15 March 2022 Afternoon Session Analysis

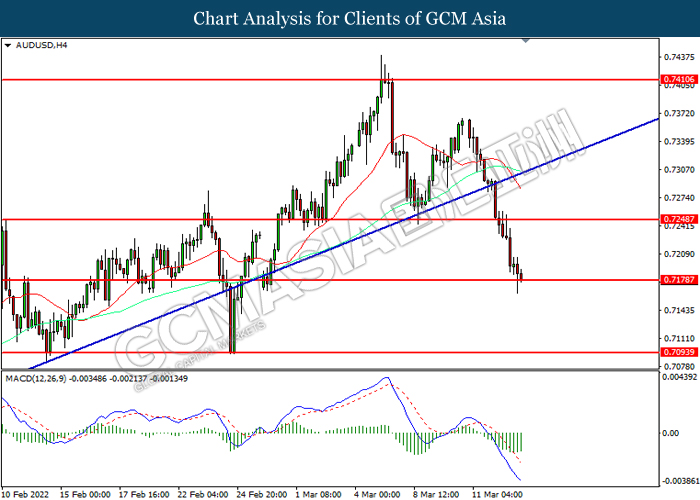

Australia Dollar slump as China Covid-19 case surge.

The Australian Dollar has slumped since yesterday amid the backdrop of surging Covid-19 cases in China. According to CNBC, Mainland China is facing its worst Covid-19 outbreak since the country clamped down on the pandemic in 2020, with major cities rushing to limit business activity. Shenzhen, the biggest city in the manufacturing hub of Guangdong province, told all businesses not involved with essential public services to suspend production or have employees work from home for a week starting Monday. Meanwhile, China had ordered about 51 million residents into lockdown, with three rounds of testing. All public transport is halted and all businesses, except essential services, will be closed until March 20. As China is the largest trading partner with Australia, it sparked negative prospects toward economic momentum in Australia region while the business activities with China are limited. It dialed down the market optimism toward Australia’s economy, spurring further bearish momentum on Australian Dollar. As of writing, the pair depreciated 0.03% to 0.7185.

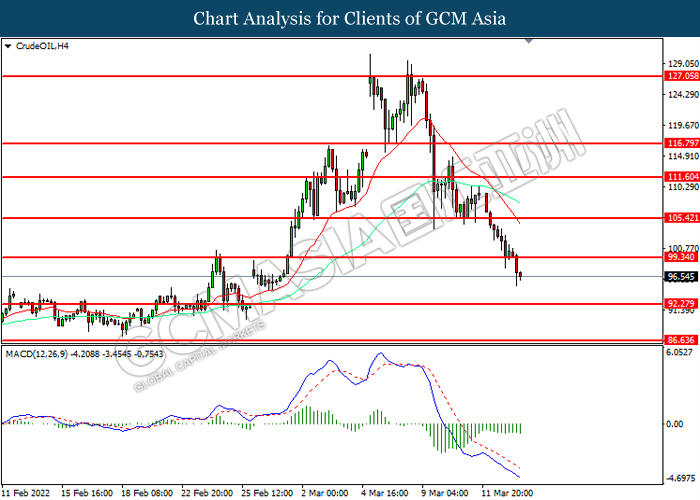

In commodities market, crude oil price extends its losses by 4.11% to $98.79 per barrel as of writing amid the addition oil supply from OPEC+. Besides, gold price depreciated by 0.83% to $1944.50 per troy ounces as of writing as the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Jan) | 4.30% | 4.60% | – |

| 15:00 | GBP – Claimant Count Change (Feb) | -31.9K | -28.0K | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Mar) | 54.3 | 10 | – |

| 21:30 | USD – PPI (MoM) (Feb) | 1.00% | 0.90% | – |

Technical Analysis

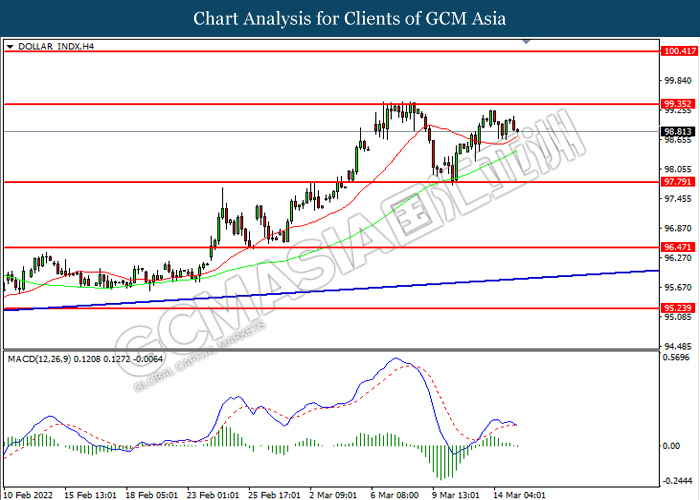

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.30, 96.45

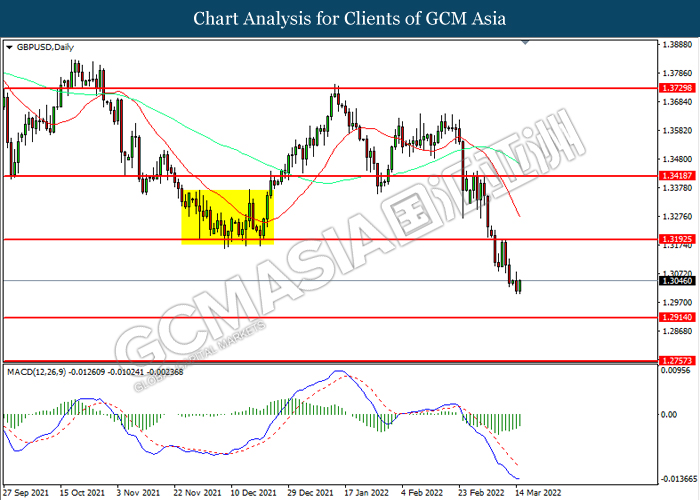

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

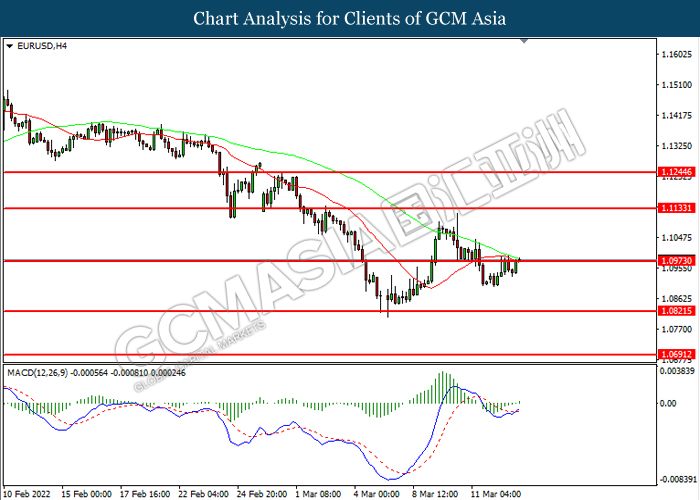

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7250, 0.7410

Support level: 0.7180, 0.7095

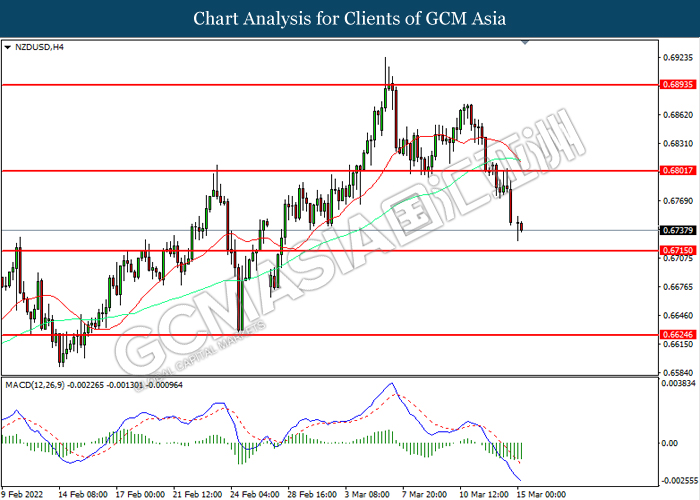

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level at 0.6895. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6800, 0.6895

Support level: 0.6715, 0.6625

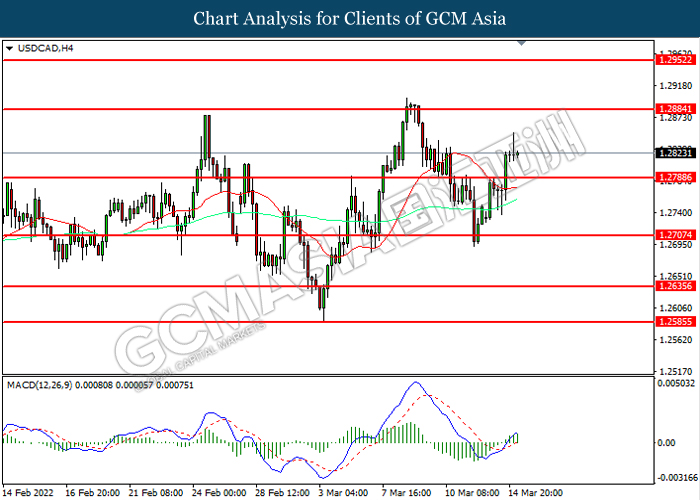

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2885, 1.2950

Support level: 1.2790, 1.2705

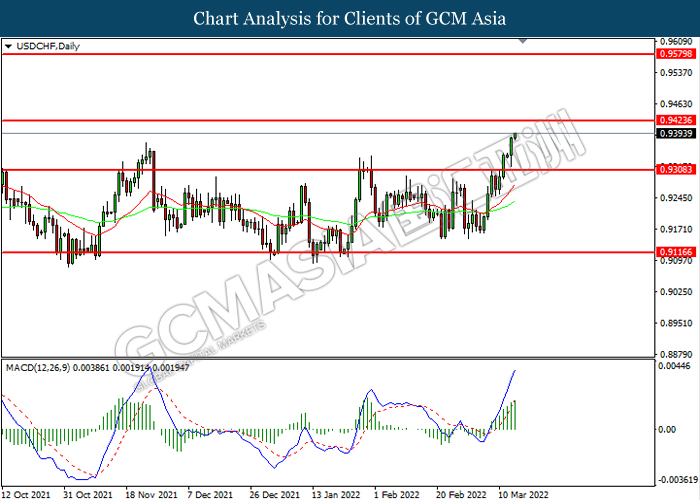

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 99.35, 105.40

Support level: 92.30, 86.65

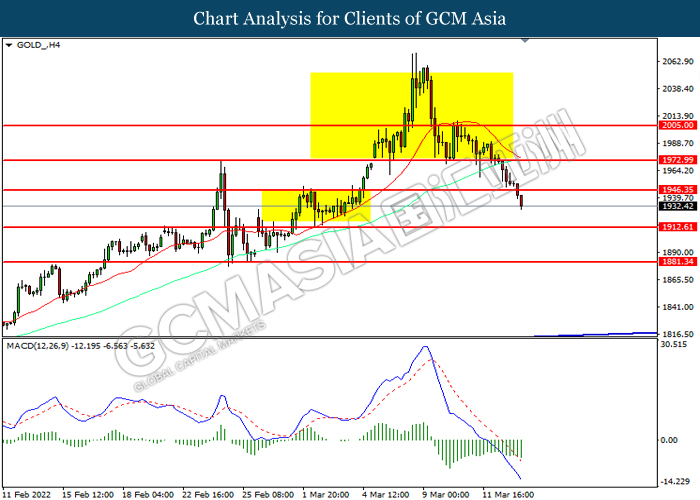

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35