15 May 2023 Morning Session Analysis

Greenback surged despite disappointing economic data.

The dollar index, which was traded against a basket of six major currencies, extended its rallies last Friday as the market participants were optimistic toward the talks of a debt ceiling between Joe Biden and the Congressional members. Early today, a top US economic official said on Sunday that the talk between congressional staff and the White House has been “constructive” as the US debt ceiling deadline approaches on June 1. Prior to that, the talk was postponed once as staff-level talks continued. Besides, President Joe Biden also said that he looks forward to getting together with the leaders to talk about how they continue to make progress. Despite no agreement or deal being sealed at this point in time, the ‘constructive’ progress in raising the debt limit has cheered the market sentiment. On the economic front, the Michigan Consumer Sentiment data, which represents consumer confidence and optimism in the US, came in at 57.7, much lower than the consensus forecast of 63.0. The consumer sentiment tumbled significantly as market worries escalated in the month of May amid ongoing banking crisis risk and the possibility of lawmakers failing to resolve the debt ceiling heightened. As of writing, the dollar index edged up 0.02% to 102.70.

In the commodities market, crude oil prices dropped by -0.02% to $70.05 per barrel after the market corrected on recession fears and a stronger US dollar. Besides, gold prices ticked down by -0.01% to $2010.60 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

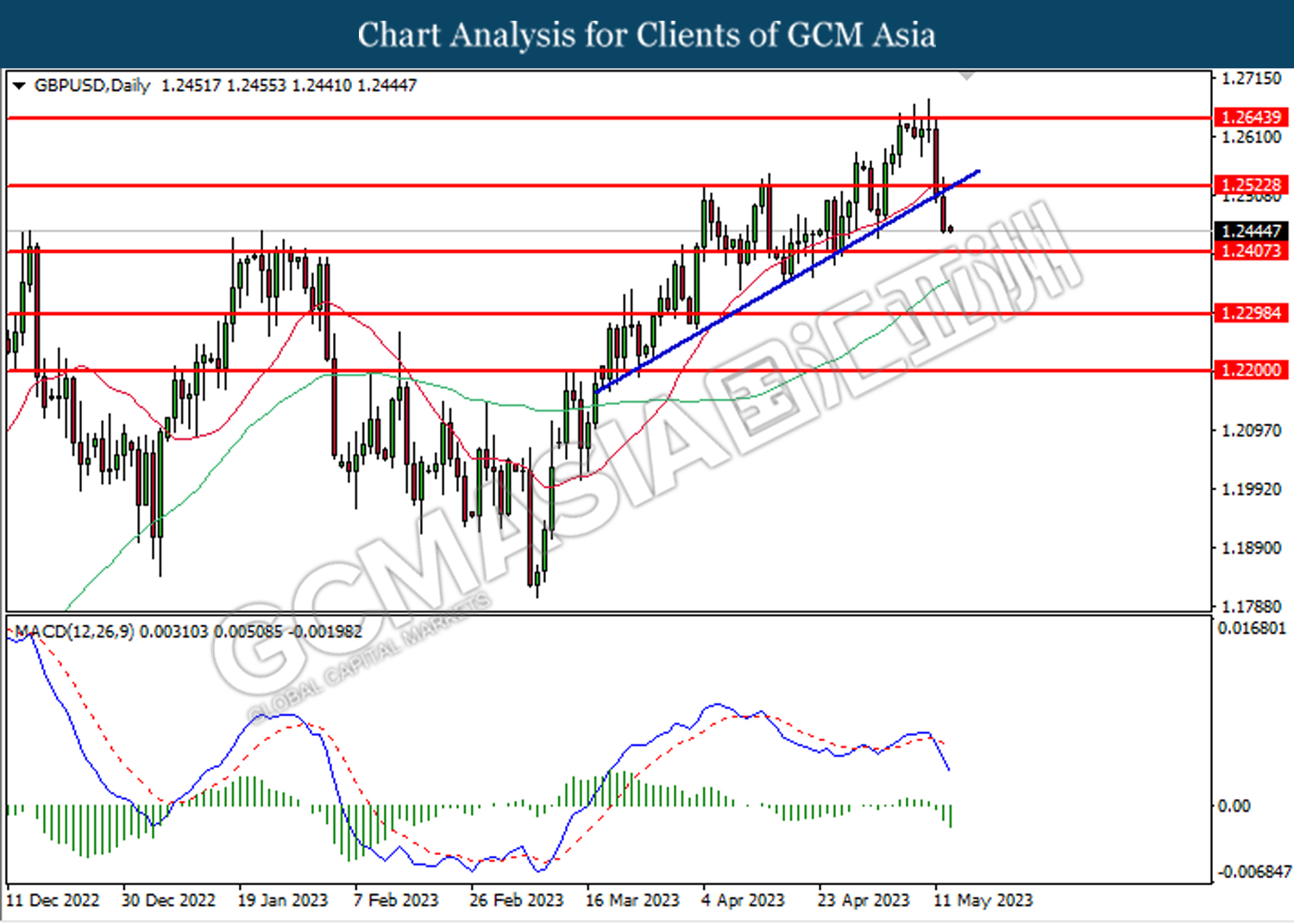

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

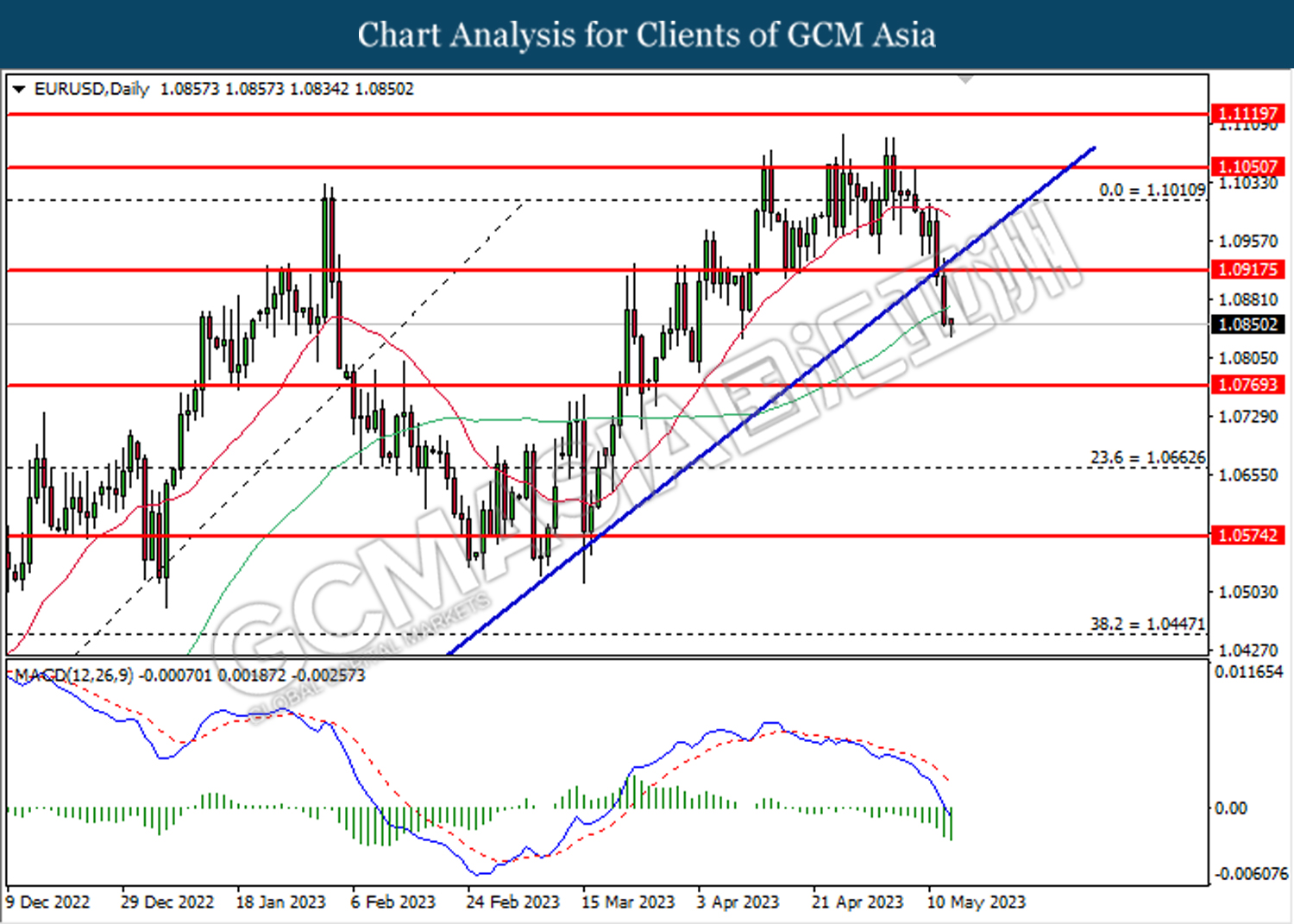

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

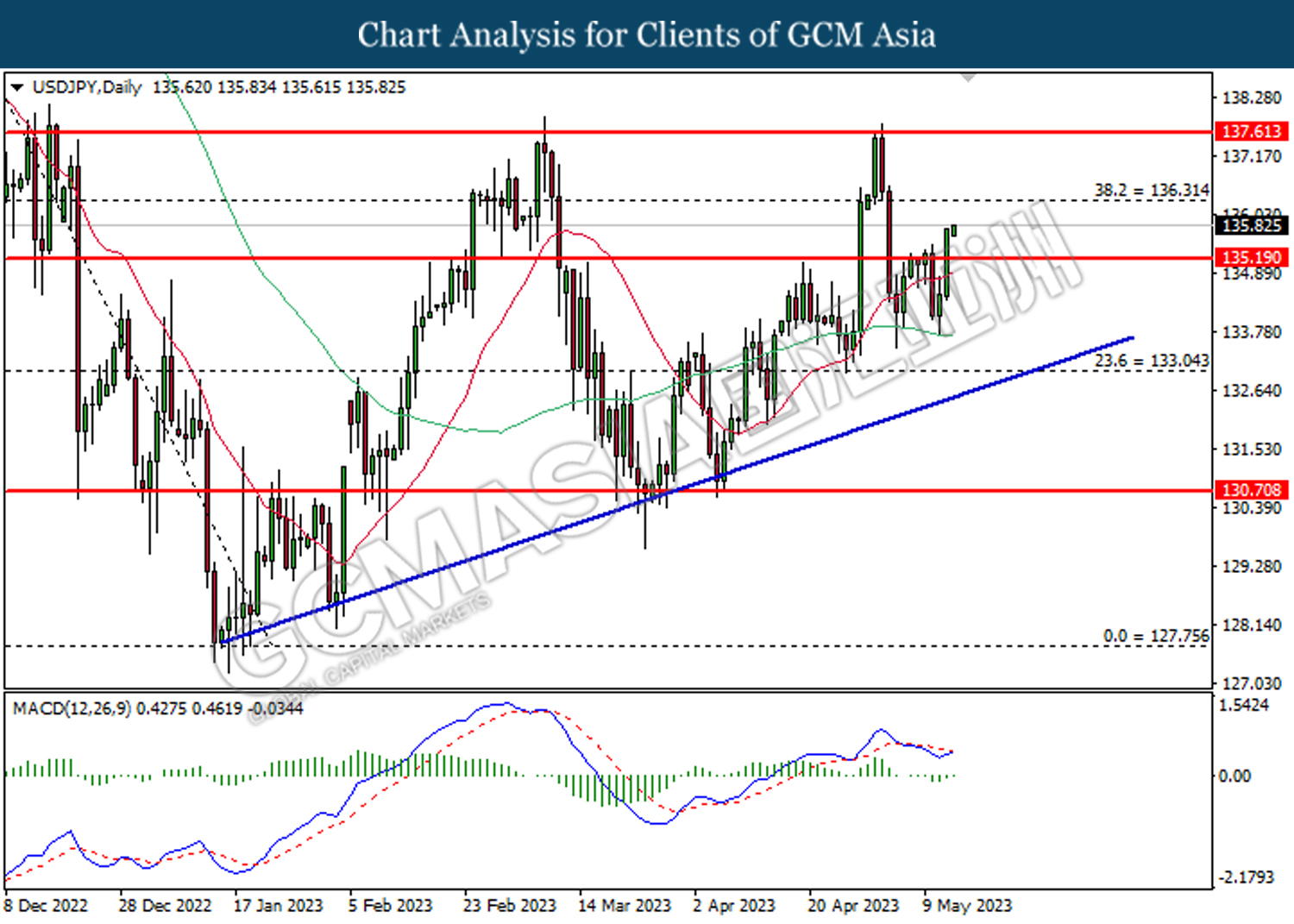

USDJPY, Daily: USDJPY was traded higher following the prior above the previous resistance level at 135.20. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 136.30.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

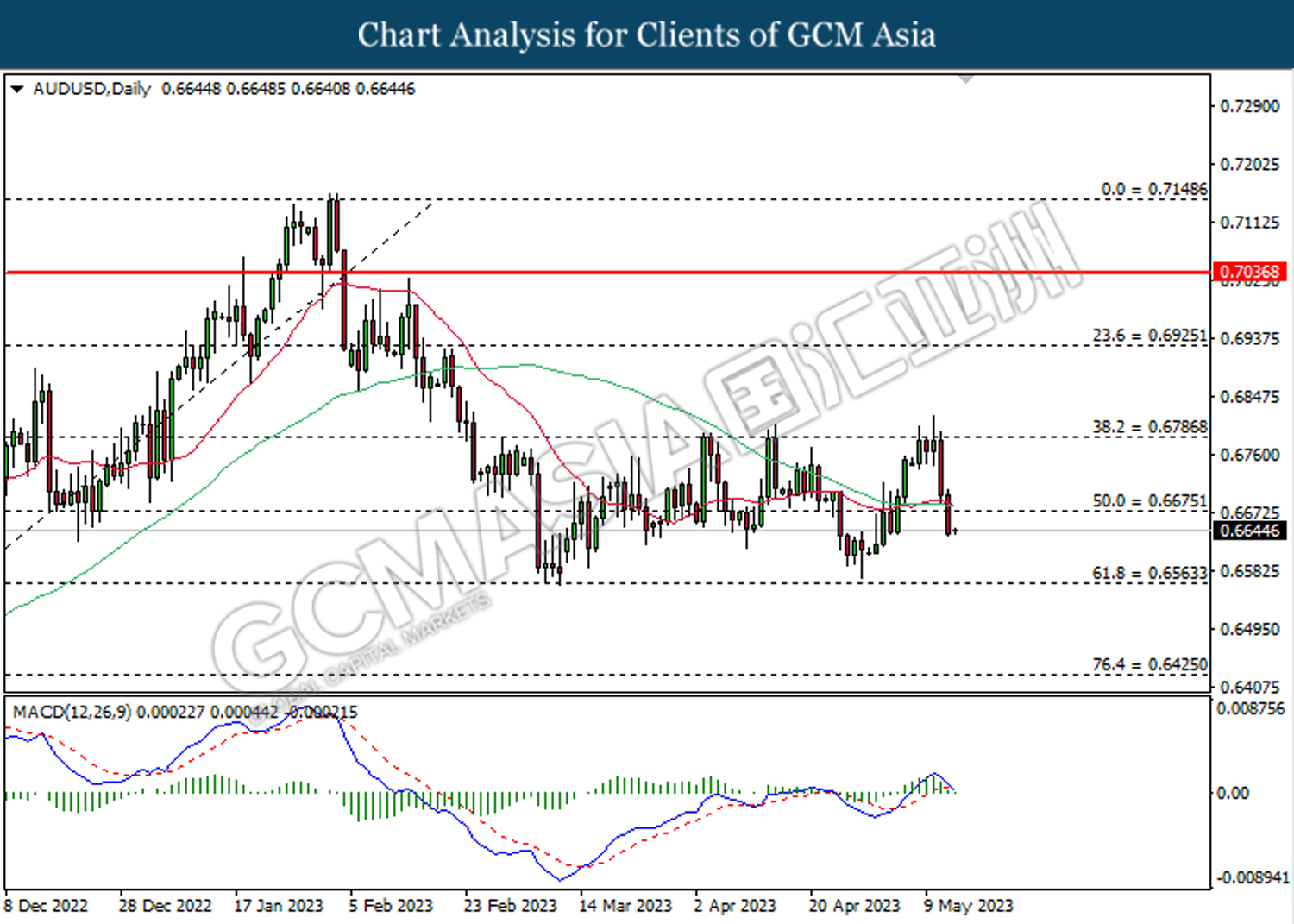

AUDUSD, Daily: AUDUSD was traded lower following prior below the previous support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

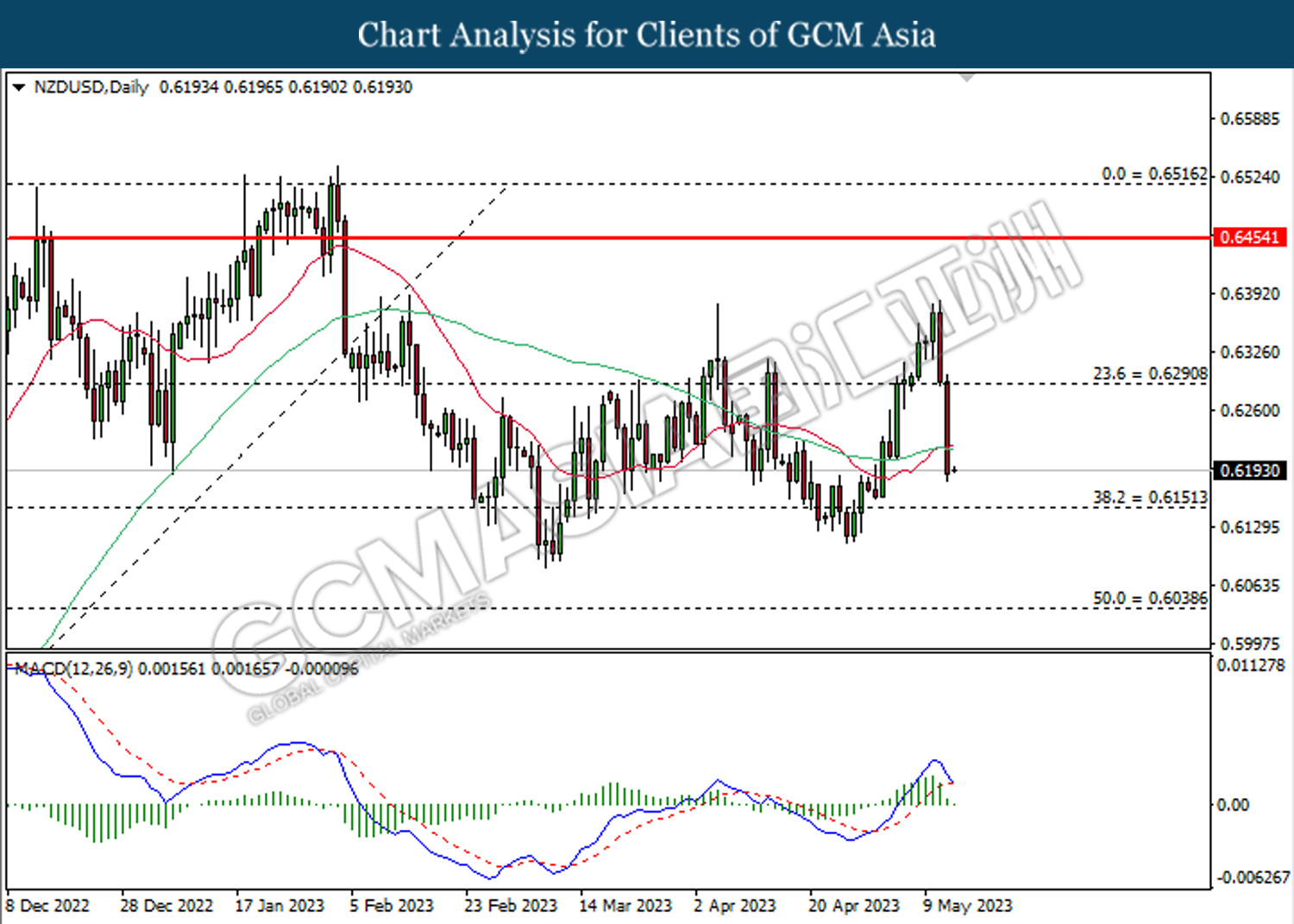

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290. 0.6455

Support level: 0.6150, 0.6040

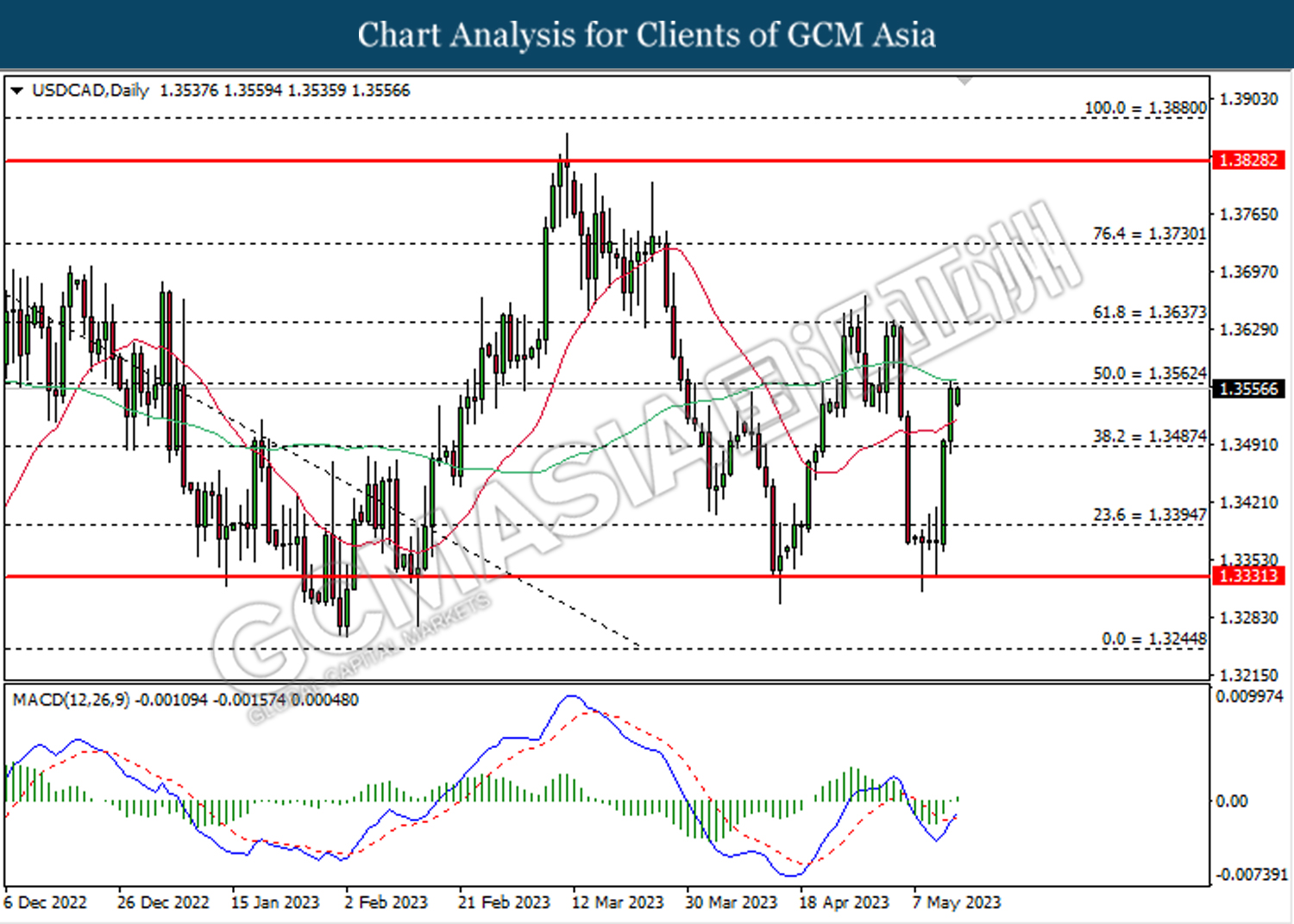

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3565. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level at 1.3565.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

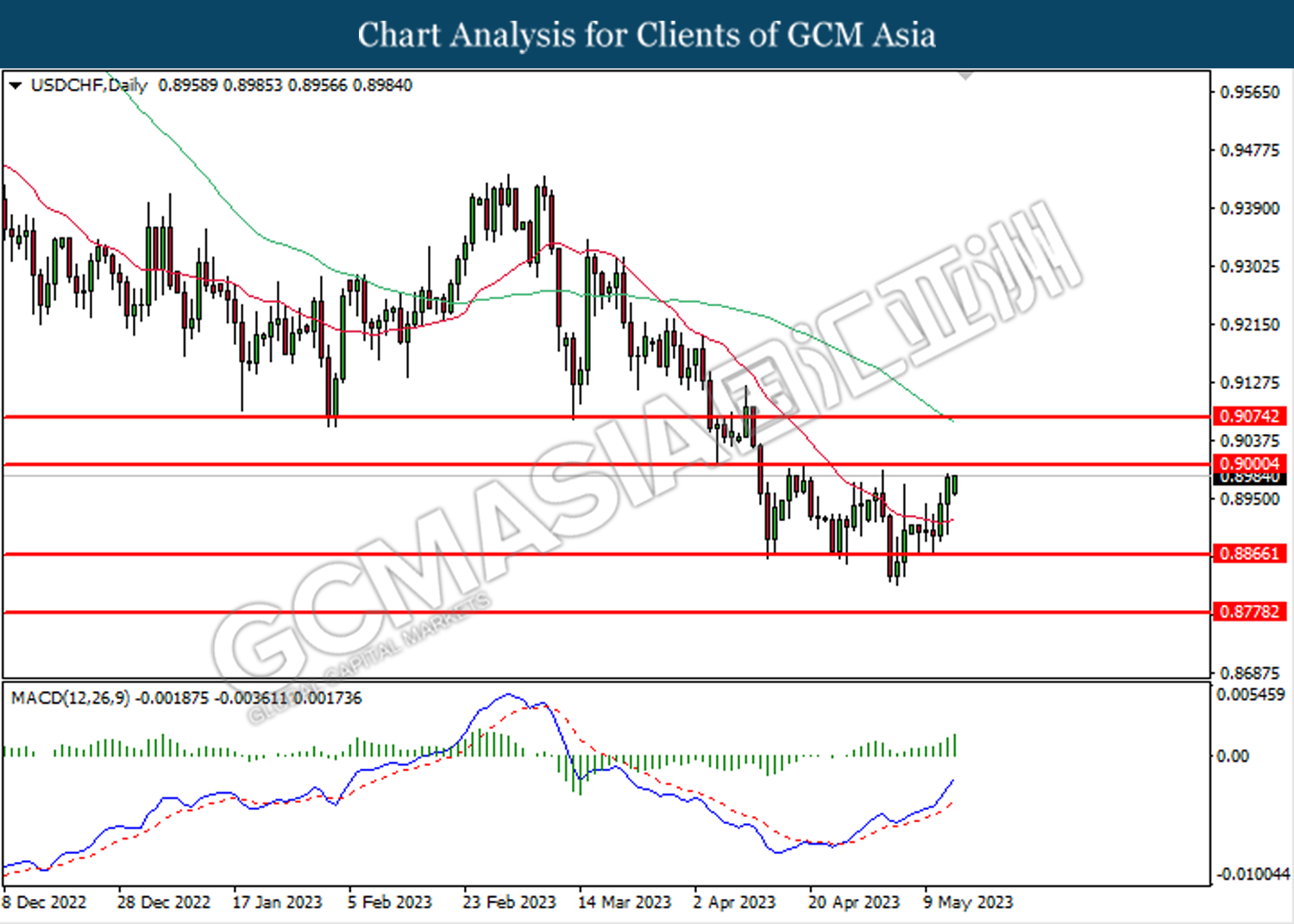

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

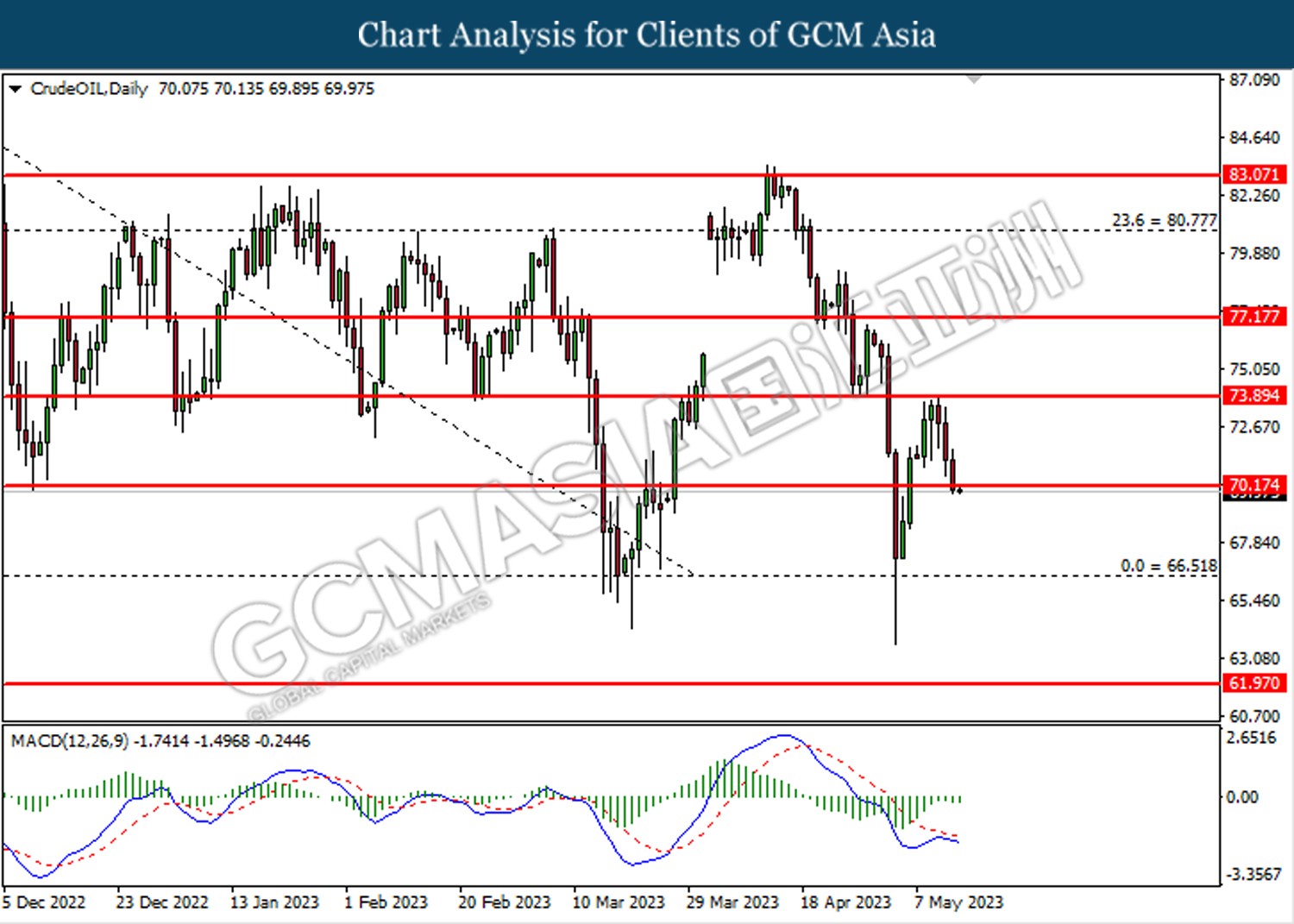

CrudeOIL, Daily: Crude oil price was traded lower while currently testing near the support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

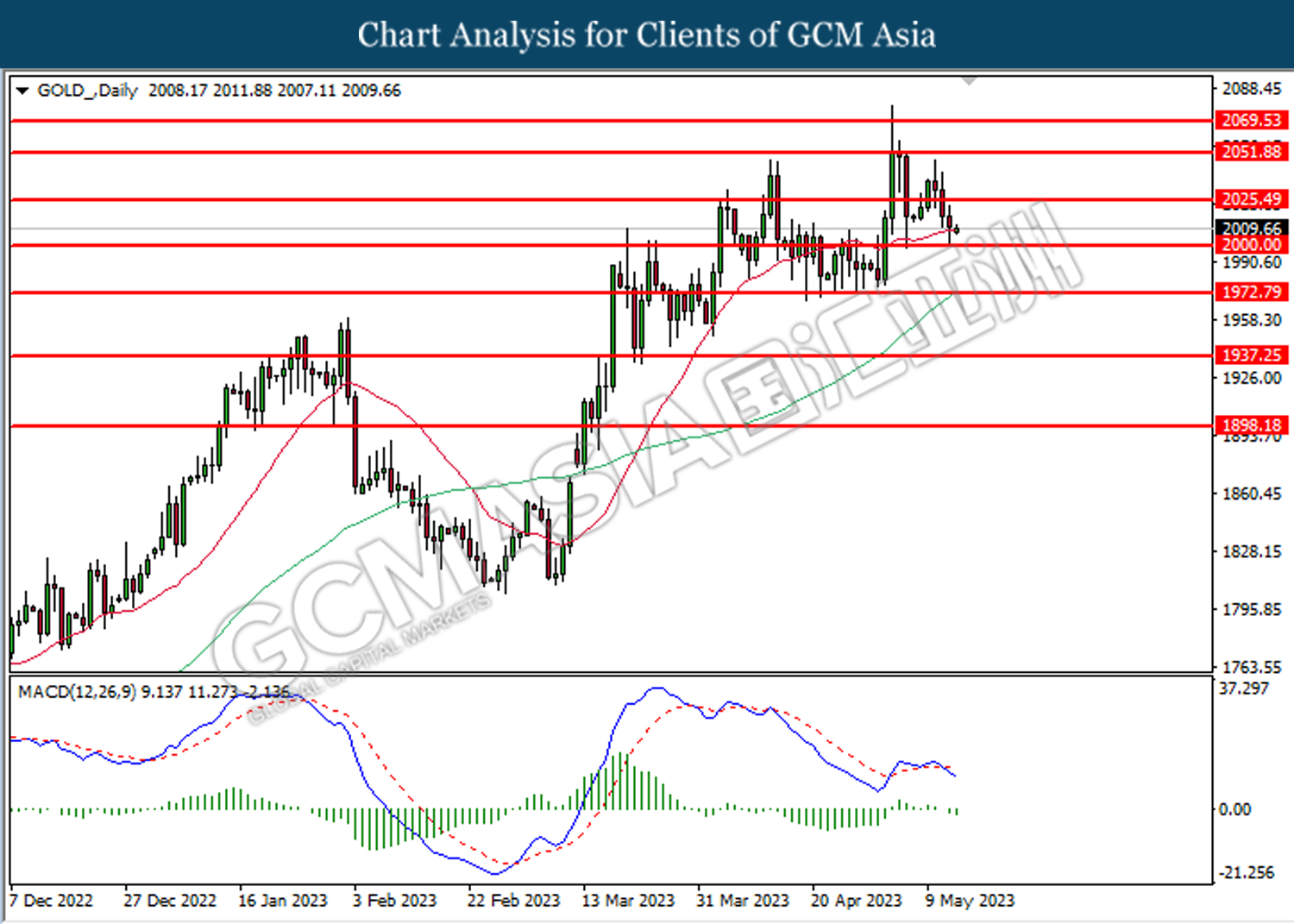

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 2000.00.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80