14 December 2018 Morning Session Analysis

ECB cancels QE, Draghi deliver doves.

Greenback flattens against other major peers on Thursday while market participants digests the results of a highly anticipated interest rate decision from European Central Bank (ECB). On yesterday, ECB announced to put an end on its three-year, €2.6 trillion bond-buying program later this month while postulating that the economy remains on track for an interest rate hike by Autumn next year. However, ECB took a dovish turn by cutting growth forecasts for 2018 and 2019 from 2.0% and 1.8% to 1.9% and 1.7% respectively. In addition, ECB President Mario Draghi is seemingly cautious with regards to the future outlook and monetary policy stance, dialing down market participant’s optimism towards the single common currency. For the time being, investor’s will place their focus upon future economic releases from the EU zone in order to gauge its strength and possible time period for an interest hike from ECB. As of writing, dollar index was quoted up 0.05% to 97.04 while EUR/USD ticks down 0.02% to 1.1363. Otherwise, pound sterling recovered its losses by 0.13% to 1.2652 against the US dollar. On yesterday, sterling received some bearish pressure after EU leaders reportedly denied the request to renegotiate Brexit withdrawal agreement, leaving PM Theresa May in a stalemate prior to UK Parliamentary voting.

In the commodities market, crude oil price rose 0.05% to $52.75 during Asian trading session. Oil prices received some support after a surprise inventory drawdown at US crude oil delivery hub, suggesting that global supply may be balanced by middle of next year. On the other hand, gold price ticks up 0.01% to $1,242.24 a troy ounce while market participants wait for further signal from the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:30 | EUR – German Manufacturing PMI (Dec) | 51.8 | 51.8 | – |

| 21:30 | USD – Core Retail Sales (MoM) (Nov) | 0.7% | 0.2% | – |

| 21:30 | USD – Retail Sales (MoM) (Nov) | 0.8% | 0.1% | – |

| 02:00

(15th) |

CrudeOIL – US Baker Hughes Oil Rig Count | 877 | – | – |

Technical Analysis

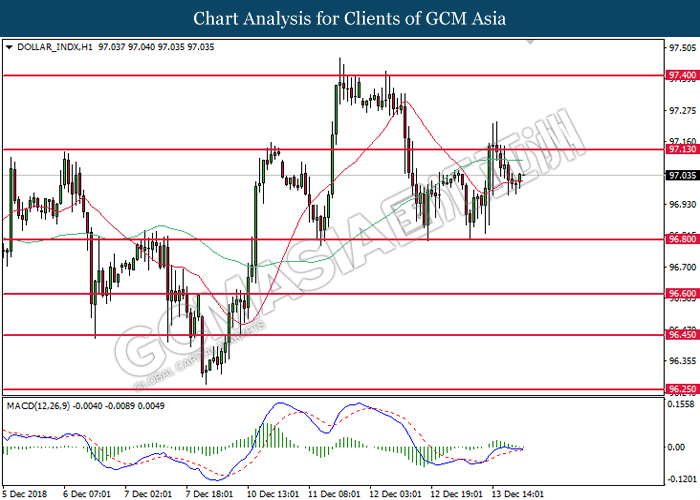

DOLLAR_INDX, H1: Dollar index was traded higher following prior rebound from the 20-MA line (red). MACD which illustrate increasing bullish momentum suggests the index to extend its gains, towards the direction of 97.15.

Resistance level: 97.15, 97.40

Support level: 96.80, 96.60

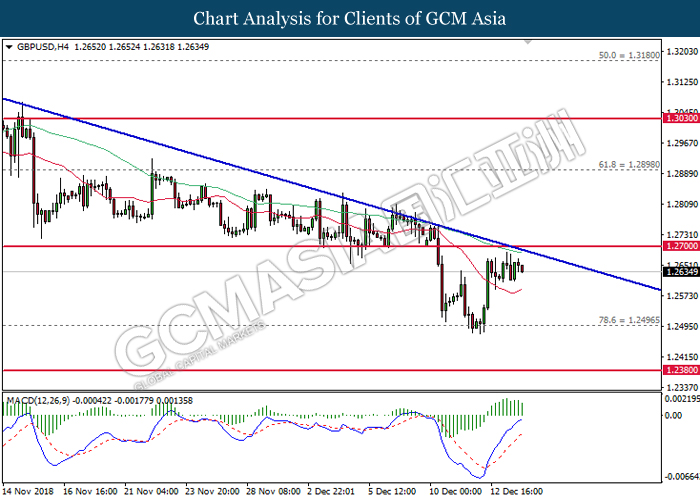

GPBUSD, H4: GBPUSD was traded lower following prior retrace from the downward trendline. MACD which illustrate diminishing upward momentum suggests the pair to be traded lower in short-term, towards 1.2500.

Resistance level: 1.2700, 1.2900

Support level: 1.2500, 1.2380

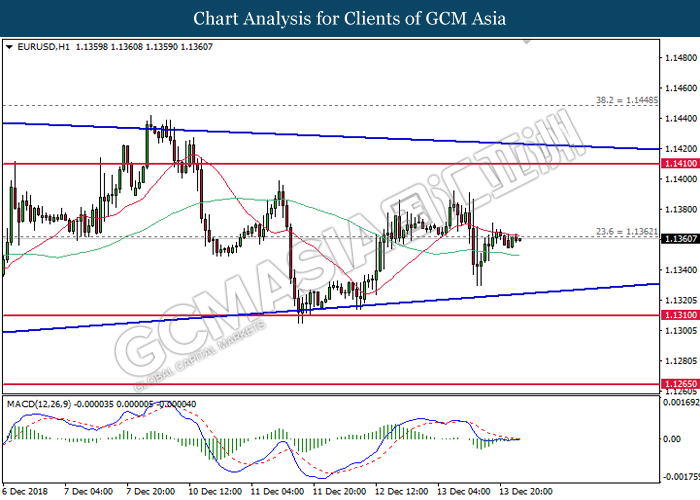

EURUSD, H1: EURUSD was traded higher following prior rebound from the lower level. MACD which begins to form a golden cross signal suggests the pair to extend its gains after closing above 1.1360.

Resistance level: 1.1360, 1.1410

Support level: 1.1310, 1.1265

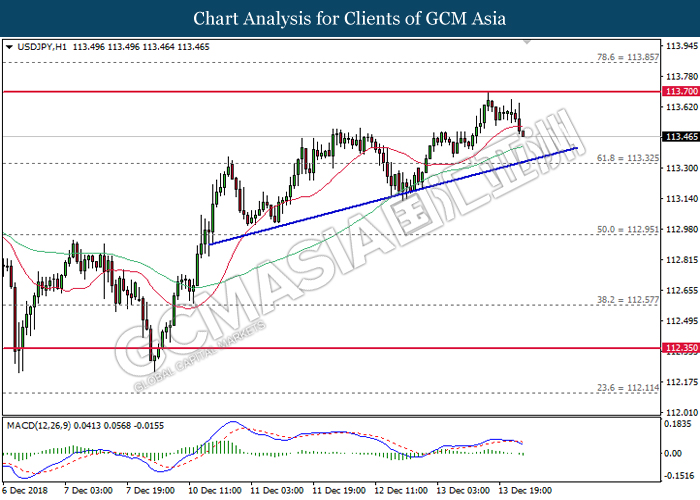

USDJPY, H1: USDJPY was traded lower following prior retracement from the resistance level near 113.70. MACD which has formed a bearish signal suggests the pair to be traded lower in short-term as technical correction.

Resistance level: 113.70, 113.85

Support level: 113.30, 112.95

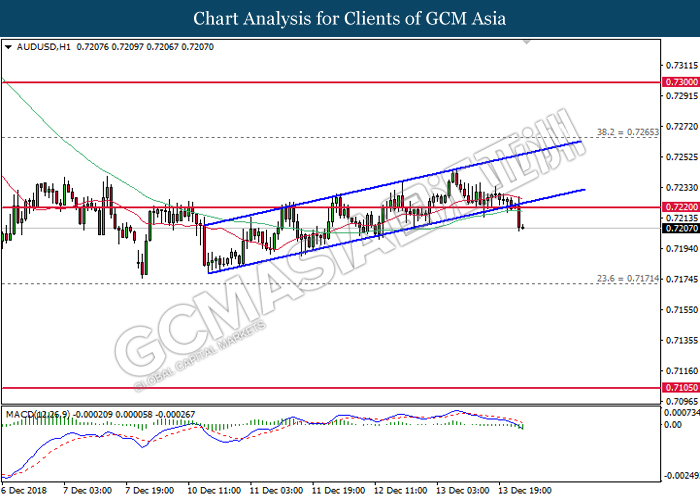

AUDUSD, H1: AUDUSD was traded lower following prior breakout from the bottom level of upward channel. MACD which illustrate bearish signal and momentum suggests the pair to extend its losses, towards the direction of 0.7170.

Resistance level: 0.7220, 0.7265

Support level: 0.7170, 0.7105

NZDUSD, H4: NZDUSD was traded lower while currently testing near the strong support at 0.6840. MACD which begins to form a death cross signal suggests the pair to advance further down after successfully closing below 0.6840.

Resistance level: 0.6890, 0.6940

Support level: 0.6840, 0.6780

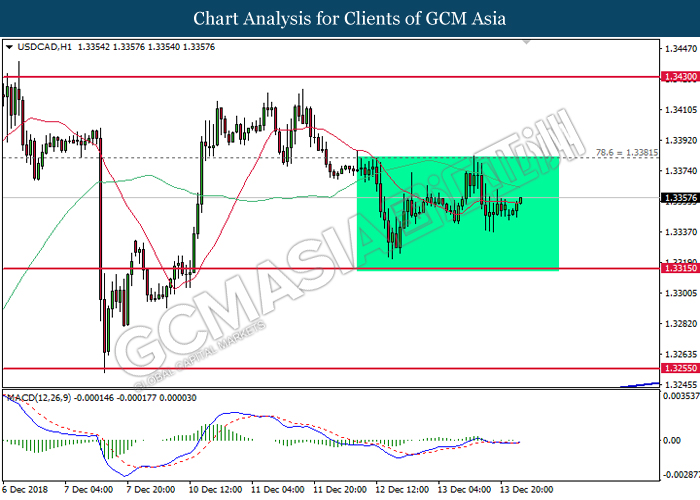

USDCAD, H1: USDCAD remains traded within a sideways channel following prior rebound from the lower level. Due to the lack of signal from MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 1.3380, 1.3430

Support level: 1.3315, 1.3255

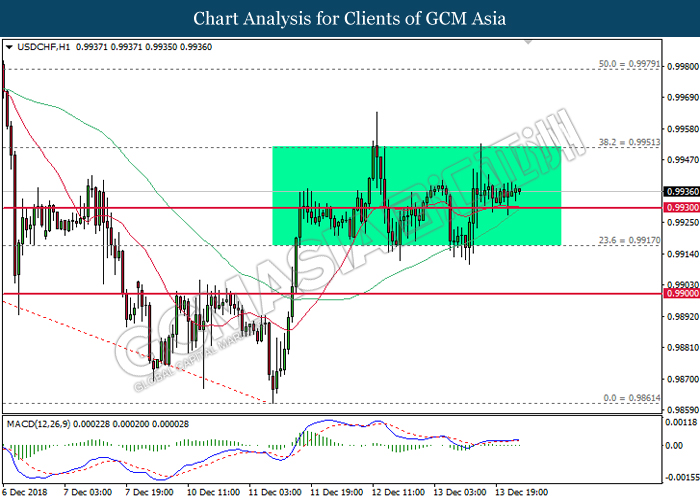

USDCHF, H1: USDCHF remains traded within a sideways channel following prior rebound from the lower level. Due to the lack of signal from MACD and price action, it is suggested to wait for a breakout before entering the market.

Resistance level: 0.9950, 0.9980

Support level: 0.9930, 0.9920

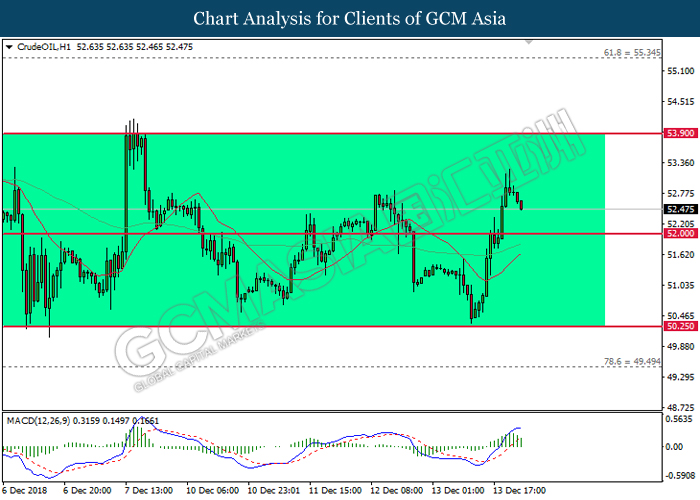

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from previous high. MACD which illustrate diminishing upward momentum suggests its prices to be traded lower in short-term and head towards the direction of 52.00.

Resistance level: 53.90, 55.35

Support level: 52.00, 50.25

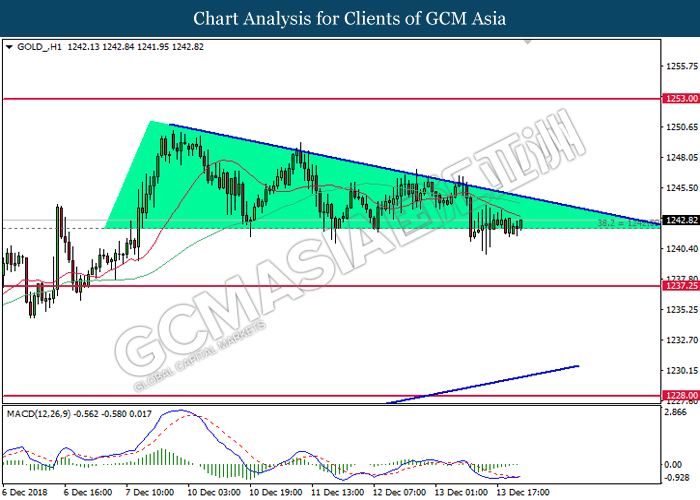

GOLD_, H1: Gold price remains traded within a descending triangle while currently testing at 1242.10. MACD which illustrate imminent formation of bullish signal suggests its prices to be traded higher in short-term as technical correction.

Resistance level: 1253.00, 1263.20

Support level: 1242.10, 1237.25