14 February 2023 Morning Session Analysis

US dollar teeters ahead of long-awaited CPI data.

The dollar index, which is traded against a basket of six major currencies, teetered on the verge of collapse as the market participant waited for the inflation report to scrutinize if there would be a pivot turn from Fed going forward. At this point in time, economists are expecting the Consumer Price Index (CPI) would drop from 6.4% to 6.2% on an annual basis, increasingly betting the Federal Reserve might take a step back further from its aggressive rate hike plan if the data shows a decent easing of inflationary pressure. A year ago, the Federal Reserve started its long journey of curbing persistent-high inflation by raising the interest rate unstoppably. With that, the inflation figure has been successfully brought down to 6.4% at the end of the year 2022 despite still being far away from the Fed’s long-term target of 2%. The first inflation figure for the year will undeniably provide a clearer picture to investors gauging the Fed monetary policy’s future path. It is noteworthy to warn that a higher-than-expected inflation number could cause markets to reconsider the possibility of keeping interest rates high for a long time, and if so, a trend reversal might be triggered. As of writing, the dollar index dropped -0.32% to 103.30.

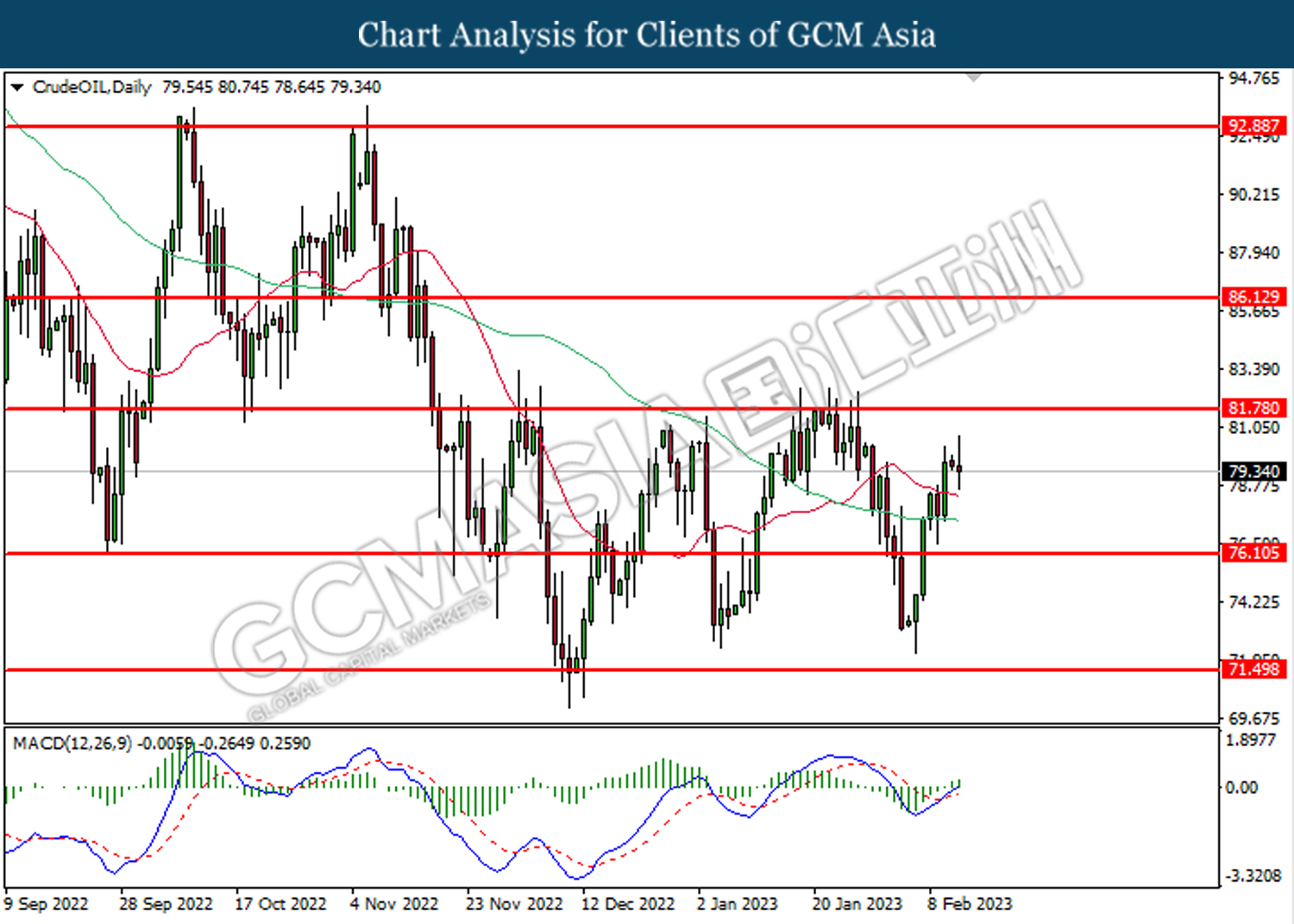

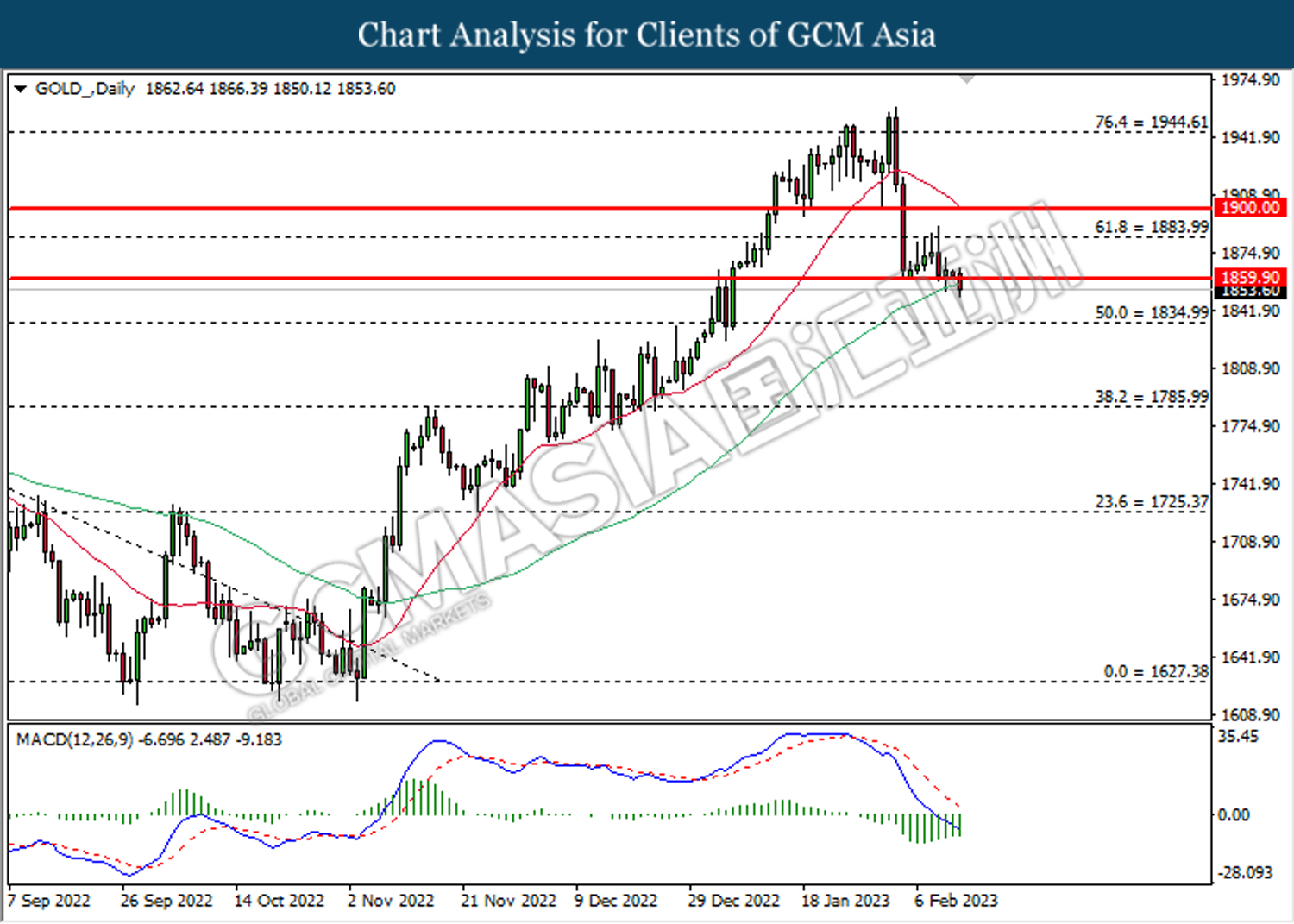

In the commodities market, crude oil prices were down by -0.72% to $79.10 per barrel amid the renewed inflation fears overshadowed the oil cut plan from Russia. Besides, gold prices edged down -0.67% to $1853.45 per troy ounce ahead of the inflation report release.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 6.4% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | 19.7K | 17.9K | – |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.4% | 0.4% | – |

| 21:30 | USD – CPI (YoY) (Jan) | 6.5% | 6.2% | – |

Technical Analysis

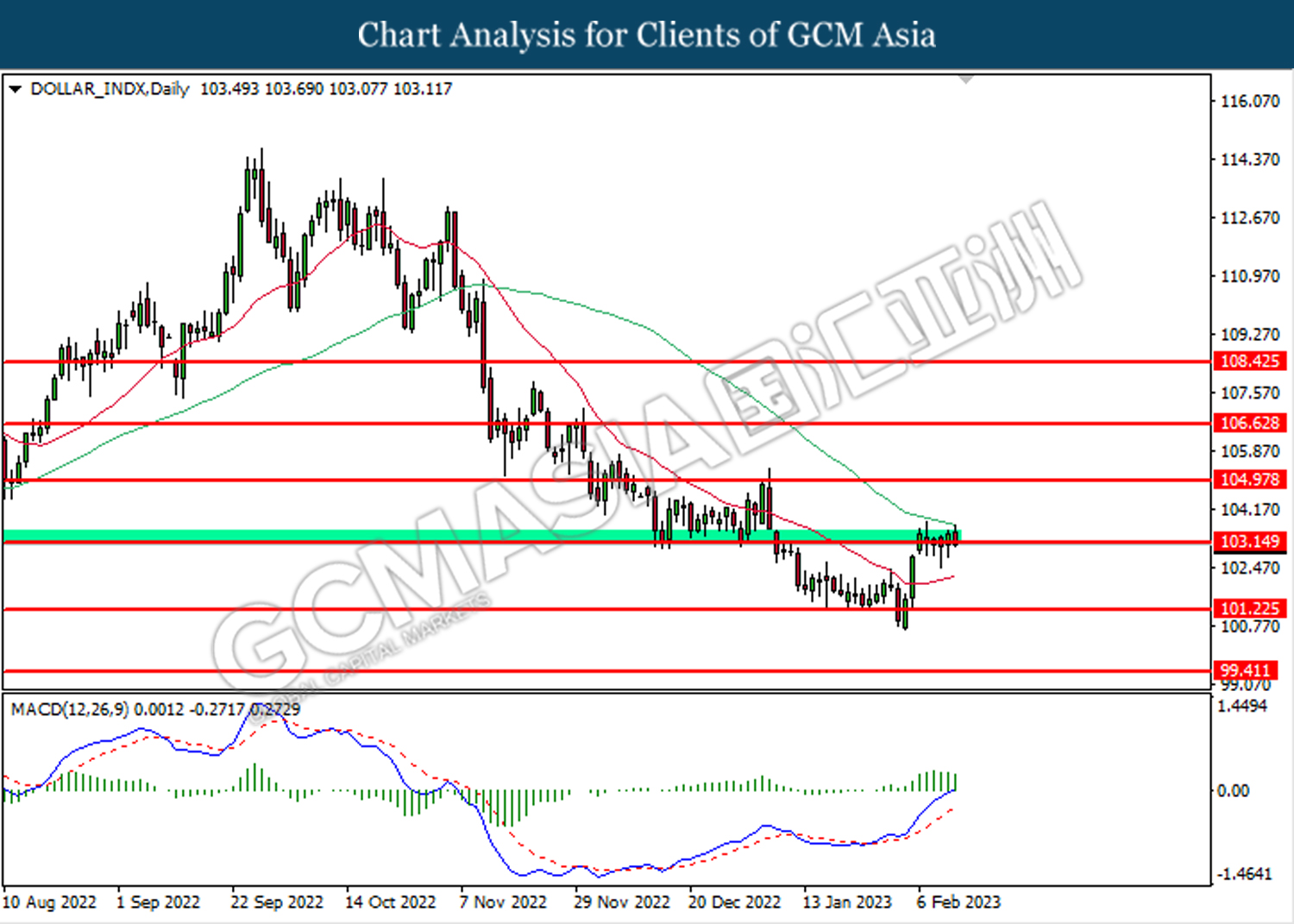

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

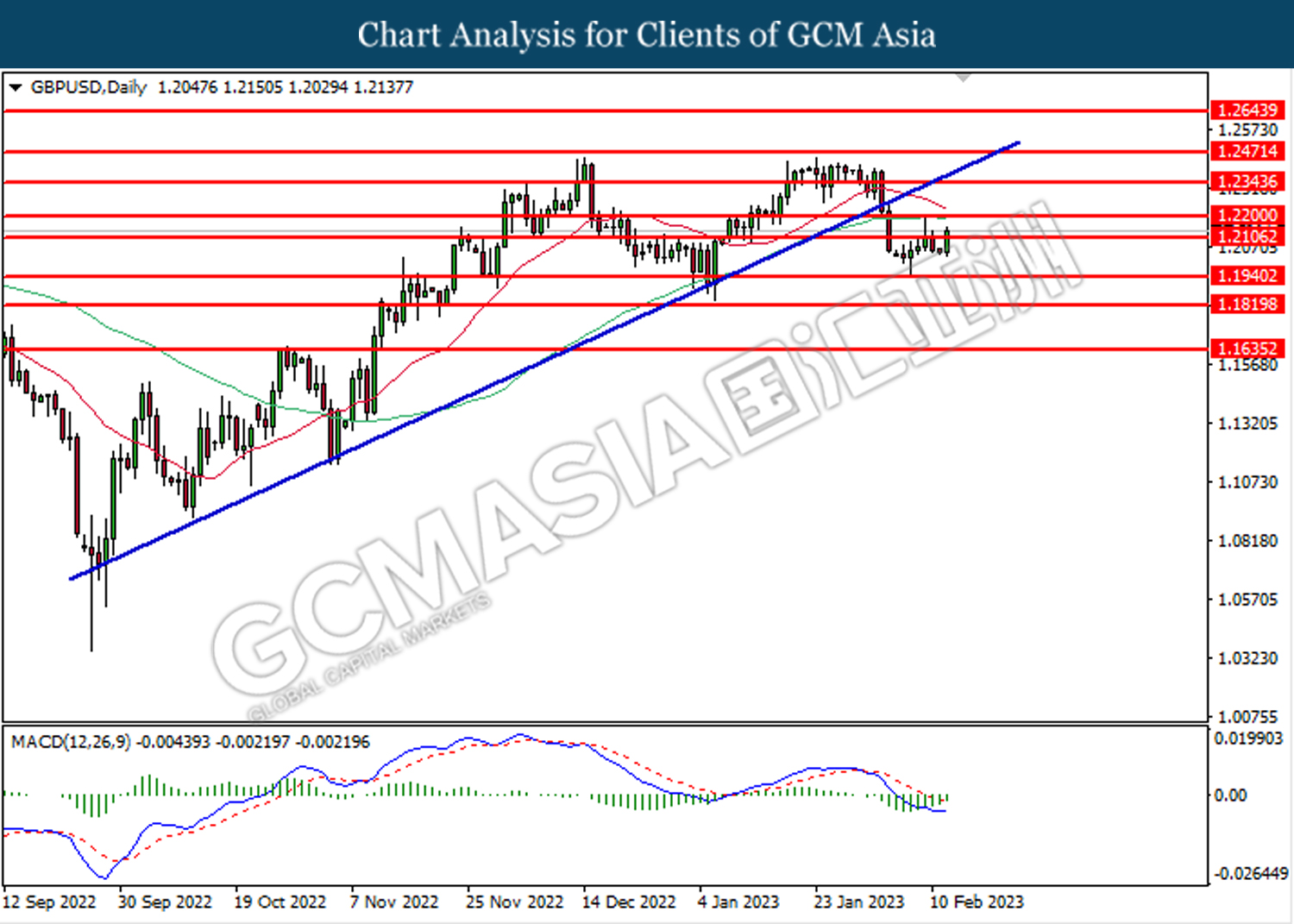

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

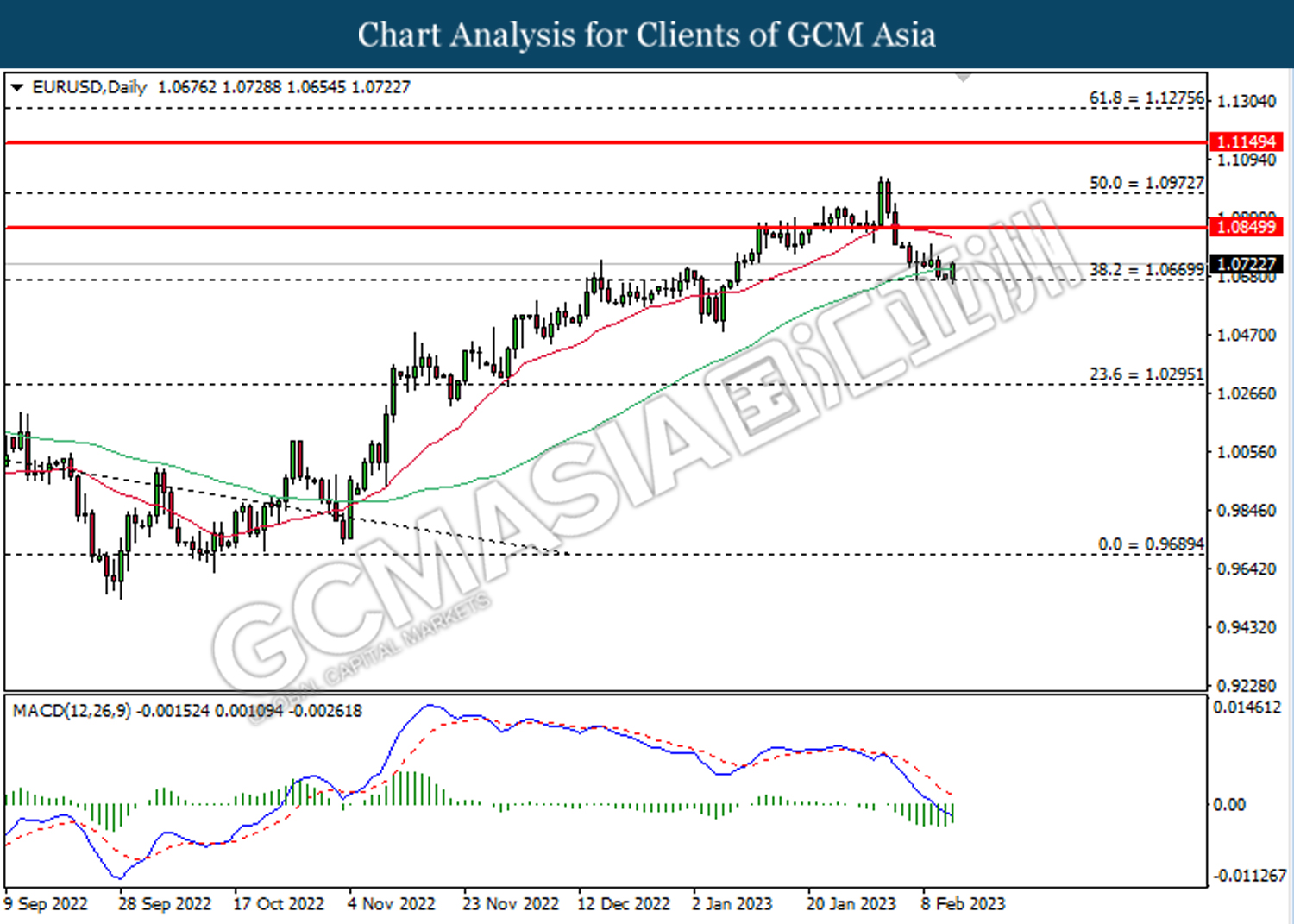

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0850.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

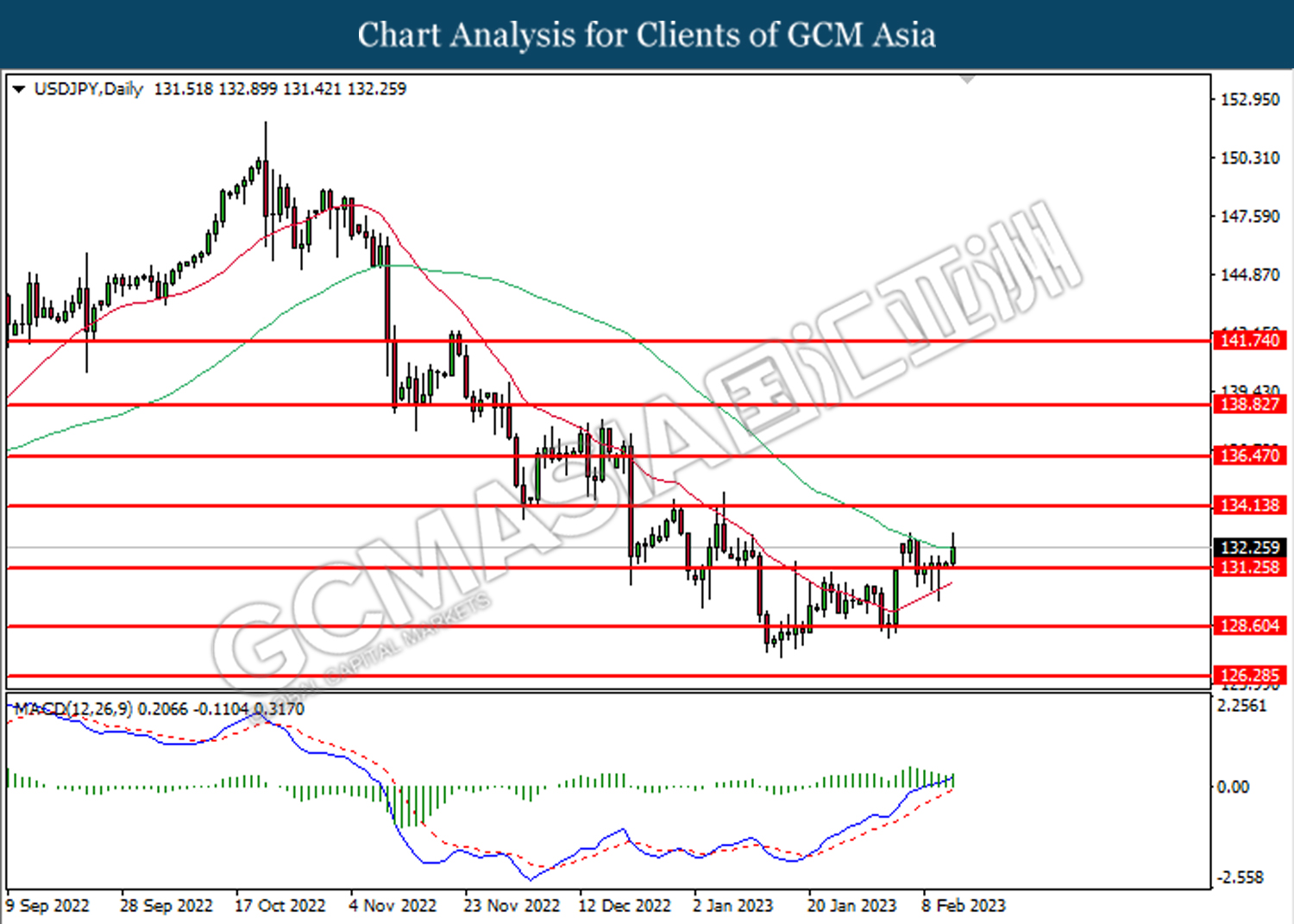

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

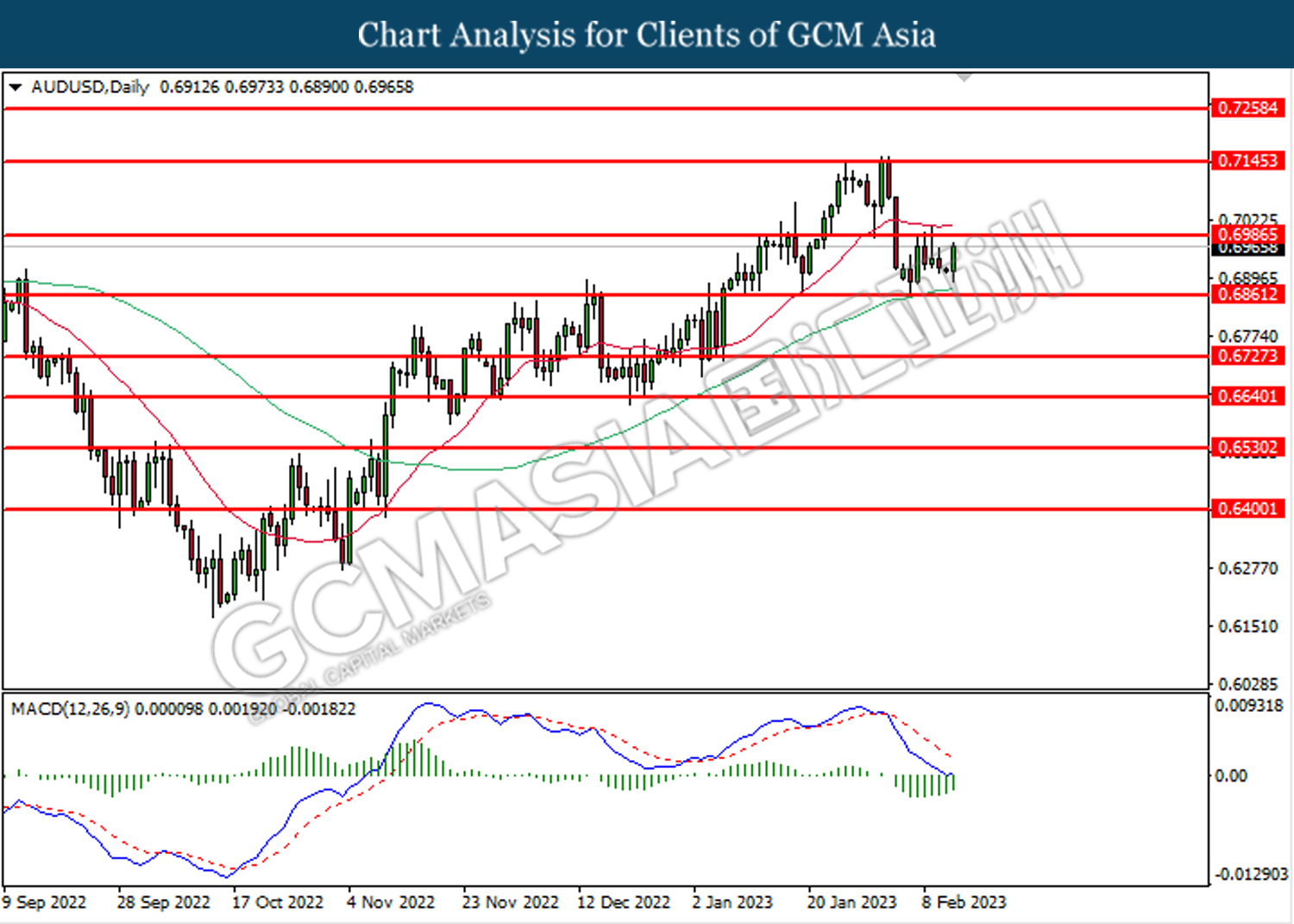

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

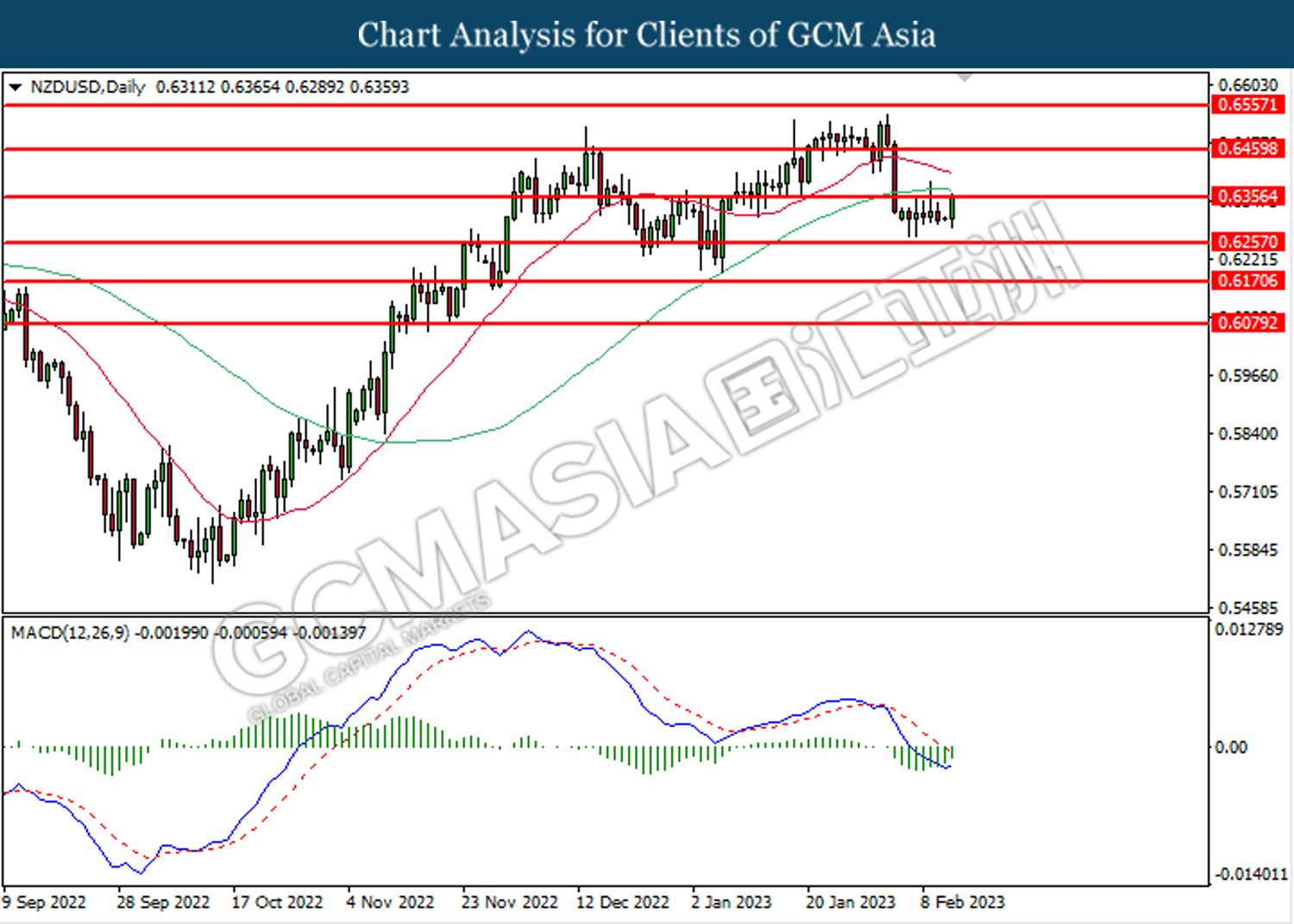

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

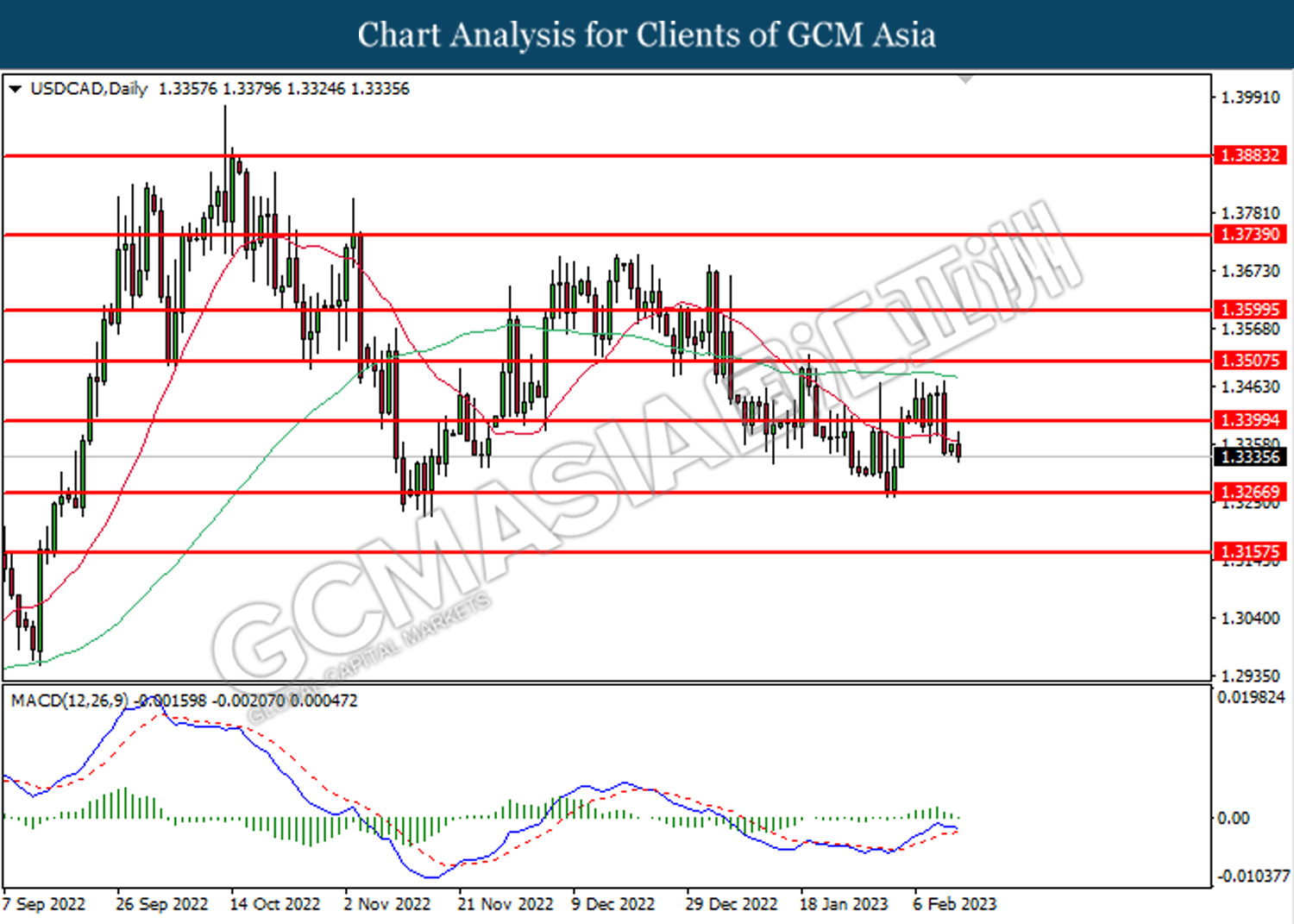

USDCAD, Daily: USDCAD was traded lower following a prior breakout below the previous support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

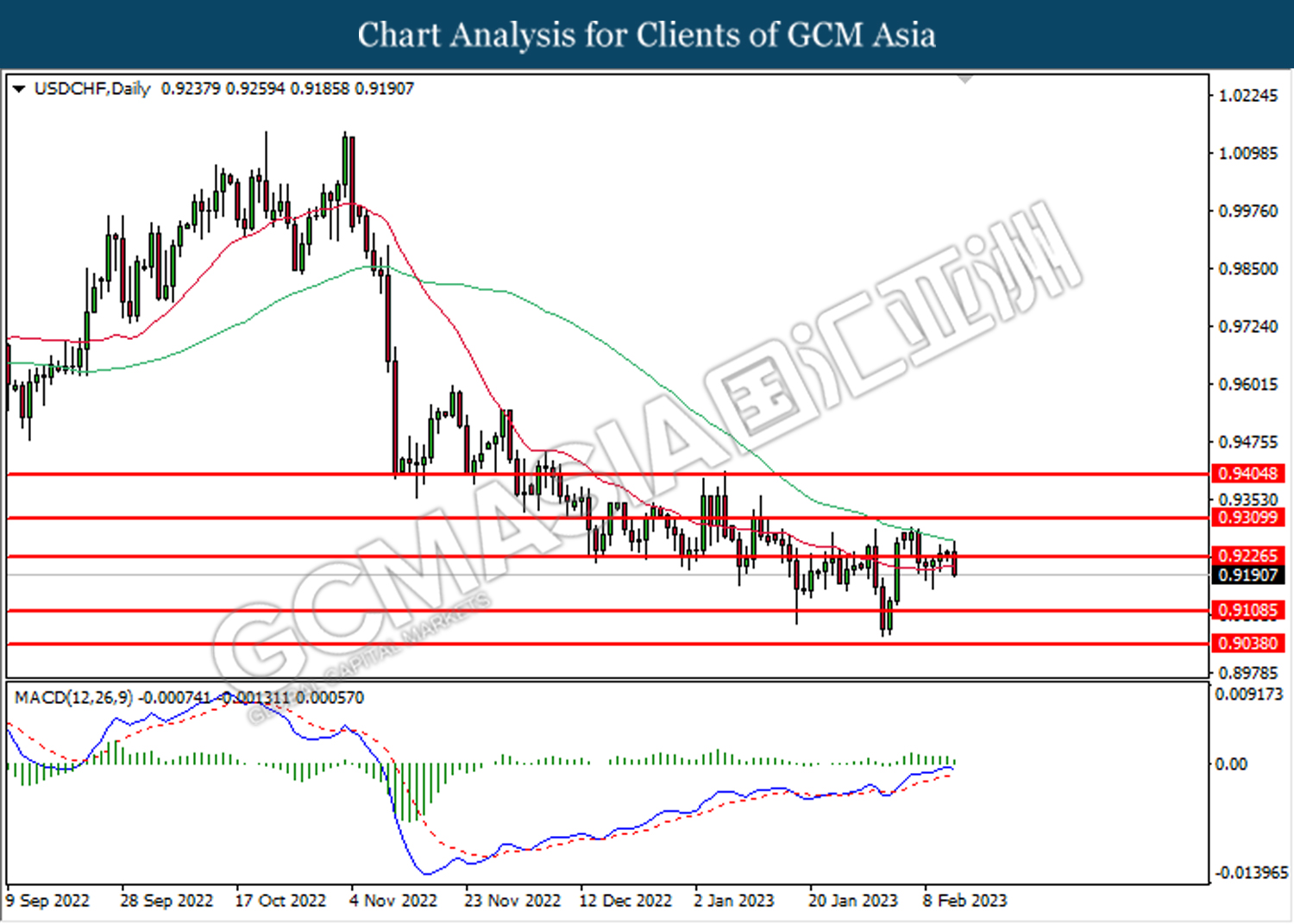

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00