15 June 2023 Morning Session Analysis

The dollar index slipped as the Fed pause rate as expected.

The dollar index, which was traded against a basket of six major currencies, slipped as the Fed pause rate as expected. Before that, the greenback was trading under heavy selling pressure from global investors after the producer price index (PPI) fell more than expected last month. PPI fell to -0.3% in May from 0.2% in April, while the core PPI was in line with consensus expectations for an unchanged 0.2% month-on-month. The readings were driven by a decline in energy and food prices and decelerated for 11 consecutive months since December 2020. As a result, it cemented that the Fed will have a pause on its interest rate decision announced late in the day. The dollar index extended its losses after the Fed passed the interest rate as widely expected. However, the losses of the greenback were limited by a hawkish speech from Fed President Jerome Powell. The central issued a new projection that suggested interest rates were likely to rise by another half of a percentage due slowing decline in inflation. The core Personal Consumption Expenditures (PCE) index, the Fed’s preferred measure of inflation has held steady for the past six months. Since the labor market remains in strength, inflation is expected to continue. As of writing, the dollar index slipped to 103.00.

In the commodities market, crude oil inched up 0.41% to $68.53 a barrel after falling in the previous session. Crude prices declined after a hawkish statement from Fed. Besides, gold prices traded up by 0.13% to $1944.40 per troy ounce as of writing, as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 10:00 | CNY – Industrial Production (YoY) (May) | 5.6% | 3.8% | – |

| 10:00 | CNY – Chinese Unemployment Rate (May) | 5.2% | 5.2% | – |

| 20:15 | EUR – Deposit Facility Rate (Jun) | 3.25% | 3.50% | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jun) | 3.75% | 4.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Initial Jobless Claims | 261K | 250K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | -10.4 | -13.5 | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.4% | -0.1% | – |

Technical Analysis

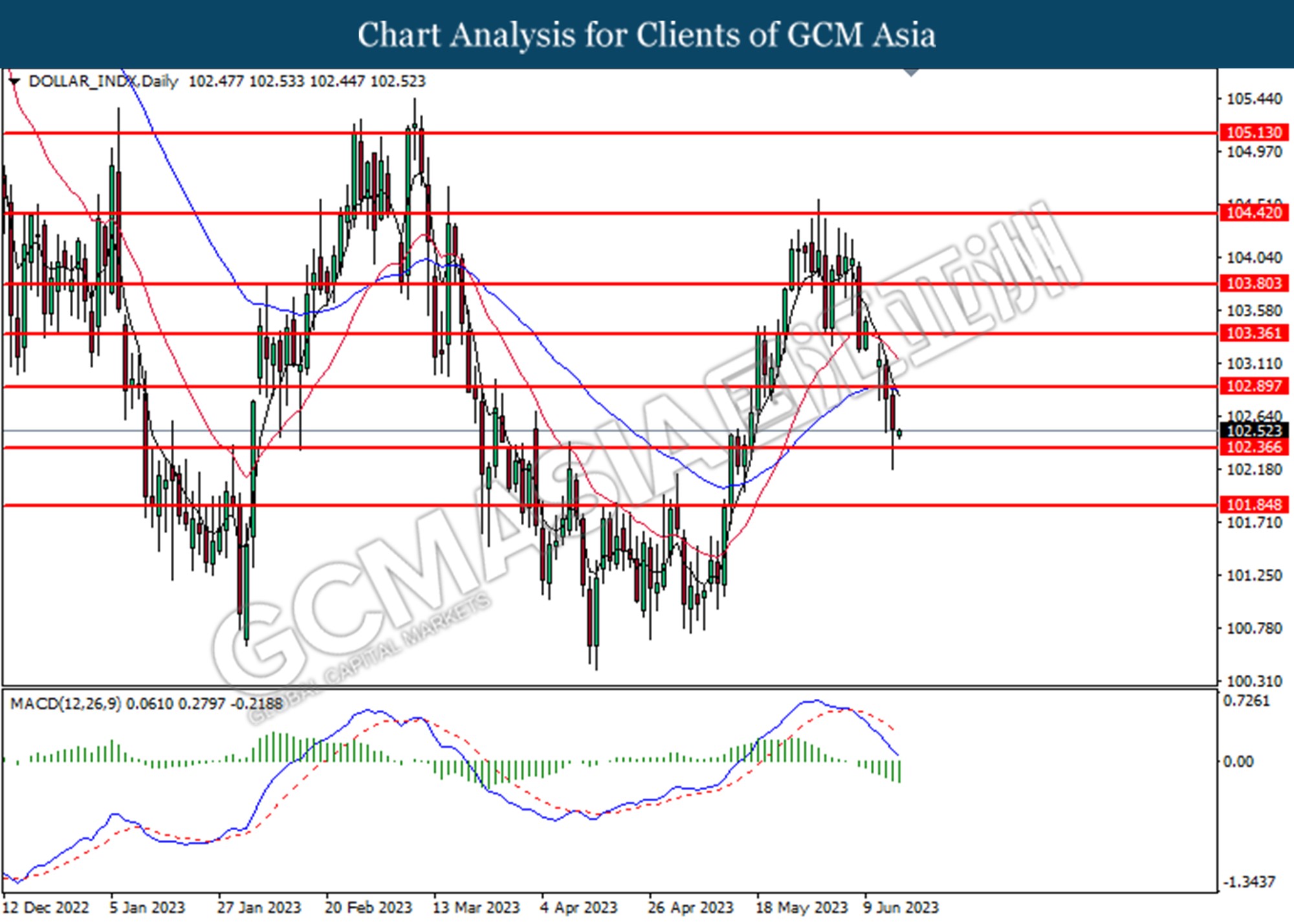

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 102.35. However, MACD which illustrated increasing bearish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

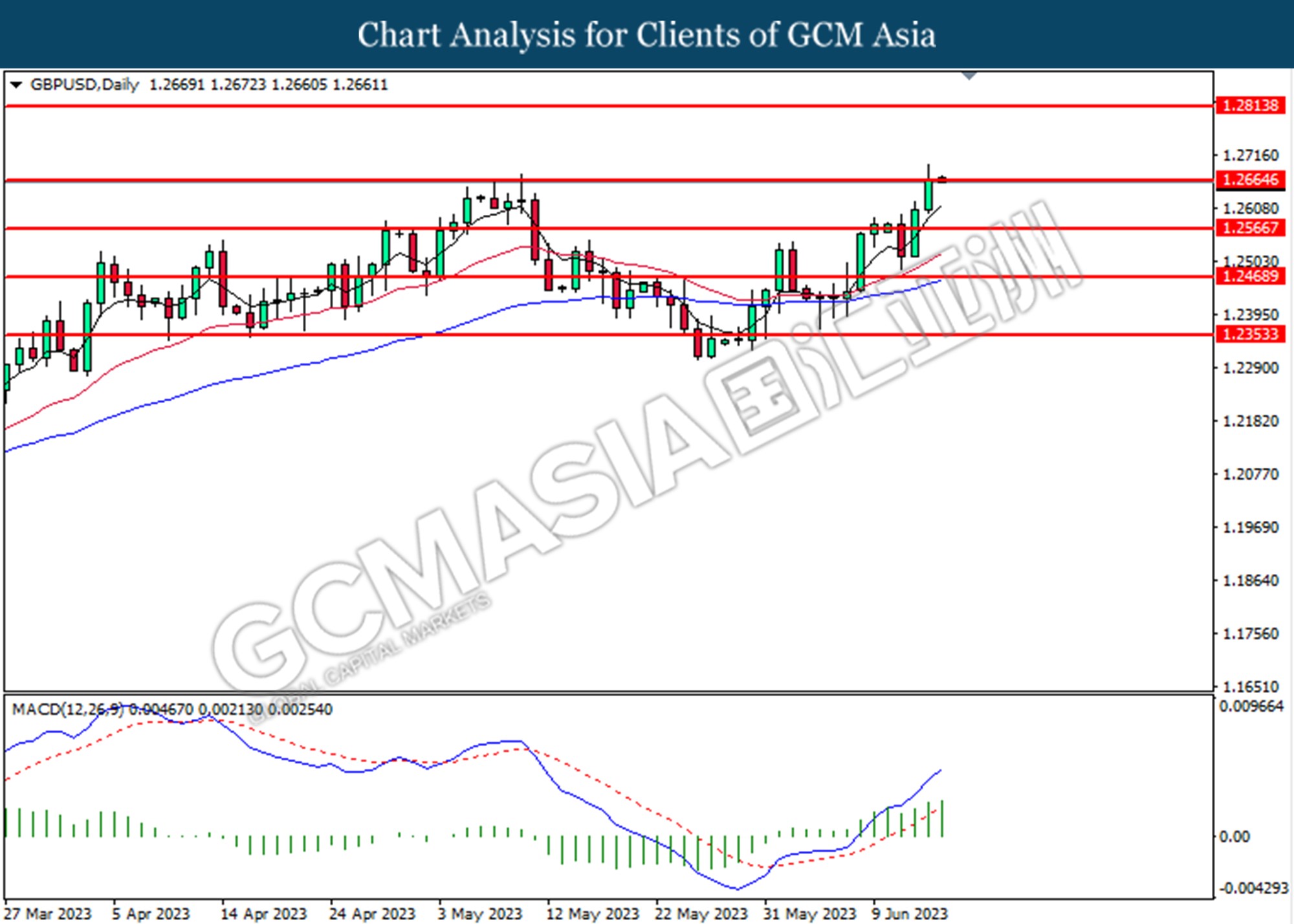

GBPUSD, Daily: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2665. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2665, 1.2815

Support level: 1.2565, 1.2470

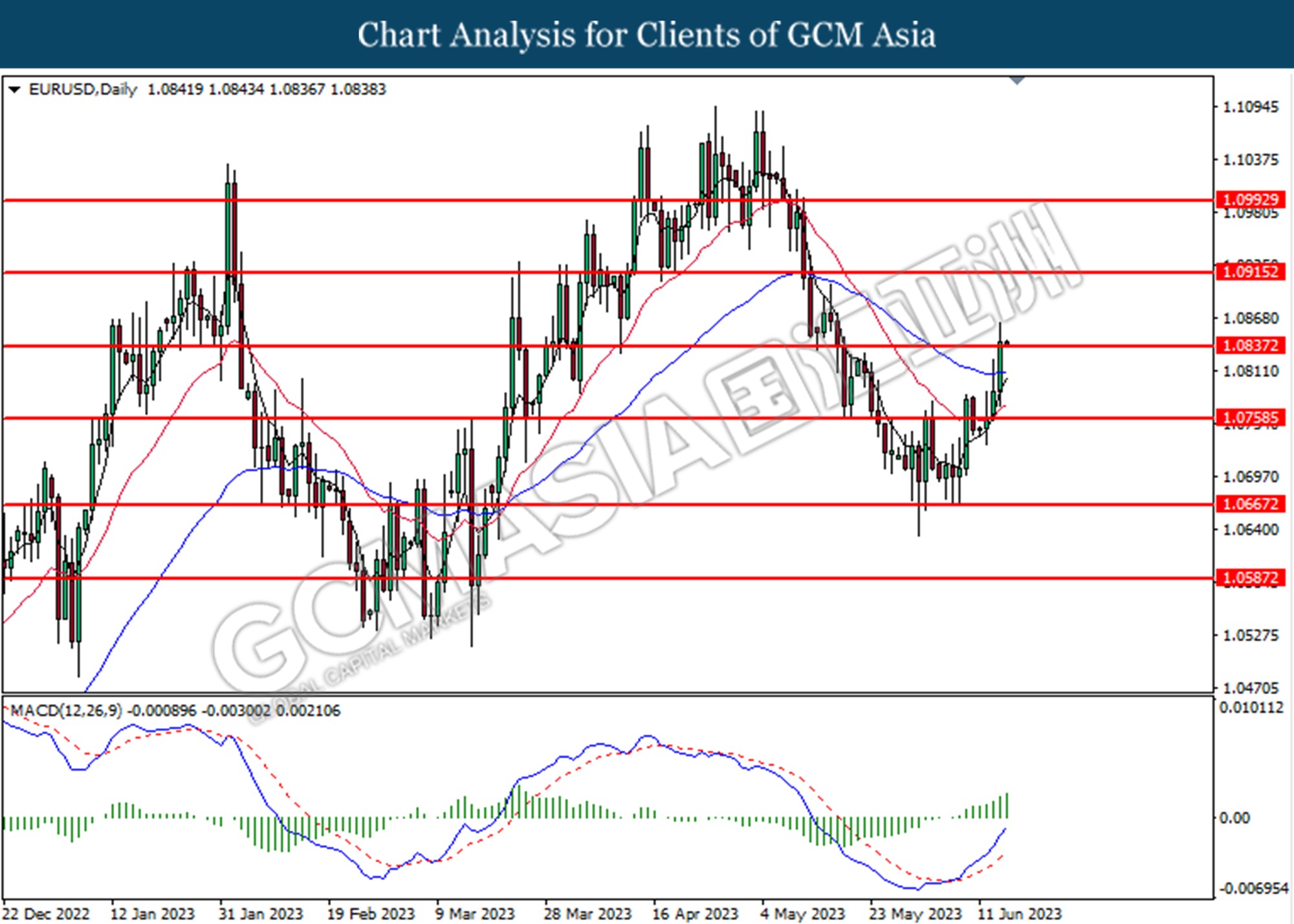

EURUSD, Daily: EURUSD was traded lower while currently testing for the support level at 1.0840. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.0915 1.0990

Support level: 1.0840, 1.0760

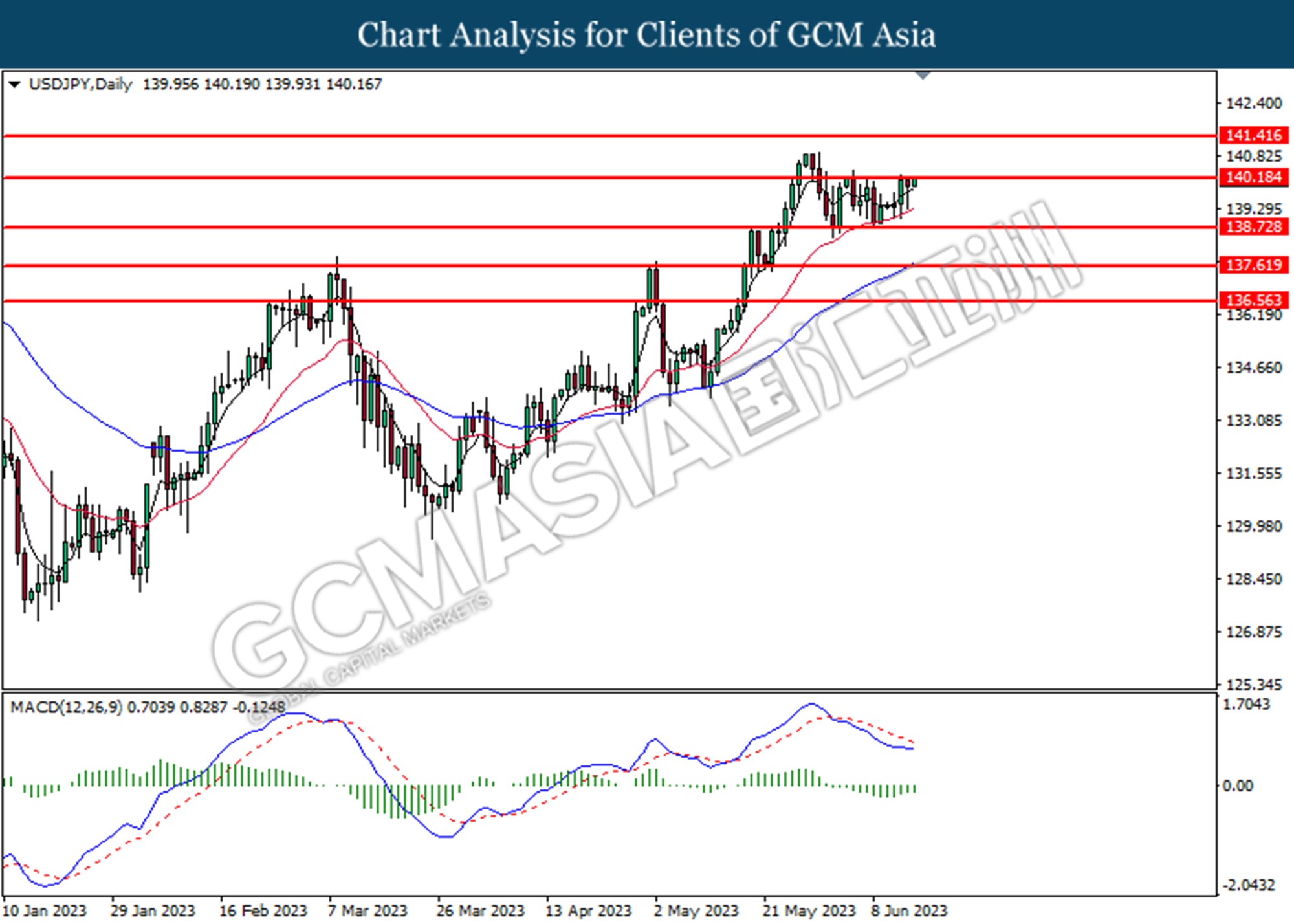

USDJPY, Daily: USDJPY was traded higher while currently testing from the resistance level at 140.20. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

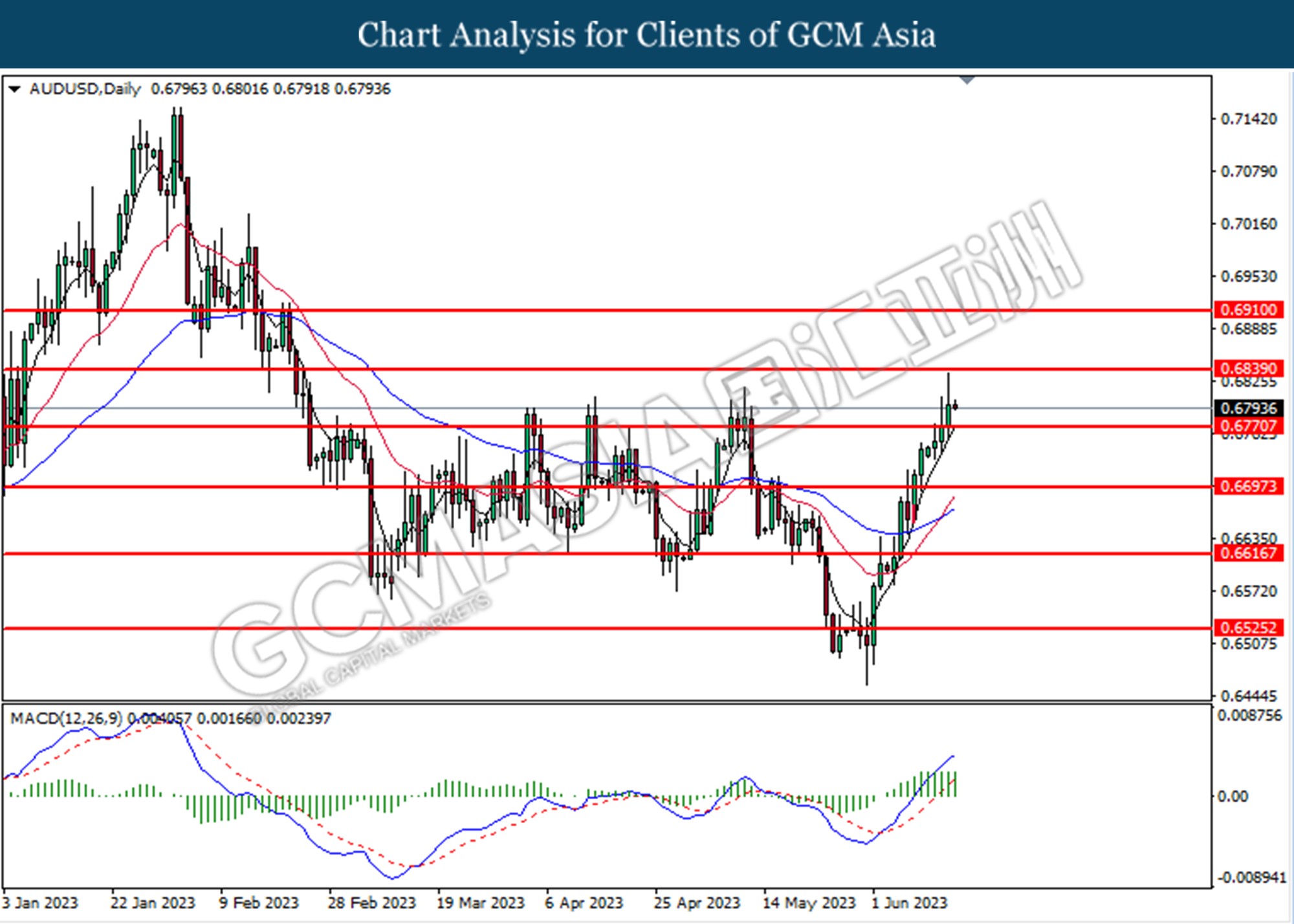

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6840. However, MACD which illustrated bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0,6840, 0.6910

Support level: 0.6770, 0.6700

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to traded higher as technical correction.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3300. MACD which illustrated diminishing bearish momentum suggests the pair extend its gains toward the resistance level at 1.3335

Resistance level: 1.3335, 1.3375

Support level: 1.3300, 1.3265

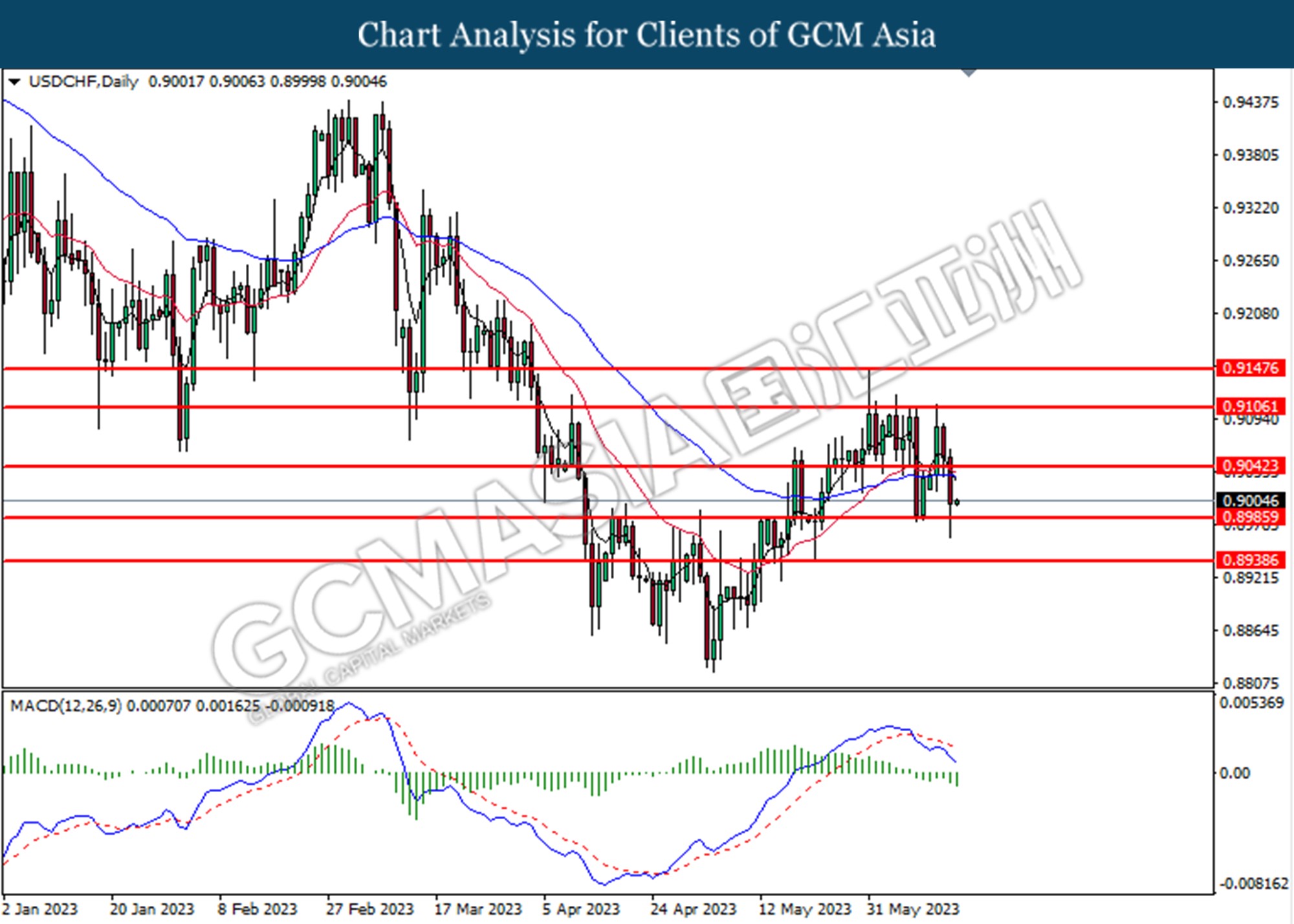

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.9040. However, MACD which illustrated increasing bearish momentum suggests the pair traded lower as technical correction.

Resistance level: 0.9040, 0.9105

Support level: 0.8985, 0.8940

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 69.30. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

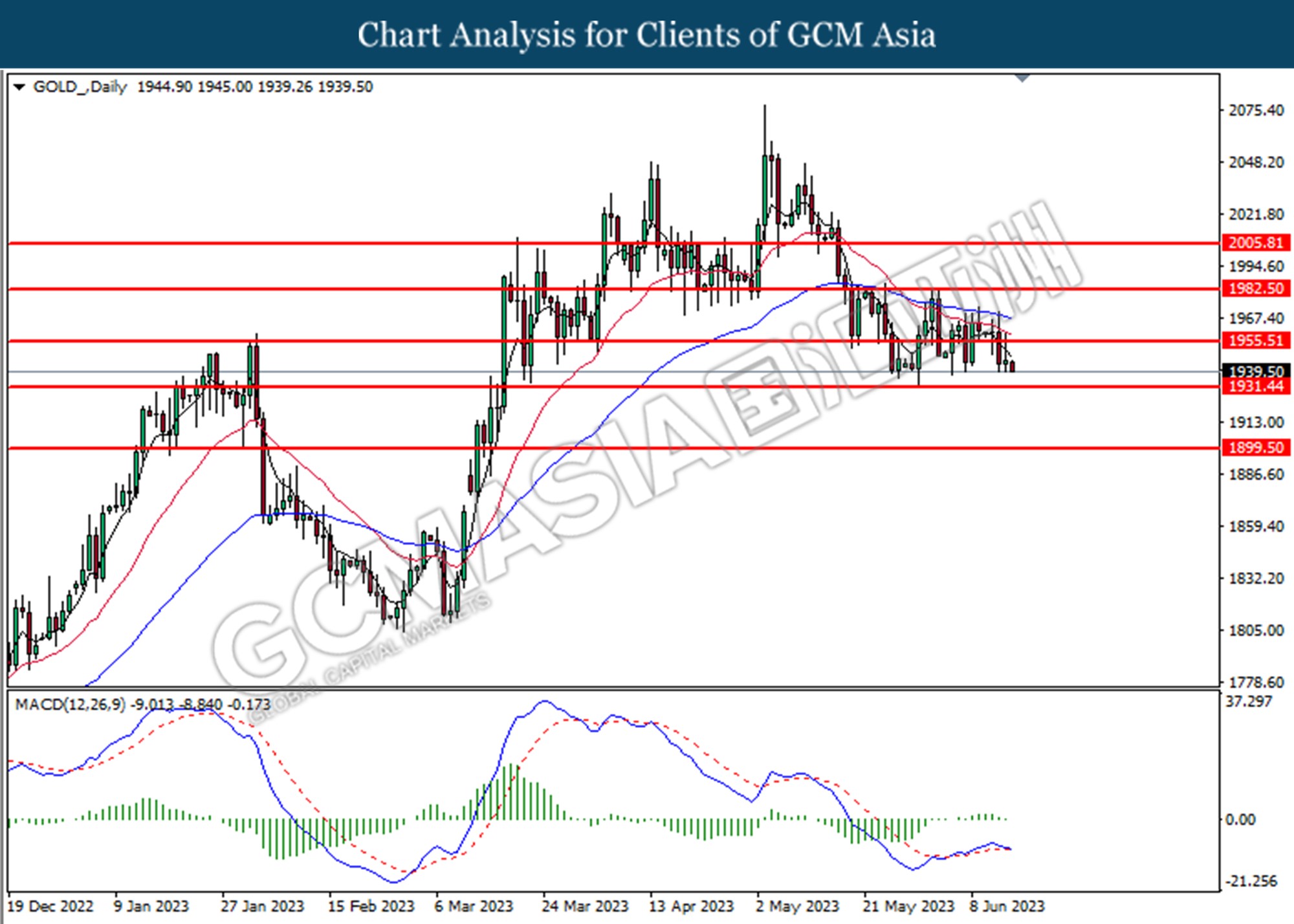

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1955.50. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1930.45, 1899.50