15 November 2022 Morning Session Analysis

US Dollar hovered as stance of Fed members are mixed.

The Dollar Index which traded against a basket of six major currencies seesawed on yesterday following mixing sounds from Fed officials. Last week, the US CPI has notched down from the prior figure of 8.2% to 7.7%, the fourth consecutive decline since August. With that, some of the Fed members were started considering about a slower pace of rate hike, which 50 basis point of interest rate increase might be implemented. Though, according to Reuters, Federal Reserve Governor Christopher Waller claimed on Monday that the market are overreacted to the October consumer inflation numbers. Waller, one of the Fed’s more hawkish voices, told a conference in Australia that the Fed will likely slow the pace of interest rate hikes from here on, but warned markets should focus less on the pace of tightening than on the ‘end point’ of the cycle. Since the market participants are gauging the Fed’s policy in the December meeting, investors decided to await the latest updates with regards of rate hike decision from Fed before entering the market. As of writing, the Dollar Index appreciated by 0.53% to 106.72.

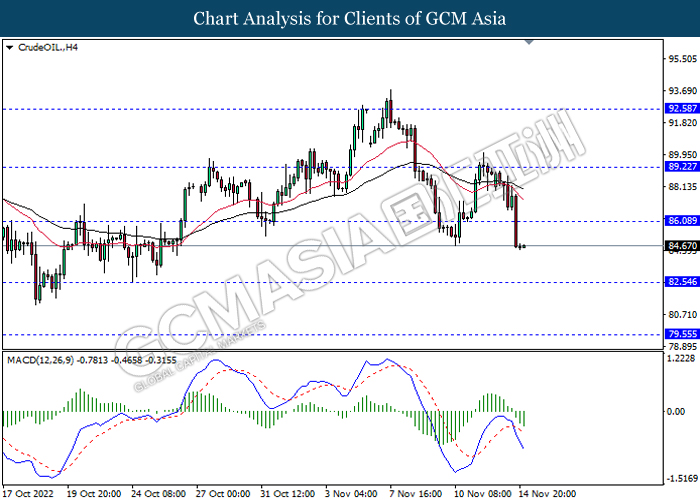

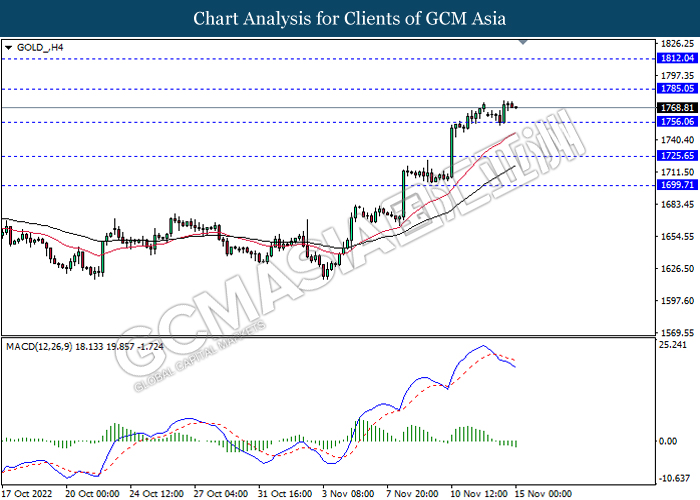

In the commodities market, the crude oil price rose by 0.14% to $85.33 per barrel as of writing after a sharp decline throughout yesterday trading session amid the surge of China Covid-19 cases. On the other hand, the gold price depreciated by 0.10% to $1769.69 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Sep) | 6.0% | 6.0% | – |

| 15:00 | GBP – Claimant Count Change (Oct) | 25.5K | – | – |

| 18:00 | EUR – German ZEW Economic Sentiment (Nov) | -59.2 | -50.0 | – |

| 21:00 | USD – PPI (MoM) (Oct) | 0.4% | 0.5% | – |

Technical Analysis

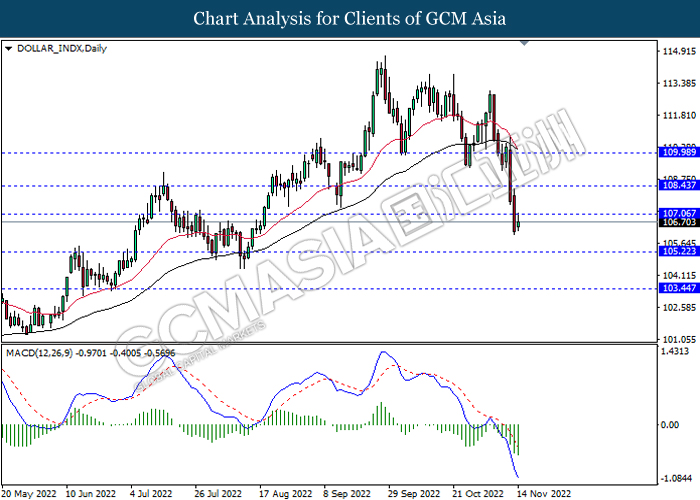

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.05, 108.45

Support level: 105.20, 103.45

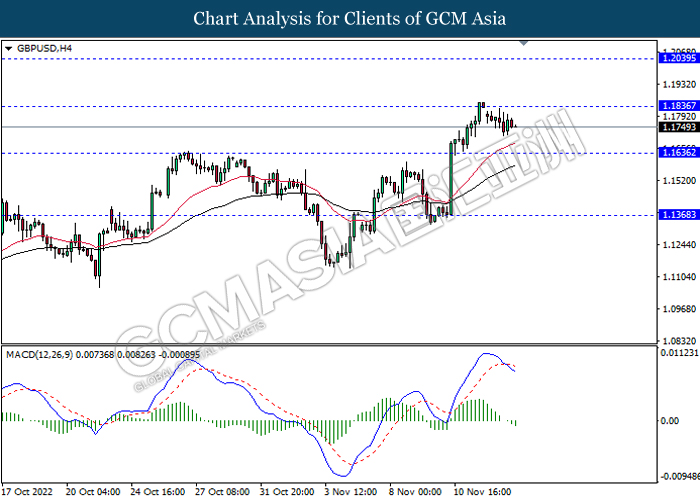

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1835, 1.2040

Support level: 1.1635, 1.1370

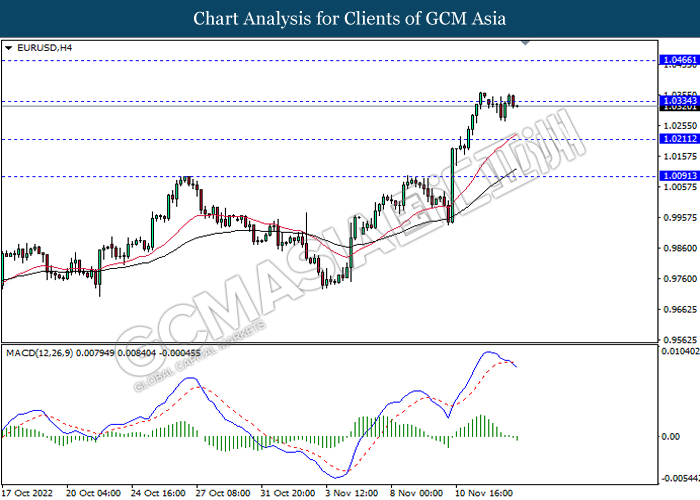

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0335, 1.0465

Support level: 1.0210, 1.0090

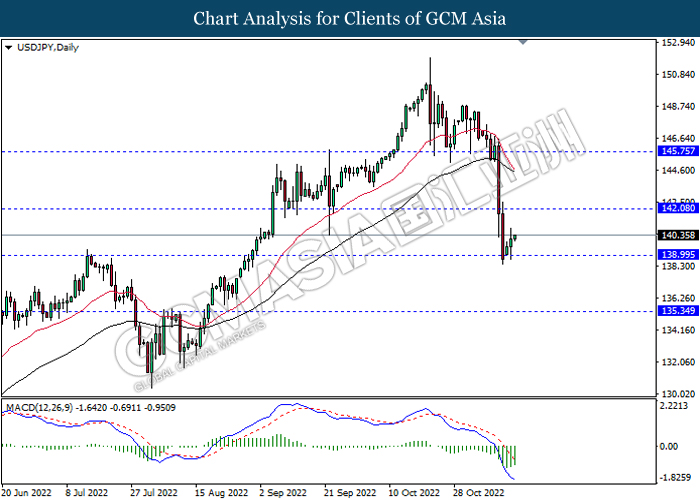

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 142.10, 145.75

Support level: 139.00, 135.35

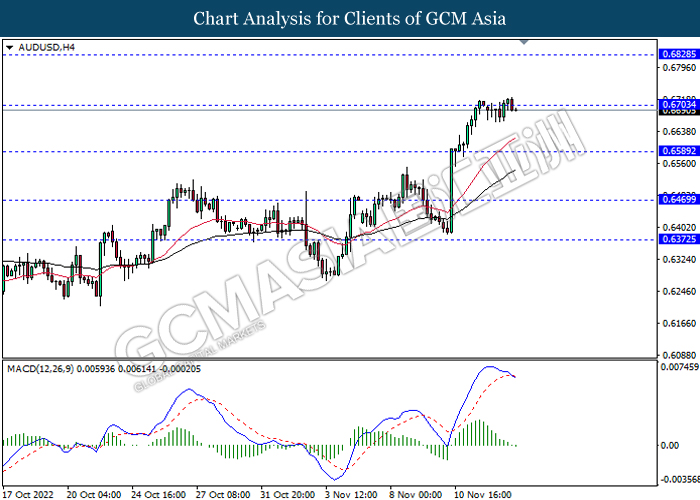

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6470

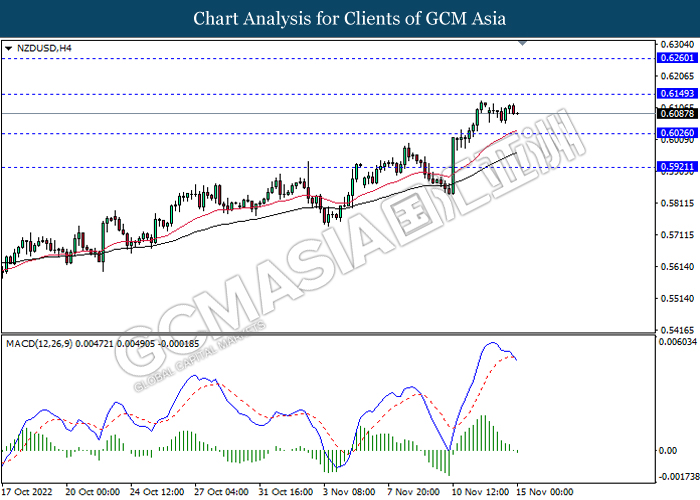

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6150, 0.6260

Support level: 0.6025, 0.5920

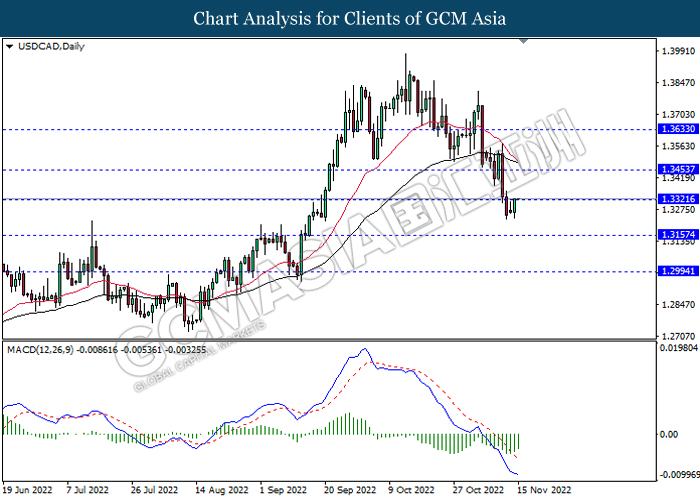

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3320, 1.3455

Support level: 1.3155, 1.2995

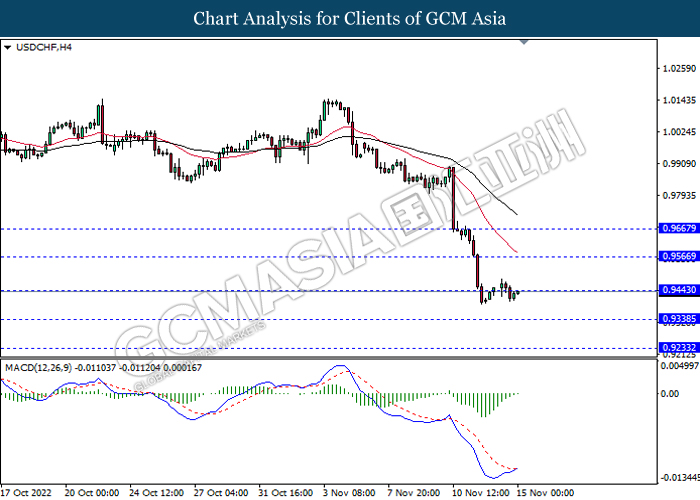

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9445, 0.9565

Support level: 0.9340, 0.9235

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 86.10, 89.20

Support level: 82.55, 79.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1785.05, 1812.05

Support level: 1756.05, 1725.65