14 October 2022 Afternoon Session Analysis

Liz Truss intends to scrap the tax-cut plan.

The Pound Sterling, which was widely traded by global investors, skyrocketed following the news reported that the new UK government is in talks of scrapping the tax-cut plan. Earlier last week, Liz Truss’s government announced a series of tax cut plan to ease the rising cost of living in the household in the UK. However, the UK government are now considering making a U-turn on the tax-cut plan following a growing public backlash. In terms of economics wise, investors reckon that the tax-cut plan may eventually exacerbate the recession risk in the UK as it may push up the UK budget deficit. With that, it diminished the investors’ confidence in the development of the UK economy. However, the news of reversing the tax-cut plan revived the market sentiment in the UK. As of now, investors are all eyeing the bond-purchasing program, which is scheduled to end today. Any extension of the emergency bond purchasing plan would likely support the economy through the economic recession. As of writing, the pair of GBP/USD rose 0.04% to 1.1333.

In the commodities market, the crude oil price edged up 0.06% to $89.40 per barrel following the depreciation of the dollar index, which dragged down the cost of oil for non-US buyers. Besides, the gold prices were up 0.06% to $1667.45 per troy ounce amid a weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Sep) | -0.3% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Sep) | 0.3% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

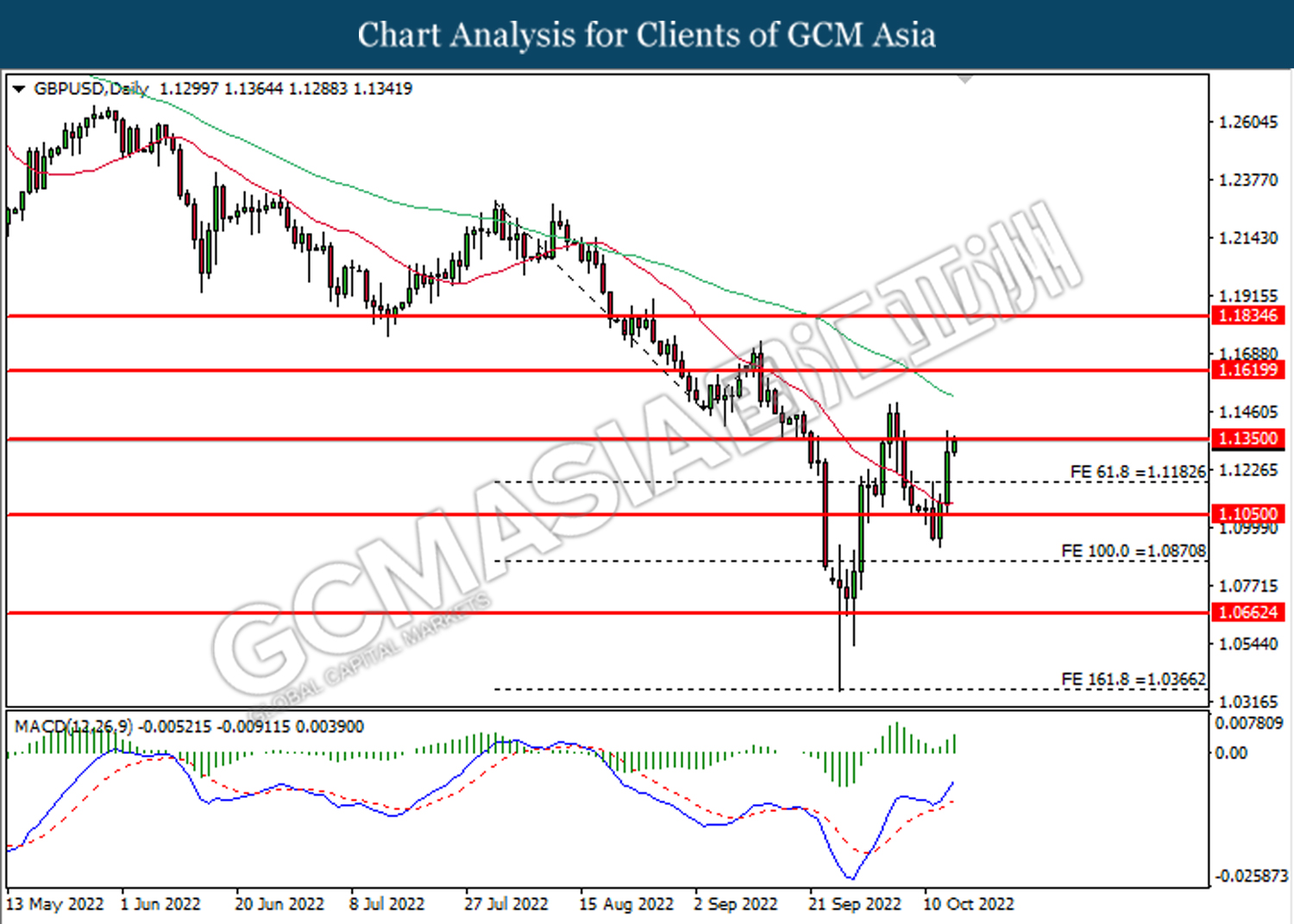

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1350. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1350, 1.1620

Support level: 1.1050, 1.0870

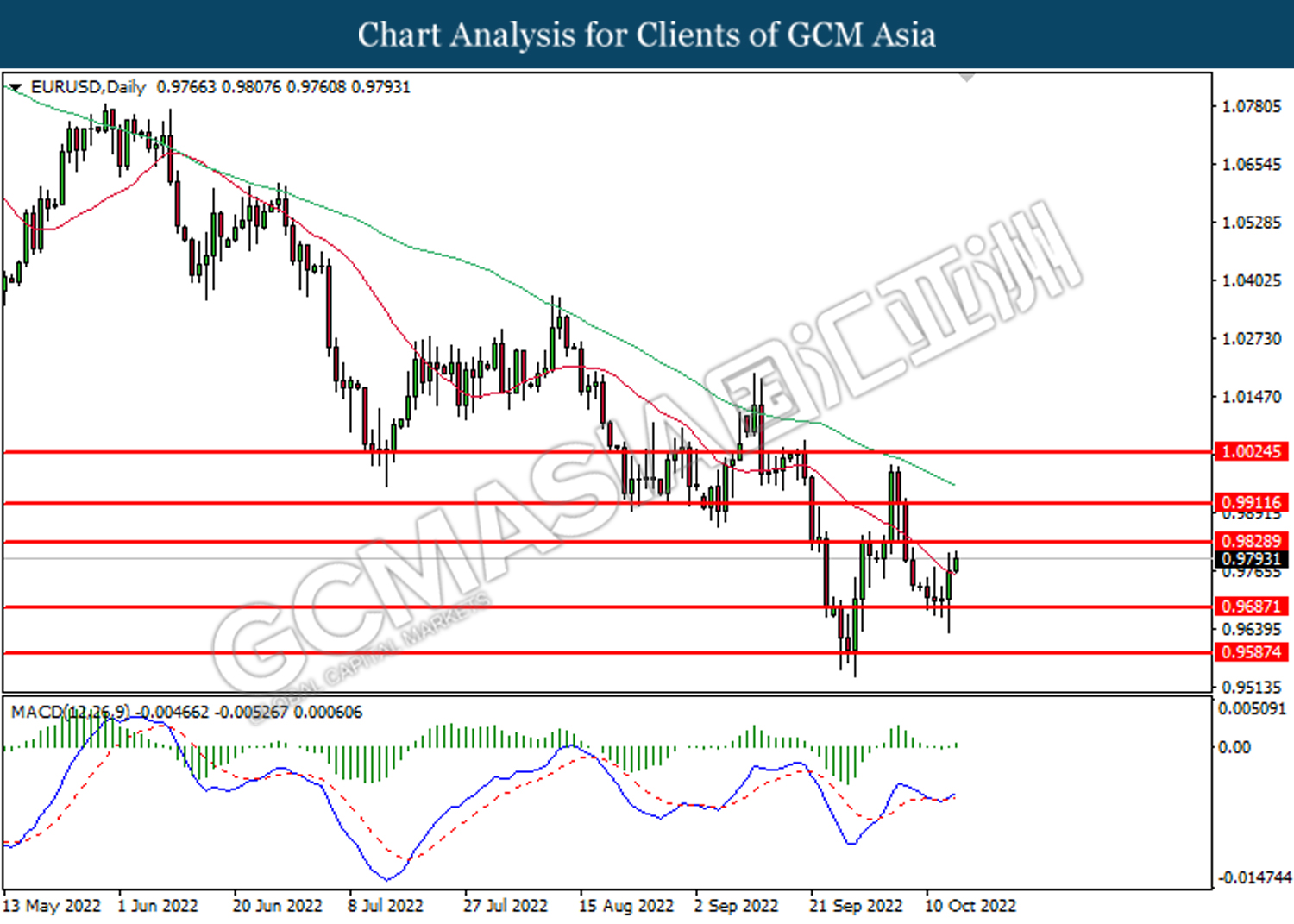

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 0.9685. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9830.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

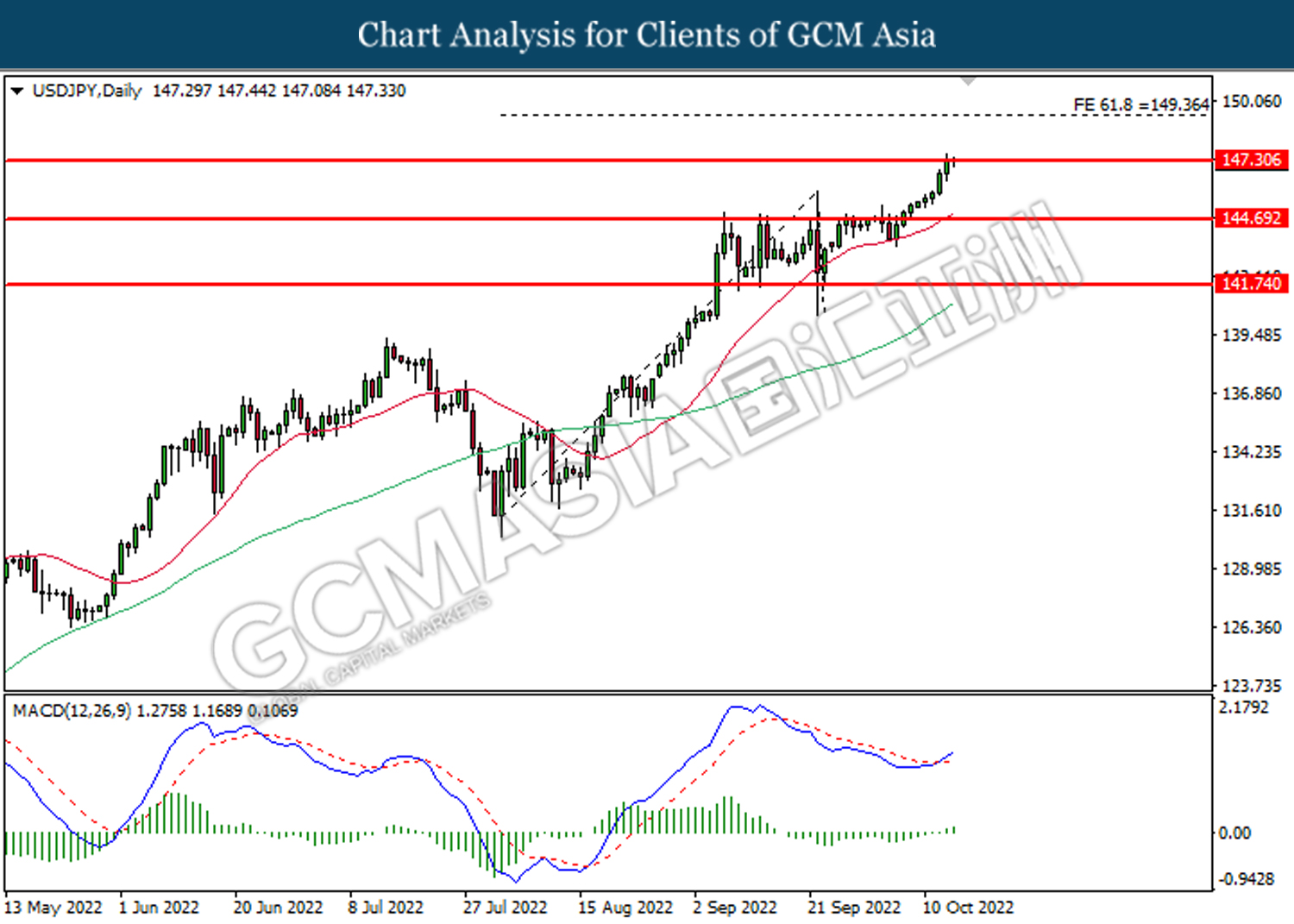

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

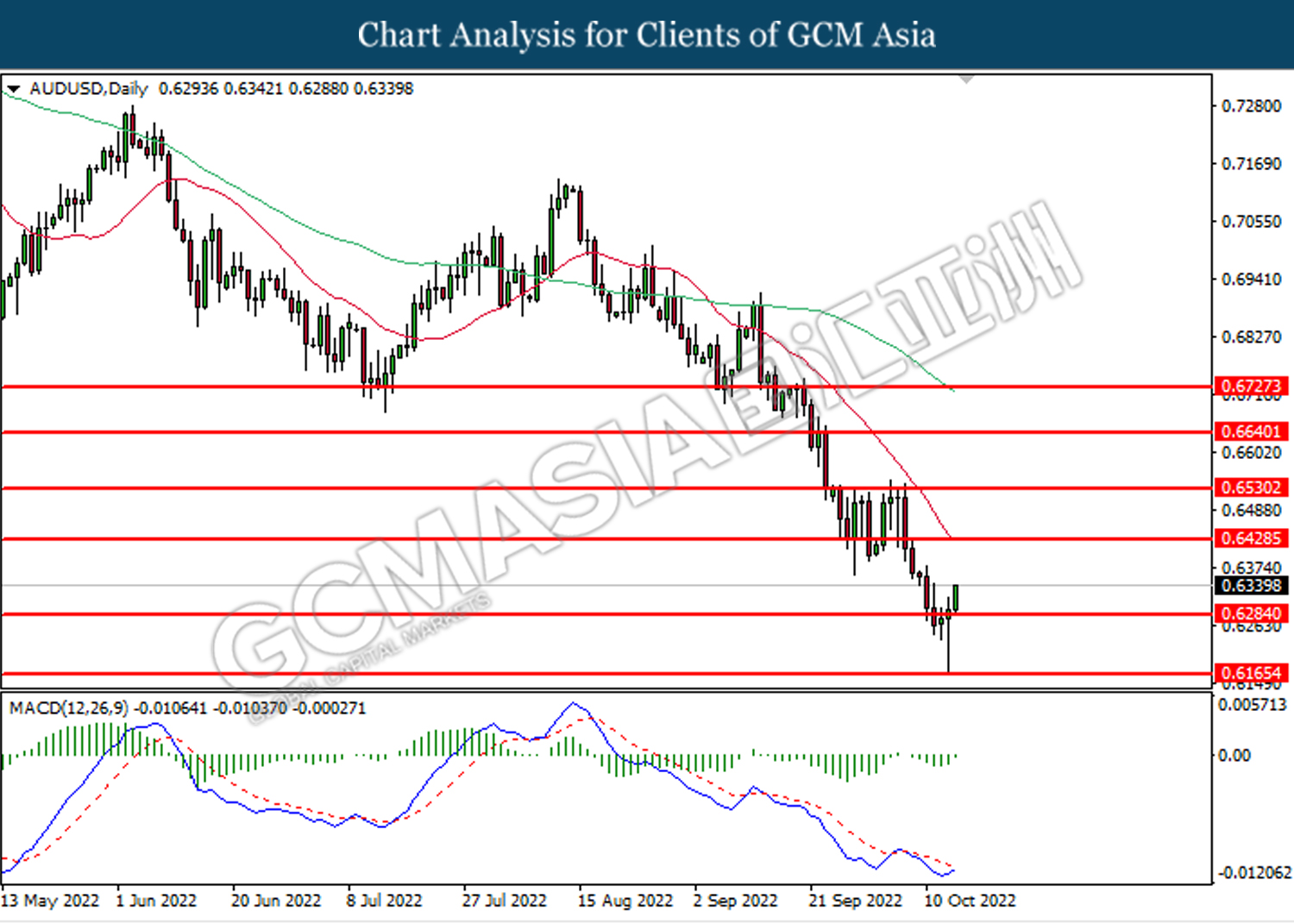

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6285. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6430.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

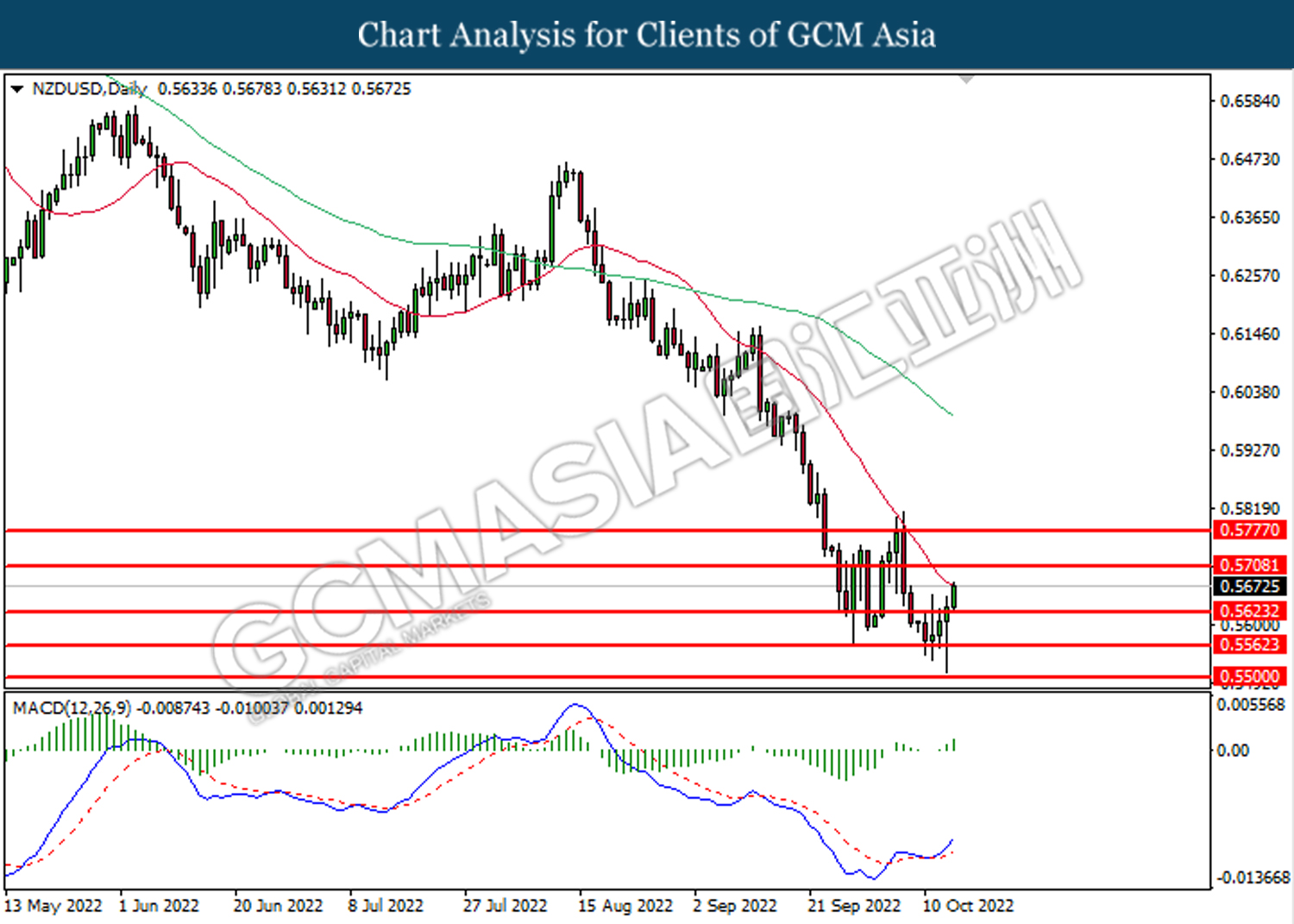

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5625. MACD which illustrated bullish bias momentum suggest the pair to extend gains toward the resistance level at 0.5710.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5565

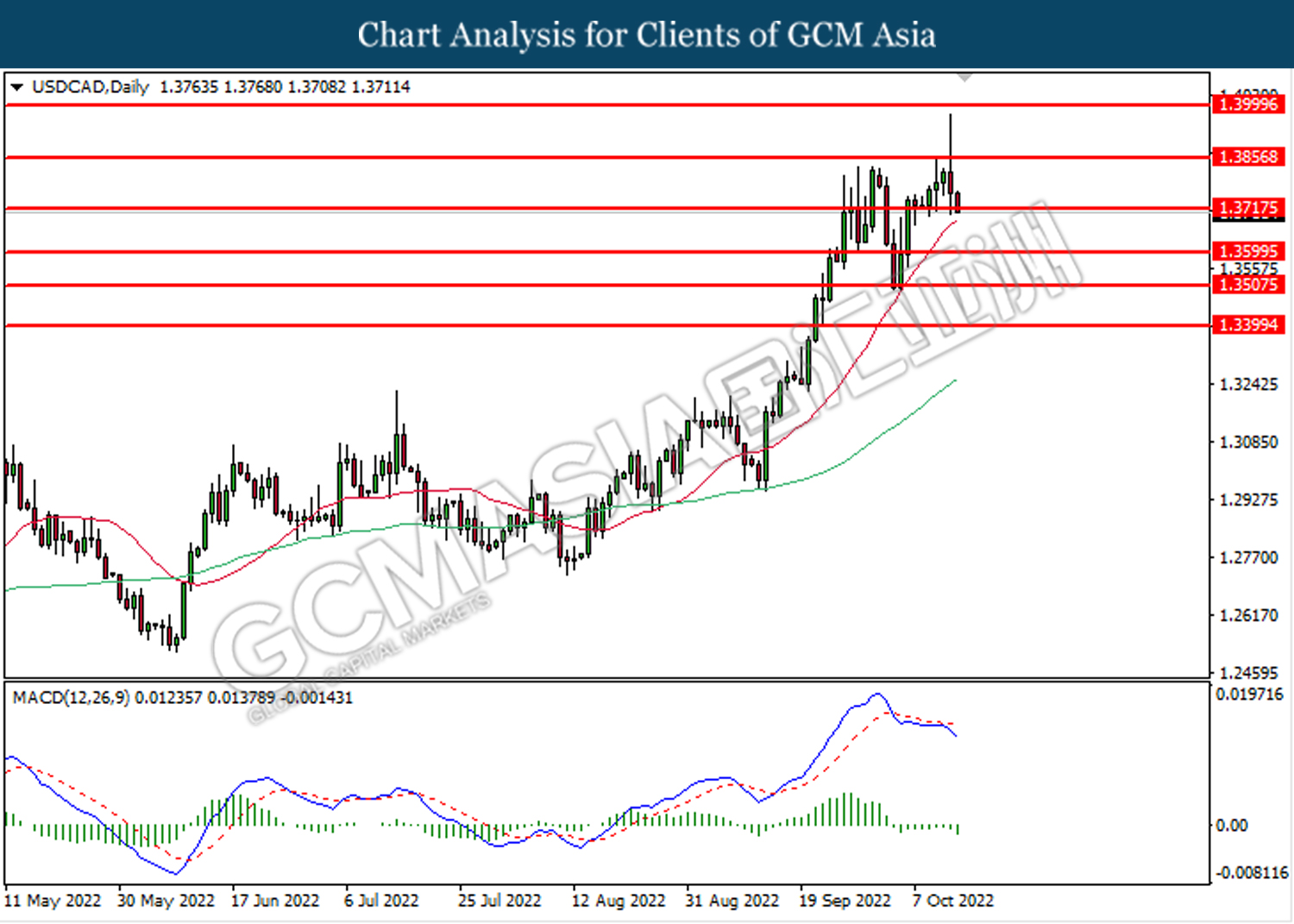

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3715. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3855, 1.4000

Support level: 1.3715, 1.3600

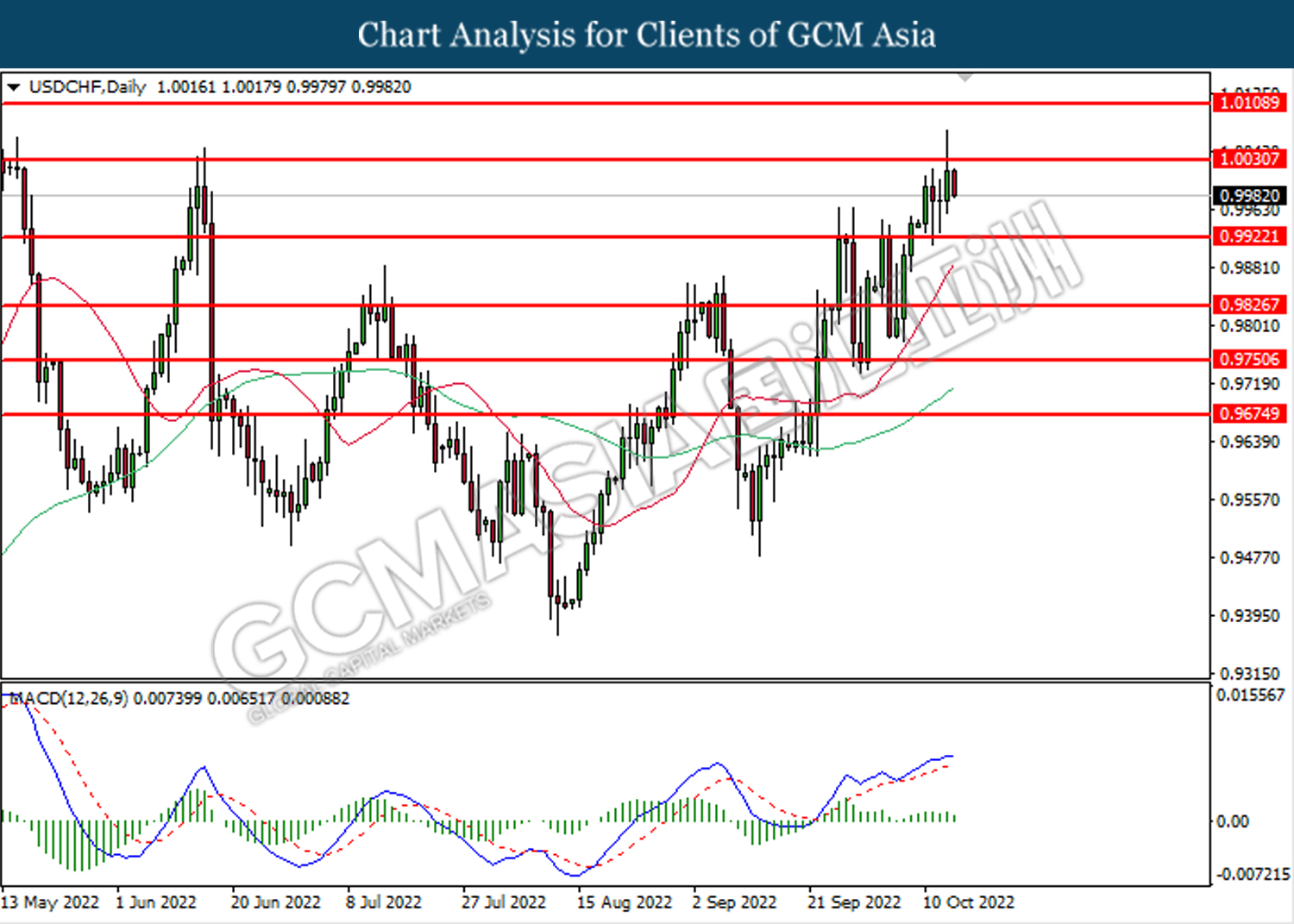

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 1.0030. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9920.

Resistance level: 1.0030, 1.0110

Support level: 0.9920, 0.9825

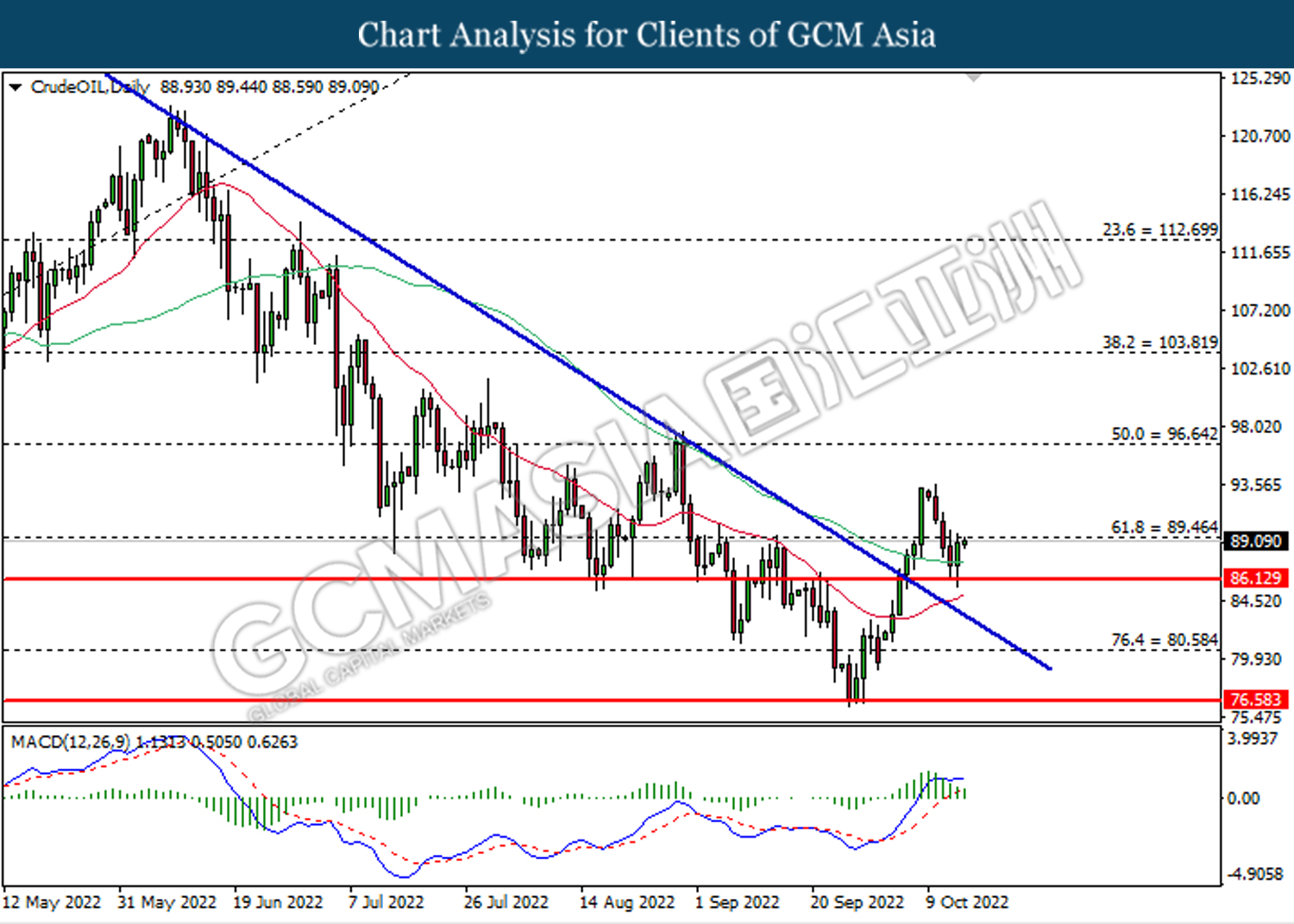

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 96.65

Support level: 86.15, 80.60

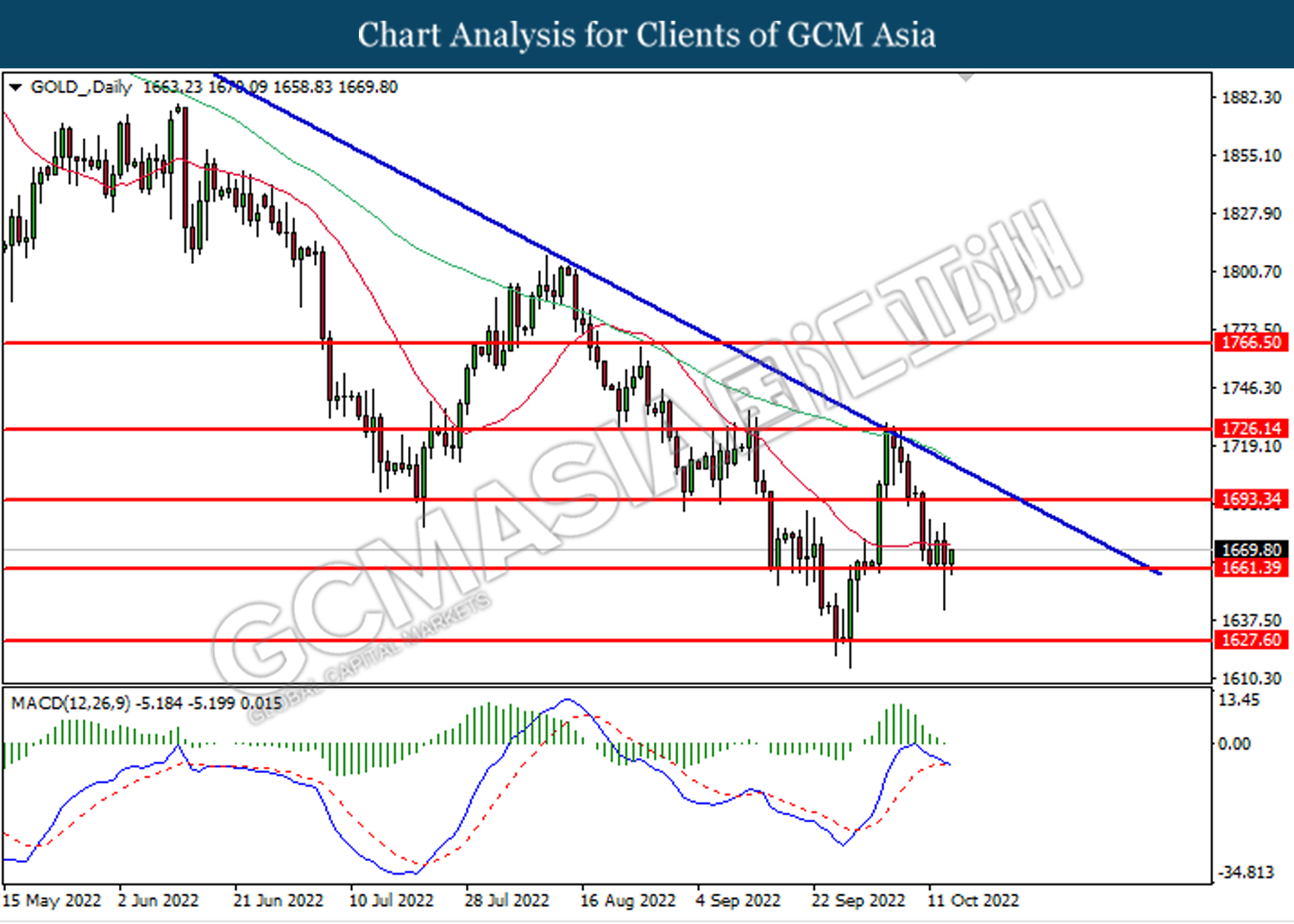

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1661.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60