14 March 2022 Morning Session Analysis

US Dollar surged on rising yield.

The Dollar Index surged over the backdrop of hawkish expectation from Federal Reserve this week. Earlier, the commodities price increased to their highest level since 2008 on growing supply shock following the implementation of sanction upon Russia. The spiking commodities price would likely to spark inflation risk in future, increasing the probability for the Federal Reserve to rate hike while sending the US 10-year Treasury yield edged higher following it dropping to its lowest level in two months. The US Core Consumer Price Index (CPI) notched up from the previous reading of 6.0% to 6.4%, exceeding the market forecast at 5.9% while hitting the 40-years high. The US Federal Reserve is scheduled to release its next policy statement on 16th March 2022. As for now, investors would continue to scrutinize the latest updates from Federal Reserve as well as geopolitical tensions between Russia-Ukraine to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.03% to 99.05.

In the commodities market, the crude oil price depreciated by 1.59% to $108.25 per barrel as of writing amid hopes upon the rising oil supply from OPEC+. On the other hand, the gold price depreciated by 0.44% to $1979.75 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 98.95, 100.40

Support level: 97.30, 95.25

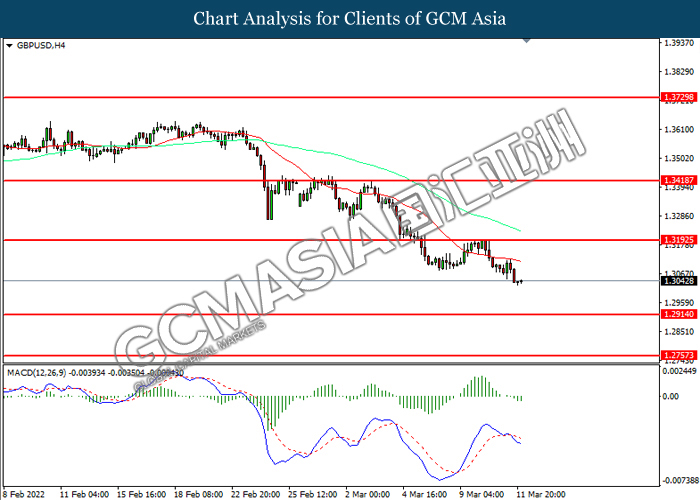

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

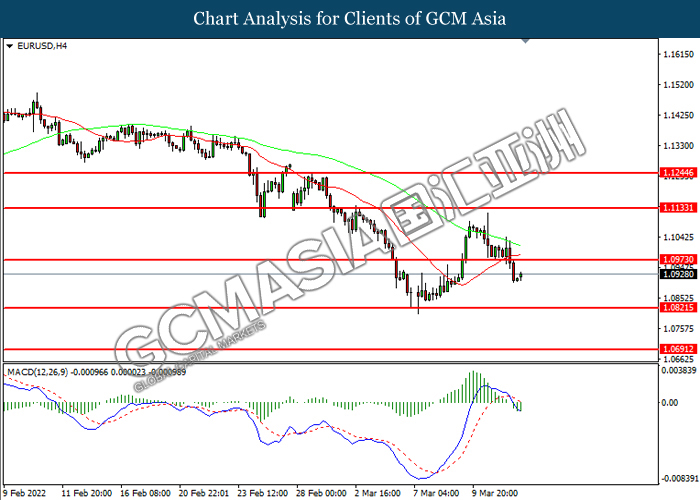

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 117.50. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 117.50, 118.90

Support level: 116.25, 114.60

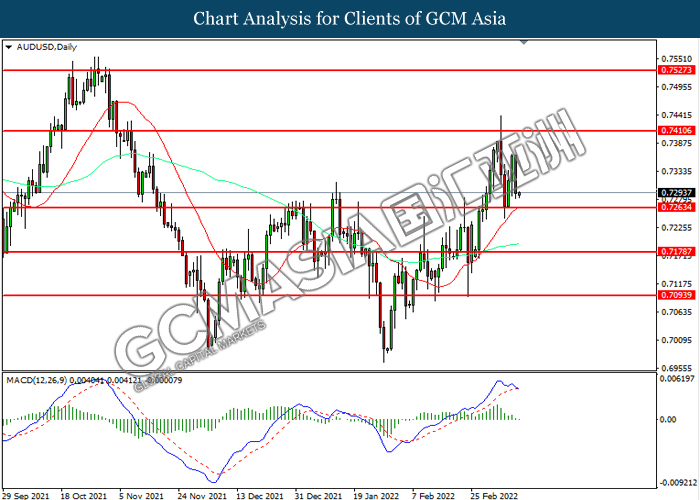

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

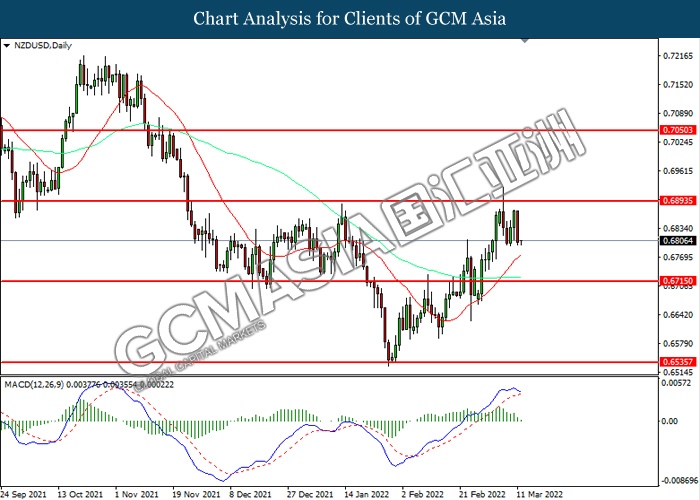

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

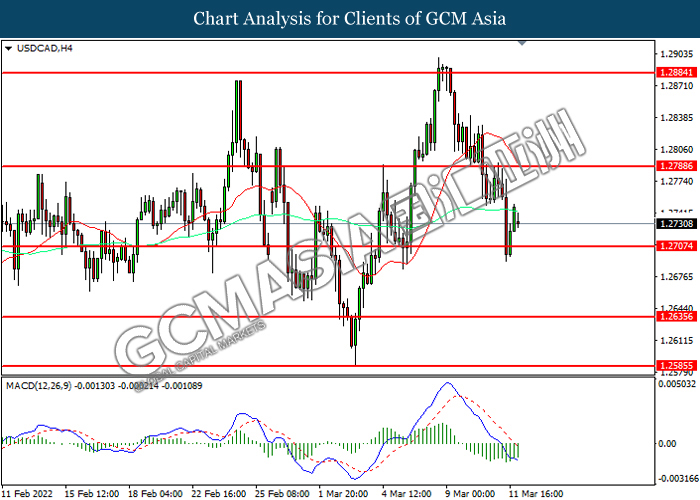

USDCAD, H4: USDCAD was traded lower following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2785, 1.2885

Support level: 1.2705, 1.2635

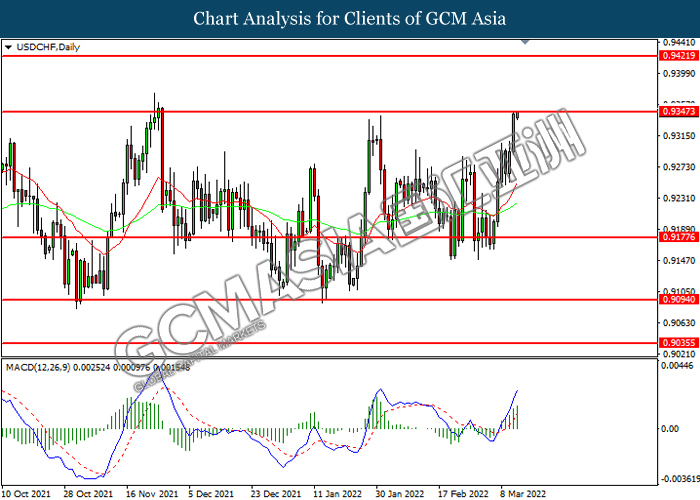

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9345, 0.9420

Support level: 0.9175, 0.9095

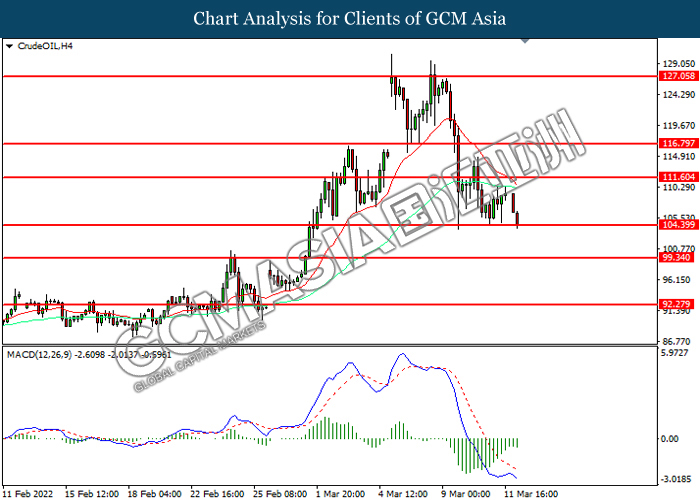

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 111.60, 116.80

Support level: 104.40, 99.35

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 2005.00, 2020.65

Support level: 1973.00, 1947.40