14 December 2021 Afternoon Session Analysis

Aussie plunged amid Omicron fears escalate.

The Australian dollar which traded against the dollar and other currency pairs continue to extend its losses and fell amid increasing concerns over Omicron variant. According to reports from Bloomberg, Australia’s largest state, population-wise, New South Wales (NSW) have recorded the highest daily virus infections tally in more than two month with new 804 infections in the 24 hours. It was the largest increase since October 2 when Sydney was in the midst of a months-long lockdown to combat the delta variant. The situation may prompt government to reintroduce lockdown in order to curb the spread of the virus. On the other hand, rising tension between U.S and China also weigh on the pair. Recently, the administration of US President Joe Biden imposed economic sanctions on the Chinese artificial intelligence company SenseTime Group and two senior government officials in the Far West Xinjiang region for alleged human rights violations in the region. At the time of writing, AUD/USD fell 0.09% to 0.7104.

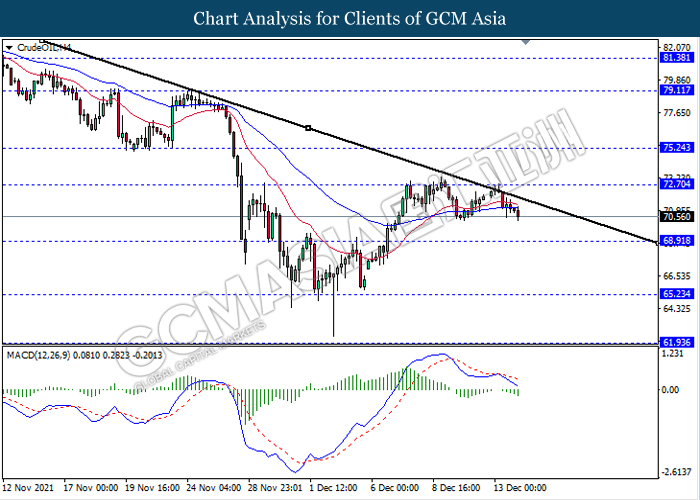

In the commodities market, crude oil price fell 0.49% to $70.58 per barrel as of writing amid demand concerns over Omicron variant. Due to rising Omicron cases, governments around the world, including most recently Britain and Norway, were tightening restrictions to stop the spread of the Omicron variant. On the other hand, gold price rose 0.08% to $1786.27 a troy ounce at the time of writing amid dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Oct) | 5.80% | 4.50% | – |

| 15:00 | GBP – Claimant Count Change (Nov) | -14.9K | – | |

| 21:30 | USD – PPI (MoM) (Nov) | 0.60% | 0.60% |

Technical Analysis

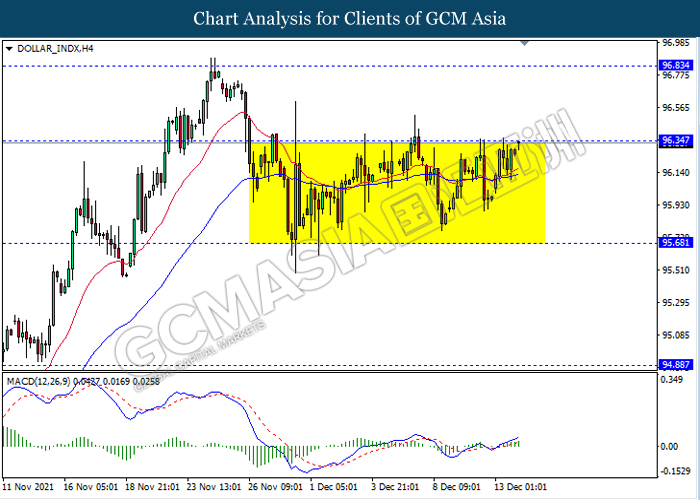

DOLLAR_INDX, H4: Dollar index remain traded in a sideway channel while currently testing the resistance level 96.35. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the dollar to be traded higher after it breaks above the resistance level.

Resistance level: 96.35, 96.85

Support level: 95.70, 94.90

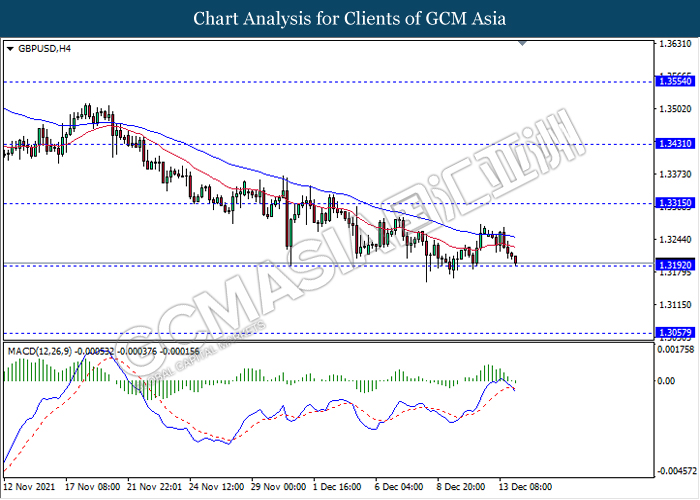

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.3190. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.3315, 1.3430

Support level: 1.3190, 1.3055

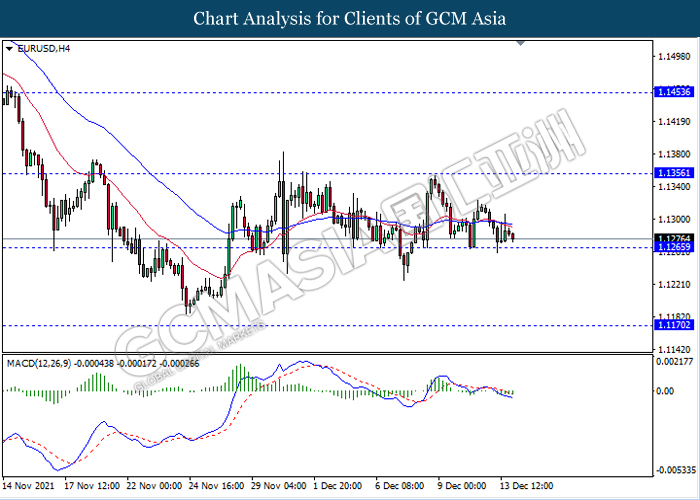

EURUSD, H4: EURUSD was traded lower while currently testing near the support level 1.1265. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1355, 1.1455

Support level: 1.1265, 1.1170

USDJPY, H4: USDJPY remain traded flat in a sideway channel. Due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 113.80, 114.60

Support level: 112.75, 112.00

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.7105. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7175, 0.7260

Support level: 0.7105, 0.7005

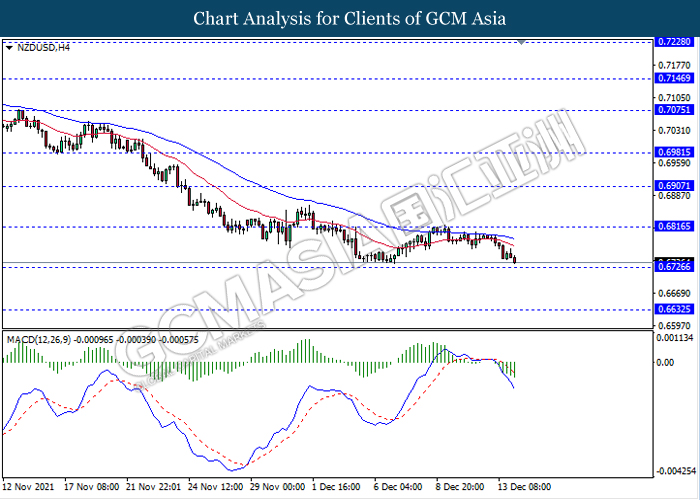

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6725. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

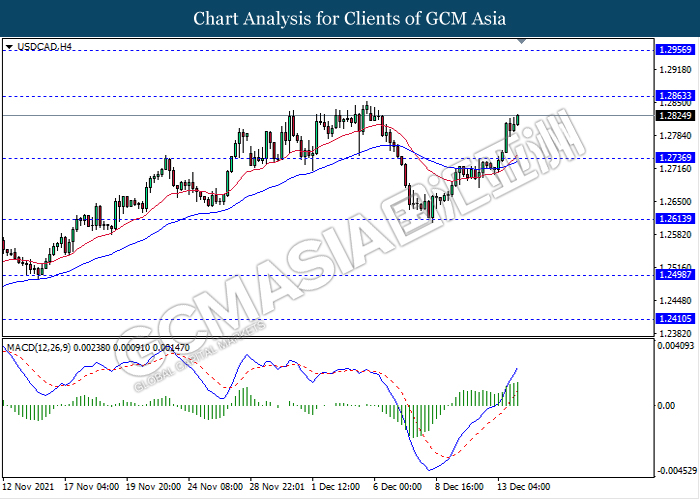

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level 1.2735. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its gains towards the resistance level 1.2865.

Resistance level: 1.2865, 1.2955

Support level: 1.2735, 1.2615

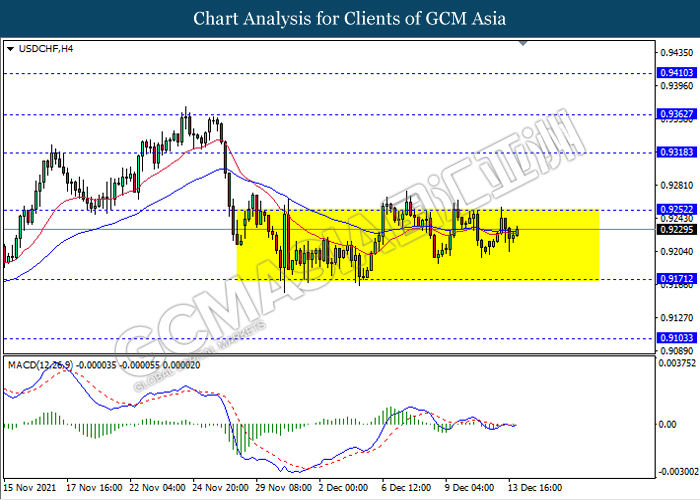

USDCHF, H4: remain traded in a sideway channel. Due to lack of clear direction and momentum, it is suggested to wait until further signal before entering the market.

Resistance level: 0.9250, 0.9320

Support level: 0.9170, 0.9105

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level 72.70. MACD which illustrate bearish momentum signal suggest the commodity to extend its losses towards the support level 68.90.

Resistance level: 72.70, 75.25

Support level: 68.90, 65.25

GOLD_, H4: Gold price was traded flat while currently testing the resistance level 1787.75. However, MACD which illustrate bullish bias signal suggest the commodity to be traded higher after it breaks above the resistance level.

Resistance level: 1787.75, 1806.80

Support level: 1763.05, 1744.00