15 February 2023 Afternoon Session Analysis

Pound flips amid investor fears on UK recessions.

The Pound Sterling, as one of the major traded currencies by global investors, was traded lower following a strong rebound in the previous trading session. Initially, a series of strong labor market data including a negative changes in unemployment claims for the month of January and a lower unemployment rate of 3.7%, contributed some gains to the pound. However, the fears of investors over the possibility of the UK economy might slip into recession offset the pound’s upside. According to a Reuter’s poll, the UK economy is currently experiencing a recession, while the Monetary Policy Committee (MPC) intending to further increase the interest rate to curb the high inflation pressures. Besides, the drop in GBP was extended following the release of mixed CPI data from the US. The January CPI in yearly reading stood at 6.4%, slightly higher than the market expectation of 6.2% but still lower than the prior month’s 6.5%. This result gave the Fed to have more room for further monetary tightening. Thus, it strengthened the value of dollar index, urging the pound according to slip against US dollar. As of writing, the GBP/USD slipped -0.26% to $1.2138.

In the commodities market, crude oil prices dropped by -1.21% to $78.10 per barrel amid American Petroleum Institute (API) reported crude oil inventories were in a surplus over the past week. Besides, gold prices edged down to -0.67% to $1852.85 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Jan) | 10.5% | 10.2% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Jan) | -1.1% | 0.7% | – |

| 21:30 | USD – Retail Sales (MoM) (Jan) | -1.1% | 1.6% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 2.423M | 1.166M | – |

Technical Analysis

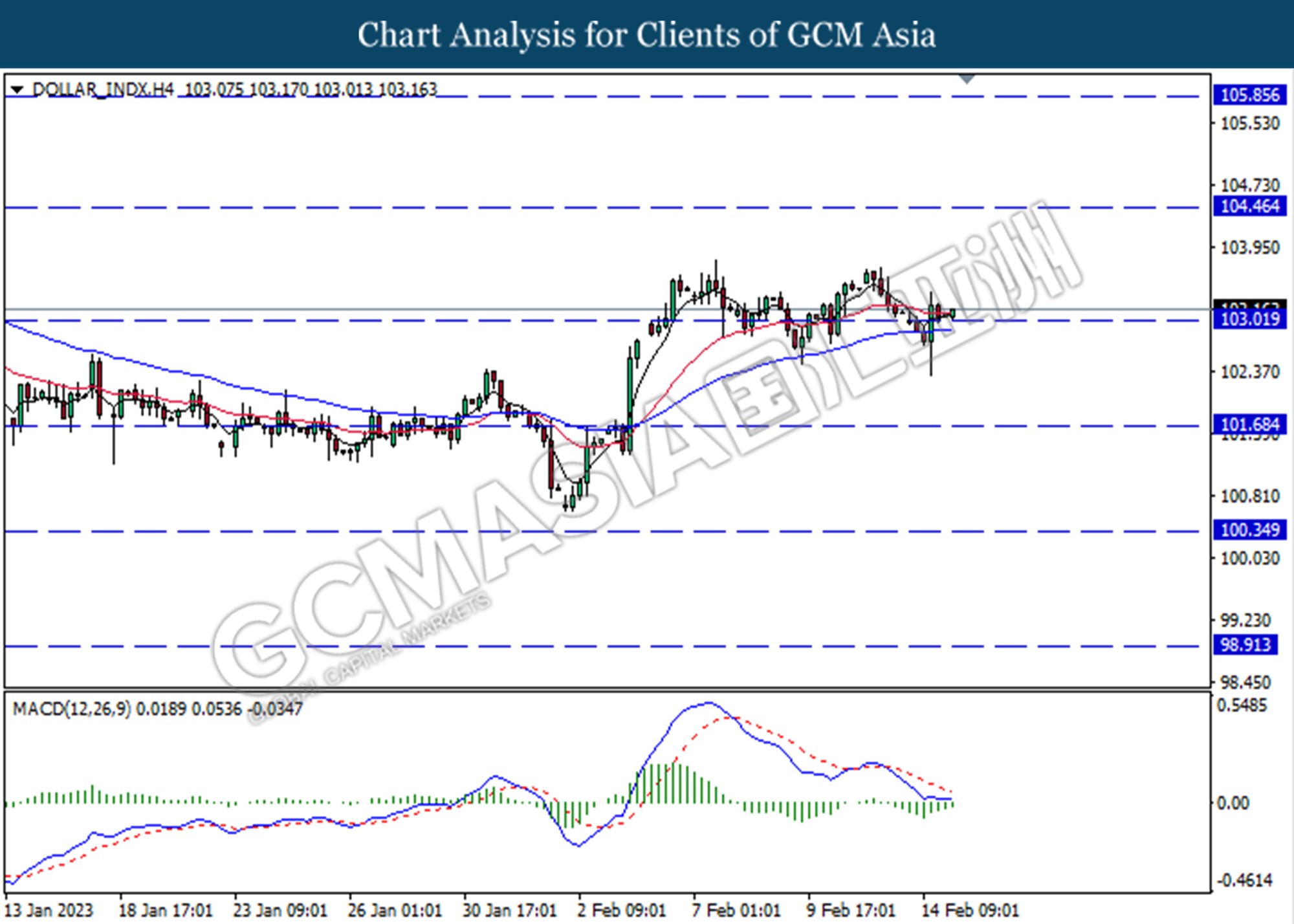

DOLLAR_INDX, H4: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 104.45.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

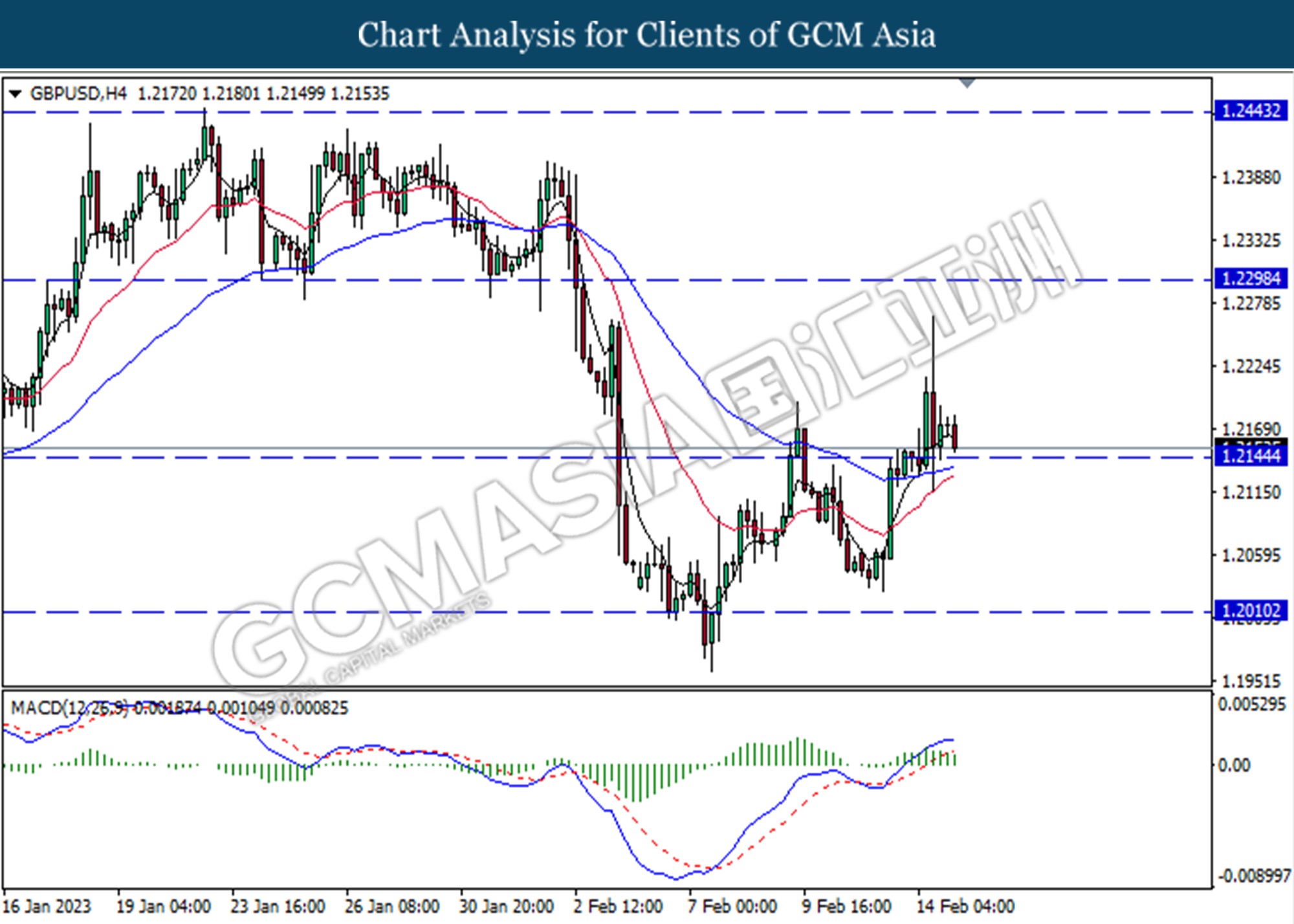

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2105. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 1.2230, 1.2445

Support level: 1.2145,1.2010

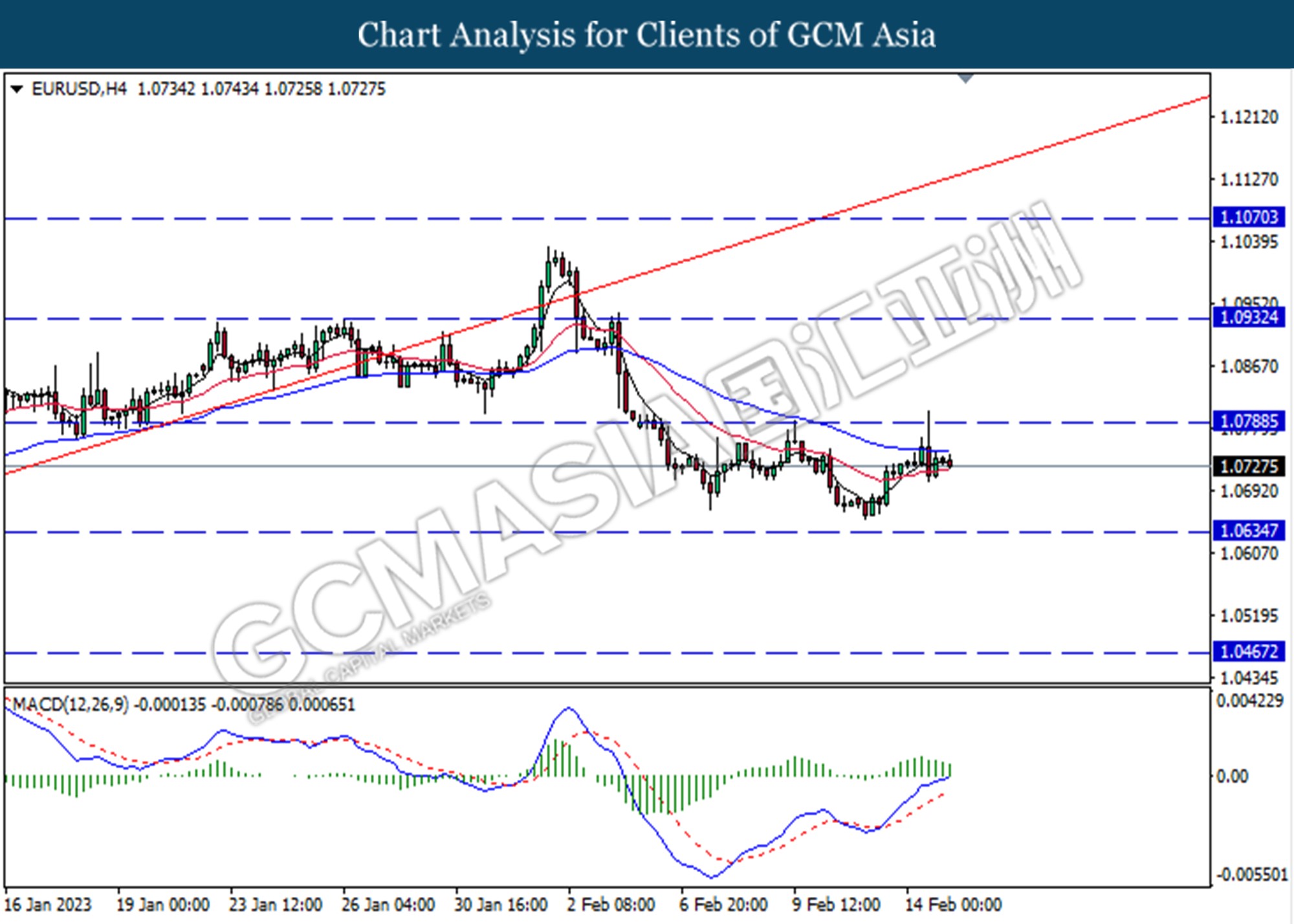

EURUSD, H4: EURUSD was traded lower following the prior retracement from the resistance level at 1.0790. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635.

Resistance level: 1.0790,1.0900

Support level: 1.0635, 1.0470

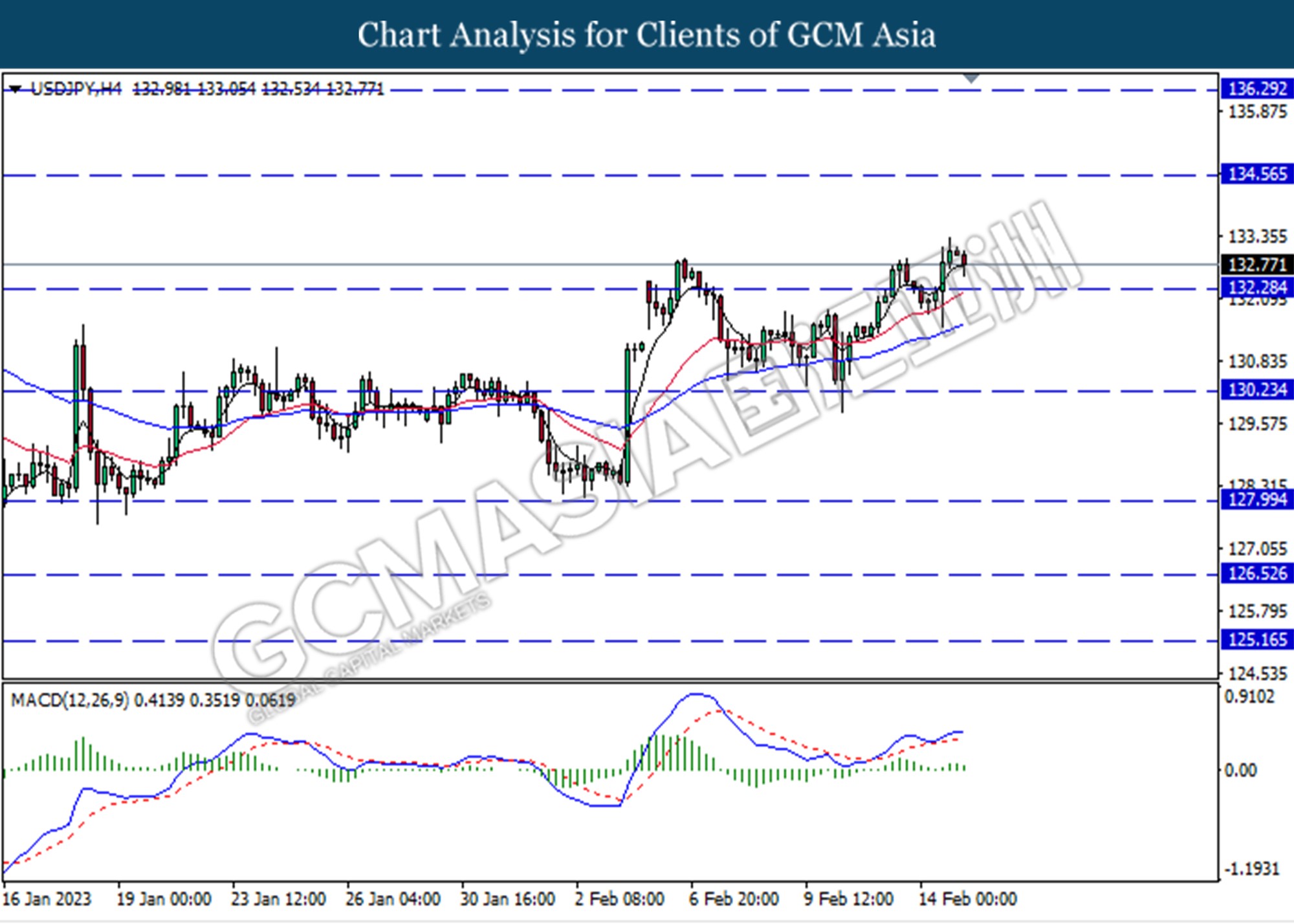

USDJPY, H4: USDJPY was traded higher following the prior breakout above the previous resistance level at 132.30. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short-term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after toward the support level at 0.6945.

Resistance level: 0.7040, 0.7120

Support level: 0.6945, 0.6870

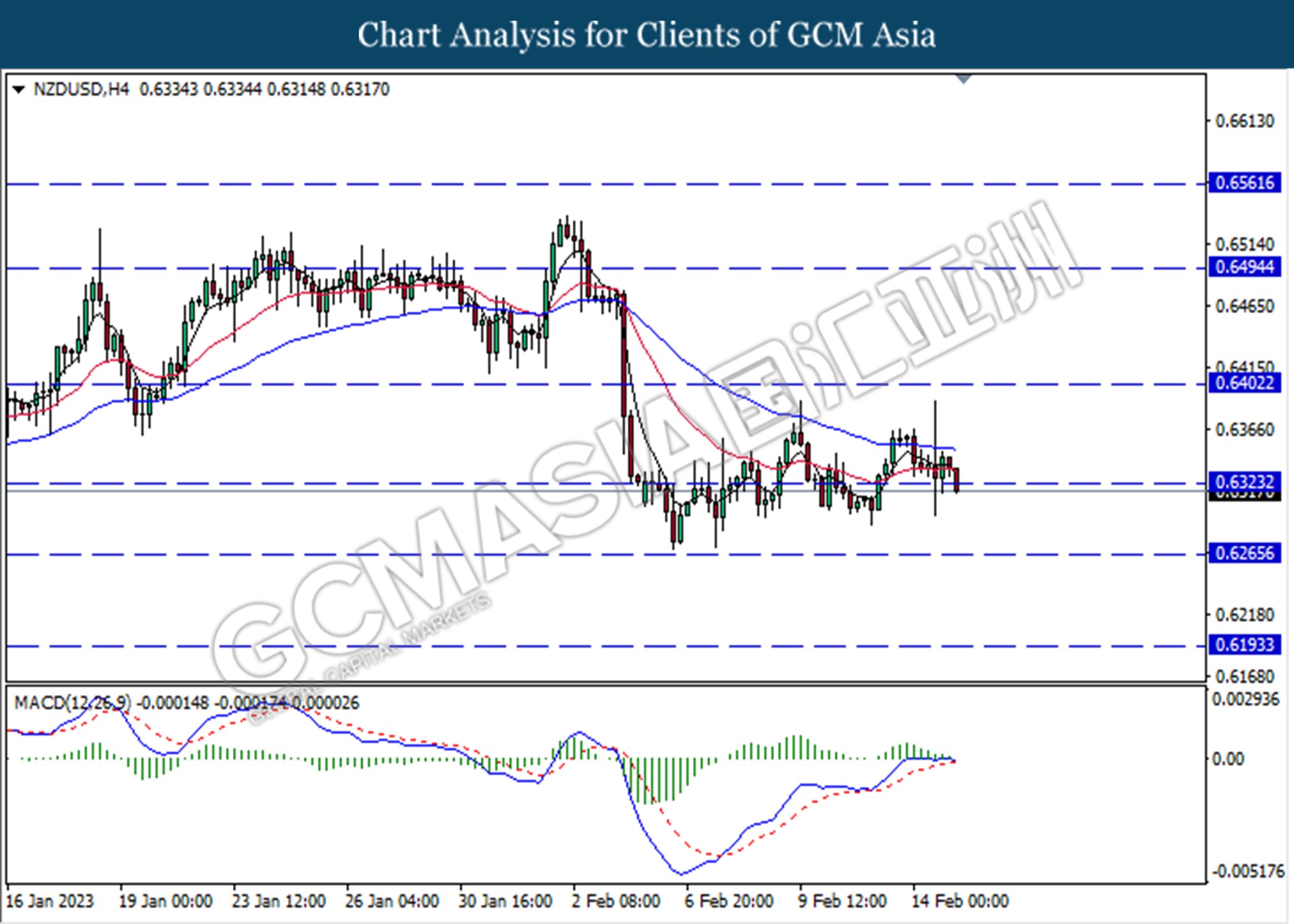

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6325. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6265.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

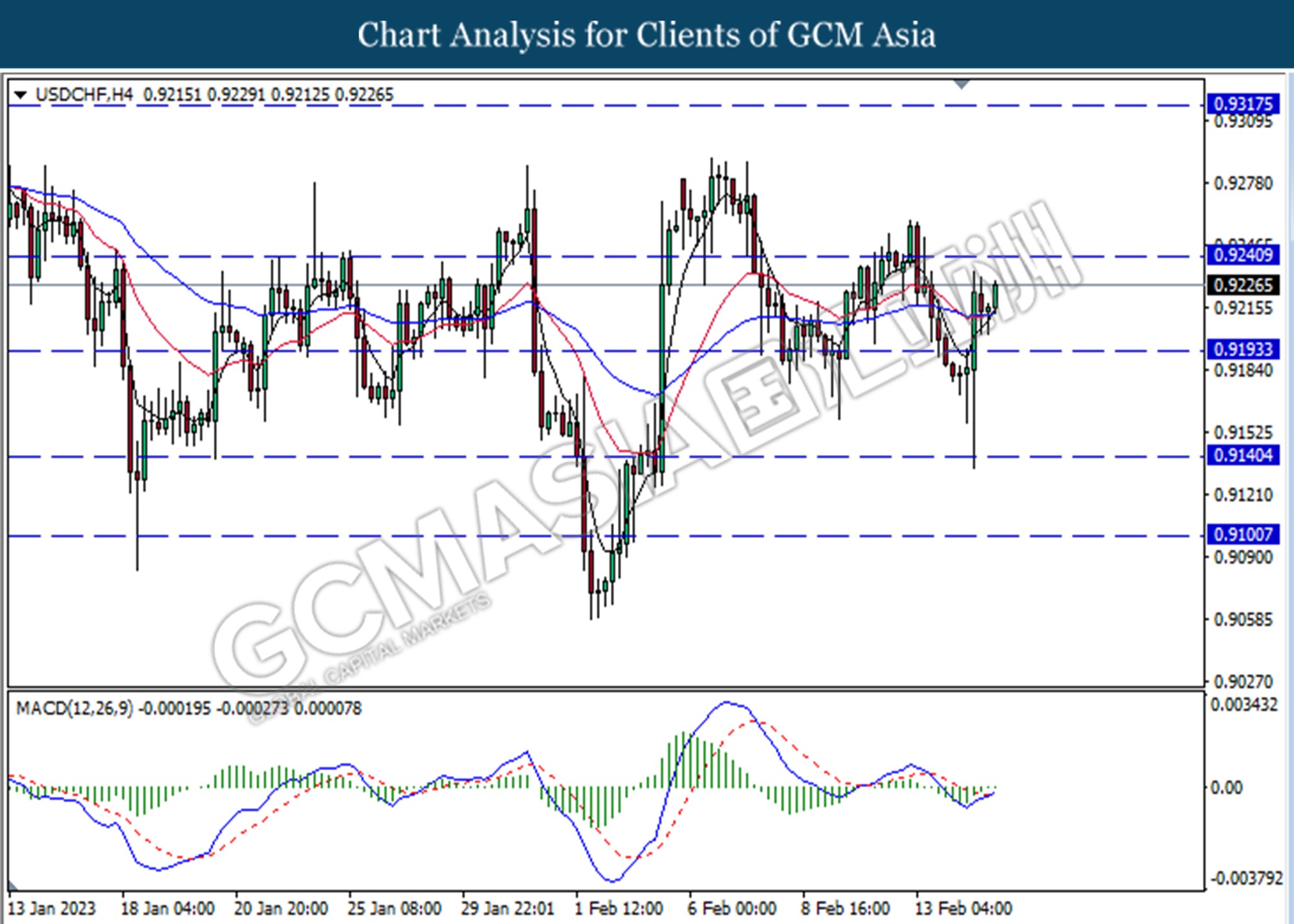

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9240

Resistance level: 0.9240, 0.9320

Support level: 0.9195, 0.9140

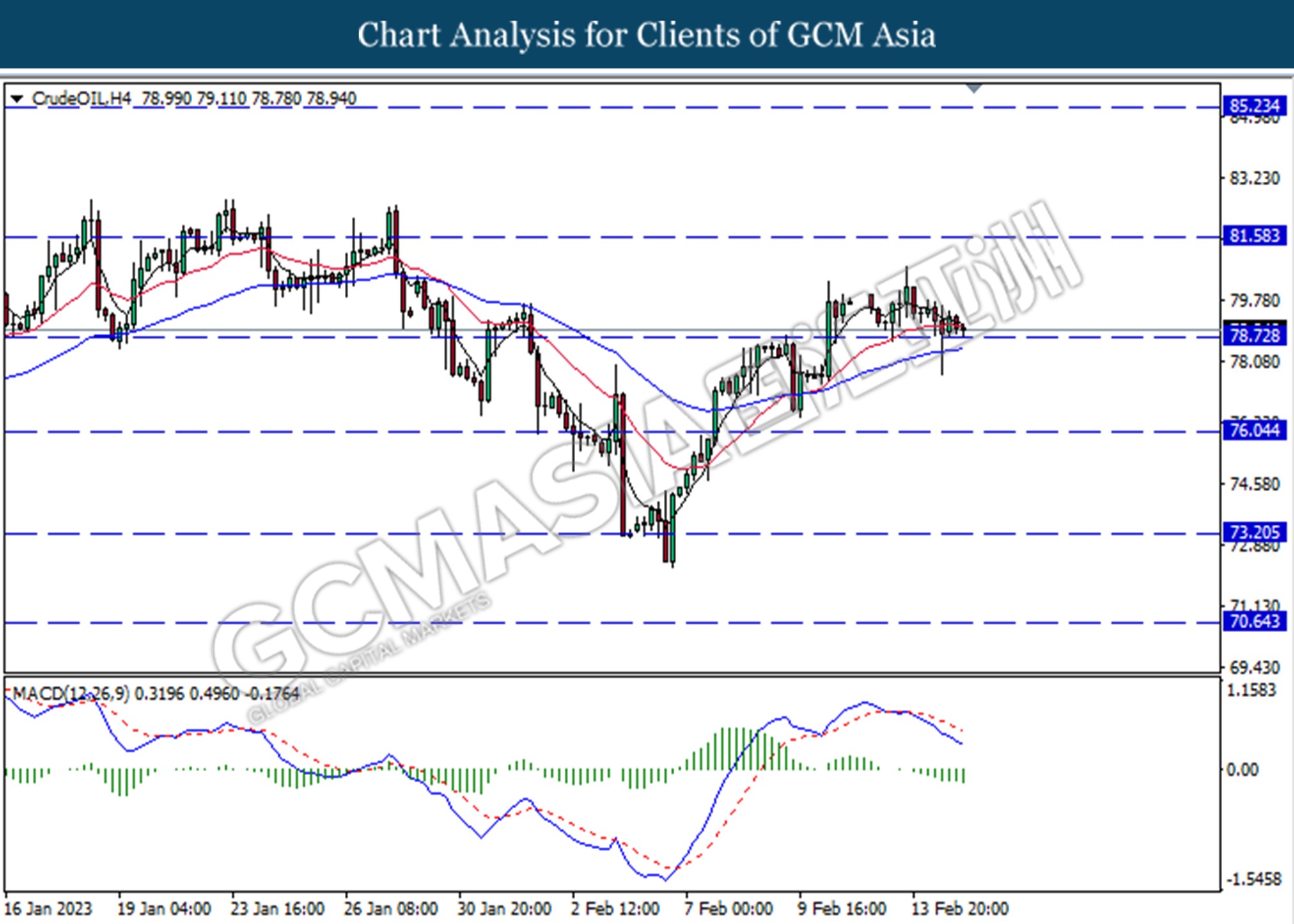

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 78.70. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully break below the support level.

Resistance level: 81.60,85.25

Support level: 78.70, 76.05

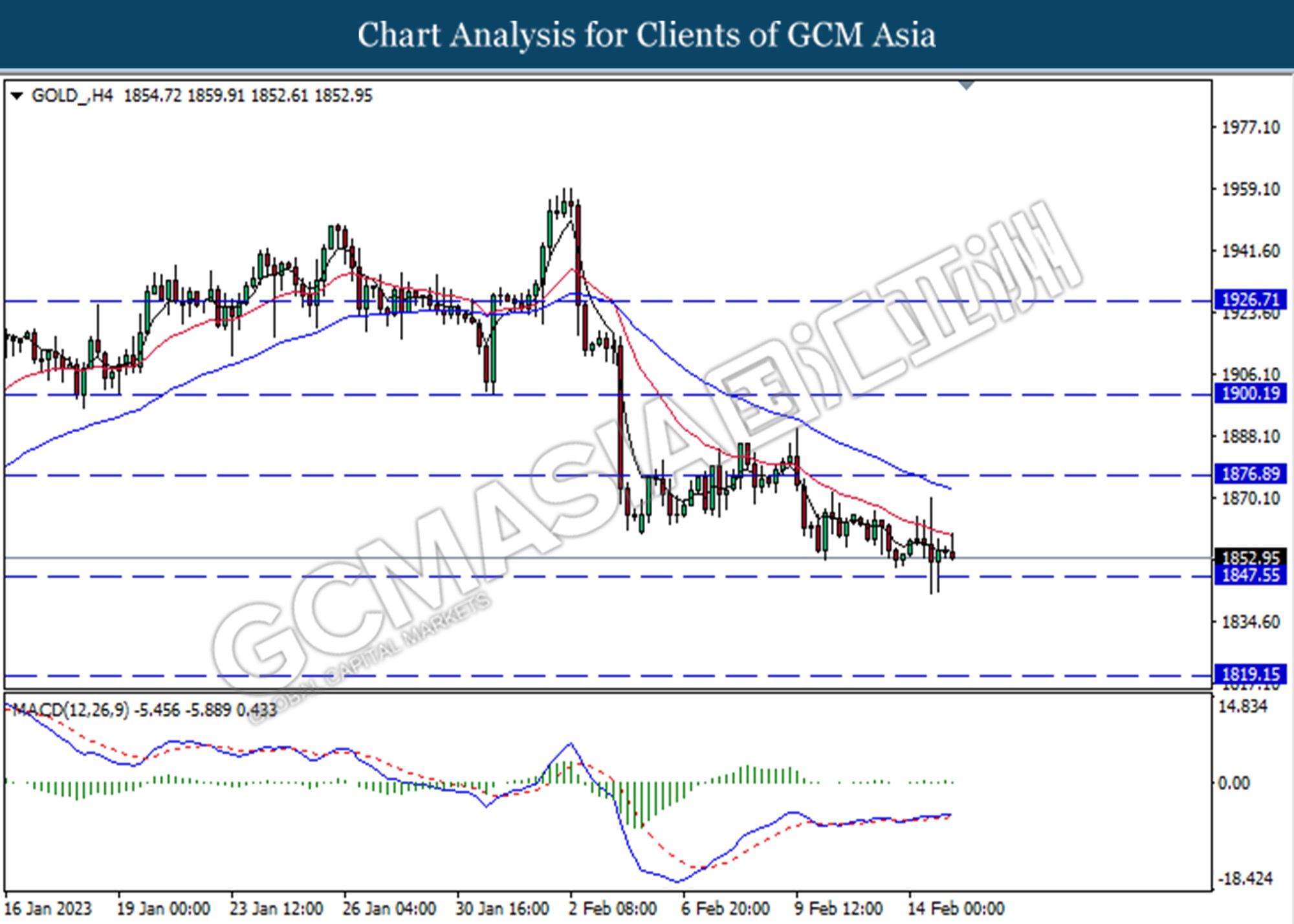

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1847.55. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1876.90.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15