14 June 2023 Morning Session Analysis

The dollar index slipped after CPI but rebounded during US session.

The dollar index, which was traded against a basket of six major currencies, slipped after the May consumer price index release but rebounded during the US session. The annual Consumer Price Index (CPI) in the US dropped to 4% in May from 4.9% in the previous, lower than expected 4.1%. As a result, the annual CPI reached its lowest level since March 2021. While the core CPI which excluded large amounts of volatility items in line with market expectations of 5.3%, slightly reduced from the previous reading of 5.5%. The index for shelter was the largest contributor to the index increase, followed by the index for used cars and trucks, but the overall increase was offset by energy prices falling, the US Bureau of Labor Statistics reported. The figures bolster expectations for the Fed to maintain current rates and the dollar index falling after CPI was released. However, the dollar index rebounded during the US session as major banks expect the Fed rates to keep steady in June to a range of 5.25%, but accompanied by communications that lean hawkish. Meanwhile, investors are eyeing on Producer Price Index (PPI) and FOMC meetings to get more cues about the money market’s directions. As of writing, the dollar index traded down by -0.33% to 102.89.

In the commodities market, crude oil prices ticked down by -0.33% to $69.20 per barrel following the API weekly cured oil inventory record a 1.024M barrel excess. Besides, gold prices traded down by -0.03% to $1942.97 per troy ounce following the upbeat US Treasury yields and equities.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) (Apr) | -0.3% | 0.2% | – |

| 20:30 | USD – PPI (MoM) (May) | 0.2% | -0.1% | – |

| 20:30 | CrudeOIL – Crude Oil Inventories | -0.451M | 1.482M | – |

Technical Analysis

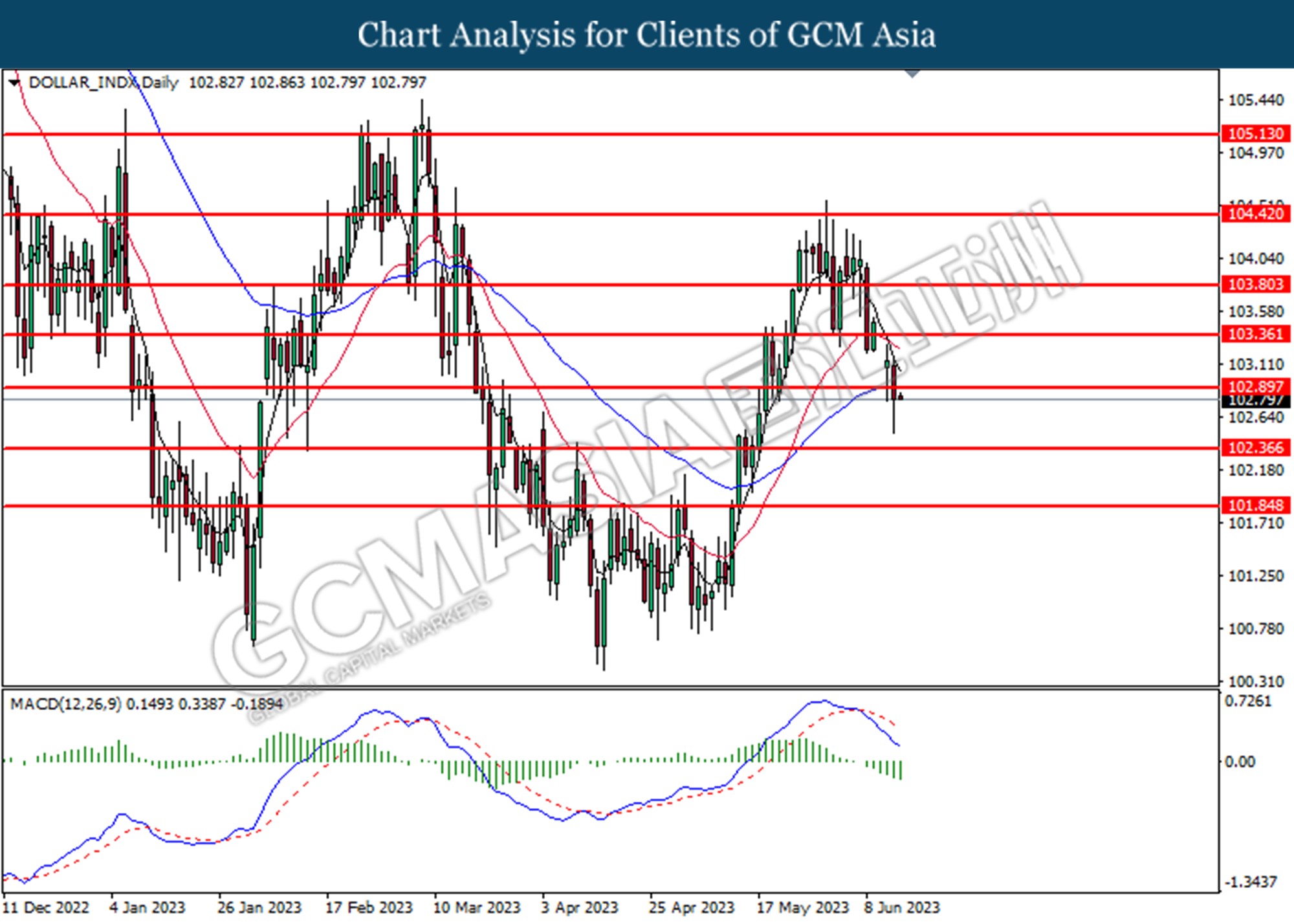

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breaks below from the previous support level at 102.90. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

GBPUSD, Daily: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2565. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2615.

Resistance level: 1.2615, 1.2665

Support level: 1.1.2565, 1.2520

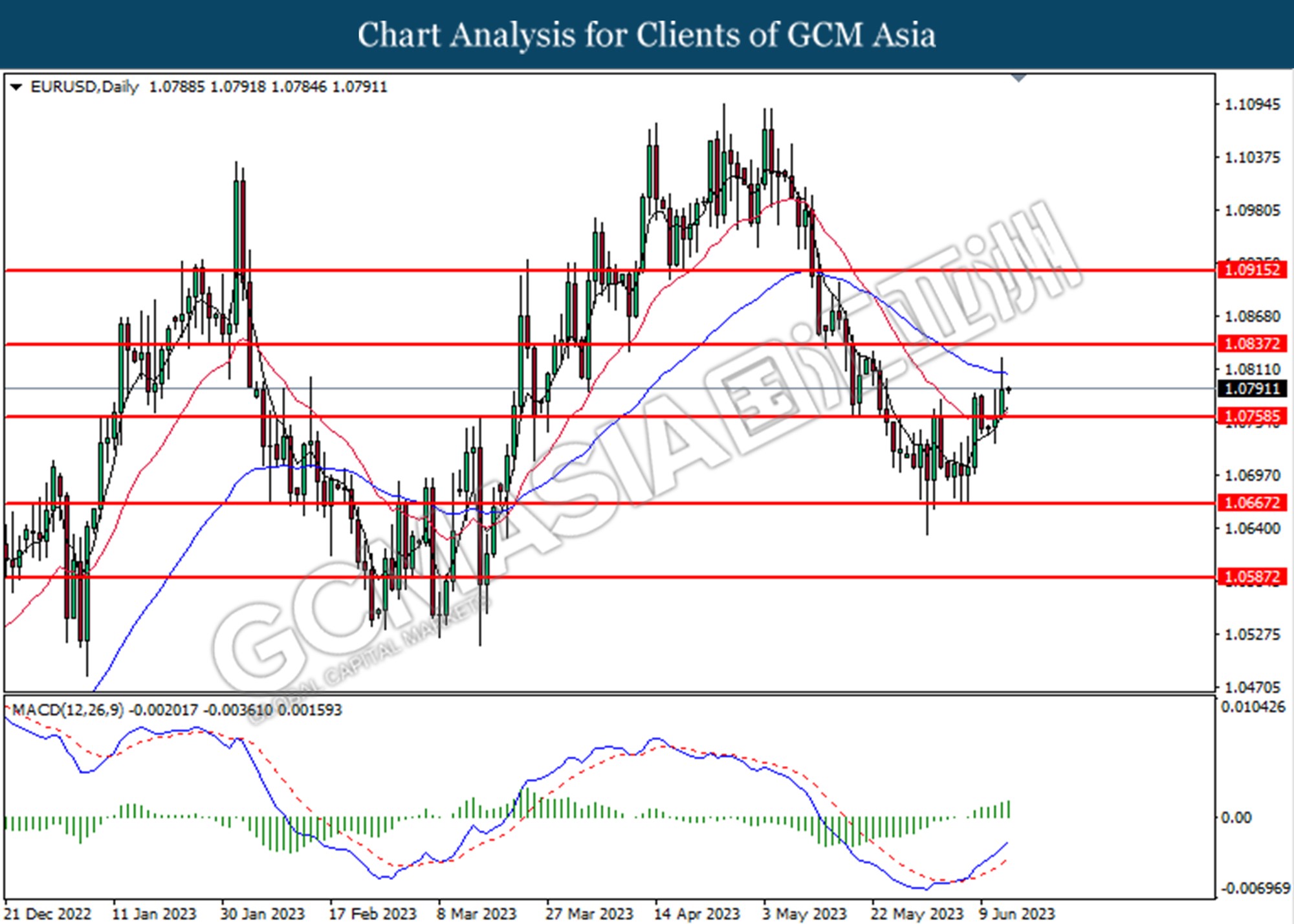

EURUSD, Daily: EURUSD was traded higher following the prior breaks above the previous resistance level at 1.0760. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0760, 1.0835

Support level: 1.0670, 1.0590

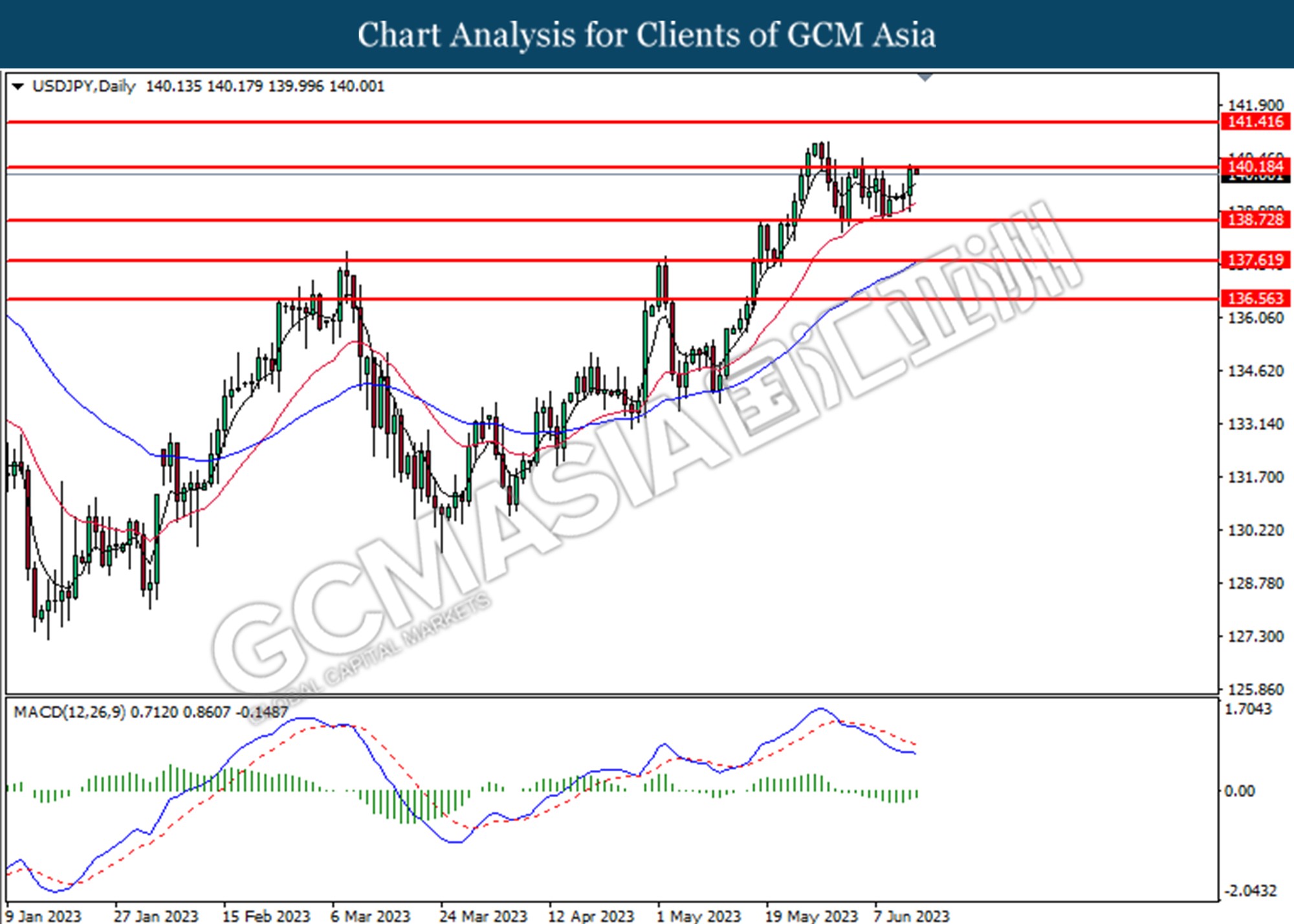

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the higher level at 140.20. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes technical correction in the short term.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

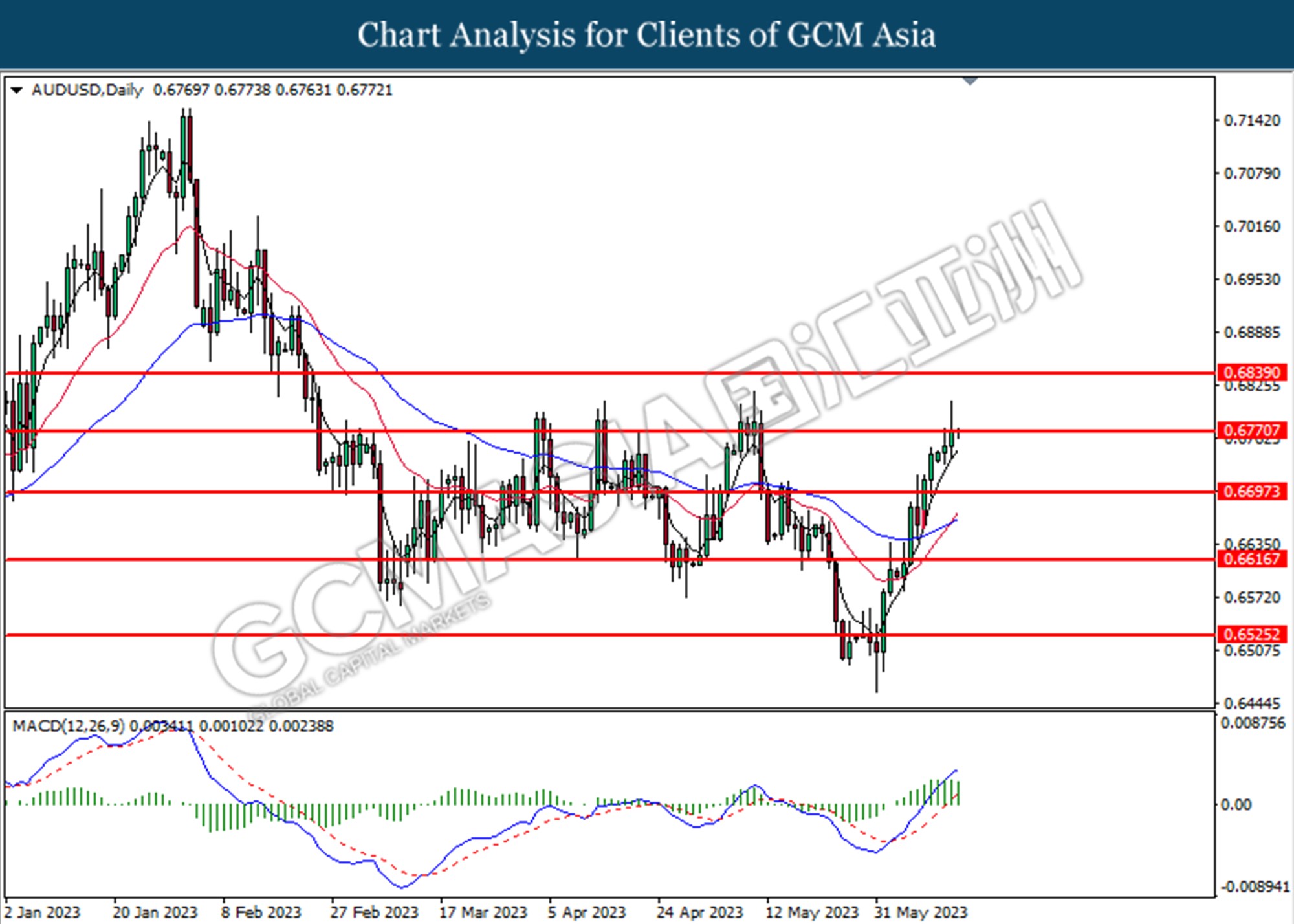

AUDUSD, Daily: AUDUSD was traded higher while currently testing for the resistance level at 0.6770. MACD which illustrated increasing bullish momentum suggests the pair to extend after its successfully break above the resistance level.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

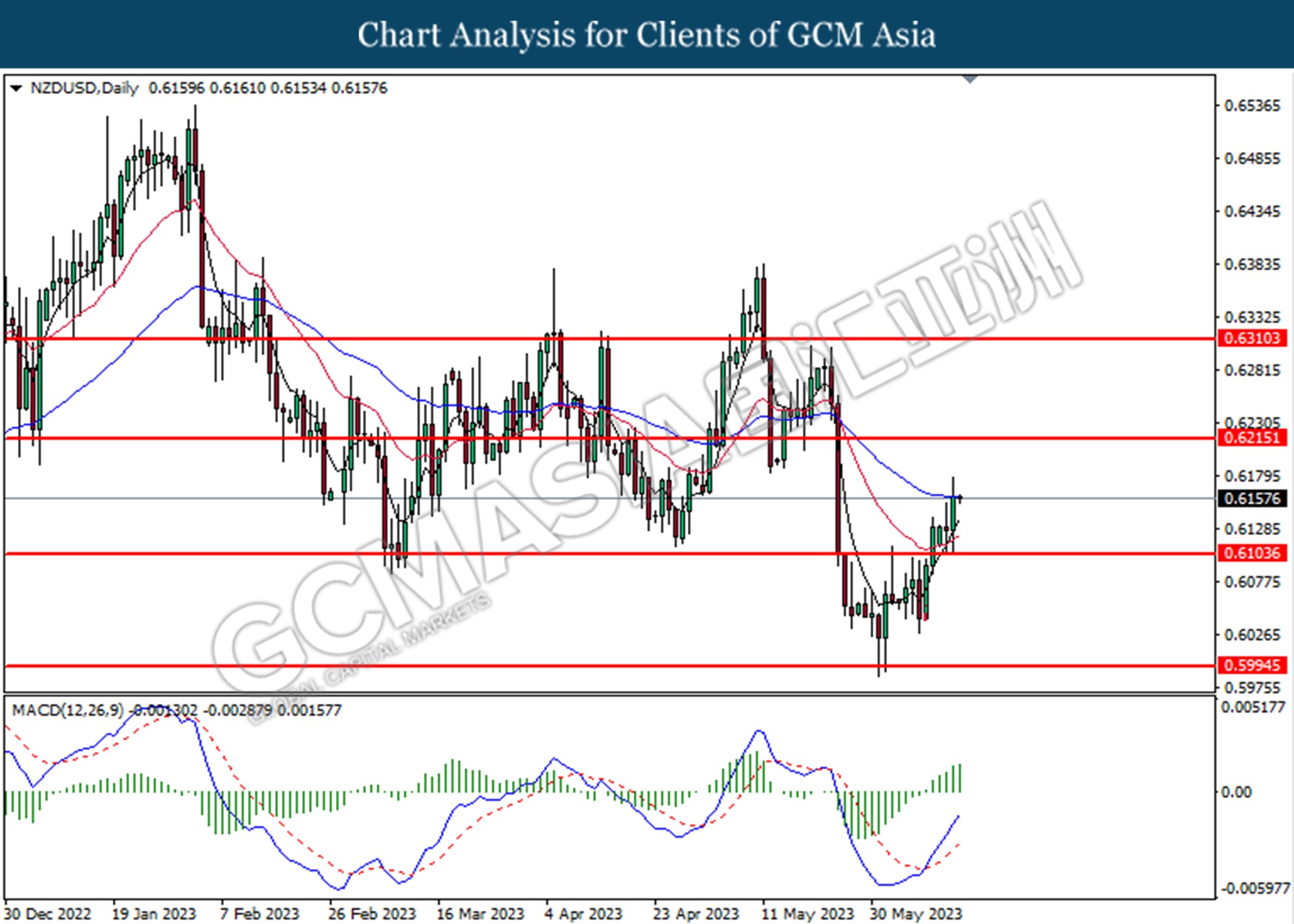

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6105. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

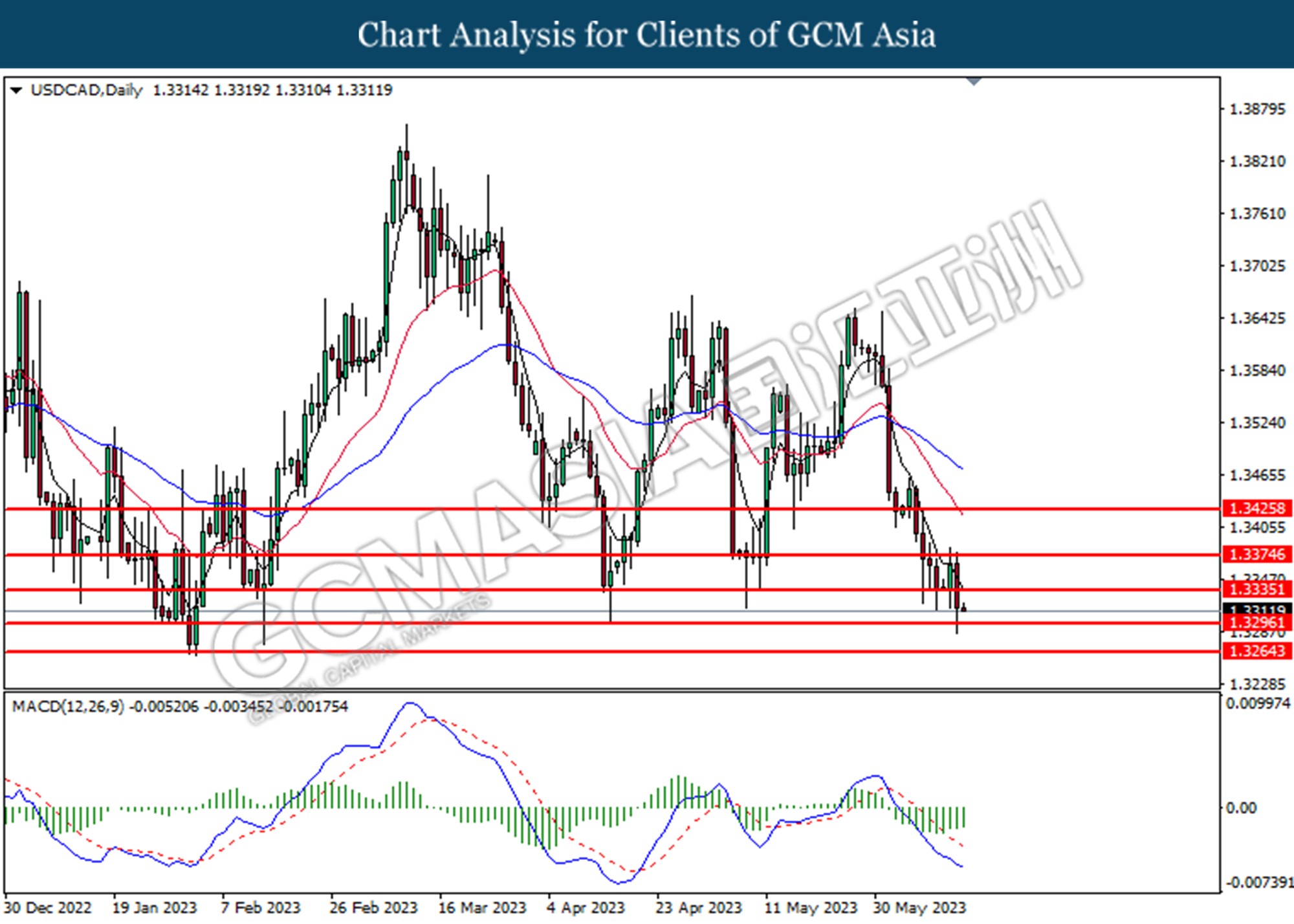

USDCAD, Daily: USDCAD was traded lower following the prior breaks below from the previous support level at 1.3335. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.3335, 1.3375

Support level: 1.3300, 1.3265

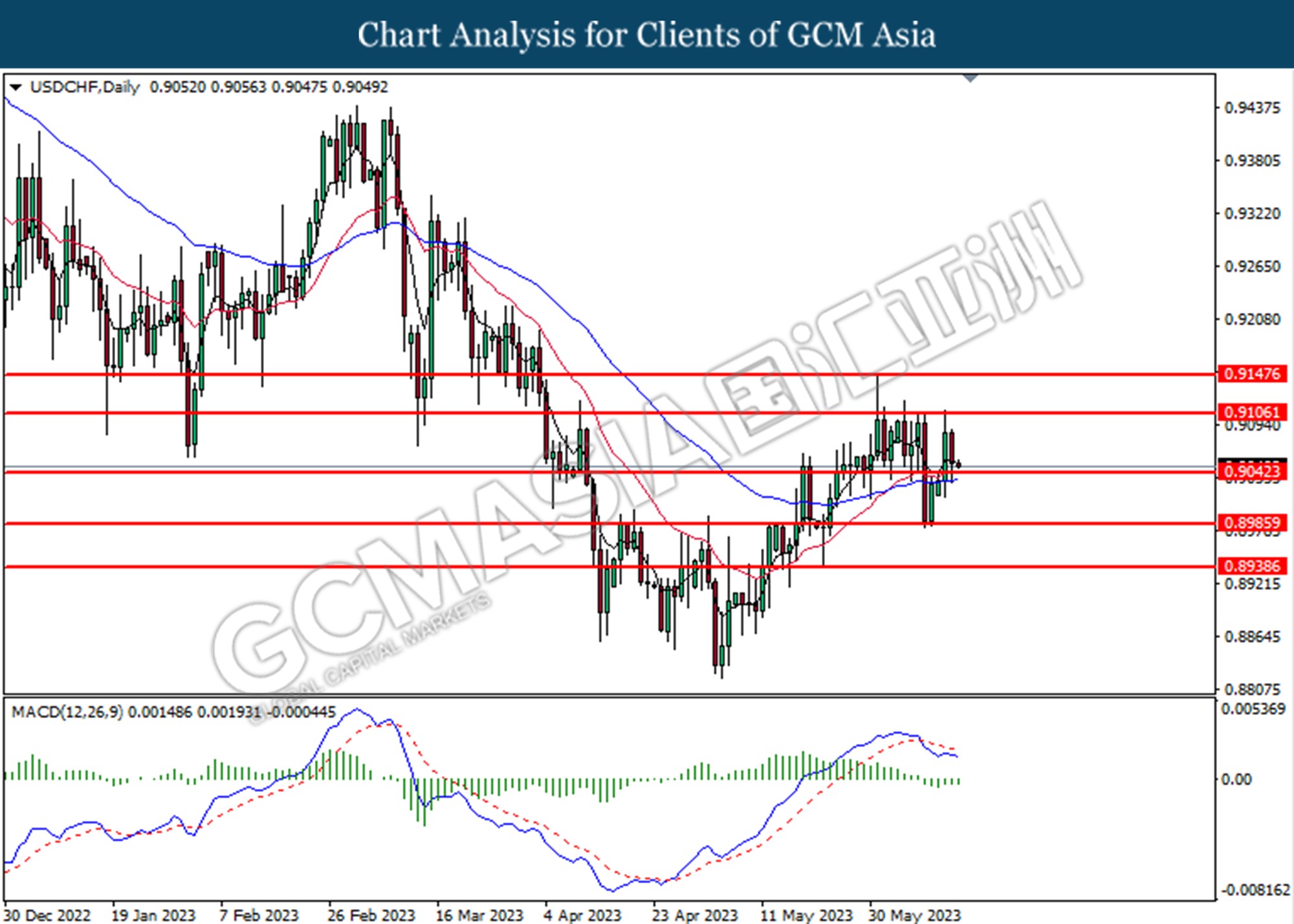

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extend its losses toward the support level at 0.9040.

Resistance level: 0.9105, 0.9150

Support level: 0.9040, 0.8985

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 69.30. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, Daily: Gold price was traded lower following the prior breaks below from the previous support level at 1955.50. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1982.50, 2005.80

Support level: 1955.50, 1930.45