15 November 2022 Afternoon Session Analysis

Japanese Yen slumped amid downbeat GDP data.

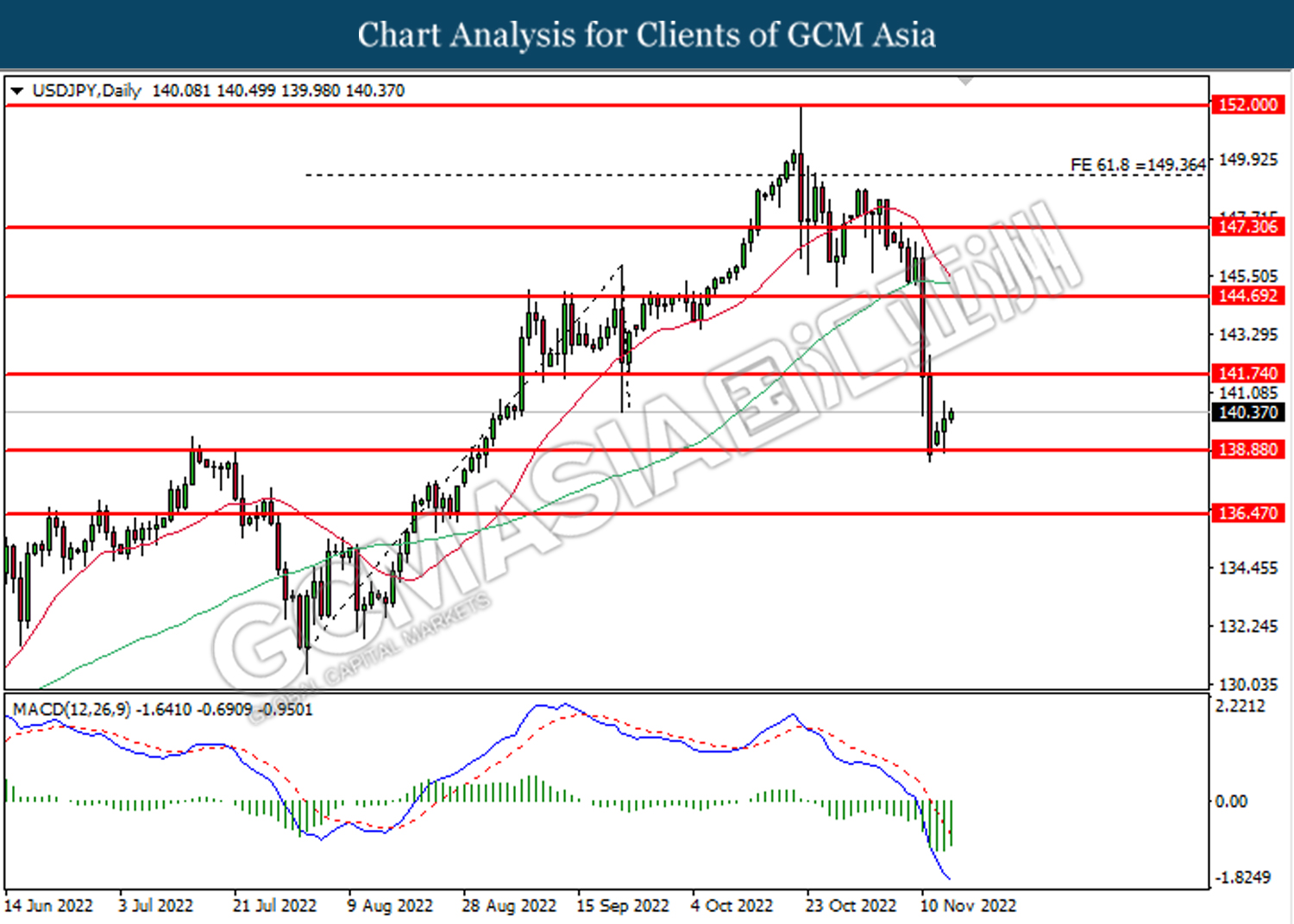

The Japanese Yen, which is majorly traded by global investors, experienced a huge sell-off pressure right after the downbeat GDP data was released this morning. According to Japan’s Cabinet Office, the GDP for the third quarter of 2022 came in at -0.3%, far lower than the consensus forecast of 0.3%, mirroring that Japan’s economy was still trapped in the recessionary stage. The unexpected shrinking of the economy was mainly attributed to the yen’s historic slide, which had battered growth momentum, leaving the country’s recovery from the pandemic in a vulnerable spot. Despite this, the future outlook of the Japanese economy turns brighter as the reopening of Japan’s borders is expected to spur the country’s tourism sector. On the other side, the dollar index was boosted by the hawkish-titled comment from the Fed’s member – Christopher Waller. He emphasized that there is no sign showing that inflation will continue to drop going forward, and it is too early to call victory on the battle against inflation. As of writing, the pair of USD/JPY rose 0.39% to 140.40.

In the commodities market, the crude oil price rebounded by 0.65% to $86.05 per barrel after plummeting significantly yesterday. Recently, the daily Covid-19 cases in China shot up and triggered market fears over the risk of renewed lockdown measures. Besides, the gold price dropped -0.01% to $1771.05 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Sep) | 6.0% | 6.0% | – |

| 15:00 | GBP – Claimant Count Change (Oct) | 25.5K | – | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Nov) | -59.2 | -50.0 | – |

| 21:00 | USD – PPI (MoM) (Oct) | 0.4% | 0.5% | – |

Technical Analysis

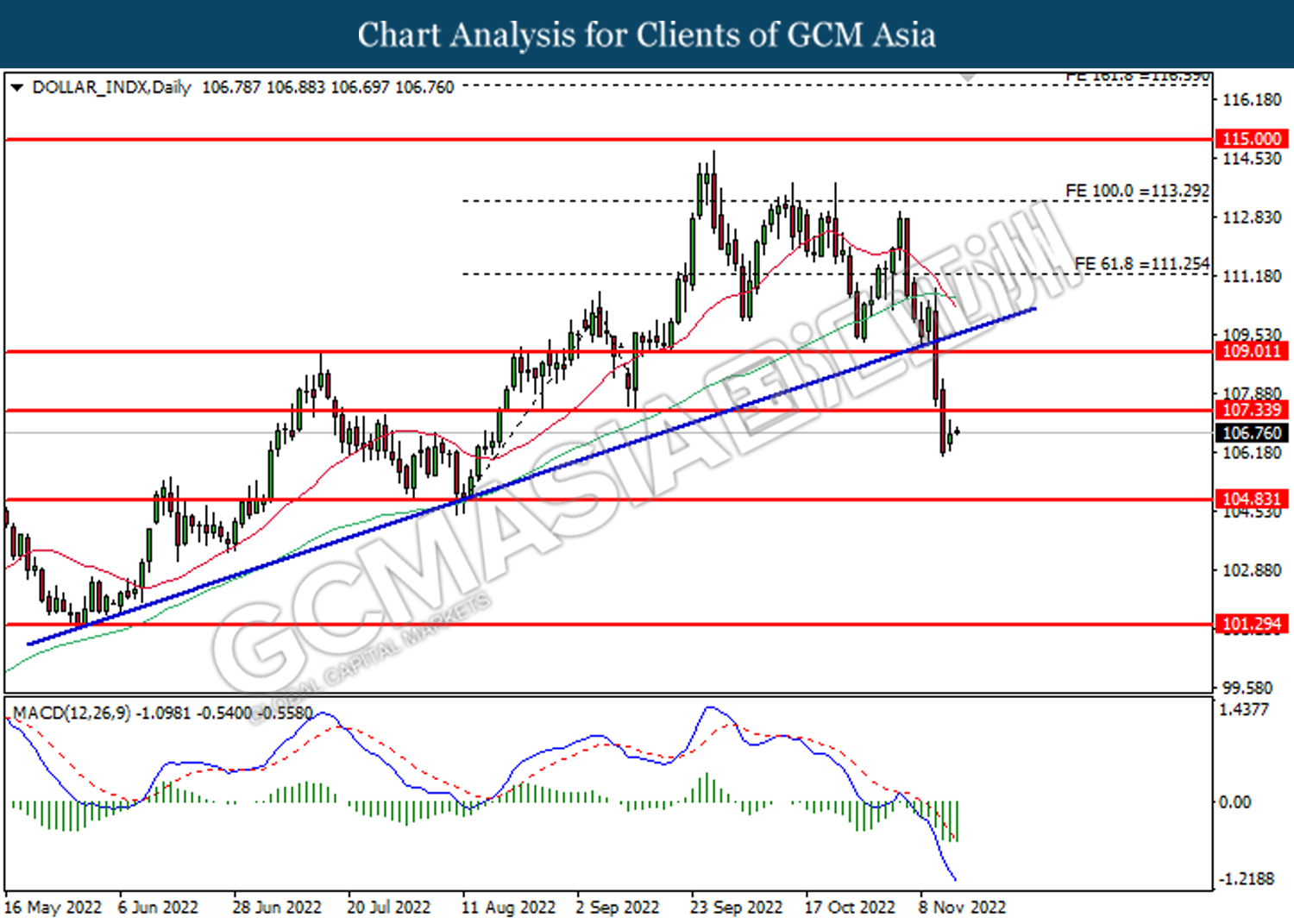

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level at 107.35. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 104.85

Resistance level: 107.35, 109.00

Support level: 104.85, 101.30

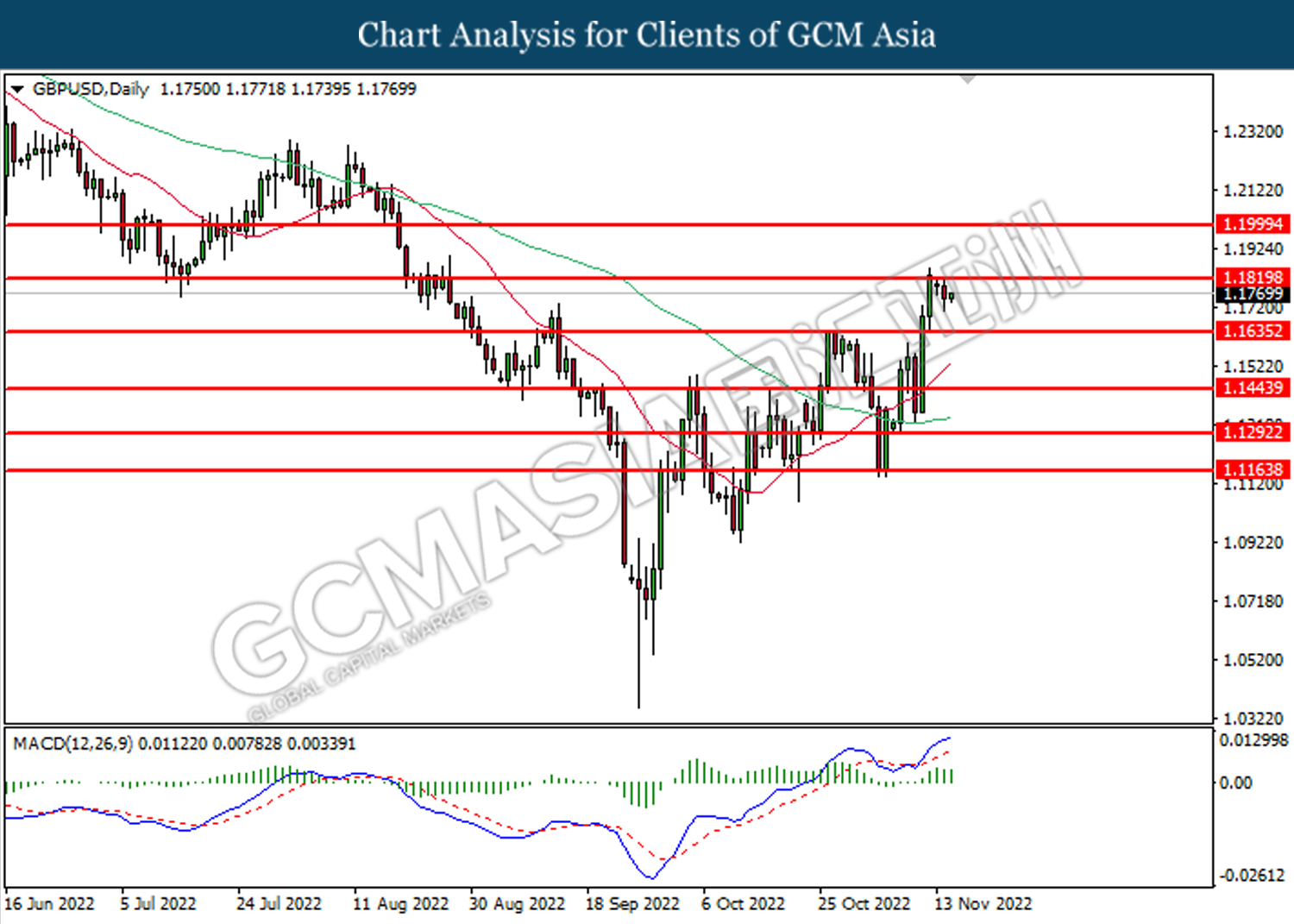

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1820. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1820, 1.2000

Support level: 1.1635, 1.1445

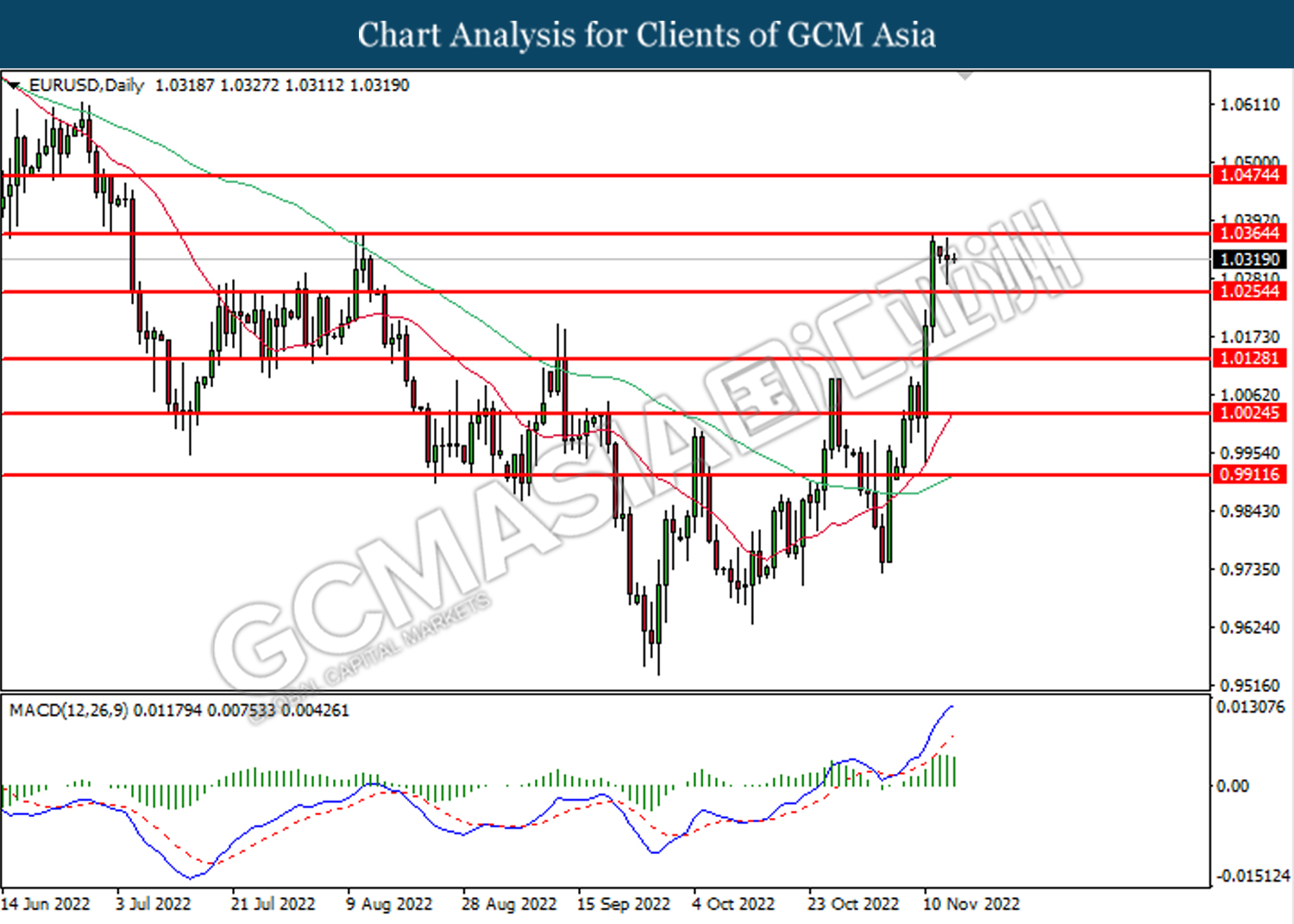

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0365. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0365, 1.0475

Support level: 1.0255, 1.0130

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 138.90. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.75.

Resistance level: 141.75, 144.70

Support level: 138.90, 136.45

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6640. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6725.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

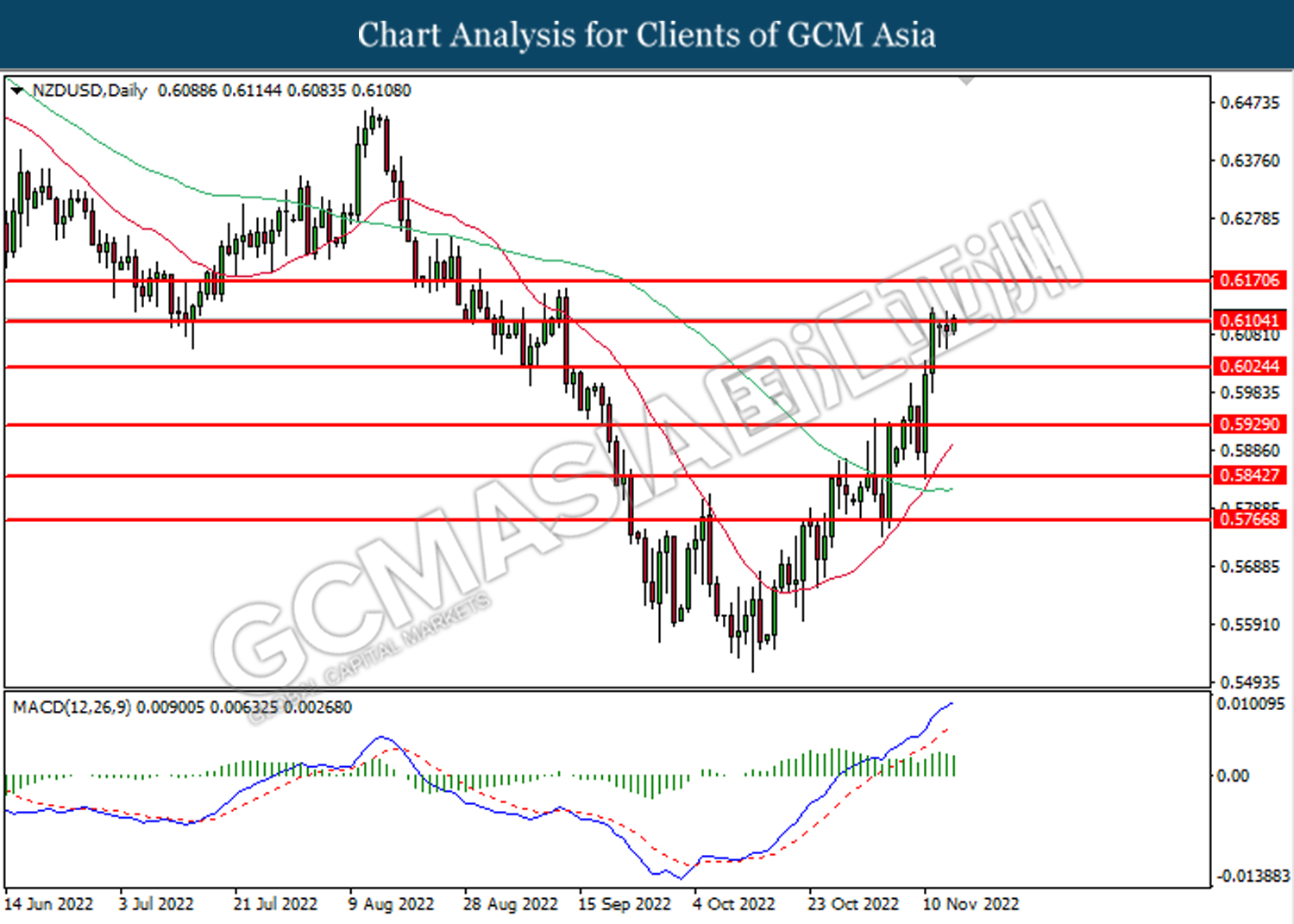

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6105. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6105, 0.6170

Support level: 0.6025, 0.5930

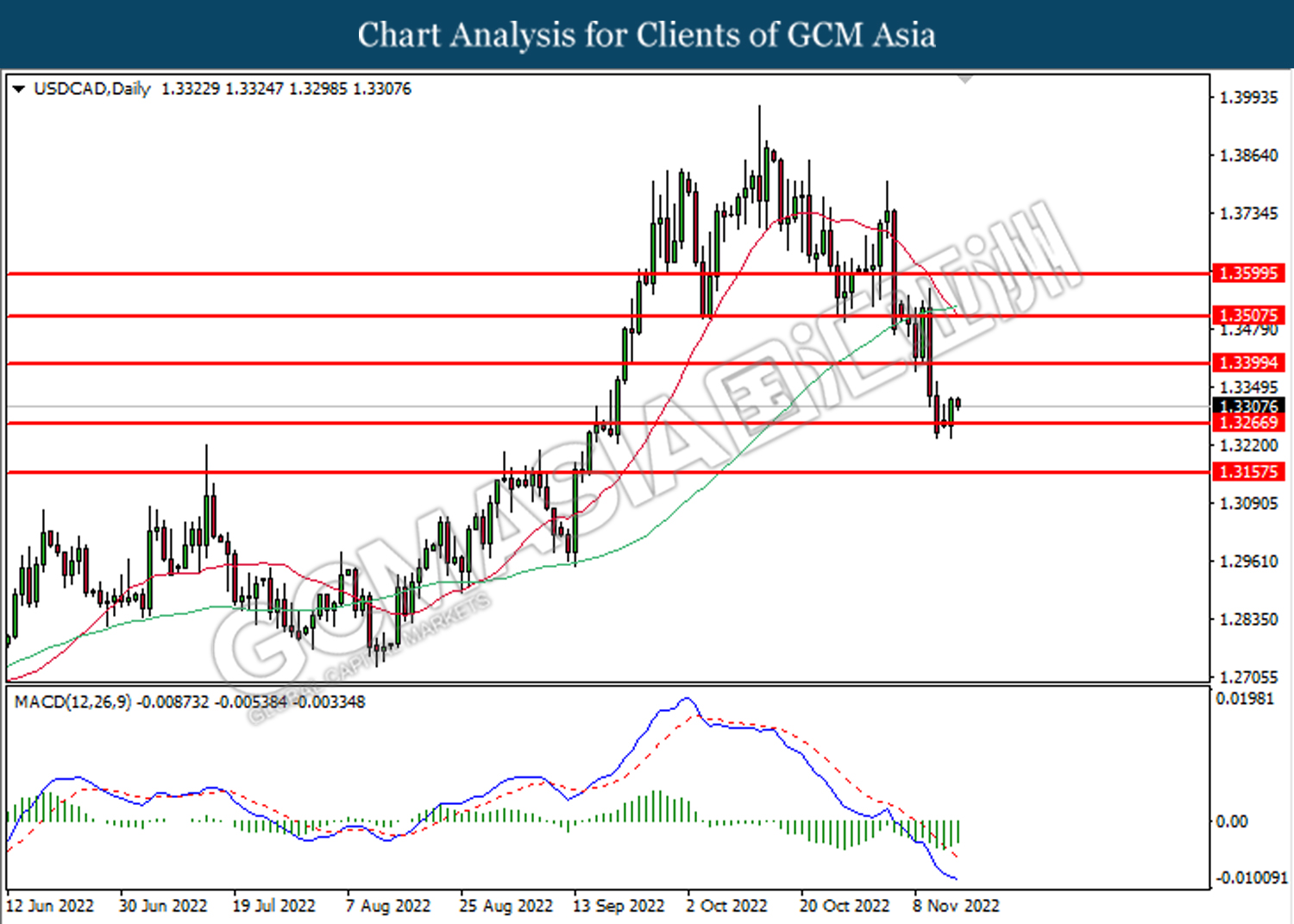

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

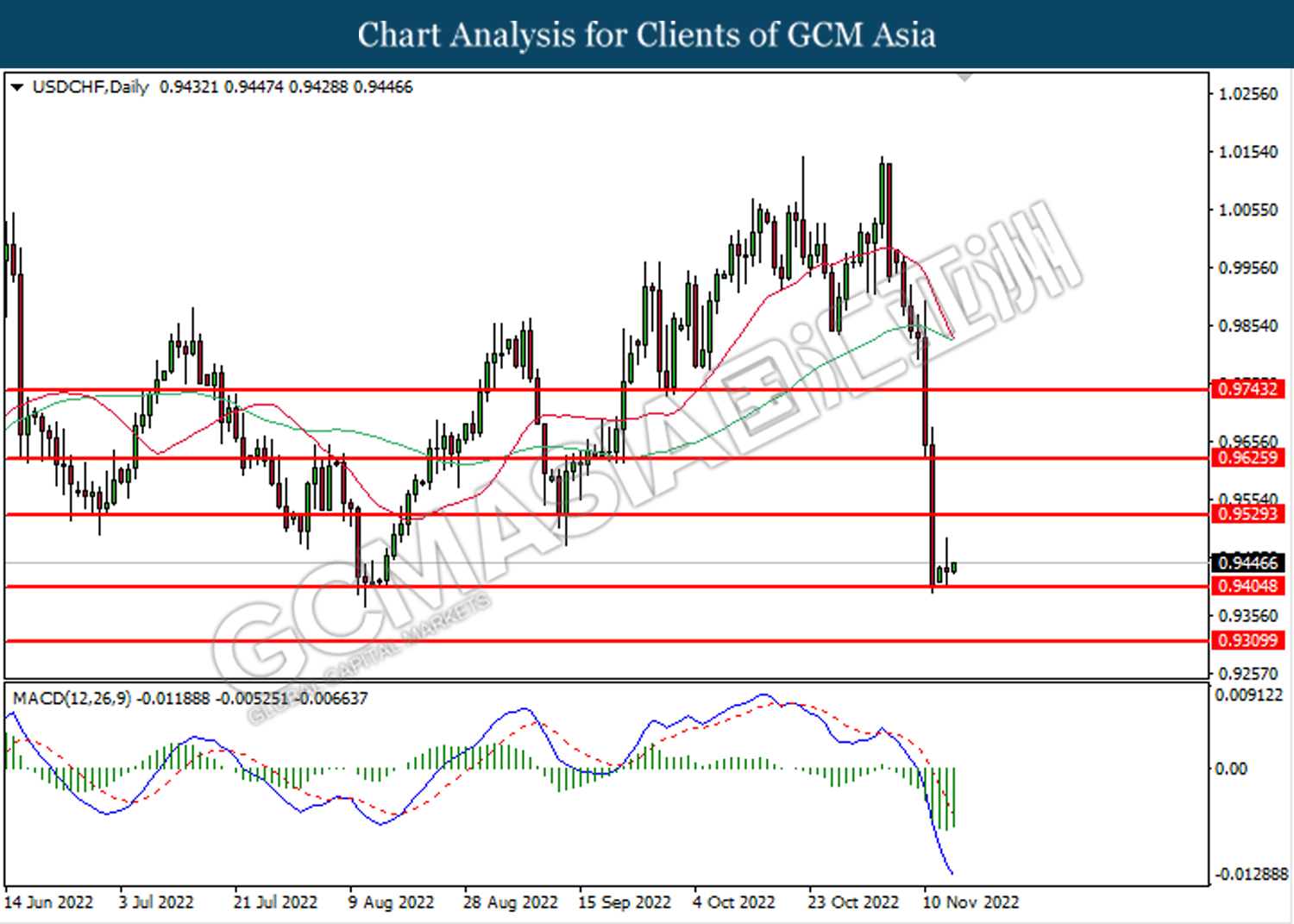

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

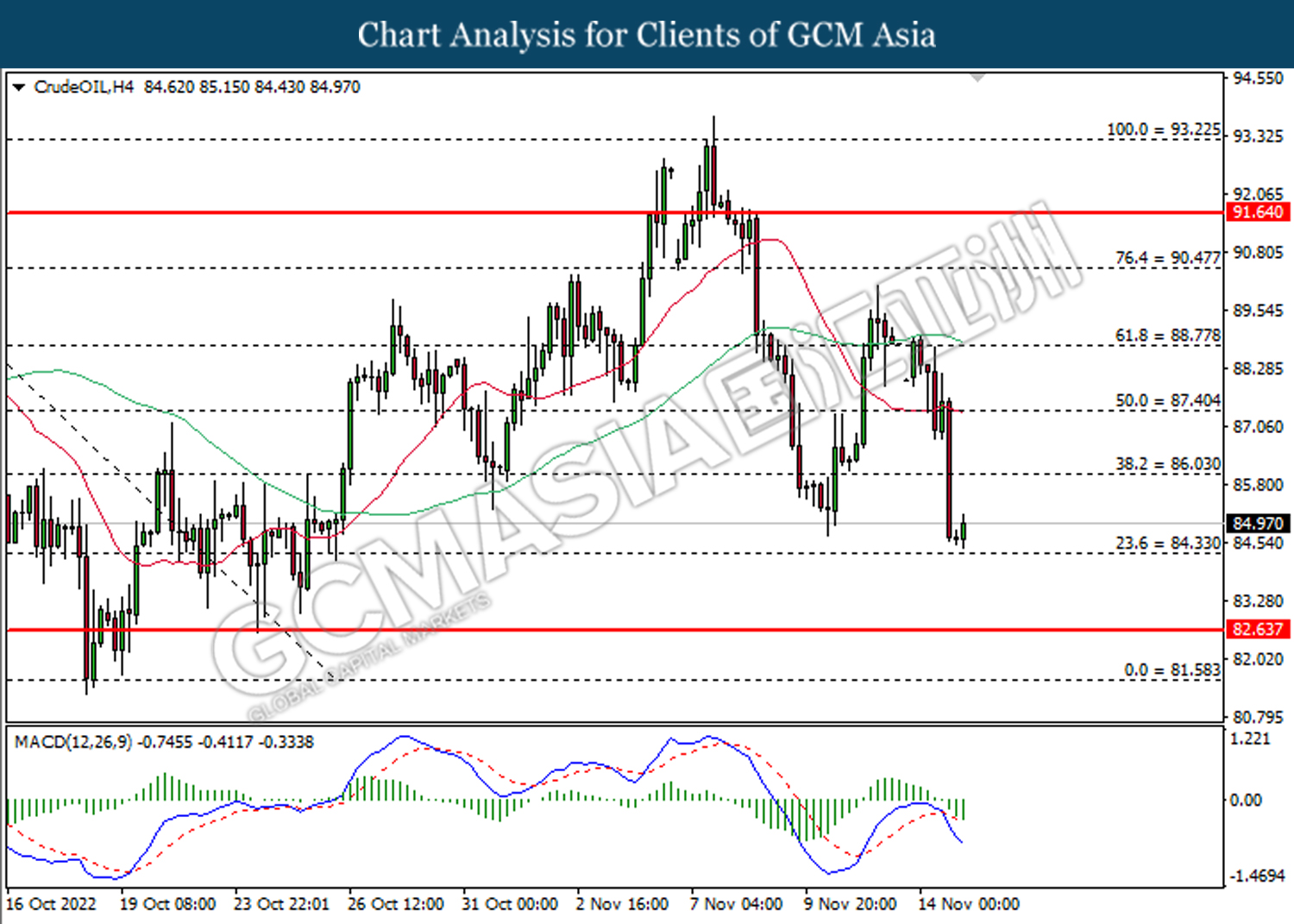

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 84.35. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 86.05, 87.40

Support level: 84.35, 82.65

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1766.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1805.90.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15