14 November 2022 Morning Session Analysis

Unstoppable losses in dollar market amid the easing in inflation.

The dollar index, which gauges its value against a basket of six major currencies, failed to recoup its losses last Friday as the investors favored riskier currencies as the cooling down in CPI data has not been fully digested by the investors yet. Last Thursday, the US Bureau of Statistics released its long-waited CPI data with a lower-than-expected result. With that, the dollar lost its ground and fell across the board for two consecutive trading sessions. The weaker-than-expected CPI data boosted the chance that the Federal Reserve might slow down the hefty rate hikes, whereby the case of a 50 basis point rate hike is likely to happen in the Fed’s December meeting. On the other hand, the dollar index dropped further as the investor’s risk appetite jumped as Chinese health authorities decided to ease the country’s Covid-19 restrictions, including reducing the quarantine times for close contacts cases and inbound travelers. As of writing, the dollar index plummeted by -1.65% to 106.40.

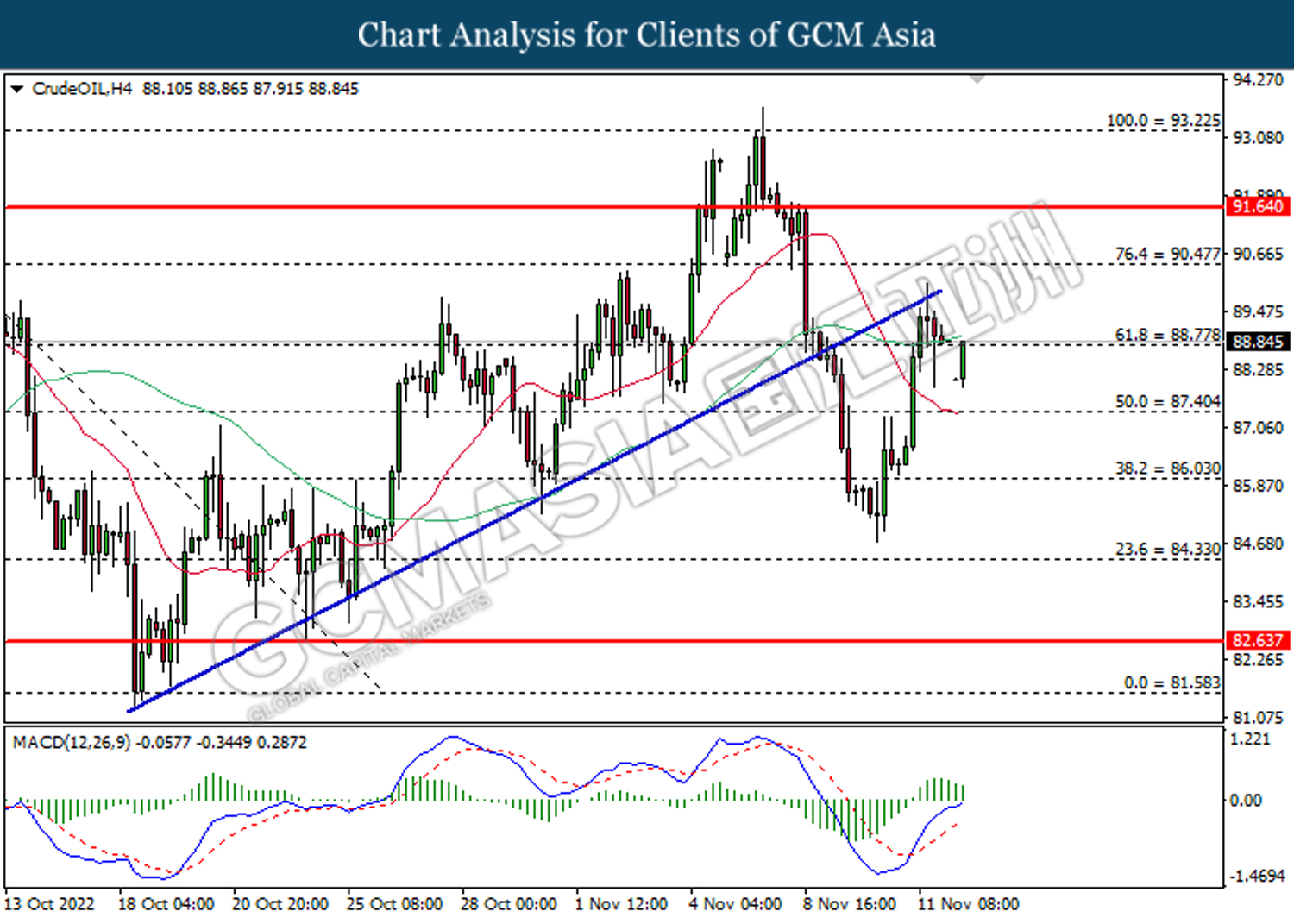

In the commodities market, the crude oil price increased by 0.05% to $88.05 per barrel as the shift away from China’s Zero Covid policy is likely to boost the oil demand in the future. Besides, the gold price went up by 0.05% to $1771.40 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

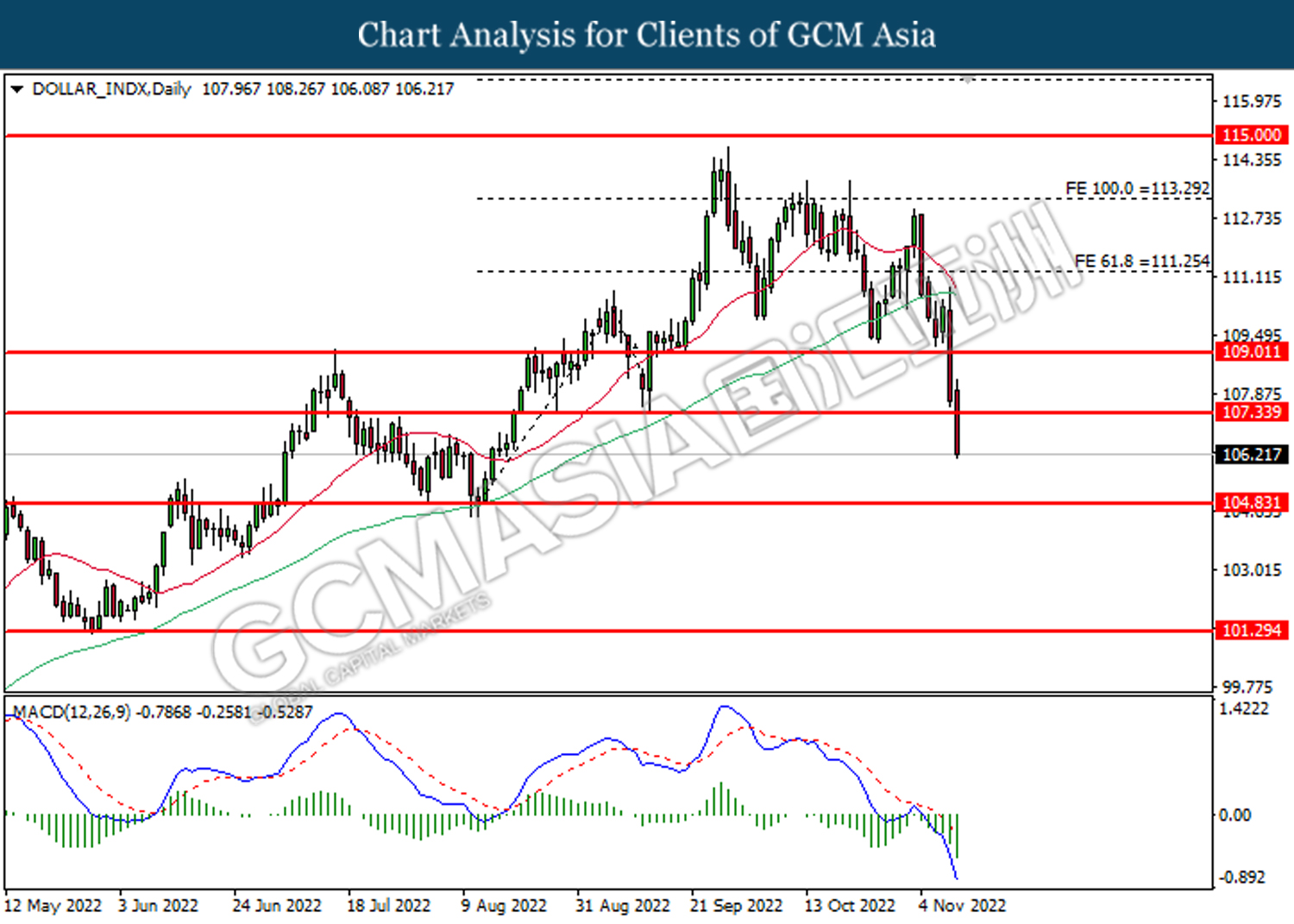

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

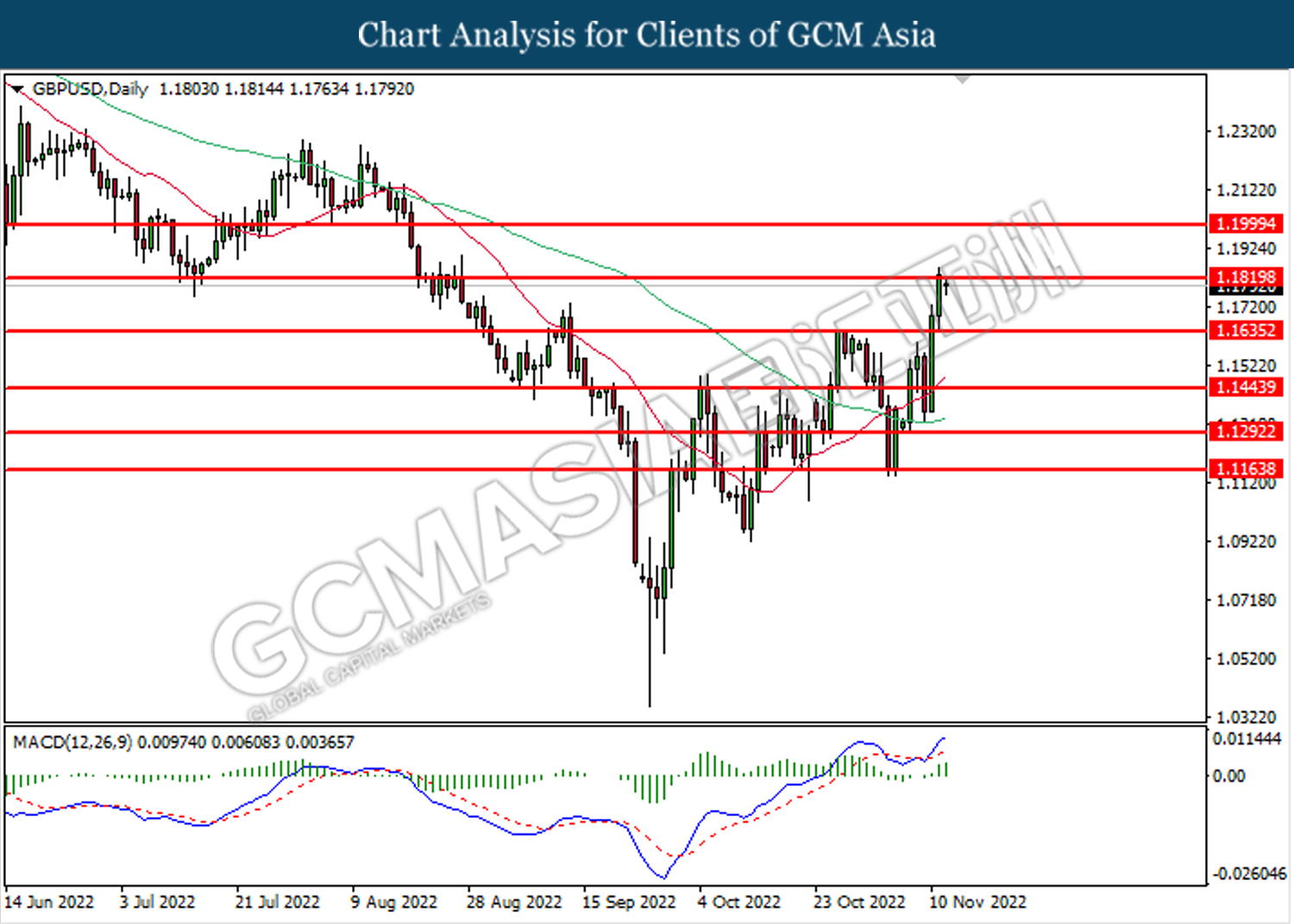

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1820, 1.2000

Support level: 1.1635, 1.1445

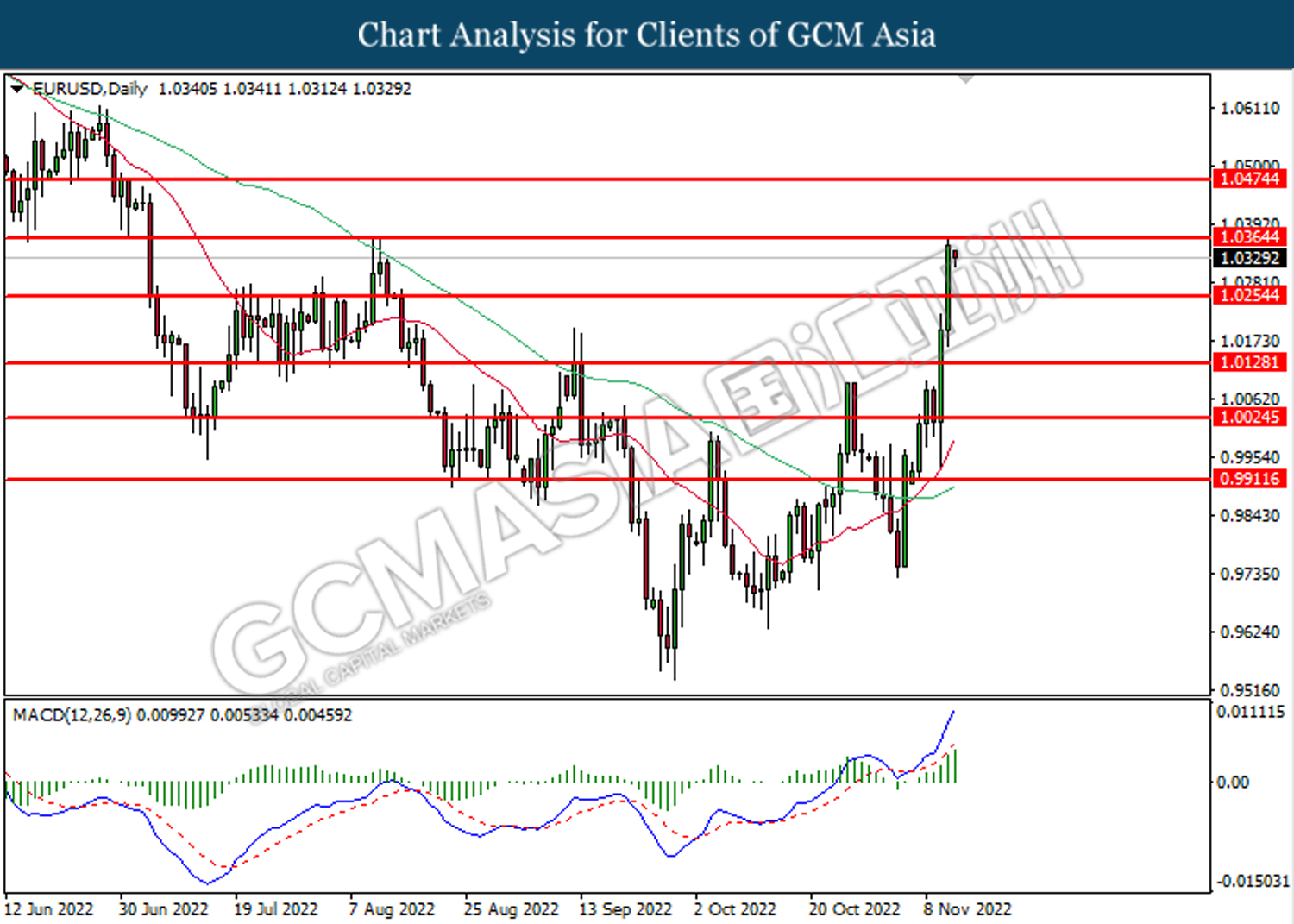

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

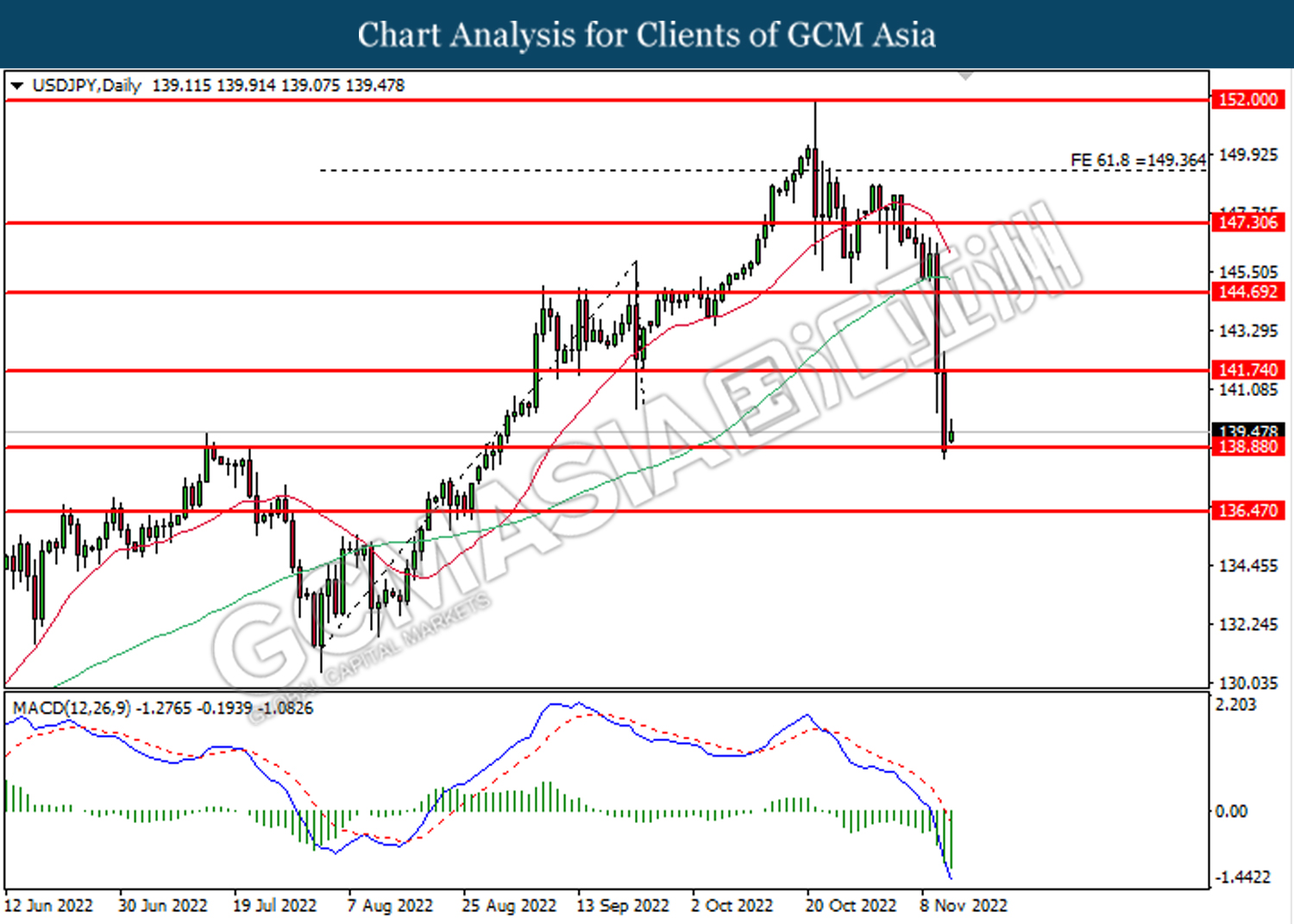

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.90. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

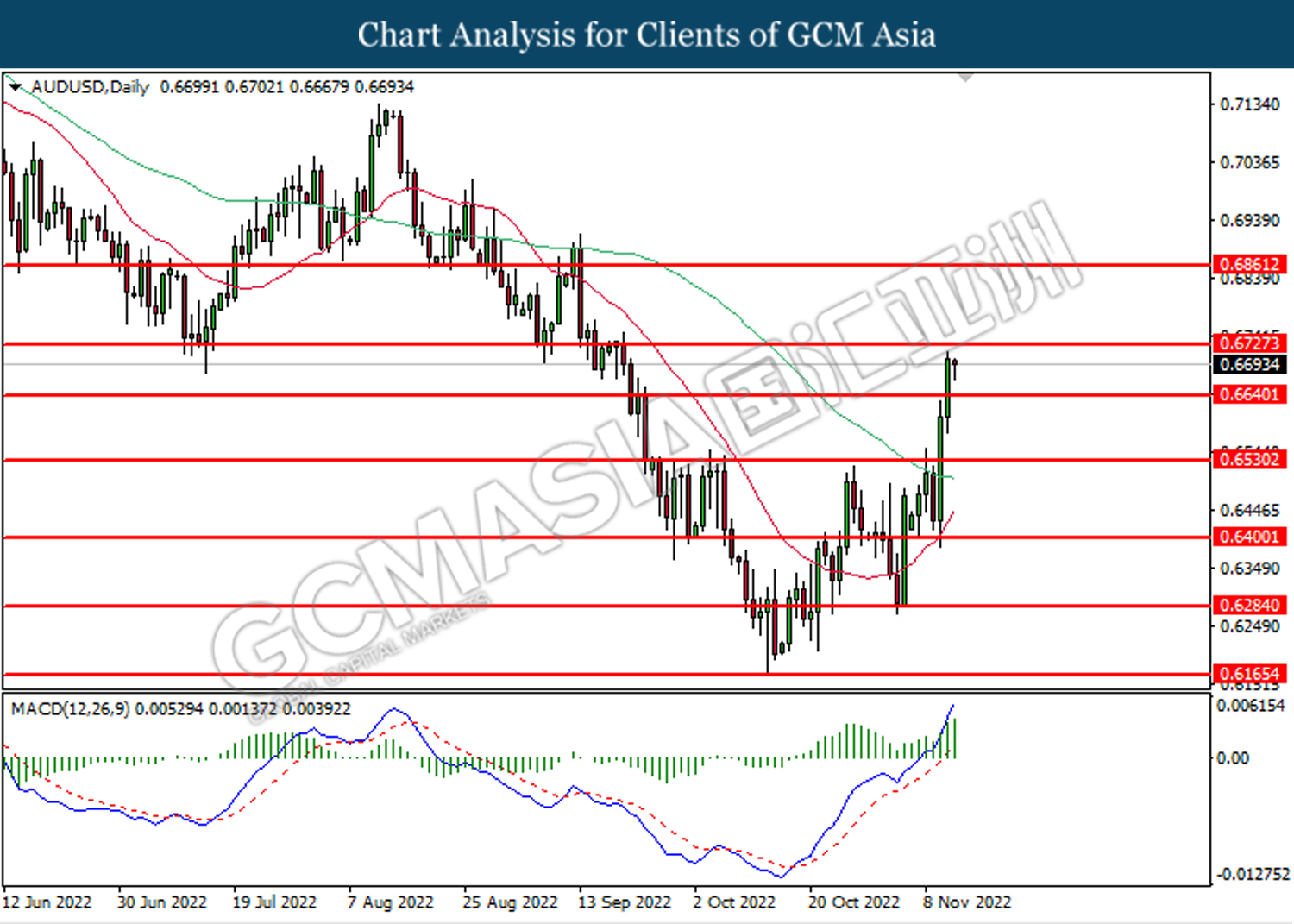

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6640. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6725.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

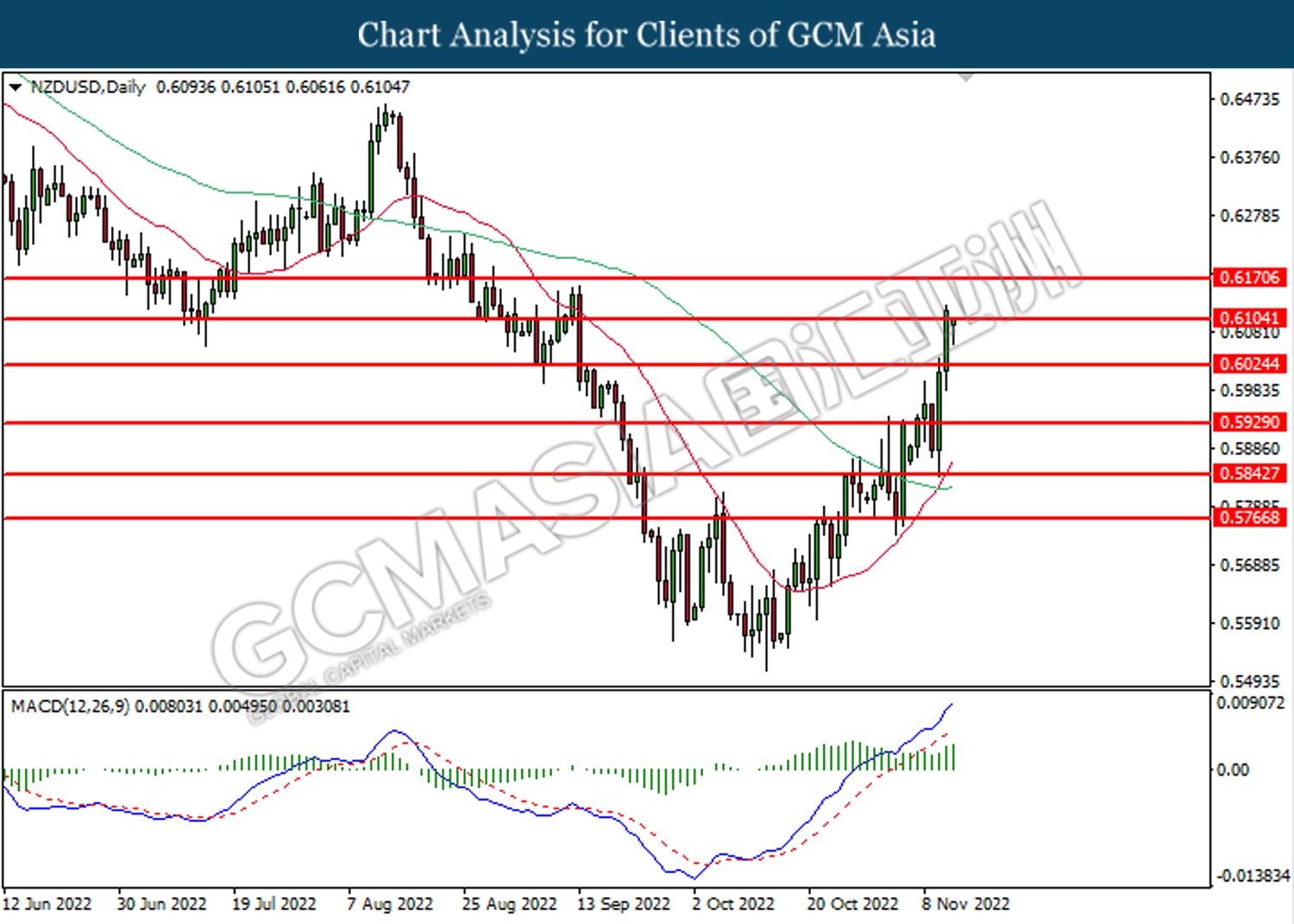

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6105. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6105, 0.6170

Support level: 0.6025, 0.5930

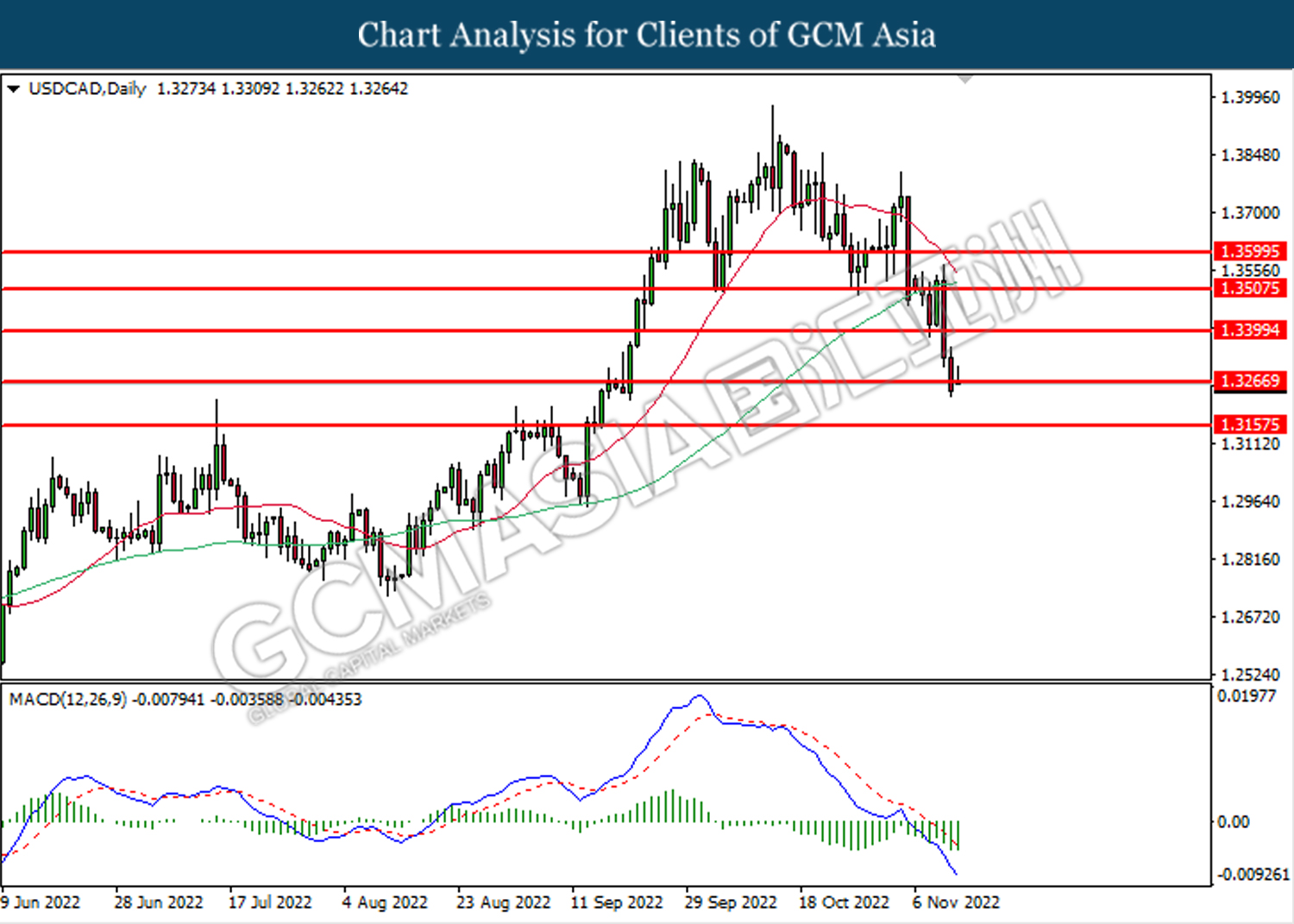

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3265. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 88.75. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 88.75, 90.45

Support level: 87.40, 86.05

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1766.50, 1805.90

Support level: 1726.15, 1693.35