15 July 2022 Afternoon Session Analysis

Geopolitical uncertainty tampered with the sentiment of euro market.

The Euro, which is traded by the majority of investors across the globe, slumped as the rising geopolitical risk in the European region continues to drag down the appeal of the currency. According to Washington Post, Italy hit a period of dizzying political turbulence Thursday, with Prime Minister Mario Draghi saying that he would resign and make way for a new government following the 5-Star movement – the largest party in the country’s coalition government withdrew its support in a parliamentary confidence vote. Investors viewed Prime Minister Mario Draghi as a crucial guarantor of economic stability in the European financial market, such sentiment had triggered further concerns for economic momentum in European. On the other hand, the heightening of market concern over the energy crisis further pressured the value of the single currency, which urged the Europe currency dropped below the parity of 1:1 against the US Dollar. As of writing, the pair of EUR/USD rebounded slightly by 0.07% to 1.0022.

In the commodities market, the crude oil price dropped 0.75% to $92.85 as the appreciation of the US dollar left the oil expensive to buy for global oil buyers. Besides, the gold prices eased by 0.10% to $1712.50 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | 0.5% | 0.6% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | -0.3% | 0.8% | – |

Technical Analysis

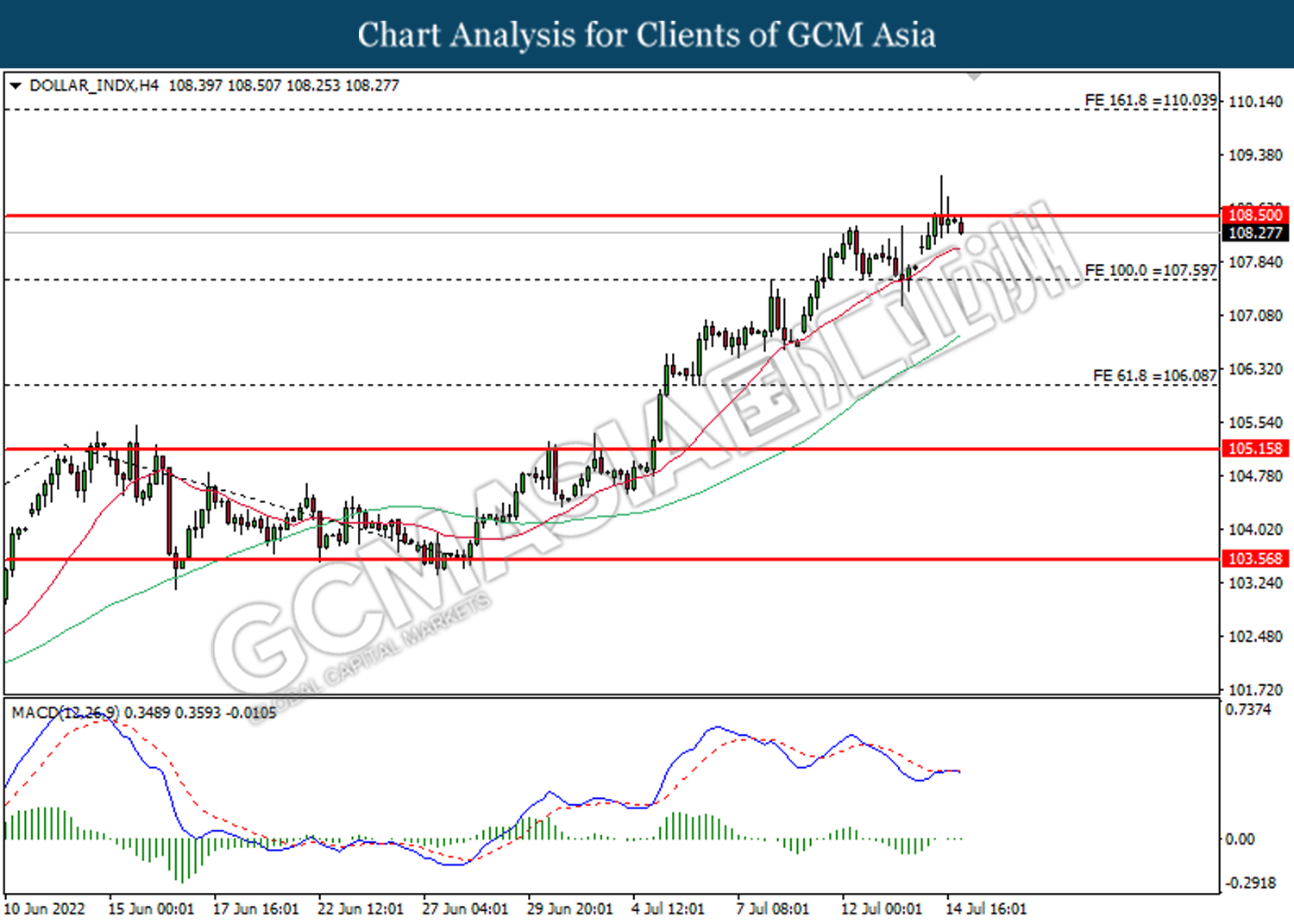

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 108.50. Due to lack of signal from the MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 108.50, 110.05

Support level: 107.60, 106.10

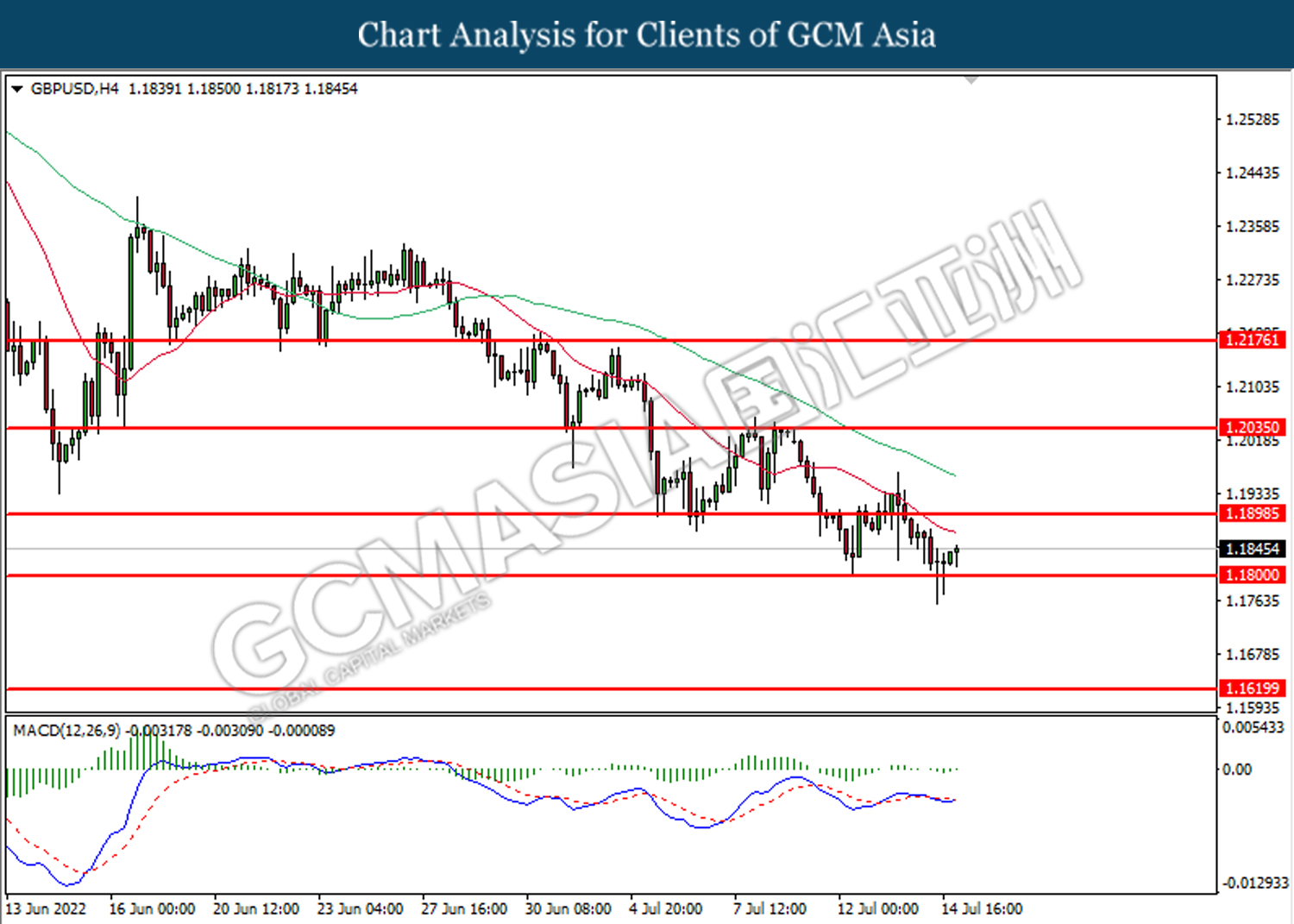

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.1800. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1900.

Resistance level: 1.1900, 1.2035

Support level: 1.1800, 1.1620

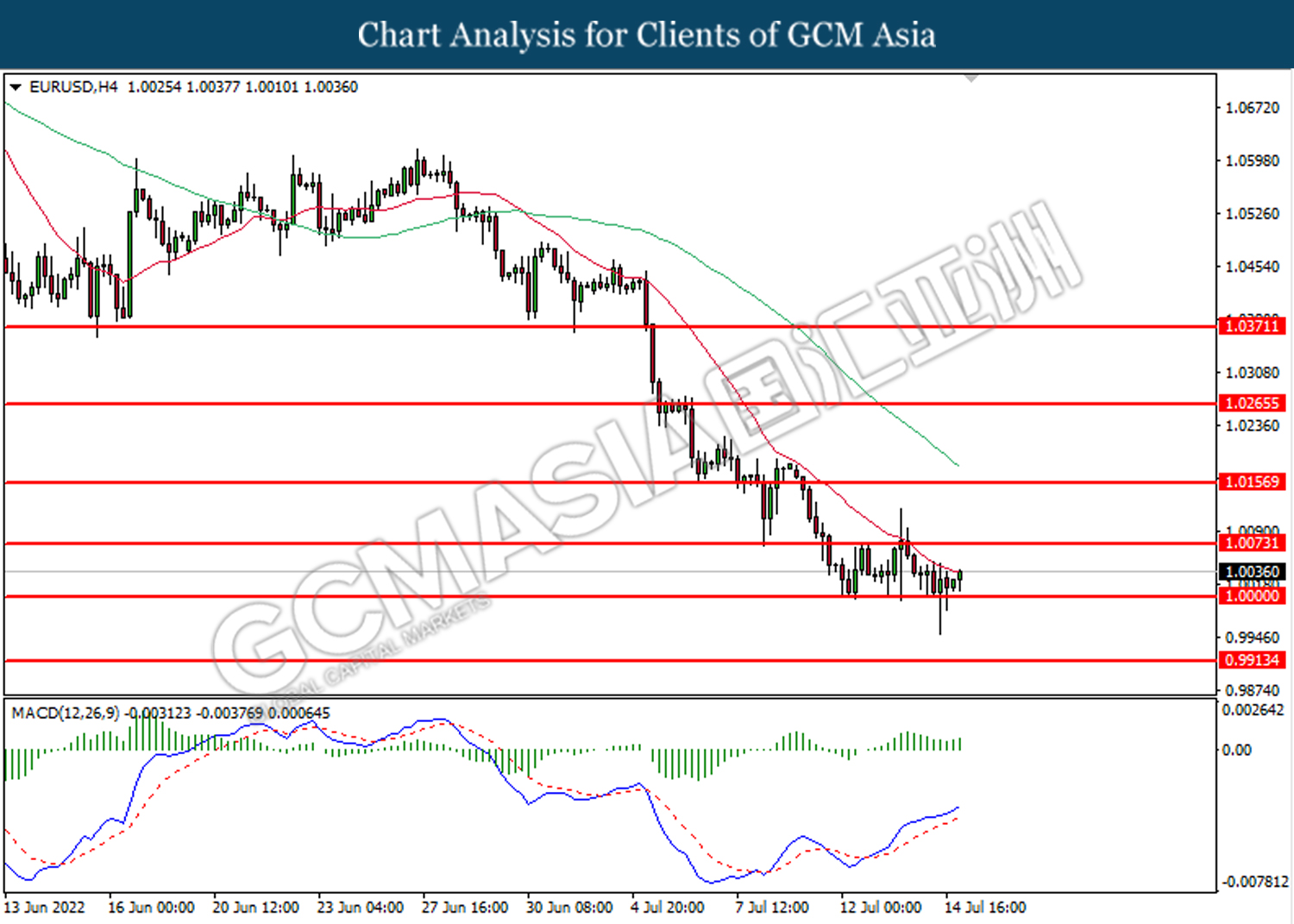

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0075.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

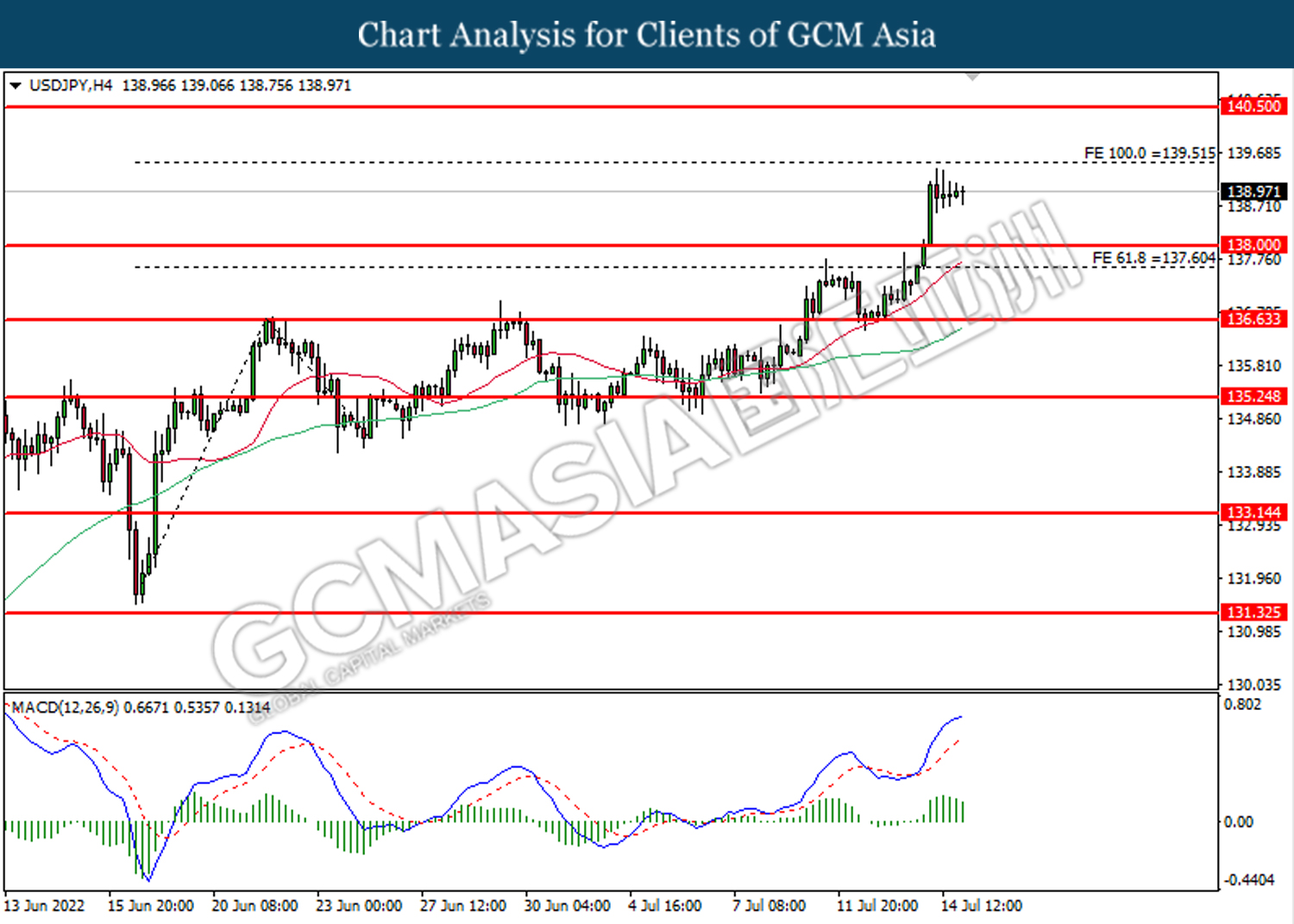

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 139.50. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 138.00.

Resistance level: 139.50, 140.50

Support level: 138.00, 137.60

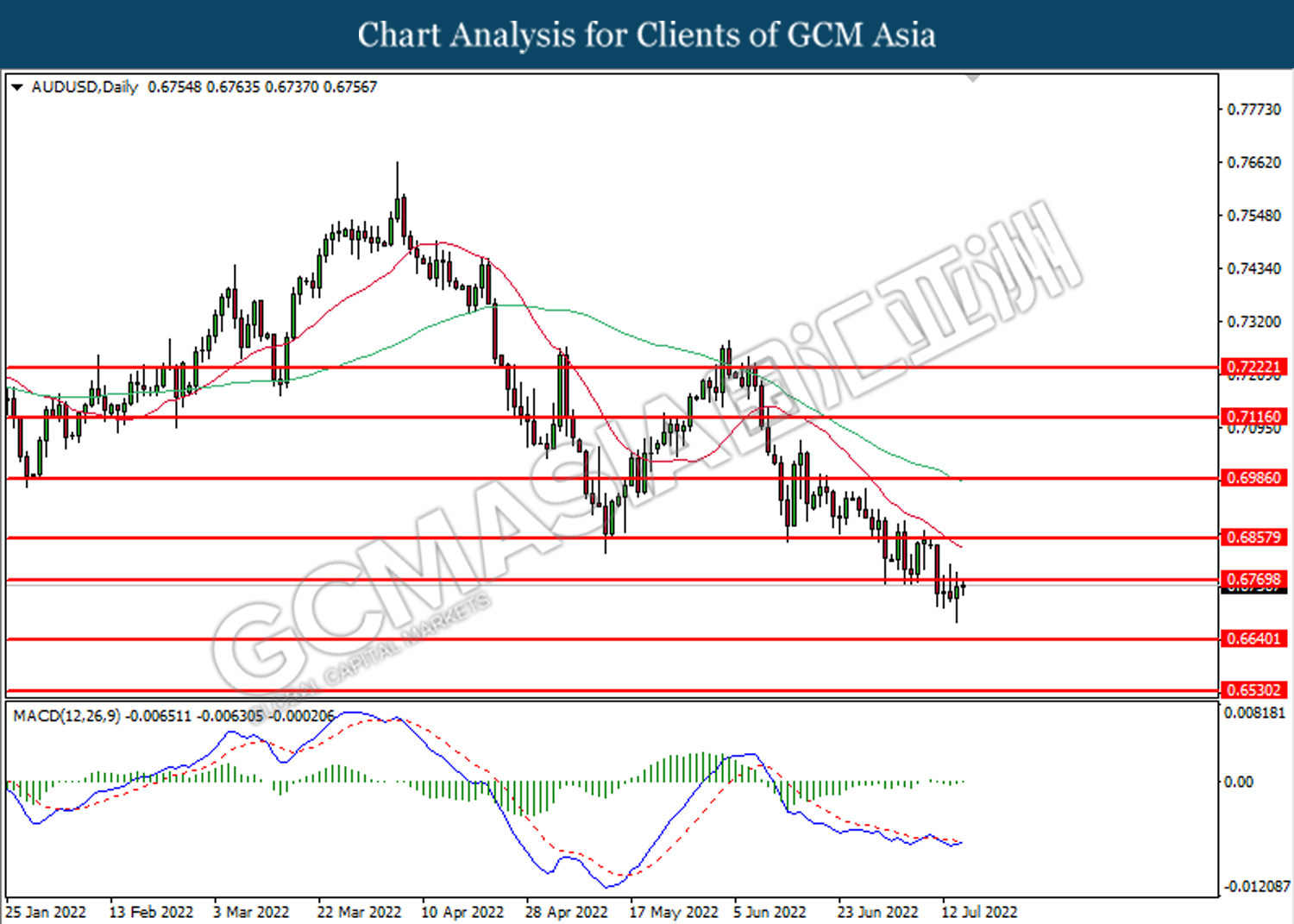

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6770. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6770.

Resistance level: 0.6770, 0.6855

Support level: 0.6640, 0.6530

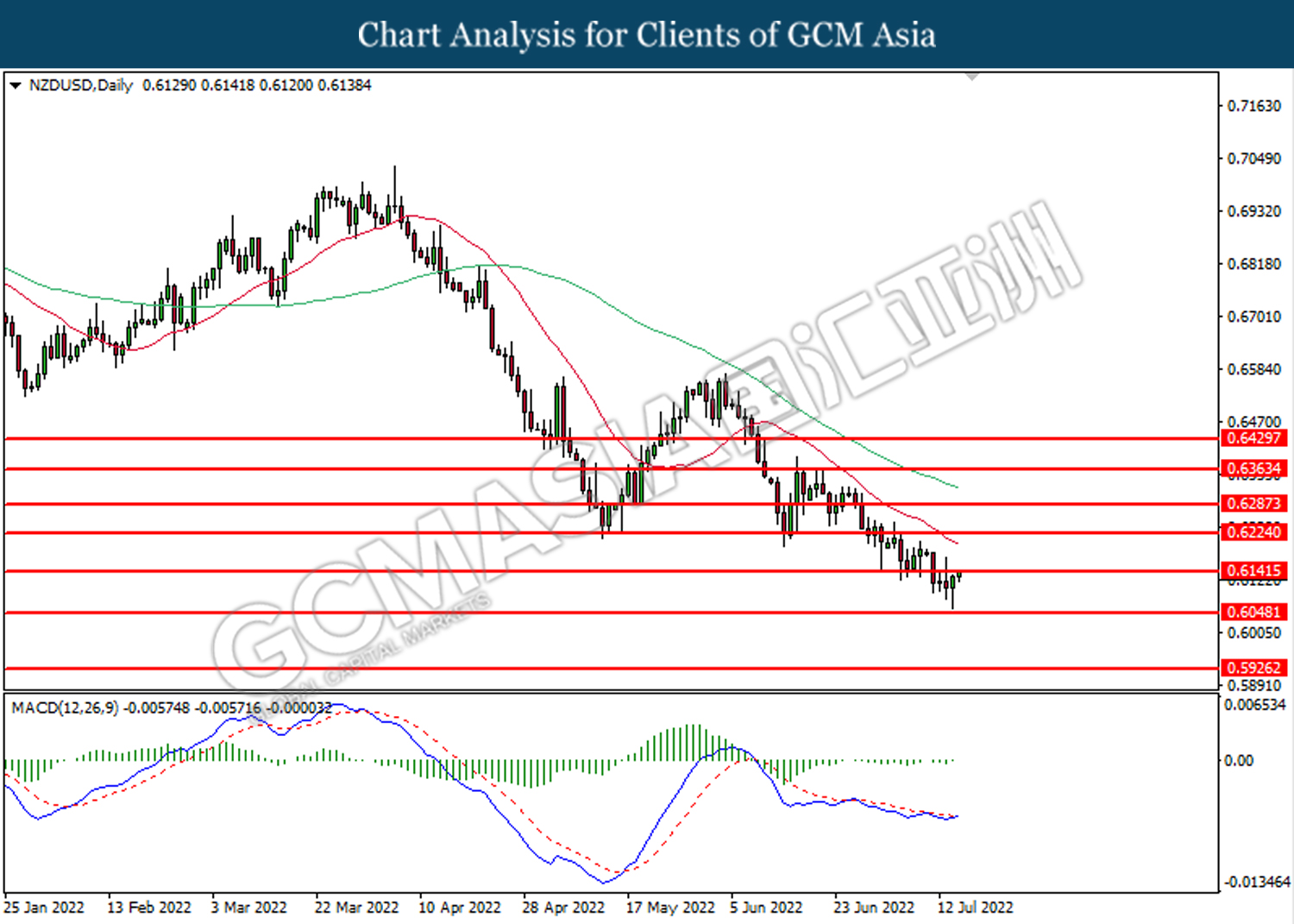

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6140, 0.6225

Support level: 0.6050, 0.5925

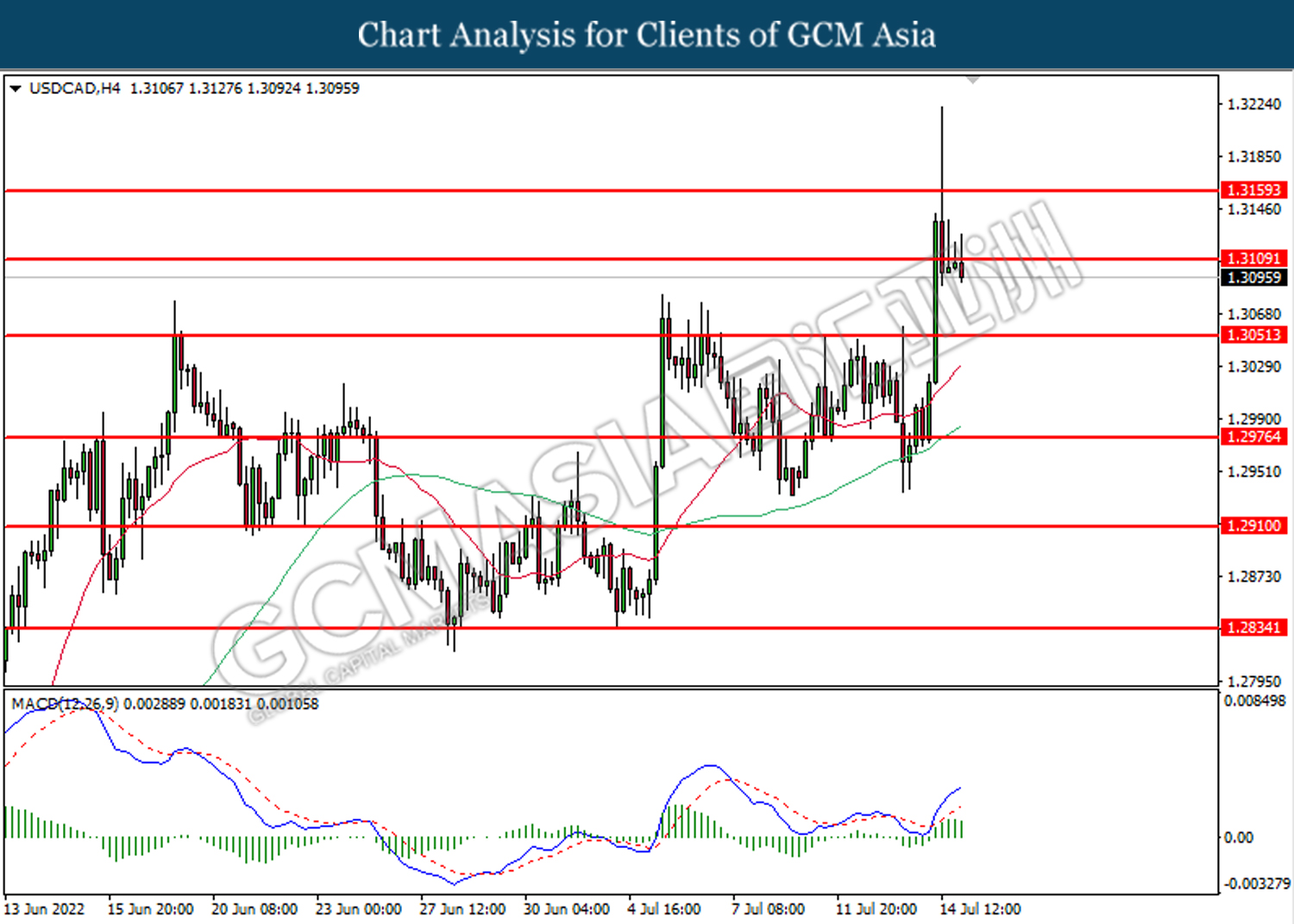

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3110. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3050.

Resistance level: 1.3110, 1.3160

Support level: 1.3050, 1.2975

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9825. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9750.

Resistance level: 0.9825, 0.9890

Support level: 0.9750, 0.9665

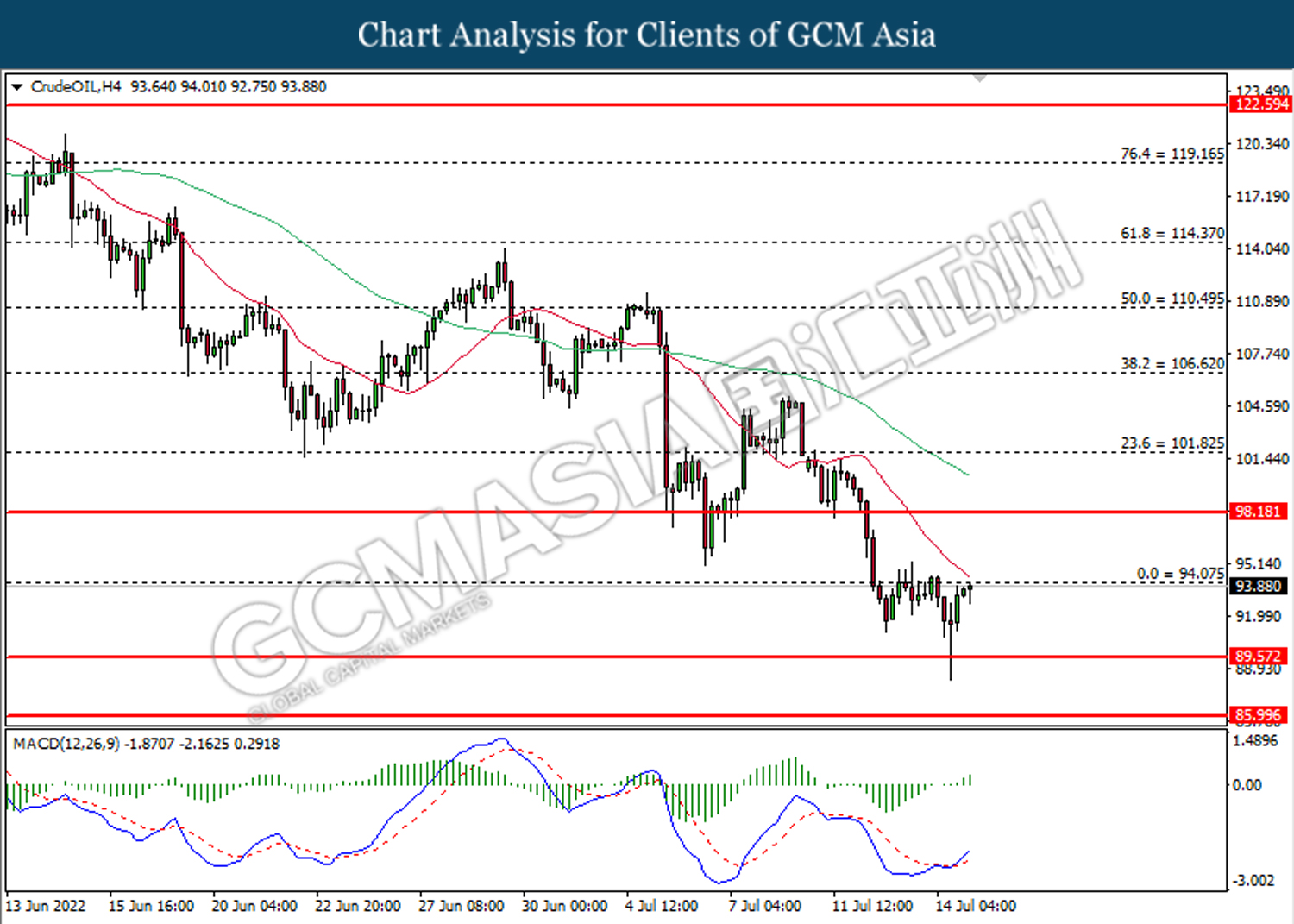

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 94.05. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 94.05.

Resistance level: 94.05, 98.20

Support level: 89.55, 86.00

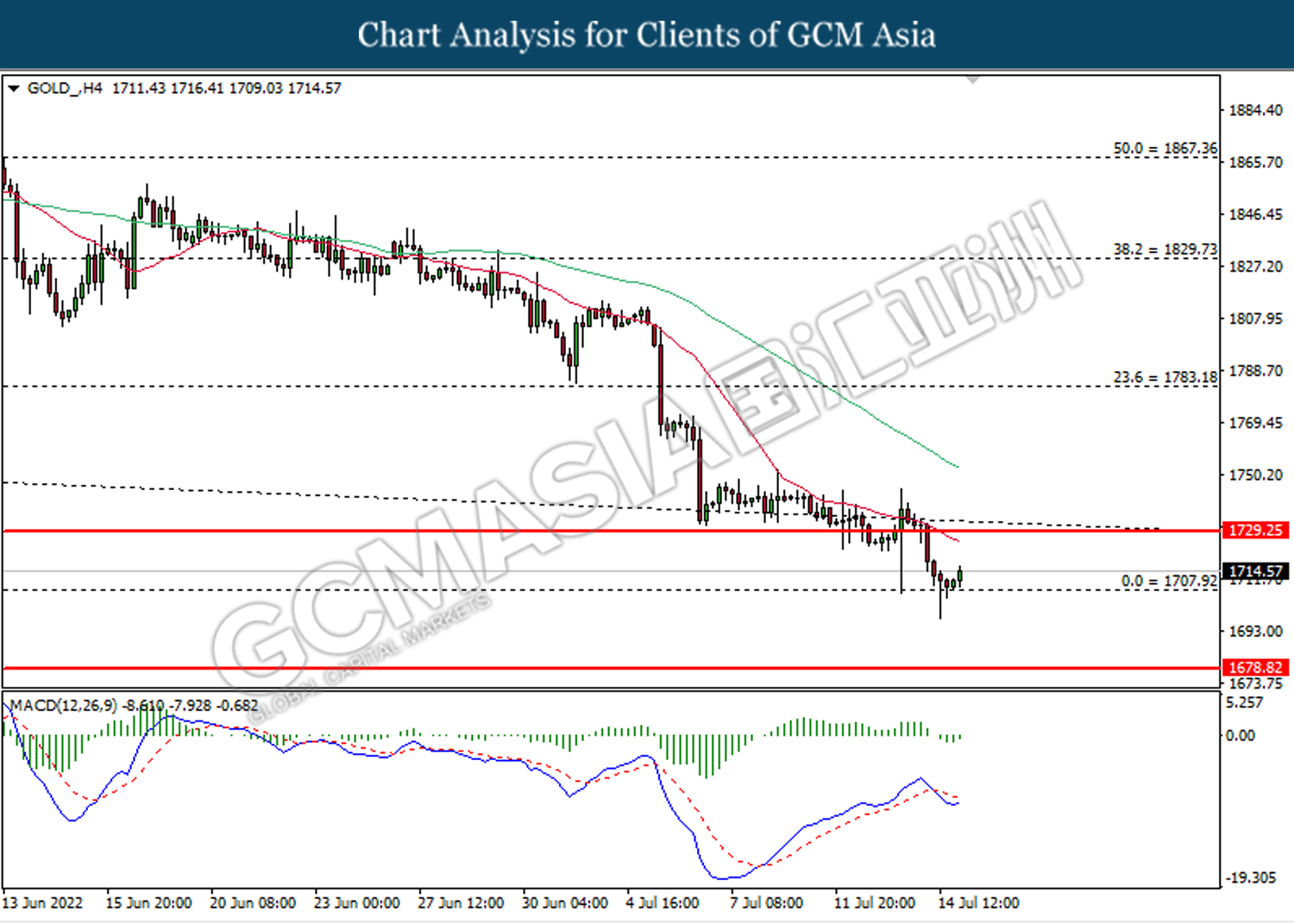

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80