15 September 2022 Morning Session Analysis

Expectation upon currency intervention from BoJ, Yen rebounded.

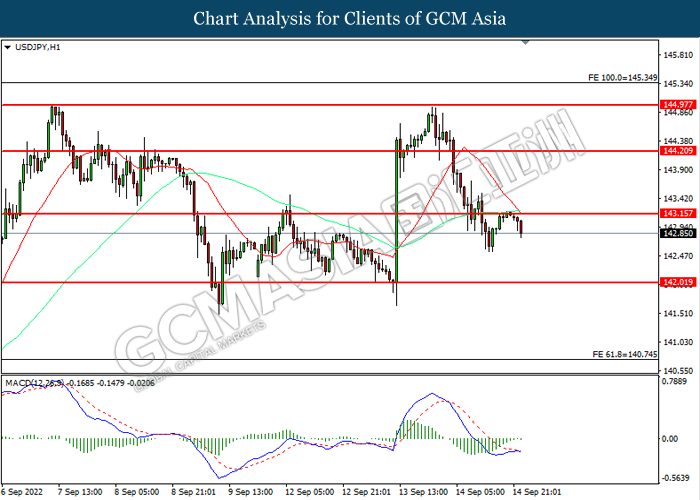

The Japanese Yen started to rebound from the 24-year low overnight amid expectation upon the currency intervention from Bank of Japan. According to Reuters, the Bank of Japan could conduct a rate check with banks in apparent preparation to stabilize the recent depreciation from Japanese Yen. Though, Finance Minister Shunichi Suzuki claimed that the authorities would make no advance announcement of plans to intervene, heightens uncertainty for firms and traders in making business decisions. Though, investors would still continue to scrutinize the latest updates from the Bank of Japan to receive further trading signal. Recently, the Japanese Yen has depreciated nearly 30% this year following the Bank of Japan (BoJ) continue to maintain its ultra-loose monetary policy, in contrast with its global peers. As of writing, the pair of USD/JPY slumped 0.14% to 142.95.

In the commodities market, the crude oil price extends its gains amid investors speculated that the manufacturing firm would start to substitute the natural gas into crude oil following Russia restrict natural gas supply into European region. On the other hand, the gold price extends its losses by 0.01% to $1697.55 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Aug) | 0.40% | 0.20% | – |

| 20:30 | USD – Initial Jobless Claims | 222K | 225K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Sep) | 6.2 | 3.5 | – |

| 20:30 | USD – Retail Sales (MoM) (Aug) | 0.00% | 0.20% |

Technical Analysis

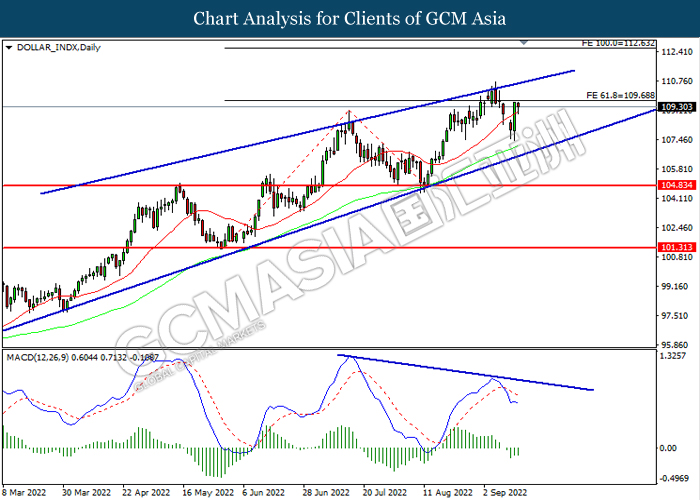

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

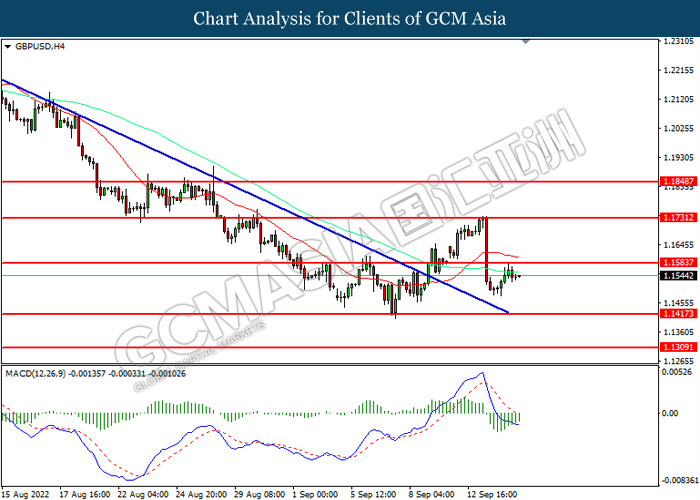

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

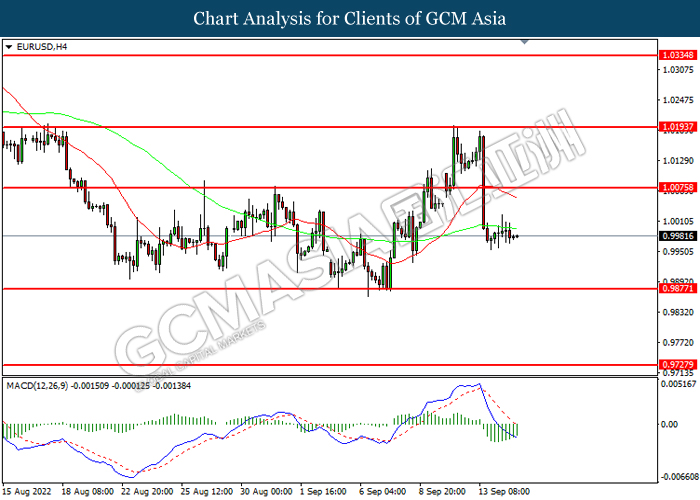

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0075, 1.0190

Support level: 0.9875, 0.9775

USDJPY, H1: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 143.15, 144.20

Support level: 142.00, 140.75

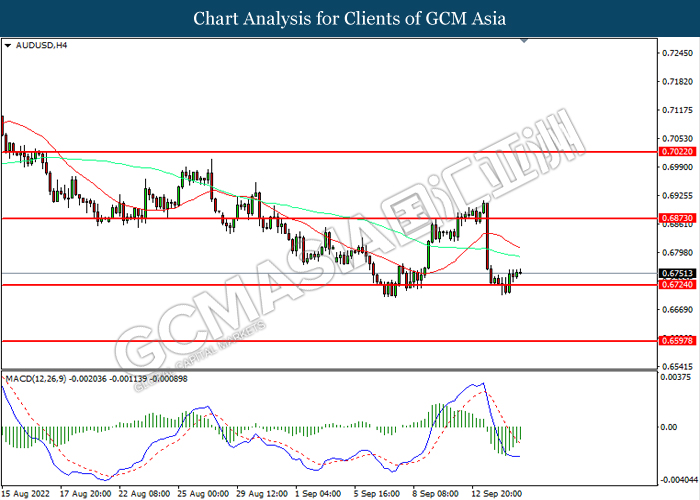

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

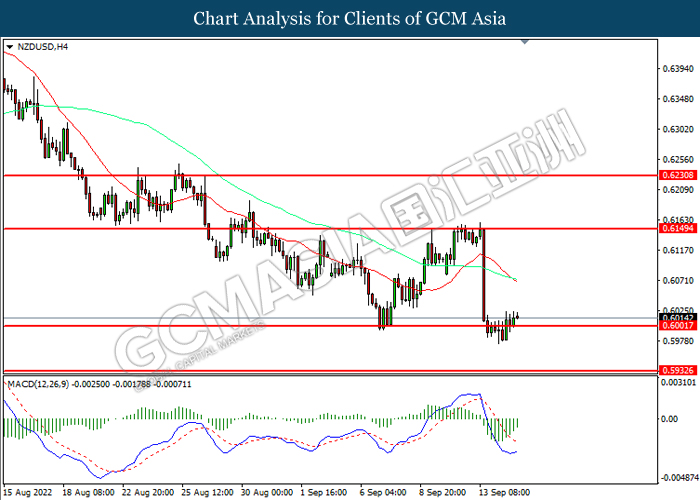

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6150, 0.6230

Support level: 0.6000, 0.5935

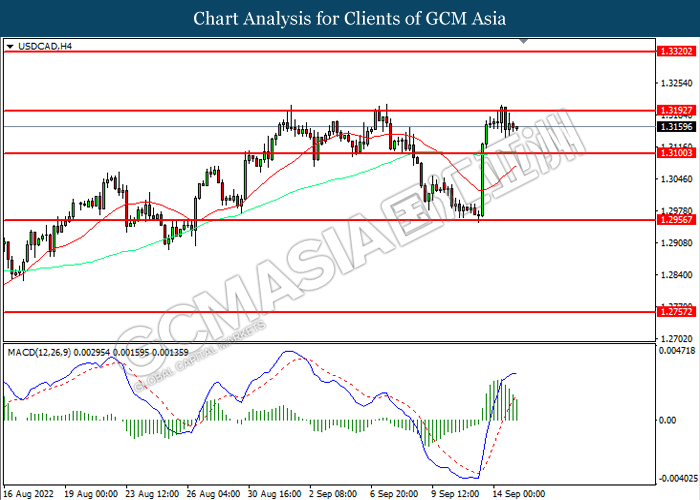

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3195, 1.3320

Support level: 1.3100, 1.2955

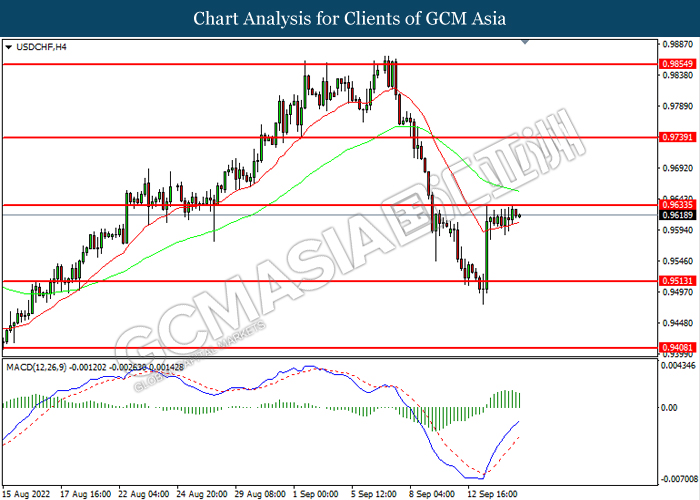

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

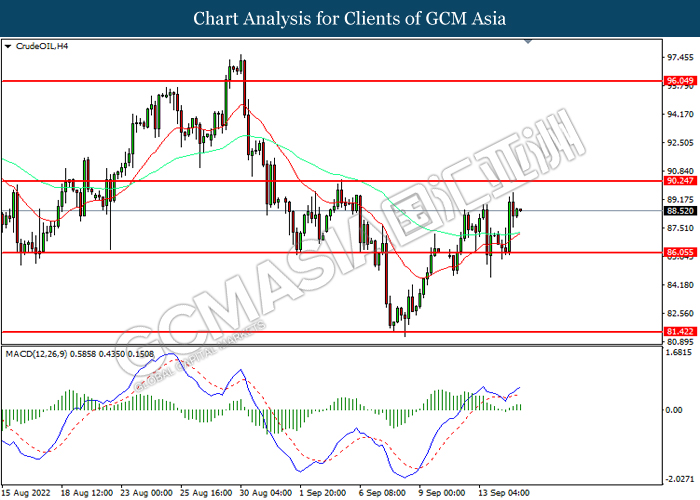

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 90.25, 96.05

Support level: 86.05, 81.40

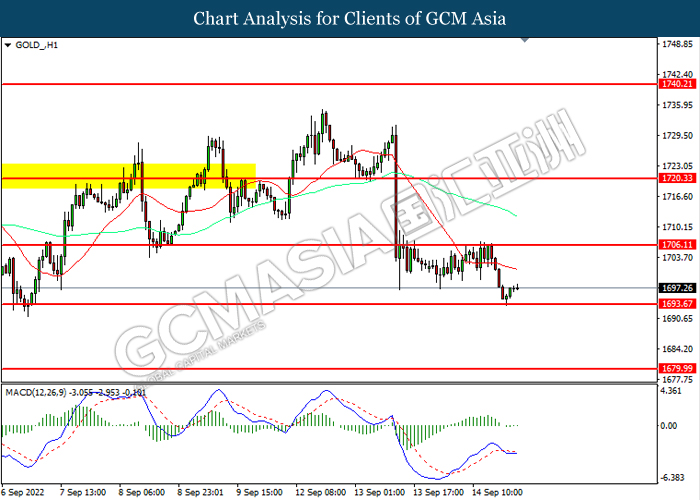

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1706.10, 1720.35

Support level: 1693.65, 1680.00