15 December 2021 Afternoon Session Analysis

Aussie fell amid weak China data, U.S-China tension.

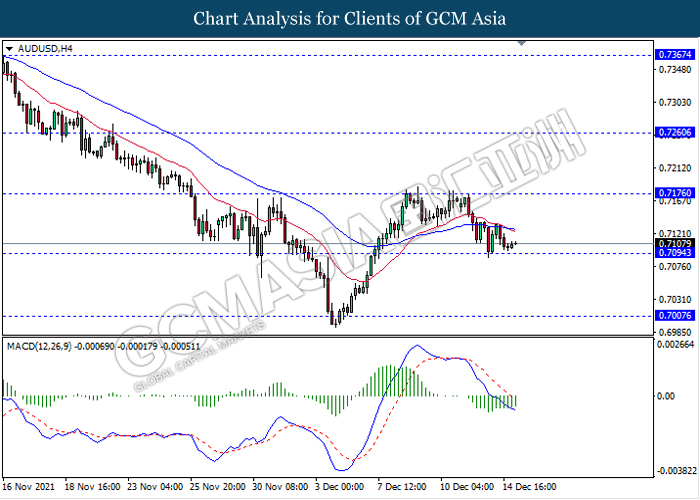

The Australian dollar which traded against the dollar and other currency pairs remains pressured and slip following latest weakness from China economic data and also escalating tension between U.S and China. According to the National Bureau of Statistics of China, China Retail Sales have grew only 3.9%, slower than market expectation of 4.6. On top of that, online sales of physical goods also fell to 13.2% compared to October’s reading of 14.6%. The weakness are mostly due to rising Covid-19 cases that reached 21 provinces and making consumers more cautious. On top of that, rising tension between U.S – China weigh further on the sentiment. According to Bloomberg, the U.S House of Representatives have voted to pass a bill that would ban goods produced by forced laborers from China Xinjiang region. The move could straining further the relationship between the two biggest economies in the world. At the time of writing, AUD/USD fell 0.04% to 0.7108.

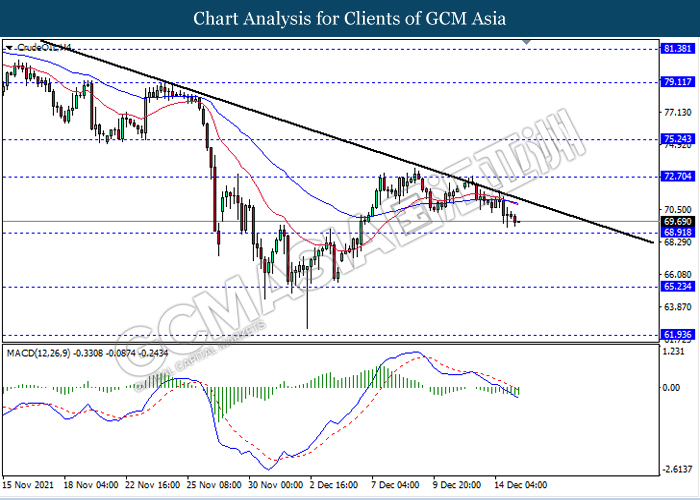

In the commodities market, crude oil price fell 0.50% to $68.91 per barrel as of writing following concerns over supply surplus. According to reports, The International Energy Agency (IEA) stated that the rising Covid-19 cases along with Omicron discovery may dent global fuel demand and crude output also expected to increase. On the other hand, gold price 0.02% to 1770.49 a troy ounce at the time of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 (16th) USD FOMC Economic Projections

03:00 (16th) USD FOMC Statement

03:30 (16th) USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Nov) | 4.20% | 4.70% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Nov) | 1.70% | 1.00% | – |

| 21:30 | USD – Retail Sales (MoM) (Nov) | 1.70% | 0.80% | – |

| 21:30 | CAD – Core CPI (MoM) (Nov) | 0.60% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -0.240M | – | – |

| 03:00 (16th) |

USD – Fed Interest Rate Decision | 0.25% | 0.25% | – |

Technical Analysis

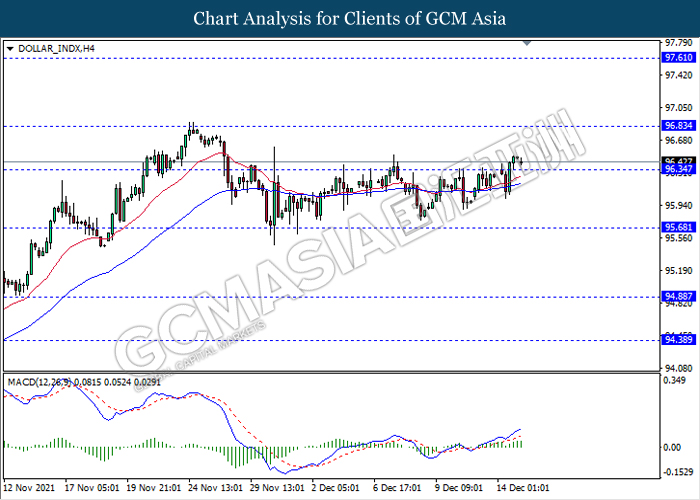

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 96.35. MACD which illustrate bullish momentum signal suggest the dollar to extend its gains towards the resistance level 96.85.

Resistance level: 96.85, 97.60

Support level: 96.35, 95.70

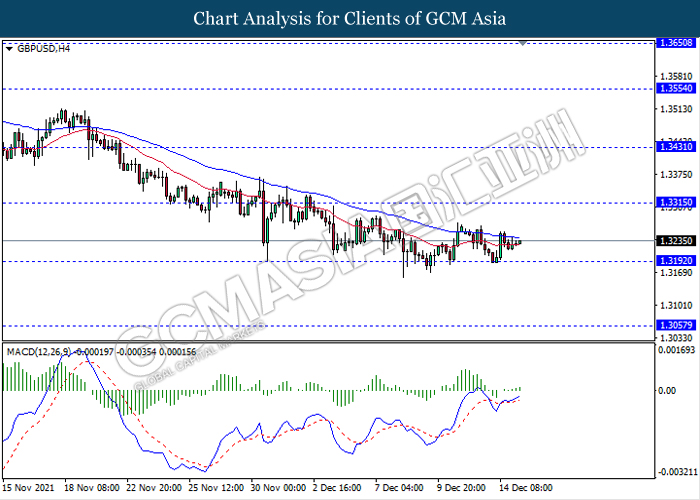

GBPUSD, H4: GBPUSD was traded higher following recent rebound from the support level 1.3190. MACD which illustrate bullish bias signal suggest the pair to extend its rebound towards the resistance level 1.3315.

Resistance level: 1.3315, 1.3430

Support level: 1.3190, 1.3055

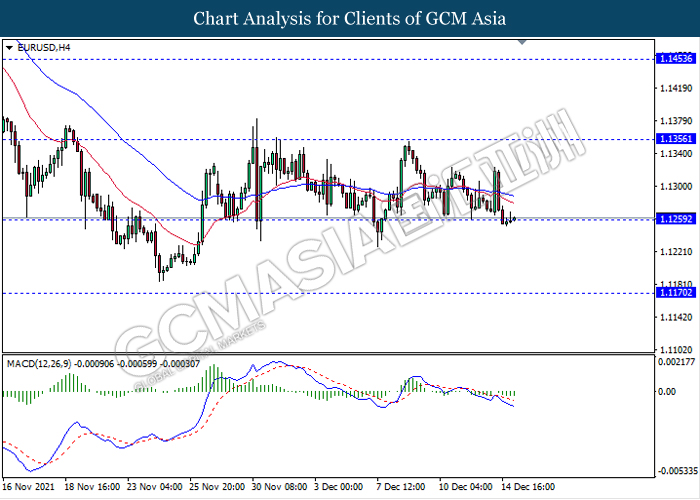

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.1260. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1355, 1.1455

Support level: 1.1260, 1.1170

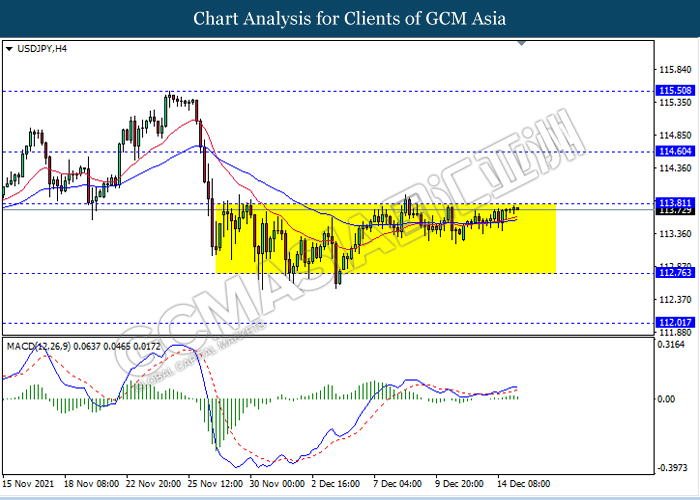

USDJPY, H4: USDJPY remain traded flat in a sideway channel while currently testing the resistance level 113.80. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower in short term towards the support level 112.75.

Resistance level: 113.80, 114.60

Support level: 112.75, 112.00

AUDUSD, H4: AUDUSD was traded lower while currently testing near the support level 0.7095. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7175, 0.7260

Support level: 0.7095, 0.7005

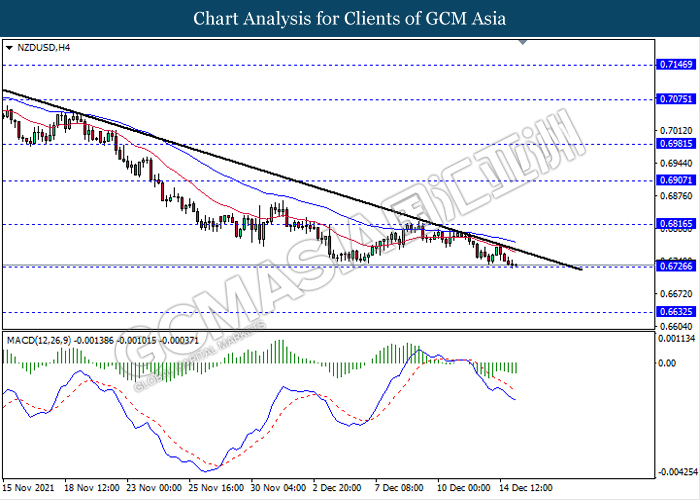

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6725. MACD which illustrate ongoing bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level 1.2865. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction towards the support level 1.2735.

Resistance level: 1.3865, 1.2955

Support level: 1.2735, 1.2615

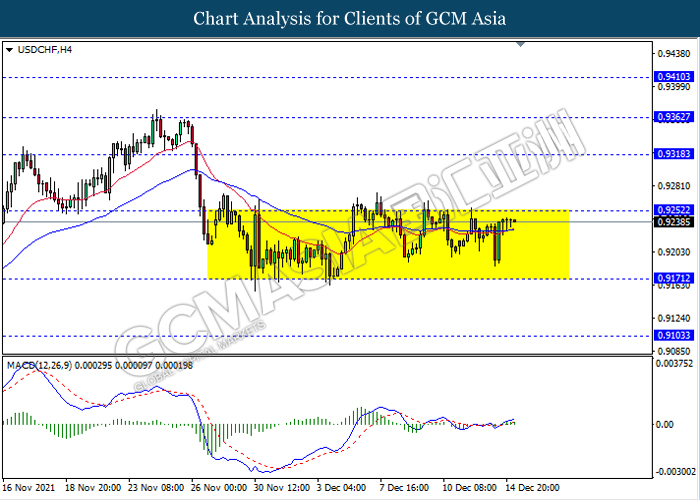

USDCHF, H4: USDCHF remain traded in a sideway channel while currently testing near the resistance level 0.9250. However, MACD which illustrate bullish bias signal suggest the pair to be traded higher after it breaks above the resistance level.

Resistance level: 0.9250, 0.9320

Support level: 0.9170, 0.9105

CrudeOIL, H4: Crude oil price was traded lower while currently testing near the support level 68.90. MACD which illustrate ongoing bearish momentum signal suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 72.70, 75.25

Support level: 68.90, 65.25

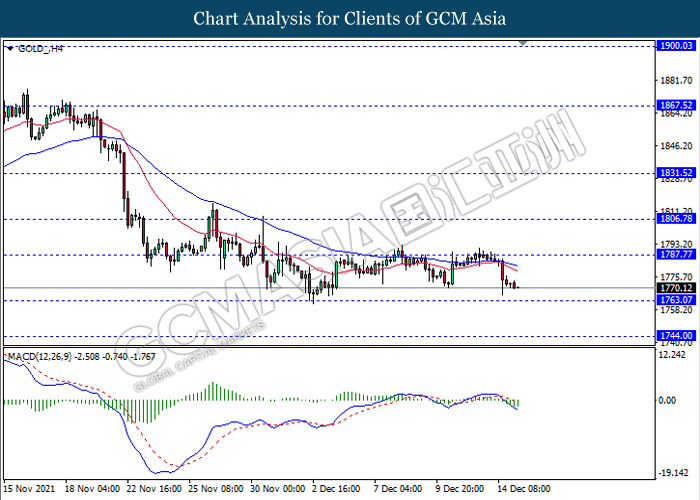

GOLD_, H4: Gold price was traded lower while currently testing near the support level 1763.05. MACD which illustrate bearish momentum signal with the formation of death cross suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 1787.75, 1806.80

Support level: 1763.05, 1744.00