13 September 2022 Afternoon Session Analysis

Downbeat data weighed on Pound.

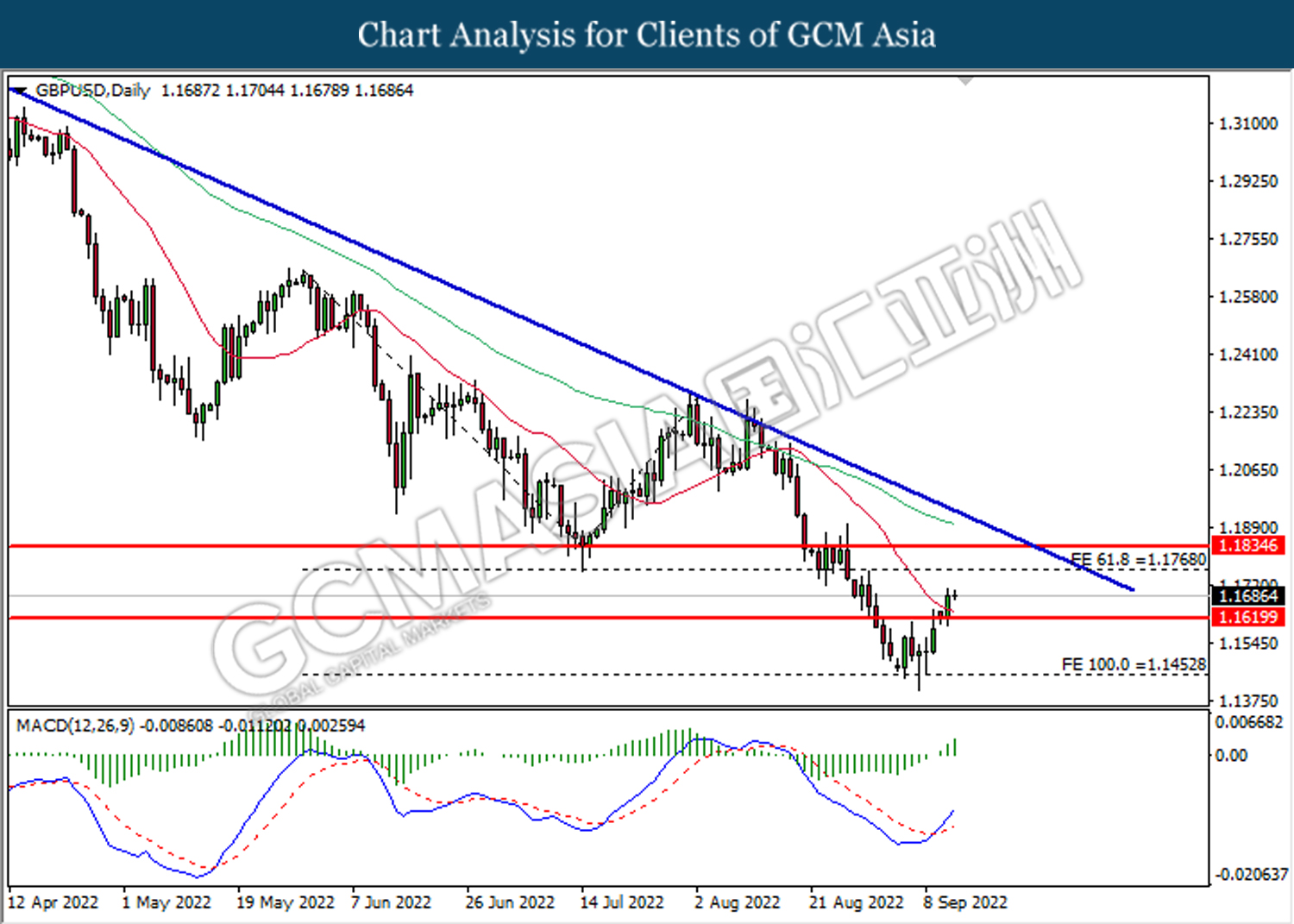

The Sterling Pound, which was majorly traded by global investors, experienced huge sell-off pressures after a series of downbeat data were released yesterday. According to the Office for National Statistics, the GDP for the month of July rose by 0.2%, weaker than the consensus forecast of 0.3%, amid the factors of worker shortages and heightening costs of living with the backdrop of heightened recession risk. Prior to now, the Bank of England (BoE) reckoned that the UK economy would enter into a recession phase for the next 15 months, as revealed during the last central bank meeting. Besides, BoE had also warned that the rising inflation fueled by the elevating energy prices would probably further exacerbate the economy into a lengthy recession. On the other side, the UK Manufacturing Production data, which came in at 0.1%, lower than the consensus forecast of 0.4% mirrored that the new order dropped further amid economic uncertainty and heightened recession risk. As of writing, the pair of GBP/USD dropped 0.04% to 1.1680.

In the commodities market, the crude oil price depreciated by -1.12% to $86.70 despite the Nuclear deal between the western countries and Iran being far off the table. Besides, the gold prices depreciated by -0.17% to $1721.80 per troy ounce while the market participants are all eyes on the long-awaited CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jul) | 5.10% | 5.20% | – |

| 14:00 | GBP – Claimant Count Change (Aug) | -10.5K | -13.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | -55.3 | -60 | – |

| 20:30 | USD – Core CPI (MoM) (Aug) | 0.30% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Aug) | 8.50% | 8.10% | – |

| 20:30 | USD – CPI (MoM) (Aug) | 0.00% | -0.10% | – |

Technical Analysis

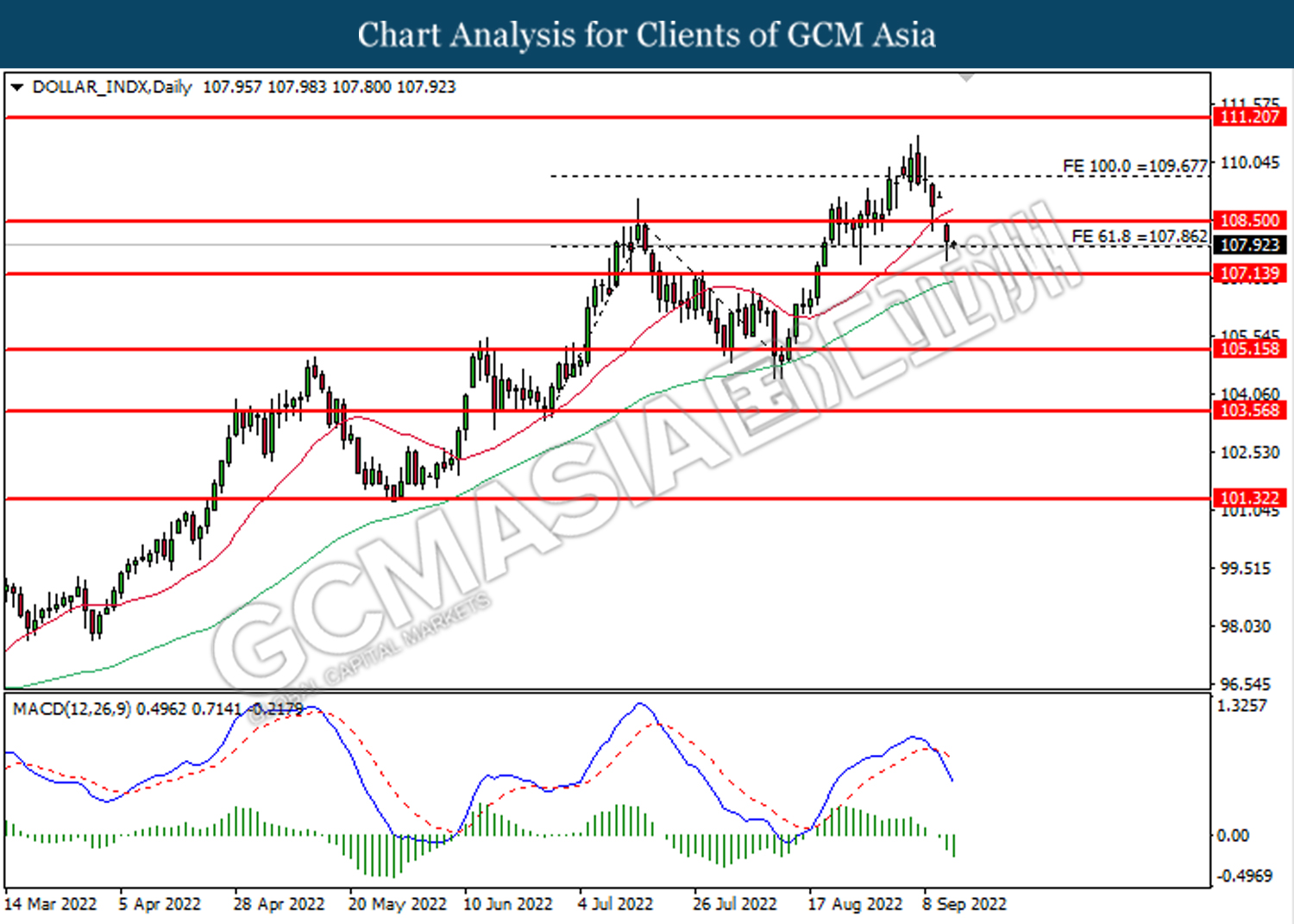

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 107.85. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 108.50, 109.65

Support level: 107.85, 107.15

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1770.

Resistance level: 1.1770, 1.1835

Support level: 1.1620, 1.1455

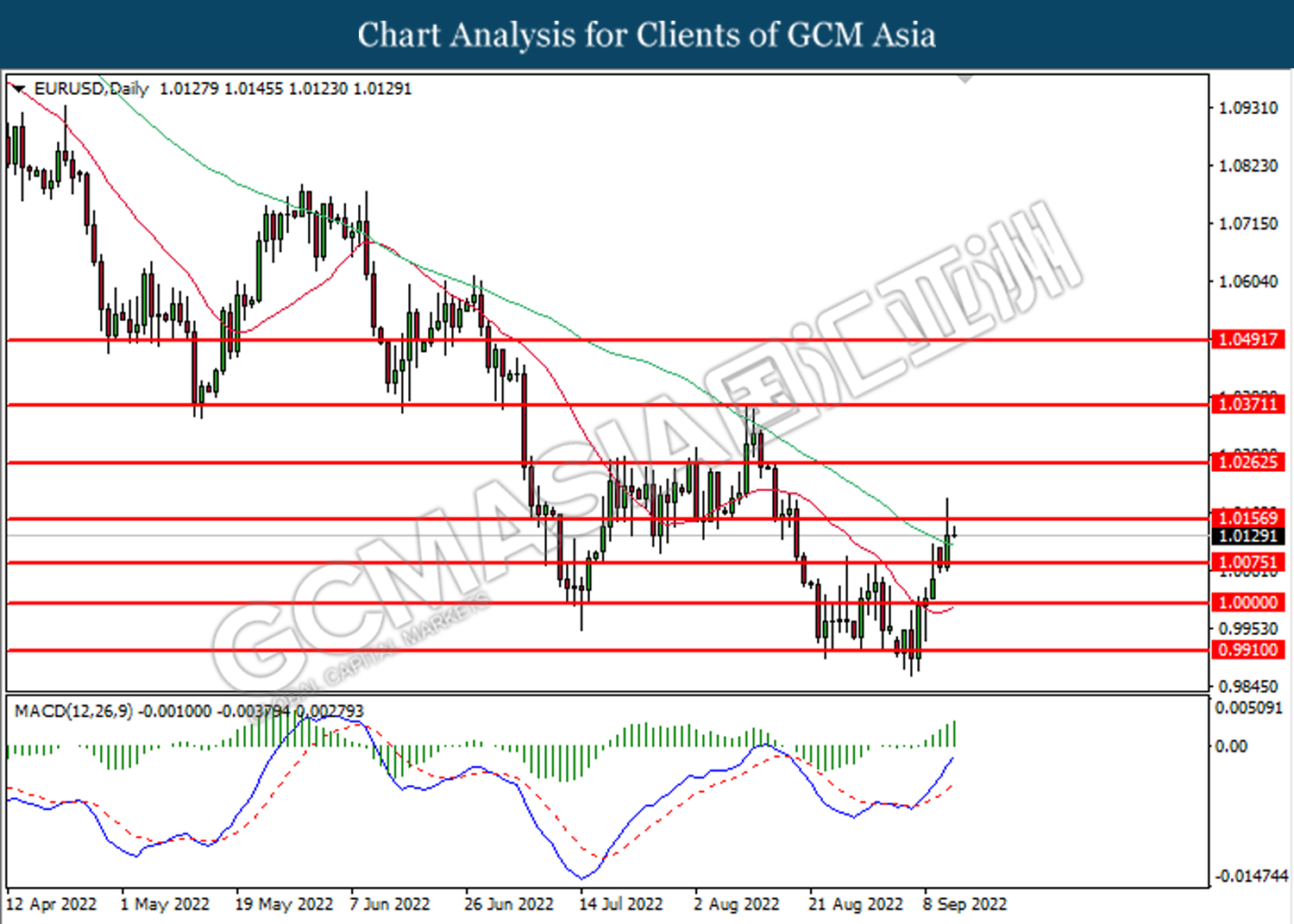

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0155.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 1.0000

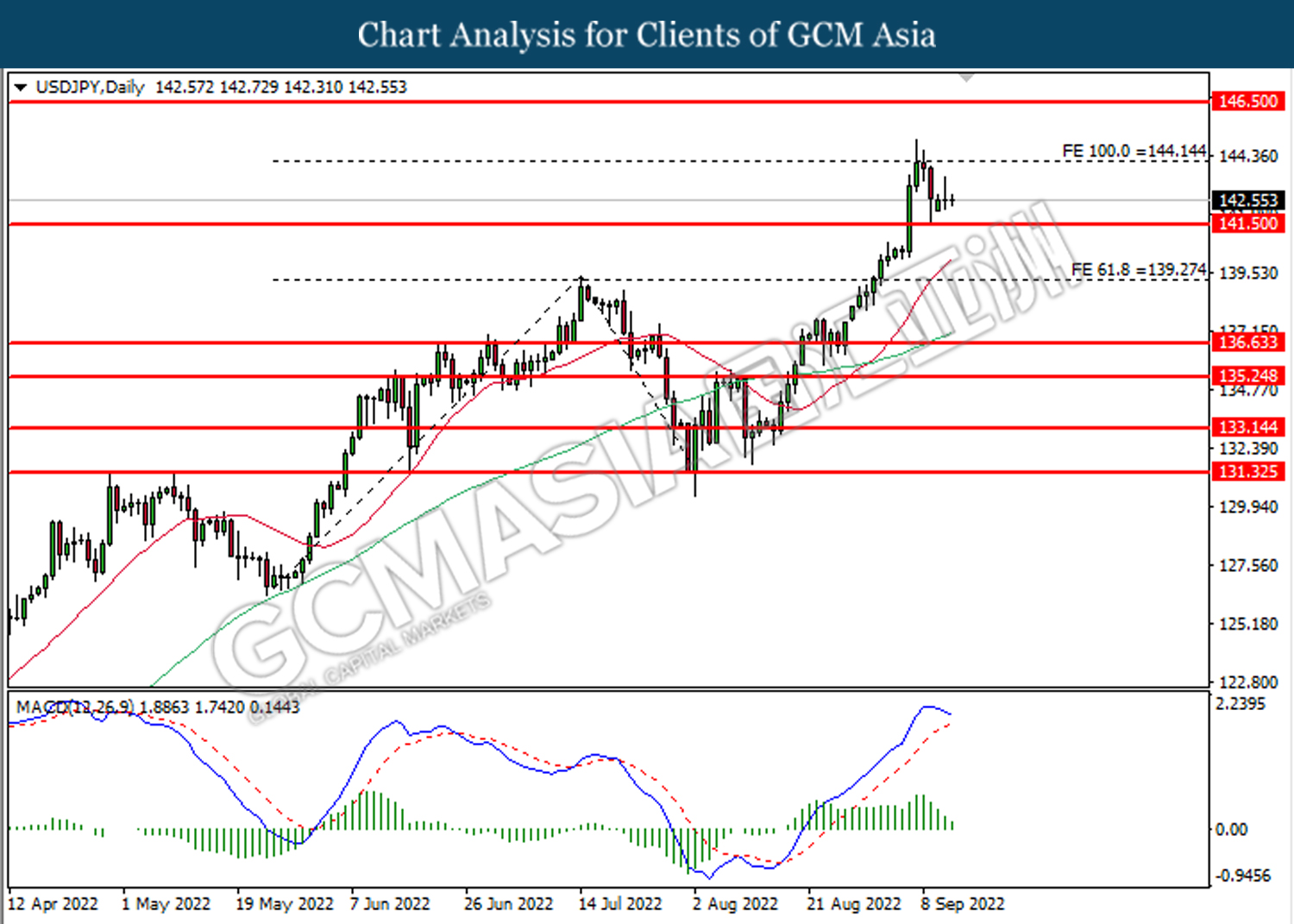

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 144.15. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

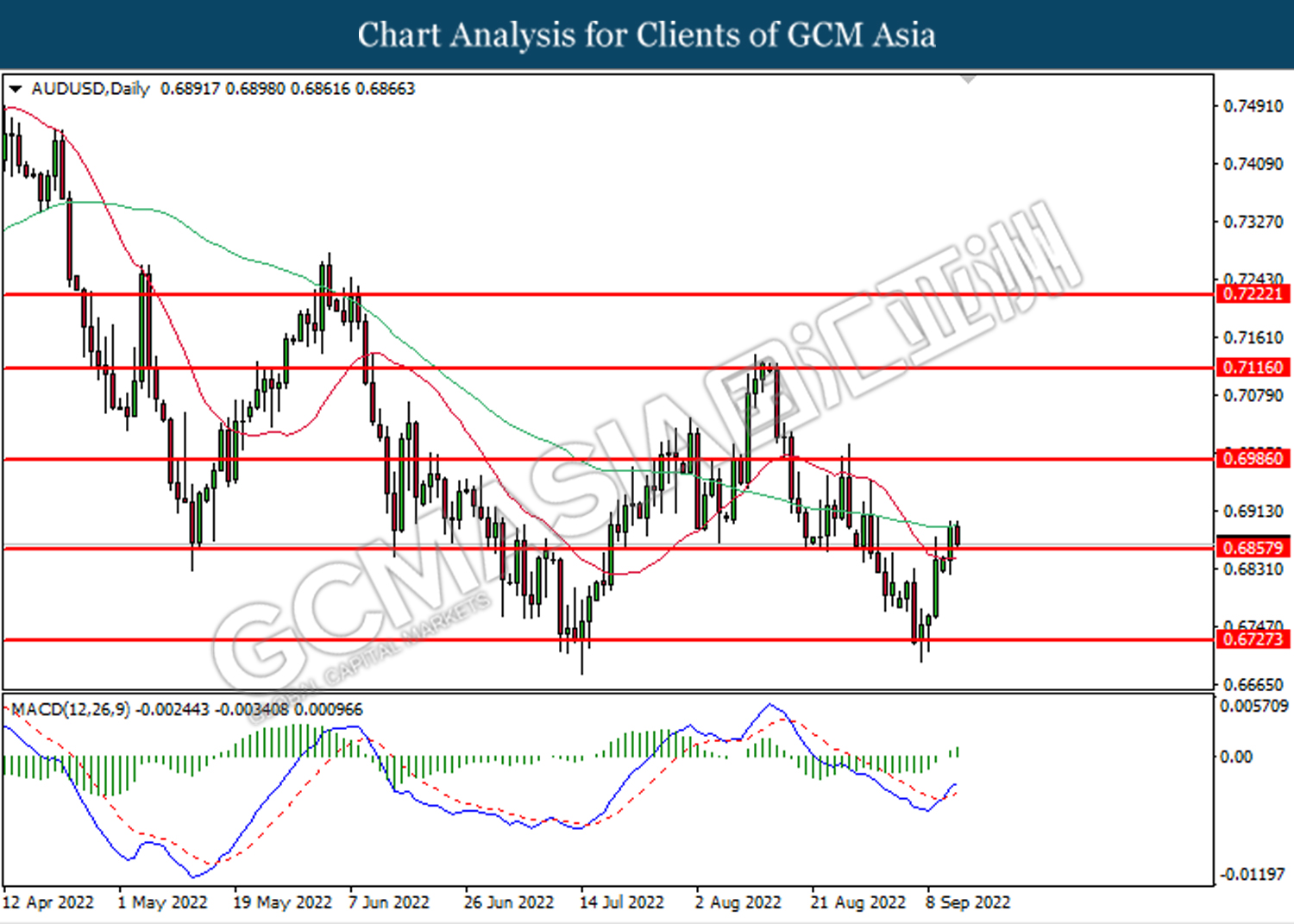

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

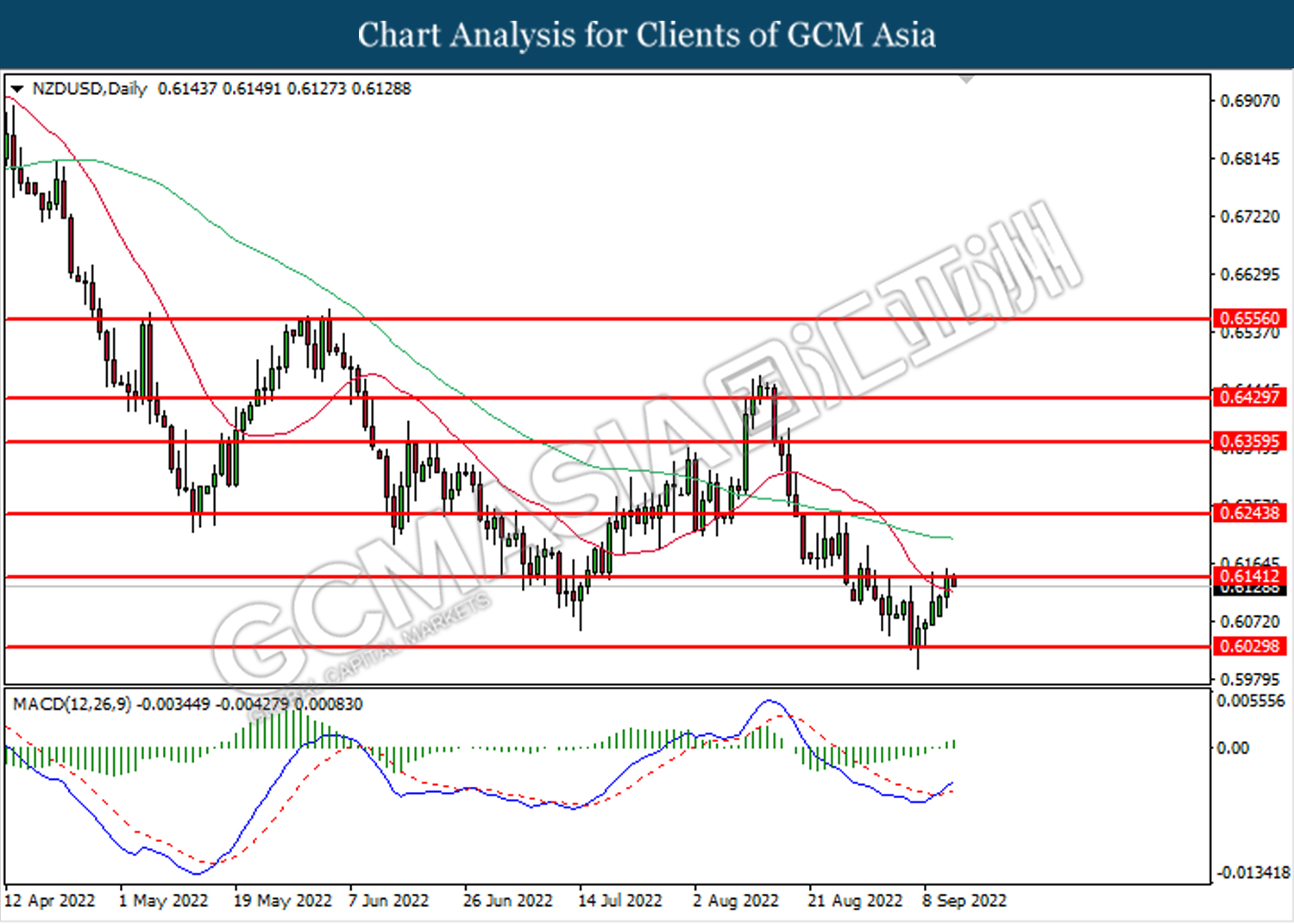

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6140. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6140, 0.6245

Support level: 0.6030, 0.5925

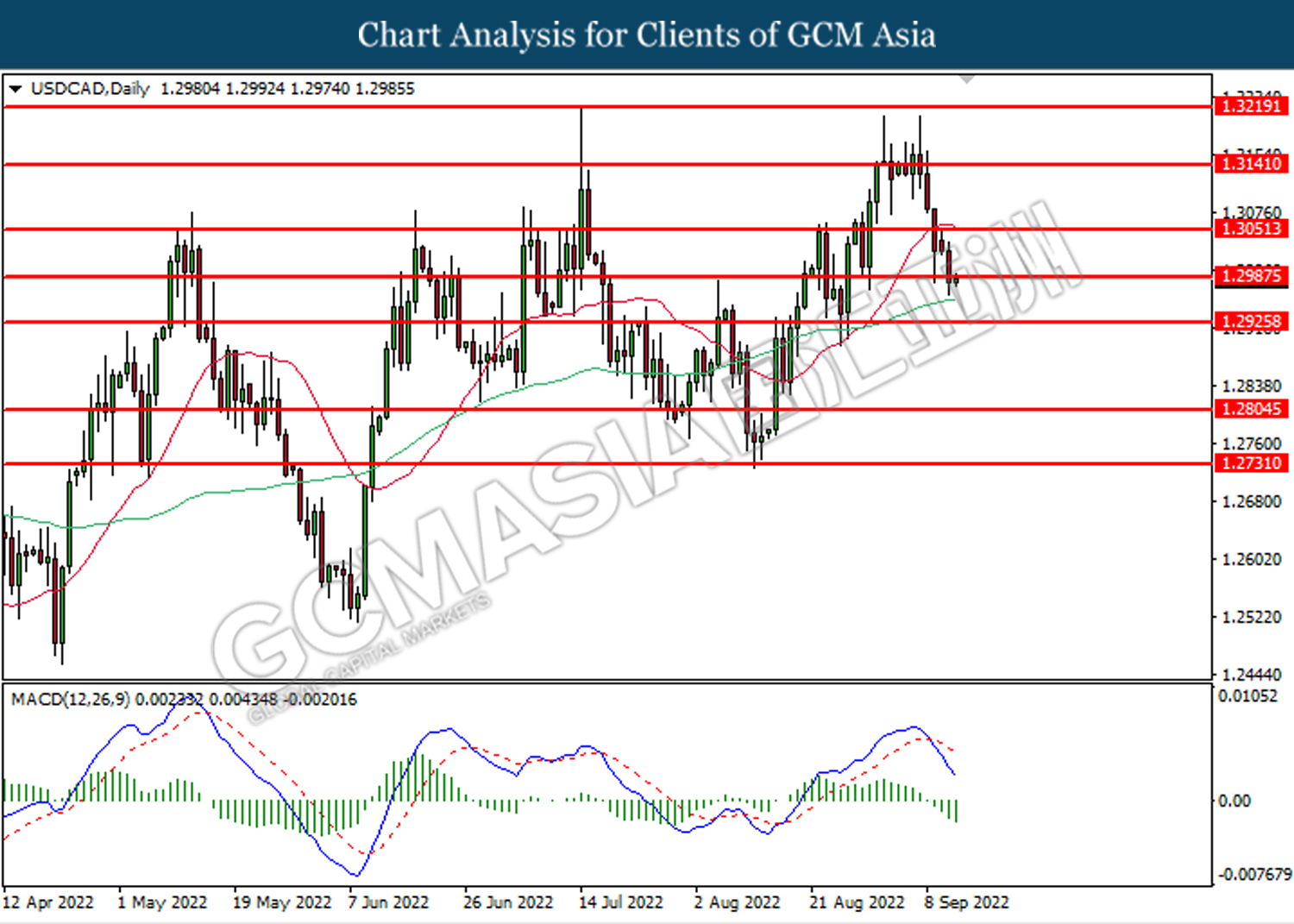

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2985. MACD which illustrated bearish bias momentum suggests the pair to extend losses toward the support level at 1.2925.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

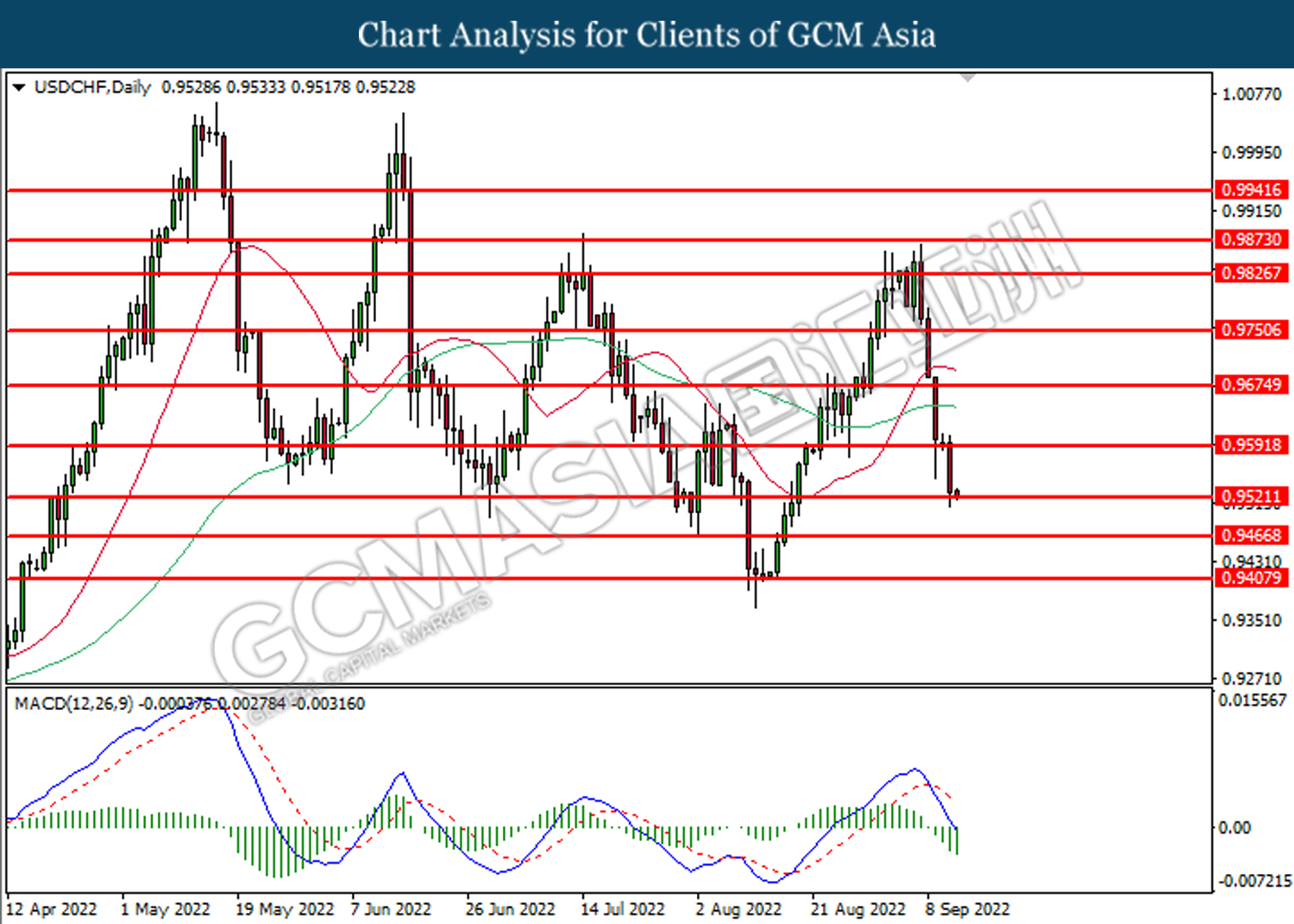

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9465

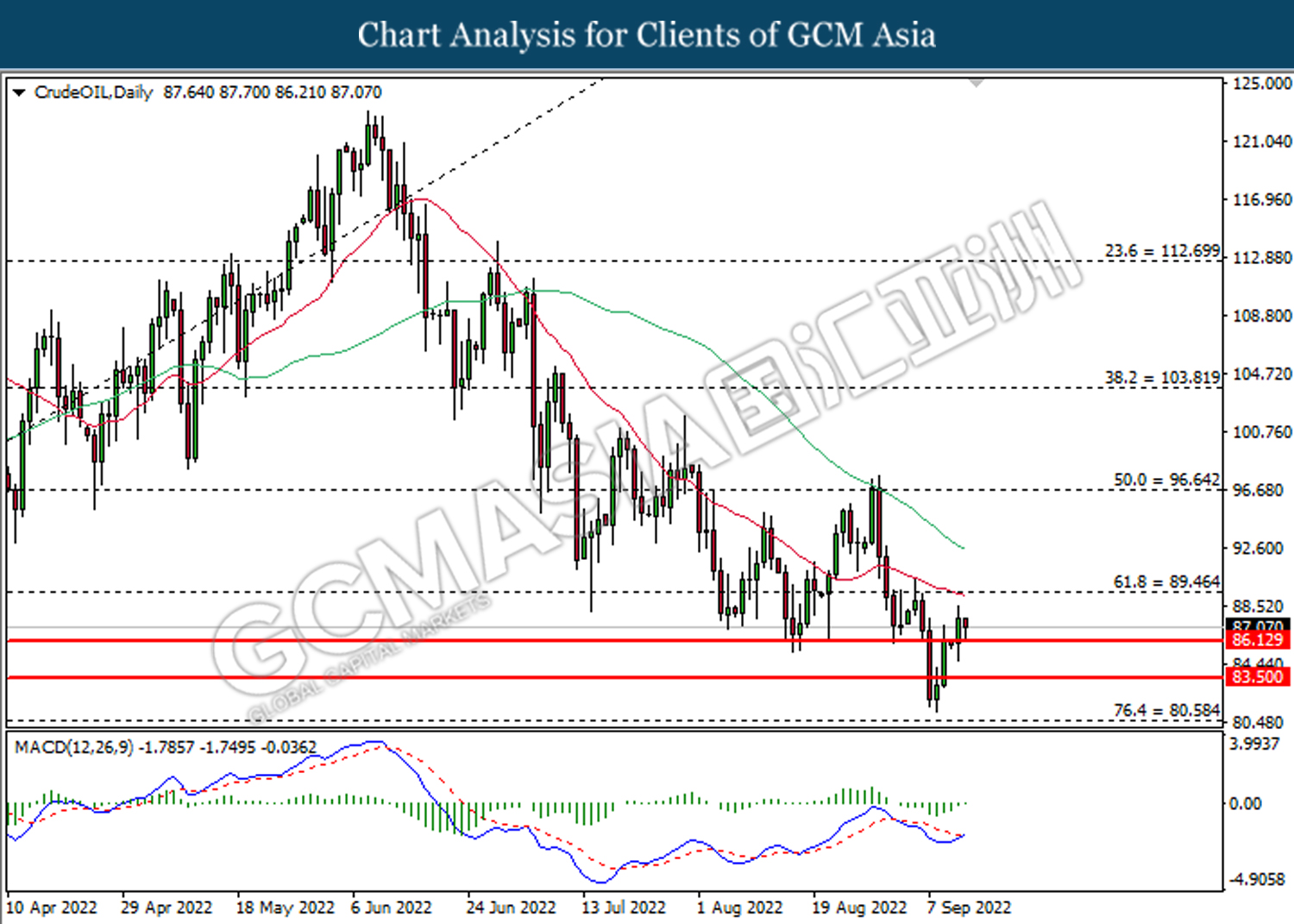

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 89.45.

Resistance level: 89.45, 96.65

Support level: 86.15, 83.50

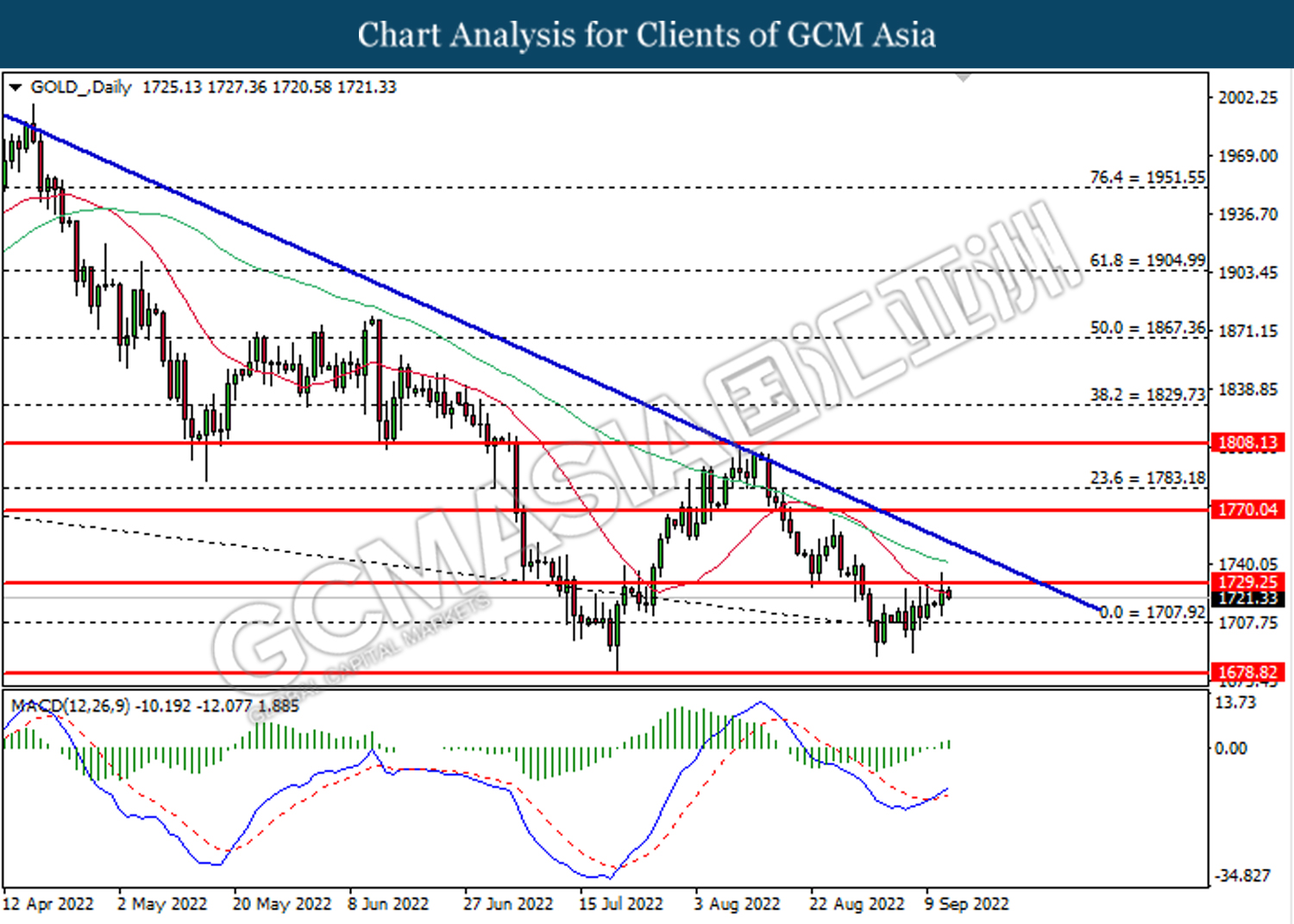

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80