14 April 2023 Afternoon Session Analysis

Pound lifted after mixed economic data was released.

The Pound Sterling lifted after a series of mixed economic data was released yesterday. The British economy is steadily at 0.0% less than the previous reading of 0.4% and the market expectation of 0.1%. The slowdown in the economy is primarily attributed to the government’s preparation for another round of brinkmanship with the European Union over the Brexit deal. The UK has drafted legislation to suspend checks on all goods arriving in Northern Ireland, slowing down the process. As a result, industrial and manufacturing sector data published by Office for National Statistics (ONS) showed no growth in February, both data stood at 0.0%. However, the construction sector was the only bright spot that lifted the economy. The data output surged at 2.4%, higher than the prior reading of -1.75, and upbeat the market expectations of 0.9%. The construction output marked as 3 months higher, lifted the economy. On the other hand, the Pound was further supported by the weakening of the dollar after the market increased expectations that the Fed paused its rate hike after an easing in Production Price Index (PPI). As of writing, the GBP/USD edged up by 0.21% to $1.2546.

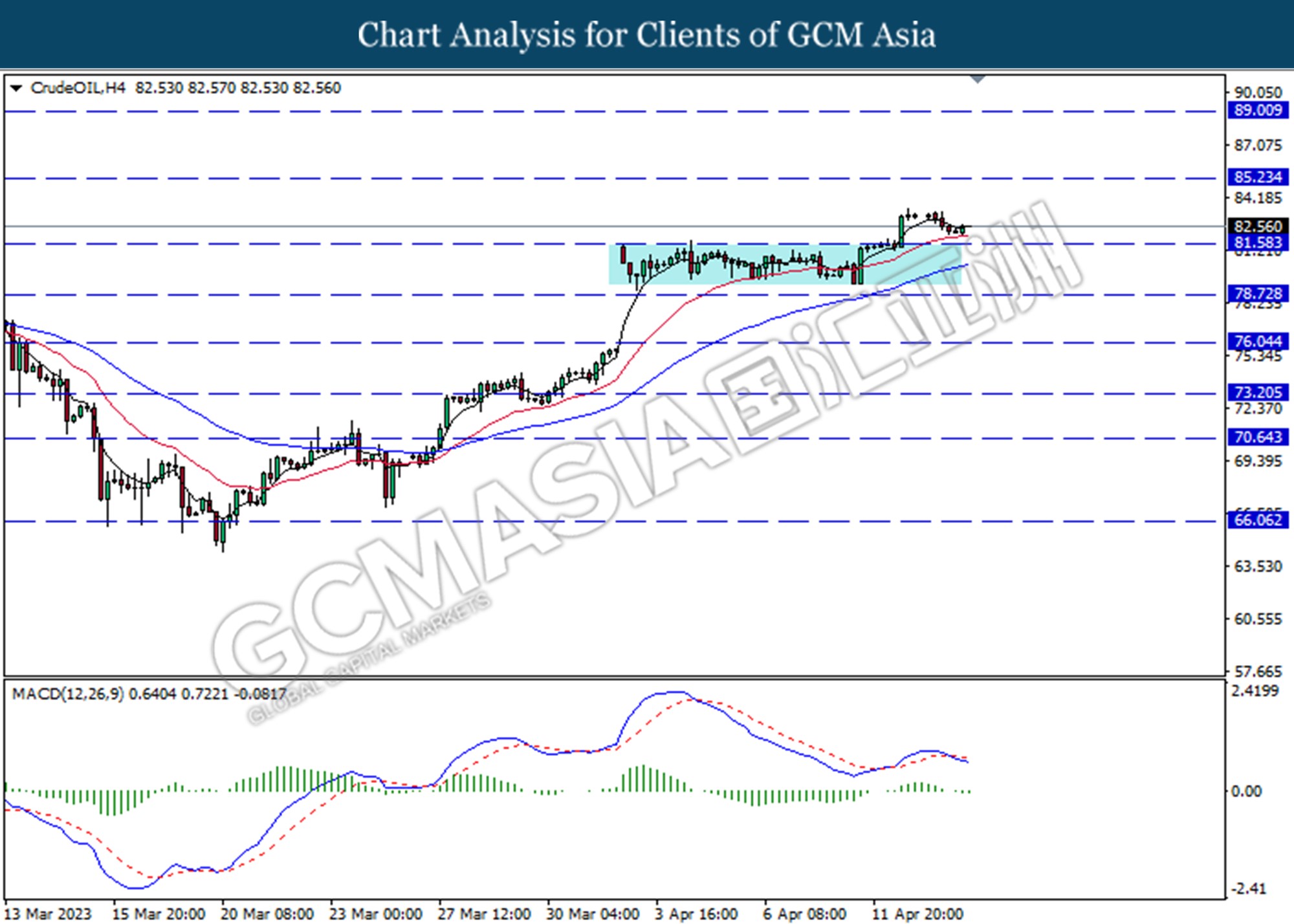

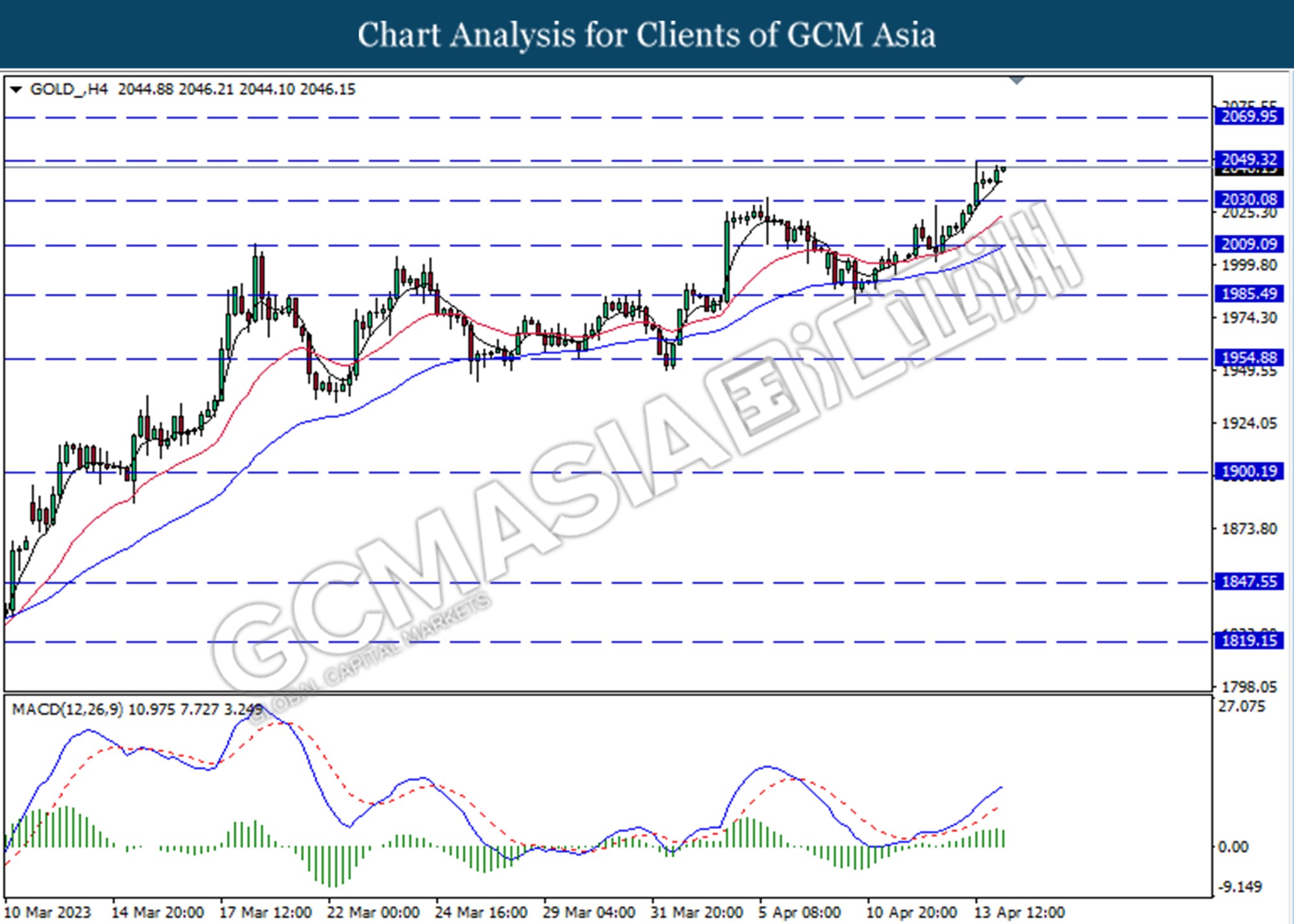

In the commodity market, the crude oil price rebounded by 0.54% to $82.60 per barrel as of writing following an increasing demand in China helps offset OPEC warning. In addition, the gold price extended gains by 0.22% to $2044.67 per troy ounce as of writing amid softer inflation in US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | -0.10% | -0.30% | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | -0.40% | -0.40% | – |

Technical Analysis

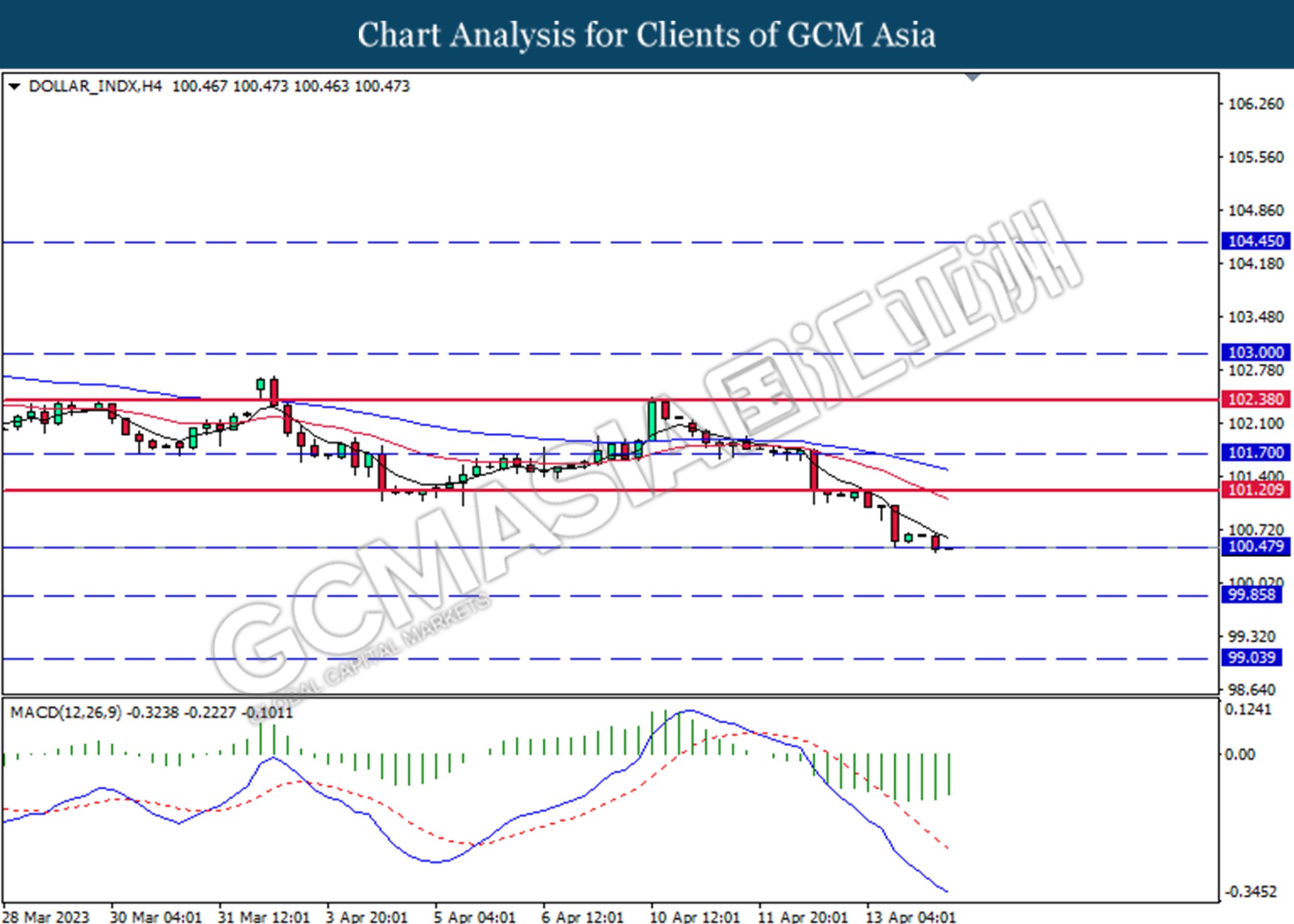

DOLLAR_INDX, H4: Dollar index was traded lower following a prior break below the previous support level at 100.50. However, MACD which illustrated decreasing bearish momentum suggests the index to undergo technical correction in the short term.

Resistance level: 100.50, 101.20

Support level: 99.85, 99.00

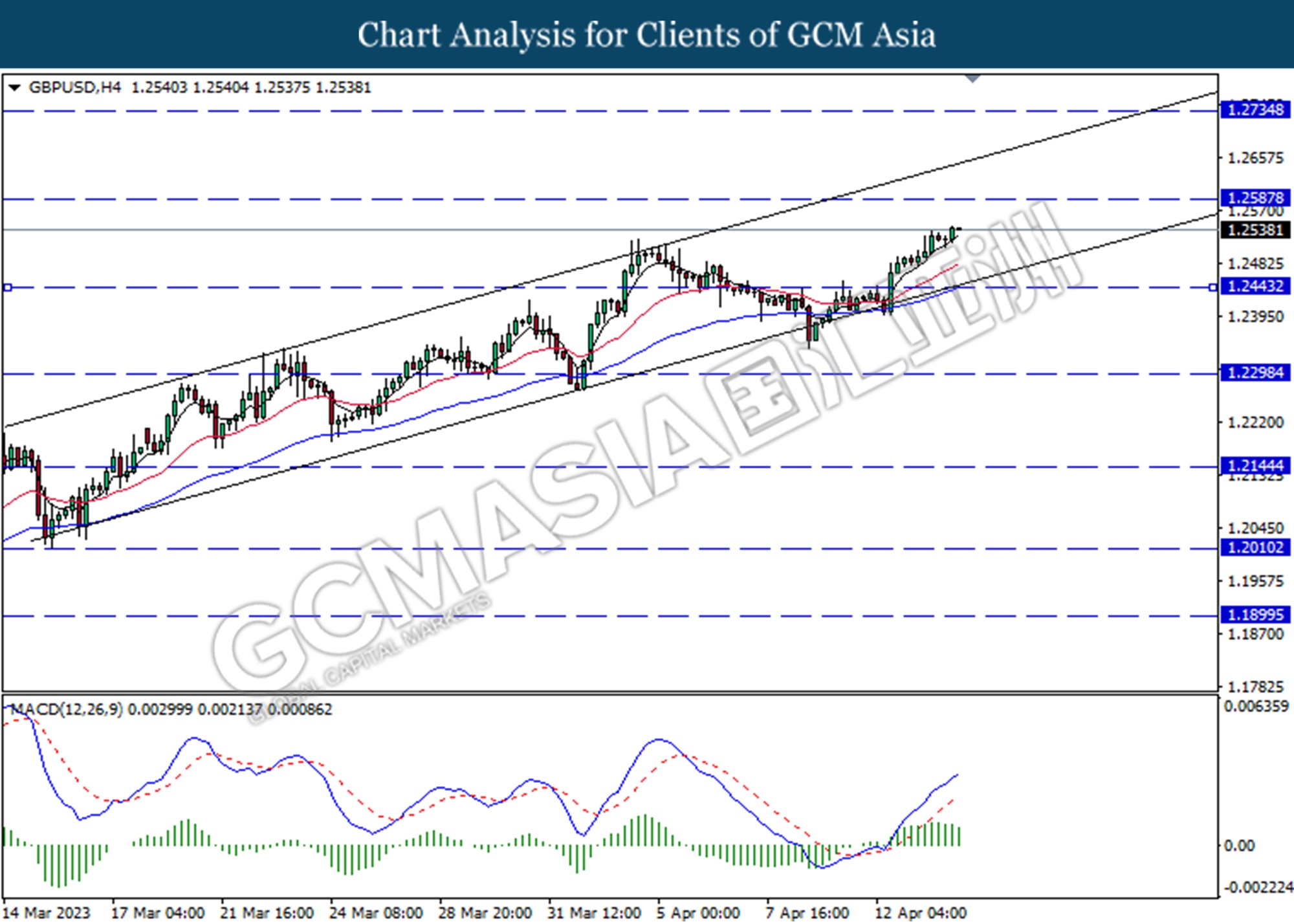

GBPUSD, H4: GBPUSD was traded higher following a prior breakout above the previous resistance level at 1.2445. However, MACD which illustrated decreasing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.2600, 1.2735

Support level: 1.2445, 1.2300

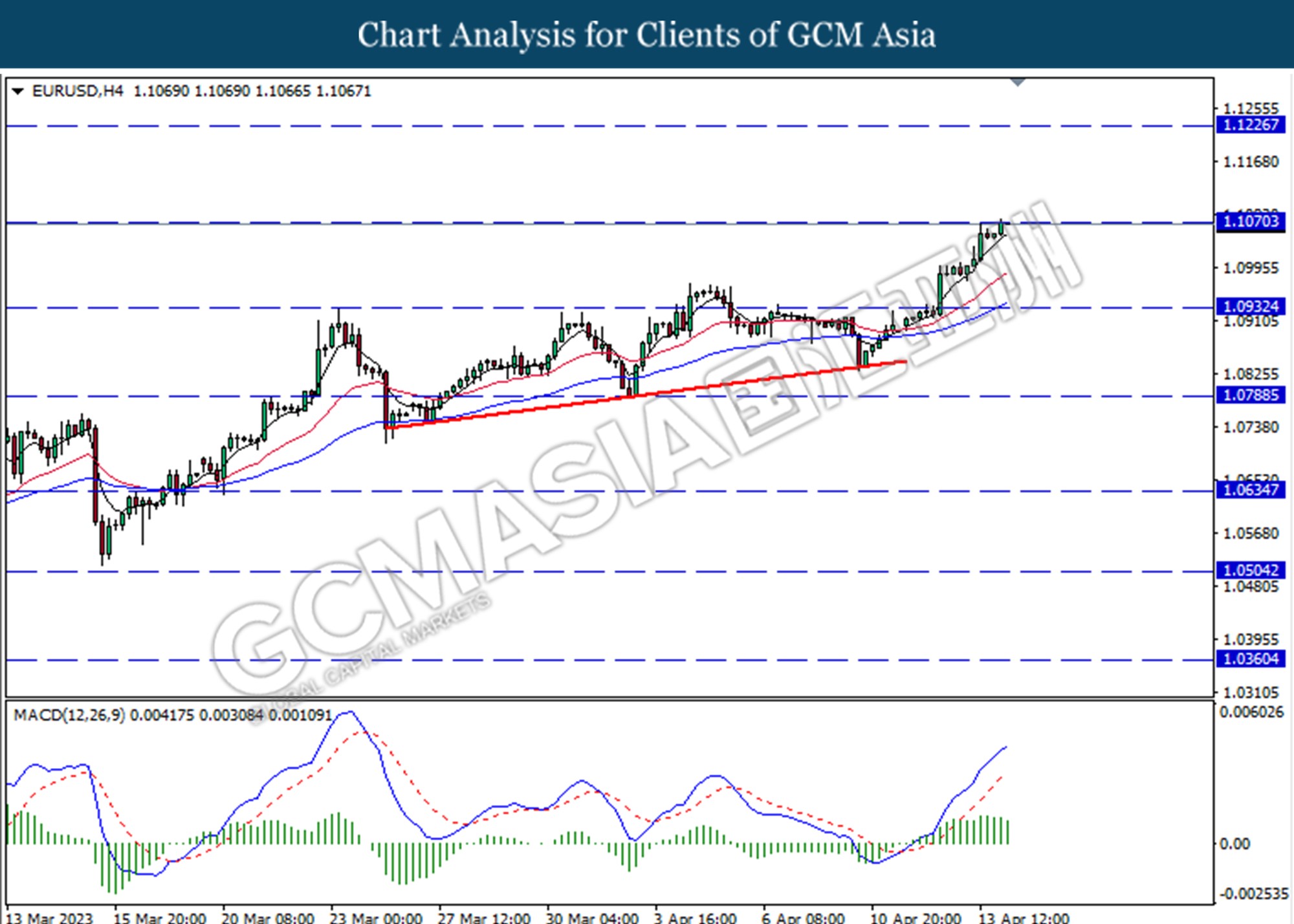

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.1070. However, MACD which illustrated decreasing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.1070, 1.1225

Support level: 1.0935, 1.0790

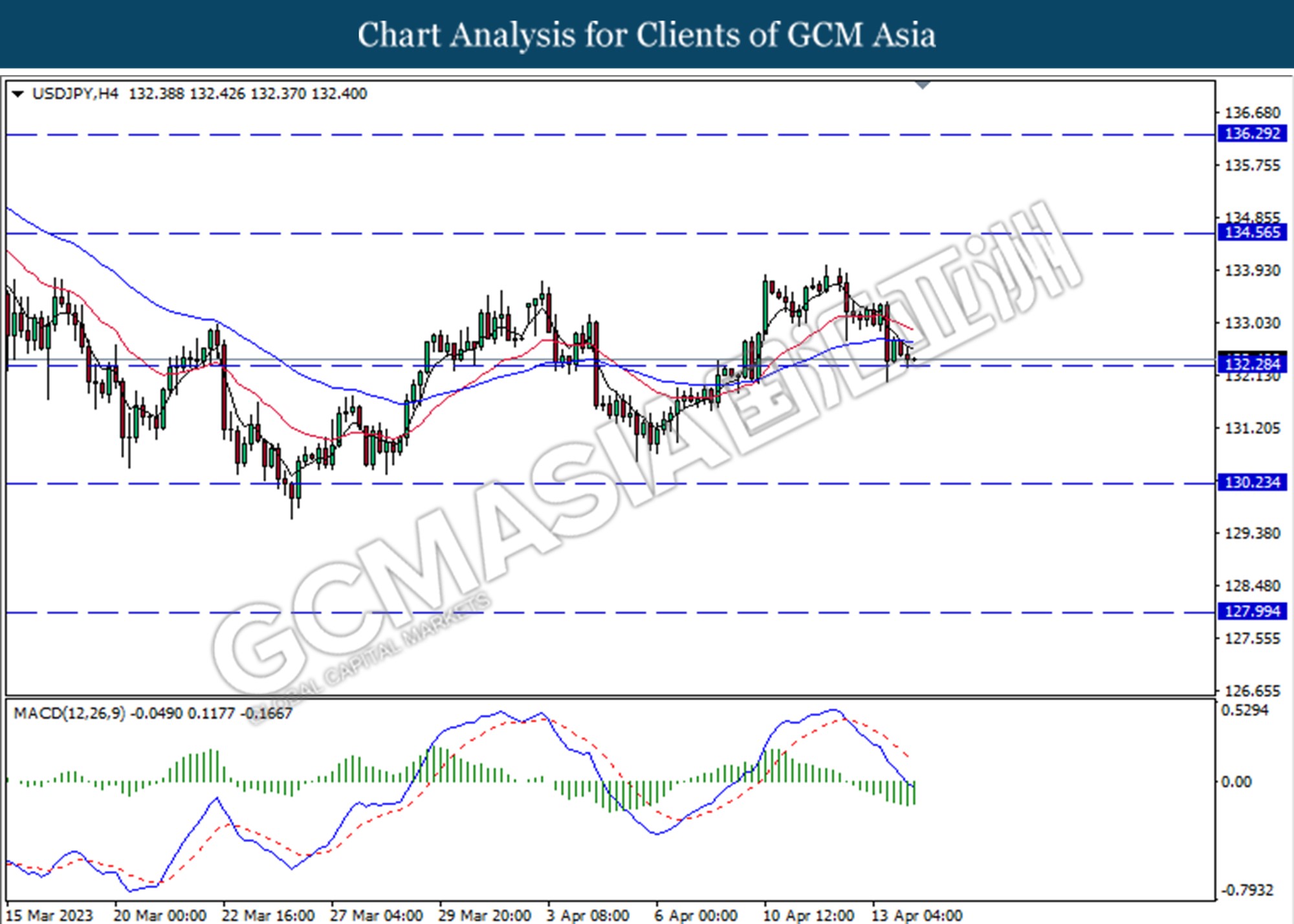

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 132.30. However, MACD which illustrated decreasing bearish momentum suggests the pair traded higher as technical correction.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

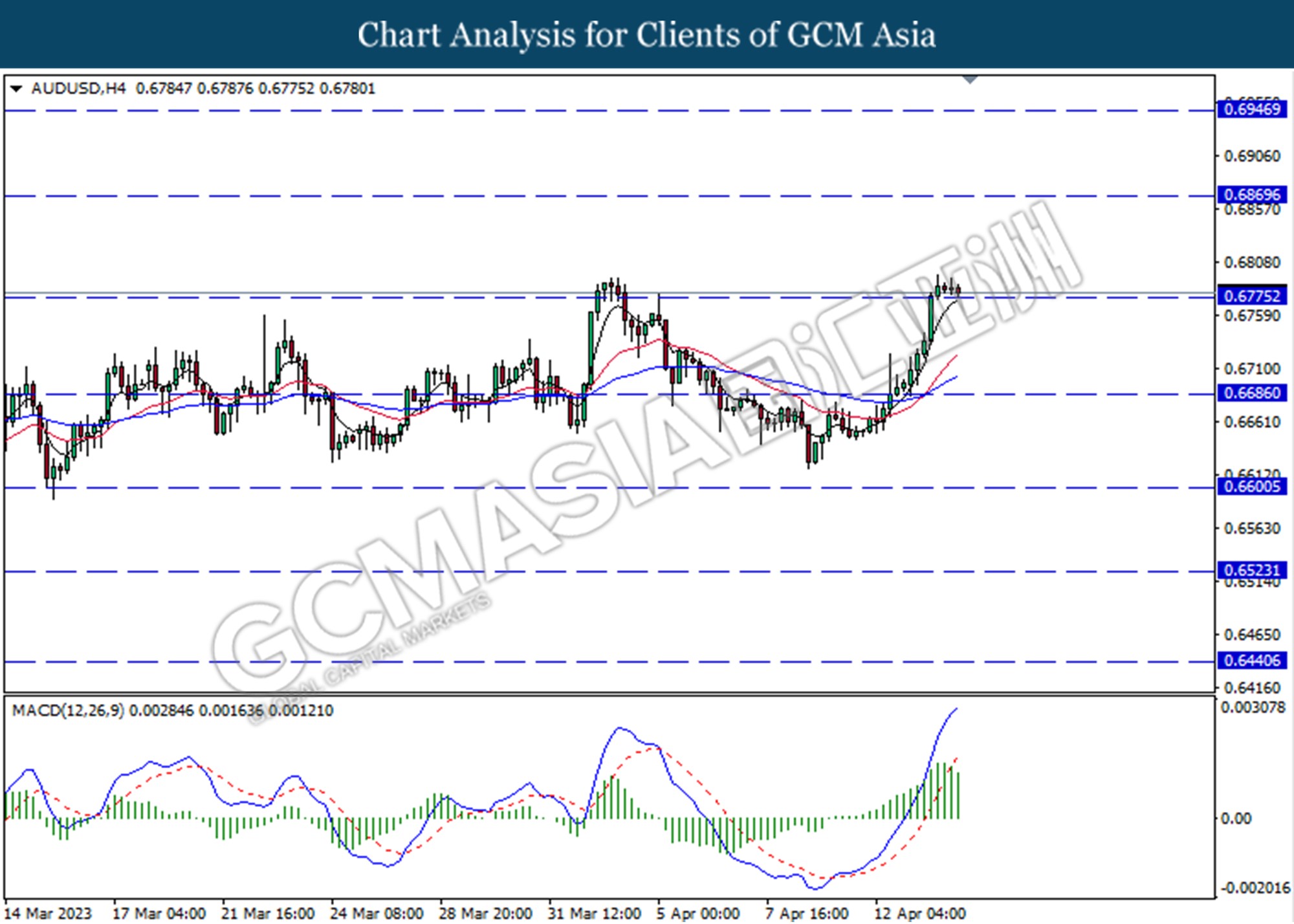

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6775. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses after successfully break below the support level.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

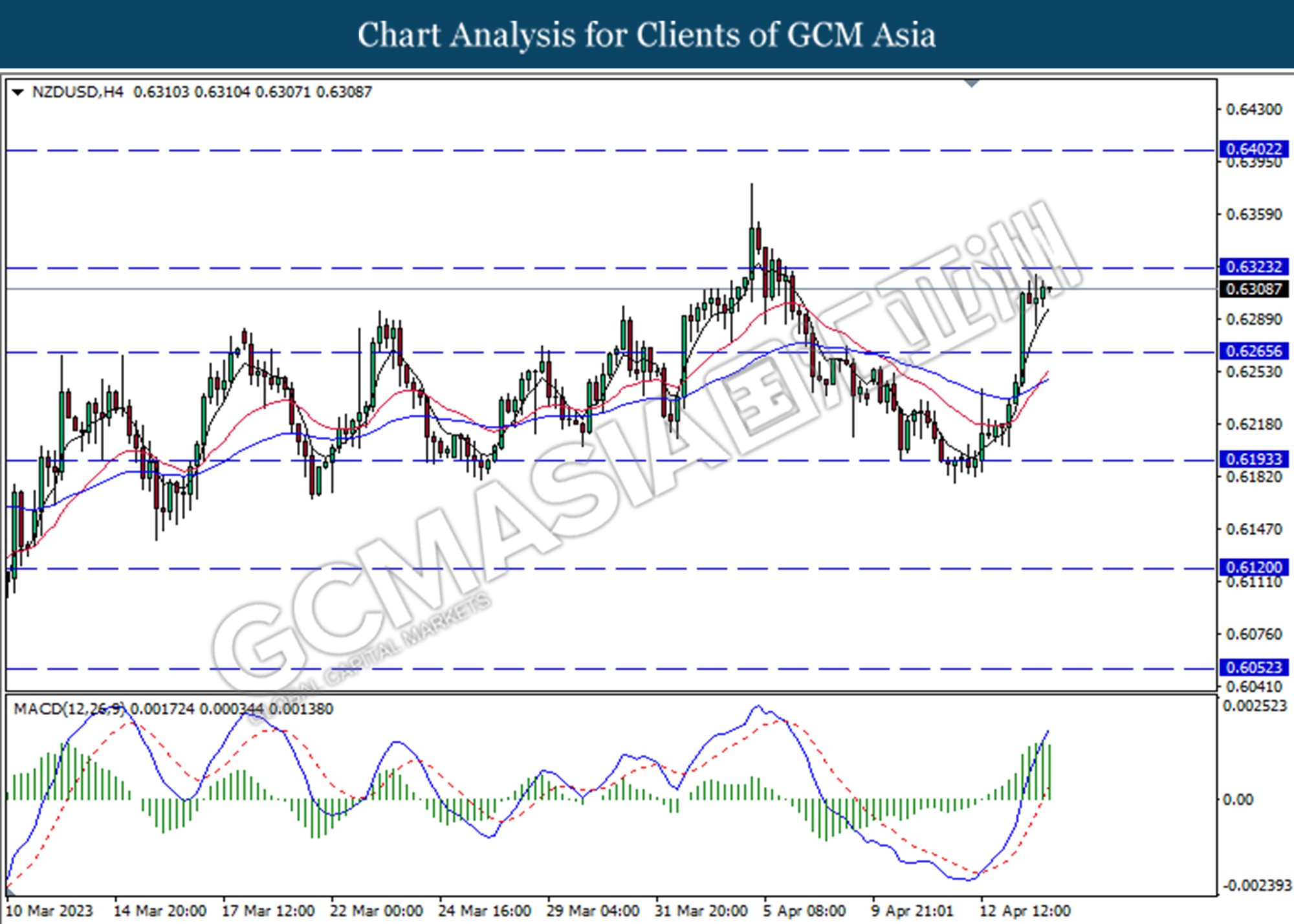

NZDUSD, H4: NZDUSD was traded higher following a prior breakout above the previous resistance level at 0.6265. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6325.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

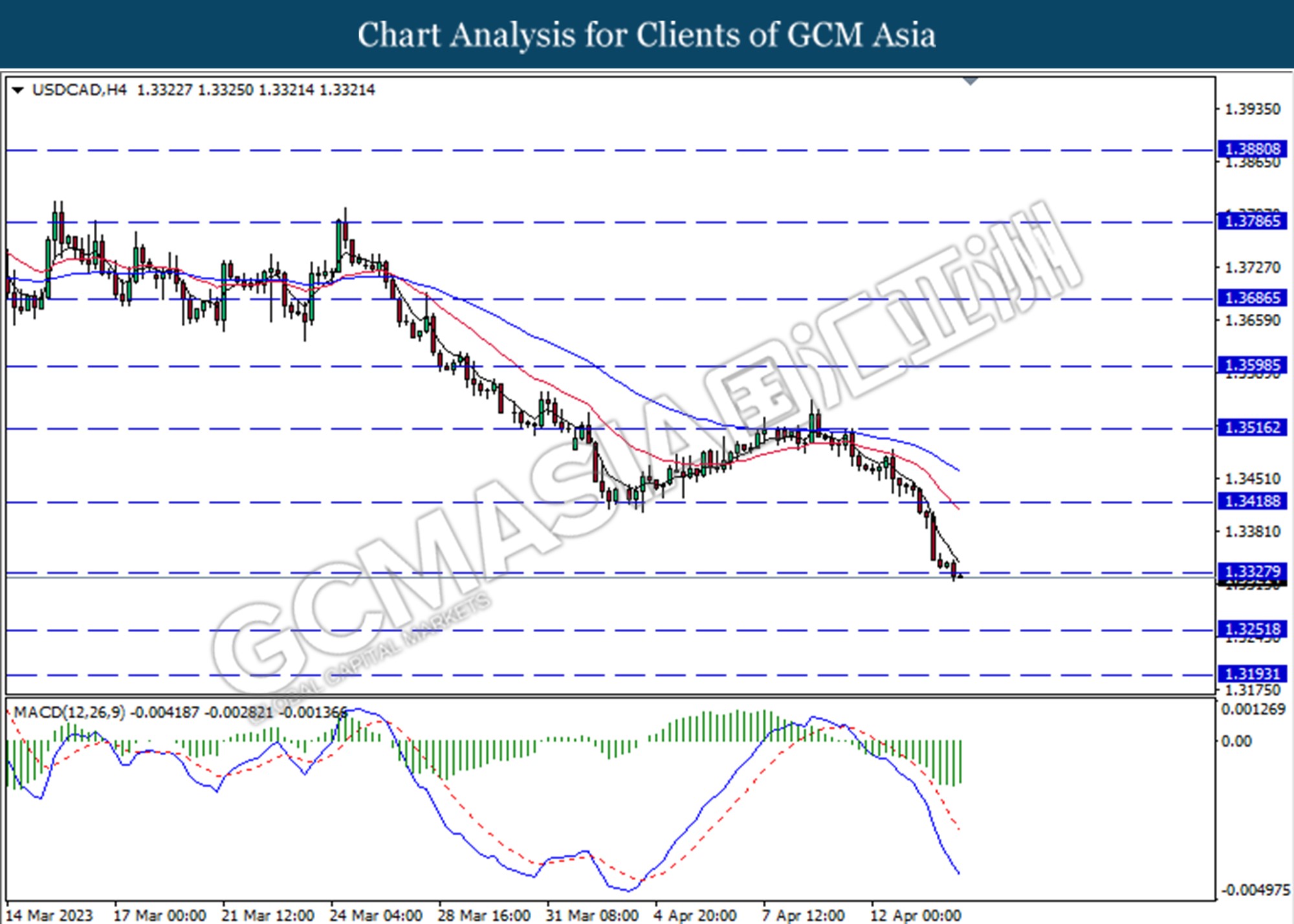

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3330. However, MACD which illustrated decreasing bearish momentum suggests the pair extended its losses toward the support level at 1.3250.

Resistance level: 1.3330, 1.3420

Support level: 1.3250, 1.3195

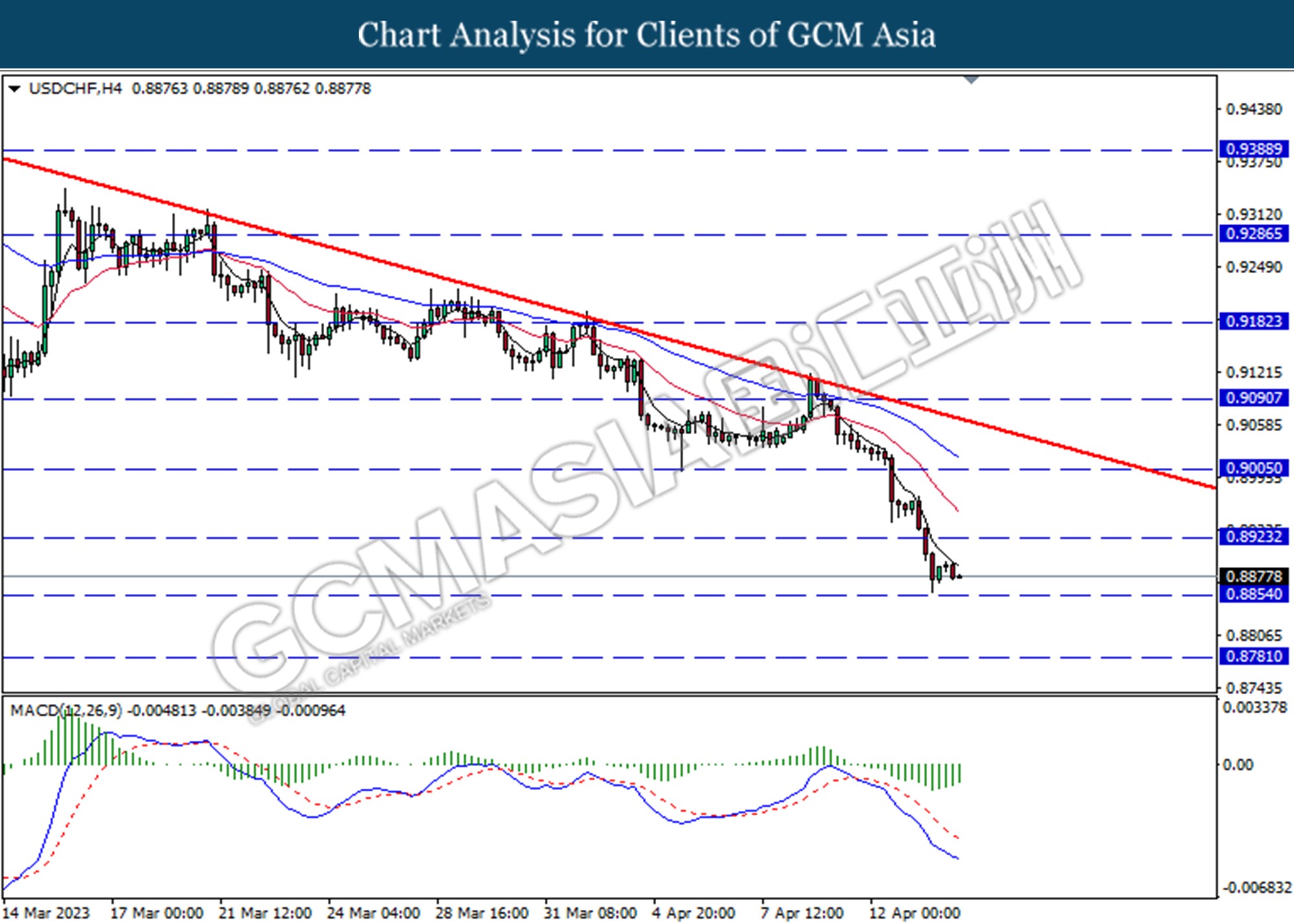

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.8925. However, MACD which illustrated decreasing bearish momentum suggests the pair to traded lower as technical correction.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level at 85.25.

Resistance level: 85.25, 89.00

Support level: 81.60, 78.70

GOLD_, H4: Gold price was traded higher while currently testing for the resistance level at 2049.30. However, MACD which illustrated decreasing bullish momentum suggests the commodity traded lower as technical correction.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10