16 March 2022 Afternoon Session Analysis

Pound rebounded amid upbeat job data.

British Pound started rebounding since its recent low. According to Office for National Statistics, UK Average Earning Index +Bonus notched up significantly from the previous reading of 4.6% to 4.8%, exceeding the market forecast at 4.6%. UK Claimed Count Change came in at the reading of -48.1k, exceeding the market forecast at -28k and the previous -67.3k. A strong jobs report supported the prospect of a Bank of England rate hike for this month’s meeting while diminishing money supply in UK market. The UK’s Unemployment Rate fell more than expected to 3.9% in the three months to January, while vacancies hit a record high in the three months to February. Meanwhile, money markets continue to fully price in a 25 basis points BoE interest rate hike on Thursday. Both jobs data sparked positive prospects upon UK labor market, dialing up the market optimism toward economic momentum in UK region and spurring bullish momentum on Pound. As of writing, British Pound appreciated by 0.10% to 1.3051.

In commodities market, the crude oil price appreciated by 0.66% to $97.08 per barrel as of writing. Nonetheless, the overall trend of oil price remained downward amid the backdrop of oil supply additions from OPEC+. Besides, gold price depreciated by 0.44% to $1921.30 per troy ounces as of writing as the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Retail Sales (MoM) (Feb) | 3.30% | 1.00% | – |

| 21:30 | USD – Retail Sales (MoM) (Feb) | 3.80% | 0.40% | – |

| 21:30 | CAD – Core CPI (MoM) (Feb) | 0.80% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.863M | – | – |

Technical Analysis

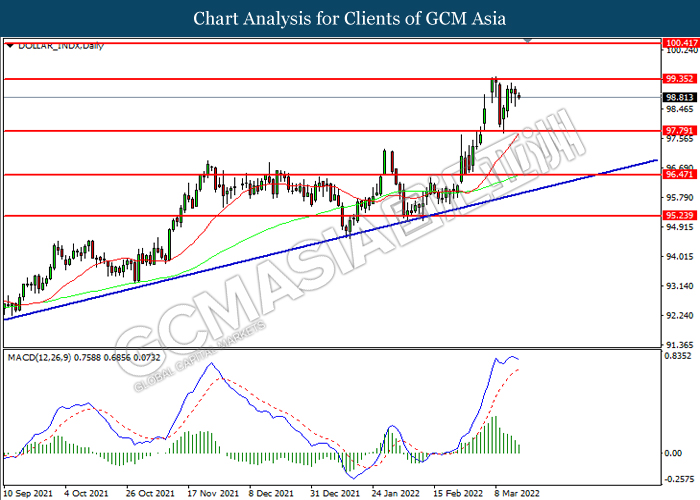

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

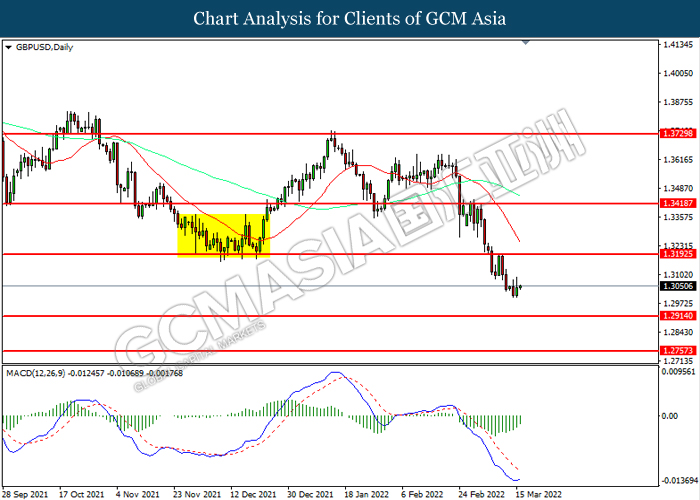

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

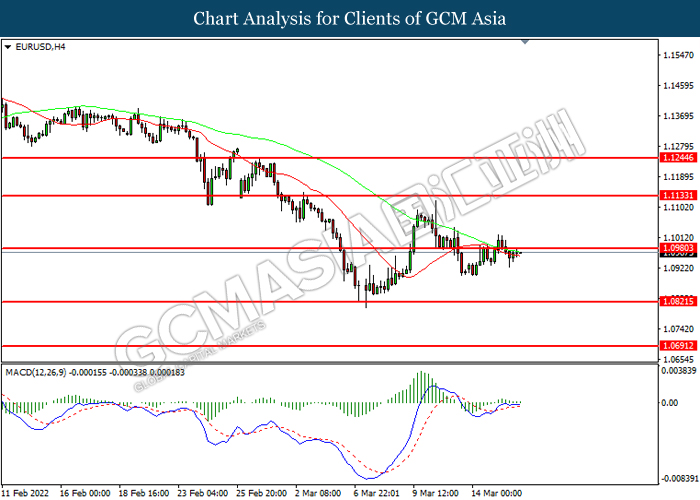

EURUSD, H4: EURUSD was traded within a range while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

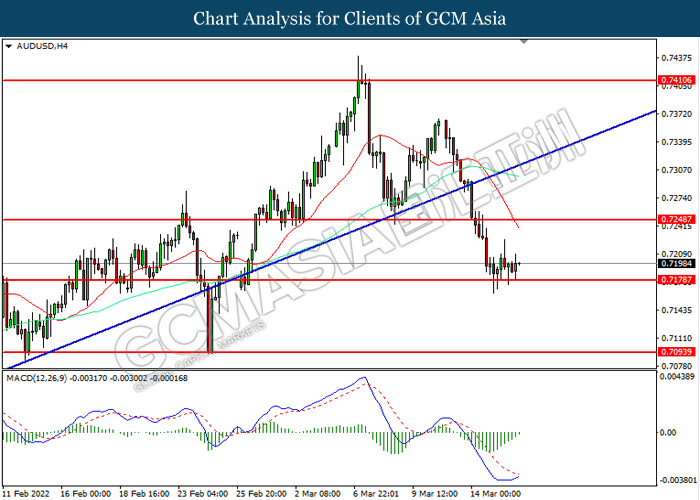

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7250, 0.7410

Support level: 0.7180, 0.7095

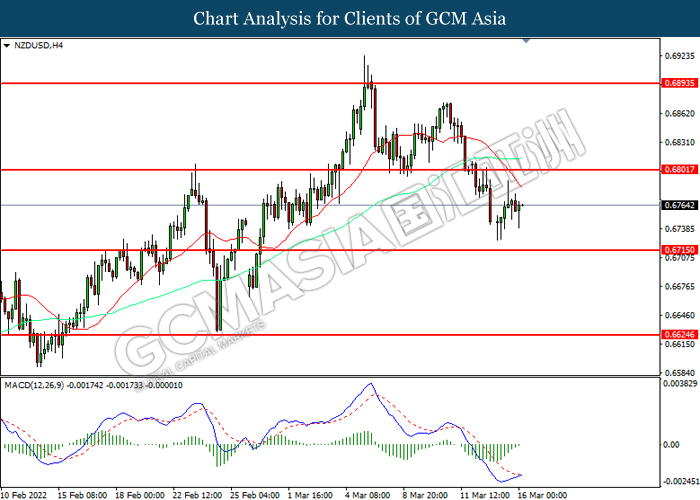

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6800, 0.6895

Support level: 0.6715, 0.6625

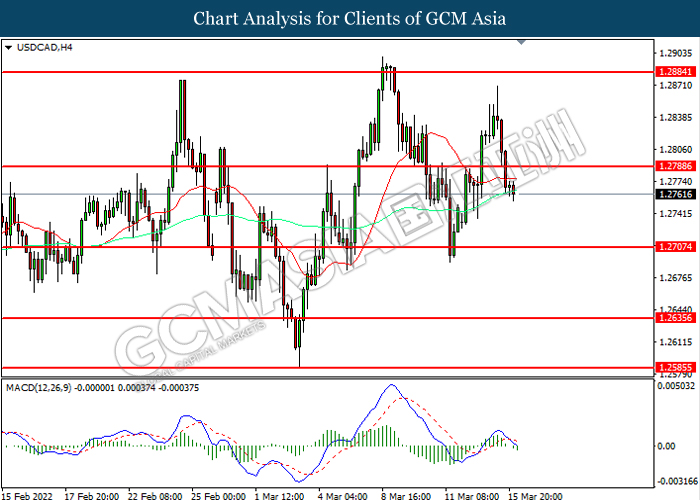

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2790, 1.2885

Support level: 1.2705, 1.2635

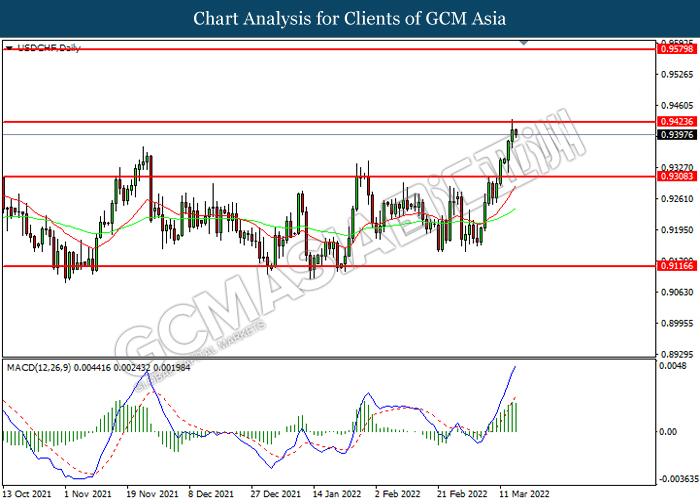

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

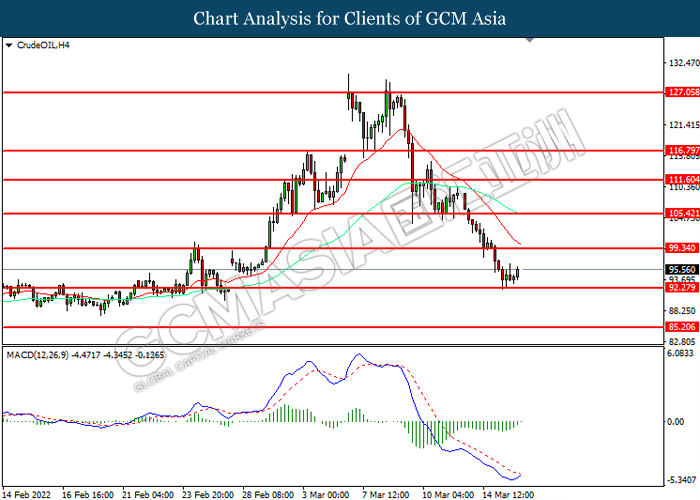

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 85.20

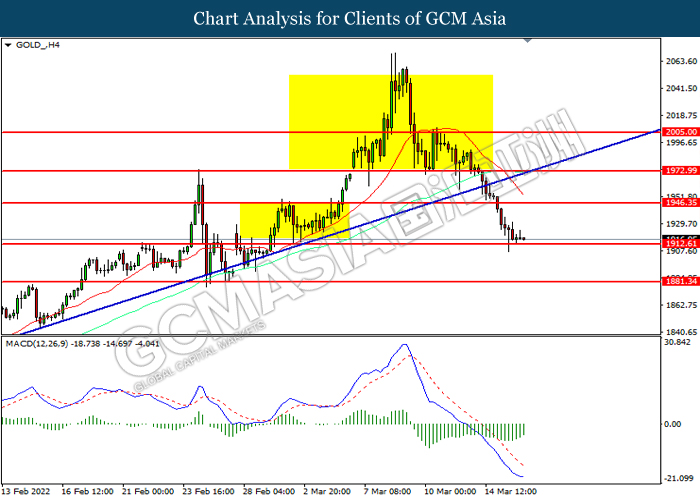

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35