14 February 2022 Afternoon Session Analysis

Doves flutters, Euro nosedive.

Euro extended its losses during Asian trading session as European Central Bank delivers more dovish signals as of recent. Last weekend, European Central Bank’s member Olli Rehn, he warned that overreaction to inflation from central bank may jeopardize overall economic growth. He commented that it is recommended to look beyond short-term inflation spikes and project inflationary trend for 2023 and 2024. Rehn also stated that European Central Bank has ample amount of time to decide in March and later meetings if the economy progresses differently as compared to current situation. While ECB emphasize to continue to expansionary monetary policy, Rehn suggests that gradual tightening will be done at a consistent pace with economic recovery and progress. As of writing, EUR/USD was down by 0.03% to 1.1340.

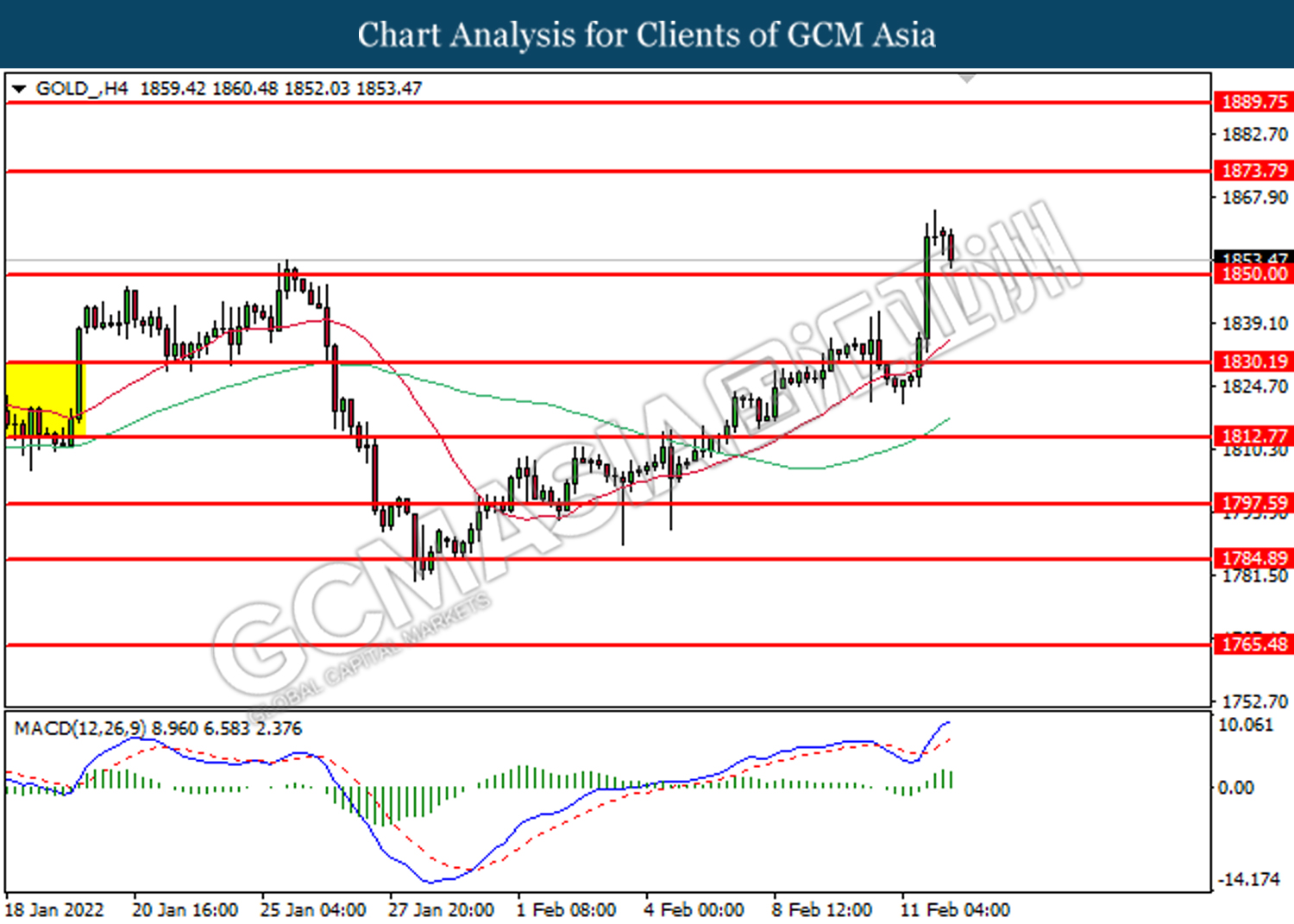

In the commodities market, crude oil price rose 0.86% to $93.00 per barrel as Russia-Ukraine tensions sparks speculation over disruption in oil supply from the region. On the other hand, gold price ticked down 0.41% to $1,853.75 a troy ounce due to technical correction.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

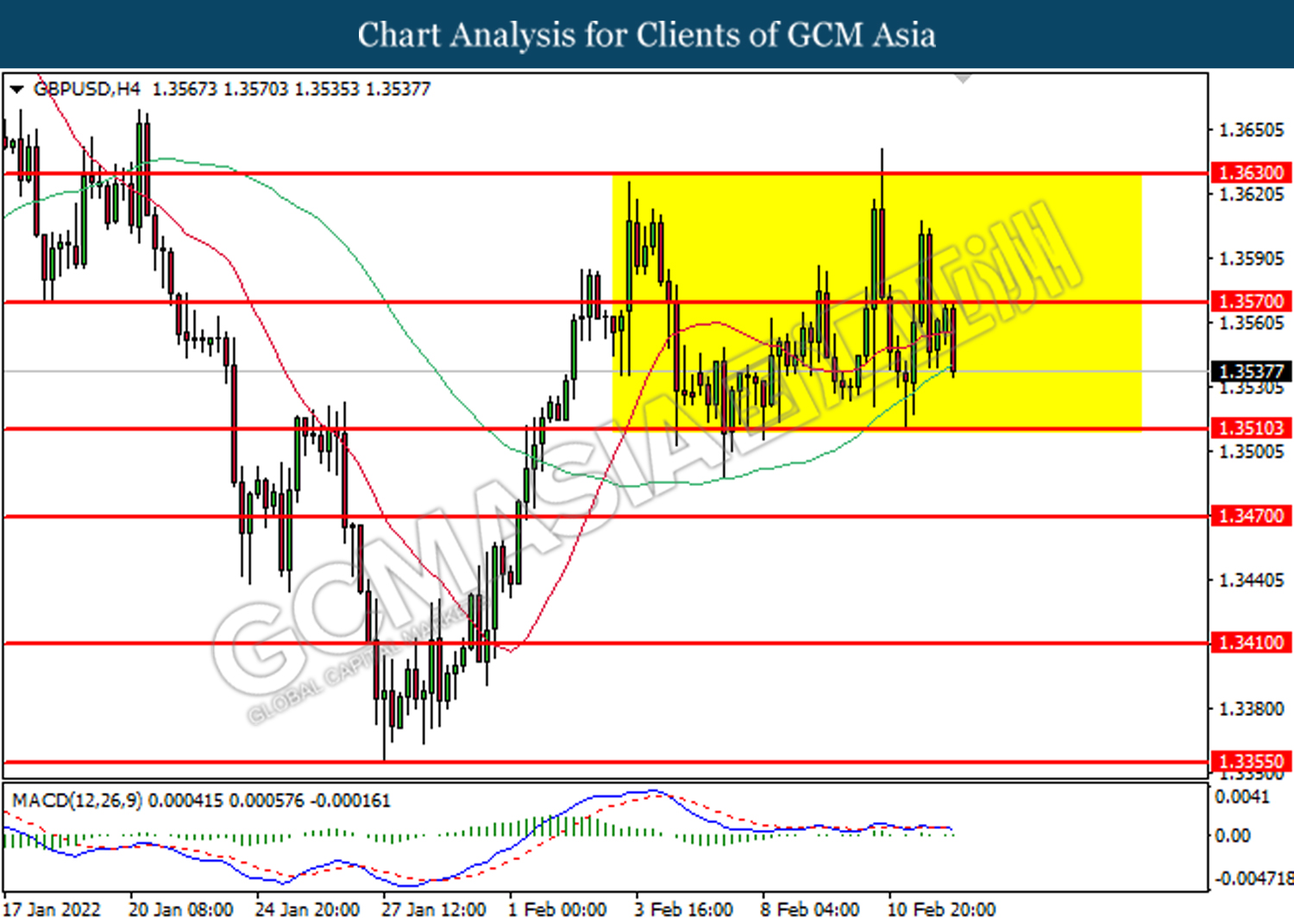

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1390, 1.1440

Support level: 1.1340, 1.1270

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

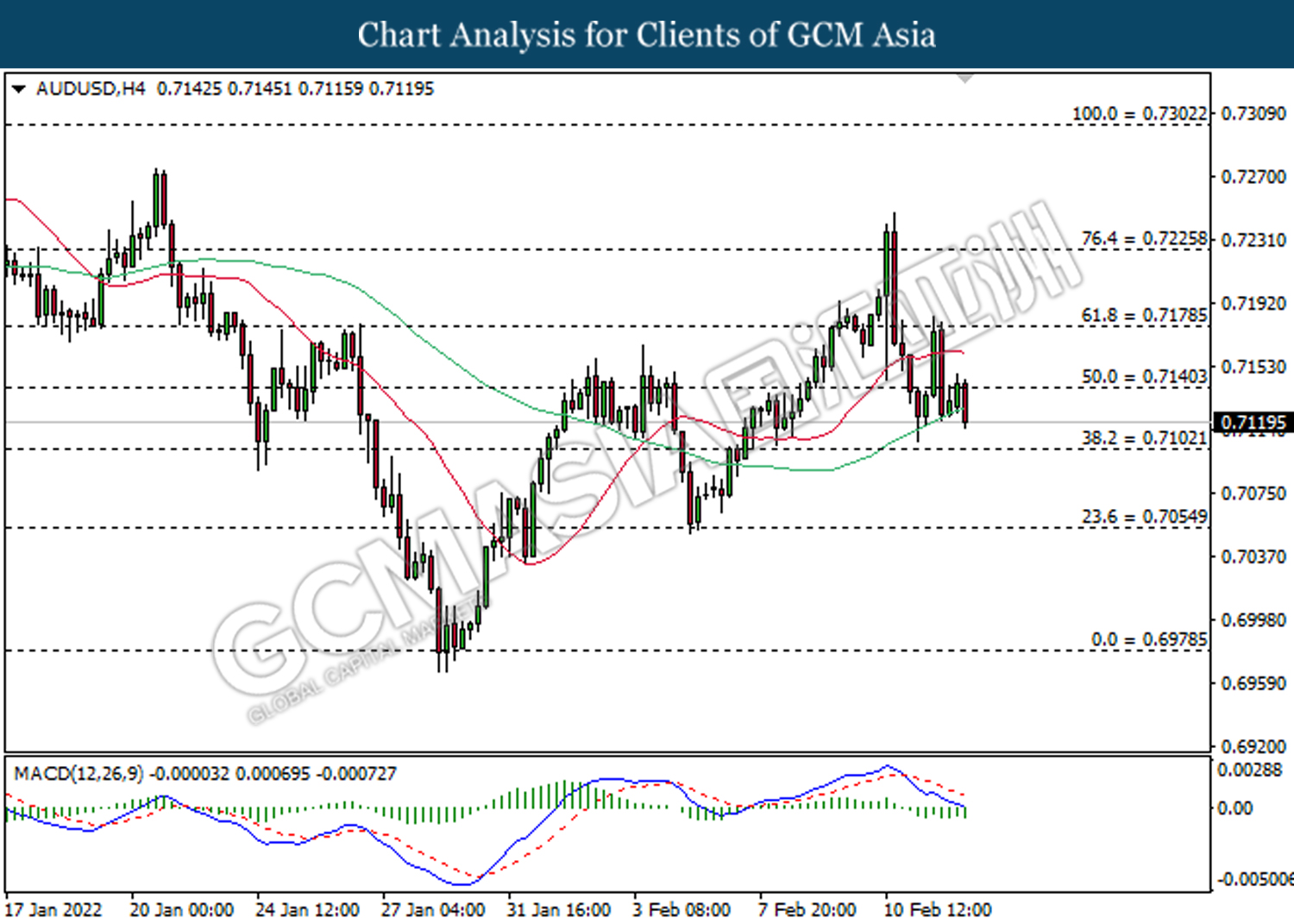

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

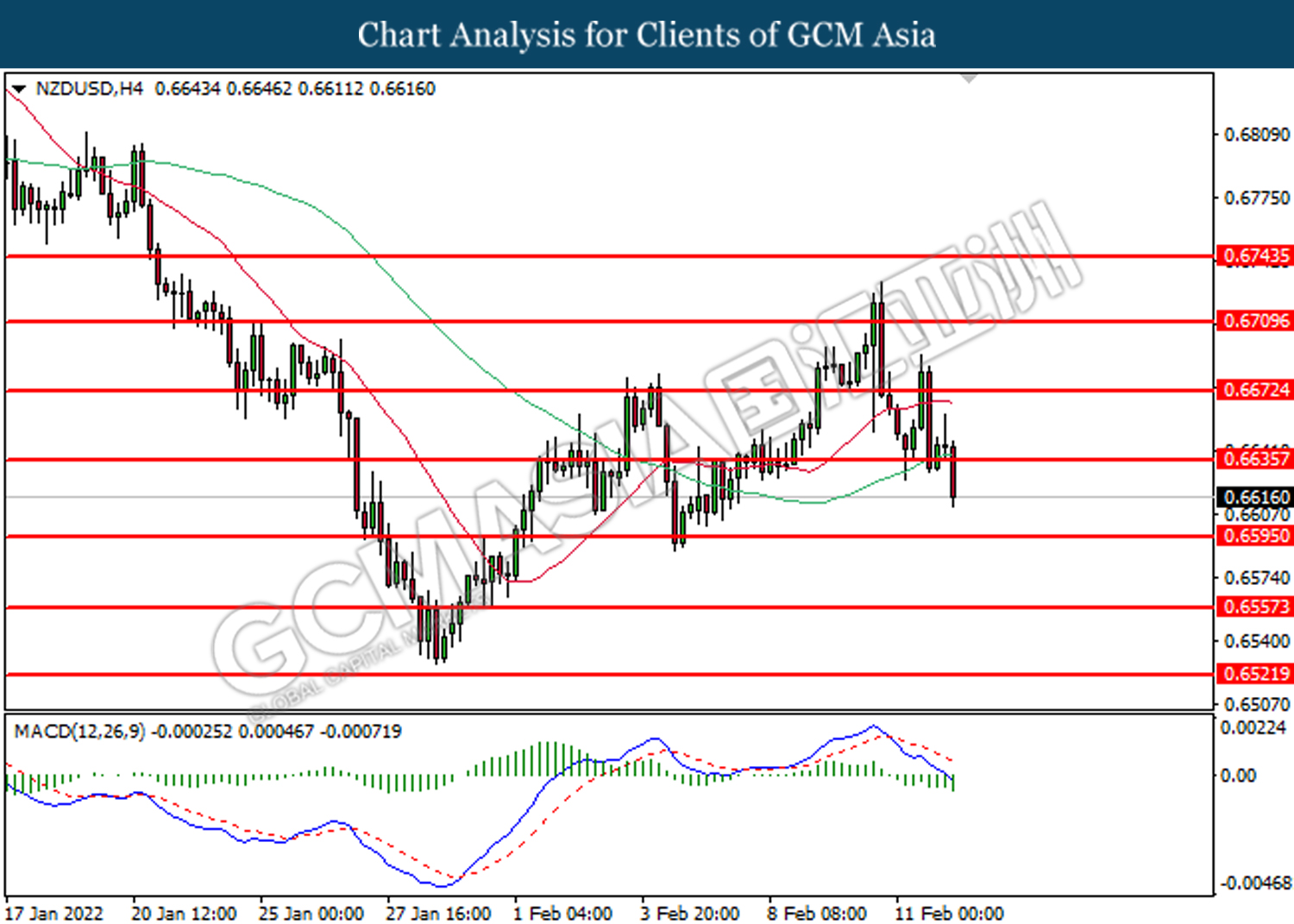

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

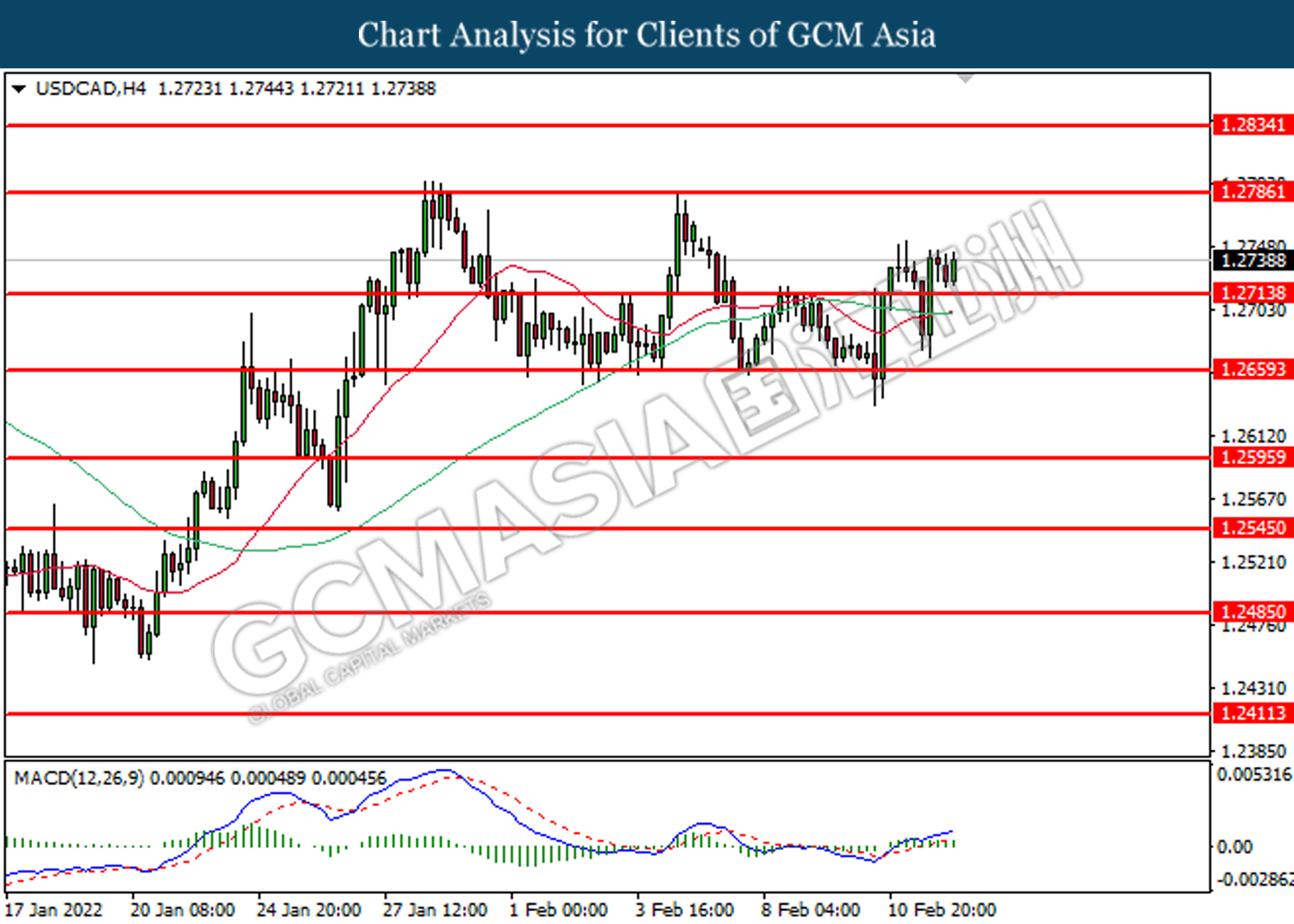

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

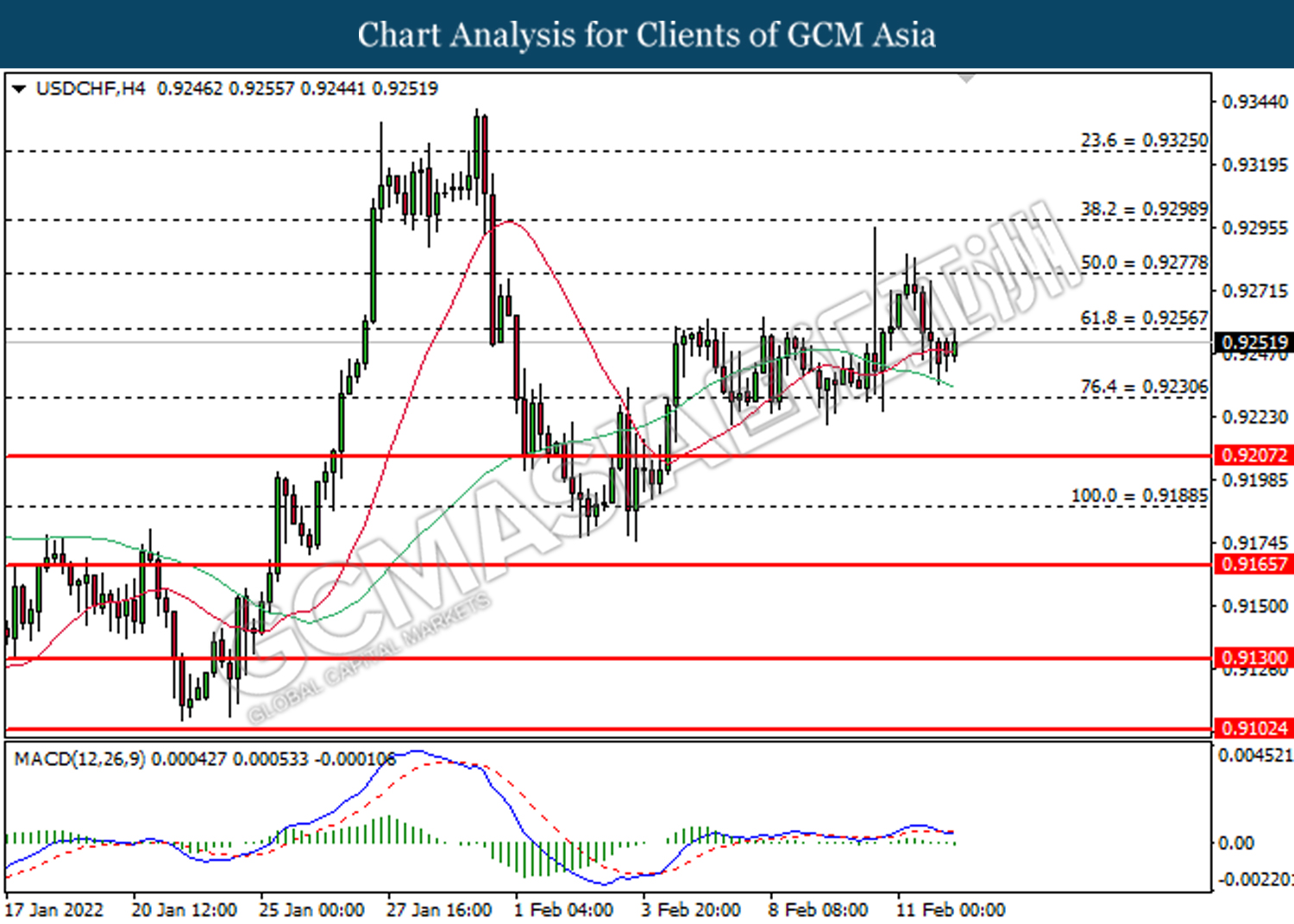

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1873.80, 1889.75

Support level: 1850.00, 1830.20