13 December 2018 Morning Session Analysis

Theresa May survives “No Confidence” drama.

US dollar depreciates against other major currencies on Wednesday following weaker-than-expected inflation data while coupled with a large buy back on the pound sterling. As of writing, the dollar index was quoted down 0.40%, last seen around 96.96 during Asian trading hours. According to US Labor Department, its Consumer Price Index (CPI) remained unchanged for the month of November, missing economist forecast for a rise of 0.1%. The data accompanies a series of bearish economic releases while some analyst postulate that the US may derail from Federal Reserve’s goal if its current condition continues to worsen. On the other hand, pair of GBP/USD surged more than 1% to 1.2630 after UK Prime Minister Theresa May survives a “No Confidence” vote against her. According to reports, 200 out of 317 members of parliament from Conservative Party voted in favor for May, allowing her to retain her party’s leadership and pushing forward with her Brexit draft. In a speech given by May, she postulates that the draft will likely be submitted to Parliament by the end of January for voting. However, EU refuses to renegotiate the deal, leaving her in a stalemate situation as of current.

As for commodities market, crude oil price settled down 1% to $51.30 per barrel. The commodity suffered from deep losses after Reuters reported a sooner-than-expected start of Sunrise oil pipe line system in West Texas that could boost crude inventories in Oklahoma to one-year high. Otherwise, gold price extended gains by 0.07% to $1,246.51 a troy ounce as dollar falters since yesterday night.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

Tentative EUR EU Leaders Summit

21:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision | -0.75% | -0.75% | – |

| 20:45 | EUR – Deposit Facility Rate | -0.40% | -0.40% | – |

| 20:45 | EUR – ECB Marginal Lending Facility | 0.25% | 0.25% | – |

| 20:45 | EUR – ECB Interest Rate Decision (Dec) | 0.00% | 0.00% | – |

| 21:30 | USD – Import Price Index (MoM) (Nov) | 0.5% | -1.0% | – |

| 21:30 | USD – Initial Jobless Claims | 231K | 226K | – |

Technical Analysis

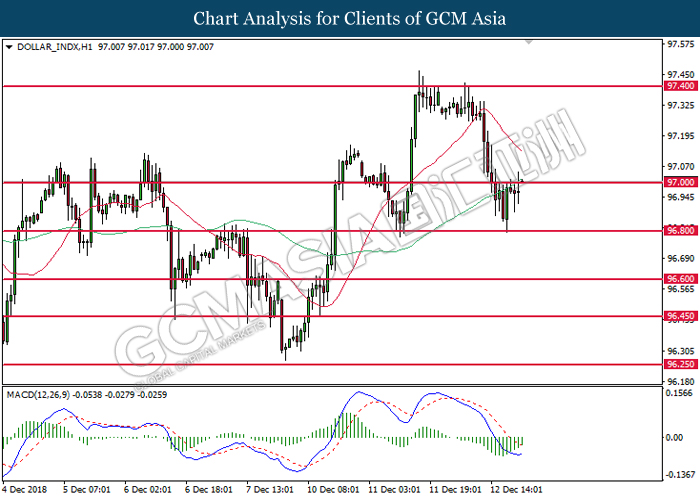

DOLLAR_INDX, H1: Dollar index was traded higher following prior rebound from the support level at 96.80. MACD which illustrate diminishing bearish momentum suggests the index to extend its gains after closing above 97.00.

Resistance level: 97.00, 97.40

Support level: 96.80, 96.60

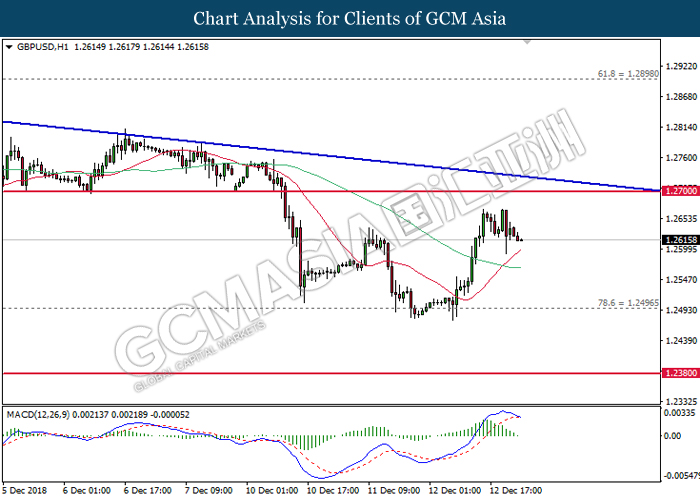

GBPUSD, H1: GBPUSD was traded lower following prior retracement near the previous high. MACD which begins to form a death cross signal suggests the pair to be traded lower after closing below 20-MA (red).

Resistance level: 1.2700, 1.2900

Support level: 1.2500, 1.2380

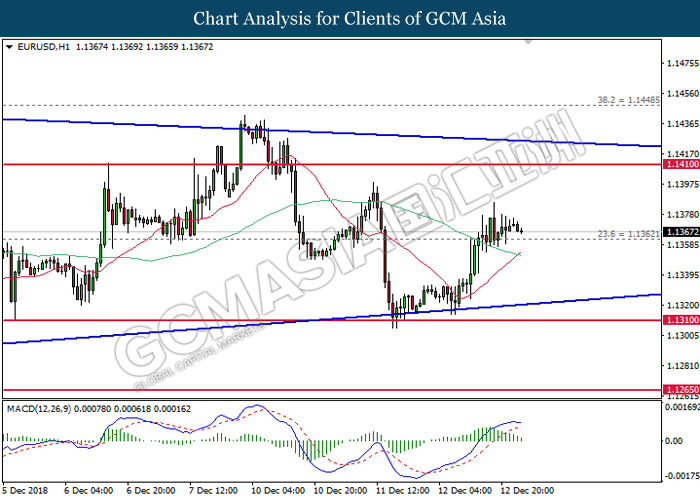

EURUSD, H1: EURUSD was traded lower following prior retracement and currently testing near 1.1360. MACD which illustrate diminishing upward momentum suggests the pair to extend its losses after closing below 1.1360.

Resistance level: 1.1410, 1.1450

Support level: 1.1360, 1.1310

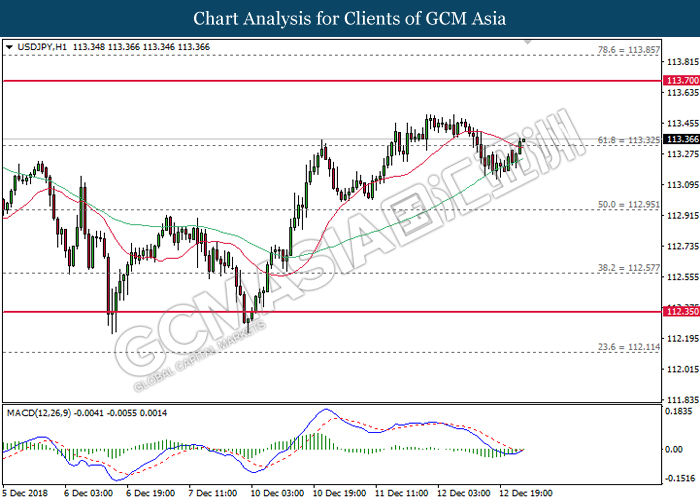

USDJPY, H1: USDJPY was traded higher following prior rebound from the lower levels. MACD which begins to form a golden cross signal suggests the pair to be traded higher in short-term, towards the direction at 113.70.

Resistance level: 113.70, 113.85

Support level: 113.30, 112.95

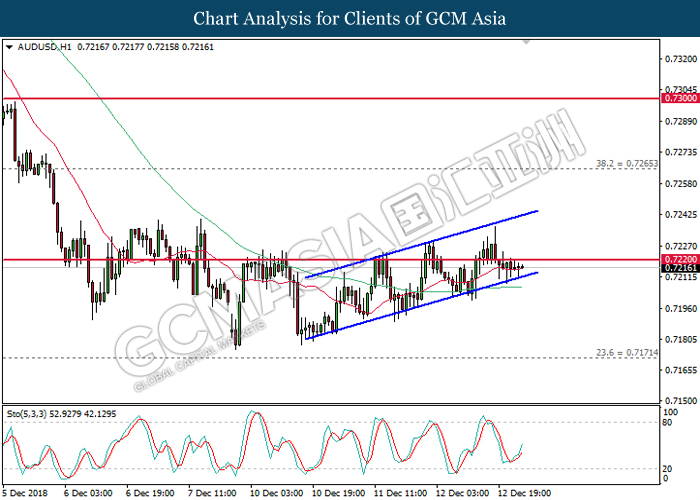

AUDUSD, H1: AUDUSD remains traded within an upward channel following prior rebound from the lower levels. Stochastic Oscillator which begins to illustrate a rebound signal suggests the pair to be traded higher in short-term with the channel itself.

Resistance level: 0.7220, 0.7265

Support level: 0.7170, 0.7105

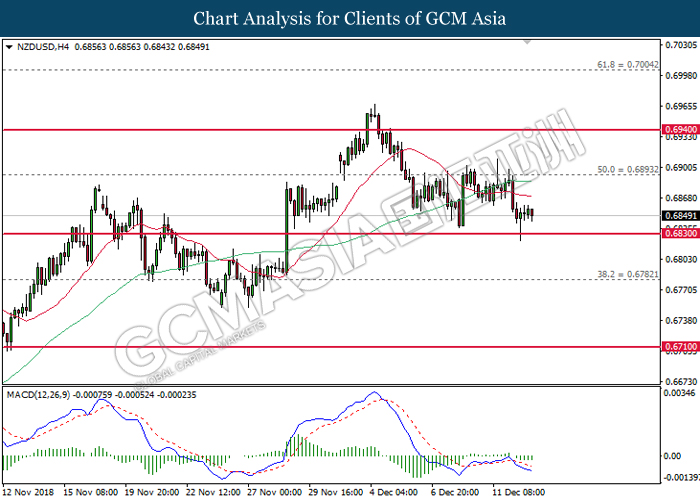

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level near 0.6890. MACD which illustrate bearish signal suggests the pair to extend its losses after a successful closure below the strong support at 0.6830.

Resistance level: 0.6890, 0.6940

Support level: 0.6830, 0.6780

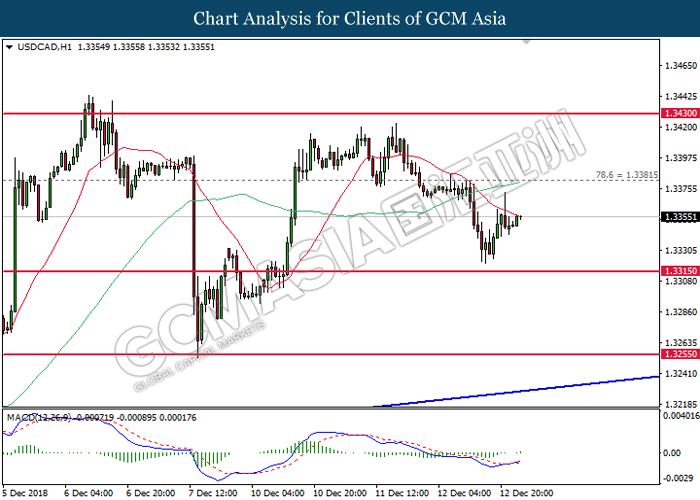

USDCAD, H1: USDCAD was traded higher following prior rebound near 1.3315. MACD which begins to form a golden cross signal suggests the pair to advance further upwards after closing above the 20-MA line (red).

Resistance level: 1.3380, 1.3430

Support level: 1.3315, 1.3255

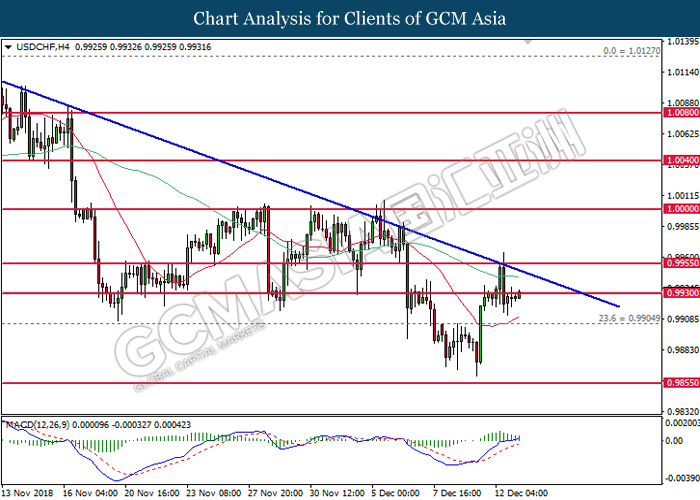

USDCHF, H4: USDCHF was traded higher following prior rebound from the lower levels. MACD which illustrate bullish signal suggests the pair to extend its recovery after closing above the resistance level near 0.9930.

Resistance level: 0.9930, 0.9955

Support level: 0.9905, 0.9855

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the lower level of sideways channel. MACD which illustrate diminishing downward momentum suggests its prices to advance further up in short-term, towards the direction of 52.00.

Resistance level: 52.00, 53.90

Support level: 50.25, 49.50

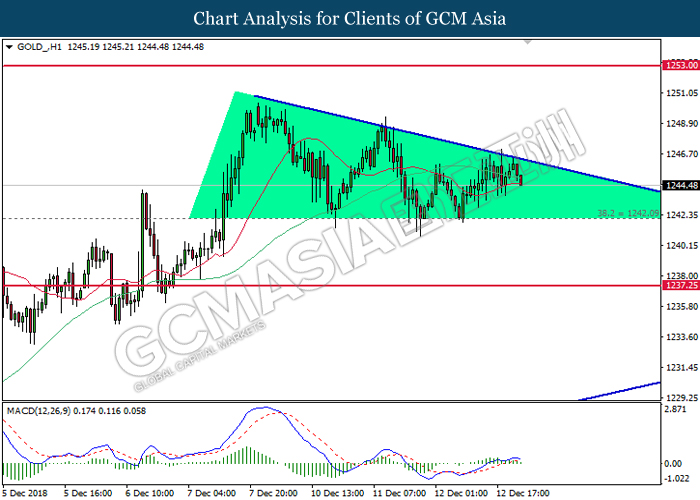

GOLD_, H1: Gold price remains traded within a descending triangle following prior retrace from the top level. MACD which illustrate diminishing upward momentum suggests its prices to be traded lower in short-term, towards the direction of 1242.10.

Resistance level: 1253.00, 1263.20

Support level: 1242.10, 1237.25