16 February 2023 Afternoon Session Analysis

Pound Sterling plunged amid diminishing red-hot inflation.

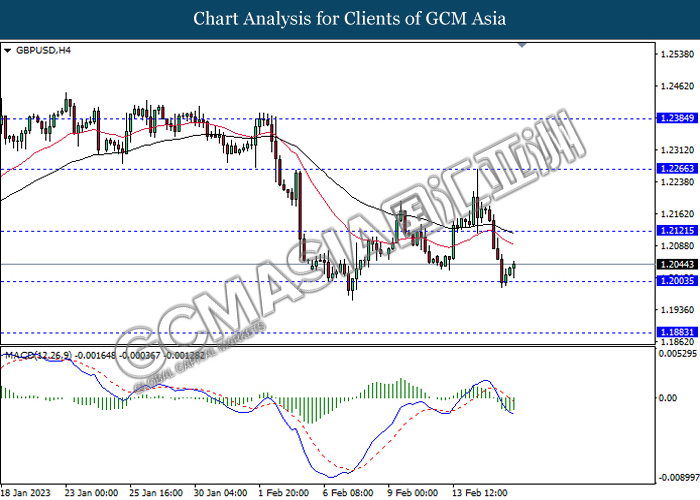

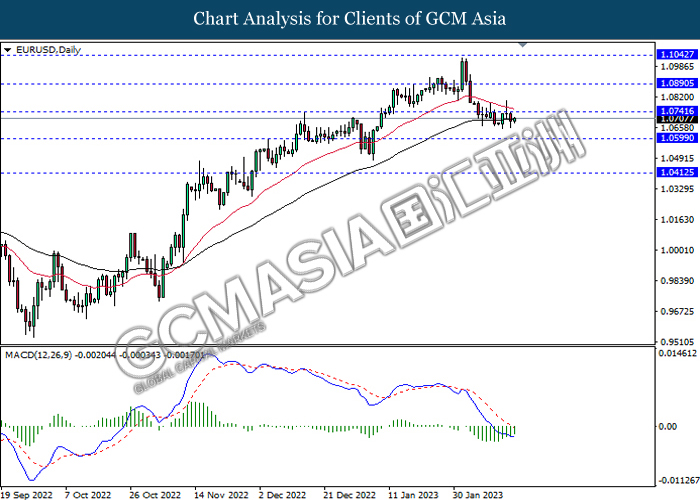

The GBPUSD, which traded by majority of investors slumped on yesterday following the easing inflationary risk in the UK. According to Office for National Statistics, the UK Consumer Price Index (CPI) YoY for January notched down from the previous reading of 10.5% to 10.1%, missing the consensus forecast of 10.3%. With the data figure that showing lower-than-expected, it indicated that the slip of goods and services price in the UK, whereas decreasing the likelihood of aggressive rate hike from Bank of England (BoE). Prior to that, BoE was speculated to pause its rate hike path, after another 25 basis point hikes in March. With that, it prompted investors to stoke a shift on sentiment toward other assets. On the other hand, the EURUSD regained its luster on Thursday following the hawkish statement from European Central Bank (ECB). ECB President Christine Lagarde claimed on yesterday that the central bank was inclined to increase its rates by 50 basis points in March in order to curb sky-high inflation. As of writing, the GBPUSD appreciated by 0.21% to 1.2051, while the EURUSD rose by 0.21% to 1.0710.

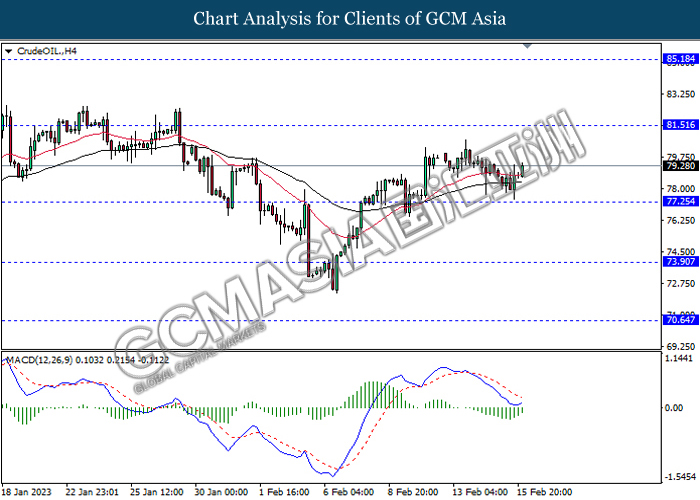

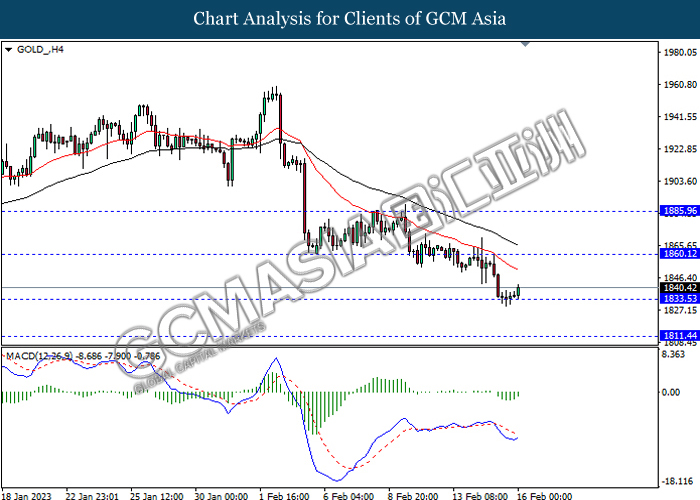

In the commodities market, the crude oil price raised by 0.56% to $79.03 per barrel as of writing following the optimistic forecast from IEA upon oil demand this year has offset the stockpile in the US crude oil inventories. In addition, the gold price appreciated by 0.26% to $1840.94 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 EUR ECB Economic Bulletin

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits (Jan) | 1.337M | 1.350M | – |

| 21:30 | USD – Initial Jobless Claims | 196K | 200K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Feb) | -8.9 | -7.4 | – |

| 21:30 | USD – PPI (MoM) (Jan) | -0.4% | 0.4% | – |

Technical Analysis

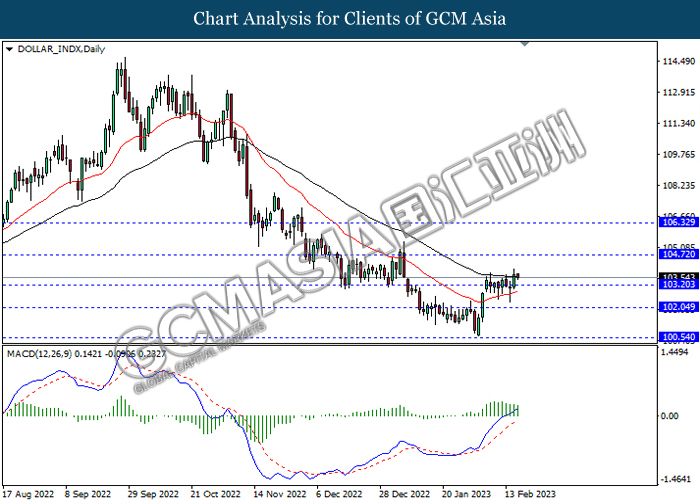

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggests the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

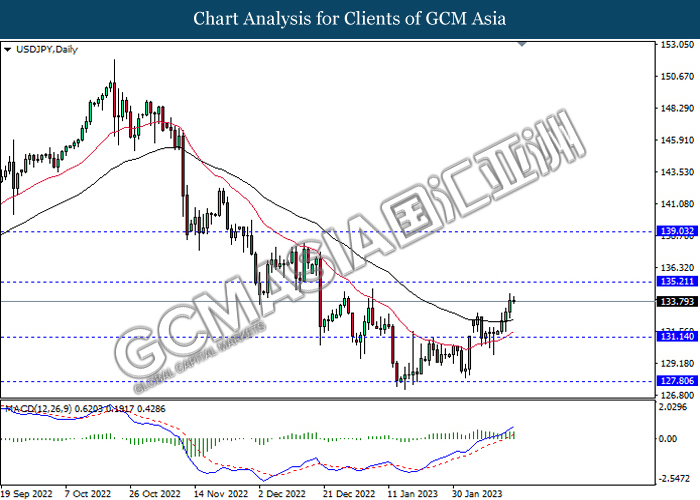

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

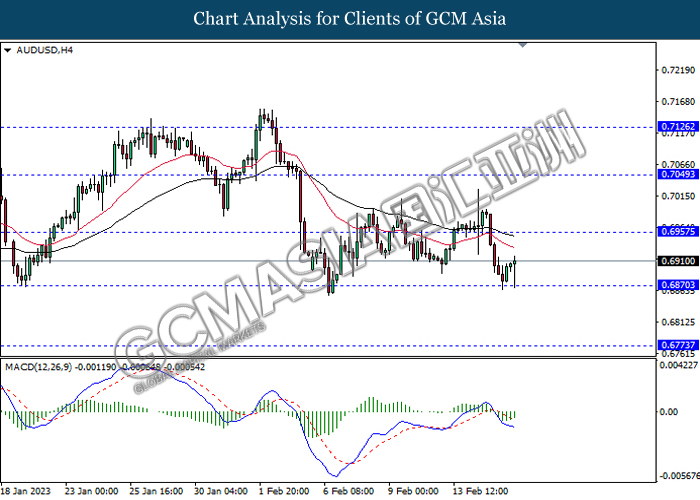

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

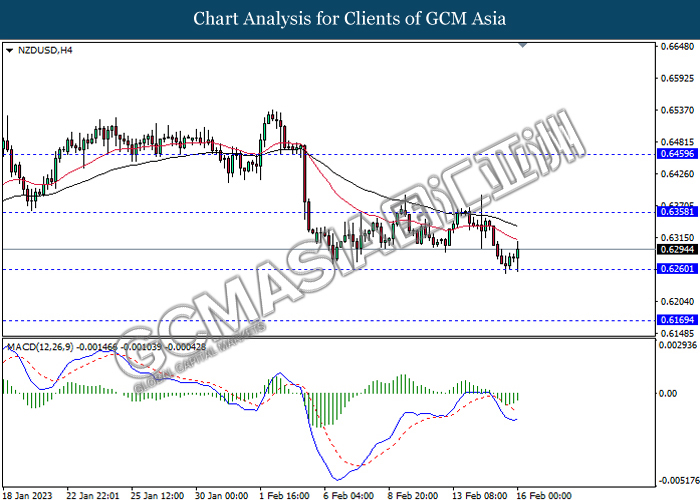

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

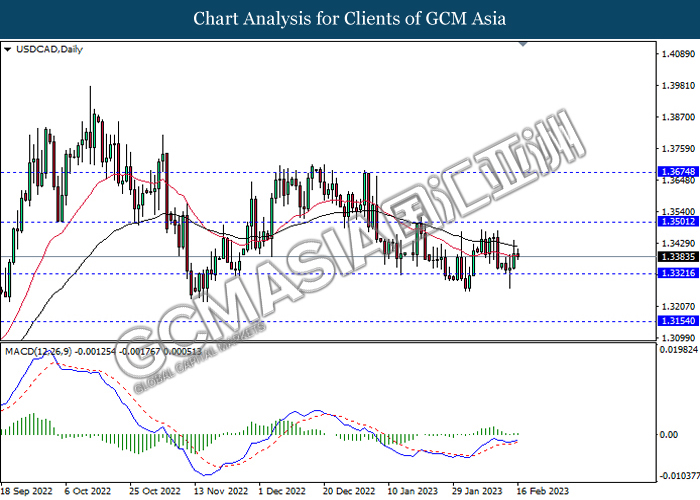

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

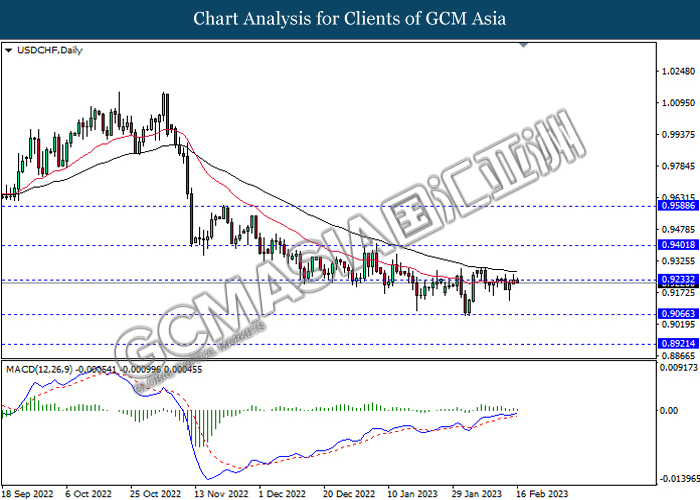

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggests the pair to be traded lower as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45