14 March 2023 Afternoon Session Analysis

Aussie weakened amid RBA’s dovish move.

The Aussie dollar, which is traded as one of the mainstream currencies edged down after the Reserve Bank of Australia’s dovish communique. The RBA Government Lowe announced a higher chance of policy pause on Wednesday after the RBA delivered a 25bp hike last Tuesday. According to the cash rate futures, it implied a 59% chance of an official rate pause in April, but that has now increased to 89% due to SVB (Silicon Valley Bank) crisis. Whilst investors embraced full panic mode regards to SVB, it does increase the odds that the Fed will step back from their tightening monetary policy, and that would likely further increase the odds of same move by RBA in April. Besides, Australian household spending plunged 14.8% in January, according to the Australian Bureau of Statistics (ABS) report. As the RBA is closely monitoring household spending, it can be taken as another factor to cease the RBA from rising its interest rate further. Investors now are keeping an eye on the Monthly Labor Force Report from the ABS. As of writing, the AUD/USD pair plunged -0.14% to $0.6656.

In the commodity market, the crude oil price edged down by -1.13% to $79.86 per barrel as of writing amid heightening of investors’ fears over the risk of global economic recession, which prompted investors to shy away from oil market temporarily. On the other hand, the gold price slipped by -0.37% to $1909.55 per troy ounce as of writing as investors are waiting for more signal from the CPI report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Feb) | 0.40% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Feb) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (YoY) (Feb) | 6.40% | 6.00% | – |

Technical Analysis

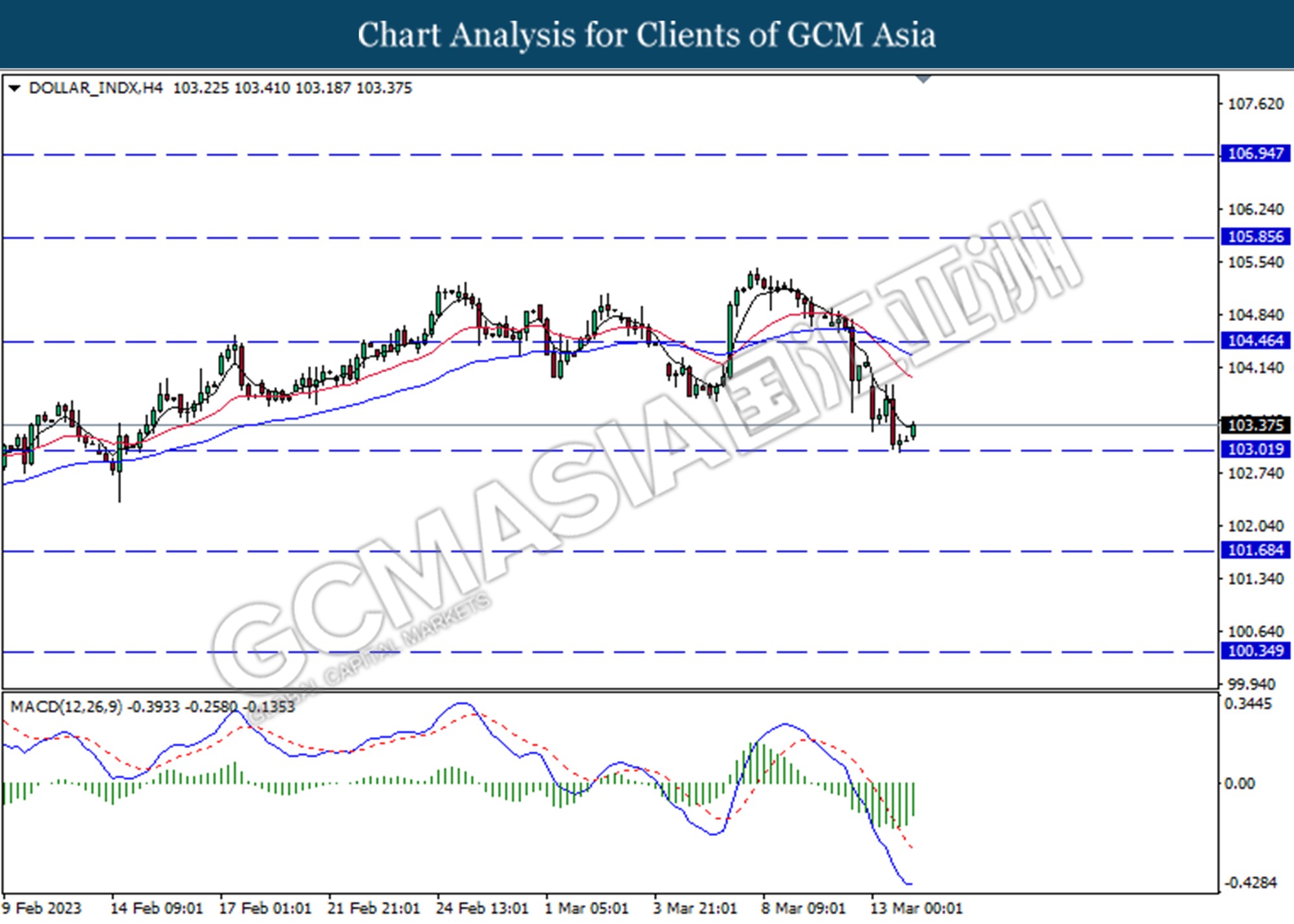

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the support level at 103.00. MACD which illustrated decreasing bearish momentum suggests the index to extend its gains toward the resistance level.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

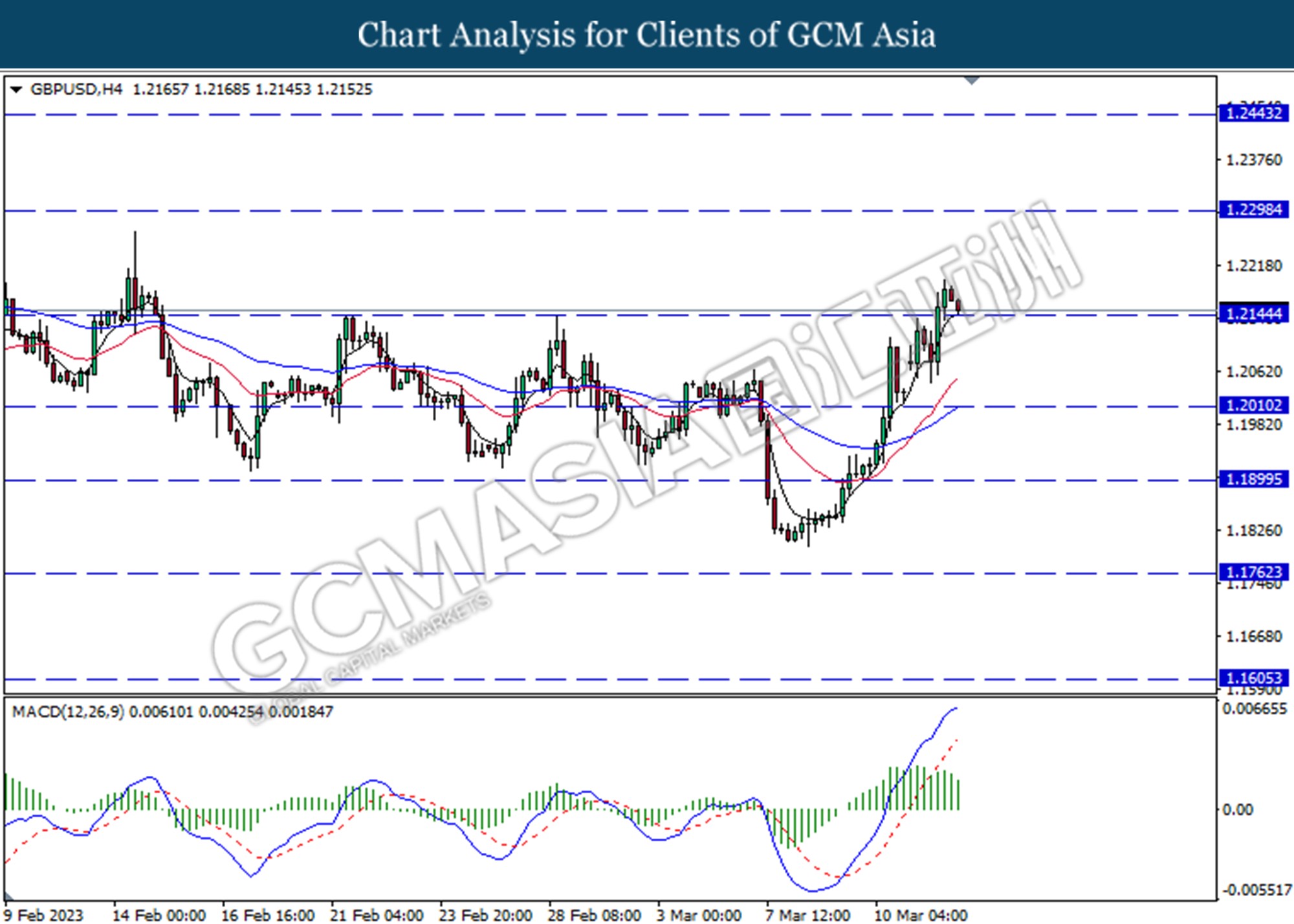

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2145. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

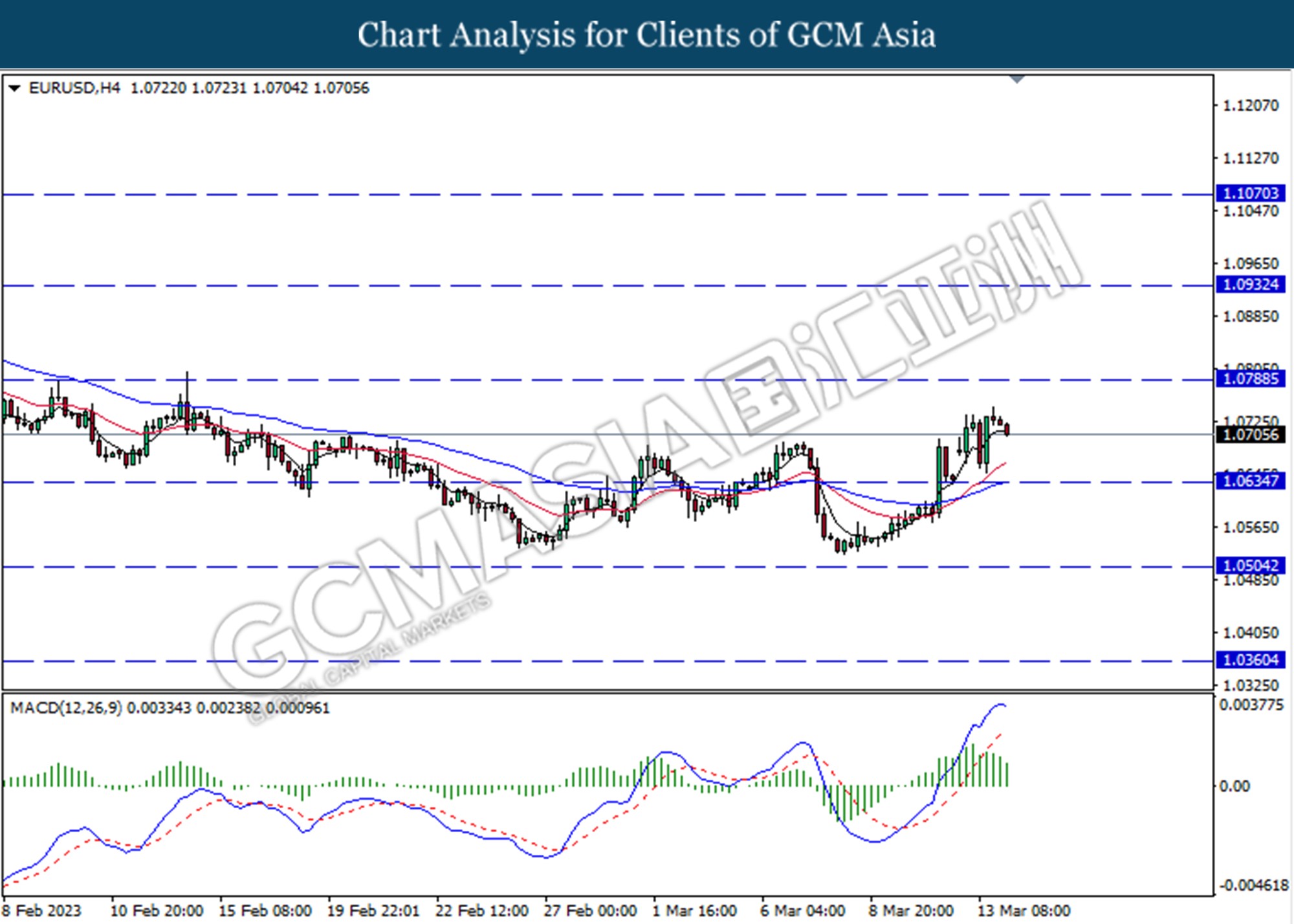

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

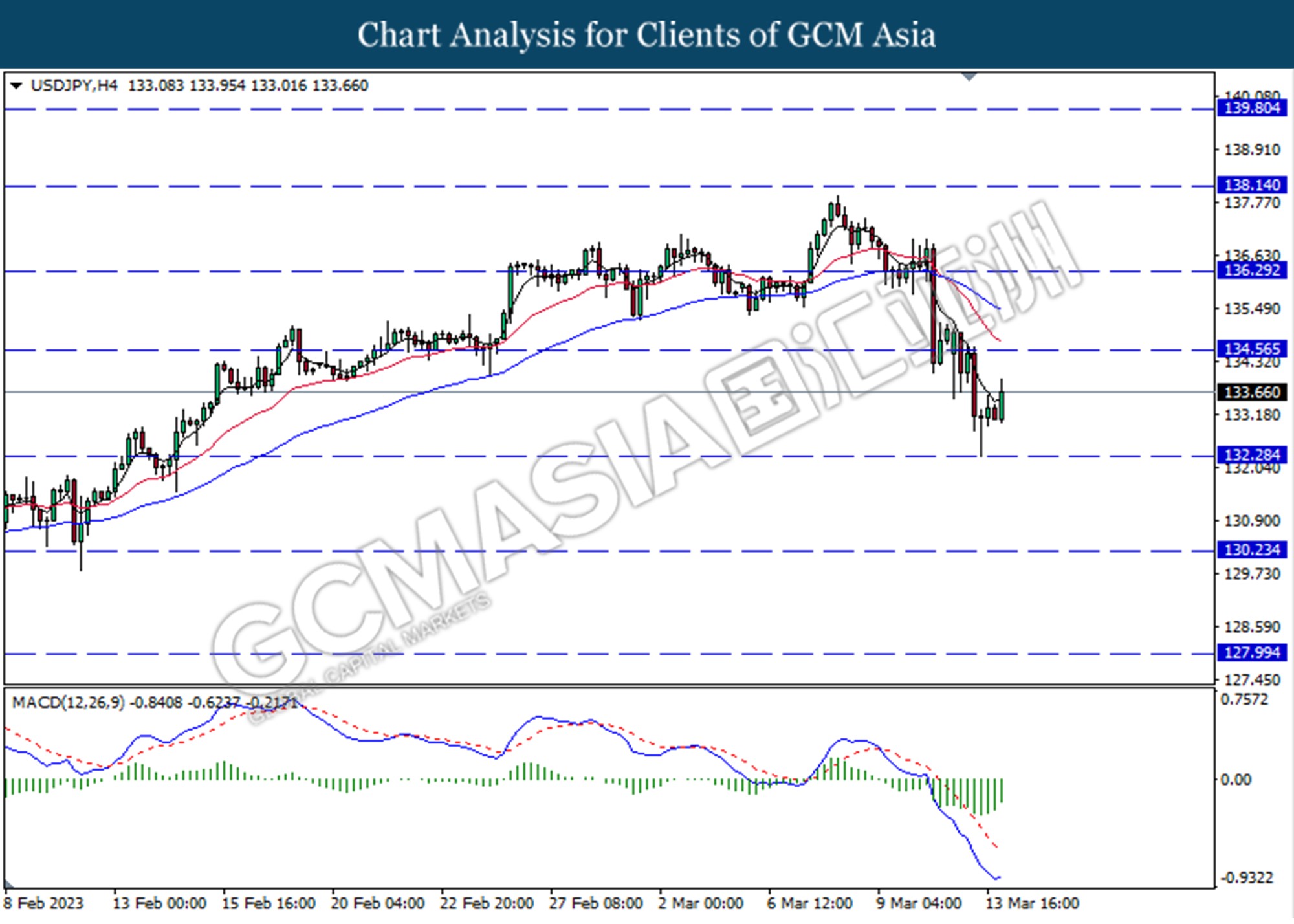

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

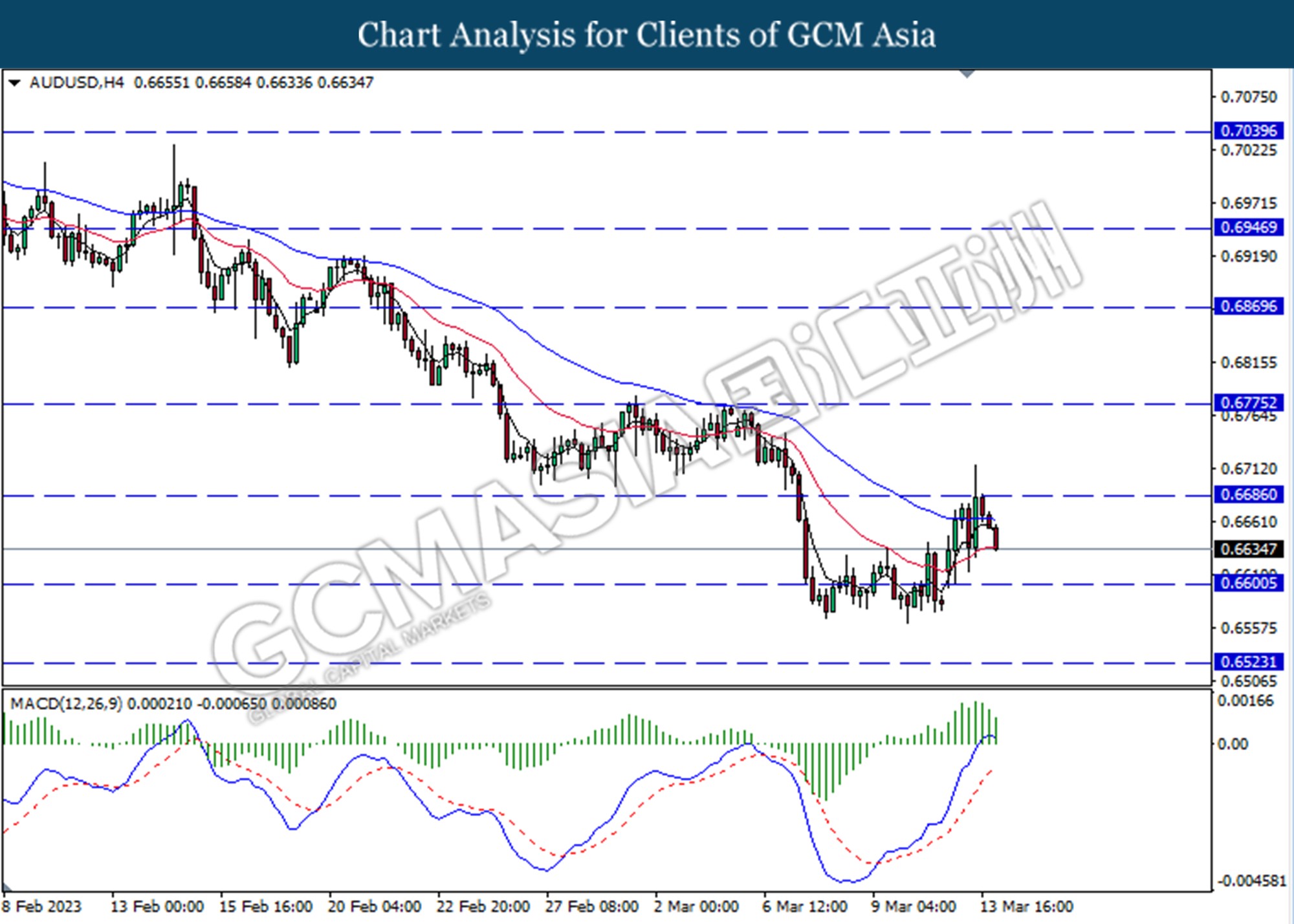

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the resistance level at 0.6685. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.6600.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

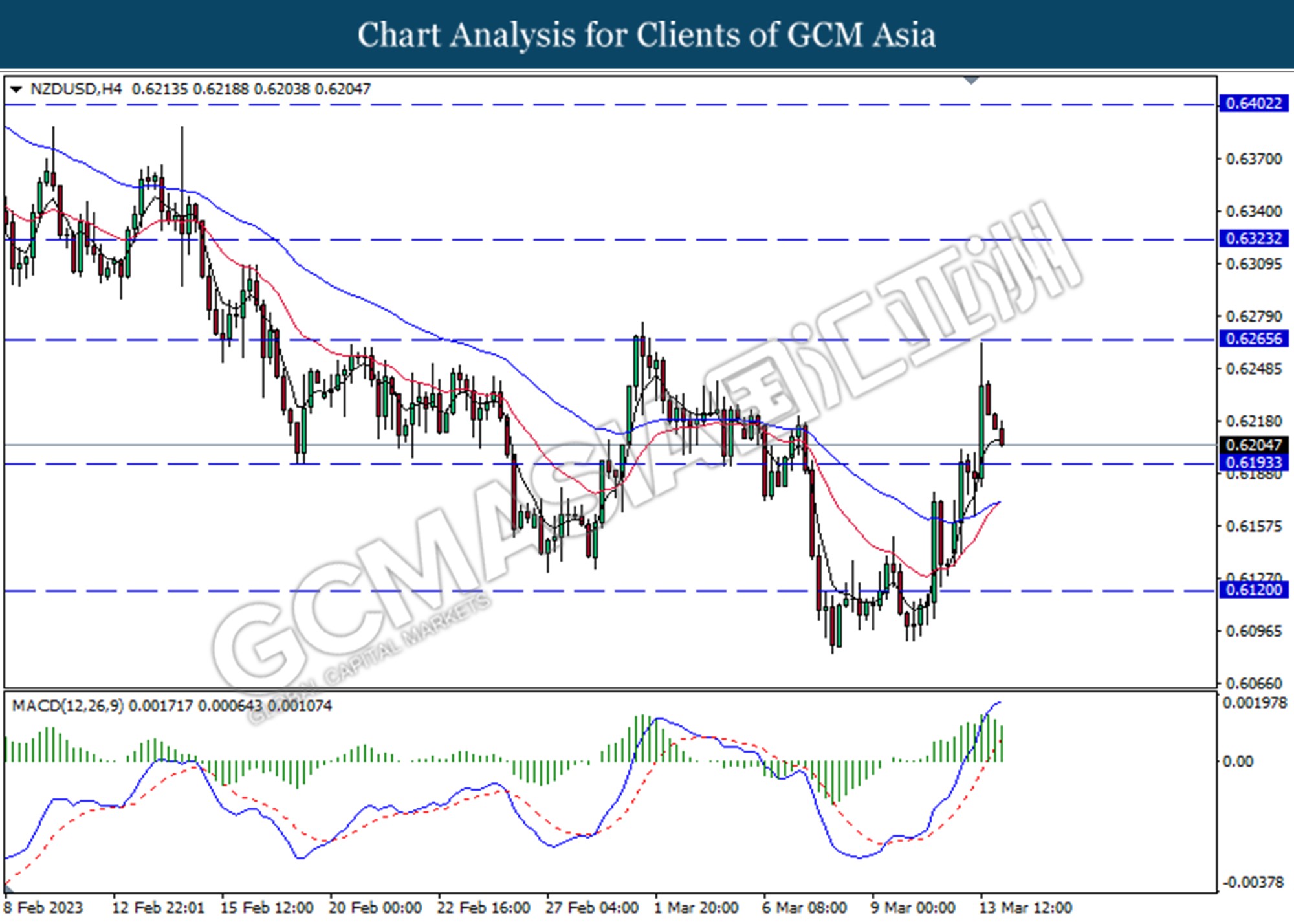

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

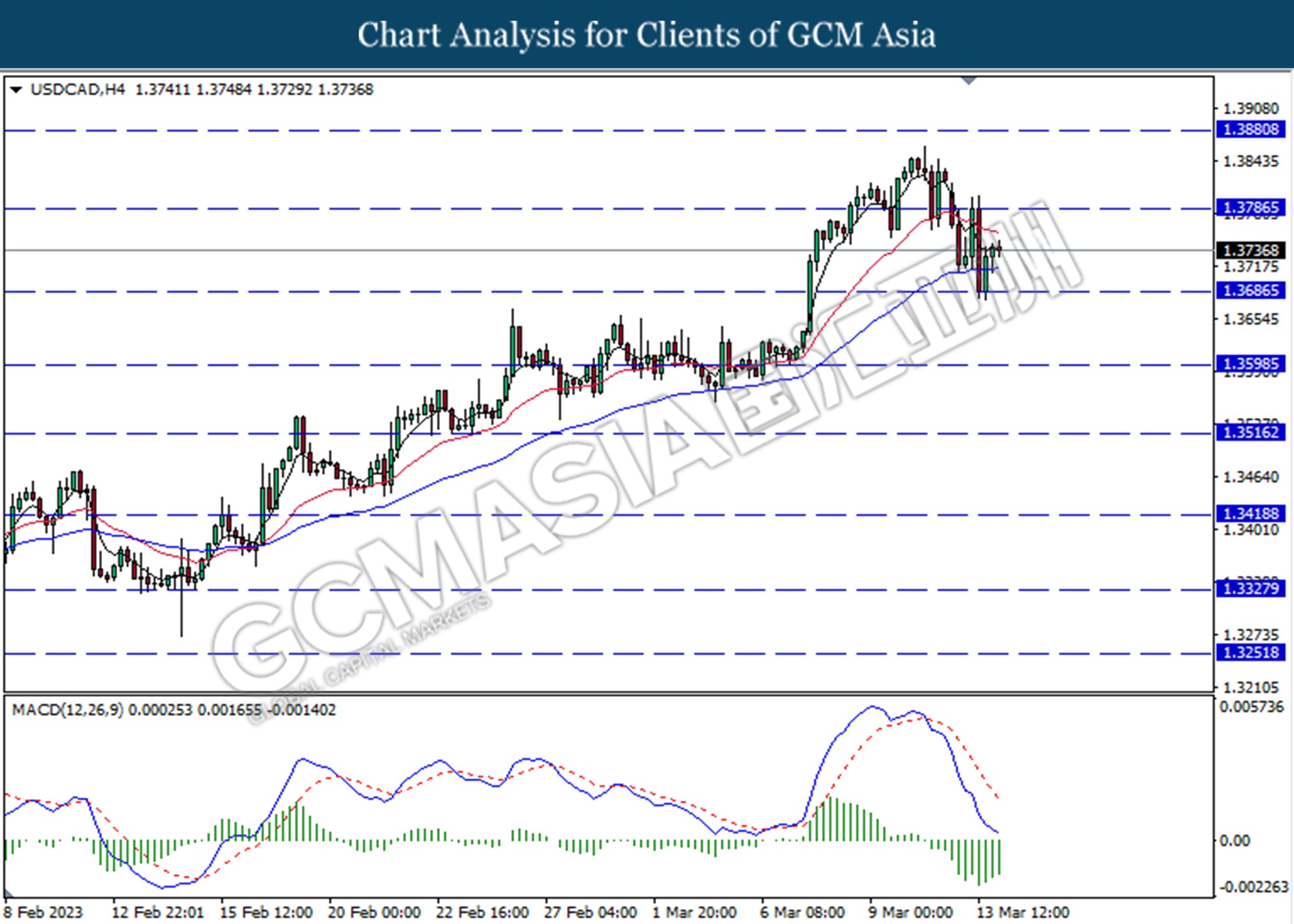

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3685. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3785.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

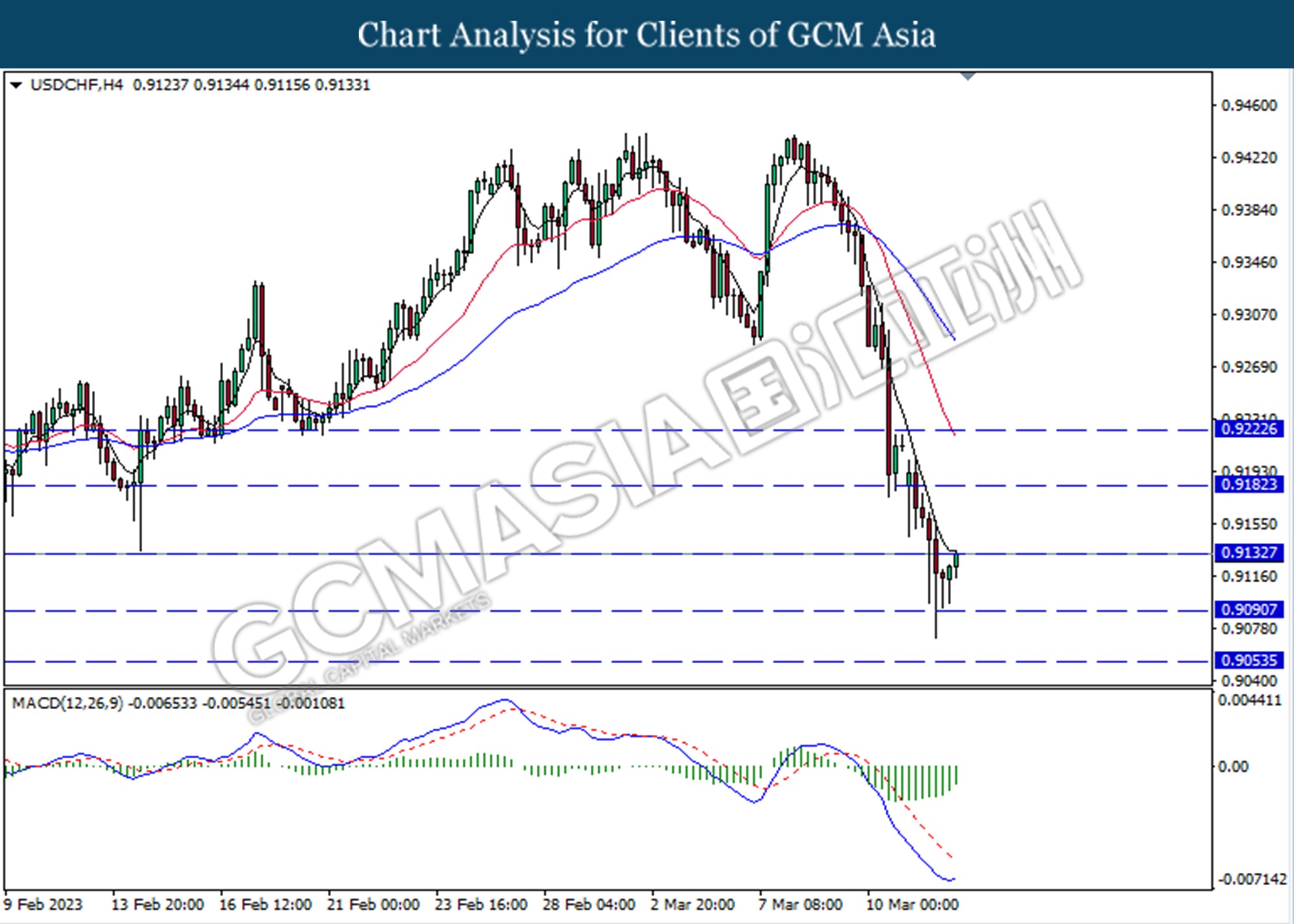

USDCHF, H4: USDCHF was traded higher while currently testing for the resistance level at 0.9135. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

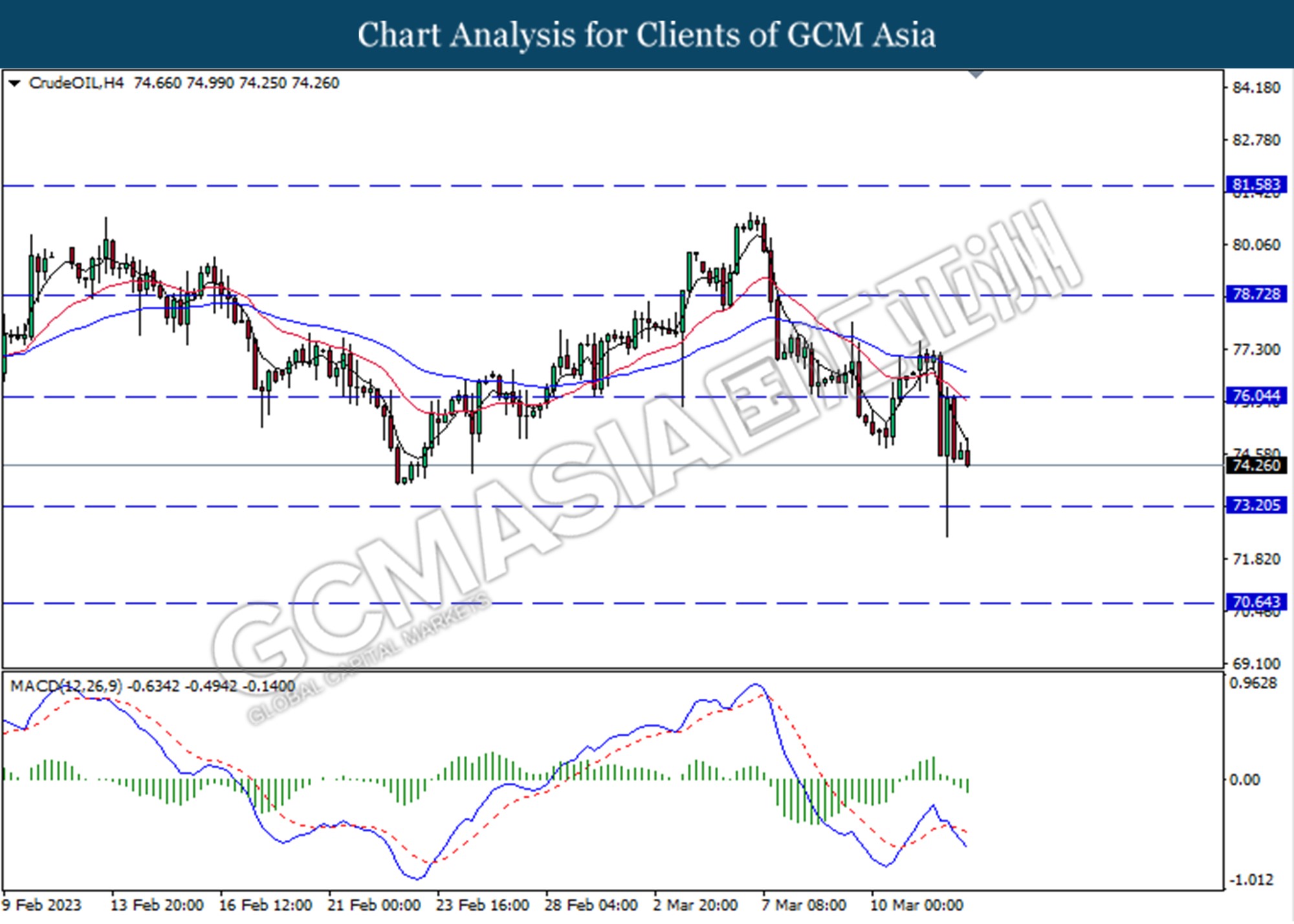

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 76.05. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 73.20.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

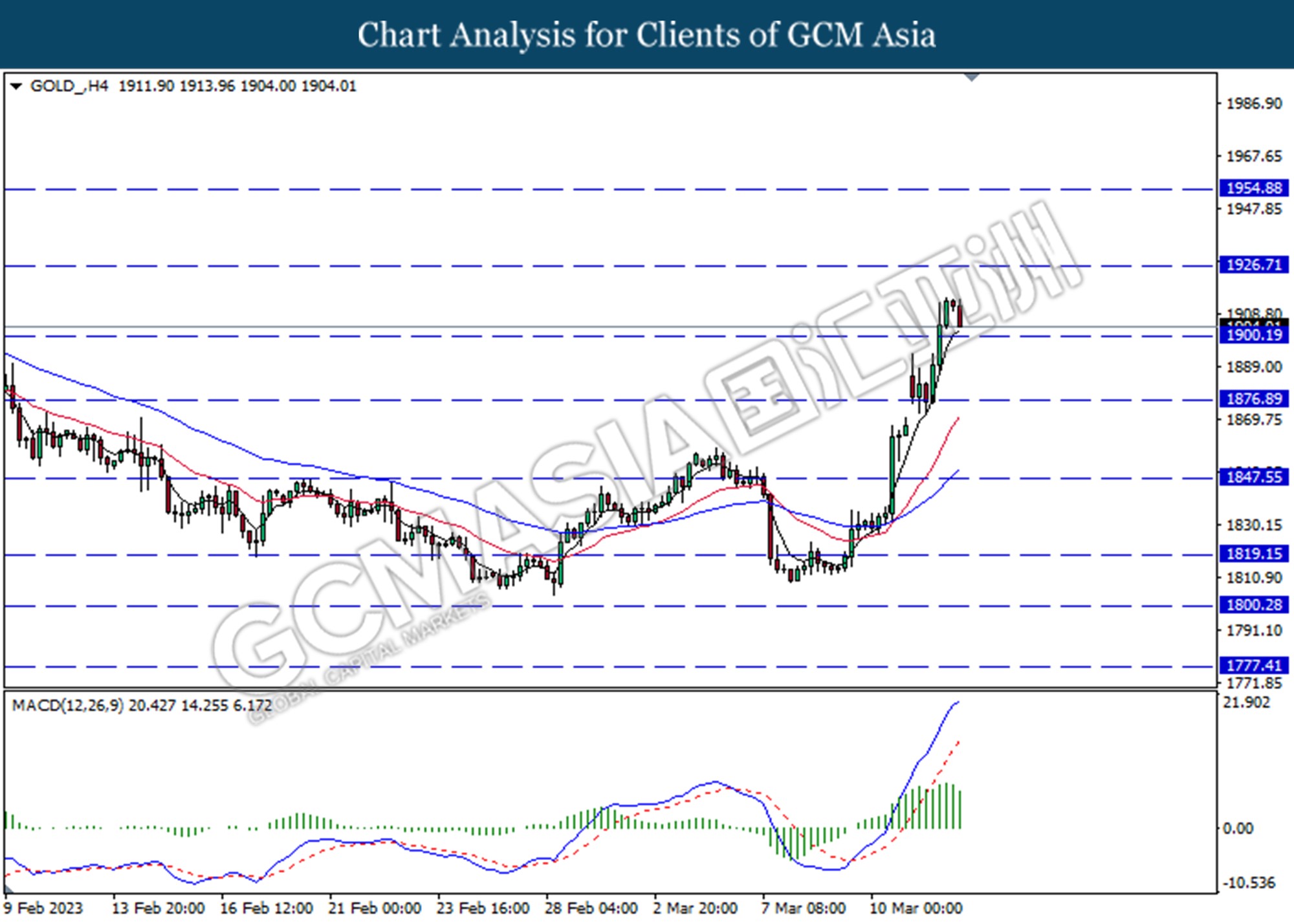

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses toward the support level at 1900.19.

Resistance level: 1926.70, 1954.90

Support level: 1900.19, 1876.90