15 June 2022 Afternoon Session Analysis

US Dollar hovered at decade high while investors are eyeing on FOMC meeting.

The Dollar Index which traded against a basket of six major currencies hovered at new decade high as investors continue to eye on an aggressive rate hike from Federal Reserve. Currently the market expected that nearly 90% probability for a 75-basis-point increase in interest rate at the conclusion of two-day meeting on Wednesday, according to FedWatch Tool. With the rising stagflation risk and growth-related concerns continue to jeopardize the global economic, investors started to shift their portfolio toward safe-haven US Dollar. On the economic data front, the Producer Price Index (PPI) rose 0.8% for last month, doubling of the 0.4% reading in April. As for now, investors continue to scrutinize the latest updates with regards of the latest monetary policy decision to receive further trading signal for the US Dollar. As of writing, the Dollar Index appreciated by 0.02% to 105.30.

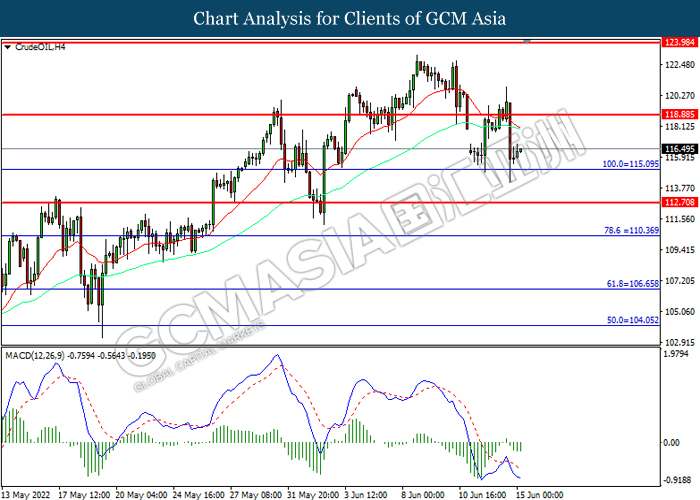

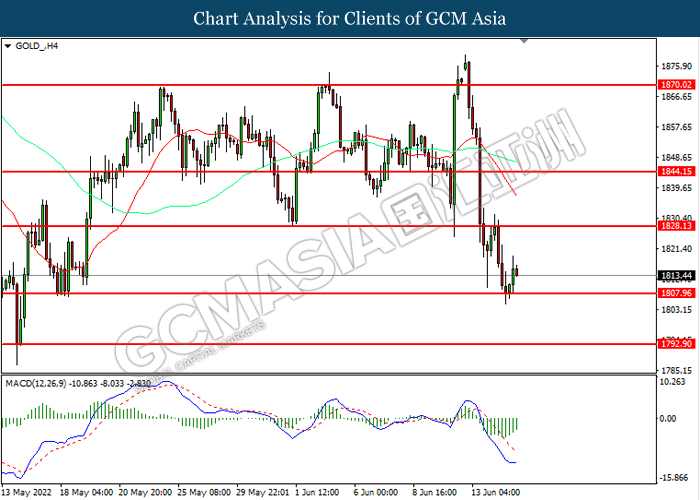

In the commodities market, the crude oil price depreciated by 0.01% to $116.40 per barrel as of writing. The oil market edged lower as OPEC delegates and industry sources forecasted that the world oil demand growth will slow down in 2023 as surging commodity prices recently continue to drive up the stagflation risk while dragging down the economic momentum in the world. On the other hand, the gold price surged 0.35% to $1814.35 per troy ounces as of writing amid technical correction. Though, the overall trend for the gold still remained bearish amid hopes upon the tightening monetary policy from global central bank.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.6% | 0.8% | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.9% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 2.025M | -1.917M | – |

Technical Analysis

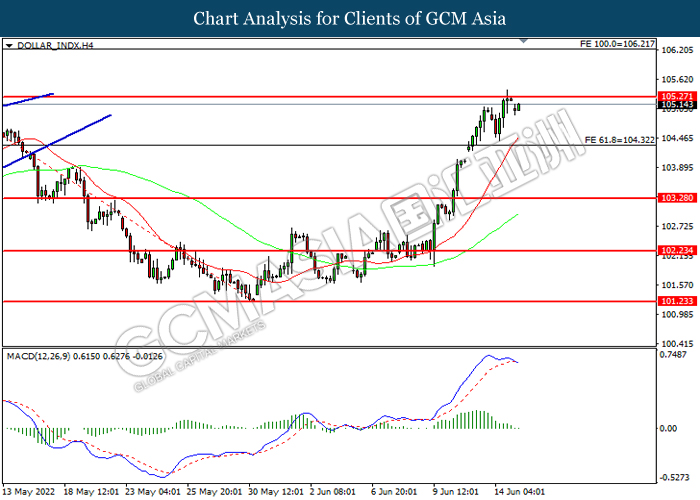

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 105.25, 106.20

Support level: 104.30, 103.30

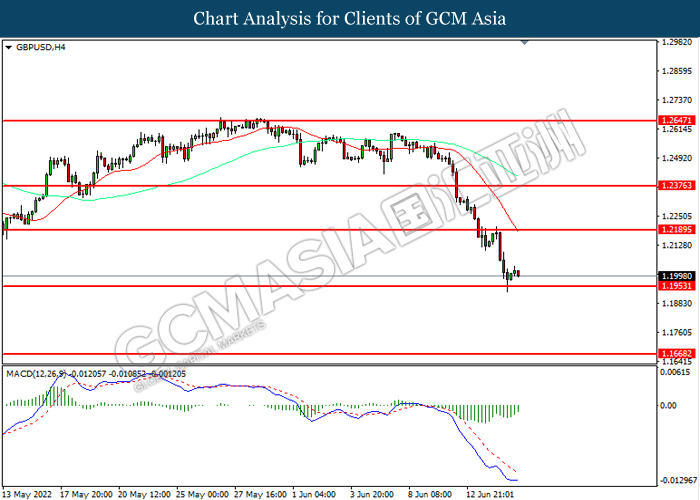

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2190, 1.2375

Support level: 1.1955, 1.1670

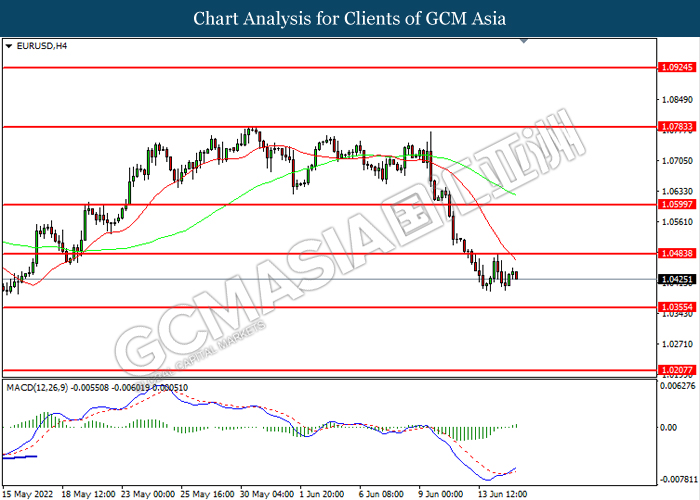

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0485, 1.0600

Support level: 1.0355, 1.0205

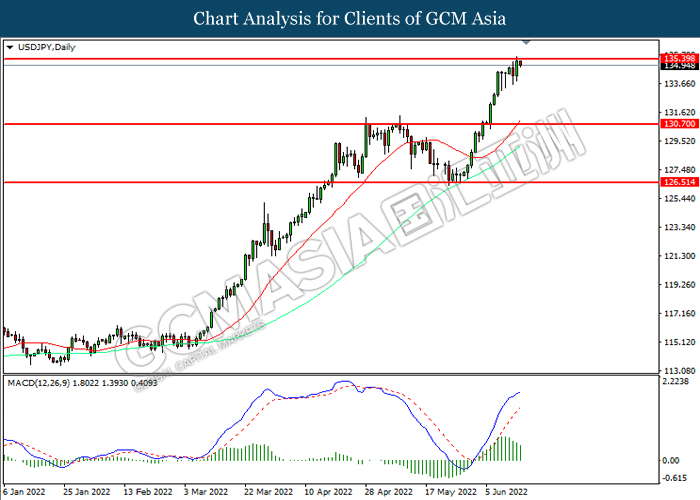

USDJPY, Daily: USDJPY was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.40, 140.00

Support level: 130.70, 126.50

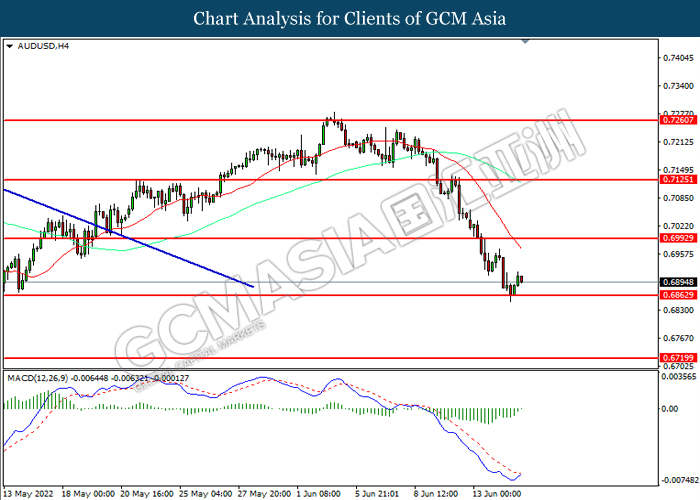

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7125

Support level: 0.6865, 0.6720

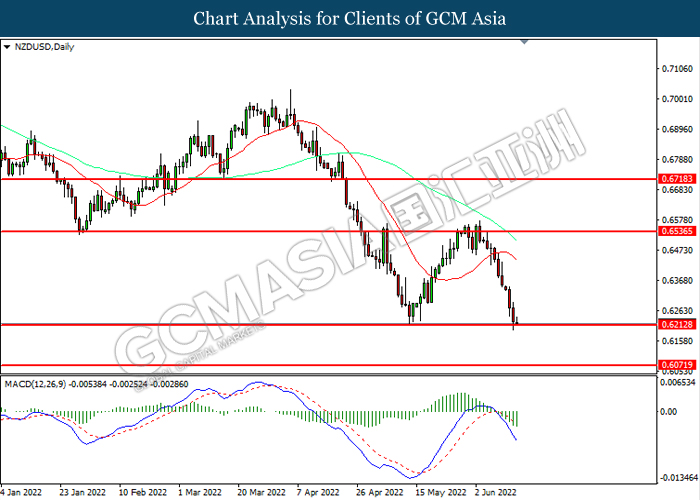

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6535, 0.6720

Support level: 0.6215, 0.6070

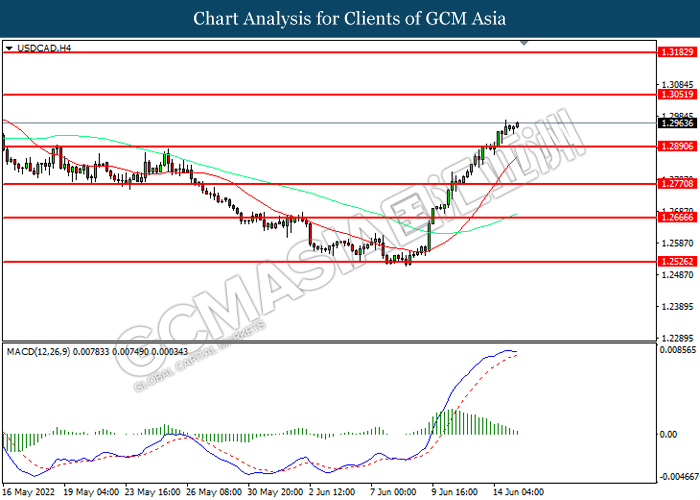

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2890, 1.2770

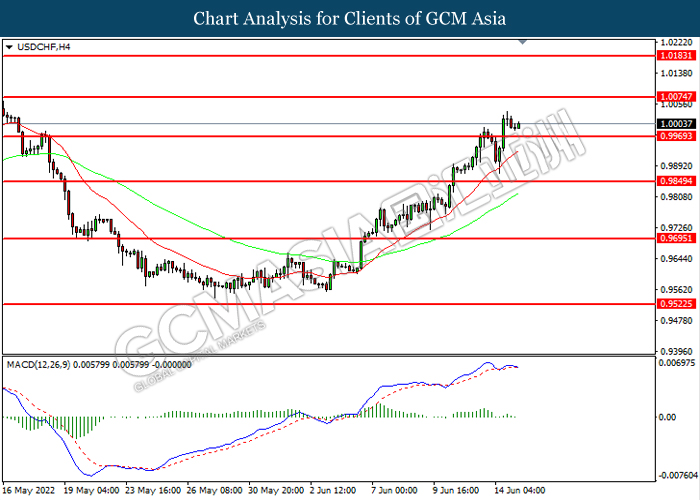

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 118.90, 124.00

Support level: 115.10, 112.70

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1828.15, 1844.15

Support level: 1807.95, 1792.90