14 July 2022 Morning Session Analysis

US Dollar rallied over the upbeat CPI data.

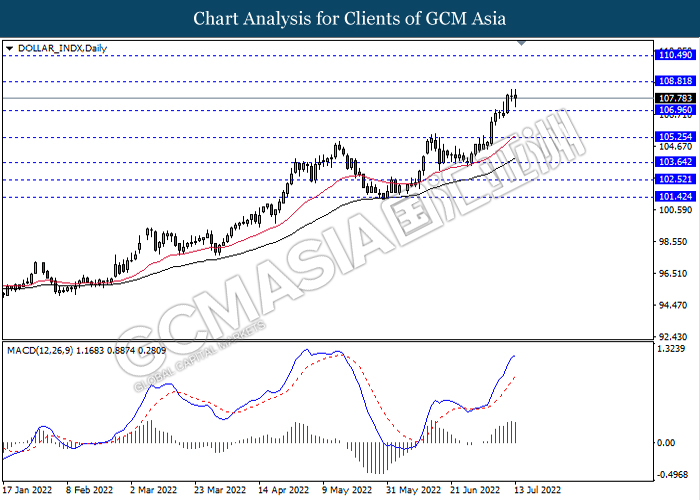

The dollar Index which traded against a basket of six major currencies rose significantly on yesterday after the CPI data has been released. According to the US Department of Labor, the US Consumer Price Index (CPI) YoY for June notched up from the previous reading of 8.6% to 9.1%, exceeding the market forecast of 8.8%. The CPI data was used to measure the changes of price which paid by the US consumer, which is a crucial indicator to determine the inflation rate. The higher-than-expected of CPI reading hinted that the inflation risk keep soaring in the US market, which rising the odds of aggressive rate hikes from Federal Reserve in the upcoming meeting to stabilize the increasing prices. Besides, according to Reuters, market participants started to ponder 100 basis point increase from Fed after the unleash of CPI data, sparkling the appeal of US Dollar. As of writing, the Dollar Index edged down by 0.05% to 107.85.

In the commodities market, crude oil price depreciated by 0.49% to $95.83 per barrel as of writing. According to Energy Information Administration, the US Crude Oil Inventories increased by 3.254M, higher than the market expectation of -0.154M. On the other hand, gold price depreciated by 0.32% to $1729.90 per troy ounce as of writing amid the backdrop of aggressive rate hikes expectations from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 235K | 235K | – |

| 20:30 | USD – PPI (MoM) (Jun) | 0.80% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

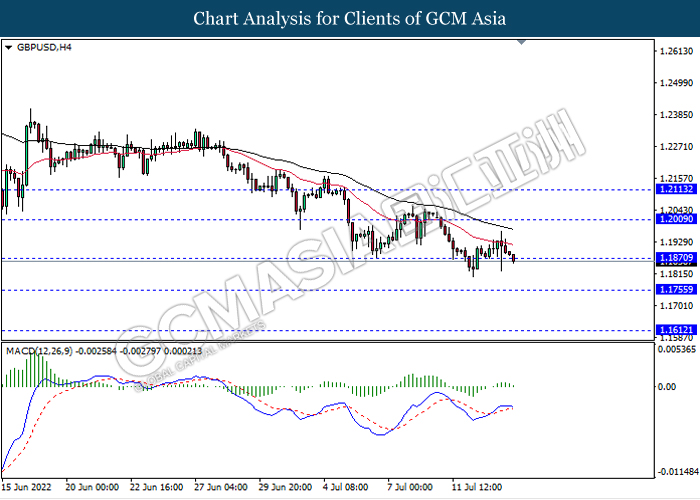

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1870, 1.2010

Support level: 1.1755, 1.1610

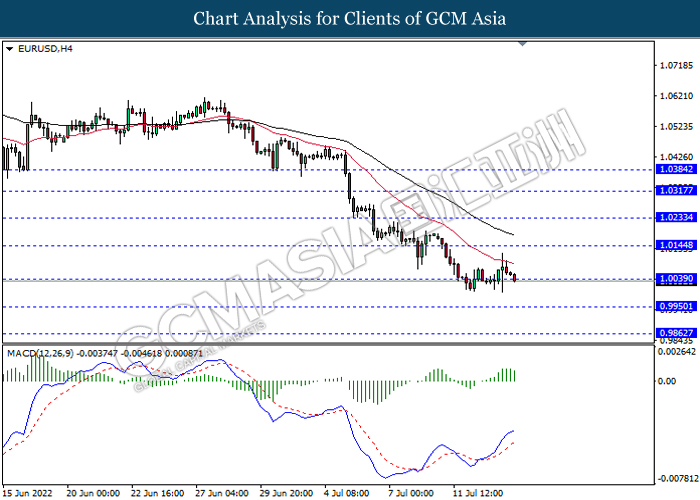

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0040, 1.0145

Support level: 0.9950, 0.9860

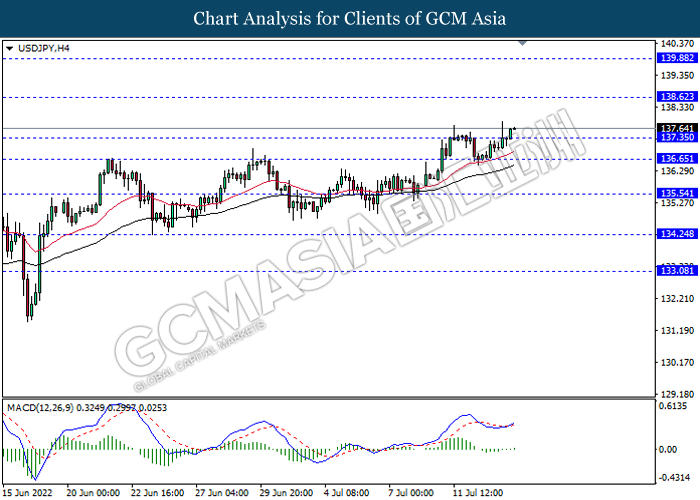

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

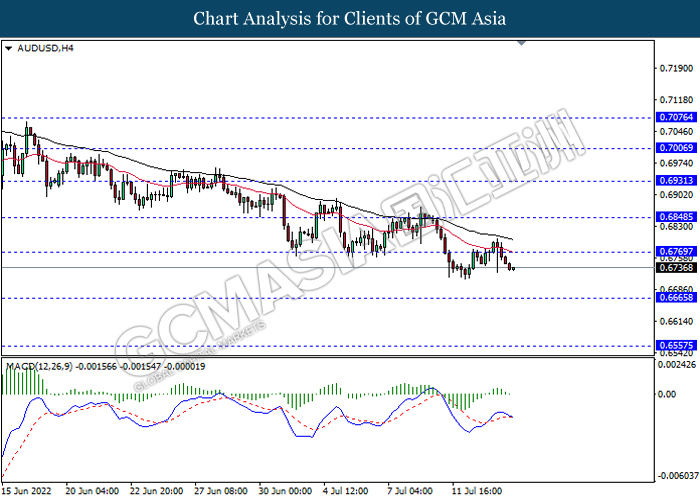

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

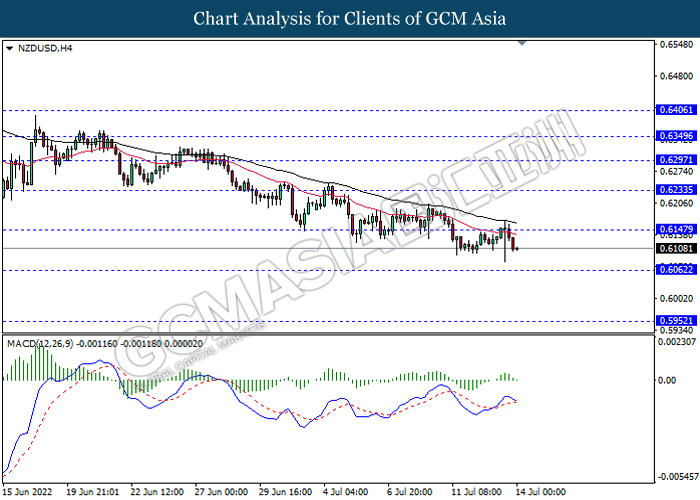

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

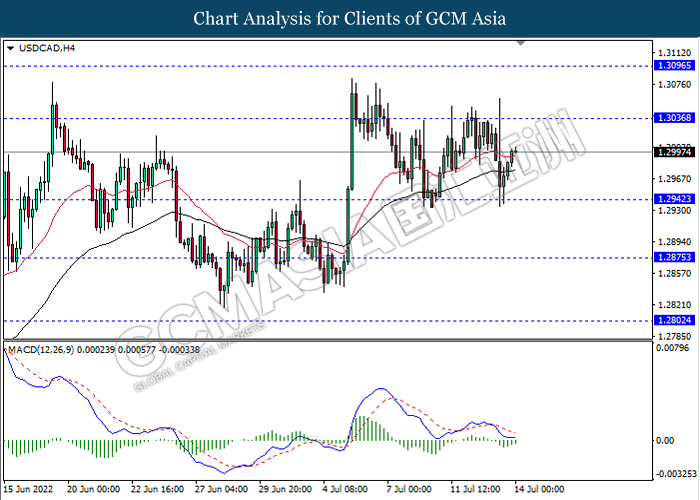

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

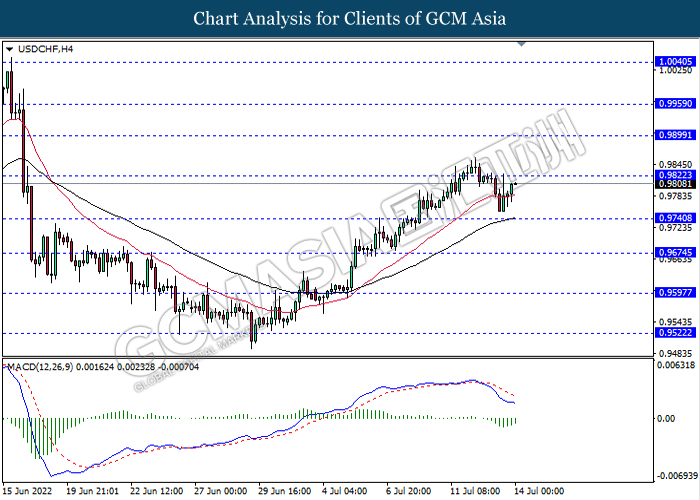

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

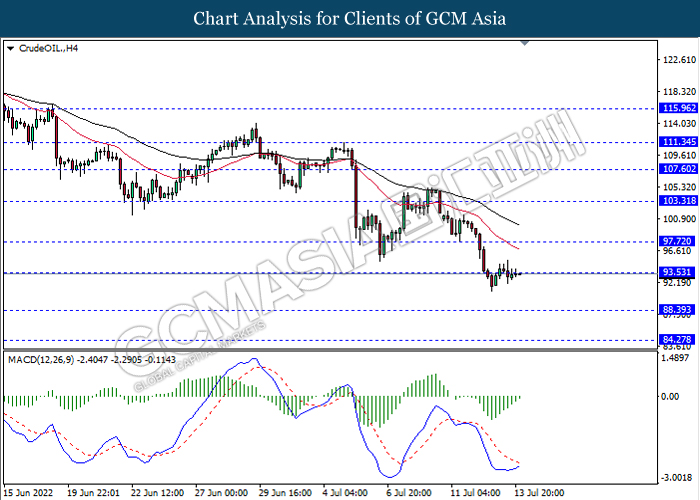

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 93.55, 97.70

Support level: 88.40, 84.25

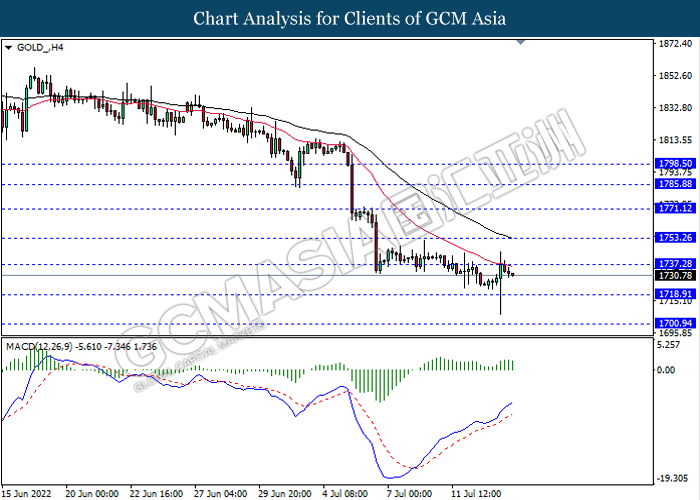

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1737.30, 1753.25

Support level: 1718.90, 1700.95