16 May 2022 Afternoon Session Analysis

Australia Dollar slumped amid bearish Chinese economic prospect.

The Chinese-proxy currencies such as Australia Dollar slumped significantly over the backdrop of downbeat prospect for the Chinese economy, dialing down the market optimism toward the Australia Dollar. According to National Bureau of Statistics, China Industrial Production notched down significantly from the previous reading of 5.0% to -2.9%, missing the market forecast at 0.4%. Such data was the lowest since China’s industrial production dropped by 25.87% in February. The China’s economic slowdown continued in April amid the implementation of Covid-19 controls continue to jeopardize the supply side industry. Besides, restriction across the country, especially the lockdown of China’s most prosperous city of Shanghai since late March, have continued to weigh down the consumer consumption, with retail sales slumping by 11.1% in April. As of writing, AUD/USD depreciated by 0.83% to 0.6880.

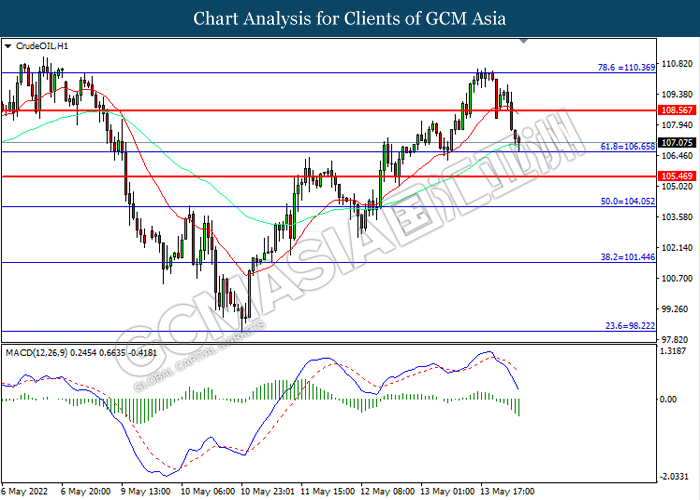

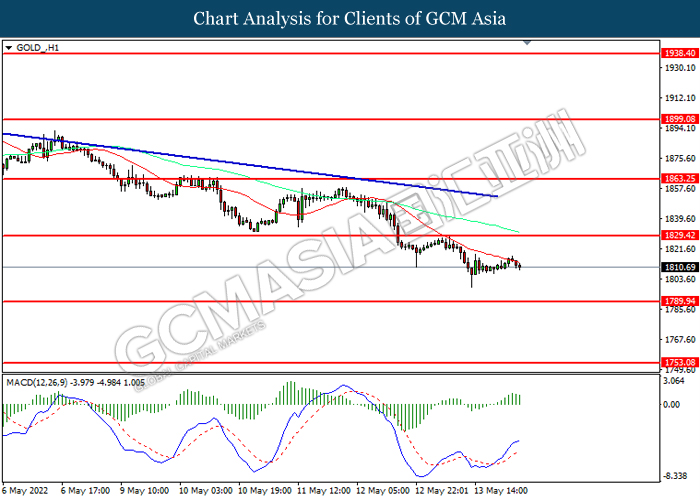

In the commodities market, the crude oil price depreciated by 0.90% to $107.07 per barrel as of writing amid fears upon the global economic recession continue to drag down the appeal for the crude oil demand. On the other hand, the gold price slumped 0.04% to $1810.40 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

N/A

Technical Analysis

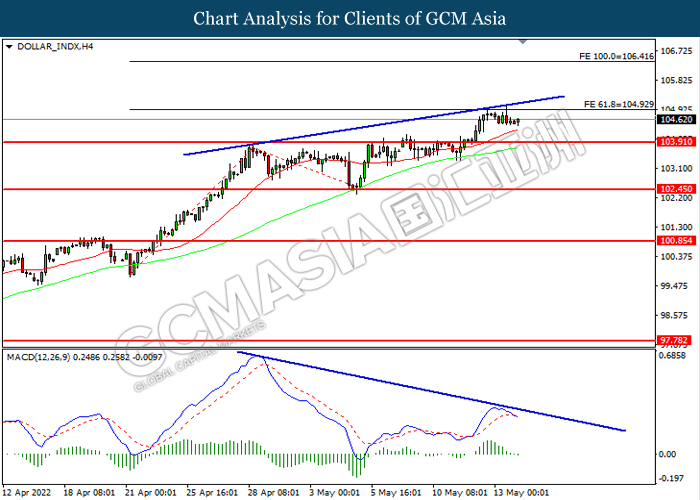

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 104.95, 106.40

Support level: 103.90, 102.45

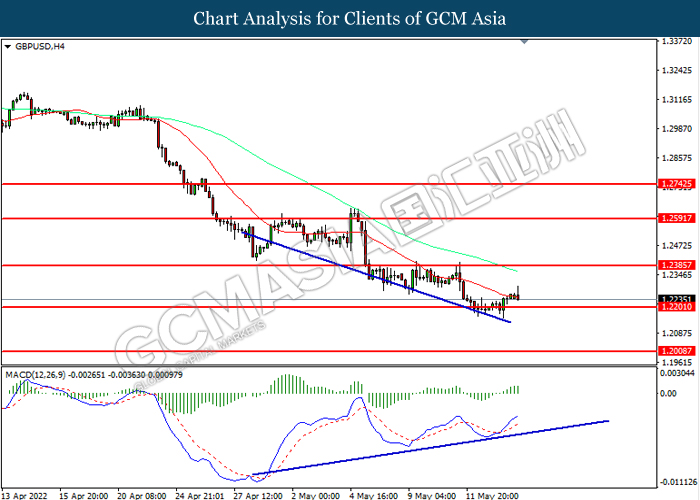

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2385, 1.2590

Support level: 1.2200, 1.2010

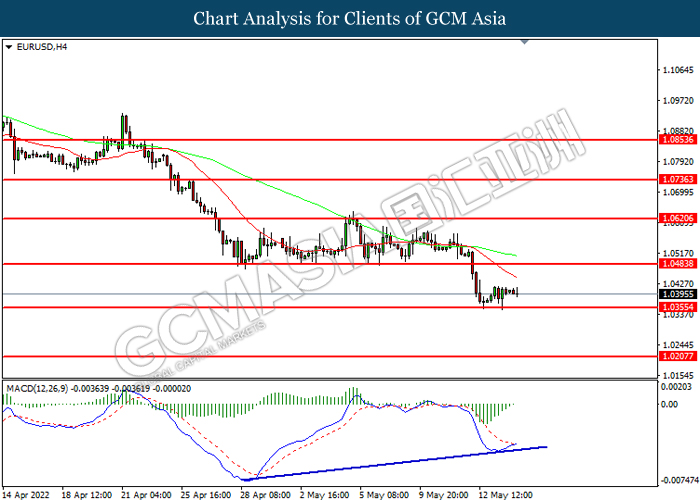

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0485, 1.0620

Support level: 1.0355, 1.0205

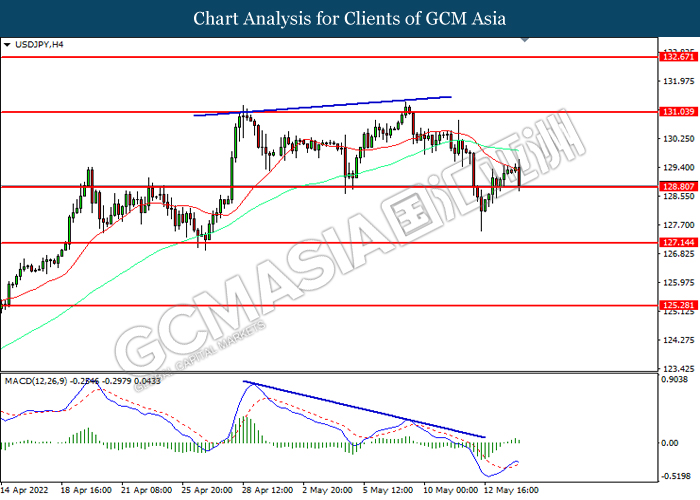

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 131.05, 132.65

Support level: 128.80, 127.15

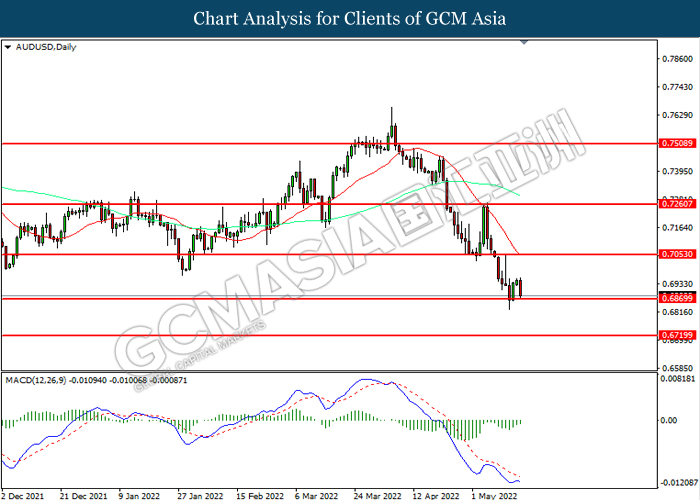

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7055, 0.7260

Support level: 0.6870, 0.6720

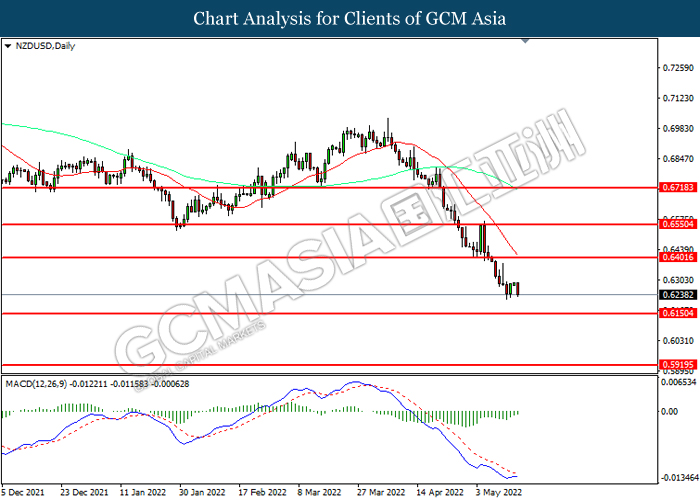

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6150, 0.5920

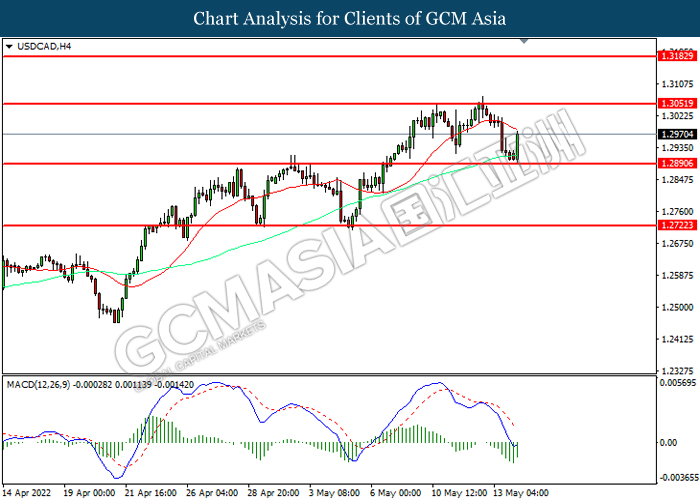

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.3050, 1.3185

Support level: 1.2890, 1.2720

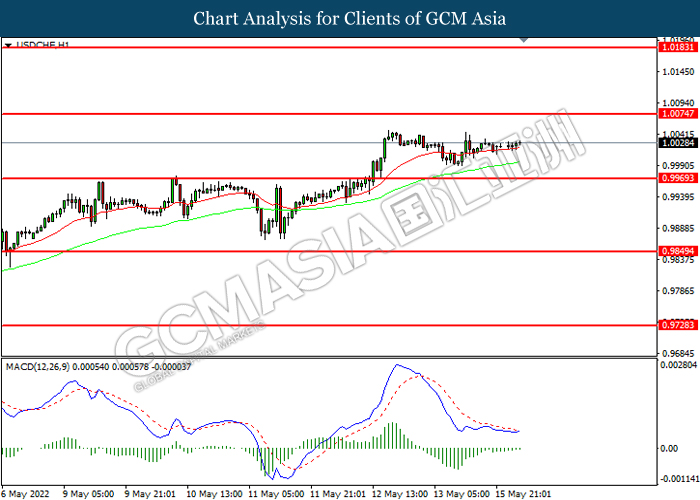

USDCHF, H1: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 108.55, 110.35

Support level: 106.65, 105.45

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1829.40, 1863.25

Support level: 1789.95, 1753.10