14 February 2022 Morning Session Analysis

Rising tensions between Russia-Ukraine, spurring bullish momentum on safe-haven Dollar.

The Dollar Index which traded against a basket of six major currency surged following the rising tensions between Russia and Ukraine, which stoked a shift in sentiment toward the safe-haven US Dollar. The United States claimed on Sunday that Russia could invade Ukraine at any time and would create a surprise pretext for an attack. According to Reuters, currently Russia has more than 100,000 troops massed around Ukraine, which increasing further tensions between of both countries. President Biden spoke with Vladimir Putin yesterday and warned that the US and its allies will response “decisively and impose swift and severe costs” on Russia if Putin decide to invade Ukraine. Market participants speculated that such rising geopolitical tensions between both countries would likely to be jeopardizing the global economic, which increasing the appeal for safe-haven asset. As of writing, the Dollar Index appreciated by 0.10% to 96.10.

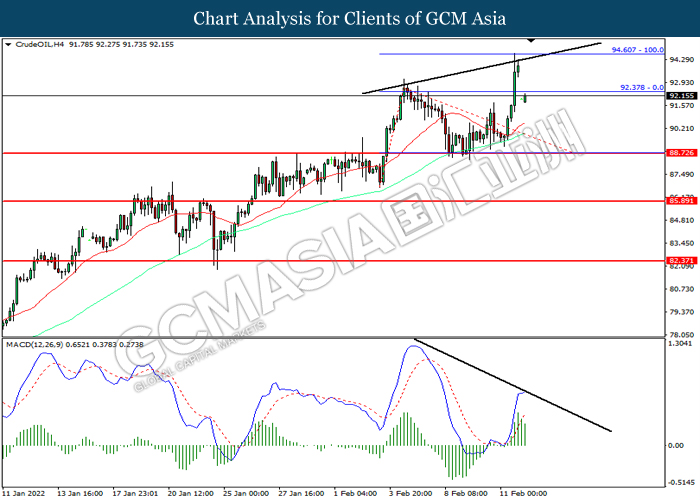

In the commodities market, the crude oil price surged 0.04% to $94.15 per barrel as of writing following the escalating fears of an invasion of Ukraine by Russia, added further concerns over the global supply disruption for crude oil. As for now, investors would continue to focus on the development with regards of the tensions between Russia-Ukraine to gauge the likelihood movement for this black-commodity. On the other hand, the gold price appreciated by 0.15% to $1861.40 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

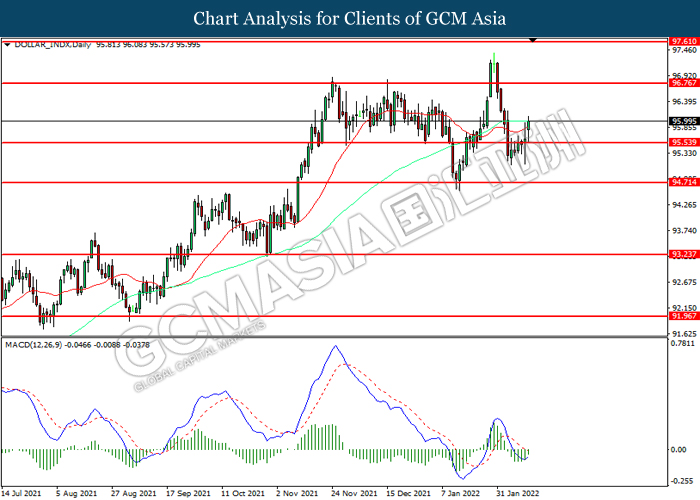

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher in short-term.

Resistance level: 96.75, 97.60

Support level: 95.55, 94.70

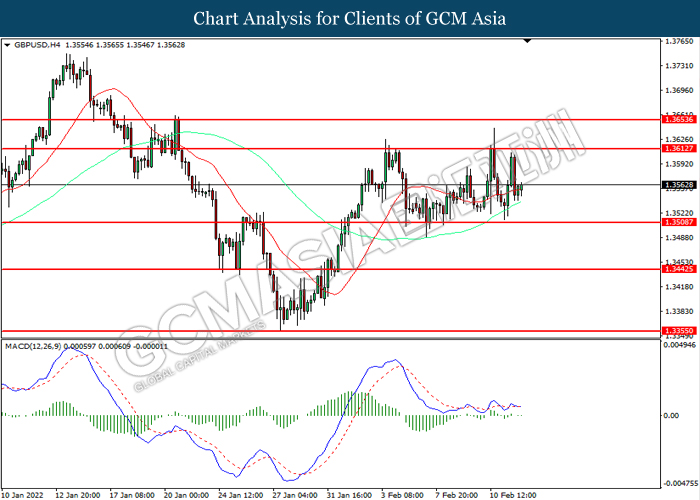

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.3615, 1.3655

Support level: 1.3510, 1.3445

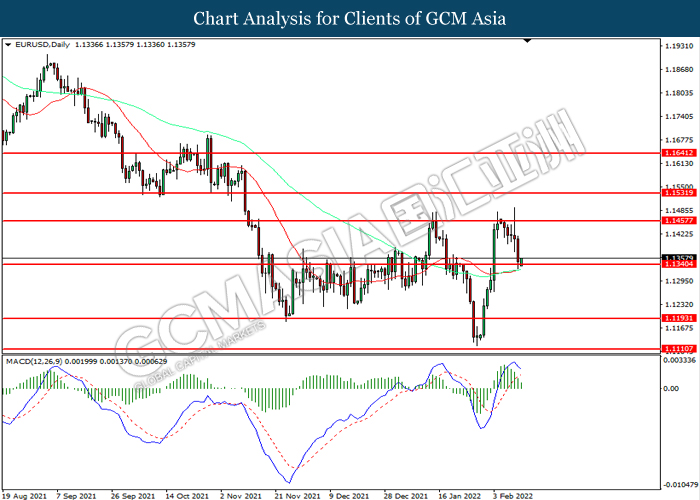

EURUSD, Daily: EURUSD was traded lower following prior retrace from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 1.1455, 1.1530

Support level: 1.1340, 1.1195

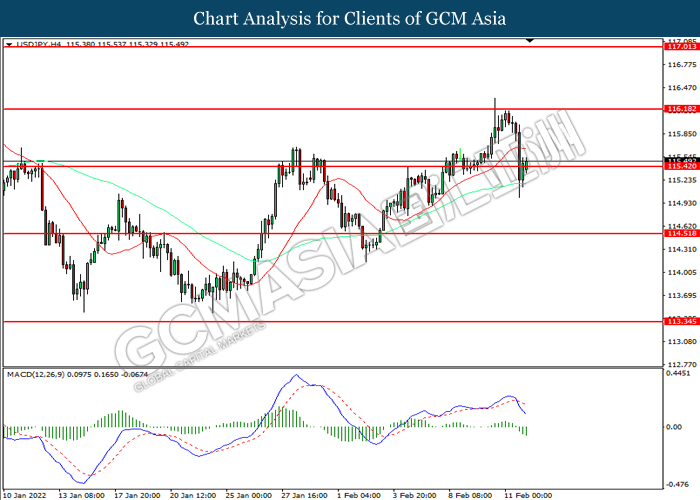

USDJPY, H4: USDJPY was traded lower following retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 116.20, 117.0

Support level: 115.40, 114.50

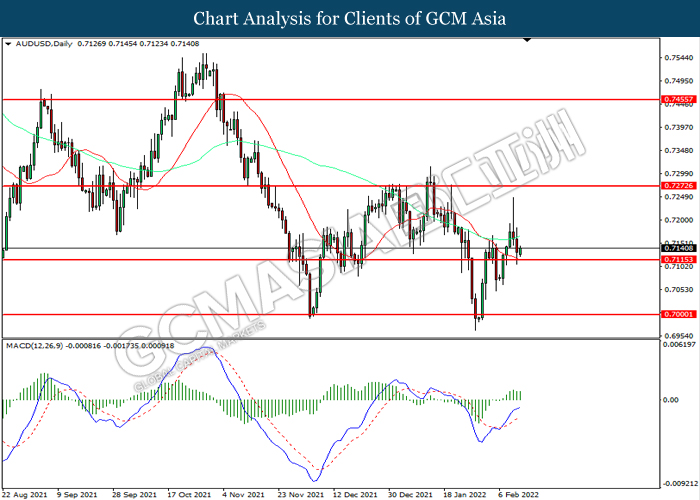

AUDUSD, Daily: AUDUSD was traded lower following retracement from higher level. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.7270, 0.7455

Support level: 0.7115, 0.7000

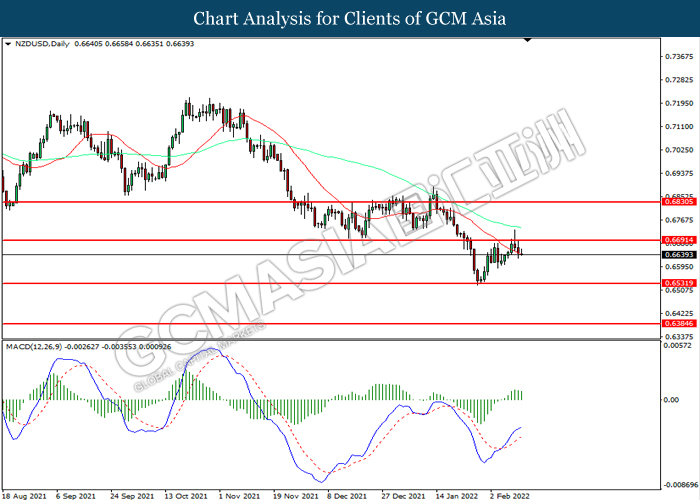

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.6690, 0.6830

Support level: 0.6530, 0.6385

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to extend gains after it successfully breakout the resistance level.

Resistance level: 1.2755, 1.2825

Support level: 1.2660, 1.2580

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9215. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9305, 0.9375

Support level: 0.9215, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded in short-term.

Resistance level: 92.40, 94.60

Support level: 88.75, 85.90

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1850.50. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 1873.30.

Resistance level: 1873.30, 1896.50

Support level: 1850.50, 1829.65