15 March 2023 Afternoon Session Analysis

GBP dribbled as mixed UK data released.

The pair of GBP/USD, which is traded as one of the most popular traded currencies, dribbled around $1.2100 amid mixed UK data and a lack of hawkish move from the Bank of England (BoE). On Tuesday, the UK unemployment rate steadied at 3.7% for three months in a row, slightly lower than the expectation of 3.8%. The latest survey details from the UK Income Data Research (IDR) suggested that British employers agreed on a rise of averaging 5.0%. A tight labor market means consumer spending remains strong, likely to keep inflation buoyed at a high level. However, the Claimant Count Change increased to -11.2k in Feb, well above the market forecast at -12.4k, while the Average Earnings including Bonus data matched with analyst estimations at 5.7%. The possibility of a rate pauses by the BoE heightened after the announcement of the UK data. At this point in time, investors await more clues from the UK Budget 2023 announcement to scrutinize the further direction of the currency. As of writing, the GBP/USD slipped -0.05% to $1.2153.

In the commodities market, crude oil prices were traded up by 1.05% to $72.08 per barrel as investor awaits the key US Retails Sales Report, as well as the Produce Price Index (PPI) data. Besides, gold prices depreciated by -0.31% to $1905.00 per troy ounce amid rate hike uncertainty.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

20:30 GBP Spring Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Feb) | 2.3% | -0.1% | – |

| 20:30 | USD – PPI (MoM) (Feb) | 0.7% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Feb) | 3.0% | -0.3% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.694M | 0.555M | – |

Technical Analysis

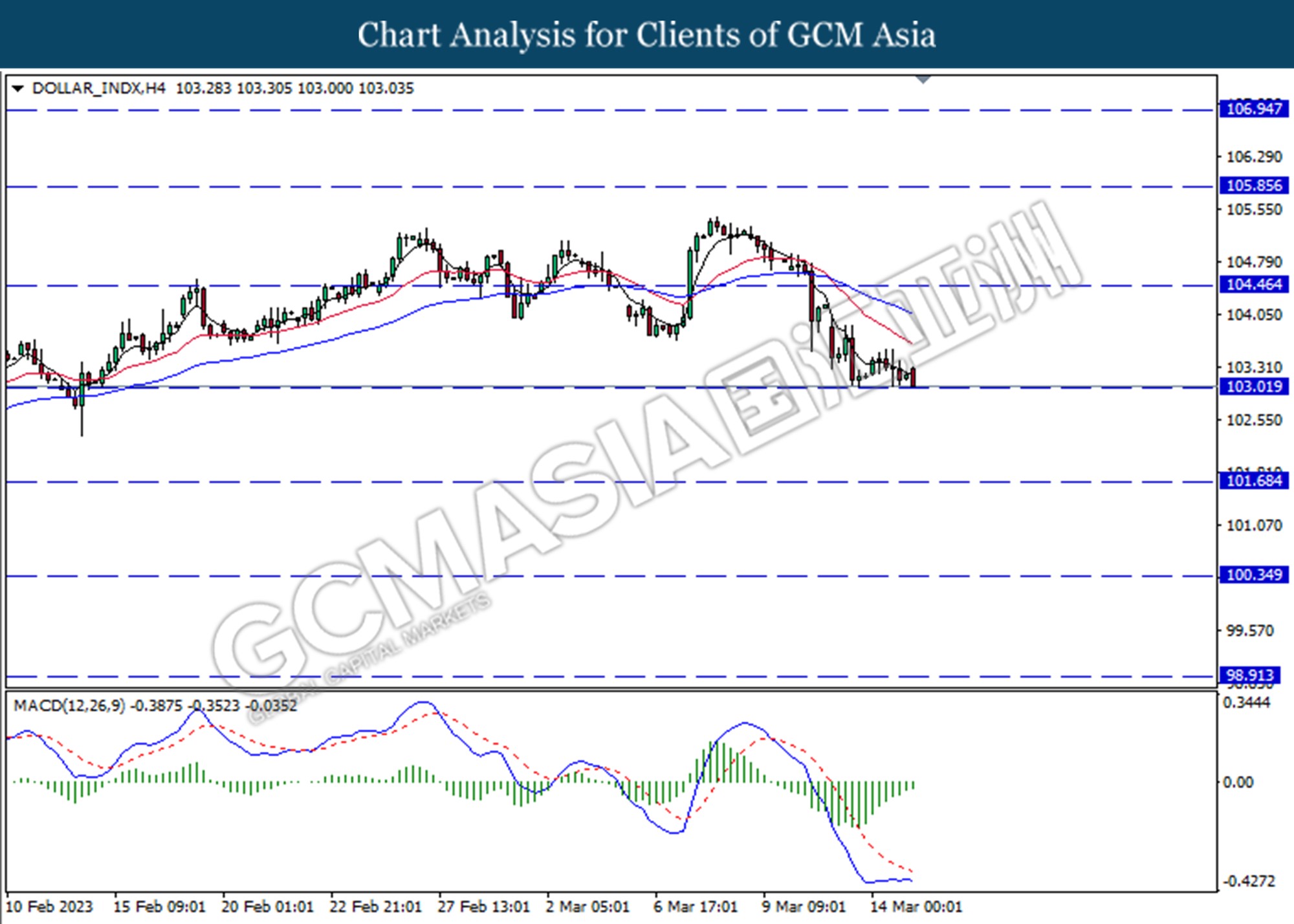

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in the short term.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

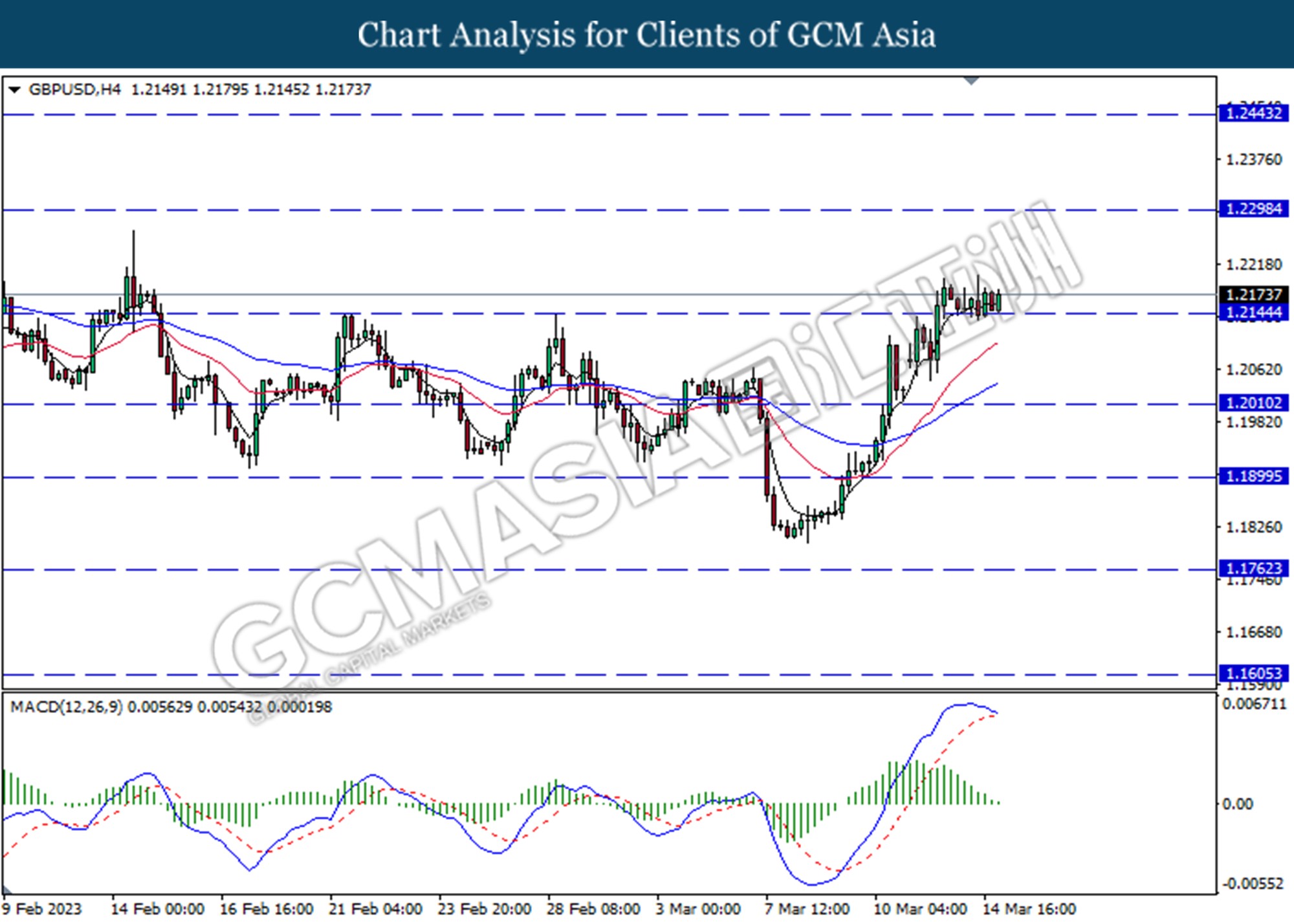

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from a support level at 1.2145. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo a technical correction in the short-term.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

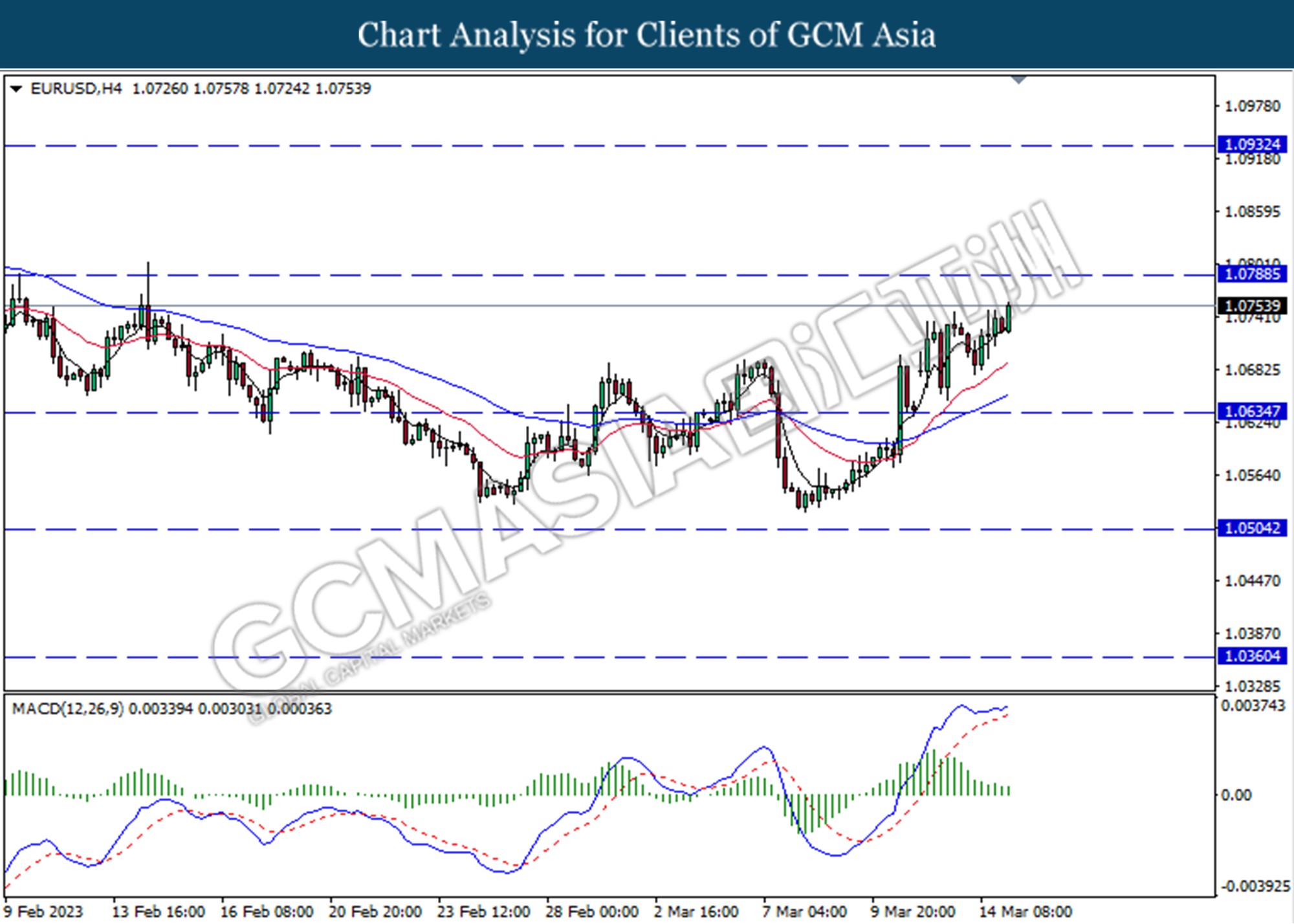

EURUSD, H4: EURUSD was traded higher following the prior breakout above the higher level. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as technical correction.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

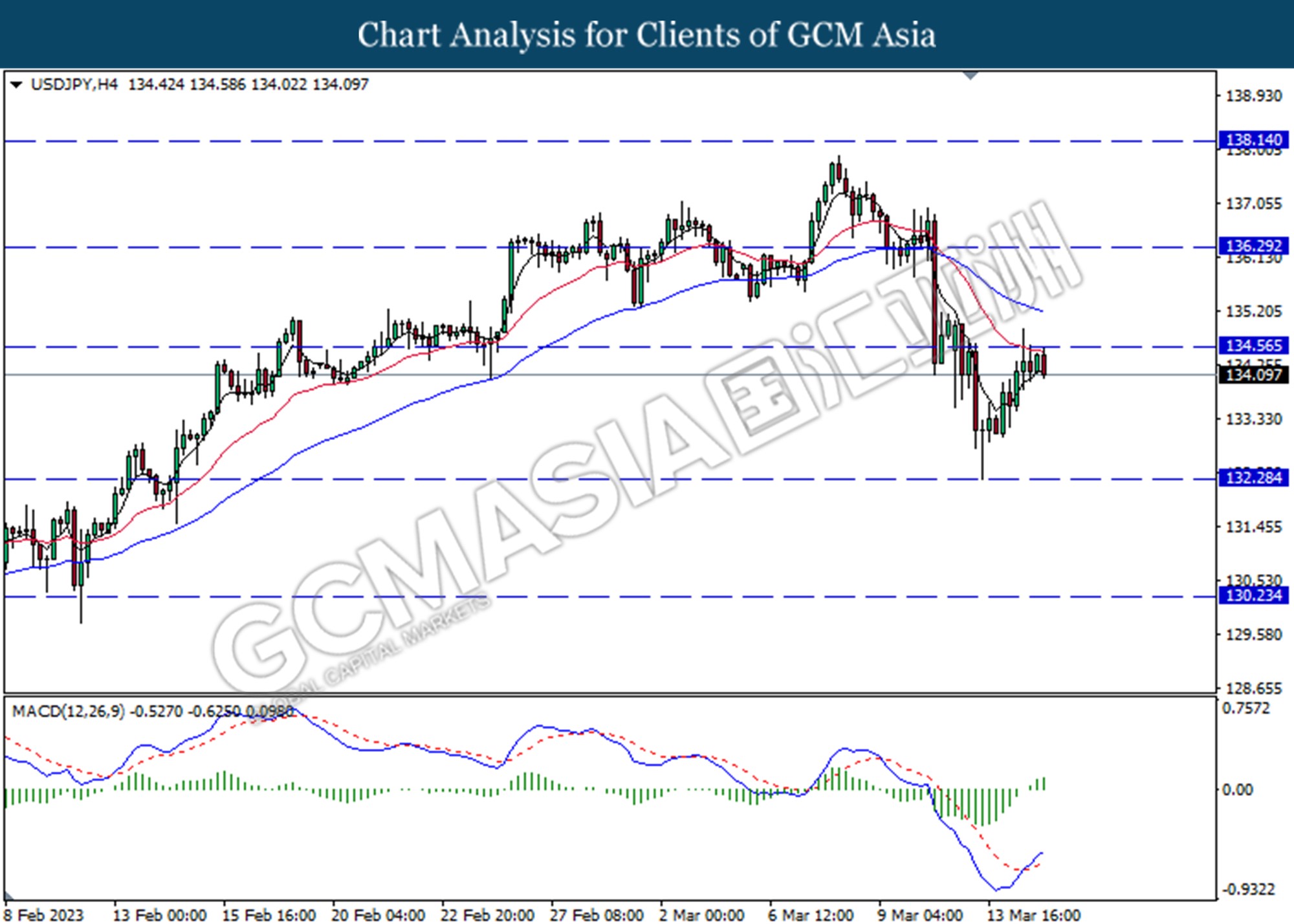

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 134.55. However, MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

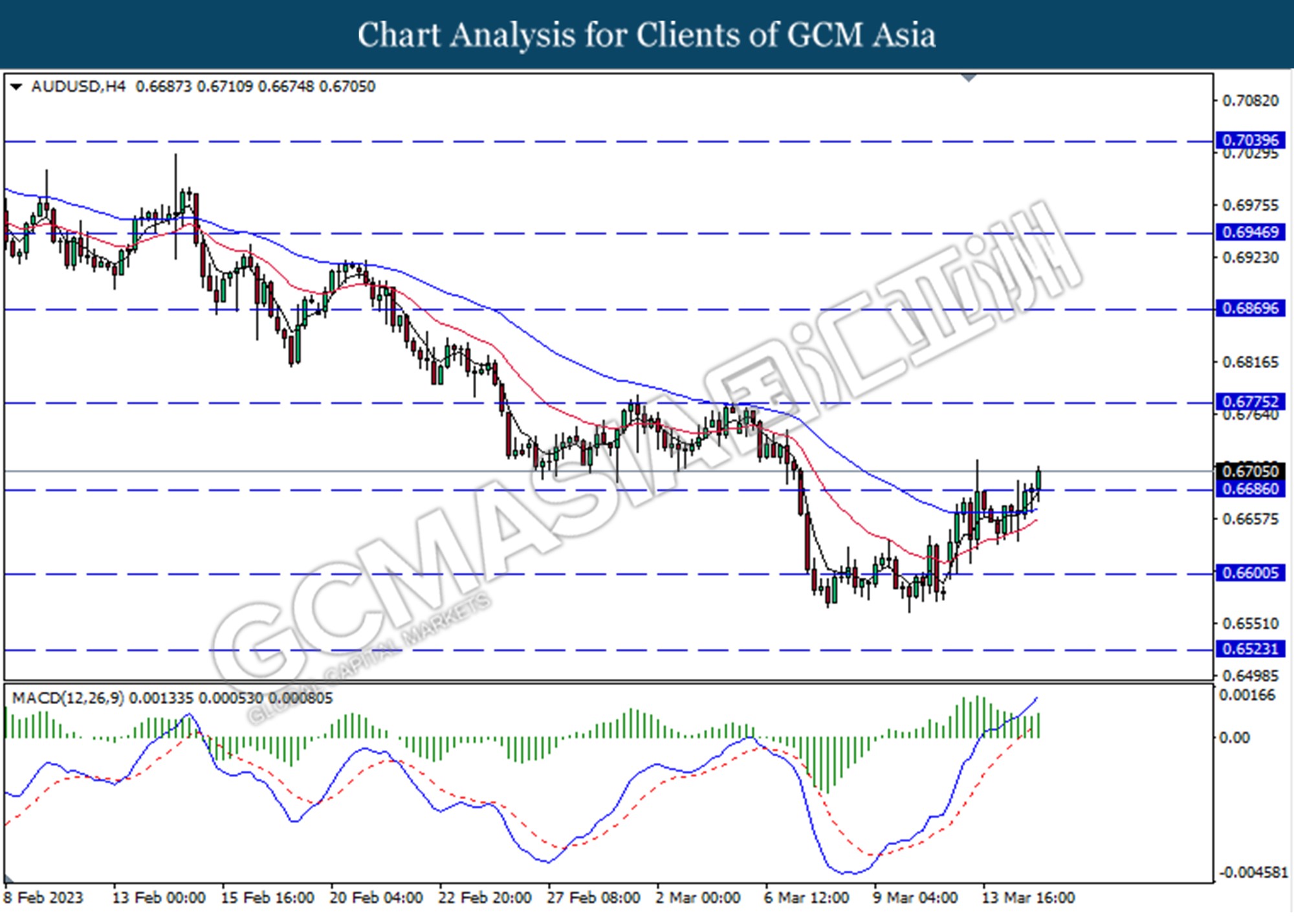

AUDUSD, H4: AUDUSD was traded higher following a prior break above the previous resistance level at 0. 6685. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

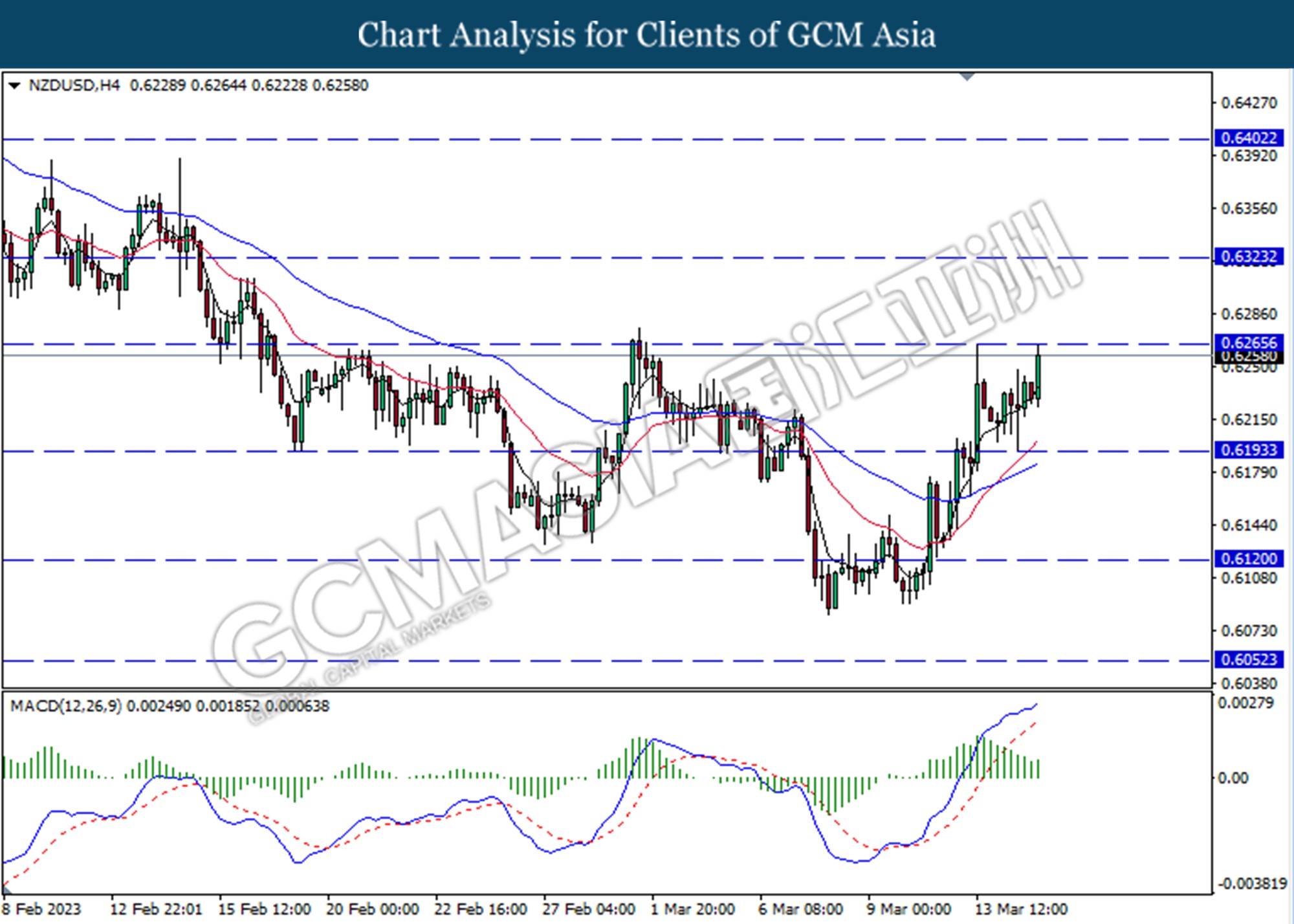

NZDUSD, H4: NZDUSD was traded higher while currently testing for the resistance level at 0.6265. MACD which illustrated bullish bias momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

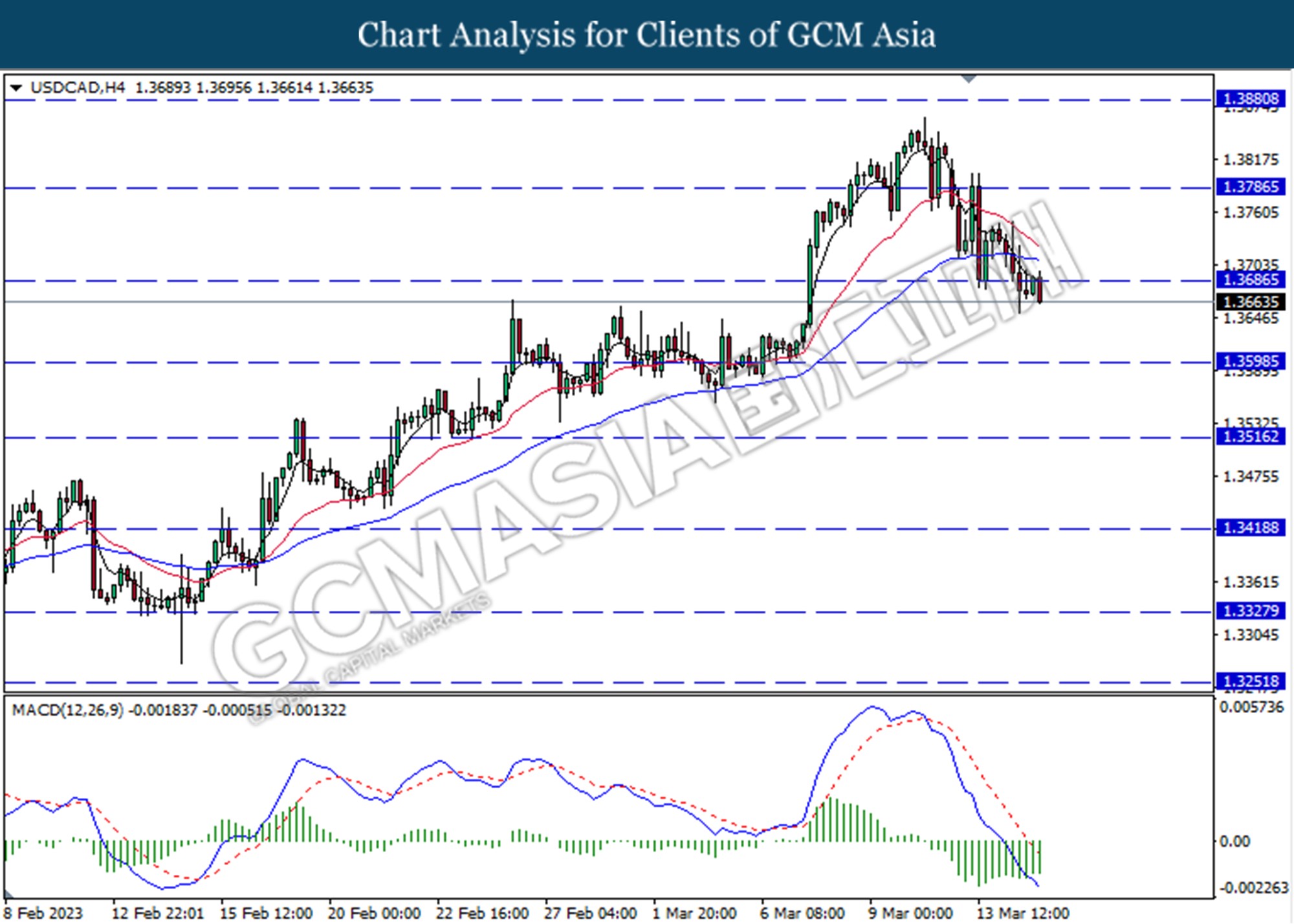

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3685. MACD which illustrated bearish momentum suggests the pair to extend its losses toward the support level at 1.3600.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

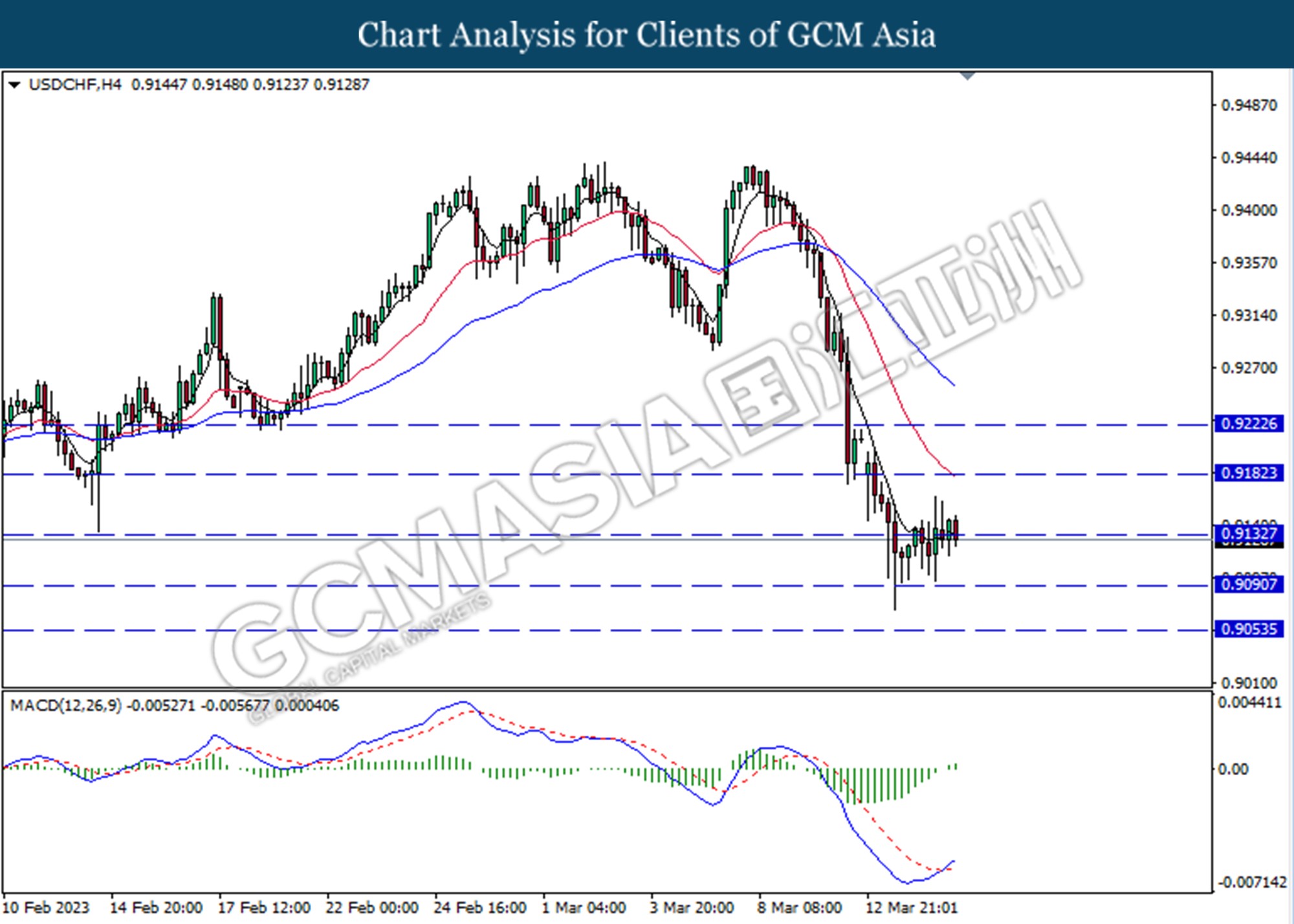

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.9130. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in short-term.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

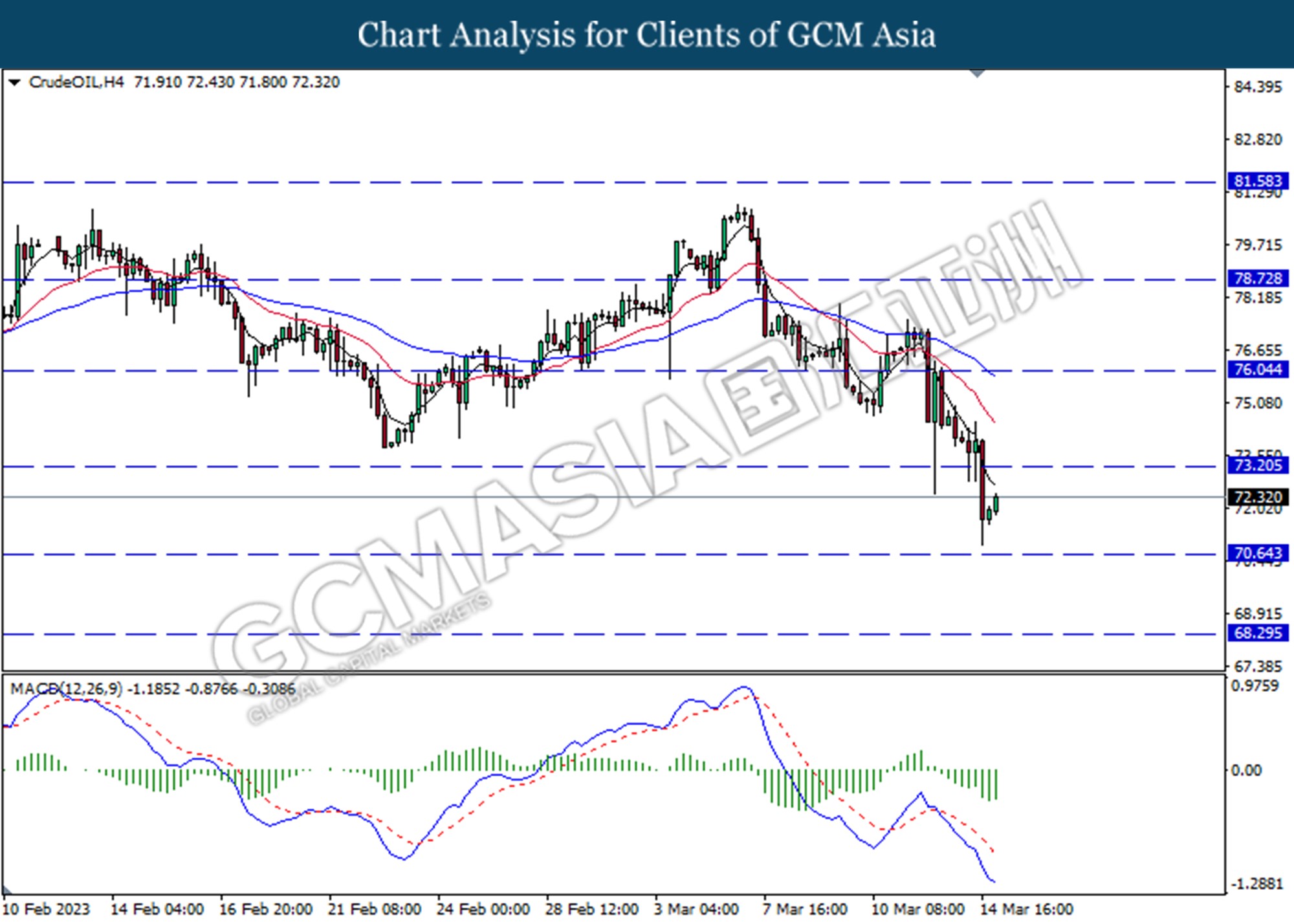

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 73.20.

Resistance level: 73.20, 76.05

Support level: 70.65, 68.30

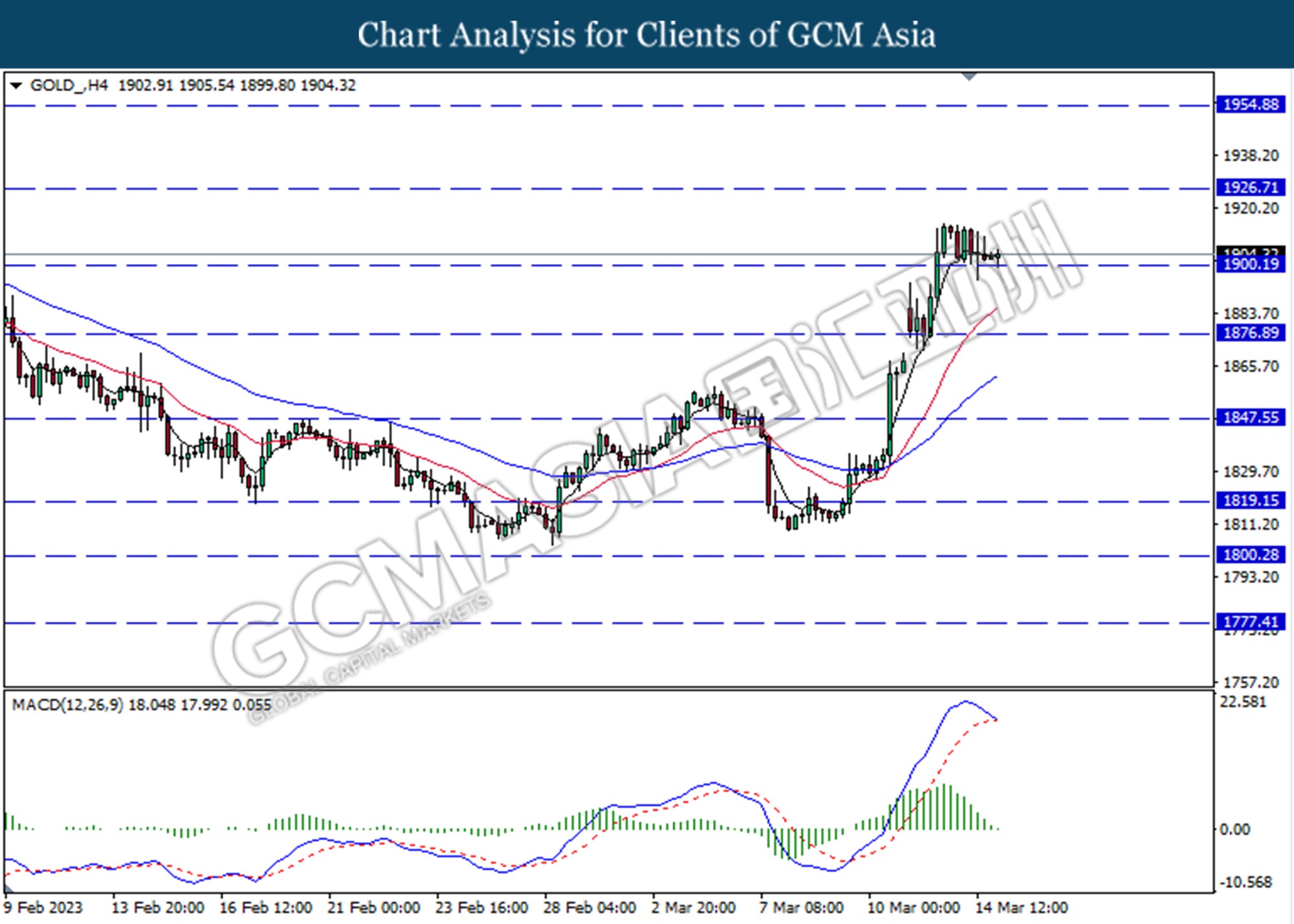

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1900.20.

Resistance level: 1926.70, 1954.90

Support level: 1900.20, 1876.90