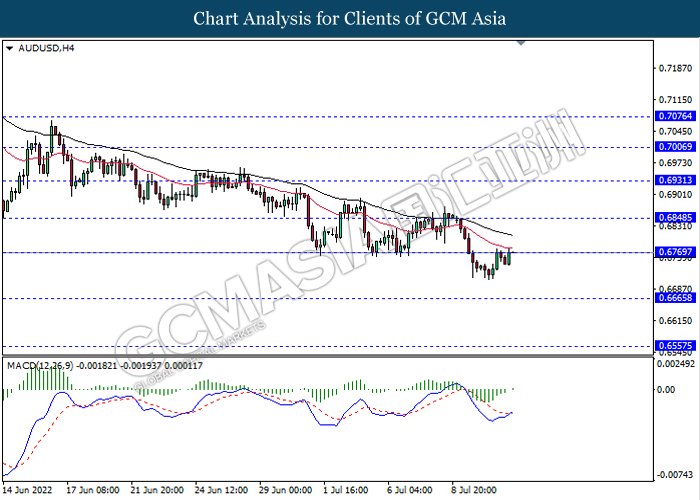

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

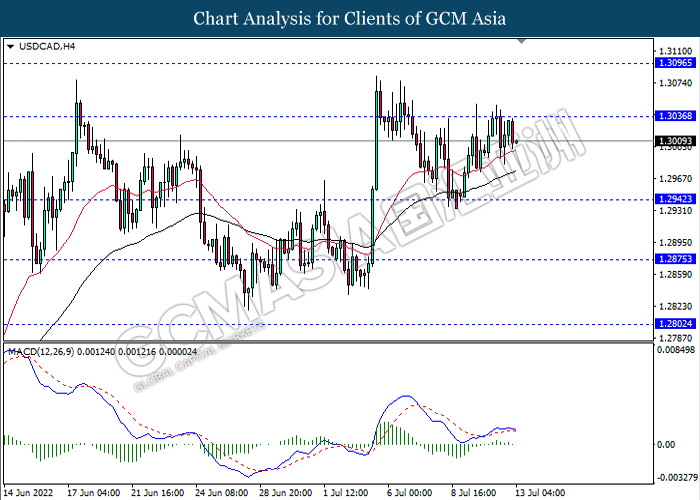

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

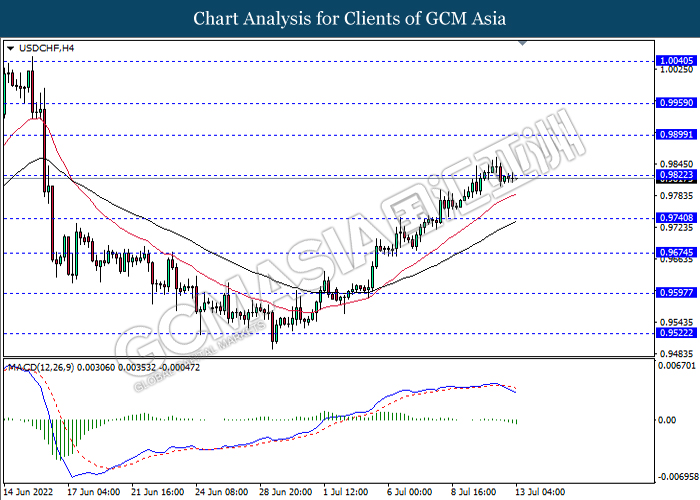

USDCHF, H4: USDCHF was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

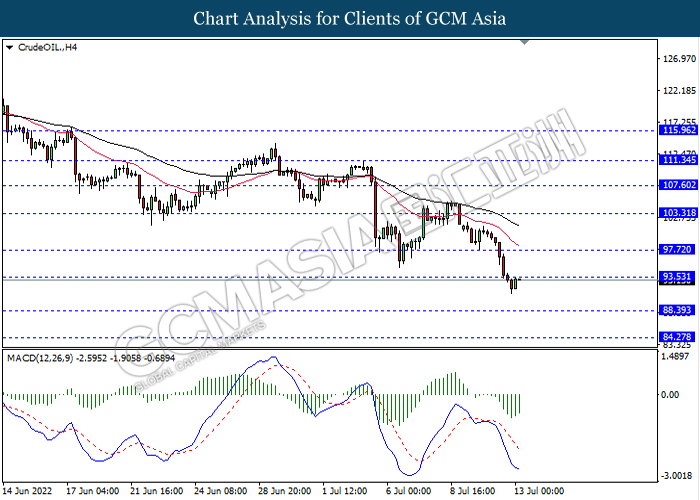

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to be extend its gains if successfully breakout the resistance level.

Resistance level: 93.55, 97.70

Support level: 88.40, 84.25

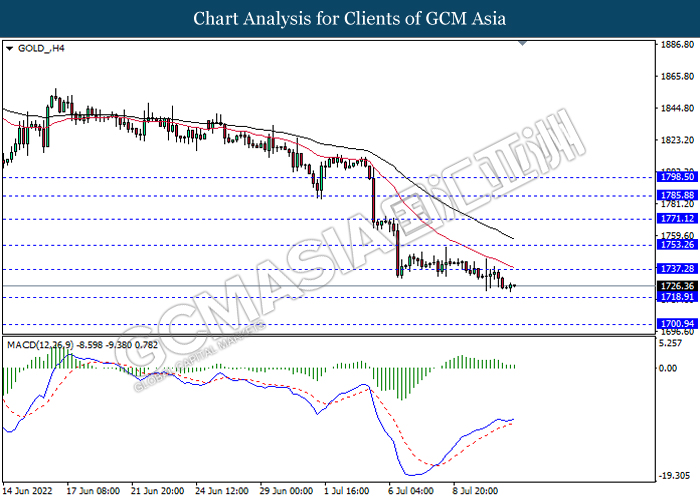

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1737.30, 1753.25

Support level: 1718.90, 1700.95