14 November 2018 Afternoon Session Analysis

Dollar sags amid Brexit optimism.

US dollar remained subdued amid reports on European Union and Brexit have struck a draft on Brexit withdrawal agreement which improved risk sentiment around risky assets. UK Prime Minister Theresa May has prepared a preliminary text and will present it to her senior ministers on Wednesday. However, the draft will be a challenge for Theresa May to seal the deal amid hard Brexit supporters have accused Theresa May to surrender to EU demands. Meanwhile, markets will shift their focus on today meeting where British cabinet will meet to consider the draft withdrawal agreement. Dollar index slips 0.16% to 96.95 as of writing. On the other hand, AUD/USD remains steady amid uptick data in Wage Price Index. According to Australia Bureau of Statistics, the index ticked higher to 0.6% compared to previous print of 0.5%. The data which have illustrate Australia job markets have been strengthening, thus improving investors confidence on the Aussie. As of writing, AUDUSD inched higher 0.03% to 0.7215.

As for commodities market, crude oil price recovers 0.38% to $55.42 per barrel after a continuous collapse as Trump pressure on OPEC continues to erase sentiment in oil markets. Moreover, gold price rebound 0.04% to $1202.30 amid investors taking gains on dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

07:00 (15th) USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German GDP (QoQ) (Q3) | 0.5% | -0.3% | – |

| 17:30 | GBP – CPI (YoY) (Oct) | 2.4% | 2.5% | – |

| 18:00 | EUR – GDP (QoQ) (Q3) | 0.2% | 0.2% | – |

| 21:30 | USD – Core CPI (MoM) (Oct) | 0.1% | 0.2% | – |

| 05:30 (15th) | CrudeOIL – API Weekly Crude Oil Stock | 7.830M | – | – |

Technical Analysis

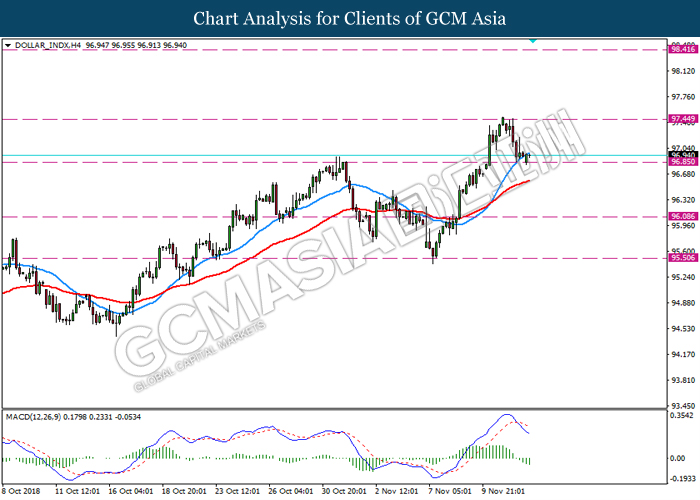

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level 97.45. MACD which illustrate bearish signal with the formation of death cross suggest the pair extend its losses towards the support level 96.85.

Resistance level: 97.45, 98.40

Support level: 96.85, 96.10

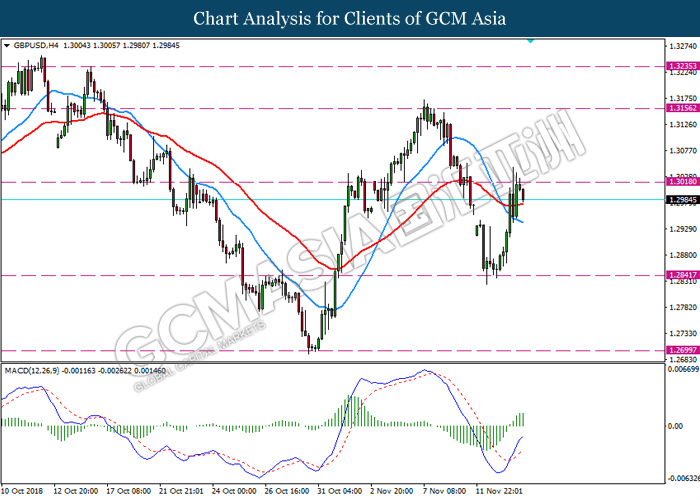

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.3020. Although MACD which display bullish signal with formation of golden cross, a breakout is above the resistance level 1.3020 is required to attain further confirmation.

Resistance level: 1.3020, 1.3155

Support level: 1.2840, 1.2700

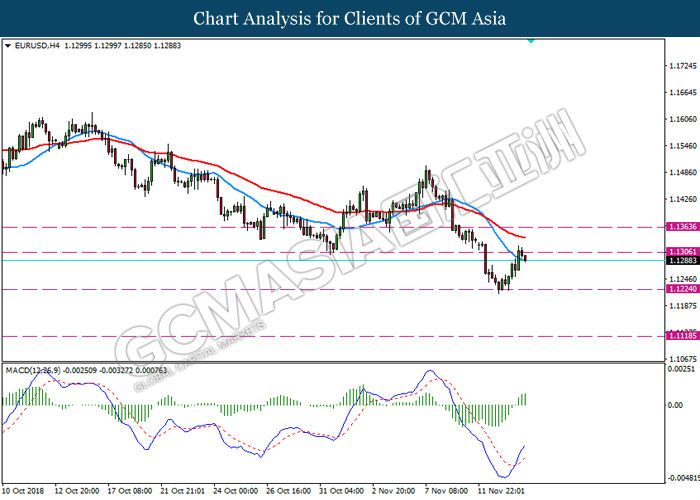

EURUSD, H4: EURUSD was traded lower following recent retracement from the resistance level 1.1305. Although MACD which illustrate bullish signal with the formation of golden cross, a breakout above the resistance level 1.1305 is required to attain further confirmation.

Resistance level: 1.1305, 1.1365

Support level: 1.1225, 1.1120

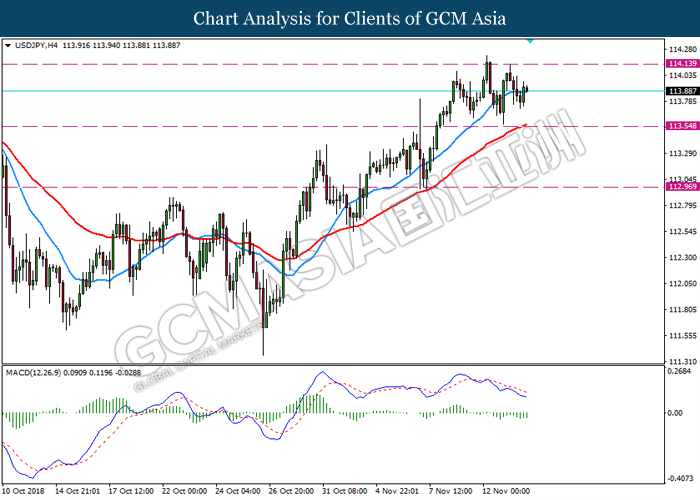

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level 114.15. MACD which illustrate bearish momentum signal suggest the pair to extend its retracement towards the support level 113.55.

Resistance level: 114.15, 114.55

Support level: 113.55, 112.95

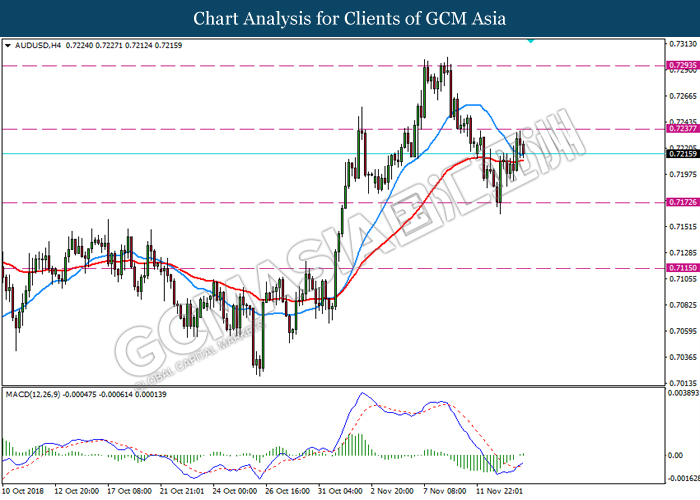

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7235. Although MACD which illustrate bullish bias with the formation of golden cross, a breakout above the resistance level 0.7235 is required to attain further confirmation.

Resistance level: 0.7235, 0.7290

Support level: 0.7170, 0.7115

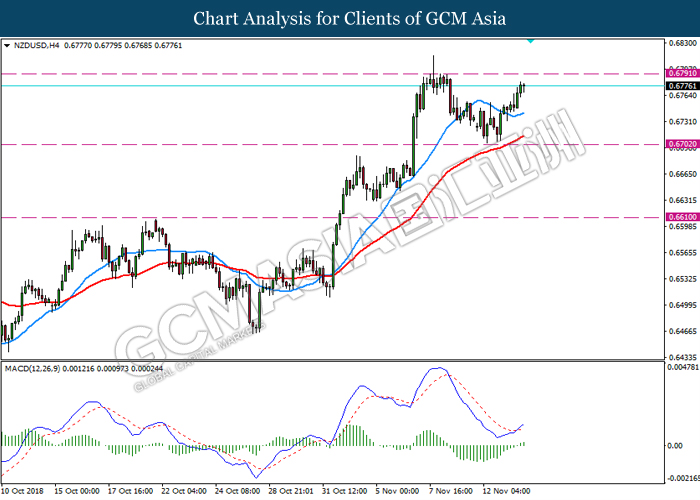

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level 0.6700. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.6790.

Resistance level: 0.6790, 0.6855

Support level: 0.6700, 0.6610

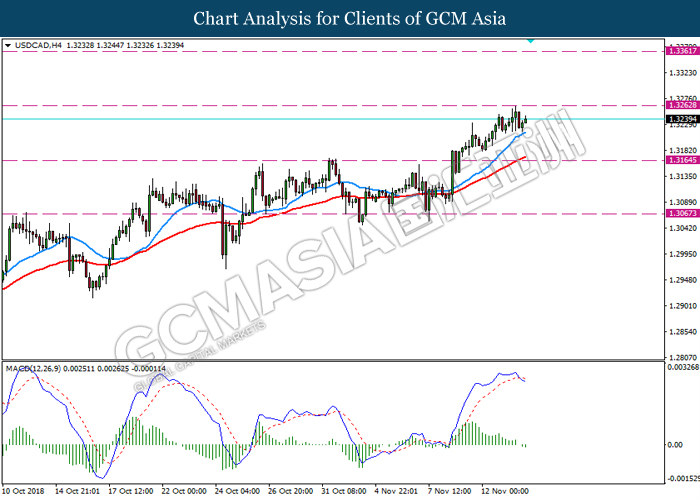

USDCAD, H4: USDCAD was traded higher while currently testing near the resistance level 1.3260. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to experience a technical correction in short-term towards the support level 1.3165.

Resistance level: 1.3260, 1.3360

Support level: 1.3165, 1.3065

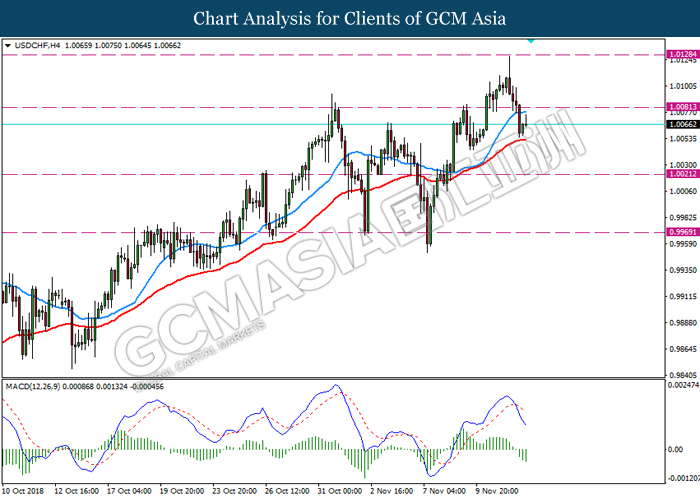

USDCHF, H4: USDCHF was traded lower following recent breakout below the previous support level 1.0080. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to extend its losses towards the support level 1.0020.

Resistance level: 1.0080, 1.0130

Support level: 1.0020, 0.9970

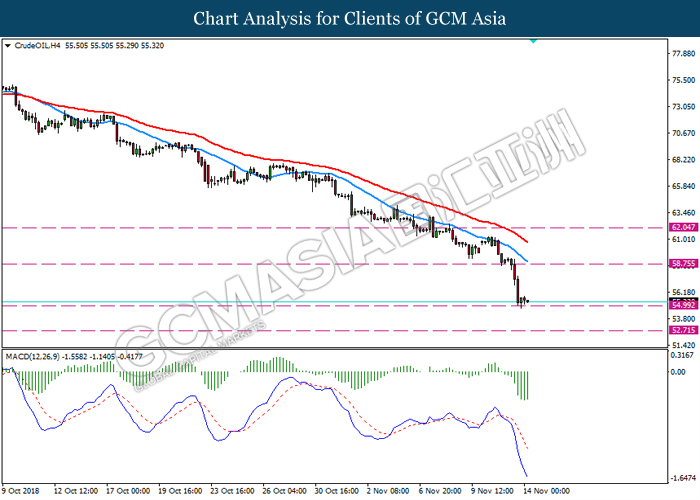

CrudeOIL, H4: Crude oil was traded lower while currently testing the support level 55.00. MACD which illustrate diminishing bearish momentum suggest the commodity to experience a short term technical correction towards the resistance level 58.75.

Resistance level: 58.75, 62.05

Support level: 55.00, 52.70

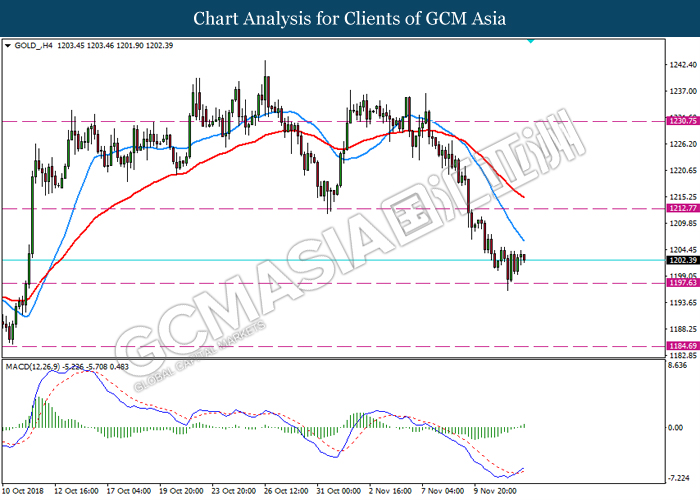

GOLD_, H4: Gold price was traded higher following prior rebound from the support level 1197.50. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 1212.50.

Resistance level: 1212.75, 1230.75

Support level: 1197.50, 1184.50