14 November 2022 Afternoon Session Analysis

Pound Sterling’s bulls continues upon optimistic economic data.

The GBP/USD, which widely traded by majority of investors surged on last Friday after the upbeat economic data has been released. According to Office for National Statistics, the UK Gross Domestic Product (GDP) YoY came in at the reading of 2.4%, exceeding the market forecast of 2.1%. Furthermore, the UK Manufacturing Production MoM in September has shown the expansion in the UK manufacturing sector, which it notched up from the prior figures of -1.6% to 0.0%. A series of bullish economic data has dialed up the market optimism toward economic progression in the UK. Besides, the hawkish statement from Bank of England (BoE) member has spurred further bullish momentum on Pound Sterling. According to Reuters, BoE interest rate-setter Jonathan Haskel claimed on 11 November that the economy recession in UK did not imply a need of slowing aggressive rate hike path, as well as the central bank should keep on the tightening monetary policy to dampen inflationary risk. With that, it stoked a shift in sentiment toward UK currency. As of writing, GBP/USD eased by 0.41% to 1.1789.

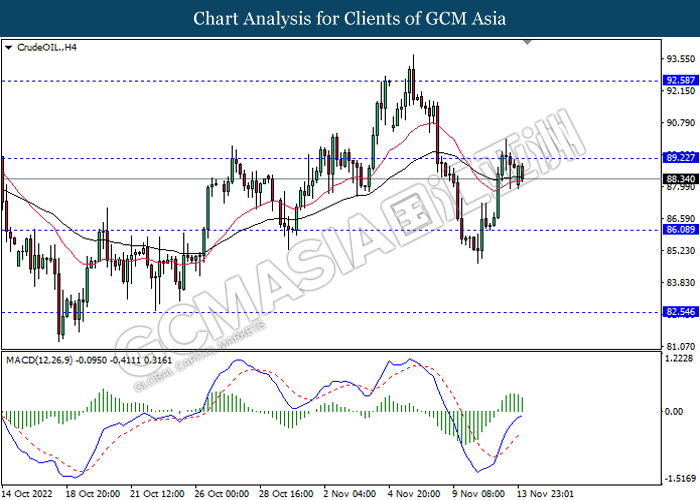

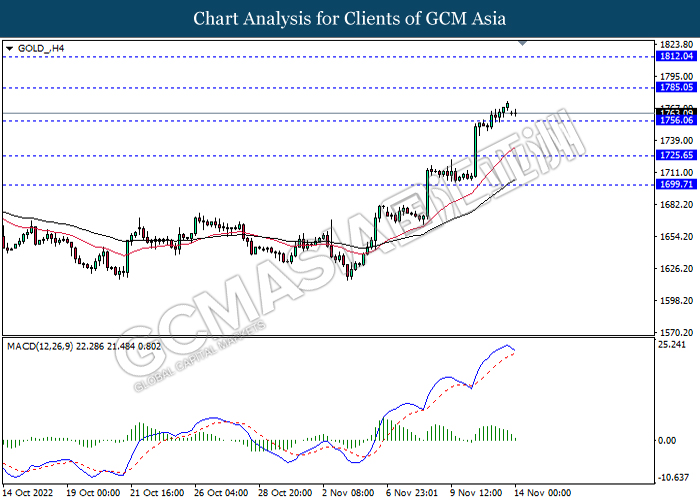

In the commodities market, the crude oil price appreciated by 0.35% to $89.27 per barrel as of writing following the looming curbs on Russian oil shipments also appeared set to tighten supply. On the other hand, the gold price edged down by 0.04% to $1765.34 per troy ounce as of writing following the slightly rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

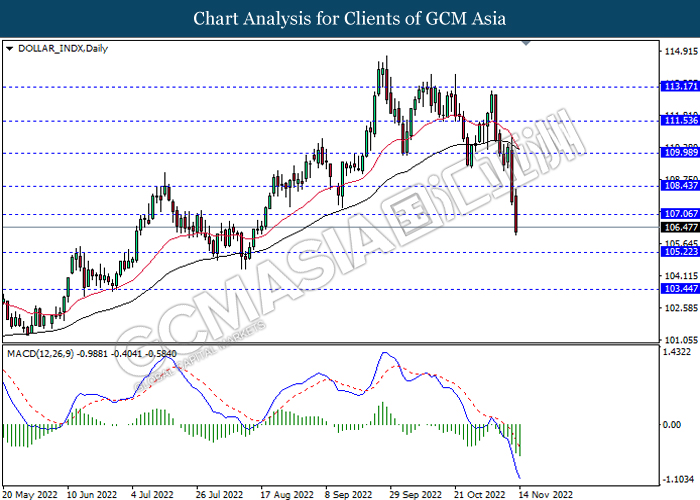

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

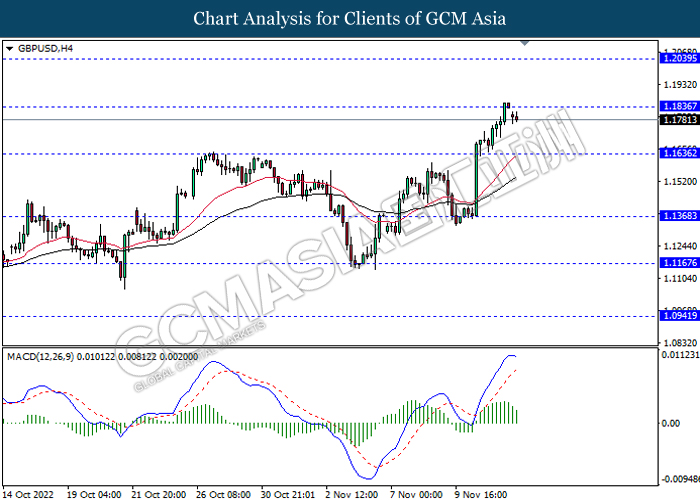

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1835, 1.2040

Support level: 1.1635, 1.1370

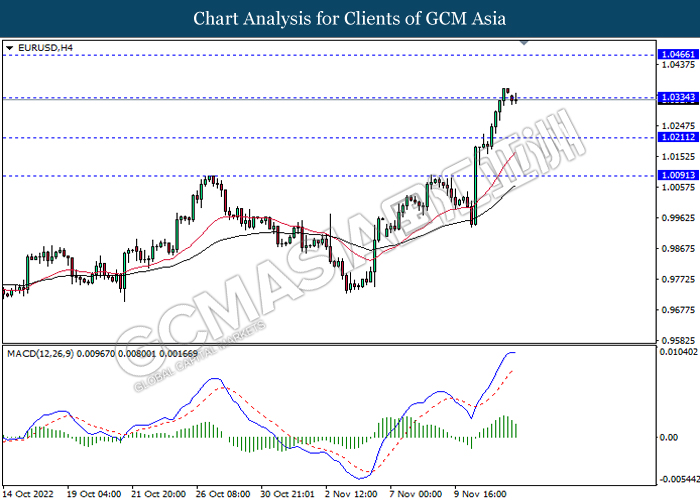

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

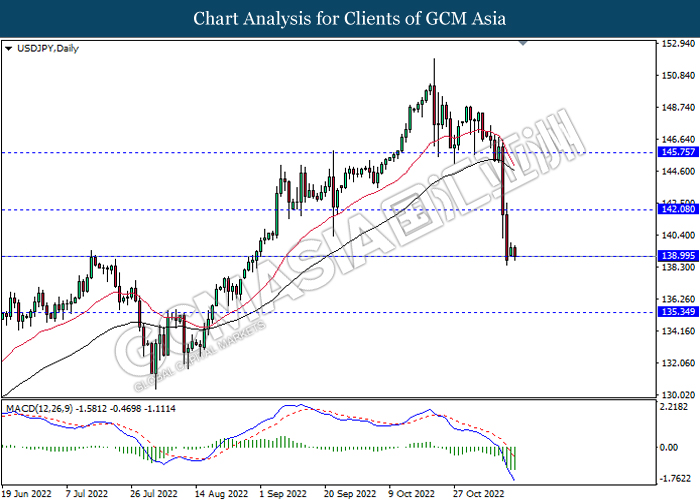

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

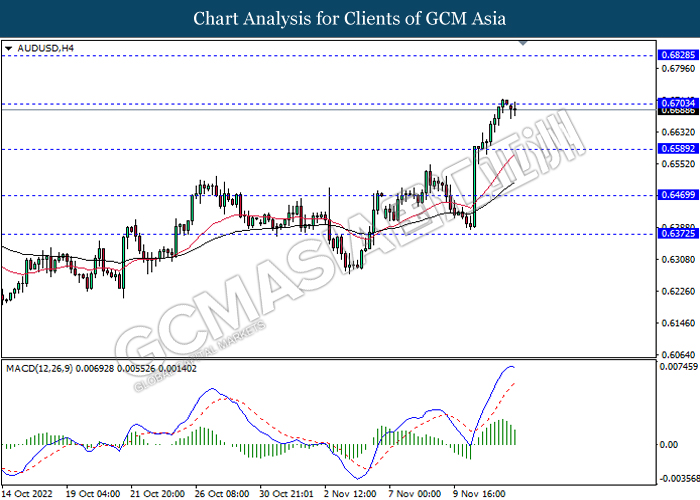

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6470

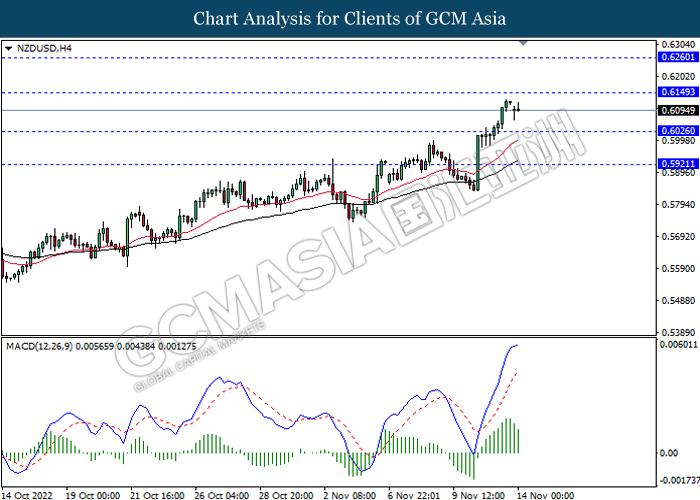

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

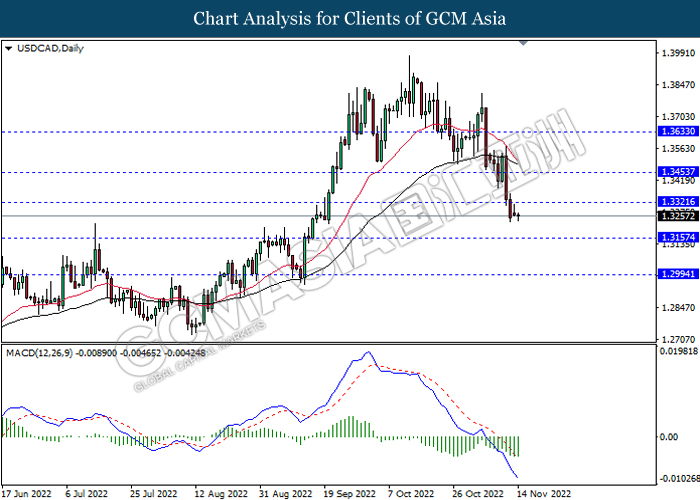

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3320, 1.3455

Support level: 1.3155, 1.2995

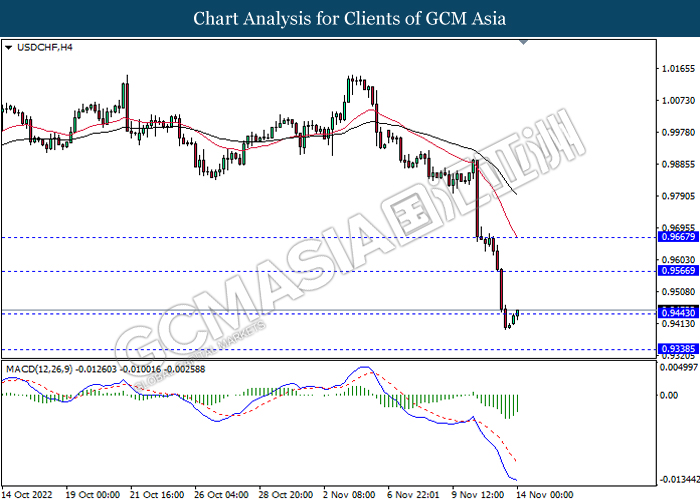

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9565, 0.9665

Support level: 0.9445, 0.9340

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 89.20, 92.60

Support level: 86.10, 82.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65