14 June 2022 Morning Session Analysis

Pound dived as the UK GDP shrank in April.

The Pound, which was widely traded by the global investors, was being thrown off by market participants after a series of downbeat data spurred the slowdown fears in the UK. According to the Office of National Statistics, UK GDP contracted by -0.3%, weaker than the consensus forecast at 0.1%, mirroring that the UK economy remains fragile. The contraction of GDP could be mainly attributed to the increases in the cost of production, which affected most of the businesses in the UK. Besides, the Manufacturing Production data in the UK has further solidified the statement that the UK Economy is staring at both a recession and stagflation. According to the same institution (ONS), the country’s manufacturing production declined by -1.0%, missing the consensus forecast of a 0.2% growth. Despite the slowdown figure, the Bank of England (BoE) is expected to raise its interest rate for the fifth time since December 2021 in the upcoming BoE meeting. With that being said, a dovish statement could be foreseen in the post-meeting conference as the UK economic growth has shown a sharp contraction in the recent month. As of writing, the pair of GBP/USD rebounded 0.2% to 1.2135.

In the commodities market, the crude oil price was down by 0.16% to $121.25 amid the ongoing tight supply situation that continued to support the black commodity price. Besides, the gold price up 0.10% to $1820.85 per troy ounce after falling tremendously during the overnight session amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Apr) | 7.0% | 7.6% | – |

| 14:00 | GBP – Claimant Count Change (May) | -56.9K | -42.5K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Jun) | -34.3 | -27.5 | – |

| 20:30 | USD – PPI (MoM) (May) | 0.5% | 0.8% | – |

Technical Analysis

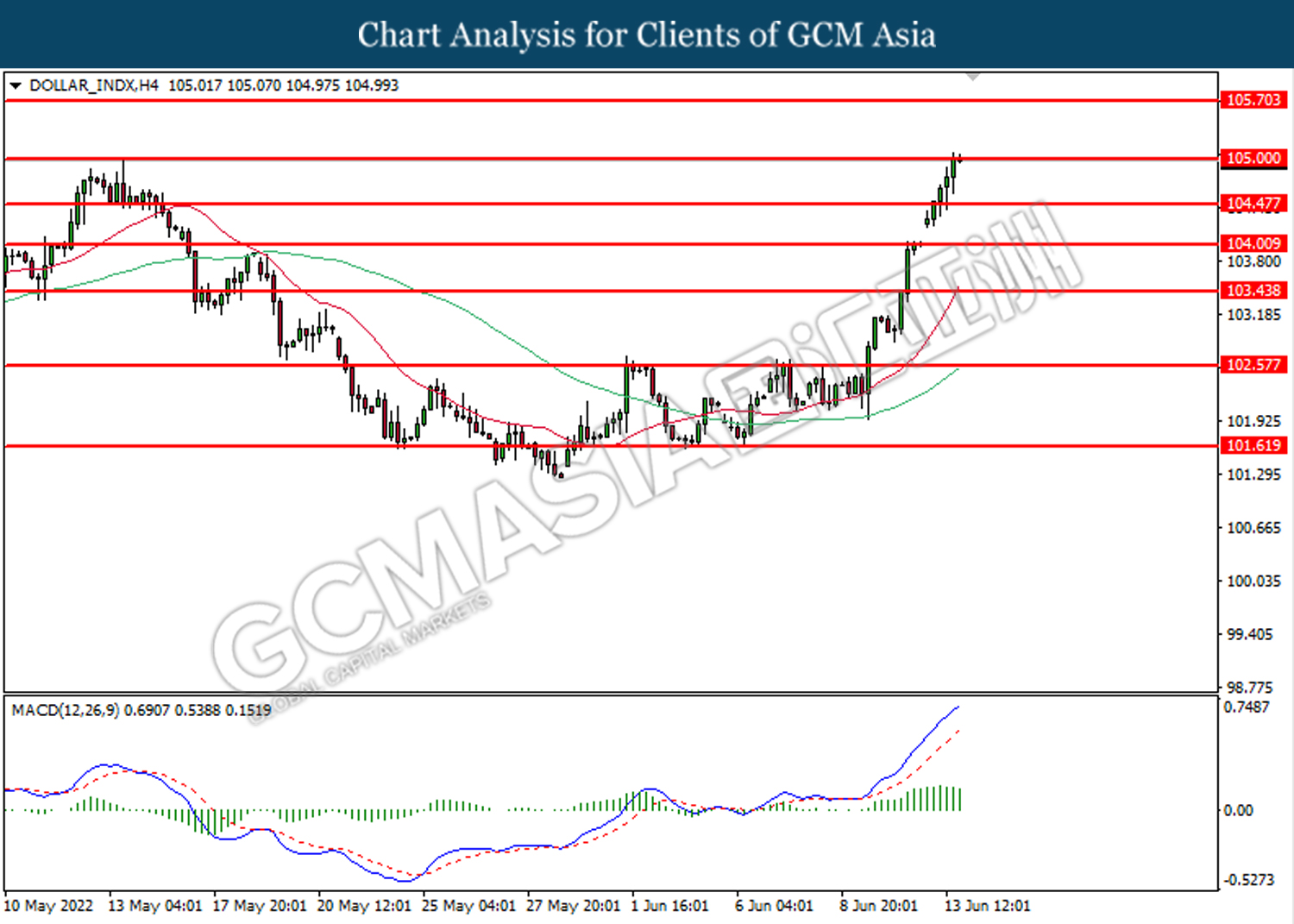

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 105.00. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 105.00, 105.70

Support level: 104.45, 104.00

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2165. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2085.

Resistance level: 1.2165, 1.2235

Support level: 1.2085, 1.2020

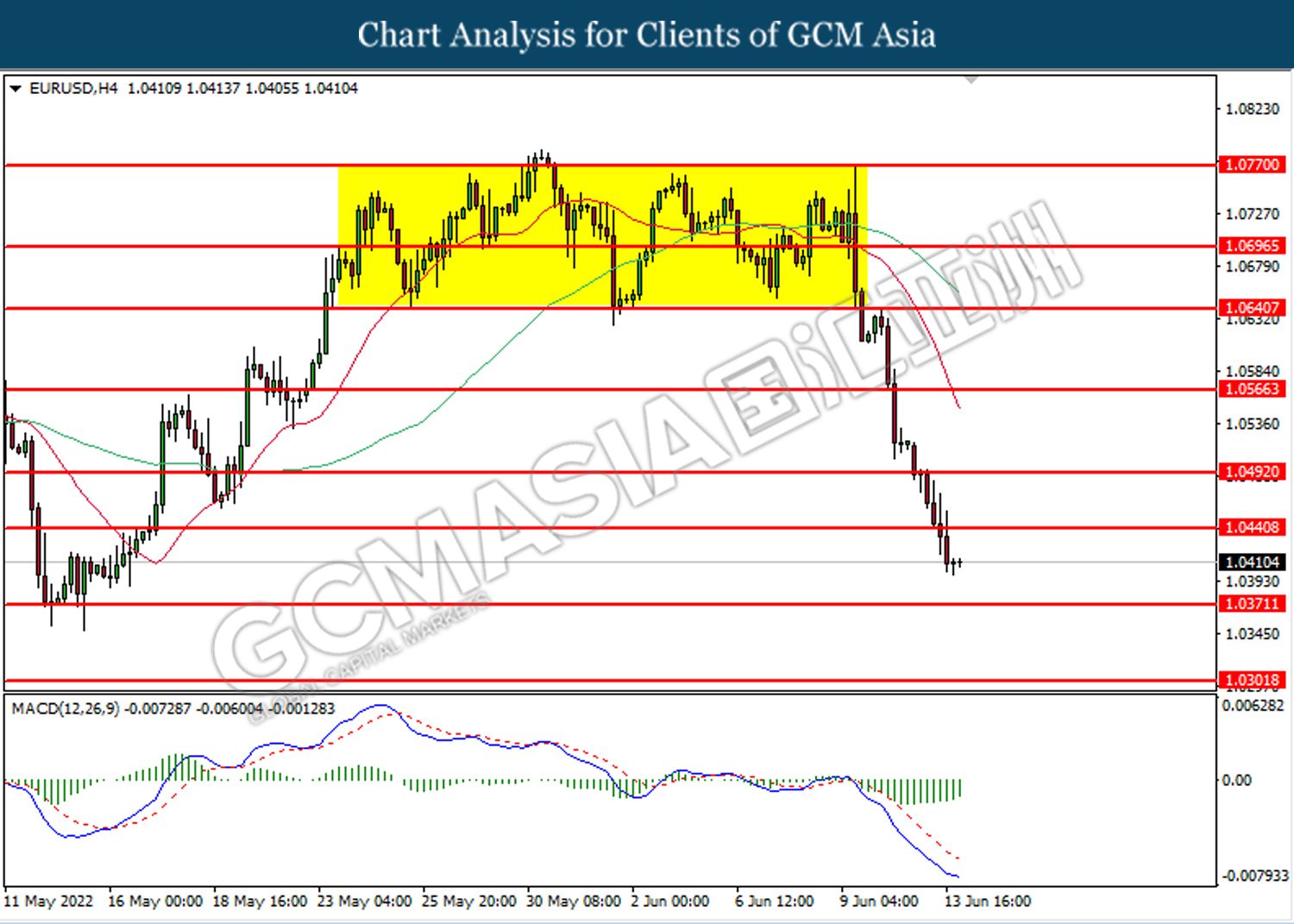

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.0440. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0370.

Resistance level: 1.0440, 1.0490

Support level: 1.0370, 1.0300

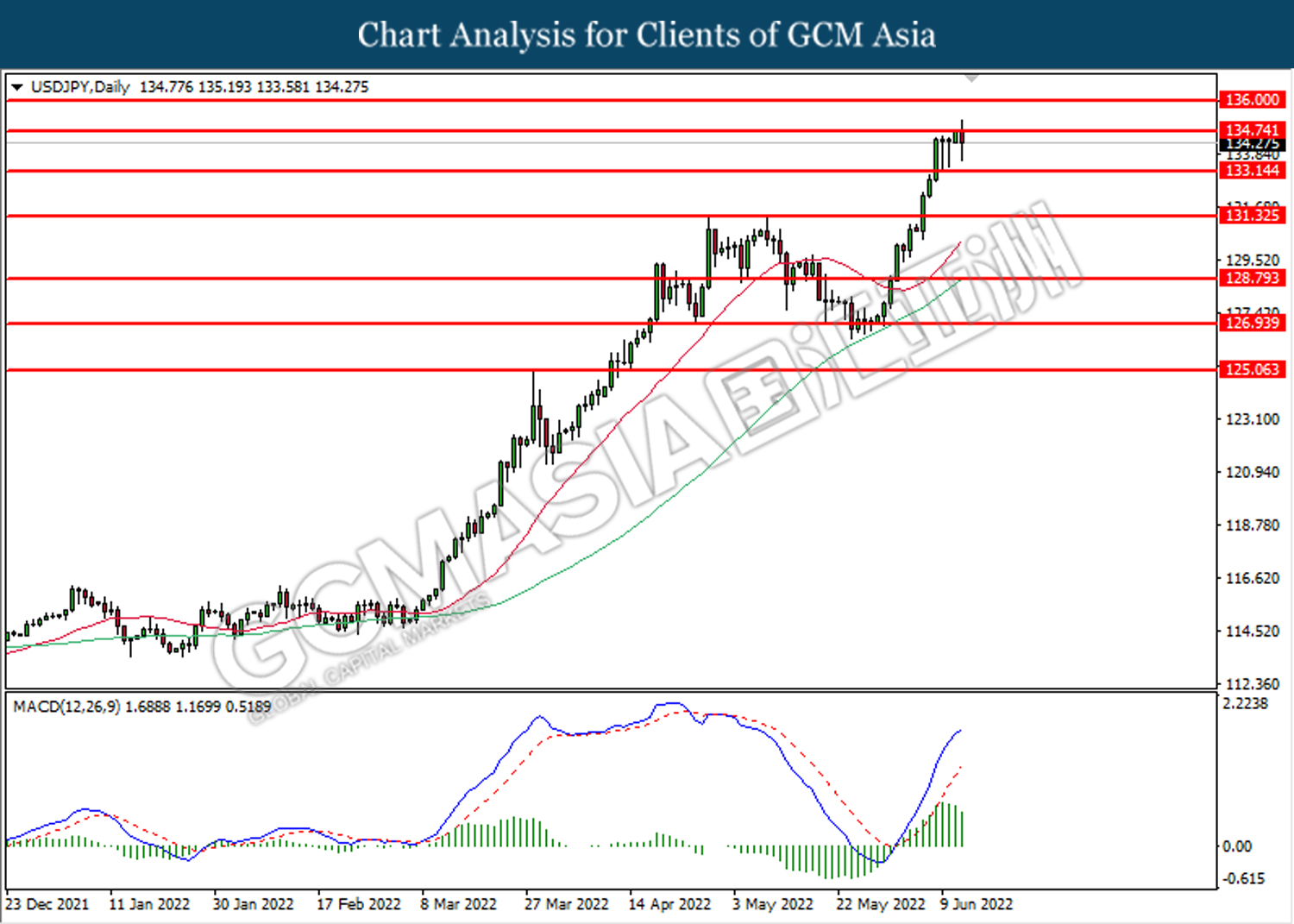

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.75. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

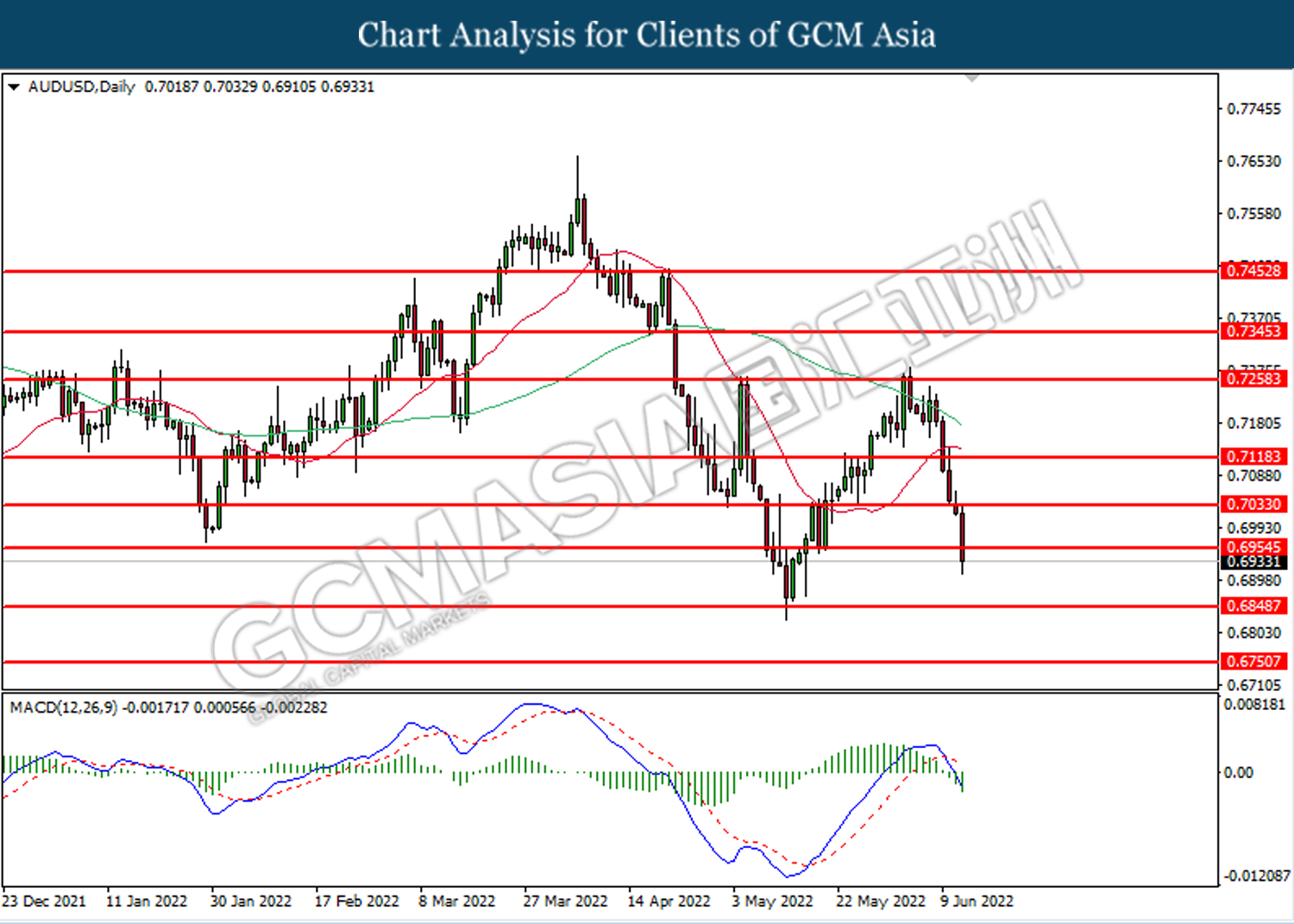

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6955. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.7035, 0.7120

Support level: 0.6850, 0.6750

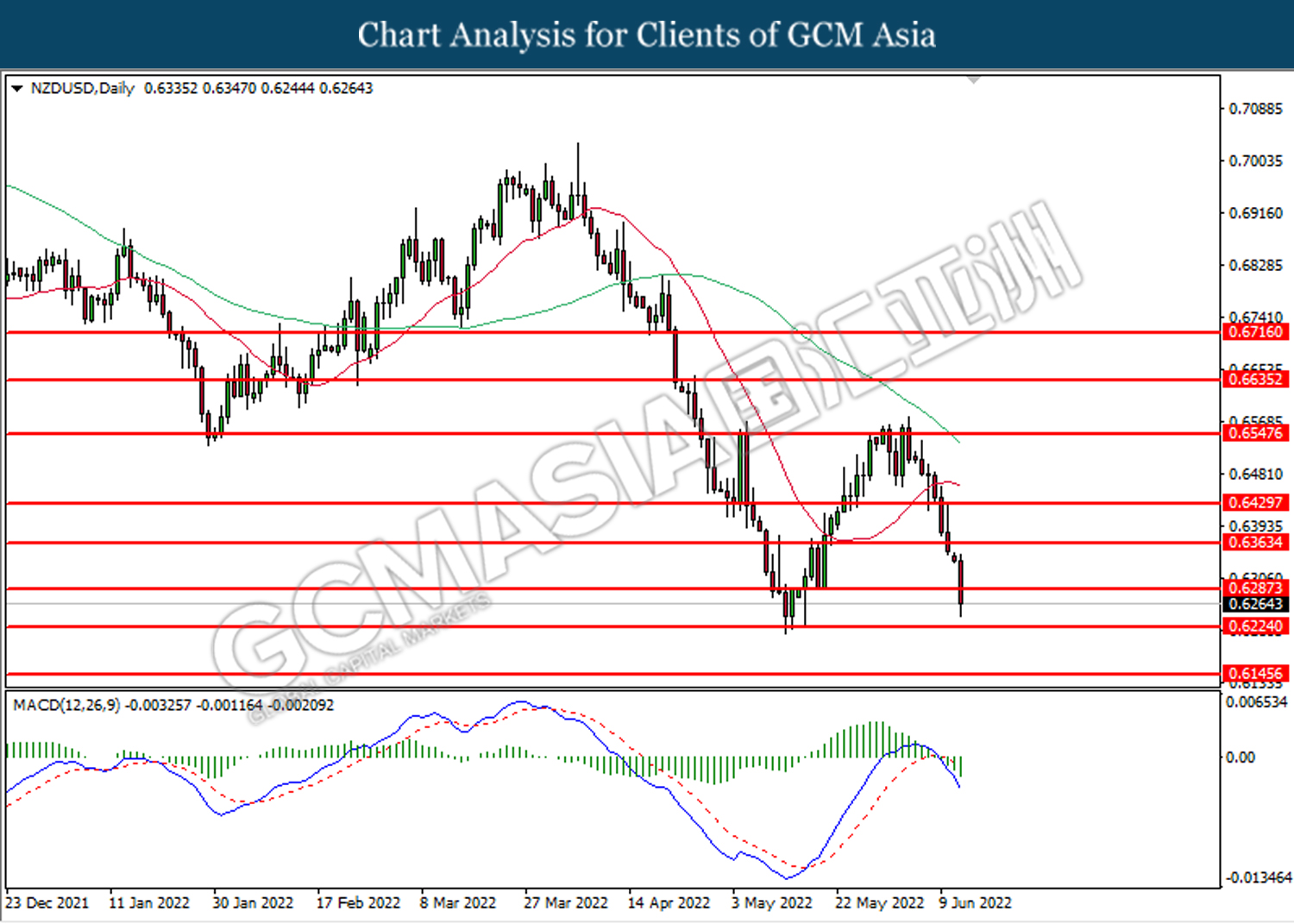

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6285. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully close below the support level.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

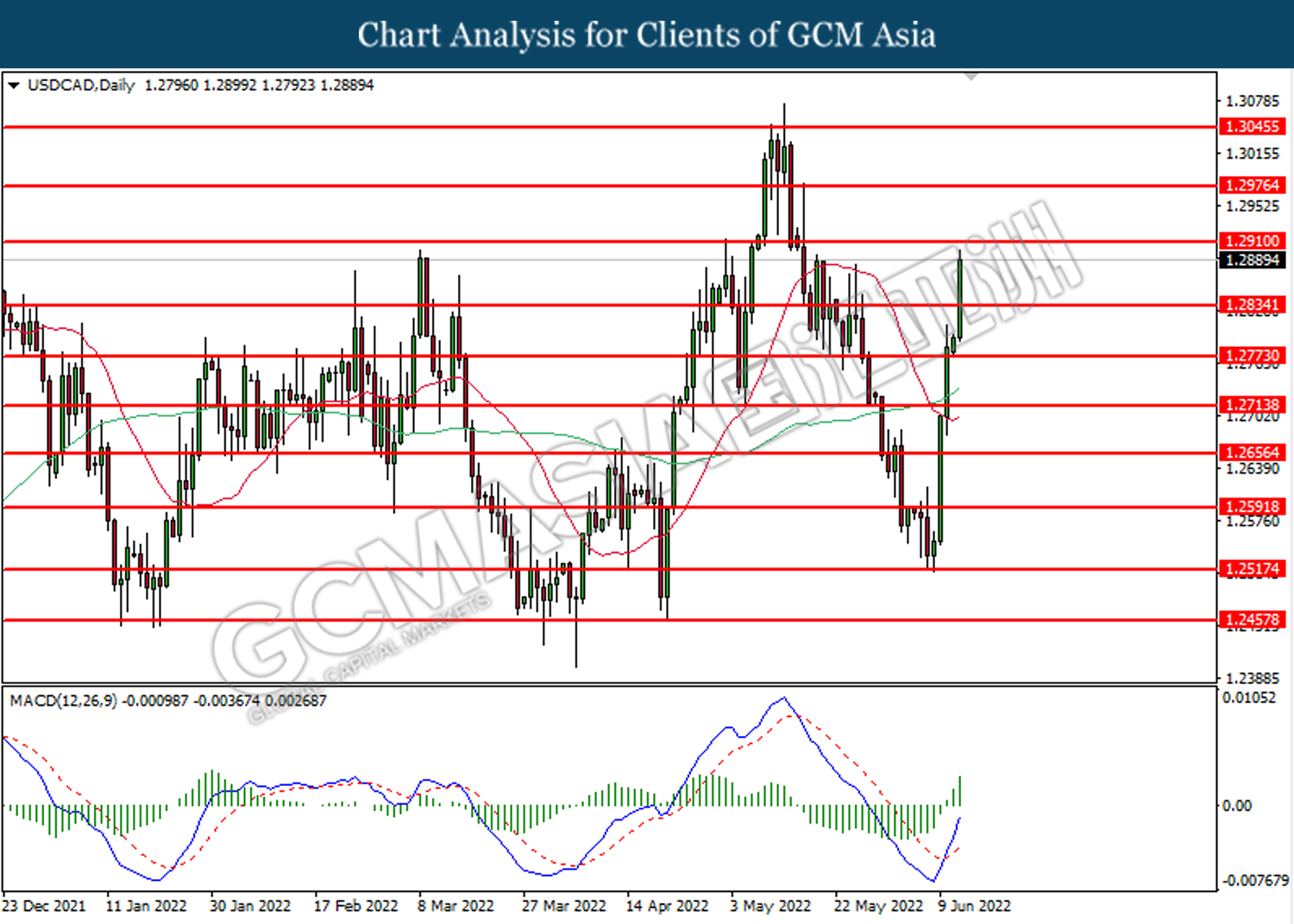

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2835. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2910.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2775

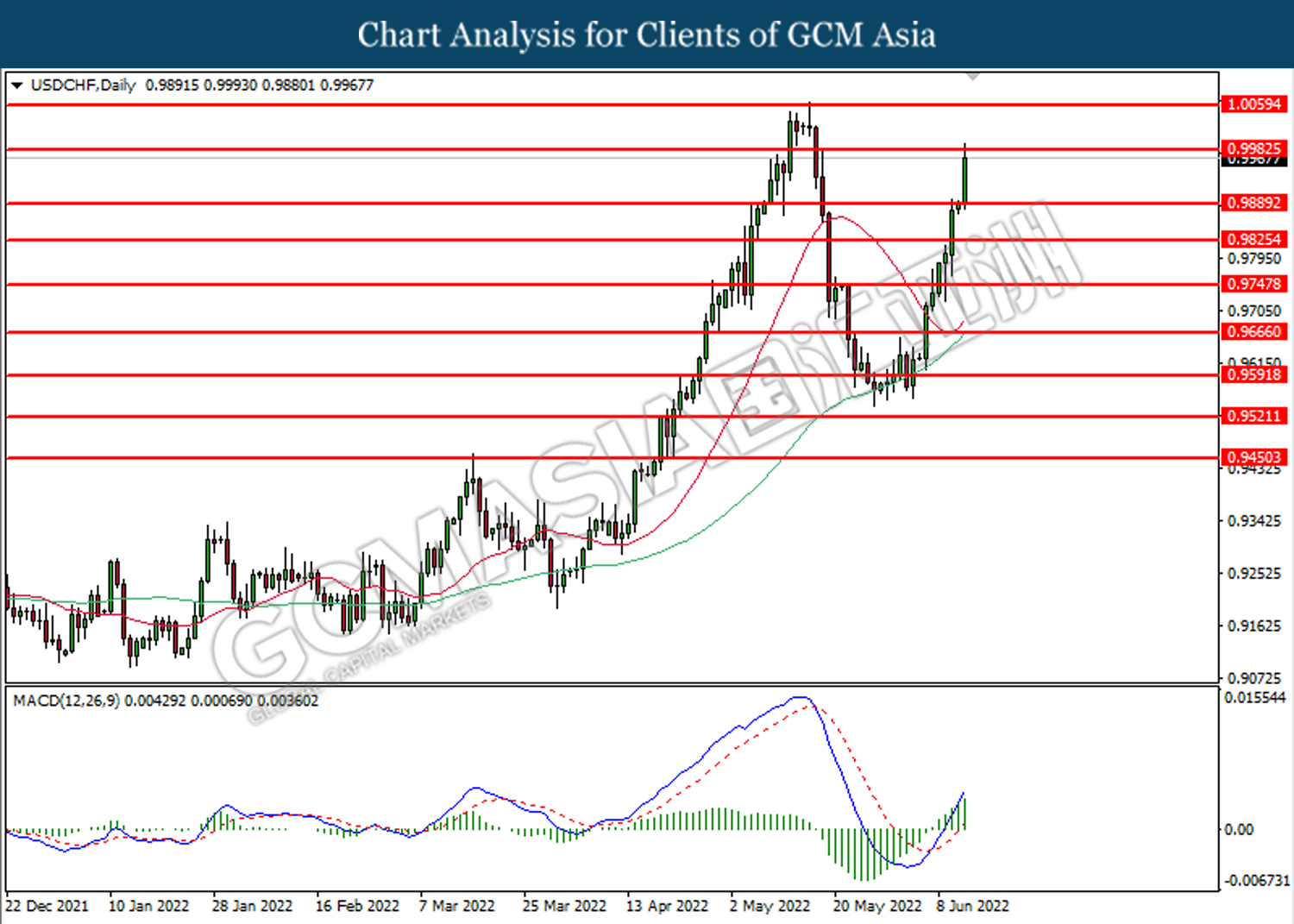

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9980. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9980, 1.0060

Support level: 0.9890, 0.9825

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 119.00. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 119.00, 120.70

Support level: 116.50, 113.50

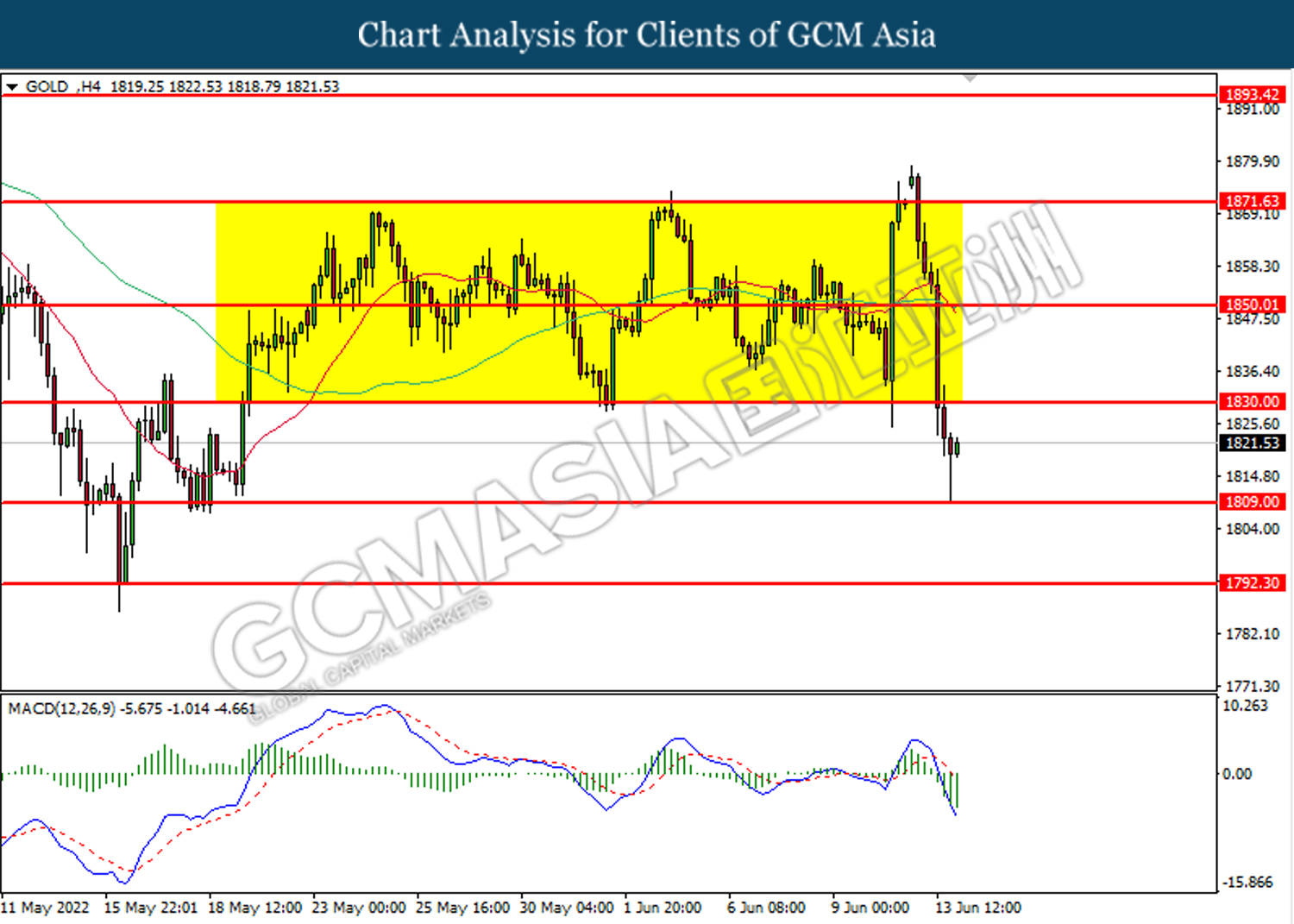

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1830.00. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1809.00.

Resistance level: 1830.00, 1850.00

Support level: 1809.00, 1792.30