13 December 2022 Morning Session Analysis

Greenback slumped despite inflation pressure persists.

The dollar index, which traded against a basket of six major currencies, lost its ground and plunged to the one week low despite last Friday’s inflation figure showed inflation persists in the nation. During the later session of last Friday, US Bureau of Labor Statistics reported its Produce Price Index (PPI) data for November at a reading of 0.3%, slightly higher than the consensus forecast at 0.2%. With that, it reversed the market sentiment in the dollar market as it stumbled the market optimism over the cooling down of inflation. The headline of higher-than-expected PPI sparked the chances that the Federal Reserve would implement larger rate hike for longer to tackle the sky-high inflation effectively. Nonetheless, the sell-off of Greenback was resumed after UK posted a brilliant economic performance over the past one month. According to the Office for the National Statistics, the UK GDP data jumped from -0.6% to 0.5% over the past one month, beating the consensus forecast at 0.4%. As of writing, the pair of GBP/USD inclined by 0.02% to 1.2270.

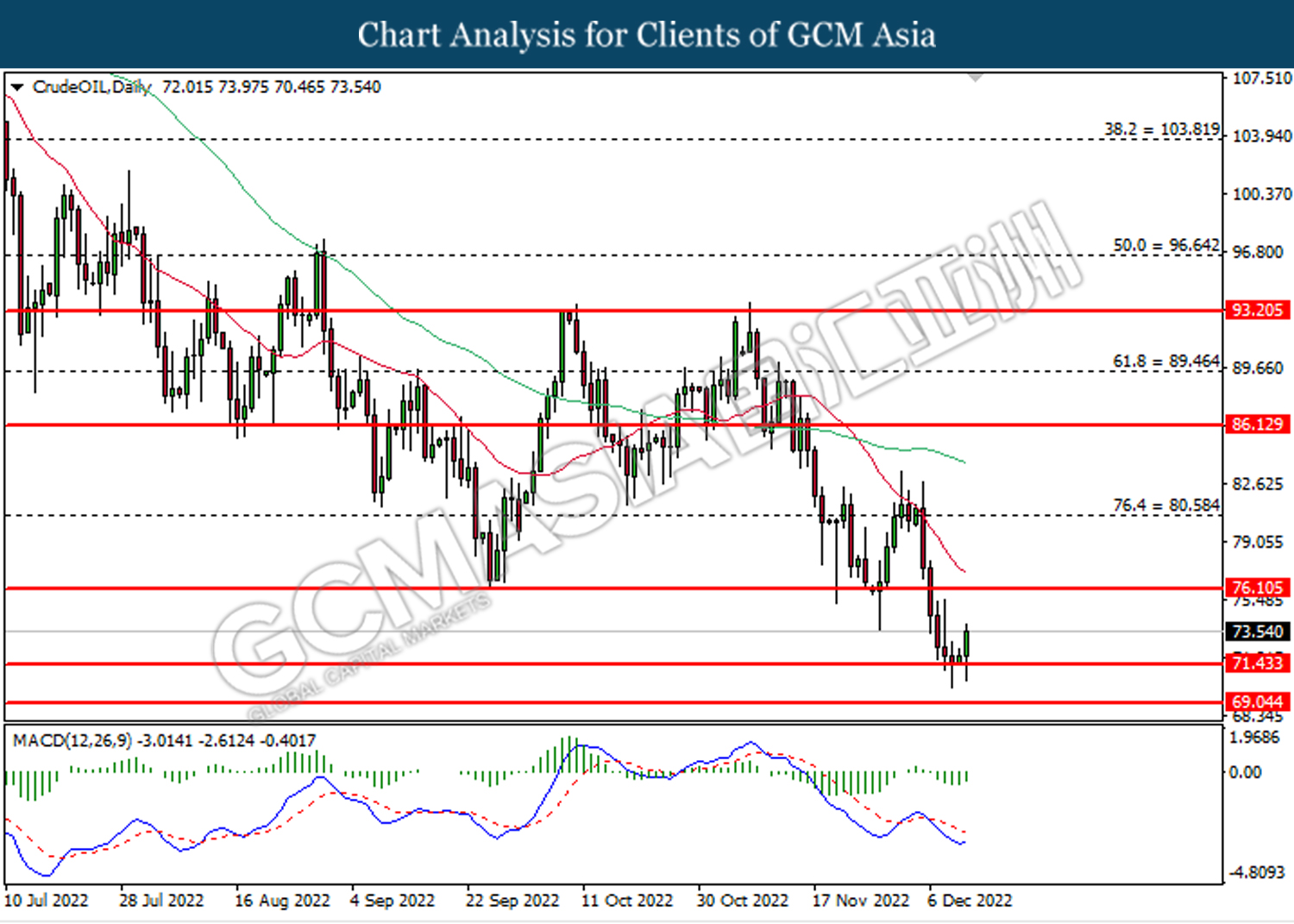

In the commodities market, crude oil prices skyrocketed by 2.45% to $73.65 per barrel after last week recession-related sell off. With the Keystone pipeline between the US and Canada remained closed, it is still threatening the supply side of the oil market. Besides, gold prices appreciated by 0.89% to $1781.05 per troy ounce as the US dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Oct) | 6.0% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Nov) | 3.3K | 3.5K | – |

| 15:00 | EUR – German CPI (YoY) (Nov) | 10.0% | 10.0% | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Dec) | -36.7 | -26.4 | – |

| 21:30 | USD – Core CPI (MoM) (Nov) | 0.3% | 0.3% | – |

| 21:30 | USD – CPI (YoY) (Nov) | 7.7% | 7.3% | – |

Technical Analysis

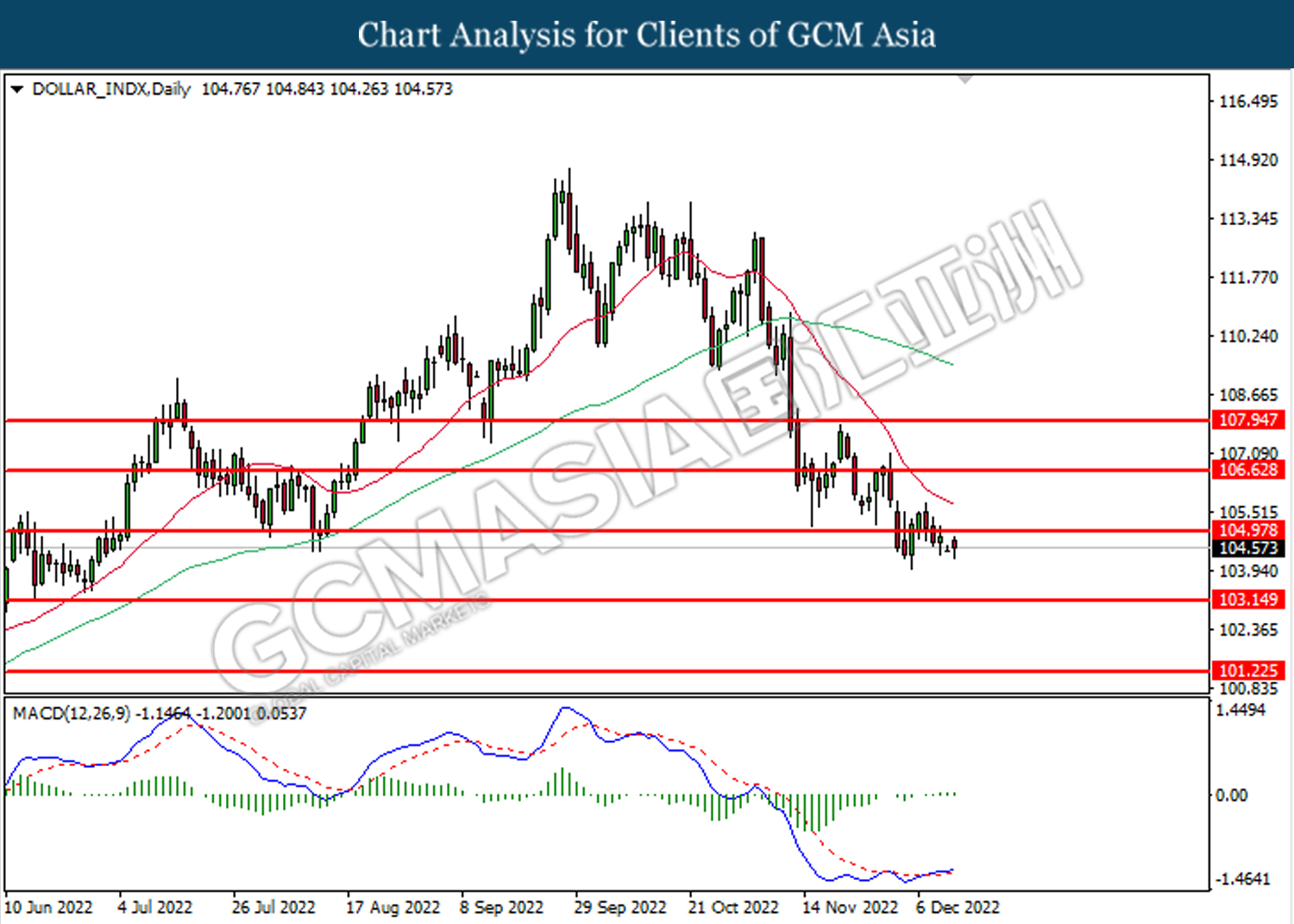

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 105.00. However, MACD which illustrated bullish bias momentum suggests the index to undergo technical correction in short term.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

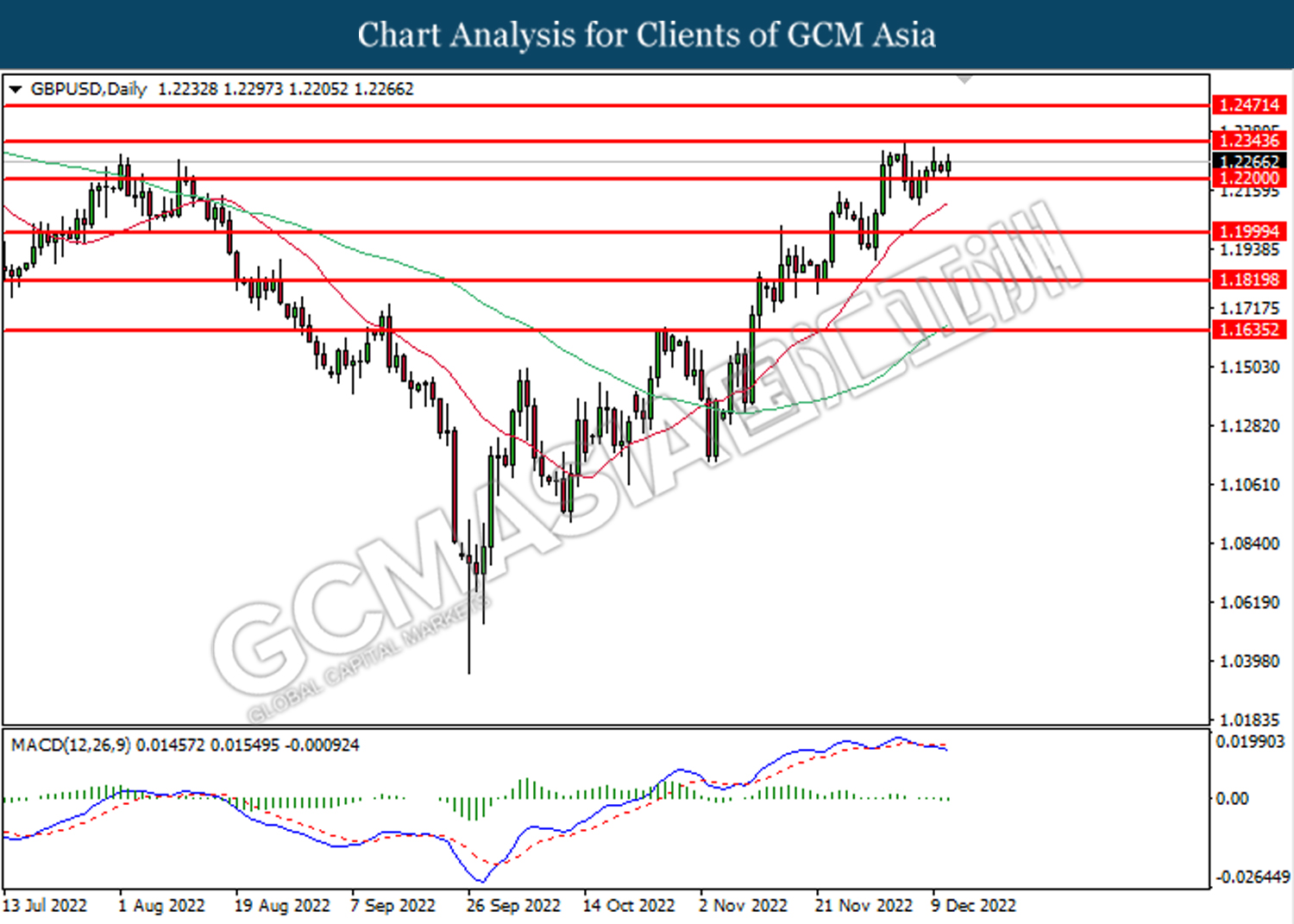

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

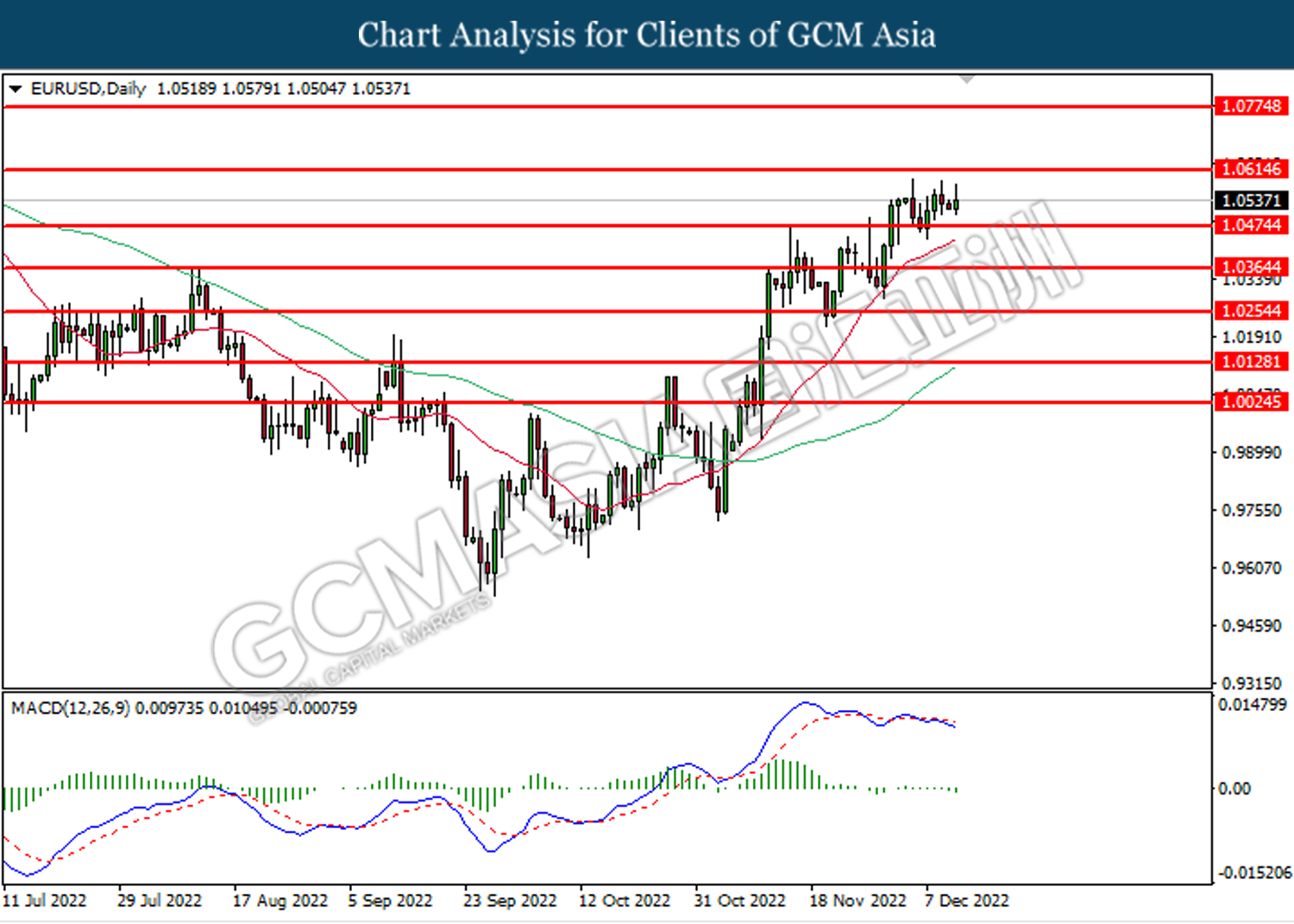

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0475. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

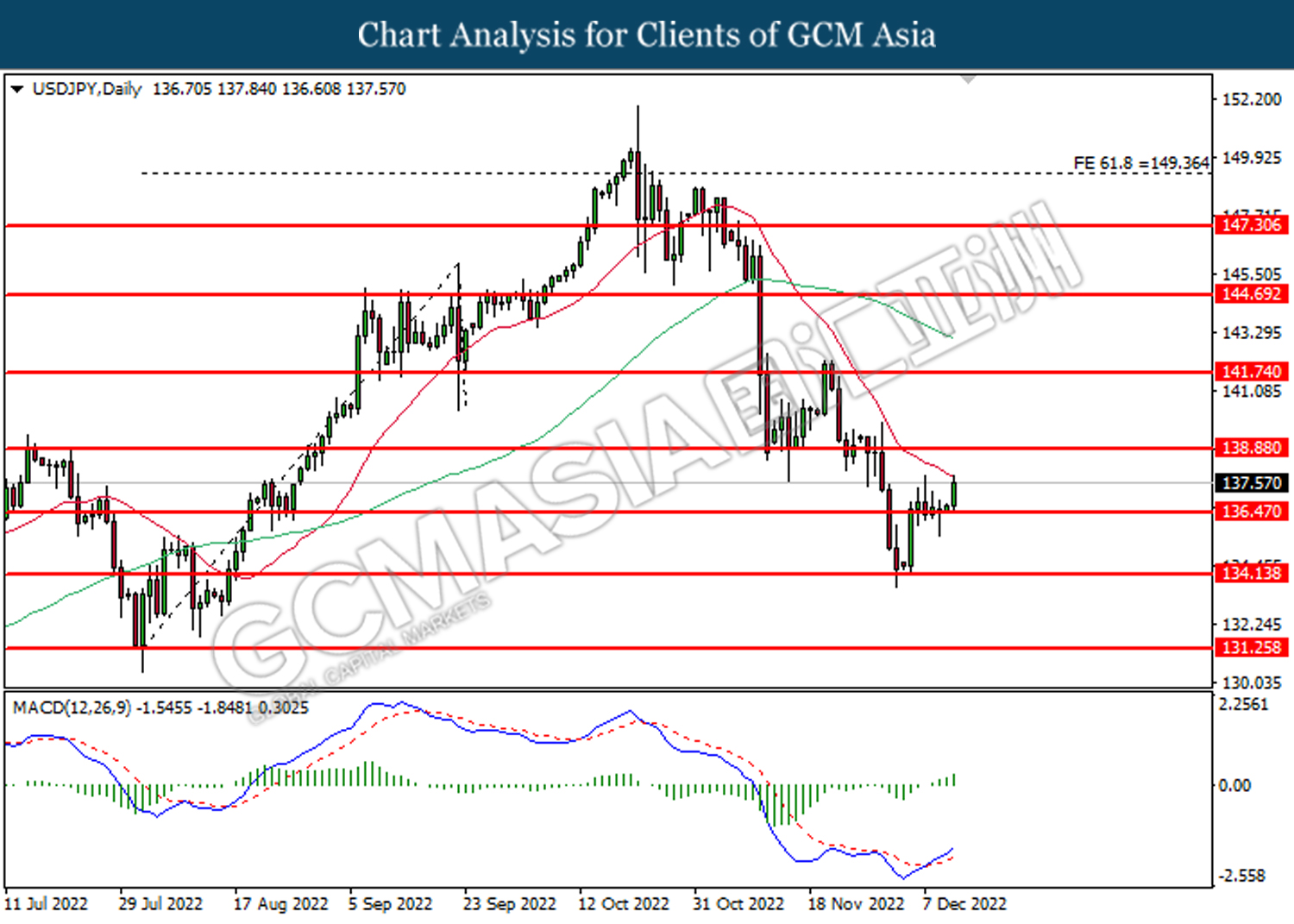

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 136.45. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 138.90.

Resistance level: 138.90, 141.75

Support level: 134.15, 131.25

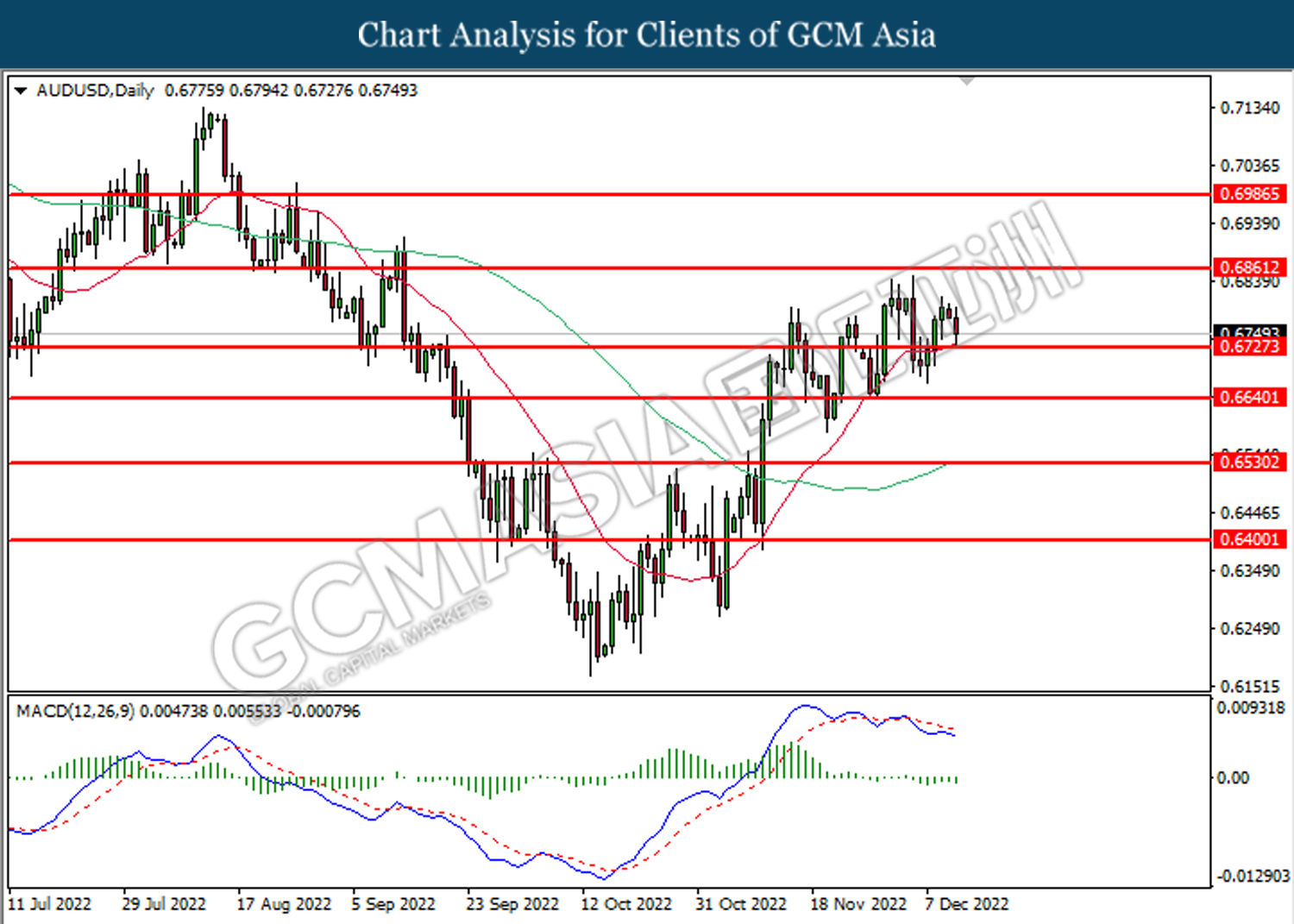

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

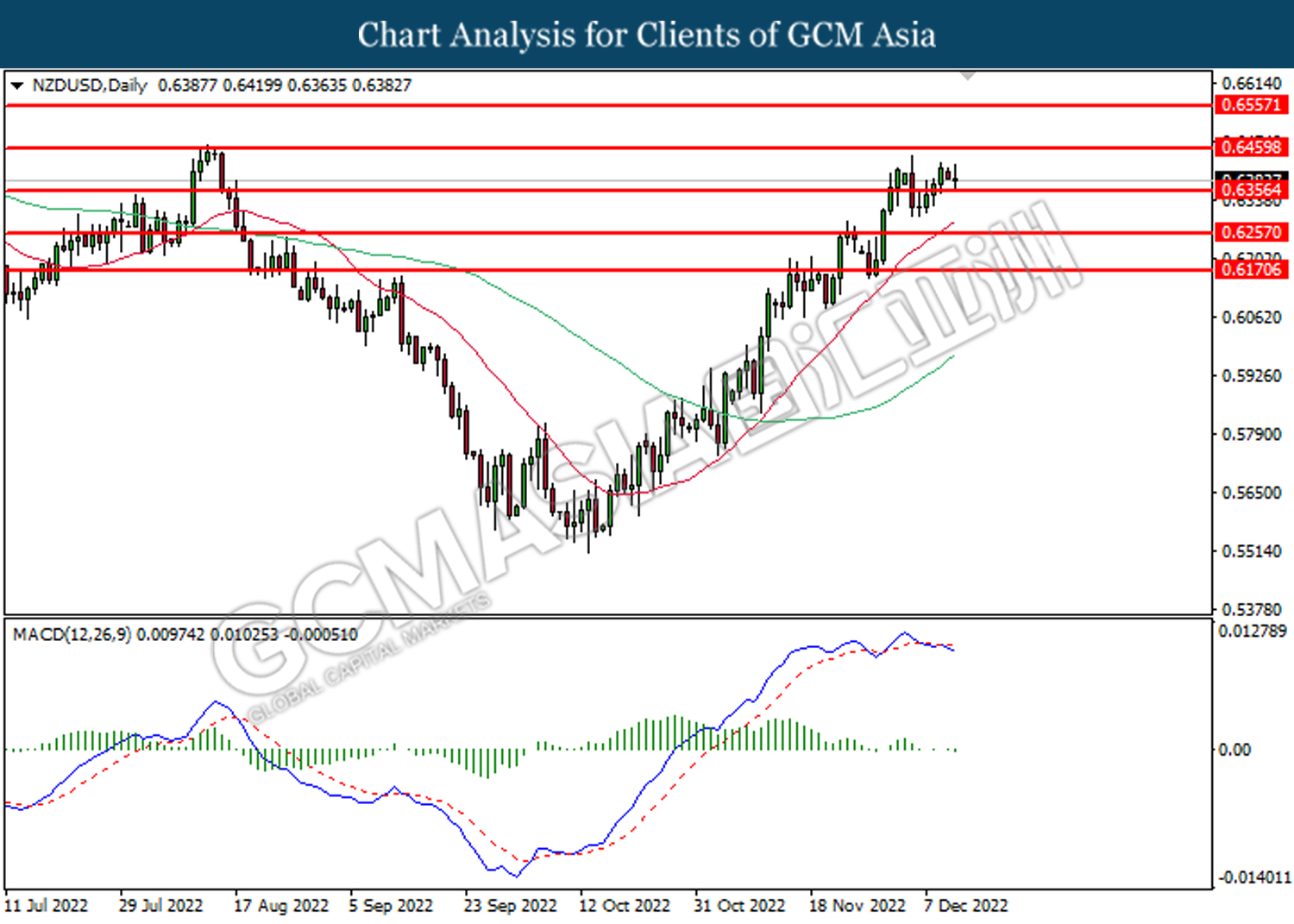

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6355.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

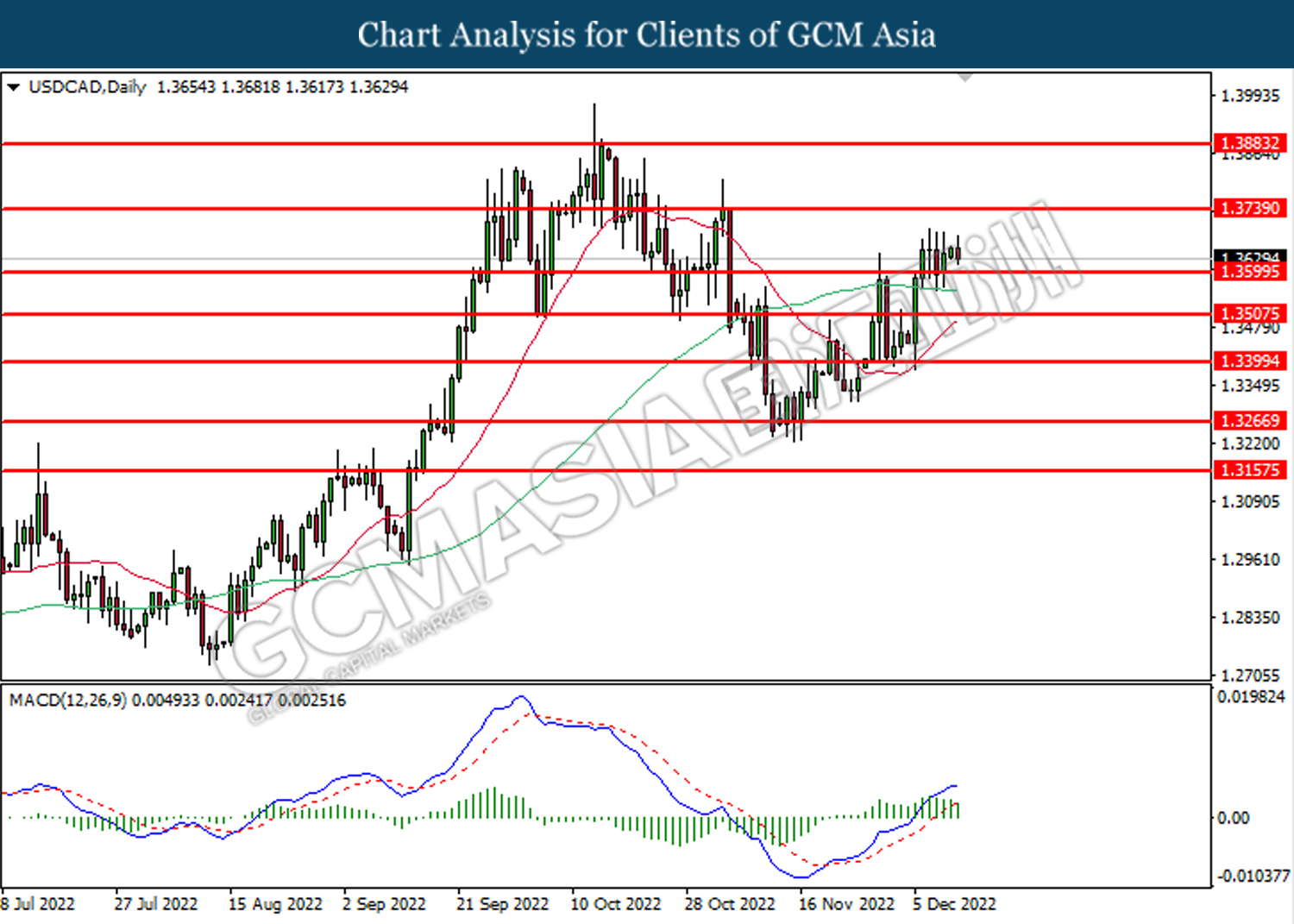

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

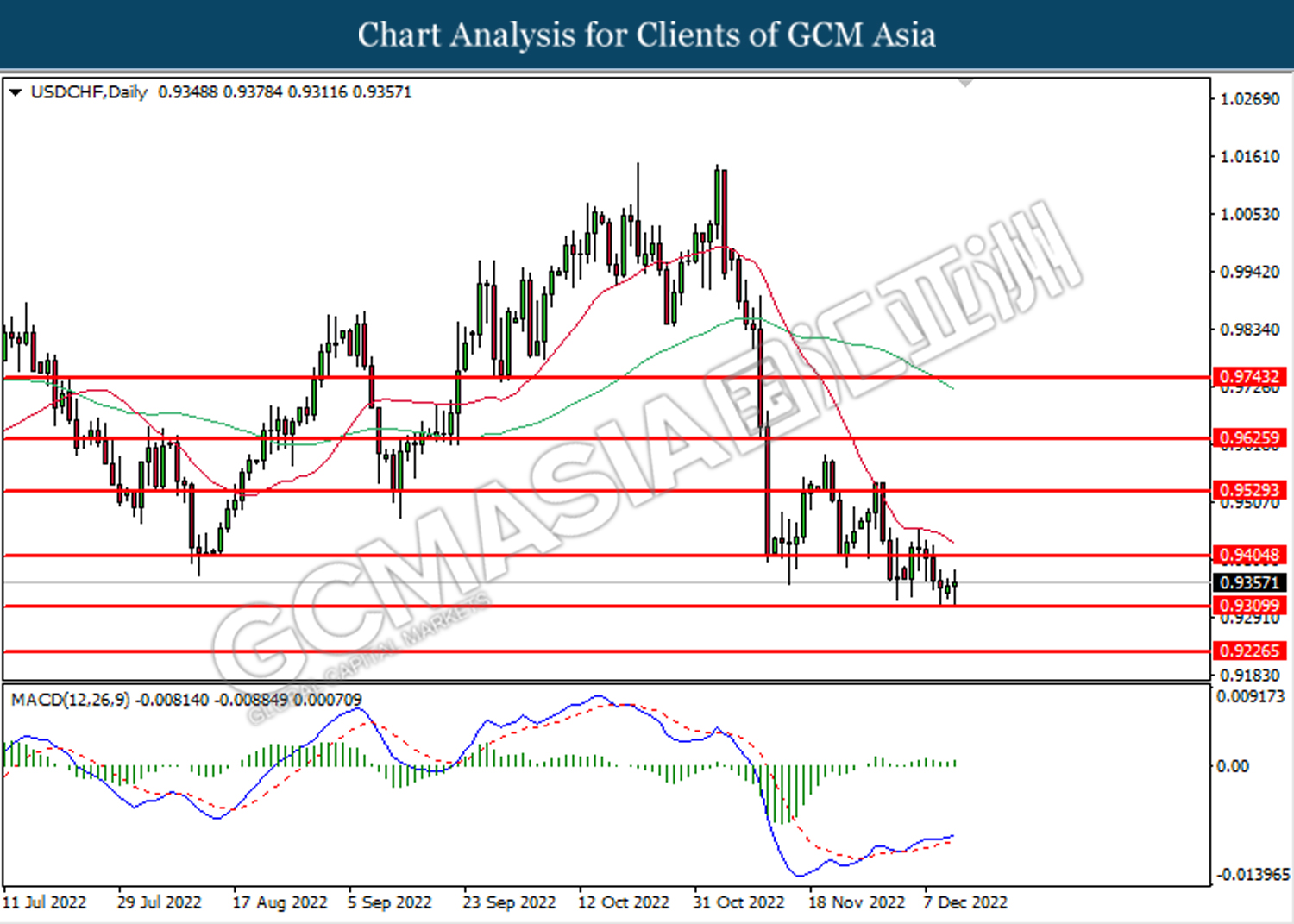

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9405.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 71.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 76.10.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1786.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1806.35, 1835.30

Support level: 1786.00, 1759.15