16 May 2022 Morning Session Analysis

US Dollar eased following the downbeat economic data.

The Dollar Index which traded against a basket of six major currencies slumped on Monday following the downbeat economic data. According to US Department of Labor, US Initial Jobless Claims notched up from the previous reading of 202K to 203K, exceeding the market forecast of 195K. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. The higher than expected reading indicated that there were more citizens who were unemployed, which brought negative prospects toward the economic progression in US. It prompted investors to selloff US Dollar and purchase other assets which having better prospects. Nonetheless, the overall trend for Dollar Index remained bullish over the Federal Reserve claimed that it would likely to raise interest rates by 50 basic points at each of its next two meetings in June and July is sensible. Investors would continue to scrutinize the latest updates with regards of the rate hike decisions from Fed in order to receive further trading signals. As of writing, Dollar Index edged down by 0.02% to 104.62.

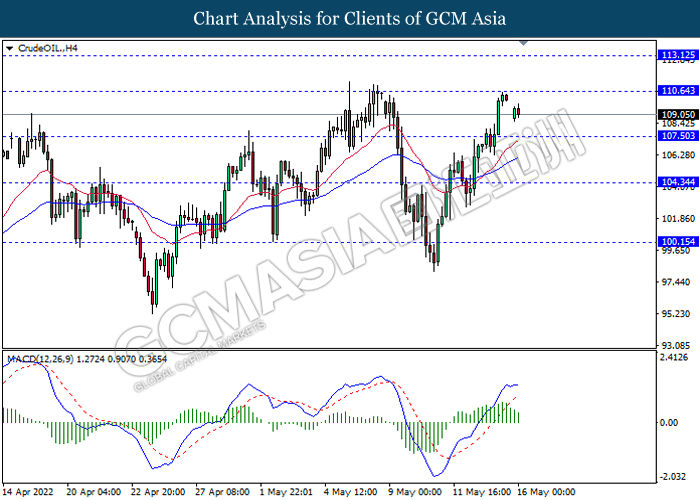

In commodities market, crude oil price appreciated by 0.70% to $109.40 per barrel as of writing amid the Europe proposed sanctions on Russia commodities. Besides, gold price appreciated by 0.04% to $1809.71 per troy ounce as of writing over the easing of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 105.25, 106.00

Support level: 104.50, 103.75

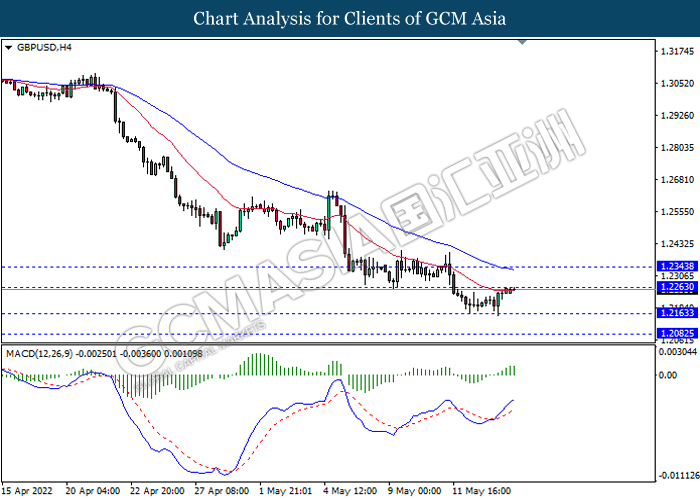

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2265, 1.2345

Support level: 1.2165, 1.2080

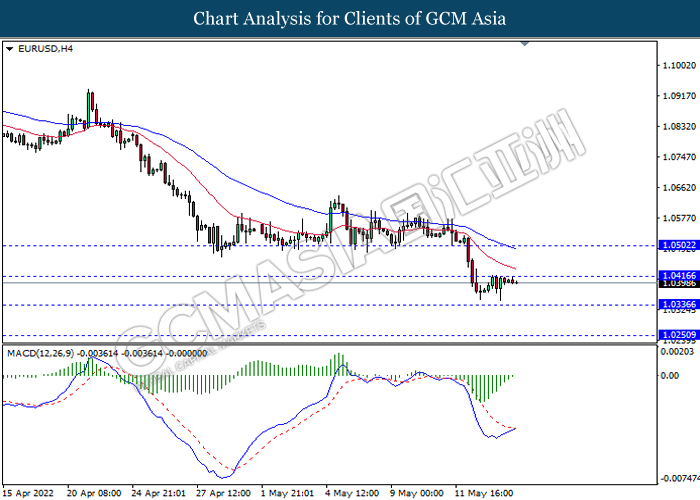

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0415, 1.0500

Support level: 1.0335, 1.0250

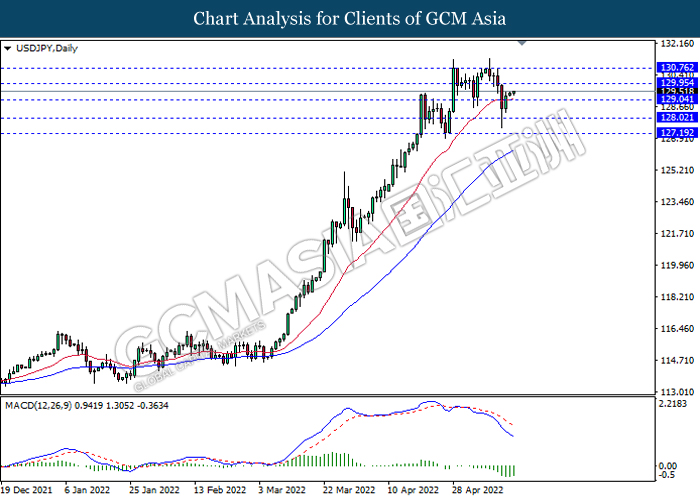

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

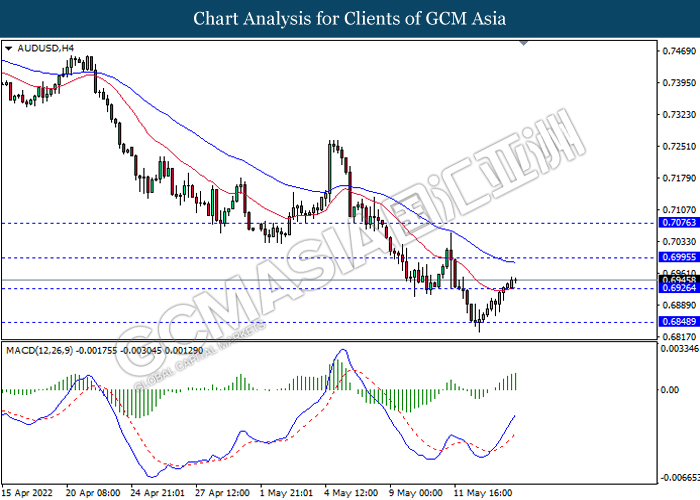

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6850

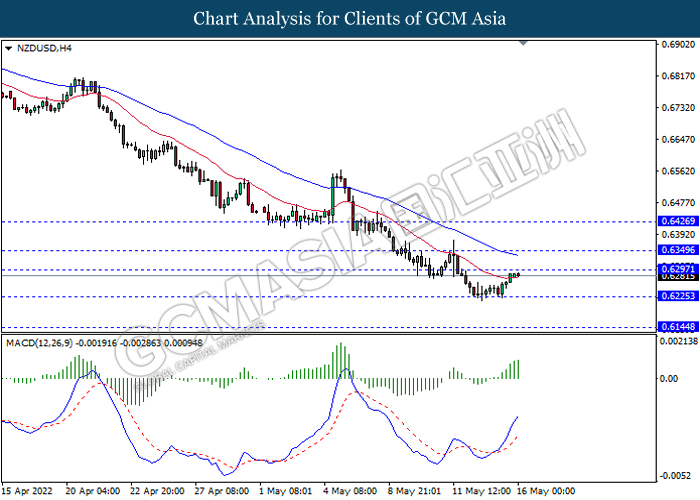

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

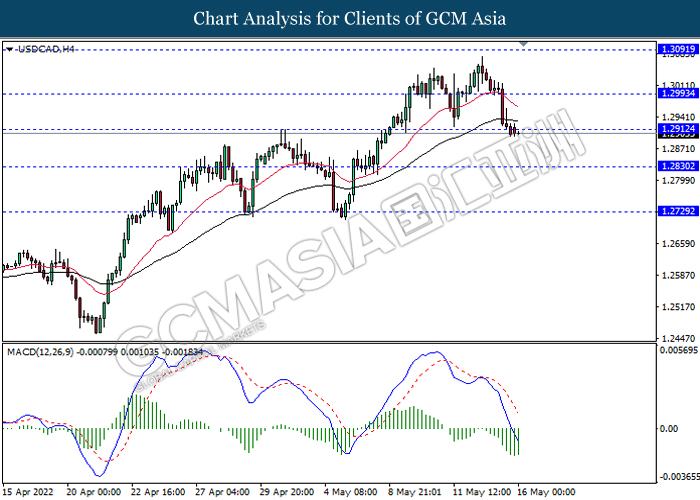

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2910, 1.2995

Support level: 1.2830, 1.2730

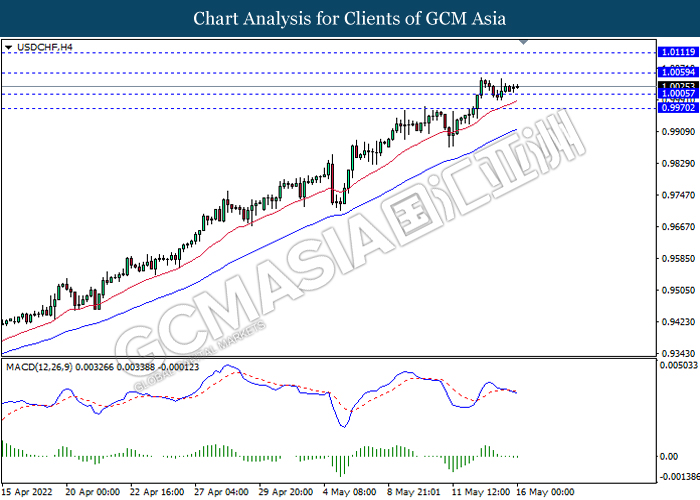

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0060, 1.0110

Support level: 1.0005, 0.9970

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

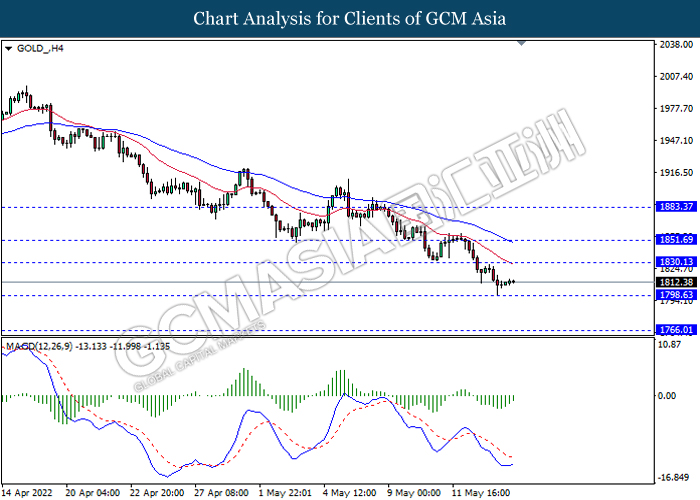

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00