13 July 2022 Morning Session Analysis

Euro slumped amid bearish economic data.

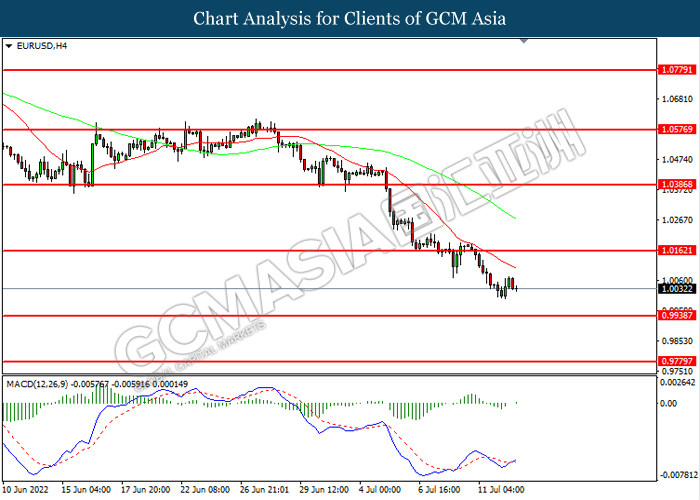

The Euro slumped significantly over the backdrop of bearish economic data yesterday. According to ZEW, Germany ZEW Economic Sentiment notched down significantly from the previous reading of -28.0 to -53.8, missing the market forecast at -38.3. Market participants remained concerns upon the energy crisis in Germany as well as the rate hike decision from European Central Bank to stabilize the inflation risk would continue to dampen the economic outlook in European region. Besides, economists predicted the current economic situation significantly more pessimistic compare to previous month and have further lowered their GDP forecast in future. In addition, the Euro extend its losses following some cities in China re-impose partial lockdowns amid the resurgence of Covid-19 cases, which stoked a shift in sentiment toward other safe-haven asset such as US Dollar. As of writing, EUR/USD depreciated by 0.06% to 1.0030.

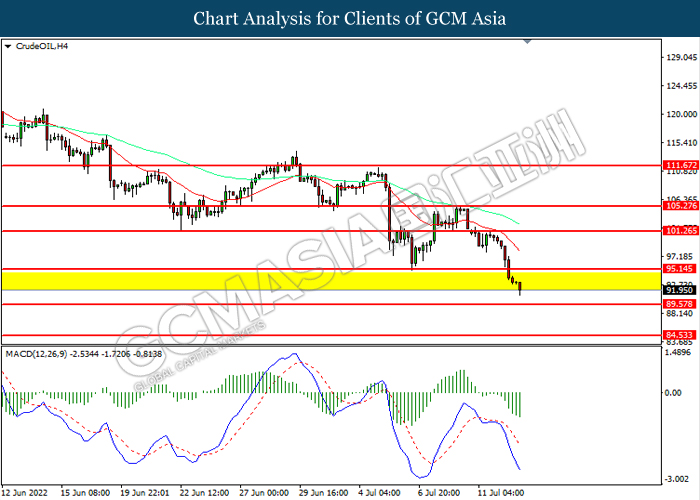

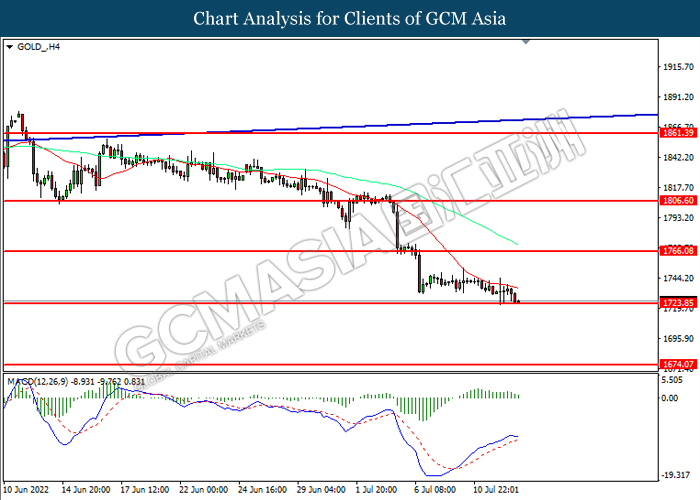

In the commodities market, the crude oil price slumped 1.57% to $91.80 per barrel as of writing. According to American Petroleum Institute (API), the crude oil inventories notched up from the previous reading of 3.825M to 4.762M, higher than the market forecast -1.933M. On the other hand, the gold price depreciated by 0.04% to $1725.00 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) | 8.70% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM) (May) | -1.00% | 0.10% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 0.20% | – | – |

| 20:30 | USD – Core CPI (MoM) (Jun) | 0.60% | 0.60% | – |

| 20:30 | USD – CPI (YoY) (Jun) | 8.60% | 8.80% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.50% | 2.25% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

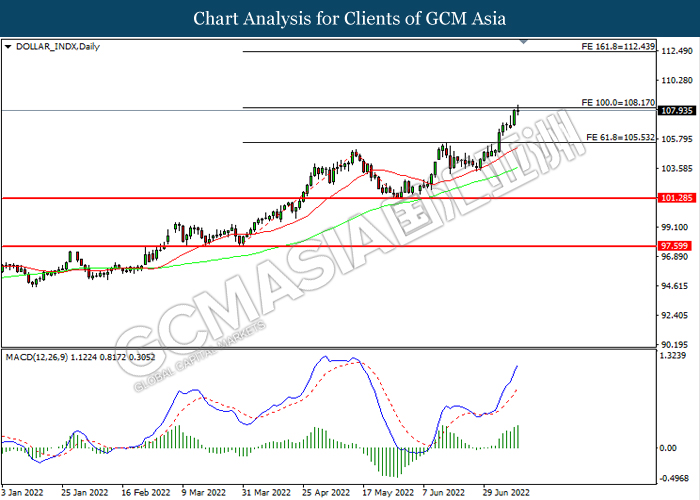

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

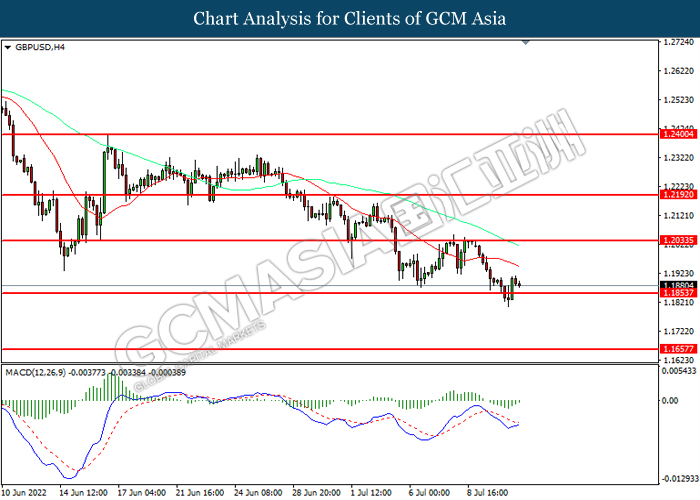

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2035, 1.2190

Support level: 1.1855, 1.1655

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0160, 1.0385

Support level: 0.9940, 0.9780

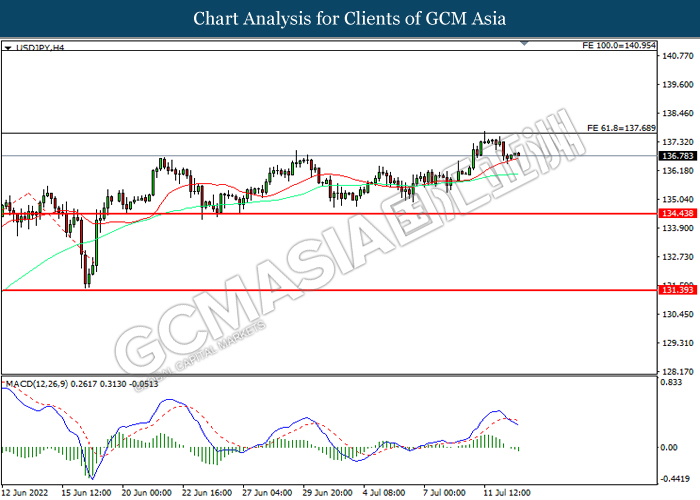

USDJPY, H4: USDJPY was traded lower higher while currently near the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 137.70, 140.95

Support level: 134.45, 131.40

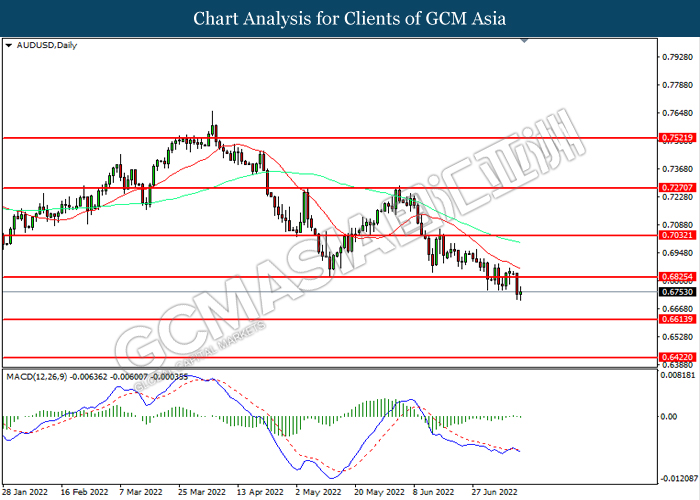

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6825, 0.7030

Support level: 0.6615, 0.6420

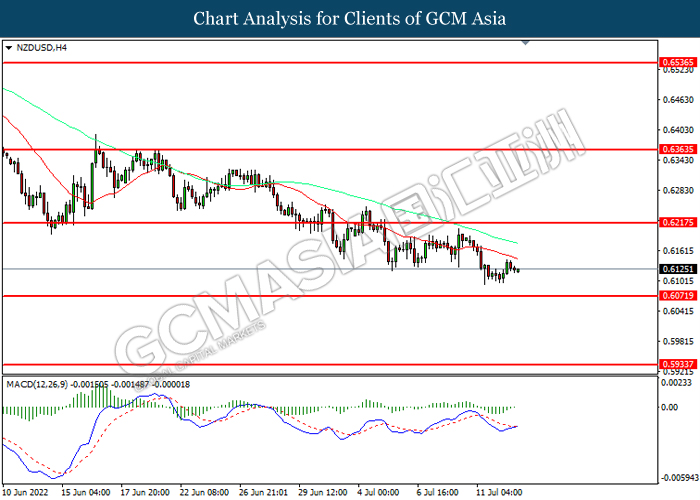

NZDUSD, H4: NZDUSD was traded within a range while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

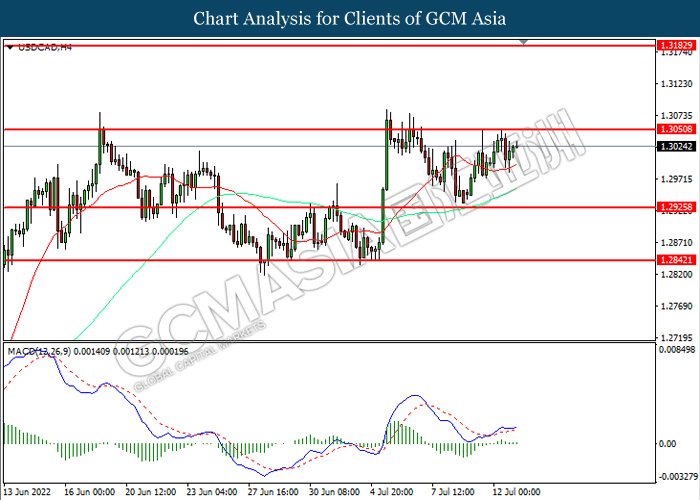

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

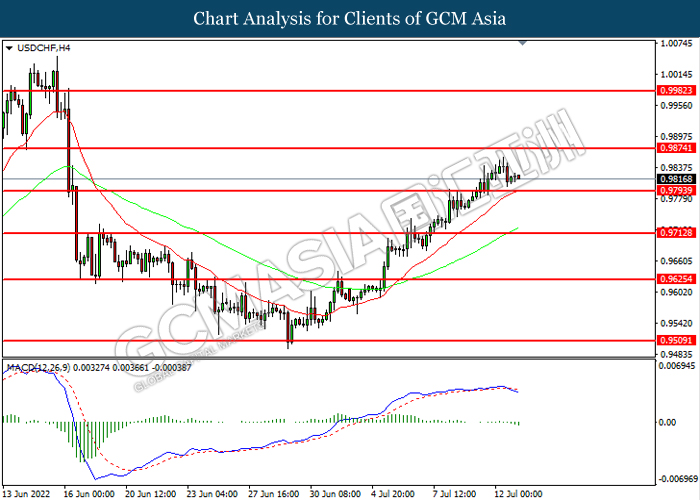

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9875, 0.9980

Support level: 0.9795, 0.9715

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 95.15, 101.25

Support level: 89.60, 84.55

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1766.10, 1806.60

Support level: 1723.85, 1674.05