13 October 2022 Afternoon Session Analysis

Yen tumbled as stagflation risk continue hovered in financial market.

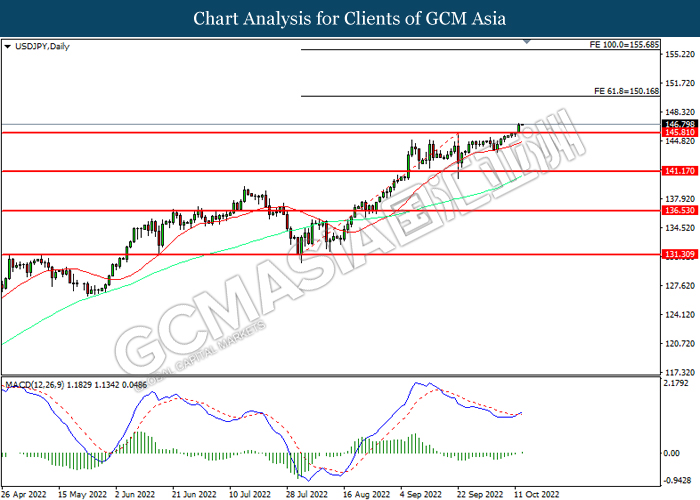

The Japanese Yen extend its losses on Thursday, currently hovering its weakest level in 32 years following the released higher-than-expected inflation reading from United States, prompting the widening the interest differential between Japan and US Treasury yield. Nonetheless, the losses experienced by the Japanese Yen was limited by the expectation upon the currency intervention from Bank of Japan as the Japanese Policymakers continued to warn against significant depreciation of Japanese Yen. On the economic data front, Bank of Japan (BoJ) reported that the current Japan Producer Price Index (PPI) notched up significantly from the previous reading of 9.4% to 9.7%, exceeding the market forecast at 8.8%. Given that most businesses have taken to passing on high material costs to customers, the Japan’s consumer price index is currently trending at an eight-year high. As of writing, USD/JPY appreciated by 0.01% to 146.85.

In the commodities market, the crude oil price slumped 0.03% to $87.10 per barrel as of writing. The oil market edged lower amid weakening global demand outlook following both OPEC+ and the US Energy Department have cut their demand outlooks, diminishing the appeal for the demand of this black-commodity. On the other hand, the gold price depreciated by 0.05% to $1669.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (YoY) (Sep) | 10.0% | 10.0% | – |

| 20:30 | USD – Core CPI (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | USD – CPI (MoM) (Sep) | 8.3% | 8.1% | – |

| 20:30 | USD – Initial Jobless Claims | 219K | 225K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -1.356M | – | – |

Technical Analysis

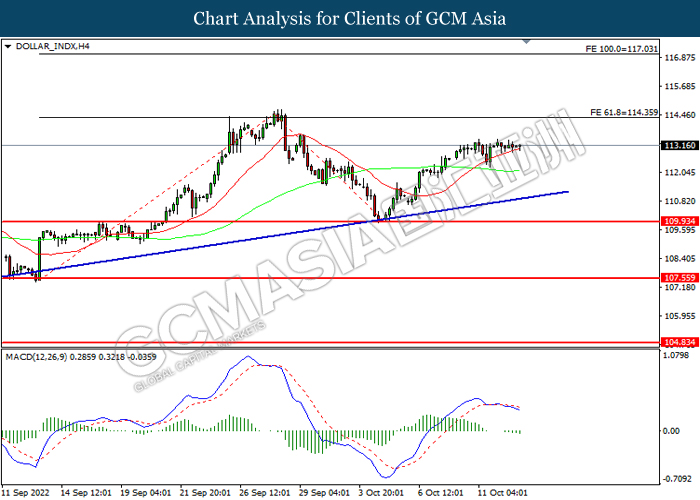

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

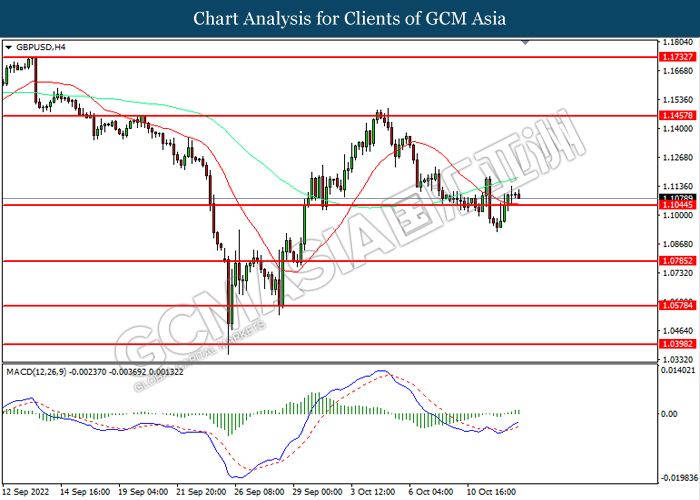

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

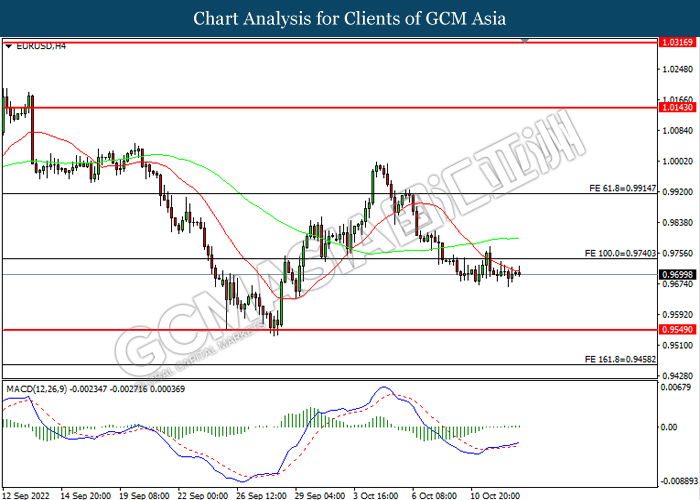

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9740, 0.9915

Support level: 0.9550, 0.9460

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

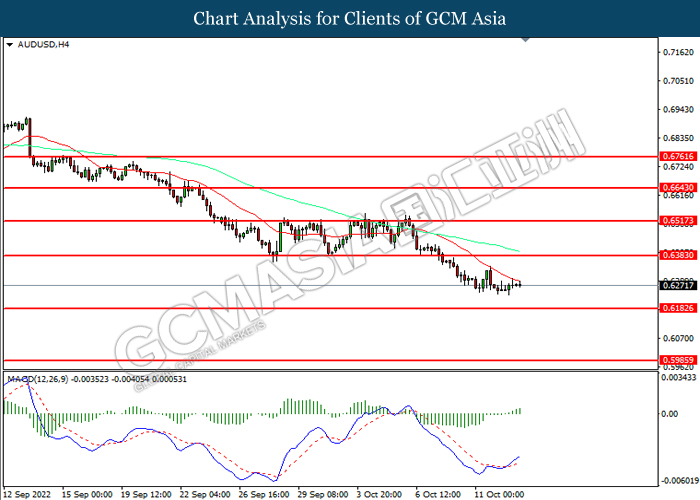

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6515

Support level: 0.6185, 0.5985

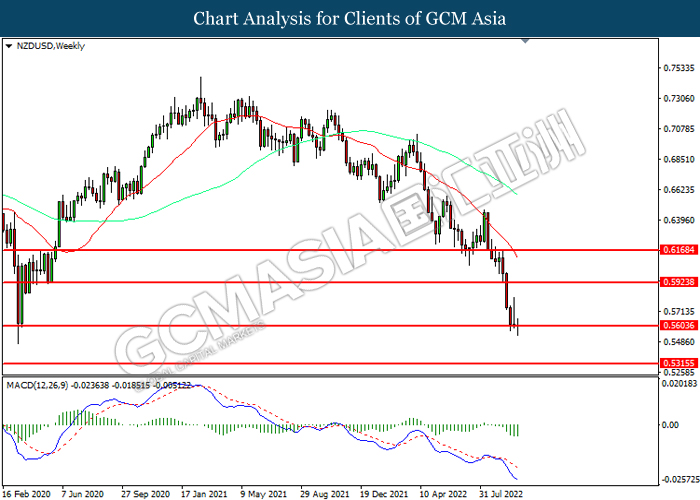

NZDUSD, Weekly: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 0.5925, 0.6170

Support level: 0.5605, 0.5315

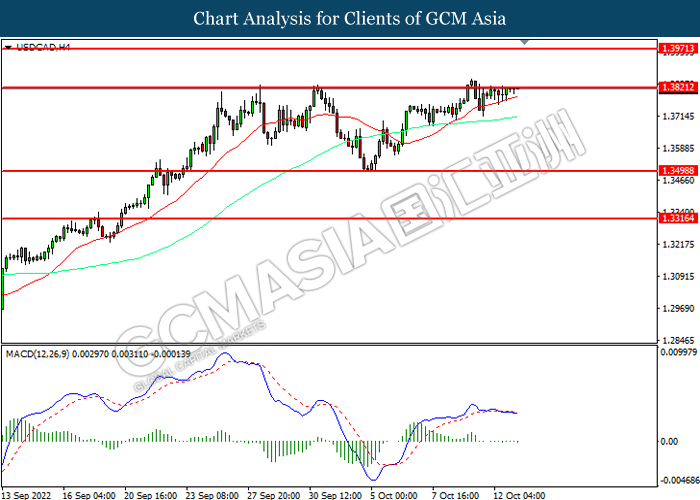

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

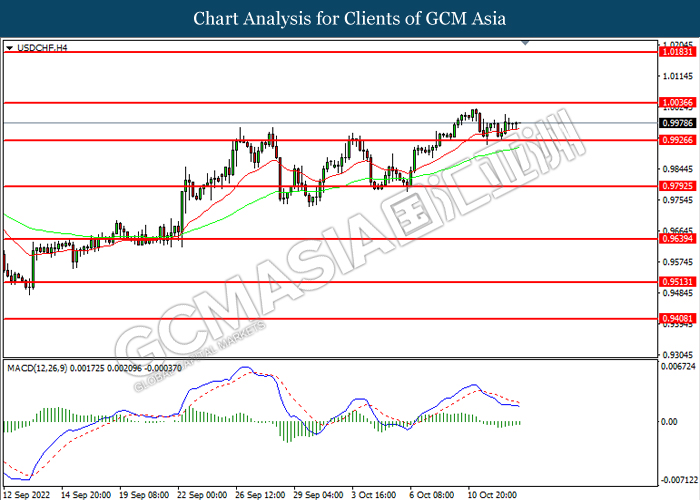

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 89.20, 93.10

Support level: 86.35, 81.95

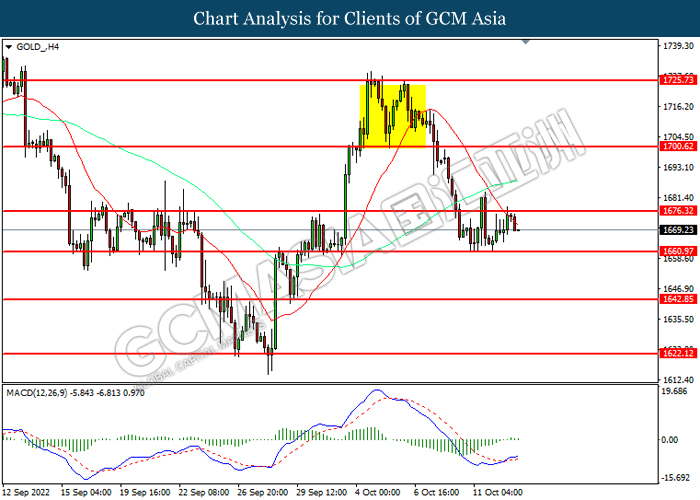

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85