14 March 2023 Morning Session Analysis

US Dollar’s bear continued following the rate hike path might be stepped back.

The Dollar Index which traded against a basket of six major currencies continued its downward movement on Monday following the market participants afraid of happening of financial crisis. On Friday, the collapse of Silicon Valley Bank (SVB) was like dropping a stun bomb on the market, which indicating that the financial crisis driven by aggressive rate hike would likely to occur. Besides, the regulators also took control of SVB’s stricken peer Signature Bank. With that, investors would started to anticipate the likelihood of reducing rate hike by Fed in order to avoid economy hard-landing. However, it is note-worthy that the current situation has not stopped part of investors to expect a rate hike in the upcoming meeting, as the Fed Chairman Jerome Powell has reiterated the needs of inflation-fighting efforts. According to CME FedWatch Tool, the possibility of 25 basis point rate hike has reached 67.9%. Following to that, the announcement of CPI which scheduled tonight would highly gather the eyes of market participants. As of writing, the Dollar Index appreciated by 0.07% to 103.29.

In the commodity market, the crude oil price depreciated by 0.41% to $74.48 per barrel as of writing following the fresh concerns of SVB collapse still linger in the market. On the other hand, the gold price dropped by 0.04% to $1910.63 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Jan) | 5.90% | 5.70% | – |

| 15:00 | GBP – Claimant Count Change (Feb) | -12.9K | -12.4K | – |

| 20:30 | USD – Core CPI (MoM) (Feb) | 0.40% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Feb) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (YoY) (Feb) | 6.40% | 6.00% | – |

Technical Analysis

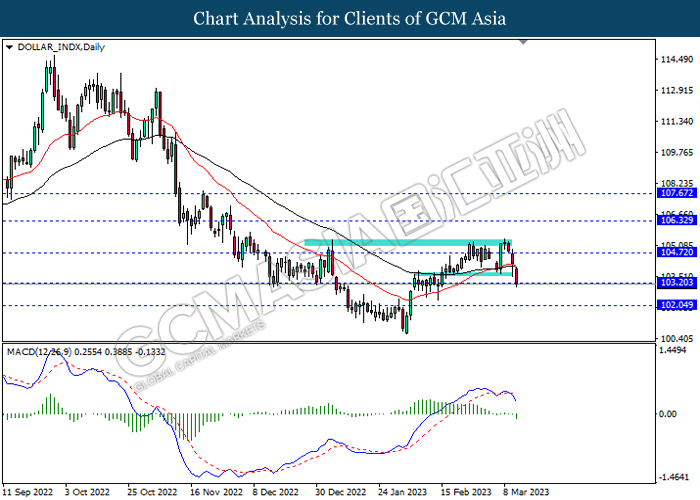

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses of successfully breakout the support level.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

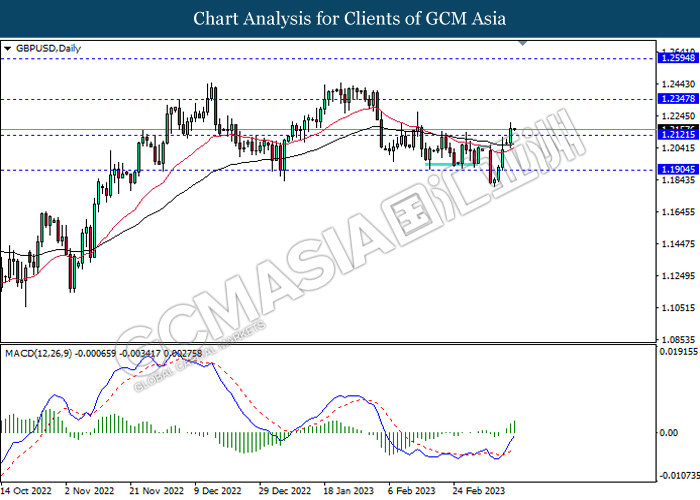

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

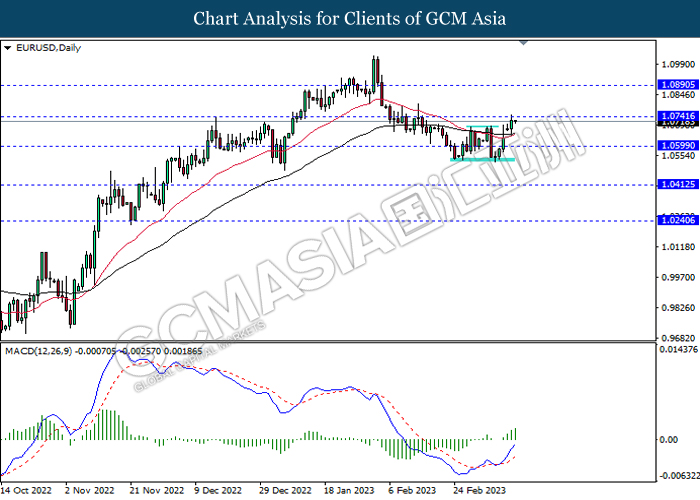

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

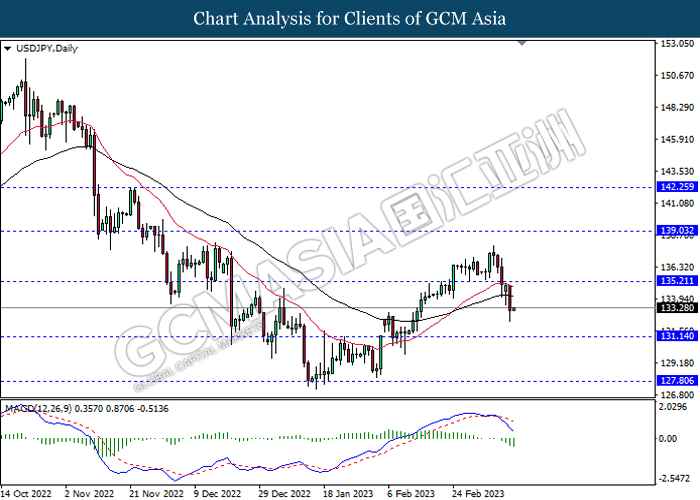

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

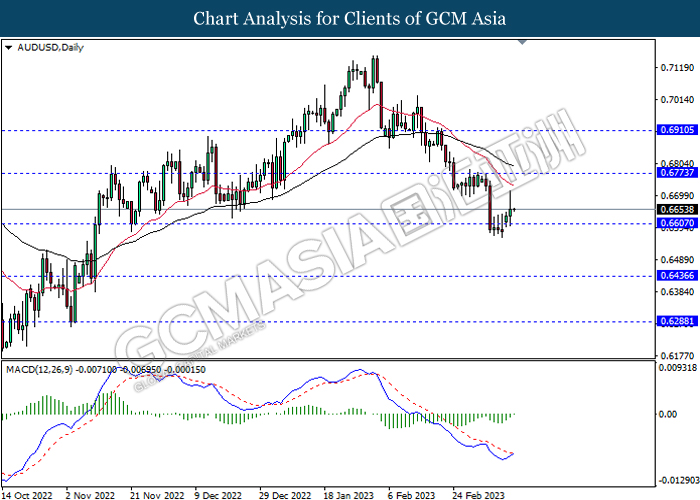

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

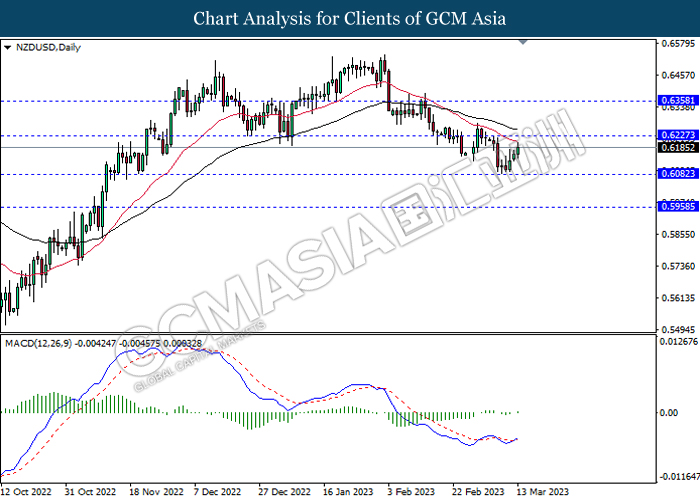

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

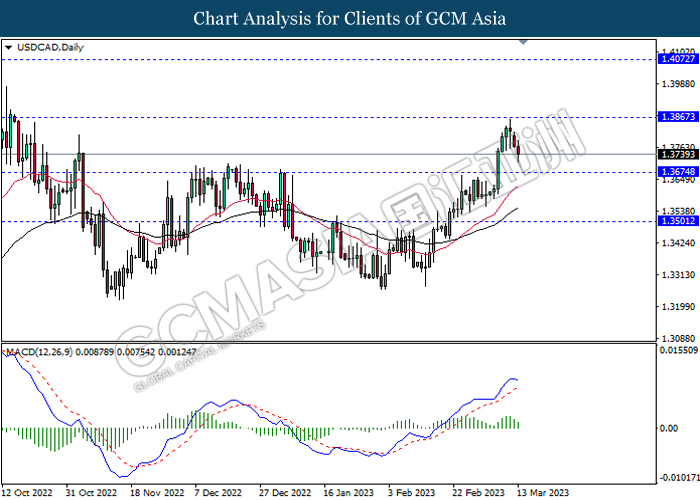

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

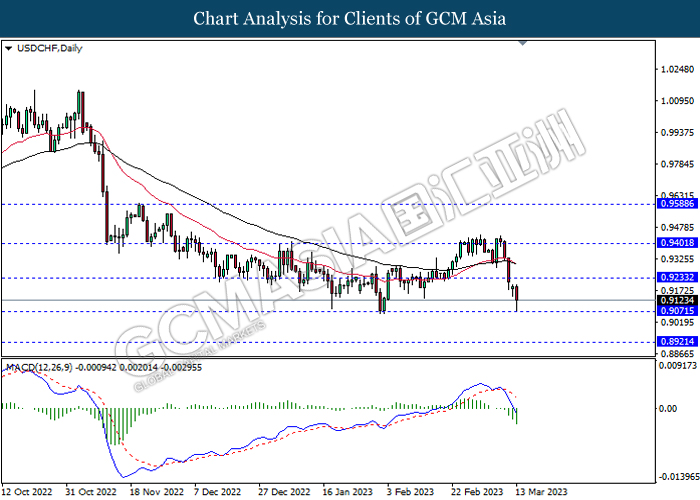

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

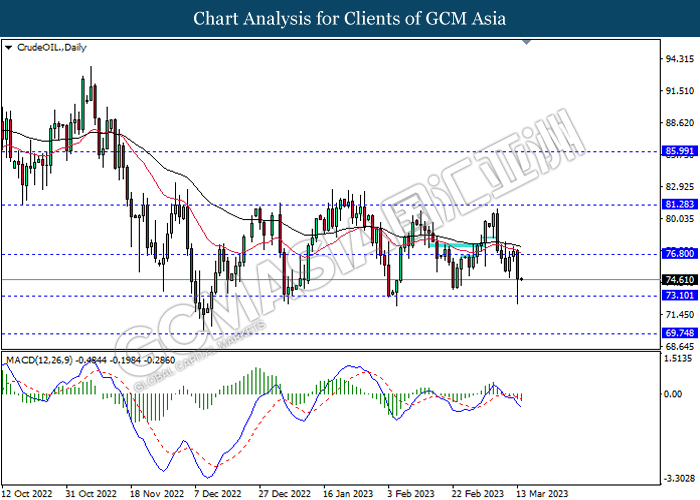

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

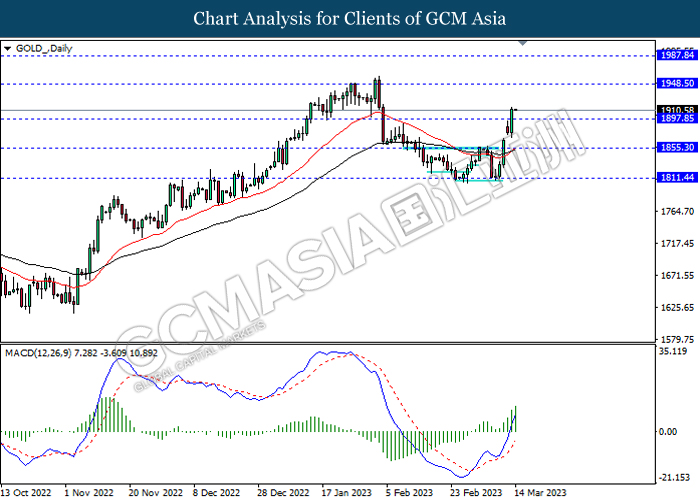

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1948.50, 1987.85

Support level: 1897.85, 1855.30