13 October 2022 Morning Session Analysis

US Dollar dropped despite upbeat PPI data.

The Dollar Index which traded against a basket of six major currencies edged down on yesterday despite the higher-than-expected PPI data. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) MoM in September notched up from the previous reading of -0.2% to 0.4%, which is higher than the consensus expectation of 0.2%. Nonetheless, as the market participants are highly eyeing on the CPI data which will be released tonight, the investors decided to flee the market in order to gauge the movement of Dollar Index. Though, the overall trend of Dollar Index remained bullish over the hawkish statement from Fed officials. During the FOMC Meeting Minutes, the Federal Reserve policymakers agreed to imply a more aggressive contractionary policy and maintain it for some time until the inflation risk lowered. In addition, the PPI data has given an upbeat figures, which hinted that the aggressive rate hike path would likely to continue. As of writing, the Dollar Index rose by 0.02% to 113.15.

In the commodities market, the crude oil price dropped by 0.06% to $87.22 per barrel as of writing amid the rising of API crude oil stock. The US API Weekly Crude Oil Stock has notched up from the prior figures of -1.770M to 7.054M. On the other hand, the gold price appreciated by 0.19% to $1674.03 per troy ounce as of writing. Yesterday, the gold price received bullish momentum amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (YoY) (Sep) | 10.0% | 10.0% | – |

| 20:30 | USD – Core CPI (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | USD – CPI (MoM) (Sep) | 8.3% | 8.1% | – |

| 20:30 | USD – Initial Jobless Claims | 219K | 225K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -1.356M | – | – |

Technical Analysis

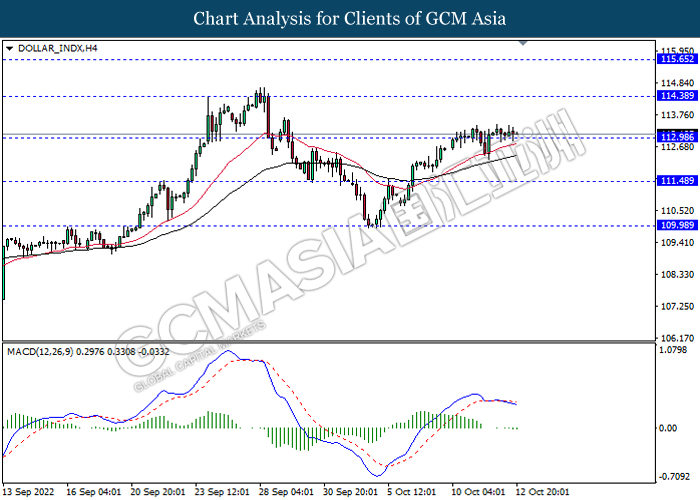

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.40, 115.65

Support level: 113.00, 111.50

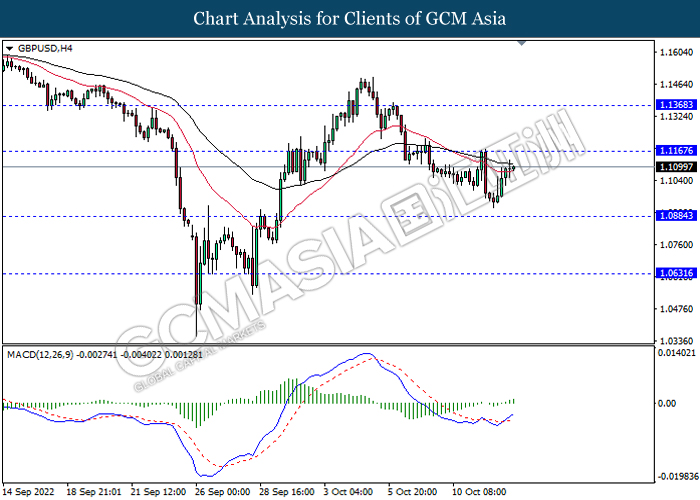

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1165, 1.1370

Support level: 1.0885, 1.0630

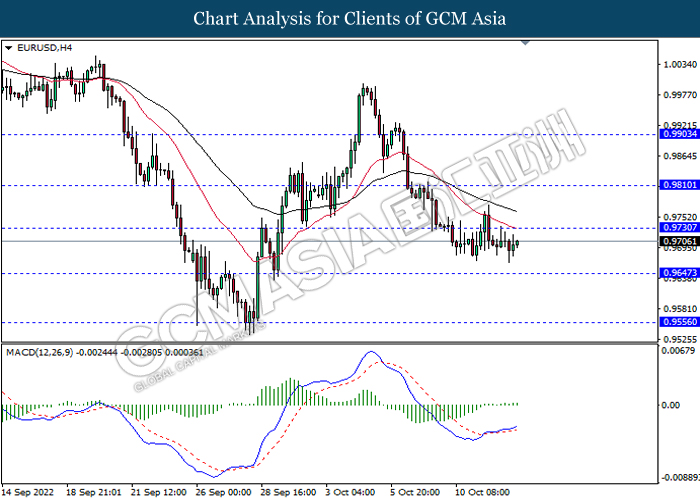

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9730, 0.9810

Support level: 0.9645, 0.9555

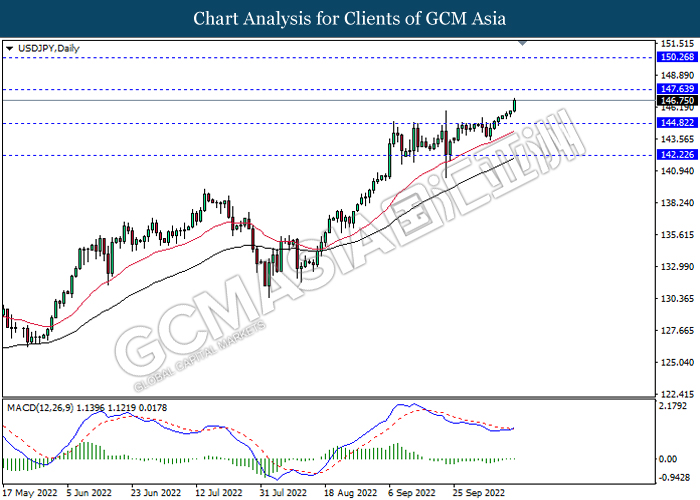

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

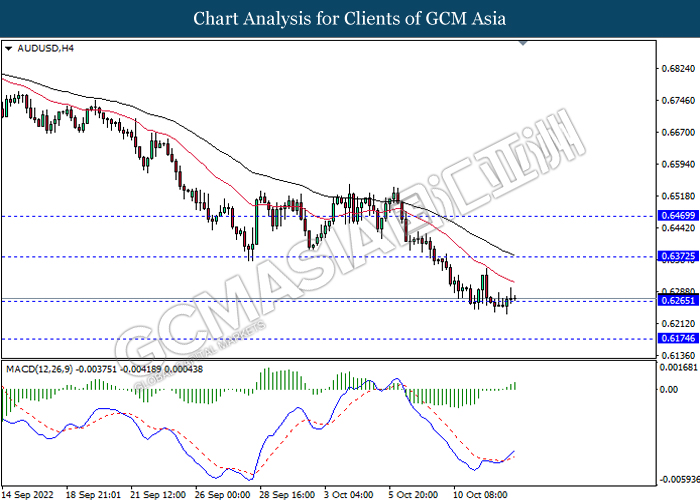

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6175

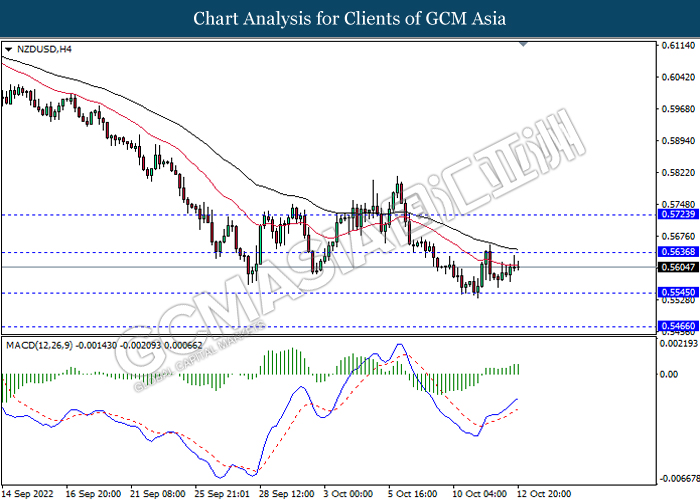

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5635, 0.5725

Support level: 0.5545, 0.5465

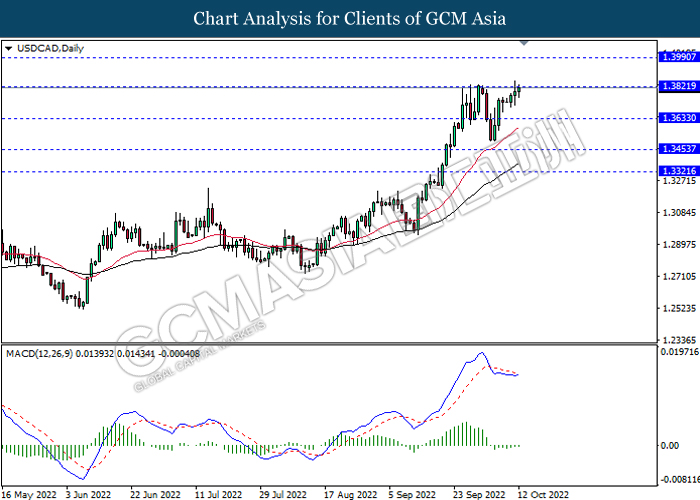

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

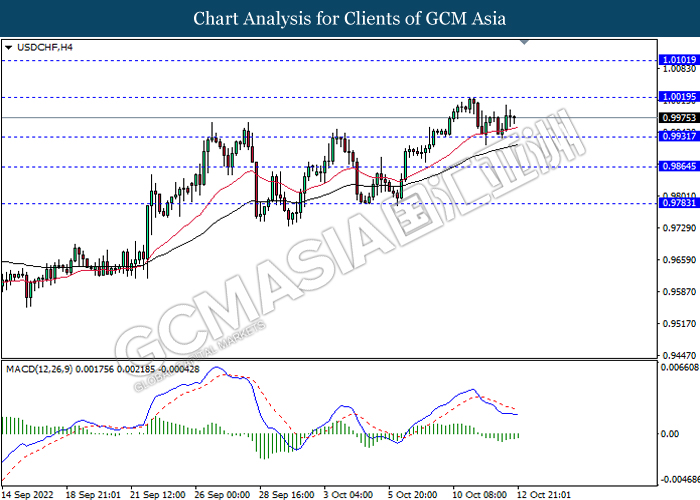

USDCHF, H4: USDCHF was traded higher following prior rebound form the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0020, 1.0100

Support level: 0.9930, 0.9865

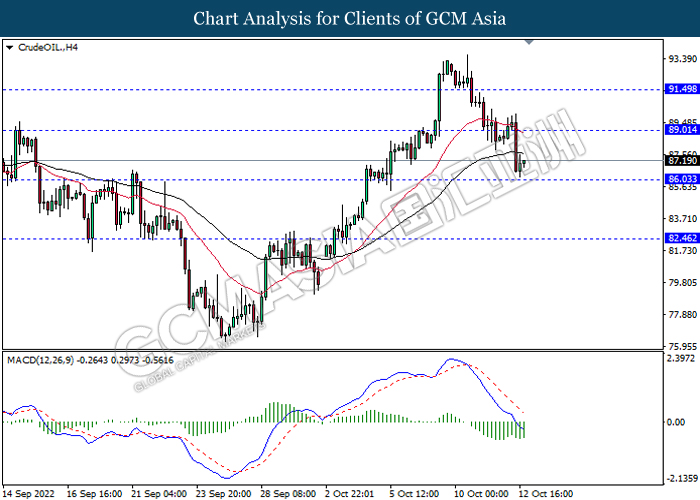

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.00, 91.50

Support level: 86.05, 82.45

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1678.65, 1693.95

Support level: 1659.90, 1637.75