15 December 2022 Afternoon Session Analysis

Aussie dollar slumped despite upbeat employment data.

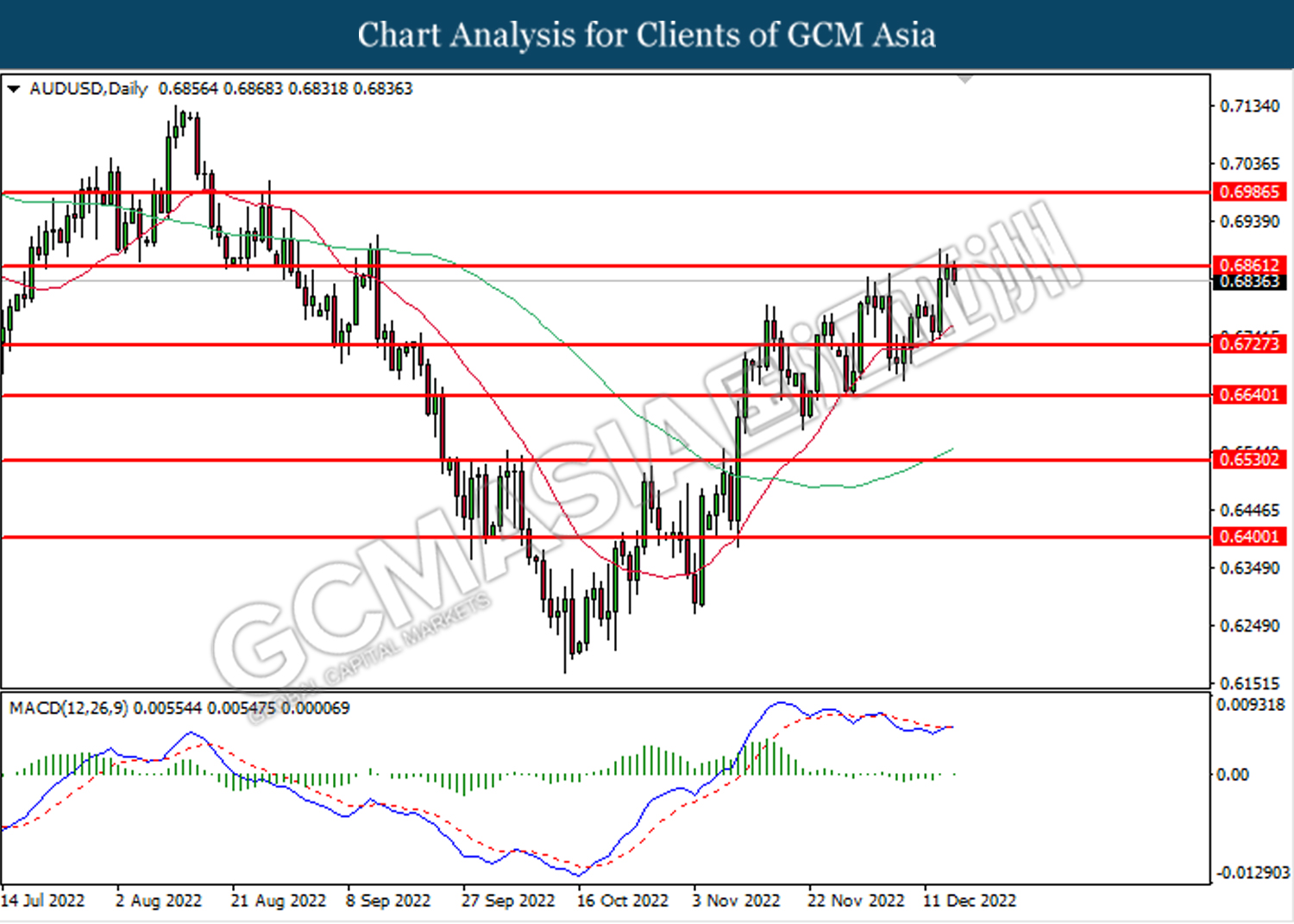

The Australian dollar, which widely known as Aussie, seesawed during the Asian early trading session amid mixed market sentiment. Earlier today, the Australian Bureau of Statistics reported its Employment Change data for the month of November with a stronger-than-expected reading, where it came in at 64.0K, significantly higher than the consensus forecast at 19.0K. The upbeat data showed that the nation’s labor market remained resilient despite sky-high inflation issue persists. However, the Aussie dollar was pressured by huge bearish momentum after China released a downbeat economic data. According to the China’s National Bureau of Statistics, the China Industrial Production data for November declined from 5.0% to 2.2%, weaker than the consensus forecast at 3.6%. The significant drop was mainly attributed to the stricter lockdown measure, which implemented by the local government throughout the month with an aim of curbing the spread of Covid-19. As of writing, the pair of AUD/USD dropped by -0.33% to 0.6845.

In the commodities market, the crude oil price slid by -0.90% to $76.85 per barrel as US crude oil inventories see huge inventory build in the past one week. According to the EIA, US Crude Oil Inventories came in at 10.231M while the consensus forecast was -3.595M. Besides, the gold prices dropped -0.89% to $1795.30 per troy ounce follow the rebound of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q4) | 0.50% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Dec) | 3.00% | 3.50% | – |

| 21:15 | EUR – Deposit Facility Rate (Dec) | 1.50% | 2.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Dec) | 1.50% | 2.50% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Nov) | 1.3% | 0.2% | – |

| 21:30 | USD – Initial Jobless Claims | 230K | 230K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Dec) | 4.50 | -1.00 | – |

| 21:30 | USD – Retail Sales (MoM) (Nov) | 1.3% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level at 103.15.

Resistance level: 104.95, 106.65

Support level: 103.15, 101.25

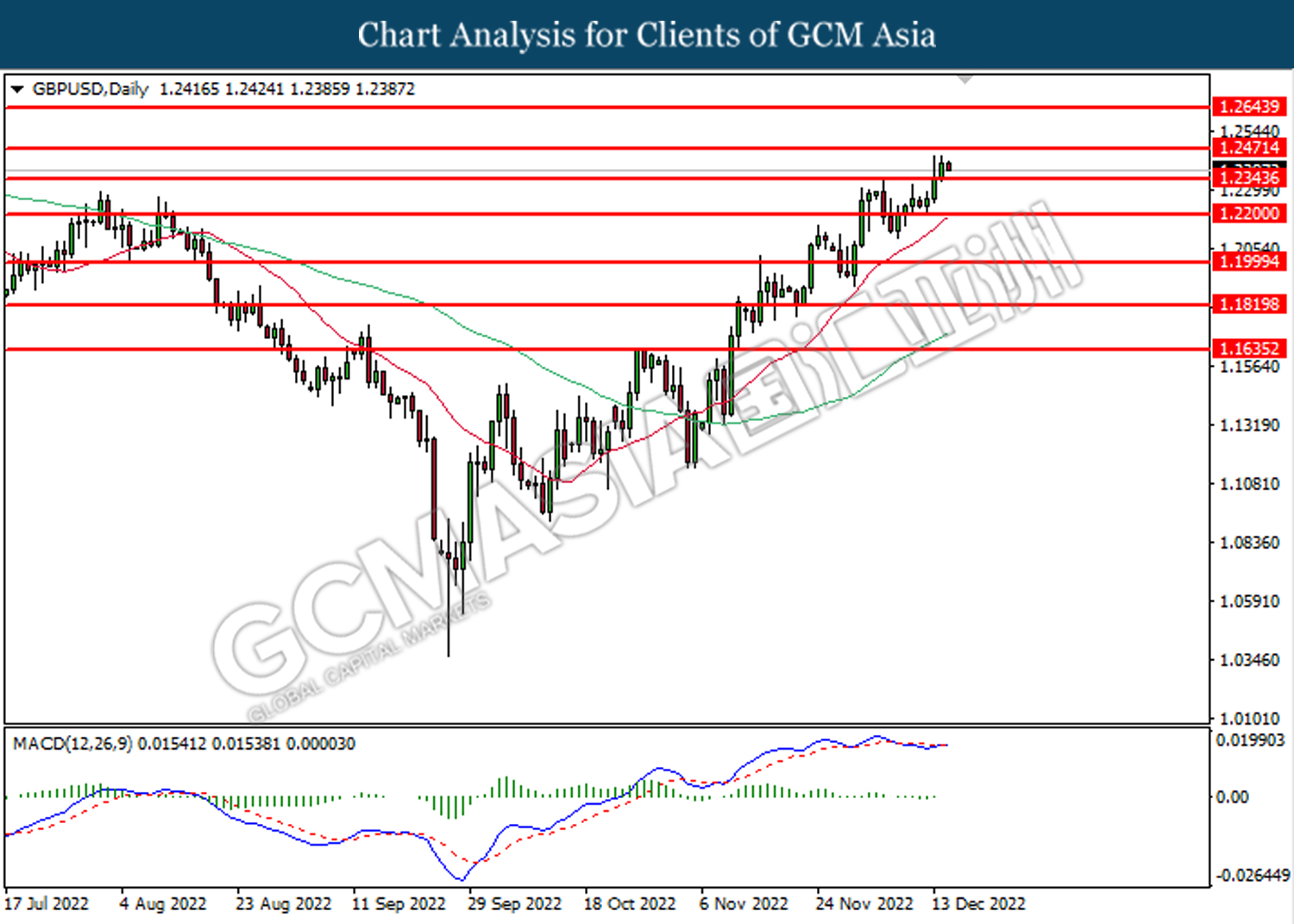

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2345. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2470.

Resistance level: 1.2470, 1.2645

Support level: 1.2345, 1.2200

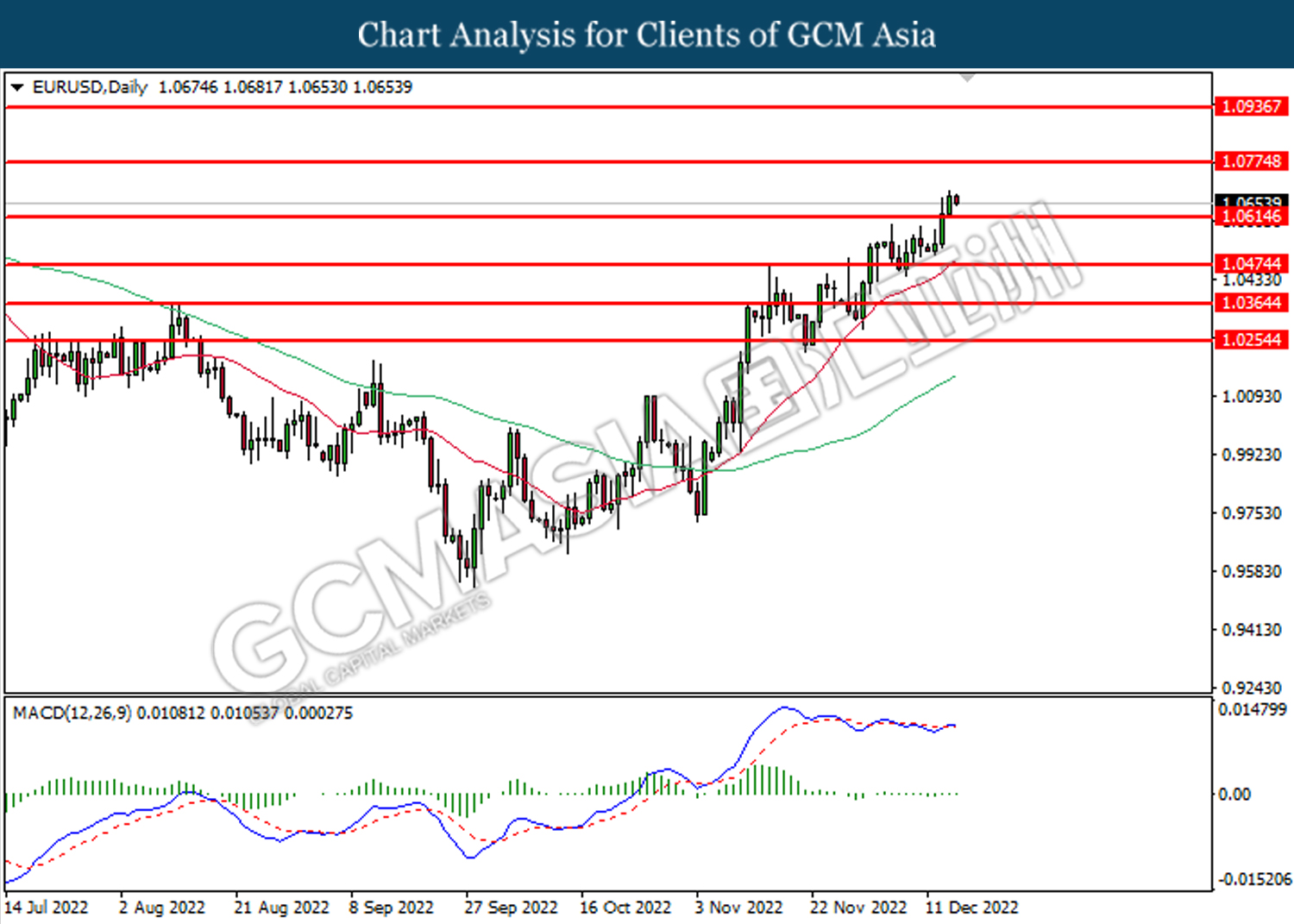

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0615. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0615, 1.0475

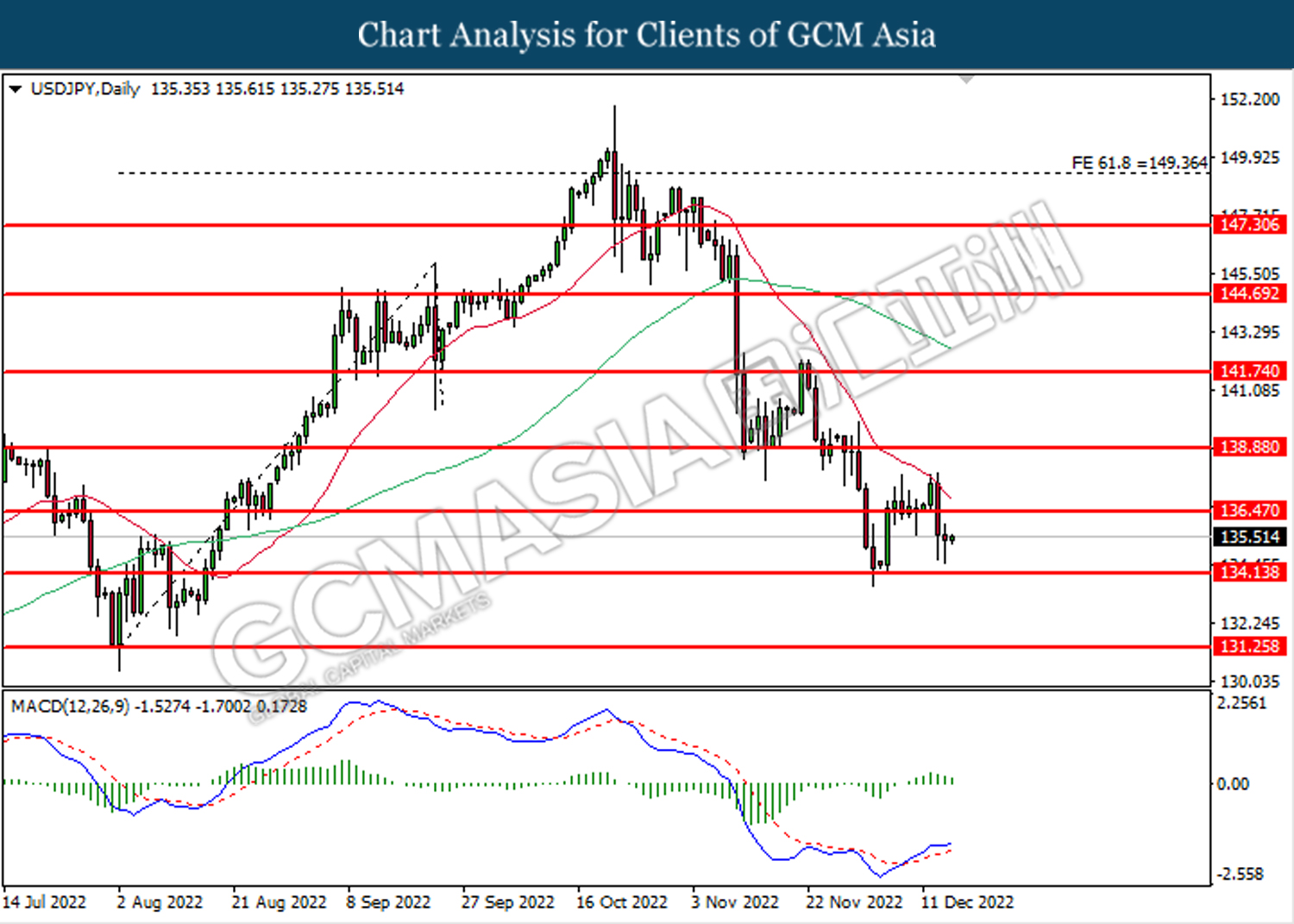

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 136.45. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

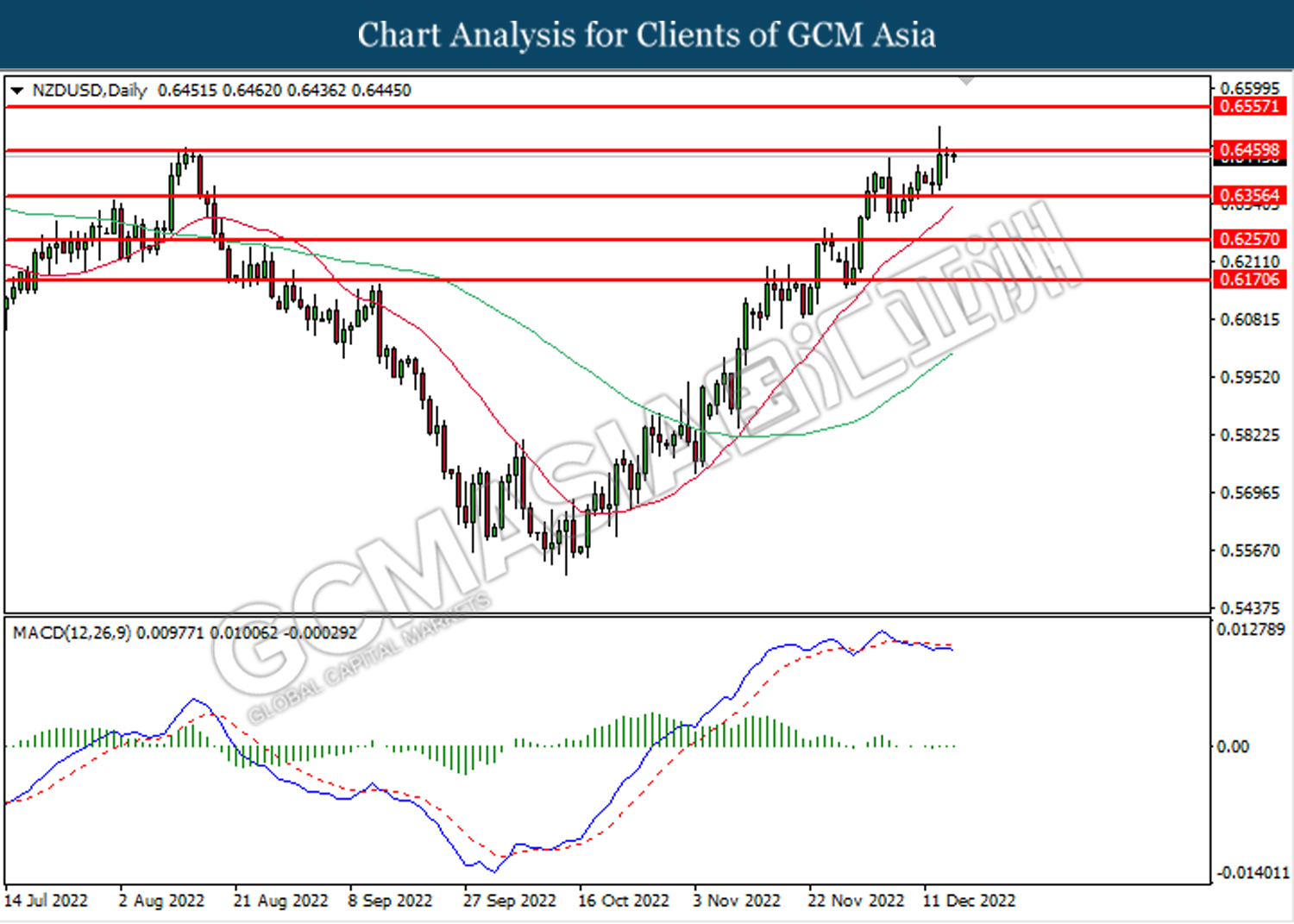

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6460. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

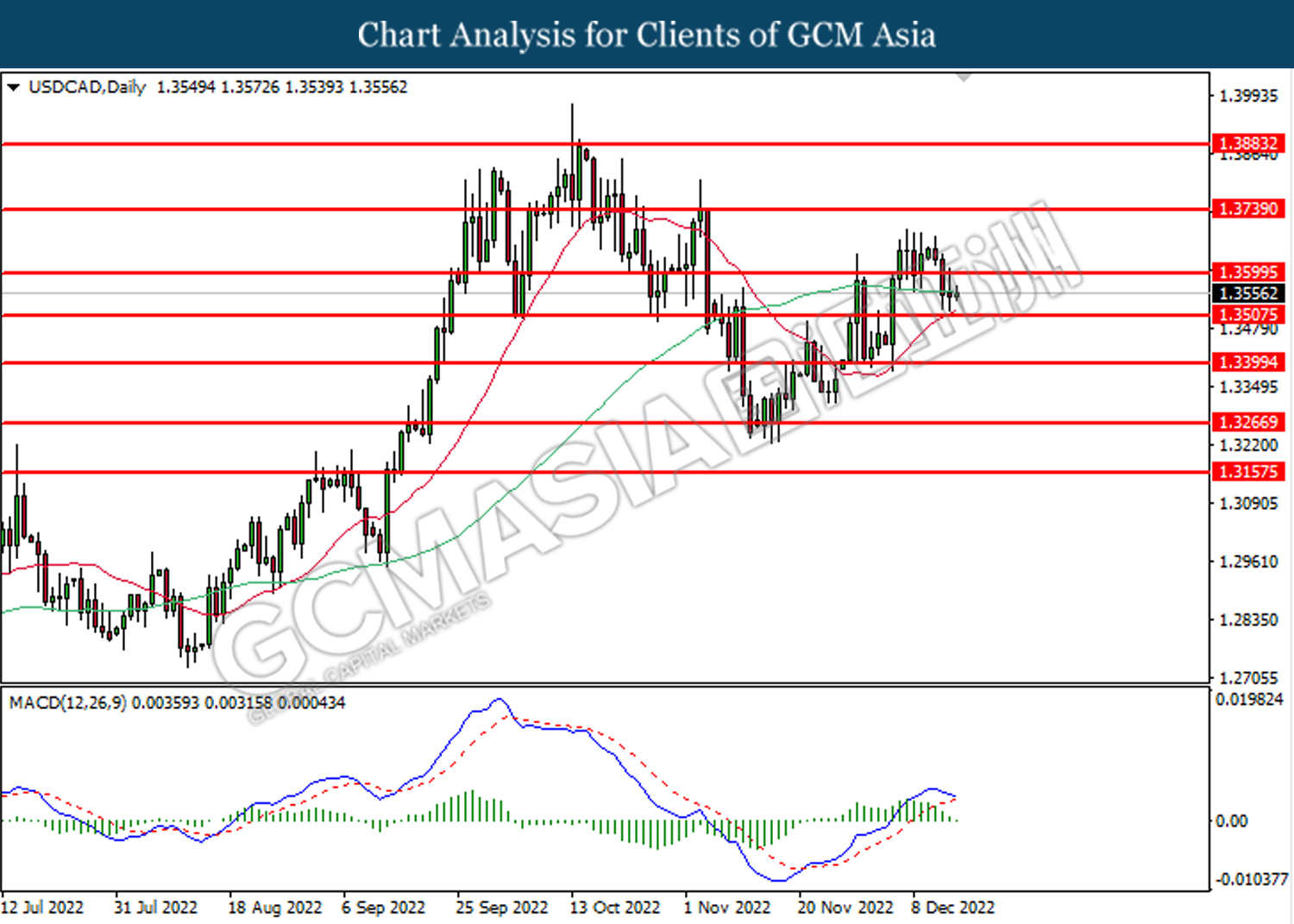

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

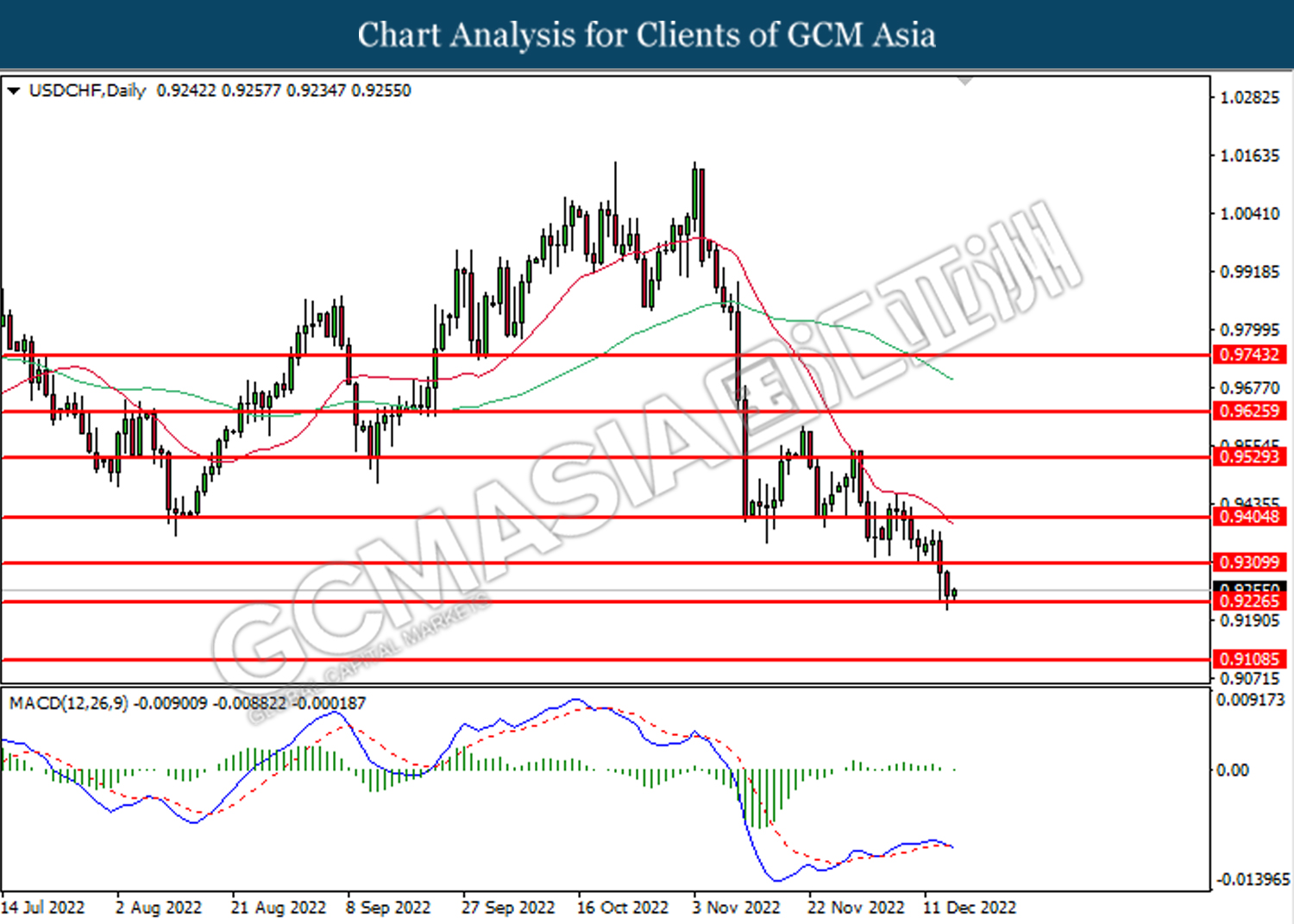

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

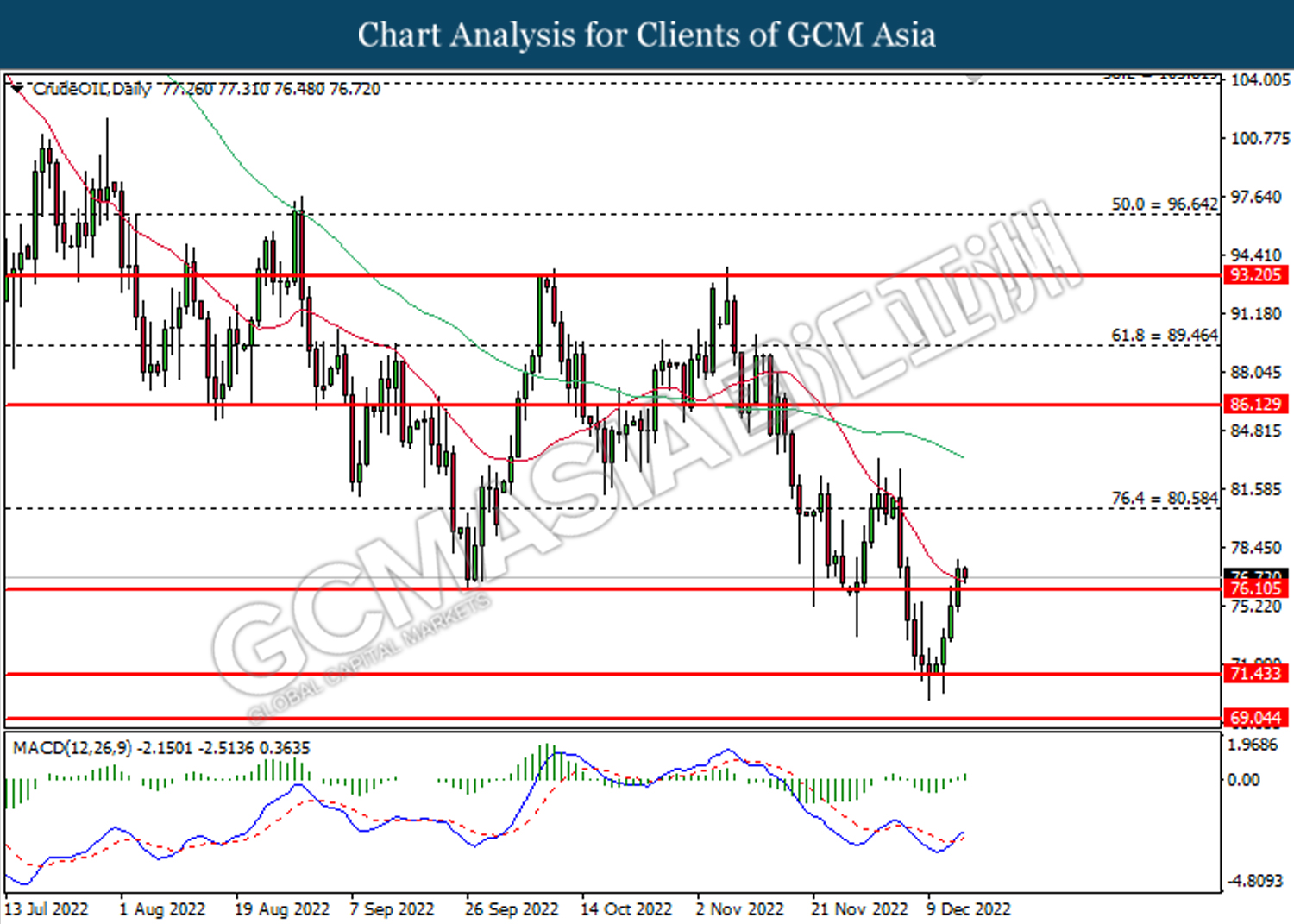

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 80.60.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

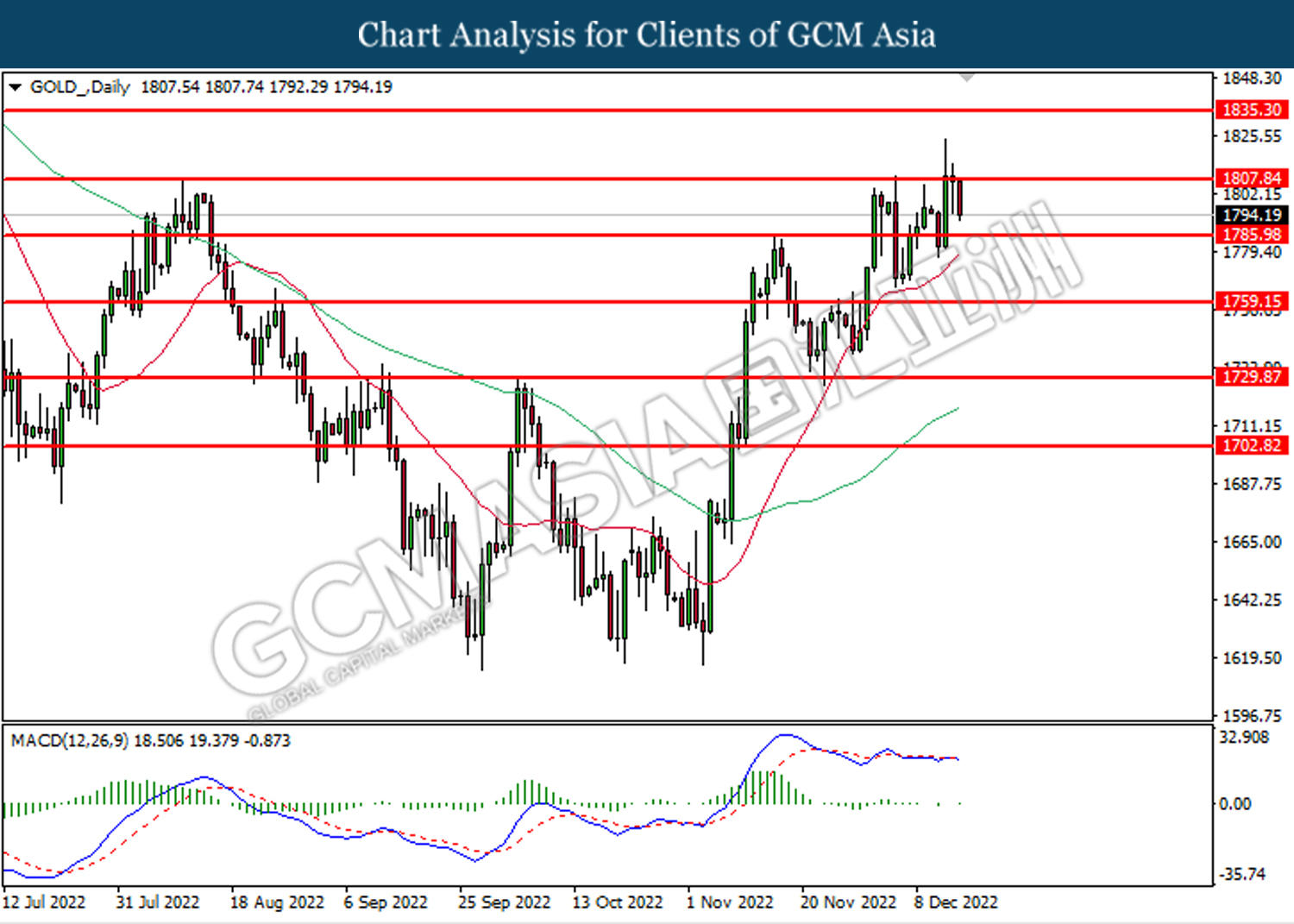

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1807.85. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1786.00.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15