15 June 2022 Morning Session Analysis

GBPUSD beaten down after the bearish economic data released.

The GBPUSD extended its losses on Tuesday amid the negative economic data was unleashed. According to Office for National Statistics, the UK Average Earnings Index +Bonus notched down from the previous reading of 7.0% to 6.8%, missing the market forecast of 7.6%. In addition to the data, the UK Claimant Count Change and UK Unemployment Rate had also given downbeat reading, which were -19.7K and 3.8%, higher than the economist expectation of 49.4K and 3.6% respectively. These downbeat data had showed that the UK labor market remained fragile, which would likely to bring negative prospects toward economic progression in UK. Thus, Bank of England (BoE) would less likely to implement rate hike in the upcoming meeting, which dialed down the market optimism toward Pound Sterling. Nonetheless, investors should continue to scrutinize the latest updates with regards of the interest rate decisions of BoE which will be announced on Thursday in order to gauge the likelihood movement of the pair. As of writing, GBPUSD edged up by 0.08% to 1.2003.

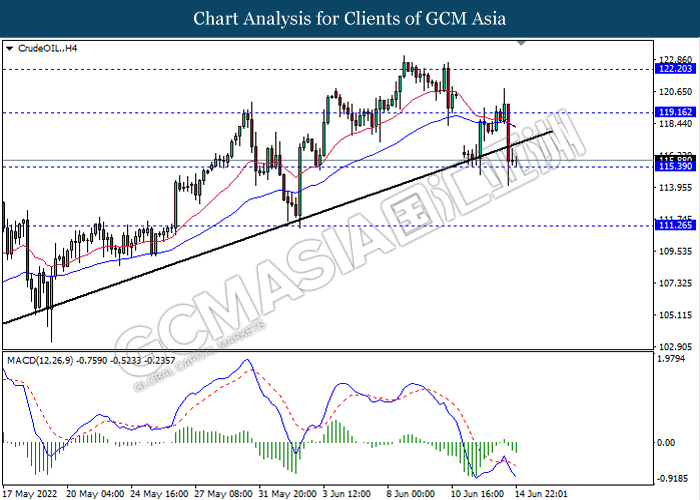

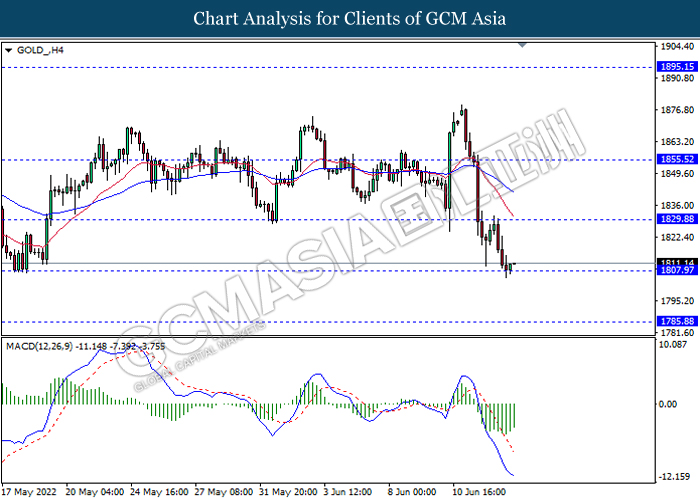

In the commodities market, crude oil price depreciated by 0.50% to $118.33 per barrel as of writing over the fears on US Federal Reserve will surprise markets with a higher-than-expected interest rate hike. On the other hand, gold price eased by 0.25% to $1808.90 per troy ounce as of writing following the rising of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.6% | 0.8% | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.9% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 2.025M | -1.917M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.90, 106.95

Support level: 104.80, 103.65

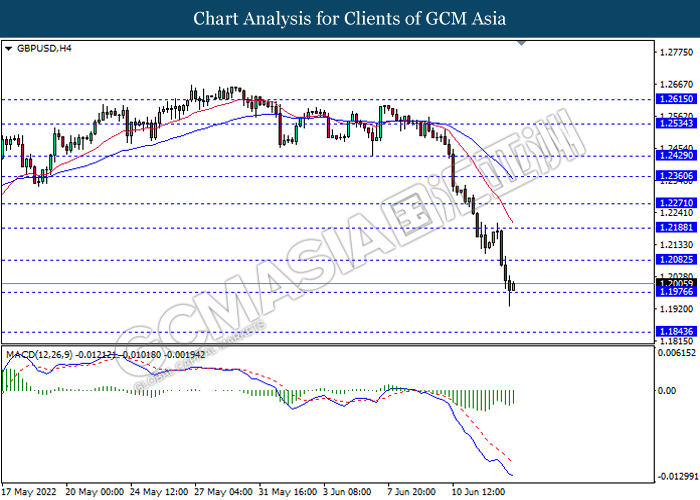

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2080, 1.2190

Support level: 1.1975, 1.1845

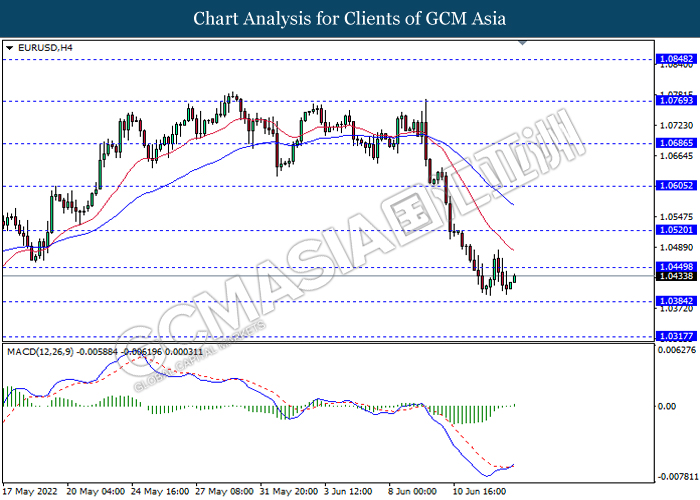

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0450, 1.0520

Support level: 1.0385, 1.0315

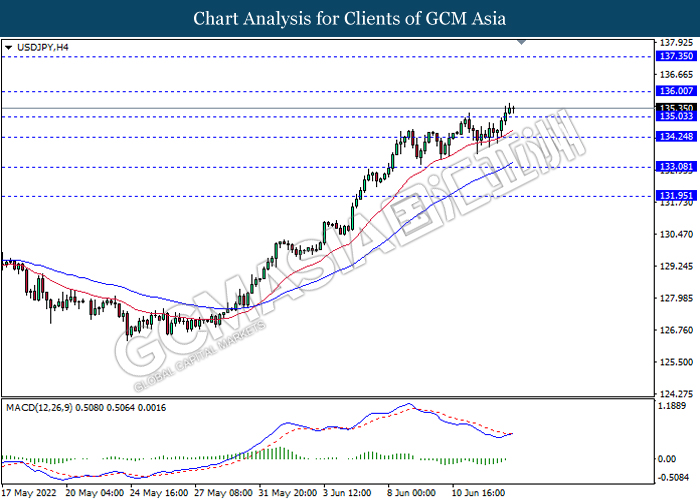

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 136.00, 137.35

Support level: 135.05, 134.25

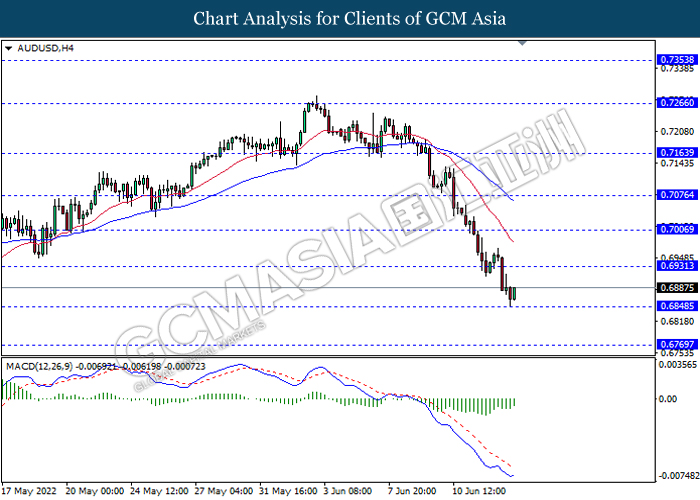

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

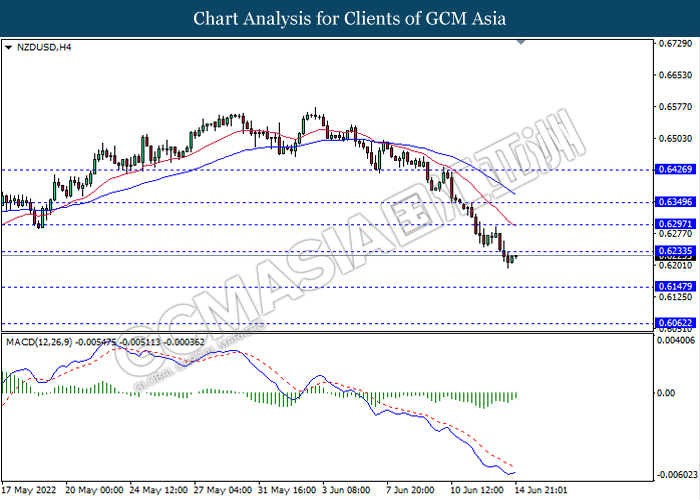

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3000, 1.3165

Support level: 1.2875, 1.2765

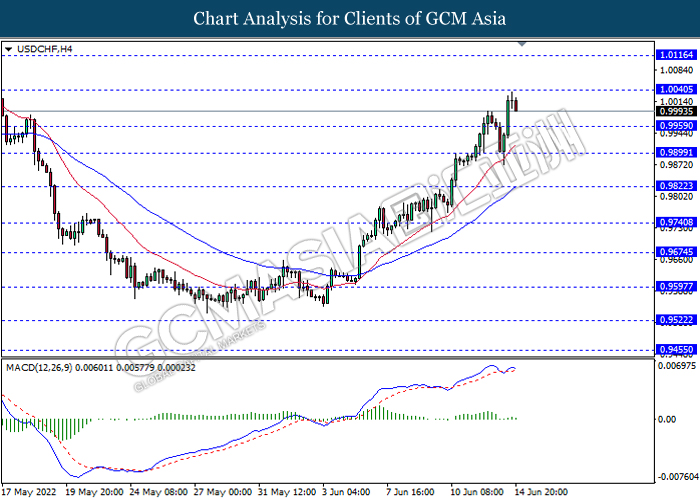

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0040, 1.0115

Support level: 0.9960, 0.9900

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 119.15, 122.20

Support level: 115.40, 111.25

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1829.90, 1855.50

Support level: 1807.95, 1785.90