15 April 2022 Morning Session Analysis

US Dollar surged as bullish economic data.

The Dollar Index which traded against a basket of six major currencies surged over the backdrop of a string of bullish economic data. According to Census Bureau, US Core Retail Sales for last month notched up significantly from the previous reading of 0.6% to 1.1%, exceeding the market forecast at 1.0%. The upbeat economic data had suggested that the consumer spending in United States picked up in the first quarter, dialed up the market optimism toward the economic progression in the Unite States. Nonetheless, the gains experienced by the US Dollar was limited by negative job data. Department of Labor reported that the US Initial Jobless Claims came in at 185K, missing the market forecast at 171K. On the other hand, the dovish tone from the European Central Bank on yesterday had dragged down the appeal for Euro, which prompting investors to shift their portfolio from the European region into US market. As of writing, the Dollar Index appreciated by 0.46% to 100.35.

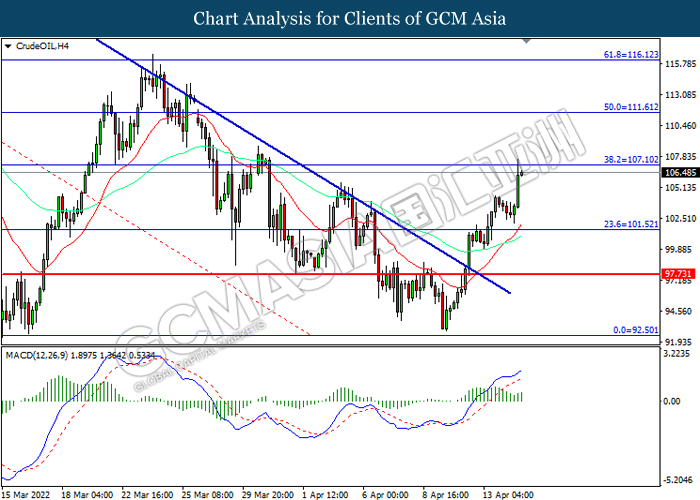

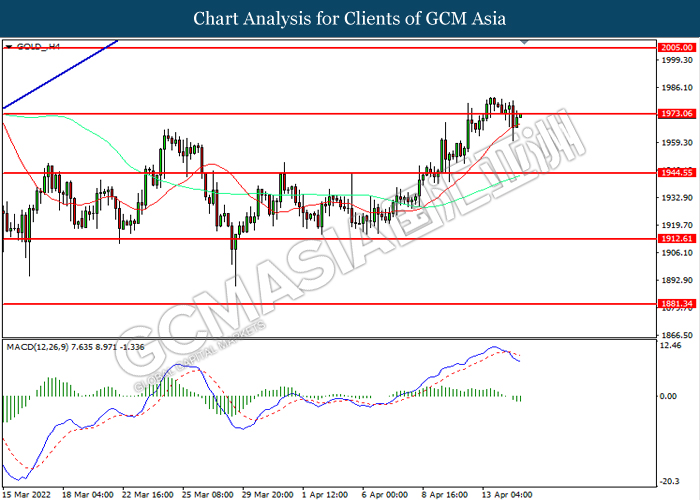

In the commodities market, the crude oil price appreciated by 2.17% to $106.48 per barrel as of writing. The oil market edged higher as market participants speculated that the implementation of the oil sanction from EU to Russia would likely to trigger the supply disruption. On the other hand, the gold price depreciated by 0.61% to $1973.30 amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

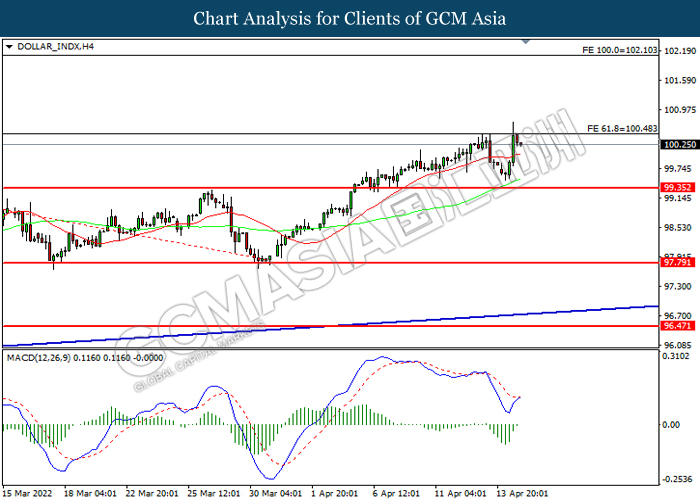

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

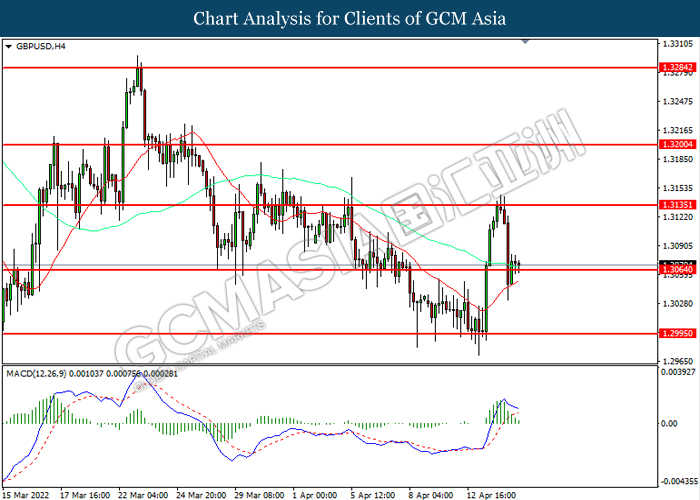

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.3065, 1.2995

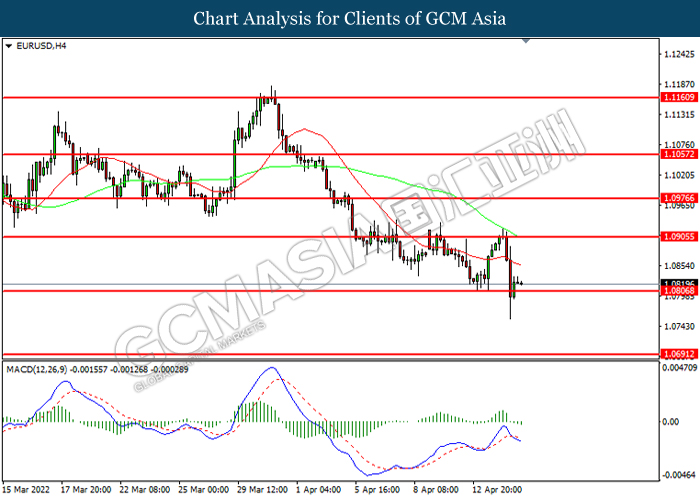

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0910, 1.0975

Support level: 1.0805, 1.0690

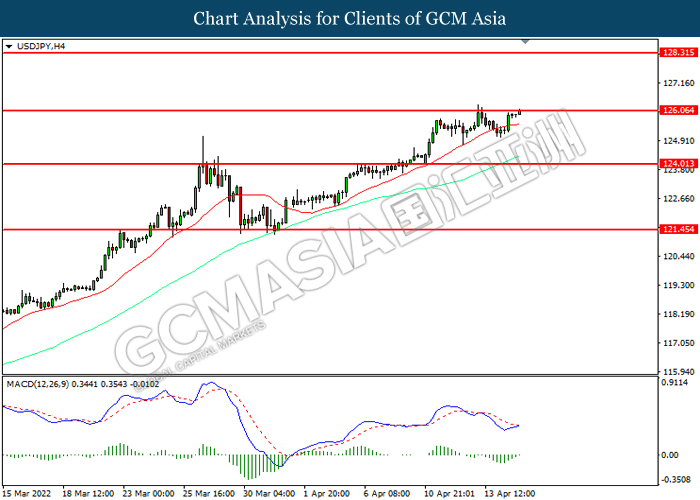

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 126.05, 128.30

Support level: 124.00, 121.45

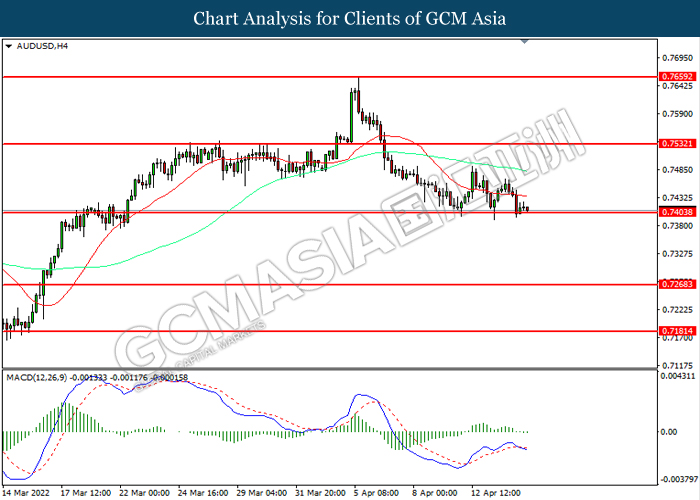

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7530, 0.7660

Support level: 0.7405, 0.7270

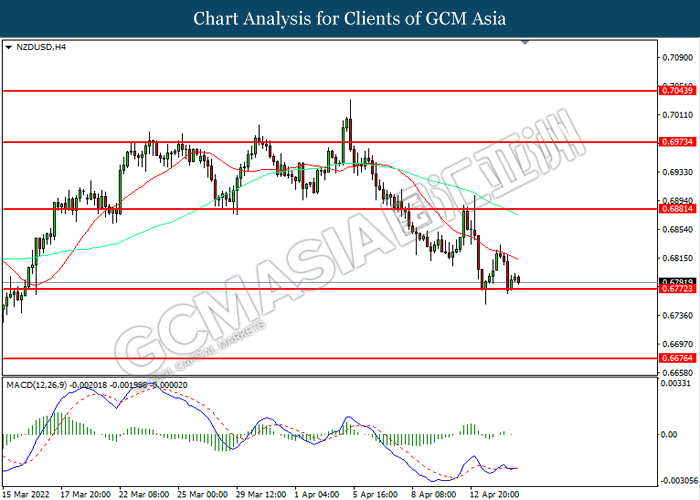

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6880, 0.6975

Support level: 0.6770, 0.6675

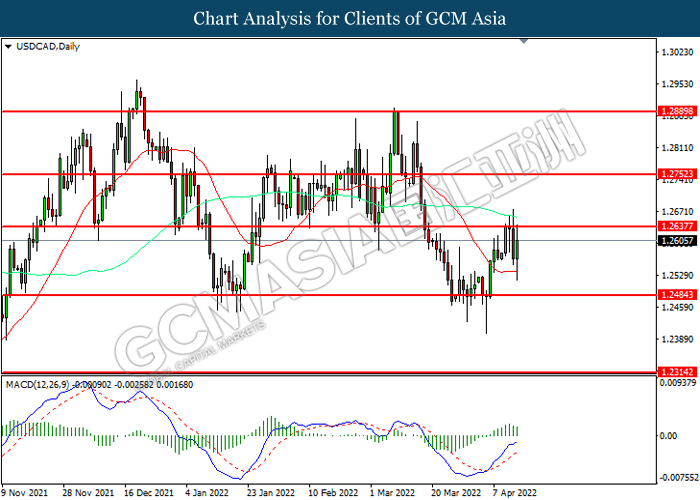

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

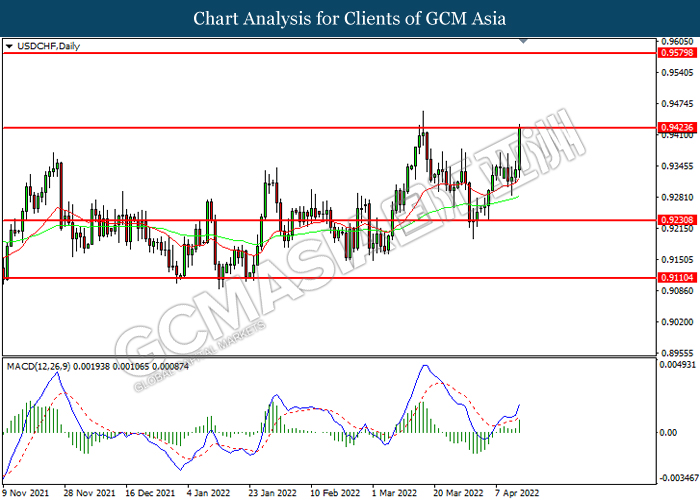

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.05, 2005.00

Support level: 1944.55, 1912.60