14 March 2022 Afternoon Session Analysis

Euro slumped amid tensions between Russia-Ukraine continued.

Euro have been beaten down since Friday under rising tension of Russia-Ukraine conflict. According to Reuters, a Ukrainian official appeared a fact on Sunday, Russia attacked a base near the Polish border and fighting raged elsewhere. A barrage of Russian missiles hit Ukraine’s Yavoriv International Centre for Peacekeeping and Security, a base just 15 miles (25 km) from the Polish border that has previously hosted NATO military instructors, killing 35 people and wounding 134. Despite diplomatic efforts to end the war in Ukraine stepped up on Monday, with Ukrainian and Russian negotiators set to talk again after both sides cited progress, it sparked negative prospect toward the economic momentum in European region indeed as the circumstance did not go through into a peaceful way after the negotiations between both parties. It dialed down the market optimism toward economy conditions of European, led investors to selloff Euro and spurring further bearish momentum on the pair. Investors should continue to scrutinize the latest updates with regards of Russia-Ukraine conflict to receive further trading signals on Euro. As of writing, Euro appreciated by 0.01% to 1.0910.

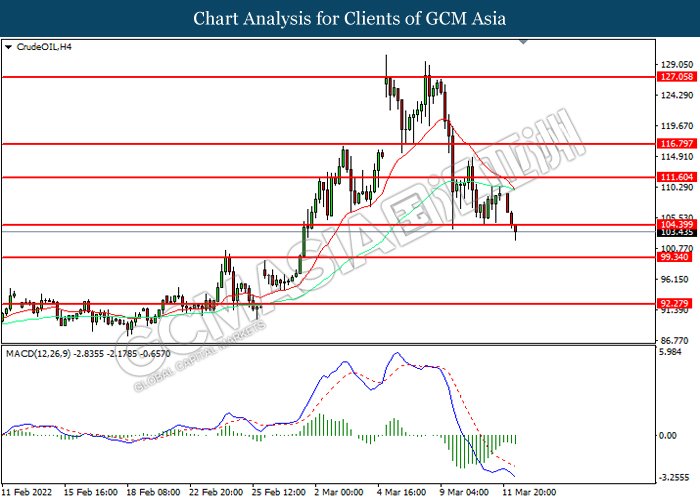

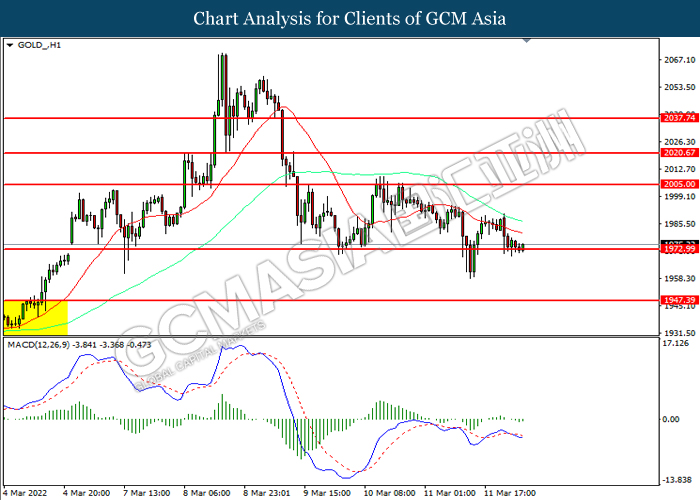

In commodities market, crude oil price depreciated by 2.98% to $106.12 per barrel as of writing upon oil supply additions from OPEC+. Besides, gold price depreciated by 0.26% to $1979.80 per troy ounces as of writing amid the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

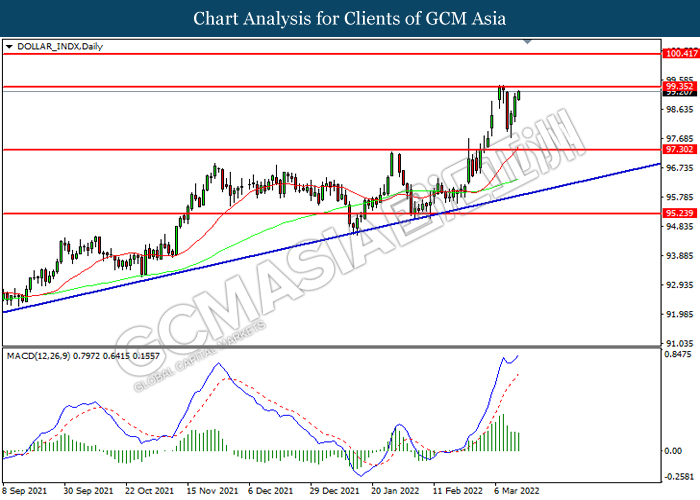

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

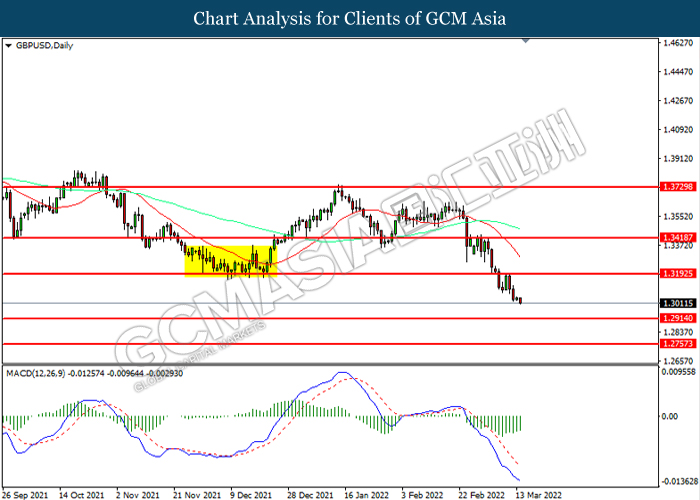

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

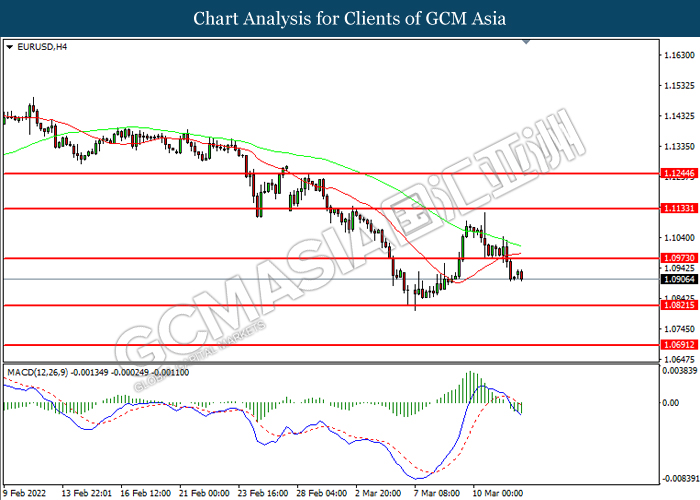

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 117.50. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 117.50, 118.90

Support level: 116.25, 114.60

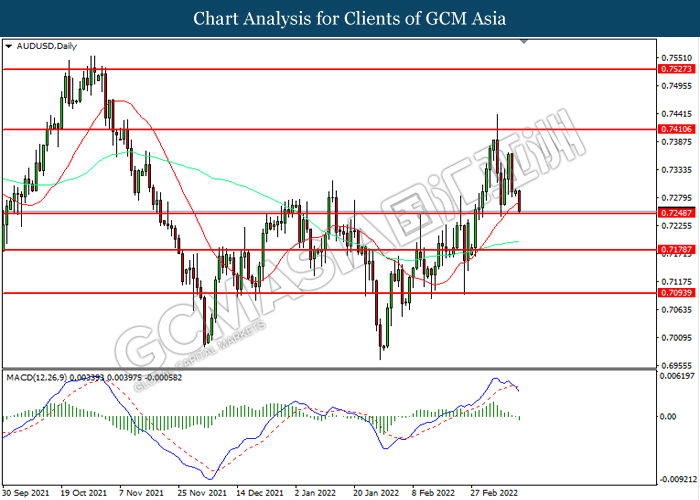

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7410, 0.7525

Support level: 0.7250, 0.7180

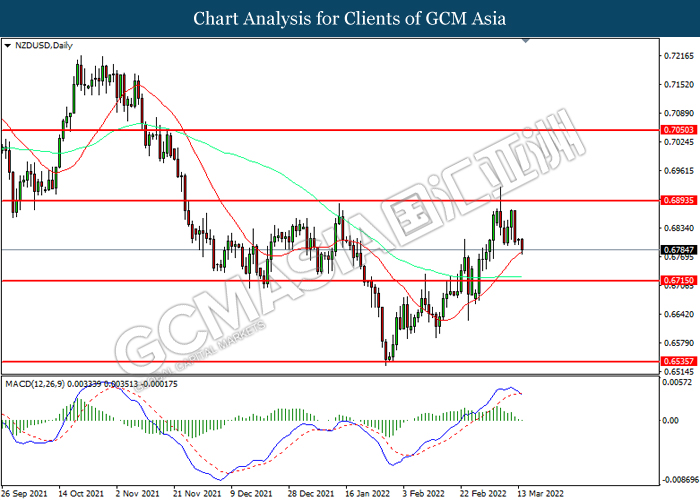

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6895. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

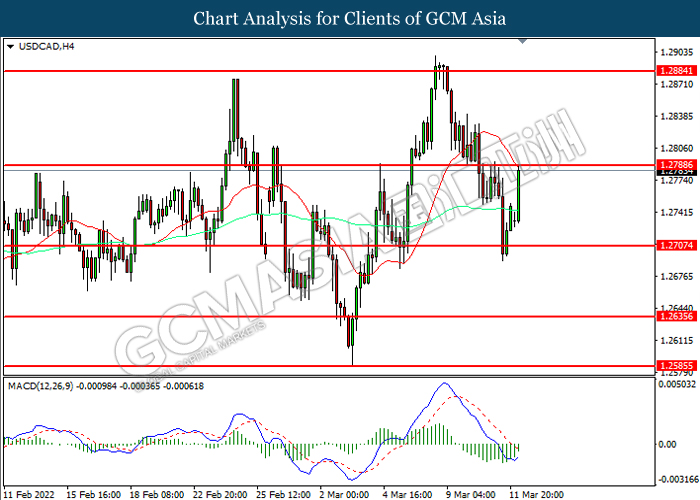

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2790. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.2785, 1.2885

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9360, 0.9420

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 104.40. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 104.40, 111.60

Support level: 99.35, 92.30

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 2005.00, 2020.65

Support level: 1973.00, 1947.40