13 December 2022 Afternoon Session Analysis

Pound Sterling rose amid optimistic GDP data.

The GBP/USD, which widely traded by global investors edged up on yesterday amid the upbeat economic data. According to Office for National Statistics, the UK Gross Domestic Product (GDP) MoM has notched up from the previous reading of -0.6% to 0.5%, exceeding the consensus expectation of 0.4%. Besides that, the UK Manufacturing Production MoM for October raised from the prior figures of 0.0% to 0.7%. With such background, the market optimism toward economic progression in the UK has been dialed up, as the data shown has outweighed the market concerns of recession that faced by the UK. Though, the gains that experienced by Pound Sterling was limited following the Bank of England (BoE) was widely expected to scale back its rate hike pace, after its outsized 75 basis point hike in November amid growing signs of a prolonged downturn. According to the BoE’s estimation, the UK will remain in recession throughout next year and the first half of 2024. The bank also forecasted at the November meeting that the UK economy would contract by 0.3% in the fourth quarter. As of writing, the GBP/USD eased by 0.01% to 1.2269.

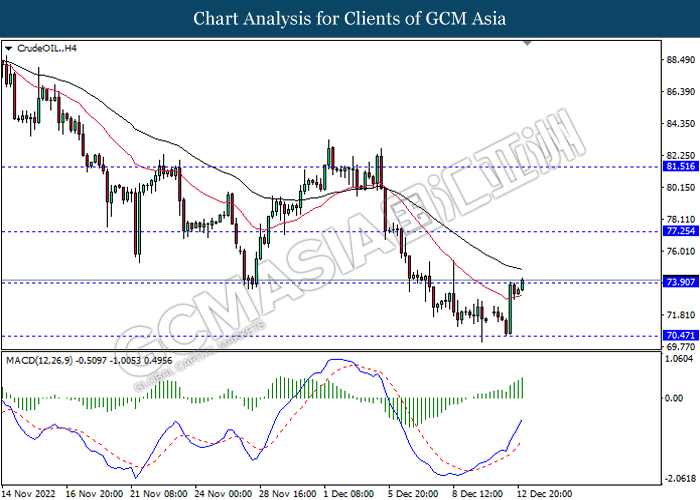

In the commodities market, the crude oil price appreciated by 1.18% to $74.04 per barrel as of writing following the expectation of loosening Covid-19 restriction in China boosted up the demand of oil. On the other hand, the gold price rose by 0.16% to $1784.28 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Oct) | 6.0% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Nov) | 3.3K | 3.5K | – |

| 15:00 | EUR – German CPI (YoY) (Nov) | 10.0% | 10.0% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Dec) | -36.7 | -26.4 | – |

| 21:30 | USD – Core CPI (MoM) (Nov) | 0.3% | 0.3% | – |

| 21:30 | USD – CPI (YoY) (Nov) | 7.7% | 7.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

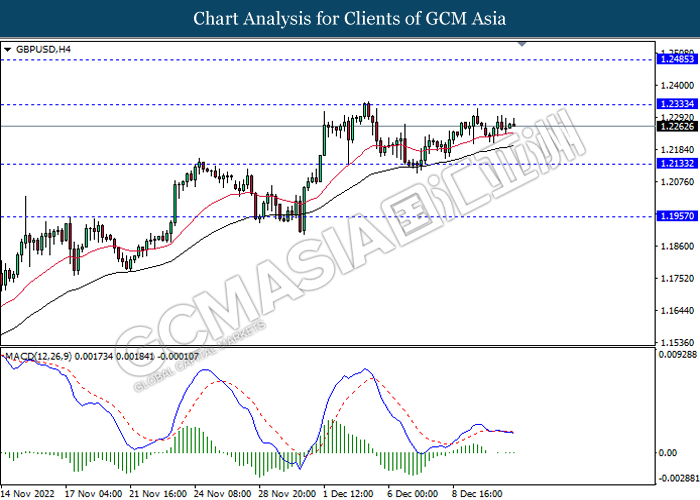

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2335, 1.2485

Support level: 1.2135, 1.1955

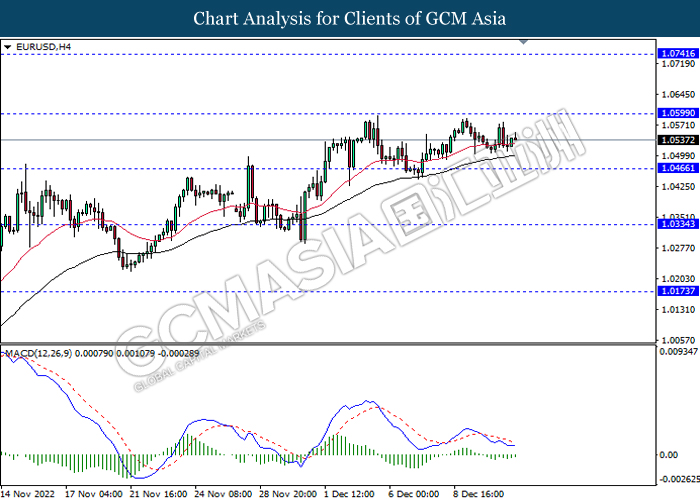

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

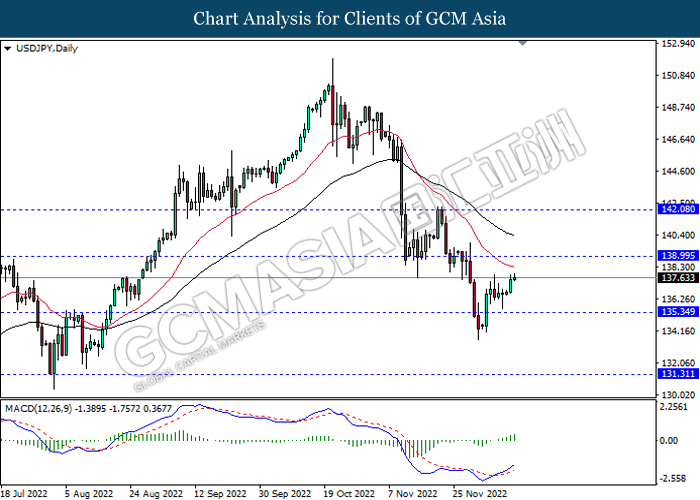

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

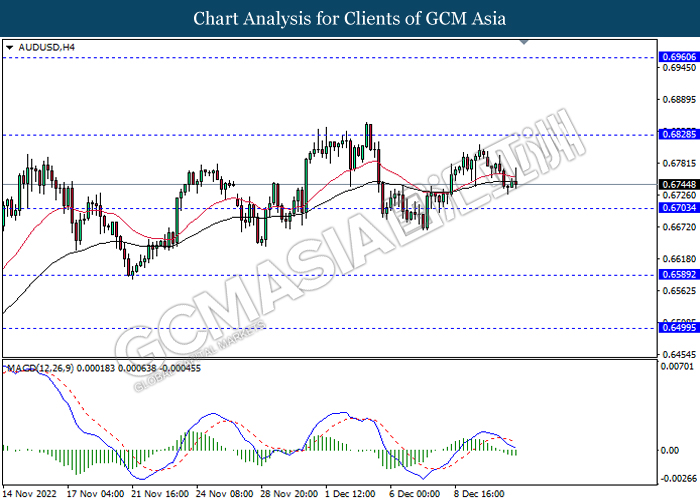

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

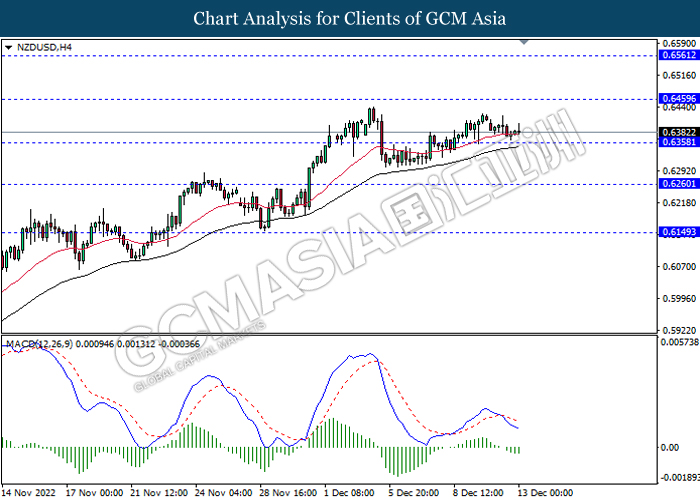

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

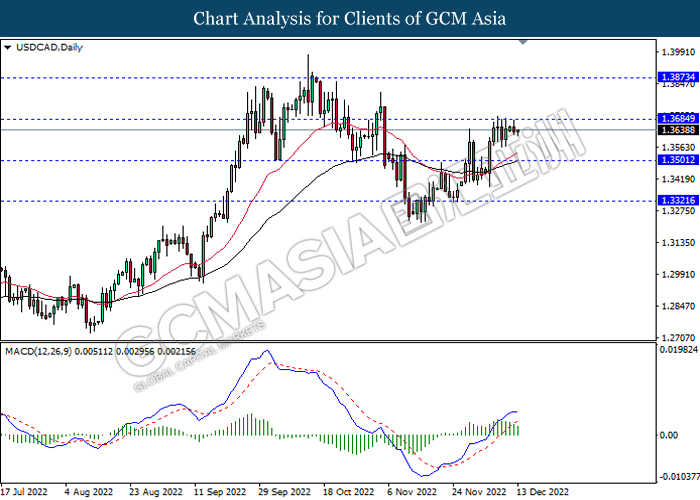

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

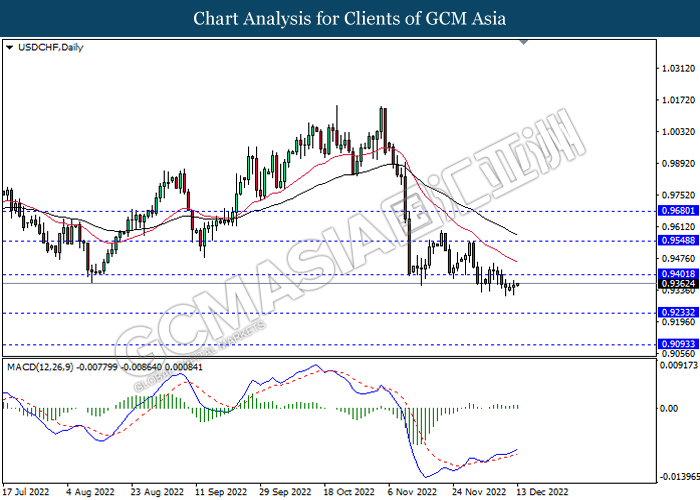

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.50, 1808.55

Support level: 1756.05, 1733.70