15 February 2023 Morning Session Analysis

US dollar firmed after US inflation report.

The dollar index, which is traded against a basket of six major currencies, managed to hold its ground after the nation released its inflation report yesterday’s night. The initial greenback market reaction was a drop in value following the release of the inflation figure, but it managed to regain its luster and ended the trading session with some gains. According to the US Bureau of Labor Statistics, the US Consumer Price Index (CPI) dropped from 6.5% to 6.4% in the month of January on a year-over-year basis, yet it still slightly higher than the economist forecast at 6.2%. With that, it showed that the US inflation is still sticky, whereby it raised the likelihood that the Federal Reserve (Fed) would be necessary to keep the interest rate elevated, at least until the inflation figure shows an obvious drop in the future. Following the US inflation report, the probability of a 50 basis point of rate hike edged up from the previous week’s 9.2% to 10.7 as of today, whereas the likelihood of a 25 basis point of rate hike ticked down from 90.8% to 89.3%, according to the CME FedWatch Tool. As of writing, the dollar index fell by 0.09% to 103.25.

In the commodities market, crude oil prices dropped by -0.40% to $79.00 per barrel after American Petroleum Institute (API) reported a large build in crude oil inventory over the past week. Besides, gold prices edged up 0.06% to $1854.45 per troy ounce amid the weakness in dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

22:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Jan) | 10.5% | 10.2% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Jan) | -1.1% | 0.7% | – |

| 21:30 | USD – Retail Sales (MoM) (Jan) | -1.1% | 1.6% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 2.423M | 1.166M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

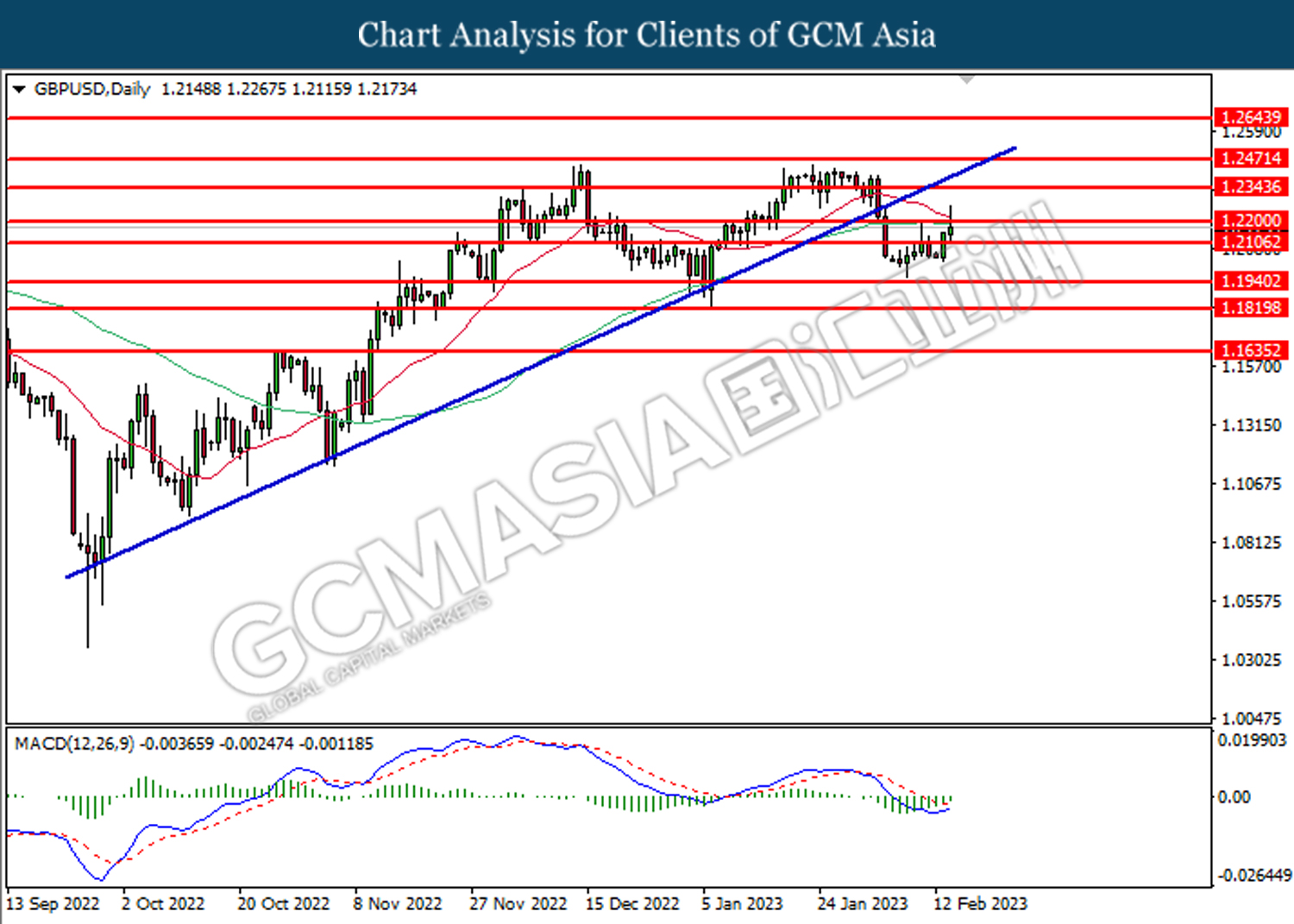

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

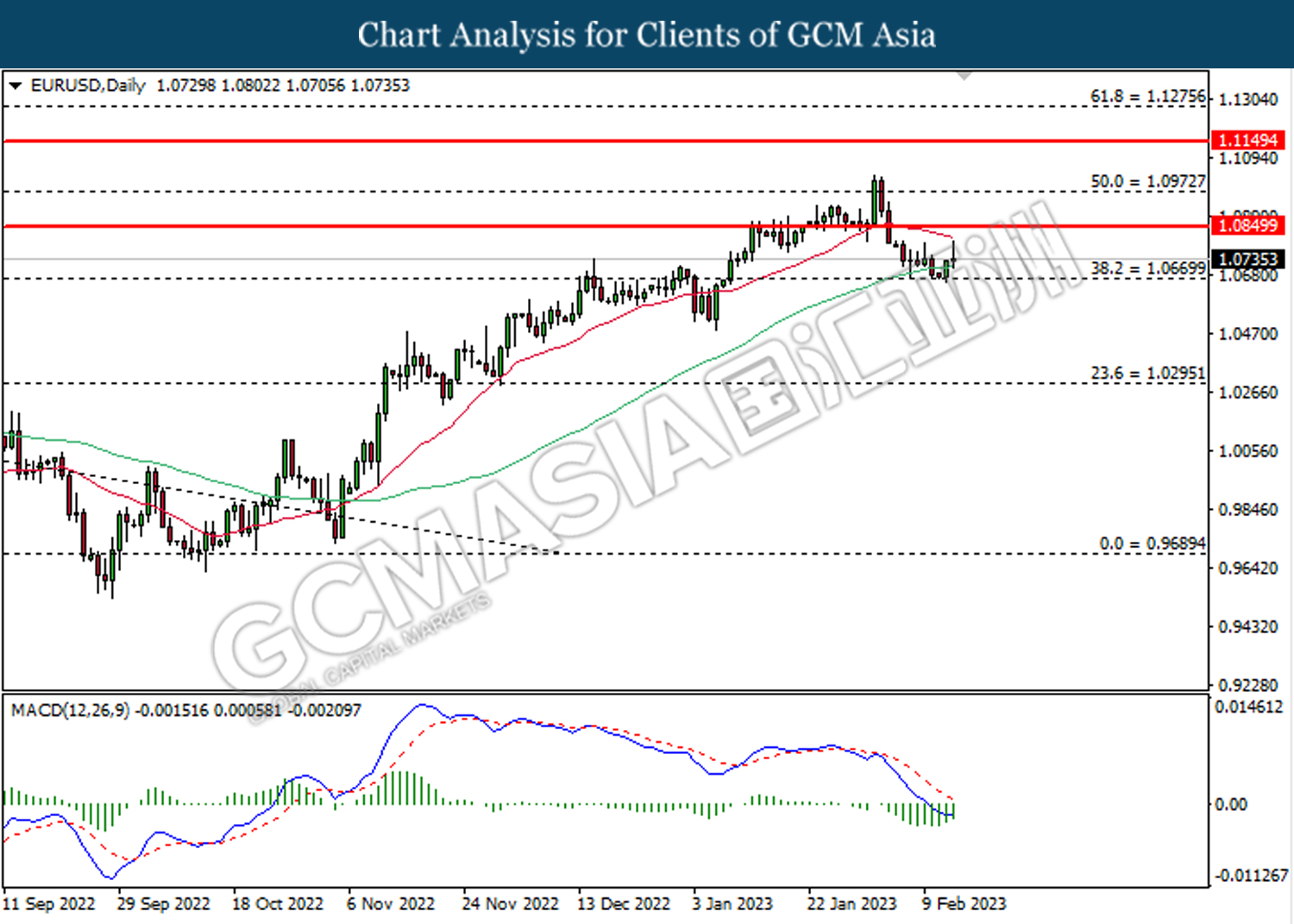

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0850.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

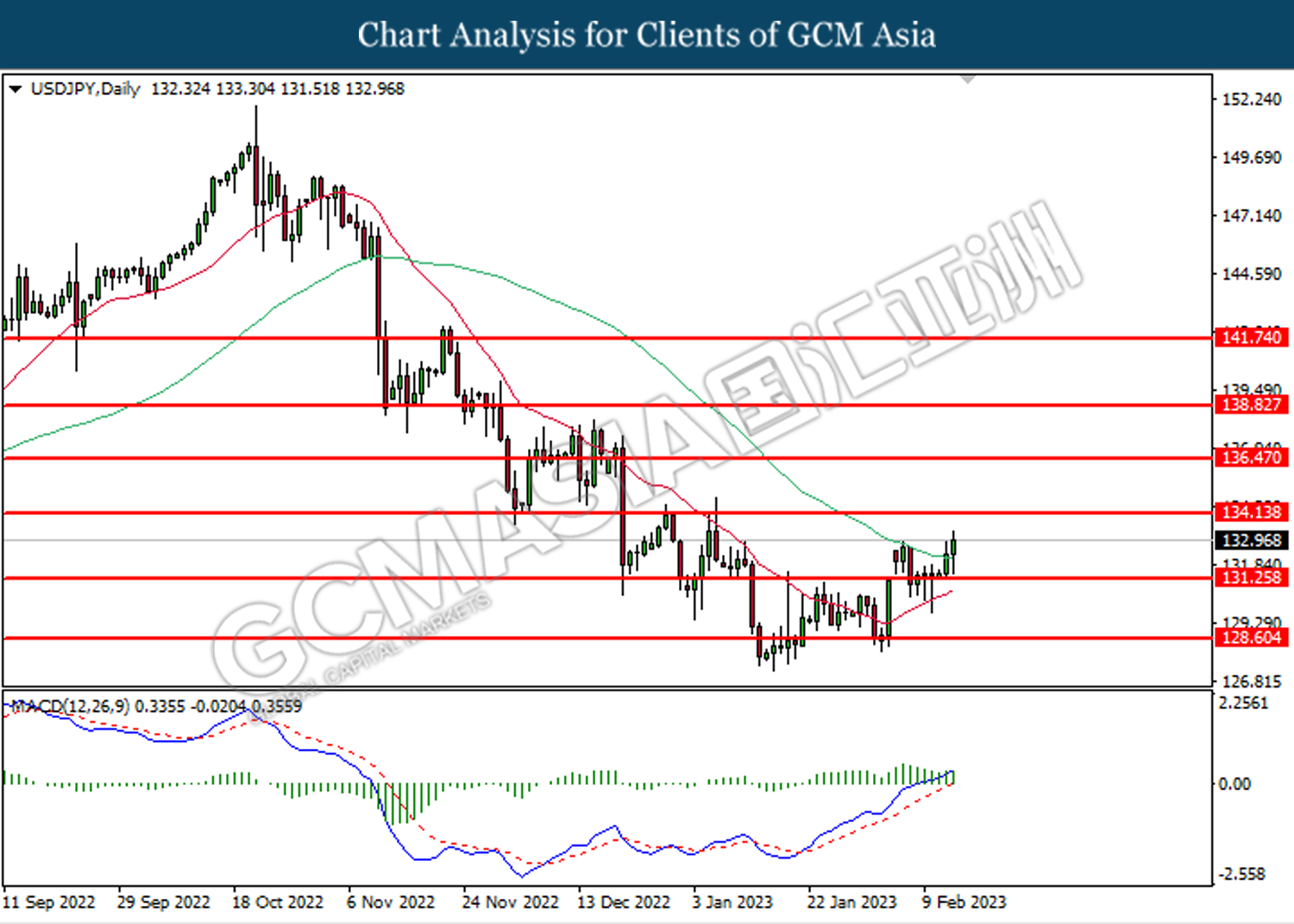

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

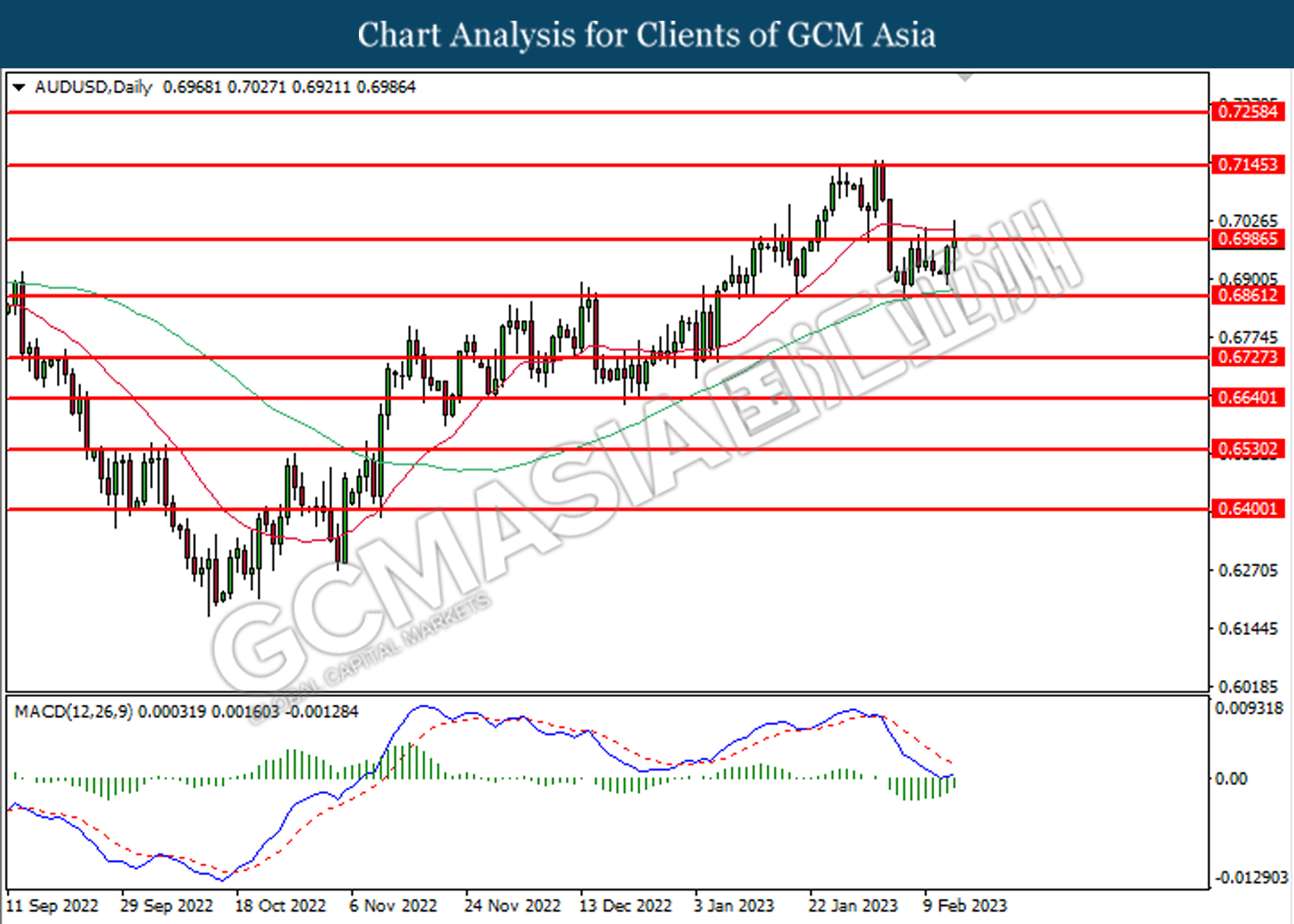

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

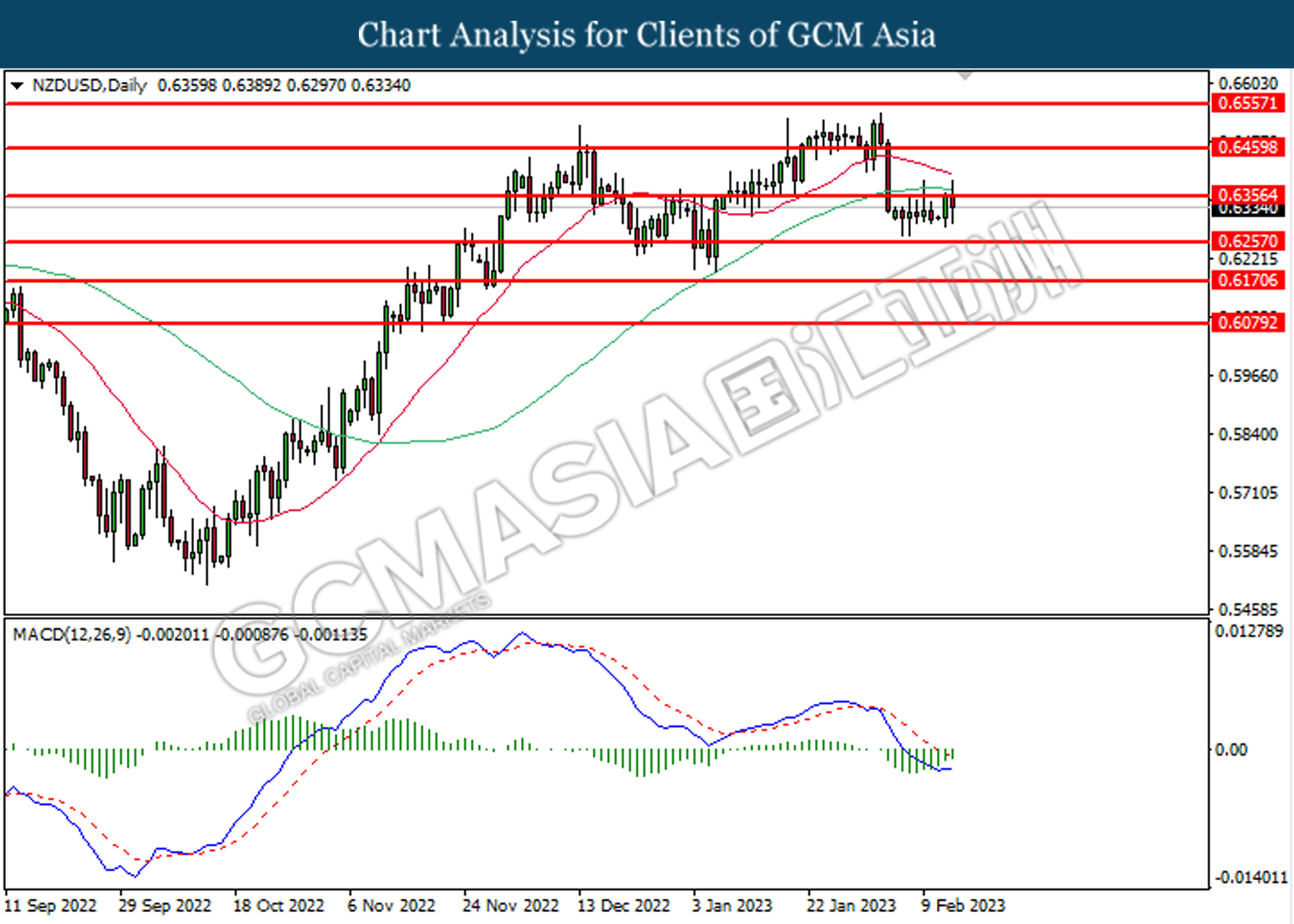

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

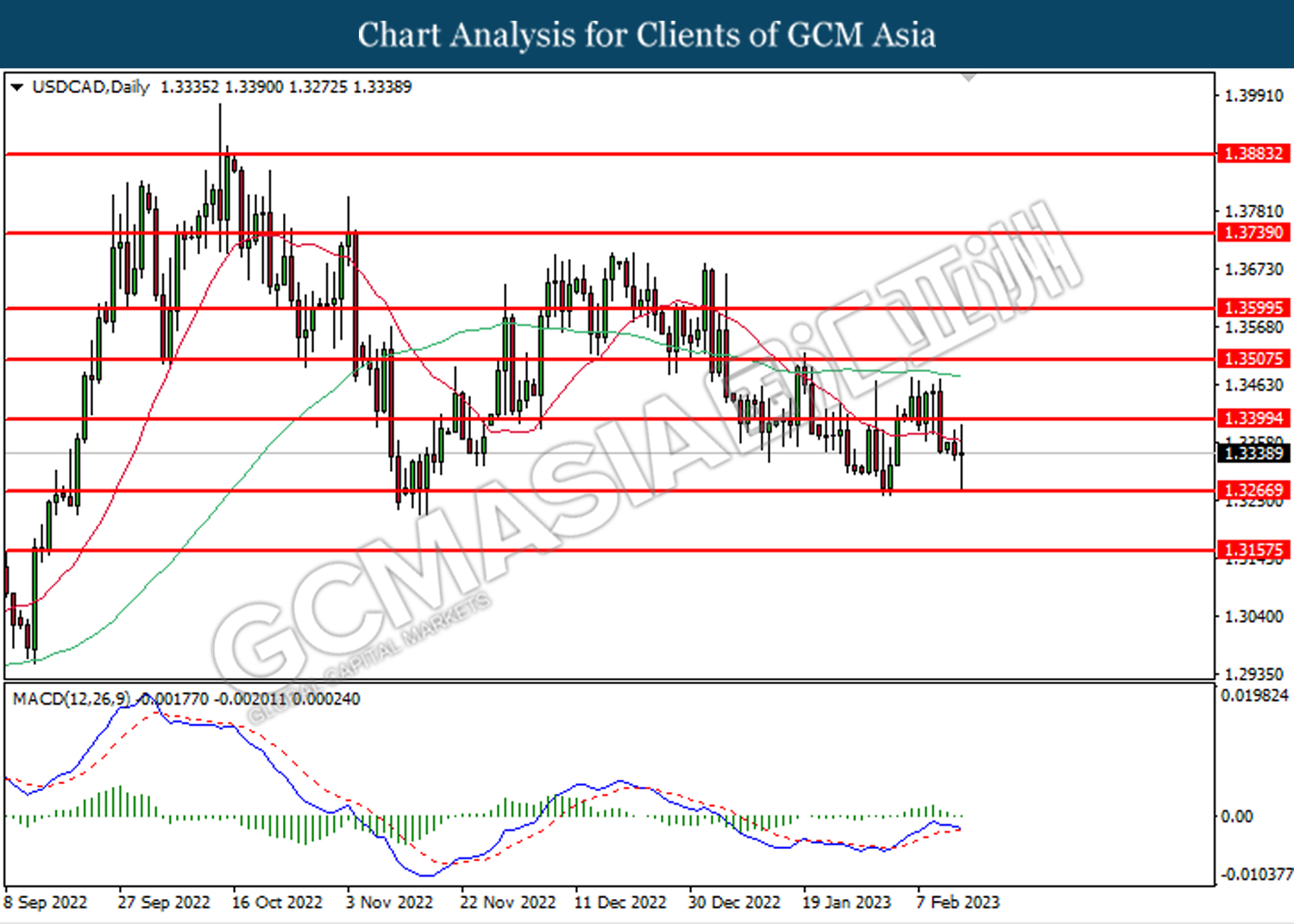

USDCAD, Daily: USDCAD was traded lower following a prior breakout below the previous support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

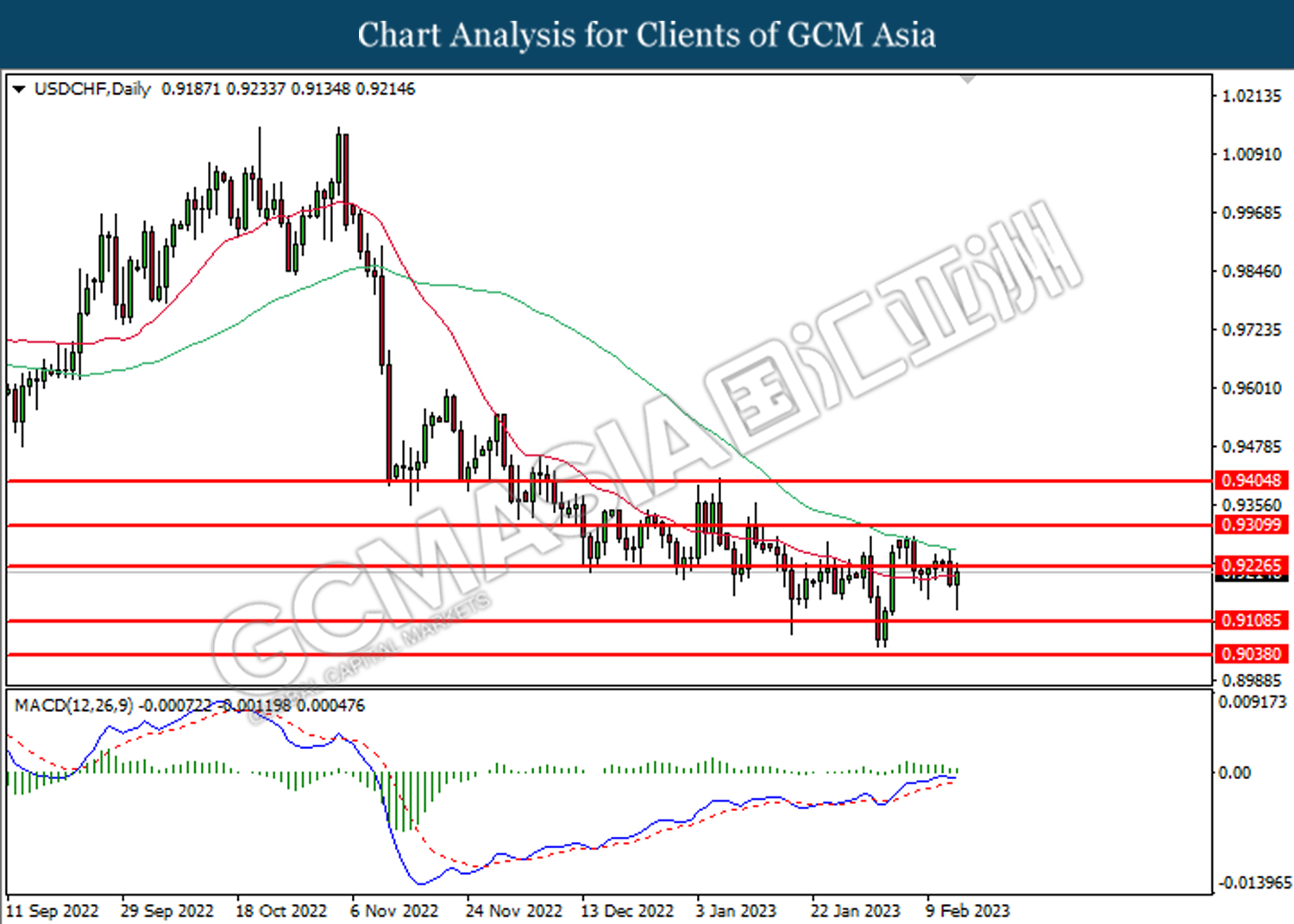

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

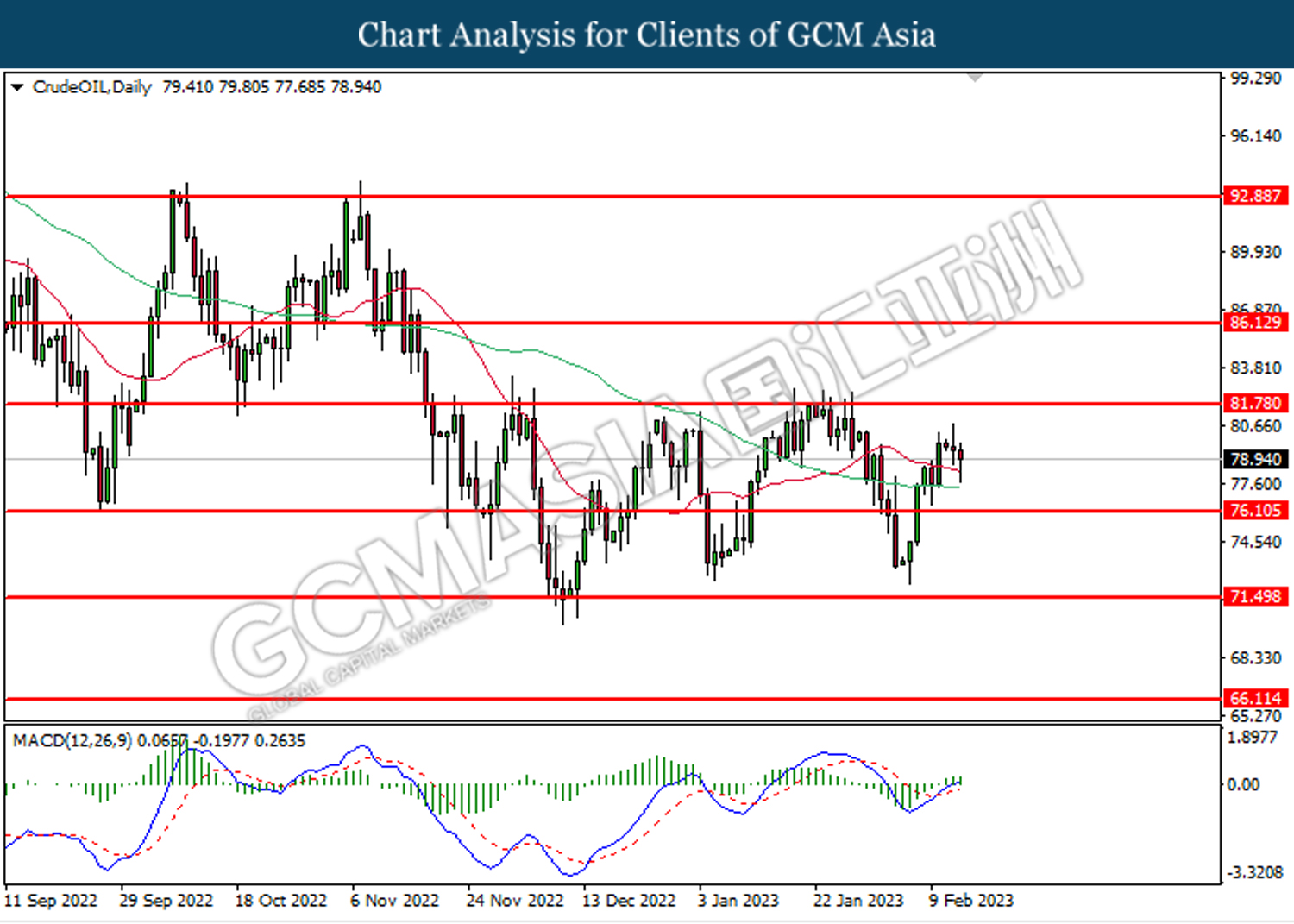

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

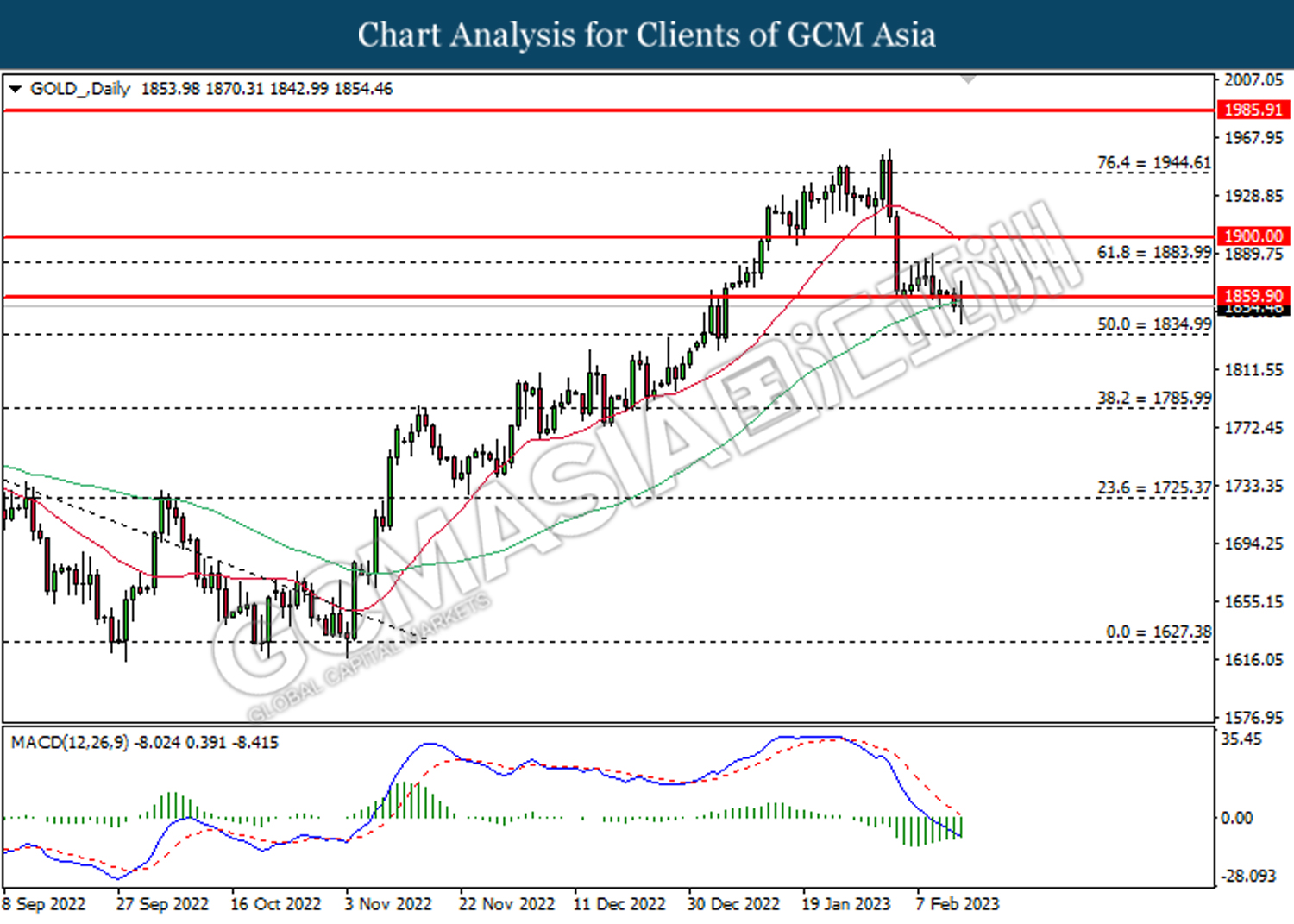

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1835.00.

Resistance level: 1859.90, 1884.00

Support level: 1834.00, 1786.00