14 December 2022 Afternoon Session Analysis

Pound Sterling eased as economic recession issues remained.

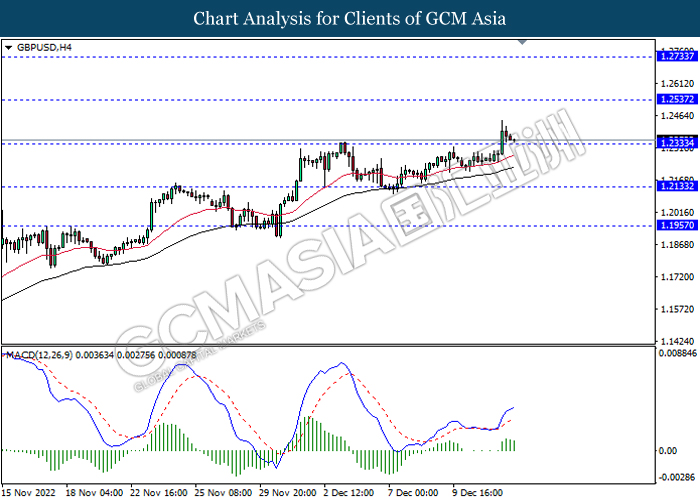

The GBP/USD, which widely traded by global investors retreated from its recent high despite the easing inflationary risk in the US. According to Office for National Statistics, the UK Average Earnings Index +Bonus came in at the reading of 6.1%, missing the consensus forecast of 6.2%. Besides, the UK Claimant Count Change for November notched up from the reading of -6.4K to 30.5K, exceeding the market expectation of 3.5K. These weak economic figures confirmed the fact that the UK economy is slowing down, which dragged down the appeal of Pound Sterling. In addition, the Bank of England (BoE) governor Andrew Bailey claimed in its Financial Stability Report yesterday that the UK economy has been deteriorated, while UK household being pressured by rising interest rate and soaring inflation. With that, the aggressive tightening monetary policy would less likely to be carried out during upcoming meeting. As of now, the announcement of UK CPI that scheduled on later 3.00pm would provide a clearer view for interest rate decision from BoE. As of writing, the GBP/USD depreciated by 0.04% to 1.2349.

In the commodities market, the crude oil price slipped by 0.33% to $75.16 per barrel as of writing over the increasing of crude oil stock. According to API, the US API Weekly Crude Oil Stock rose by 7.819M barrels, far higher than the market expectation. On the other hand, the gold price dropped by 0.15% to $1811.24 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Nov) | 11.1% | 10.9% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -5.187M | -3.595M | – |

Technical Analysis

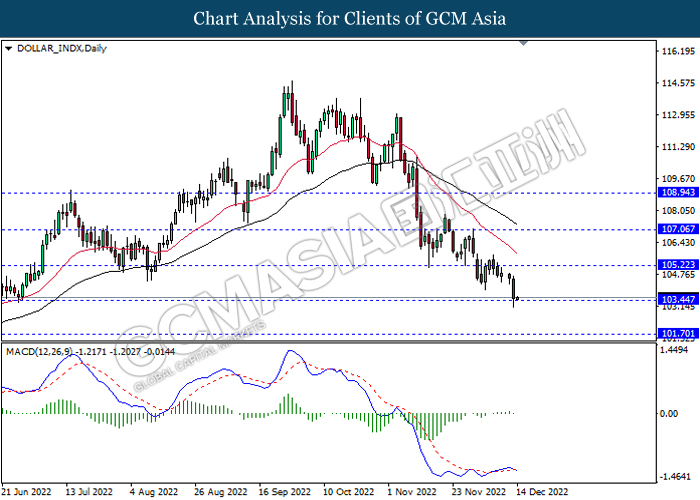

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2735

Support level: 1.2335, 1.2135

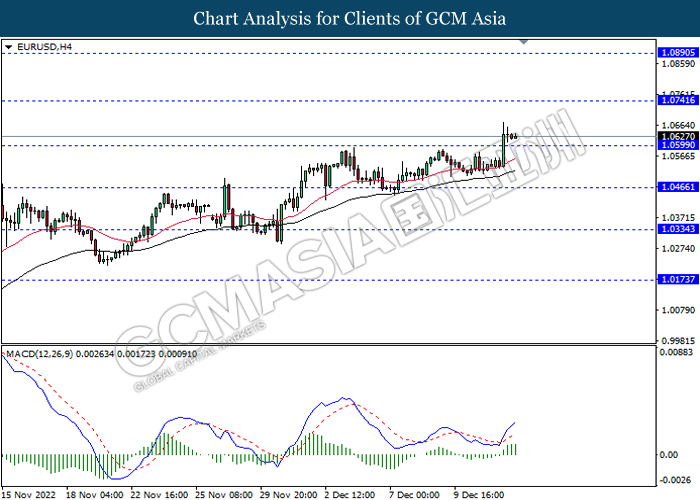

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

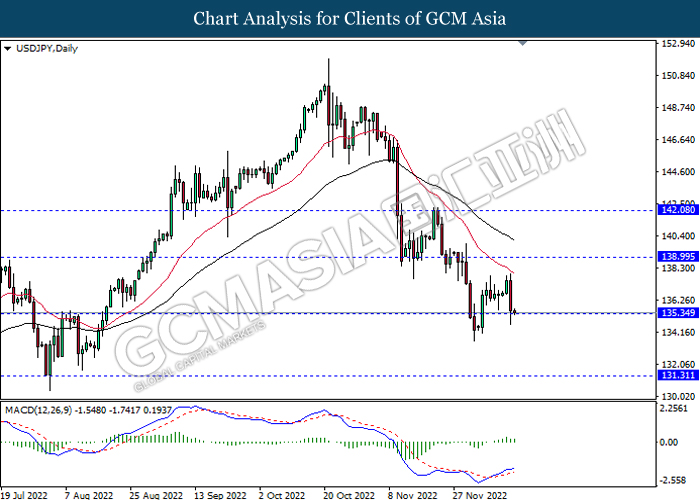

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

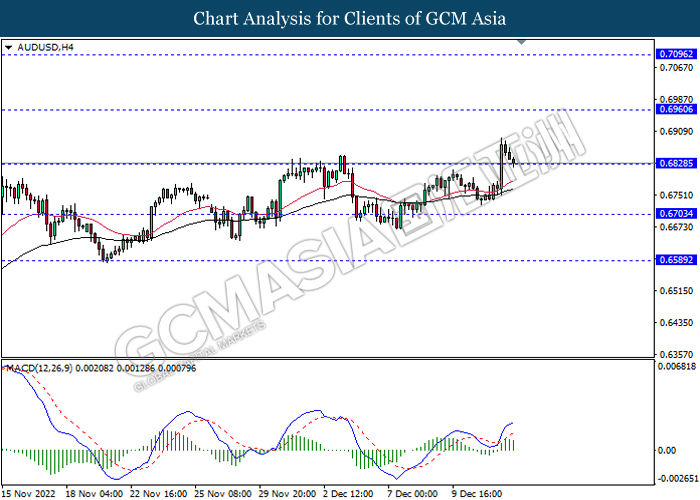

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6960, 0.7095

Support level: 0.6830, 0.6705

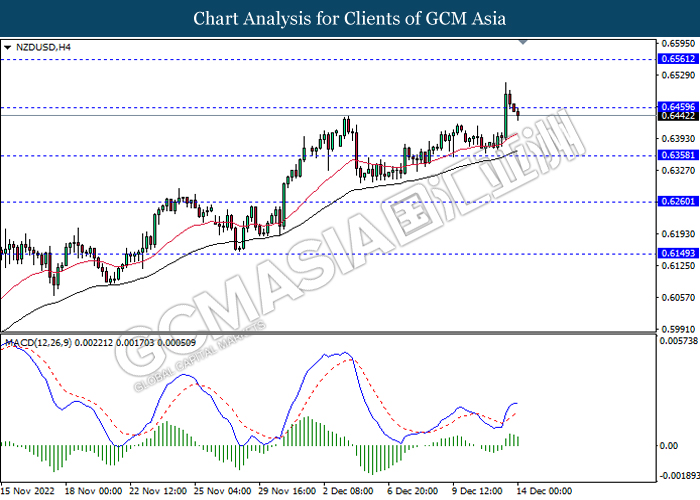

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

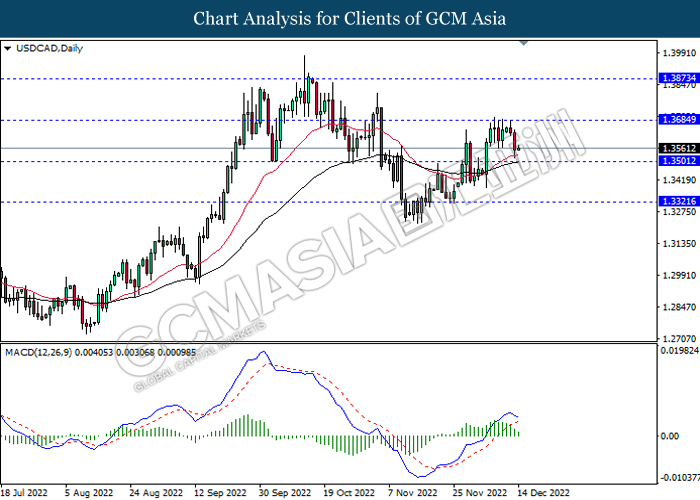

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

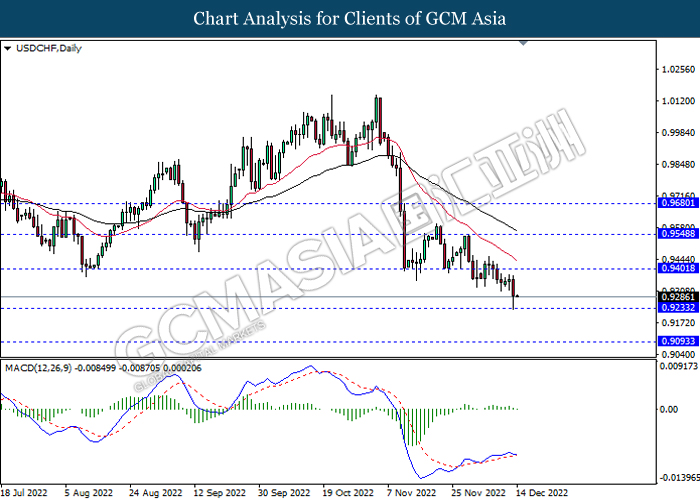

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

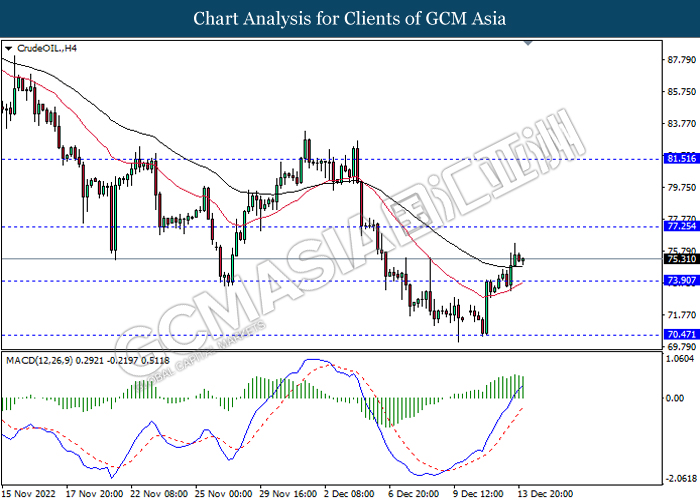

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

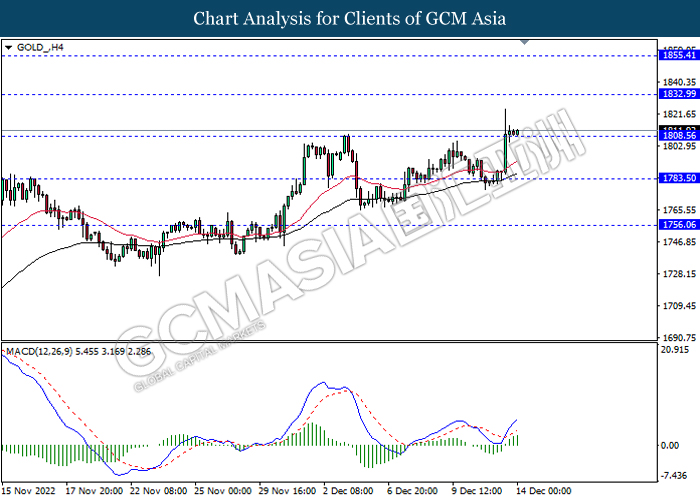

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50