16 March 2022 Morning Session Analysis

Dollar remained firm ahead of crucial Fed meeting.

The Dollar Index which traded against a basket of six major currencies surged ahead of crucial FOMC meeting this week as investors speculated the Federal Reserve have higher odds to implement contractionary monetary policy in future. Though, as for now investors would continue to remain their focus toward monetary policy decision as well as their statement to receive further trading signal. The US Producer Prices Index rose more moderately in February, keeping the Federal Reserve on track to raise interest rates this week. According to Bureau of Labor Statistics, the Producer Price Index rose significantly last month compared with February last year, the fastest year-on-year rate since 2010. Earlier, the Chair of Federal Reserve Jerome Powell has left open the option of the Fed lifting interest rates by larger increment later on this year. As for writing, the Dollar Index appreciated by 0.02% to 99.00.

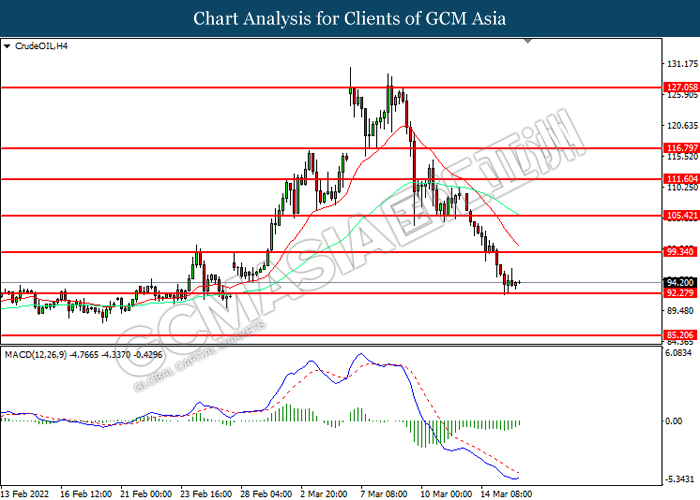

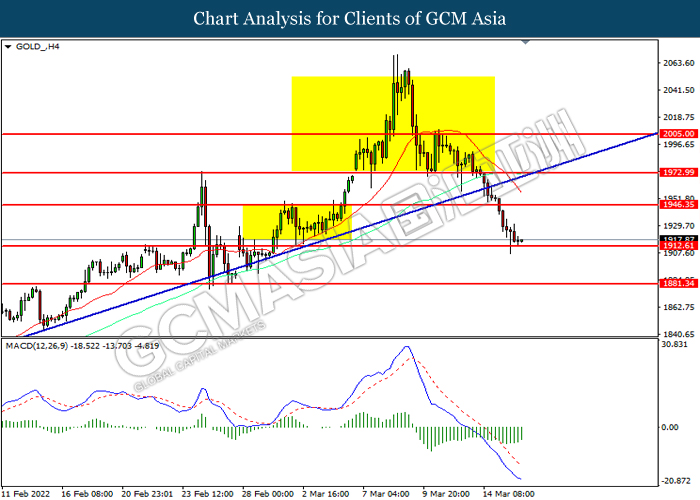

In the commodities market, the crude oil price slumped 0.04% to 94.20 per barrel as of writing over the backdrop of bearish inventory data. According to American Petroleum Institute, US API Weekly Crude Oil Stock came in at 3.754M, higher than the market forecast at -1.867M. On the other hand, the gold price depreciated by 0.02% to $1917.50 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core Retail Sales (MoM) (Feb) | 3.30% | 1.00% | – |

| 21:30 | USD – Retail Sales (MoM) (Feb) | 3.80% | 0.40% | – |

| 21:30 | CAD – Core CPI (MoM) (Feb) | 0.80% | – | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.863M | – | – |

Technical Analysis

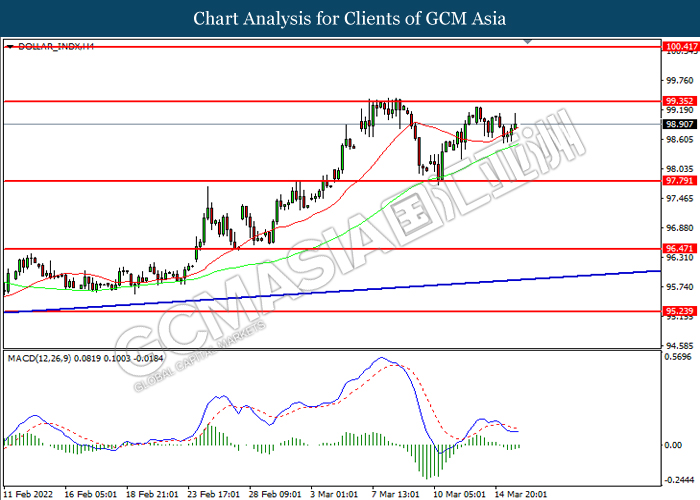

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout the resistance level.

Resistance level: 99.35, 100.40

Support level: 97.30, 96.45

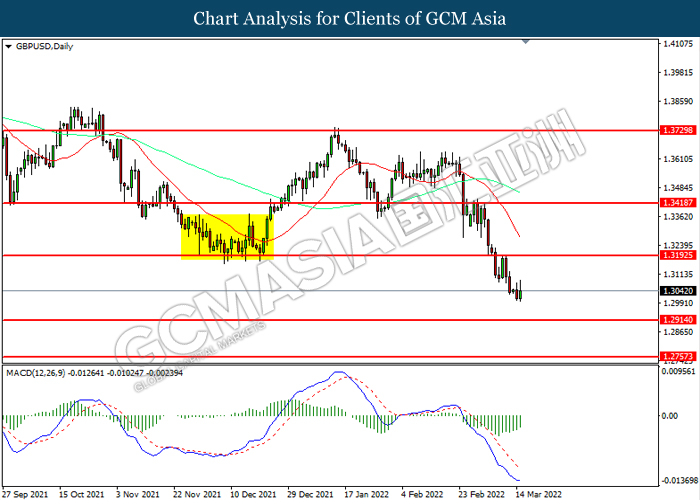

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3190, 1.3420

Support level: 1.2915, 1.2755

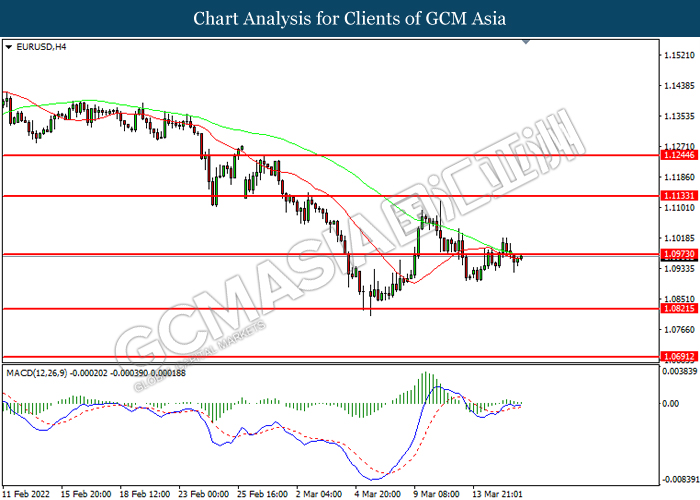

EURUSD, H4: EURUSD was traded within a range while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0975, 1.1135

Support level: 1.0820, 1.0690

USDJPY, Daily: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 118.90, 120.50

Support level: 117.50, 116.25

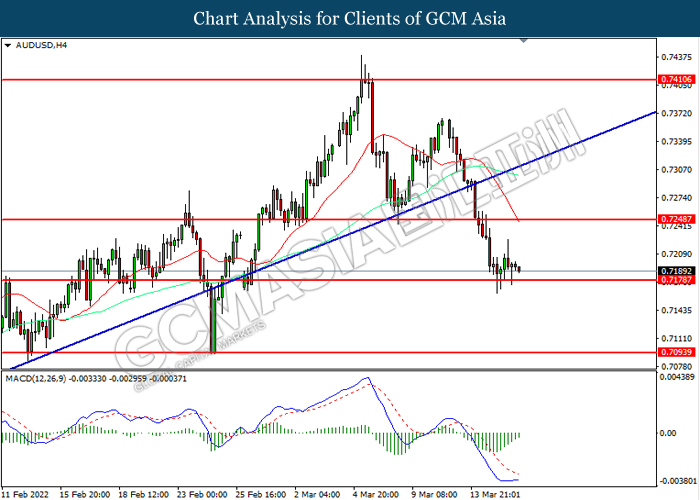

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7250, 0.7410

Support level: 0.7180, 0.7095

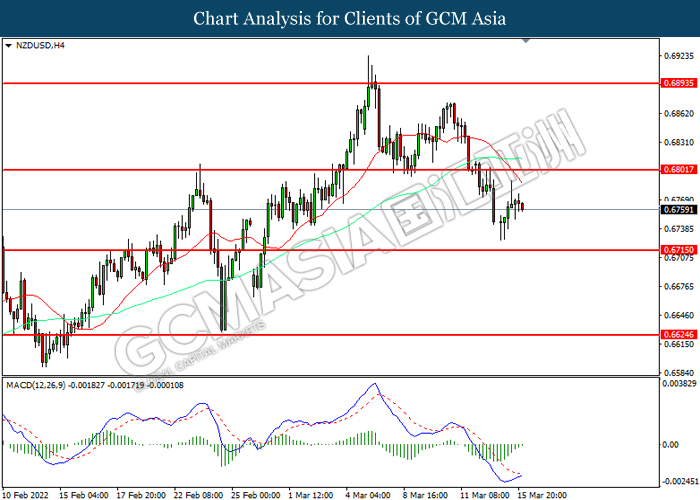

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6800, 0.6895

Support level: 0.6715, 0.6625

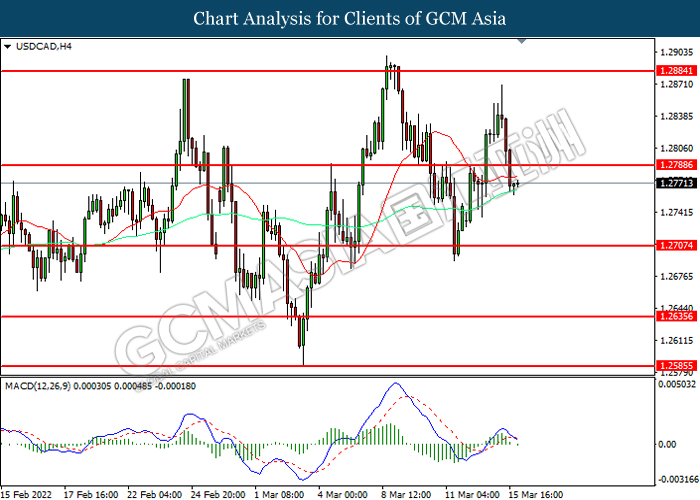

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2790, 1.2885

Support level: 1.2705, 1.2635

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9310, 0.9115

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 99.35, 105.40

Support level: 92.30, 86.65

GOLD_, H4: Gold price was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1946.35, 1973.00

Support level: 1912.60, 1881.35